Micro-Electro-Mechanical System Market Size, Share & Trends Analysis Report By Type (Sensors, Actuators, RF MEMS, Optical MEMS, Microfluidics), By Application (Consumer Electronics, Automotive, Industrial, Healthcare/Bio-MEMS, Telecom/Networking, Aerospace & Defense), By Material (Silicon, Polymers, Metals, Ceramics), By Technology (Bulk Micromachining, Surface Micromachining, High-Aspect-Ratio (DRIE/LIGA)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Micro-Electro-Mechanical System Market Overview

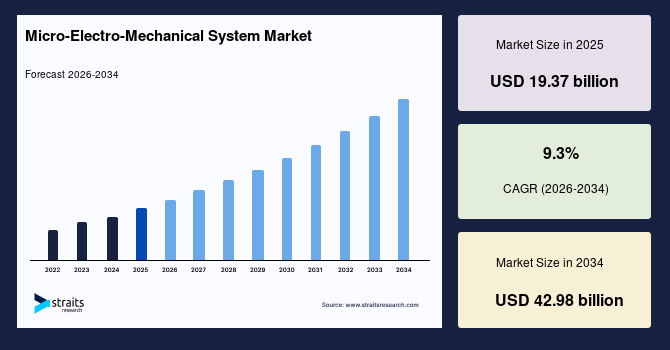

The micro-electro-mechanical system market size was valued at USD 19.37 billion in 2025 as a consolidated base year and is projected to reach USD 42.98 billion by 2034, reflecting a compound annual growth rate (CAGR) of 9.3% from 2026 to 2034. The market benefited from resilient demand for multi-sensor integration across consumer devices, automotive platforms, and industrial control, supported by normalisation of the supply chain in front-end fabs and back-end wafer-level packaging. The heightened deployment of inertial, pressure, and microphone MEMS in smartphones and wearables supported replacement cycles. At the same time, the electrification of mobility accelerated the adoption of pressure, inertial, and thermal MEMS in battery and drivetrain monitoring.

The micro-electro-mechanical system market outlook highlights diversification beyond consumer electronics into bio-MEMS, RF front-end components for 5G/6G, and industrial asset monitoring, which will lift content per unit and sustain pricing. Foundry collaboration and heterogeneous integration are now central to product roadmaps, as chipmakers balance die size, sensitivity, and power consumption to meet emergent application requirements. The analysis indicates that Asia Pacific’s manufacturing base and local demand anchors have shaped the global competitive landscape, while North America and Europe sustained innovation in design and tooling. Forecast growth will be driven by higher attach rates in vehicles, factory automation upgrades, and early deployments of microfluidic diagnostics. The Micro-Electro-Mechanical System Market forecast also factors in incremental ASP improvements in RF and bio-MEMS.

Key Highlights

- Asia Pacific dominated the market with a revenue share of 44% in 2025.

- Middle East and Africa is anticipated to grow at the fastest CAGR of 11.1% during the forecast period (2026-2034).

- Based on type, the Sensors segment held the highest market share of 64% in 2025, while RF MEMS is the fastest-growing at a 12.6% CAGR.

- By application, the Healthcare/Bio-MEMS segment is estimated to register the fastest CAGR growth of 12.8%.

- Based on material, Silicon dominated the market in 2025 with a revenue share of 78%.

- By technology, the High-Aspect-Ratio (DRIE/LIGA) segment is estimated to register the fastest CAGR growth of 11.9%.

- China dominates the market, valued at USD 4,699.20 million in 2024 and reaching USD 5,116.02 million in 2025.

Latest Market Trends

Heterogeneous Integration and Wafer-Level Packaging

The micro-electro-mechanical system (MEMS) market experienced an acceleration in heterogeneous integration. Vendors embedded MEMS with ASICs and power management on a shared substrate and transitioned audio and inertial sensors to wafer-level chip-scale packaging. The shift reduced parasitics and improved signal-to-noise, enabling smaller footprints and advanced form factors in earbuds, AR/VR devices, and wearables. Over the forecast, back-end innovations, fan-out, TSV, and 3D stacking will improve performance consistency and enable AI-at-the-edge features within MEMS modules, supporting the market’s growth trajectory and the broader industry trends toward miniaturisation and integration.

