Menopause Supplements Market Size, Share & Trends Analysis Report By Type (Hormonal Supplements, Non-hormonal Supplements), By Dosage Form (Tablet & Capsule, Powder, Liquid, Others), By Distribution Channel (Drug Stores & Retail Pharmacies, Hospital Pharmacies, Online Stores, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Menopause Supplements Market Overview

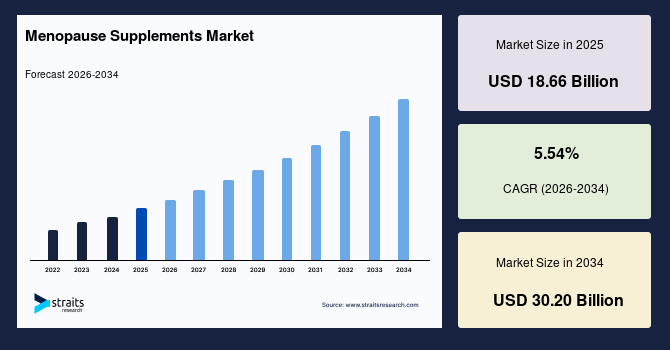

The global menopause supplements market size is valued at USD 18.66 billion in 2025 and is estimated to reach USD 30.20 billion by 2034, growing at a CAGR of 5.54% during the forecast period. The consistent growth of the market is supported by rising demand for microbiome-targeted menopause supplements that improve gut-hormone balance and enhance symptom management.

Key Market Trends & Insights

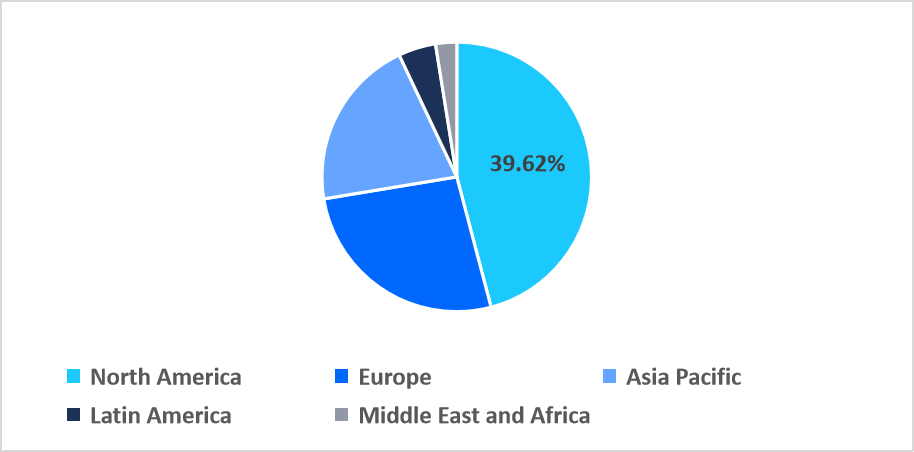

- North America dominated the global market, accounting for a 39.62% share in 2025.

- The Asia Pacific region is projected to grow at the fastest pace, with a CAGR of 7.23%.

- Based on type, the non-hormonal supplements segment dominated the market in 2025.

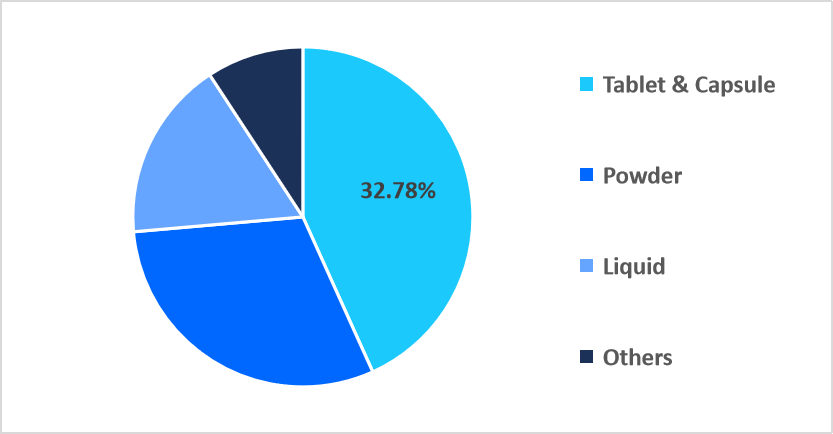

- Based on dosage form, the tablet & capsule segment dominated the market in 2025 with a revenue share of 32.78%.

- By distribution channel, the drug stores & retail pharmacies segment dominated the market, accounting for 37.61% share in 2025.

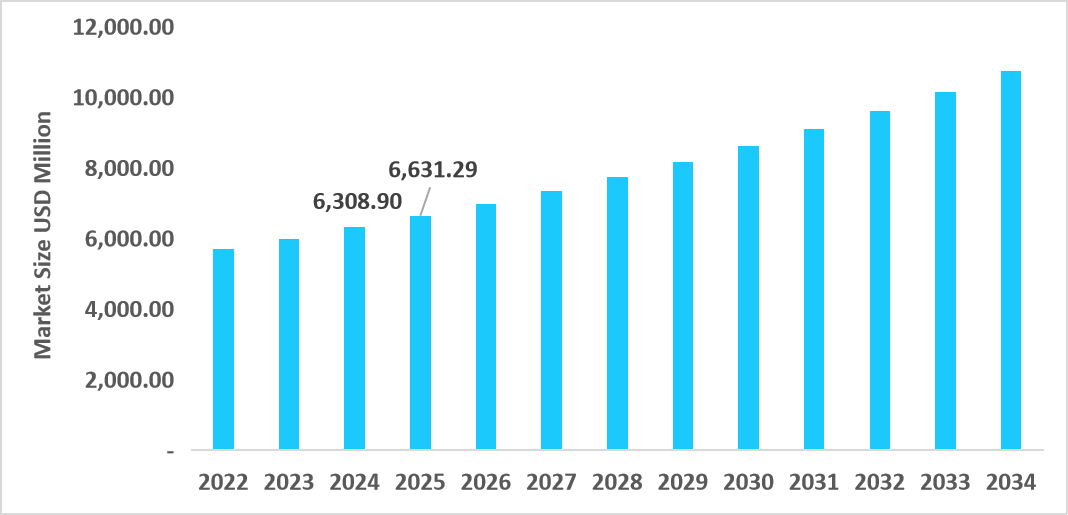

- The U.S. dominates the market, valued at USD 6.30 billion in 2024 and reaching USD 6.63 billion in 2025.

Table: U.S. Menopause Supplements Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 18.66 billion

- 2034 Projected Market Size: USD 30.20 billion

- CAGR (2026-2034): 5.54%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global menopause supplements market encompasses a diverse range of product types, including hormonal supplements and non-hormonal supplements, which are further categorised into herbal formulations, vitamins and minerals, and others. These supplements are available in various forms, including tablets and capsules, powders, liquids, and other dosage forms, catering to different consumer preferences and enhancing adherence to supplementation regimens. Moreover, these products are distributed through multiple channels such as drug stores and retail pharmacies, hospital pharmacies, online platforms, and other sales outlets, ensuring broad consumer accessibility.

Latest Market Trends

Shift Towards Platform-Based Formulations

A key trend in the global menopause supplements market is the growing preference for plant-based, clinically validated formulations. Leading companies, including Pharmavite, are expanding offerings with botanical actives such as isoflavone S‑equol blends to provide safer, non-hormonal alternatives. This development underscores the shift from conventional supplements to premium products that specifically target menopausal symptoms, enhancing consumer confidence and driving broader adoption of innovative menopause supplements.

Accelerated growth of E‑commerce and Subscription-Based Delivery Models

Currently, market key players are increasingly leveraging online platforms to reach a wider consumer base, offering convenience, personalised recommendations, and home delivery options. Subscription services allow women to receive regular, tailored supplement packs, ensuring consistent intake and improved adherence. This digital shift is transforming traditional distribution channels, enhancing accessibility, and driving the adoption of menopause supplements.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 18.66 Billion |

| Estimated 2026 Value | USD 19.62 Billion |

| Projected 2034 Value | USD 30.20 Billion |

| CAGR (2026-2034) | 5.54% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Amway, APD Pharmaceutical Manufacturing Pte Ltd, Bayer AG, Blackmores, GNC Holdings, Inc. |

to learn more about this report Download Free Sample Report

Latest Market Drivers

Growing Awareness of Menopause Related Health Problems

One of the key drivers of the global menopause supplements market is the rising awareness of menopause related health and wellness. Increasing public health initiatives, media campaigns, and educational programs are assisting women to better understand the physical and emotional changes associated with menopause. This growing awareness is leading to greater acceptance of natural supplements as safer alternatives to hormone therapy, thereby boosting product demand and supporting sustained market expansion across both developed and emerging economies.