Bio-MEMS and Environmental Sensing Convergence

Bio-MEMS for point-of-care diagnostics and environmental sensing advanced from pilots to early production volumes. In 2025, microfluidic cartridges, lab-on-chip assays, and MEMS-based gas sensors were integrated into portable analysers for air quality and pathogen detection. The micro-electro-mechanical system market forecast anticipates broader adoption in clinics and smart buildings as stakeholders prioritise rapid diagnostics and continuous environmental monitoring. Materials innovation, polymer substrates, and surface functionalization will enhance sensitivity, while multiplex detection will reduce per-test costs, aligning with healthcare decentralisation and ESG-driven building management.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 19.37 billion |

| Estimated 2026 Value | USD 21.17 billion |

| Projected 2034 Value | USD 42.98 billion |

| CAGR (2026-2034) | 9.3% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Key Market Players | STMicroelectronics, Robert Bosch GmbH (Bosch Sensortec), TDK Corporation (InvenSense), Analog Devices, Inc., Texas Instruments Incorporated |

to learn more about this report Download Free Sample Report

Market Drivers

Proliferation of Multi-Sensor Consumer Platforms

The MEMS market was propelled by rising sensor attachment rates in smartphones, hearables, and wearables. Device makers incorporated multiple inertial measurement units, barometric pressure sensors, and digital MEMS microphones to enable spatial audio, indoor navigation, and wellness features. Over the forecast, OEM roadmaps will push further integration, leveraging on-sensor machine learning cores to reduce system power and latency. This will support richer user experiences in AR/VR and enable new services, such as fall detection and continuous respiratory tracking, thereby increasing unit demand and sustaining value capture.

Electrified and Software-Defined Vehicles

The automotive transition to electrified and software-defined architectures increased MEMS content per vehicle. Battery thermal management, tire pressure monitoring, brake actuation, and cabin acoustics relied on a broad suite of MEMS sensors and actuators. The MEMS Market analysis suggests that as Level 2+ assistance and zonal Electronic/Electrical (E/E) architectures scale, automakers will require precise, low-drift sensors qualified to automotive standards. Over 2026-2034, tighter safety requirements and over-the-air calibration strategies will support higher ASPs and recurring demand through replacement cycles.

Market Restraint

Yield Variability and Capital Intensity

Manufacturing complexity constrained the micro-electro-mechanical system market. In 2024, process-induced variability across bulk and surface micromachining steps impacted yield and hindered rapid cost reductions, particularly for high-aspect-ratio structures and wafer-level packaging flows. The cost burden of speciality equipment, DRIE tools, bonding systems, and hermetic sealing raised barriers to entry, and extended qualification times further prolonged commercialisation cycles. Looking ahead, foundries will likely invest in tighter process control, inline metrology, and design-for-manufacturing libraries; however, the capital intensity and long learning curves may still temper margin expansion and delay ramp schedules for next-generation sensors.

Market Opportunities

RF MEMS for Advanced 5G and 6G Front-Ends

The micro-electro-mechanical system (MEMS) market will benefit from RF MEMS switches, tunable capacitors, and filters as radio front-ends become increasingly complex. Sub-6 GHz densification and early 6G R&D will create demand for low-loss, linear components that improve antenna tuning and extend battery life. Vendors that offer robust wafer-level packaging, high cycle endurance, and multi-throw architectures can capture sockets in handsets, small cells, and reconfigurable intelligent surfaces. Design wins in this domain can command premium pricing and longer lifecycles, expanding both unit volumes and blended ASPs.