Market Restraint

Lack of Clinical Validation

One major restraining factor in the global menopause supplements market is the lack of clinical validation for many products. Despite the growing demand for natural solutions, various supplements lack robust scientific studies to prove their efficacy and safety. This absence of standardized clinical evidence reduces consumer confidence and discourages healthcare professionals from recommending these products.

Consequently, it limits market credibility, affecting product adoption rates and hindering the overall growth potential of menopause supplements globally.

Market Opportunity

Integration of Digital Health Solutions

The growing integration of digital health platforms and teleconsultation services presents a major opportunity for the global market. With more women seeking online guidance for menopause management, digital platforms are increasingly offering personalized supplement recommendations and symptom tracking tools. This shift toward virtual healthcare enables supplement manufacturers to collaborate with telehealth providers, enhancing product visibility and consumer education.

As digital adoption expands globally, new avenues are opening for targeted marketing and direct-to-consumer sales growth in menopause care.

Regional Analysis

North America dominated the market in 2025, accounting for 39.62% market share. This growth is augmented by the region’s strong research and development capabilities, enabling the development of scientifically validated and clinically tested formulations. Continuous innovation supported by leading universities and biotechnology firms enhances product credibility, driving consumer trust and market expansion.

U.S. menopause supplements market is stimulated by the rising influence of health and wellness awareness campaigns. Initiatives by government bodies, healthcare organizations, and media platforms are educating women about menopause management, encouraging proactive supplement use. This increased awareness is boosting demand for over-the-counter and clinically supported products across the country.

Asia Pacific Market Insights

Asia Pacific is emerging as a fastest growing region with a CAGR of 7.23% from 2026 to 2034, owing to the rising demand for ayurvedic and traditional herbal formulations tailored to local preferences. Women in countries such as India, China, and Japan increasingly seek region-specific, culturally trusted botanical supplements that combine modern science with traditional wellness practices, creating a unique growth segment within the market.

China menopause supplements market growth is supported by the integration of traditional Chinese medicine (TCM) with modern supplement formulations. Products combining herbs like Dong Quai and Rehmannia with vitamins and minerals cater to cultural preferences, offering a trusted, holistic approach to managing menopausal symptoms and creating a specialized segment with strong consumer appeal.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

European market is boosted by the increasing demand for clinically certified and nutritionally regulated products. Strict EU regulations and growing consumer preference for scientifically validated supplements encourage manufacturers to focus on safety, efficacy, and transparency, boosting adoption among health-conscious women across Western and Northern European countries.

In France, the menopause supplements market is experiencing notable growth, driven by the rising popularity of pharmacy-led wellness consultations. French women increasingly depend on pharmacists for guidance on managing menopausal symptoms, including personalized supplement recommendations. This professional support, combined with the trust in regulated pharmacy products, is enhancing the adoption of menopause supplements and stimulating market growth across the country.

Latin America Market Insights

Latin America’s market is being driven by the increasing prevalence of severe menopausal symptoms that require targeted hormonal intervention. Women experiencing intense hot flashes, night sweats, mood swings, and bone density loss are turning to prescription-based hormone therapies, driving higher adoption of clinically monitored hormonal supplements and accelerating market growth.

The growth of Brazil's menopause supplements market is driven by the expansion of private wellness clinics and community health programs targeting women’s health. These initiatives increase awareness of menopause management, provide access to consultations and supplements, and promote adoption of both herbal and clinically formulated products, supporting consistent market growth across urban and semi-urban regions.

Middle East and Africa Market Insights

The Middle East and Africa market growth is stimulated by the growing presence of international health and wellness brands entering urban markets. Increased availability of high-quality supplements combined with rising female health awareness is encouraging the adoption of menopause focused products in countries like the UAE, Saudi Arabia, and South Africa.

Saudi Arabia's menopause supplements market growth is supported by the increasing integration of culturally tailored herbal and natural ingredients in supplement formulations. Products incorporating locally trusted botanicals alongside modern nutrients appeal to regional preferences, enhancing consumer acceptance and creating a specialized niche within the growing women’s health market.

Type Insights

The non-hormonal supplements segment dominated the market in 2025. This growth is driven by the rising inclusion of menopause wellness programs within corporate health initiatives. Employers are increasingly adopting non-hormonal supplements as part of workplace wellness offerings to support female employees experiencing menopausal symptoms such as fatigue, anxiety, and poor concentration. This proactive approach not only improves workforce productivity and well-being but also promotes broader acceptance of menopause supplements.

The hormonal supplements segment is estimated to register the fastest CAGR of 6.27% during the forecast period, owing to the increasing demand for bioidentical hormone formulations that closely mimic natural estrogen and progesterone. Rising medical endorsement of hormone therapy for managing severe menopausal symptoms such as hot flashes, night sweats, and mood instability is further driving adoption and supporting market growth.

Dosage Form Insights

The tablet & capsule segment dominated the market with the highest revenue share of 32.78% in 2025. This growth is attributed to their extended shelf life, accurate dosage delivery, and portability, which make them the most convenient and preferred format for consumers seeking consistent and reliable menopause symptom management solutions.

The liquid segment is projected to register the fastest CAGR of 6.84% from 2026-2034, due to its faster absorption rate and ease of consumption among older women with swallowing difficulties, driving increased preference for liquid formulations in menopause supplement products.

By Dosage Form Market Share (%), 2025

Source: Straits Research

Distribution Channel Insights

The drug stores and retail pharmacies segment dominated the market with the highest revenue share of 37.61% in 2025. This growth is augmented by increasing use of loyalty and subscription programs by pharmacy chains, encouraging repeat purchases and consistent supplement use, thereby enhancing customer retention and driving higher sales.

The online stores segment is estimated to register the fastest CAGR during the forecast period, due to the expansion of regional e-commerce platforms and cross-border shipping, which allows consumers in remote areas to access a wider variety of menopause supplements not readily available in local retail pharmacies.

Competitive Landscape

The global menopause supplements market is fragmented, with several key players influencing through product innovation and targeted marketing. Leading companies focus on developing clinically validated, natural, and herbal formulations to cater to diverse consumer preferences. Major players in the market include Bayer AG, Pfizer Inc., Pharmavite LLC, GlaxoSmithKline plc, Amway, Nature’s Way, and others are leveraging R&D, strategic partnerships, and digital distribution to strengthen their market presence.

MyPause Health Pty Ltd.: An emerging market player

MyPause Health, a specialised wellness company, is gaining traction in the market with its focus on natural formulations targeting symptom relief and overall hormonal balance.

- In 2024, the company expanded its distribution through online wellness platforms and strategic partnerships with healthcare providers, increasing accessibility.

By combining scientific research with personalised supplementation solutions, MyPause Health is positioning itself as a prominent emerging player in the global market.

List of Key and Emerging Players in Menopause Supplements Market

- Amway

- APD Pharmaceutical Manufacturing Pte Ltd

- Bayer AG

- Blackmores

- GNC Holdings, Inc.

- Herbalife Nutrition Ltd.

- Korra Lab

- Metagenics, Inc.

- MyPause Health Pty Ltd

- Nature’s Way Products LLC

- OZ Health Singapore

- Pfizer Inc.

- Pharmavite

- Prelude Health

- Pure Encapsulations, LLC

- RED SUN

- Solgar Inc.

- Thorne

- William Reed Ltd

- Others

Strategic Initiatives

- October 2025: Hims & Hers Health, Inc. launched a new specialty in women’s health, offering access to affordable treatment plans built specifically for women experiencing perimenopause and menopause.

- January 2025: Bayer AG, a global pharmaceutical company, launched a new CanesMeno Educational Hub and product range to transform menopause support.

- September 2024: Otsuka Pharmaceutical Co., Ltd. and Bonafide Health, LLC launched "Thermella", a plant-based supplement that contributes to women's health during menopause.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 18.66 Billion |

| Market Size in 2026 | USD 19.62 Billion |

| Market Size in 2034 | USD 30.20 Billion |

| CAGR | 5.54% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Dosage Form, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Menopause Supplements Market Segments

By Type

- Hormonal Supplements

-

Non-hormonal Supplements

- Herbal Supplements

- Vitamins And Minerals

- Others

By Dosage Form

- Tablet & Capsule

- Powder

- Liquid

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Stores

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.