Point-of-Care Diagnostics and Smart Consumables

Bio-MEMS will unlock new revenue streams through disposable microfluidic cartridges, integrated pumps, and sensors for decentralised testing. The micro-electro-mechanical system market outlook indicates hospitals, clinics, and home-care providers will adopt compact analysers that deliver fast pathogen, biomarker, and metabolic results. Partnerships with assay developers and materials suppliers will be strategic, while the use of automated fluid handling and multiplexing will enhance throughput. The attach rate of smart consumables will support recurring revenues, creating predictability for suppliers that align manufacturing to stringent quality and traceability requirements.

Type Insights

Sensors dominated the MEMS market by type, accounting for 64% of revenue in 2025. The category included inertial sensors (accelerometers, gyroscopes), pressure sensors, barometers, and microphones, which were embedded across smartphones, wearables, appliances, and vehicles. Actuators, optical MEMS, and RF MEMS held smaller shares, with microfluidics serving specialised medical and environmental use cases.

RF MEMS will be the fastest-growing type, registering a 12.6% CAGR over 2026-2034 as antenna tuning and low-loss switching become critical in 5G/6G devices and small cells. Growth will be supported by improved endurance, wafer-level hermetic sealing, and tighter integration with tuners and PAs in reconfigurable front-ends.

Application Insights

Consumer Electronics dominated the market by application and represented 37% of 2025 revenue. Smartphones, true wireless earbuds, AR/VR headsets, and wearables integrated multiple IMUs and digital microphones, while barometric sensors enabled altitude-aware features and indoor navigation. Automotive, industrial, and healthcare followed with distinct demand profiles.

Healthcare/Bio-MEMS will be the fastest-growing application, with a projected 12.8% CAGR during 2026–2034. Point-of-care diagnostics, infusion monitoring, and implantable devices will rely on microfluidics and pressure sensors. Sterile, disposable consumables and validated manufacturing will underpin adoption in clinical and home-care environments.

Material Insights

Silicon dominated the market by material, accounting for 78% of 2025 revenue. Its mechanical stability, mature process control, and compatibility with CMOS enabled high-volume production of inertial, pressure, and microphone devices. Metals, polymers, and ceramics served specific needs where elasticity, biocompatibility, or inertness were prioritised.

Polymers will be the fastest-growing material class, at an anticipated 11.4% CAGR from 2026 to 2034. Polymer substrates and coatings will enable flexible microfluidic channels, reduce sample adhesion, and lower the cost of disposable cartridges for diagnostics and environmental sensing, thereby expanding the addressable use cases.

Technology Insights

Bulk Micromachining, dominated by technology with a 52% share in 2025, is widely used for pressure sensors and resonant structures. Surface micromachining was employed for microphones and some inertial devices, while high-aspect-ratio processes were used for specialised components requiring deep trenches and precise geometries.

High-Aspect-Ratio (DRIE/LIGA) processes will be the fastest-growing technology, with an estimated 11.9% CAGR through 2034. Demand is driven by advanced inertial sensors, microfluidic pumps, and precision resonators, where deep structures and tight tolerances improve performance and reduce drift.

Regional Analysis

North America accounted for a significant share of the MEMS market in 2025, driven by strong demand in consumer electronics, enterprise audio, and industrial automation. The region will grow at a 8.7% CAGR during 2026–2034, underpinned by automotive retooling for EV platforms and continued outlays in smart manufacturing. Broader deployment of AI-enabled sensors in wearables and AR devices will add incremental unit volumes over the forecast.

The United States dominated regional revenue, driven by design leadership and deep integration with cloud and software ecosystems. Federal incentives for domestic manufacturing and the scaling of wafer-level packaging lines will foster local supply resilience, reinforcing the region’s role in premium MEMS categories.

European Market Trends

Europe shows growth as vehicle electrification, safety regulations, and industrial retrofits progress. The adoption of MEMS in HVAC and building automation is expected to grow in response to energy efficiency mandates and indoor air quality programs.

Germany led regional demand, driven by its strong automotive supply chain and industrial instrumentation base. Collaborative projects between Tier-1 suppliers and sensor designers will emphasise functional safety, long-term stability, and drift compensation, sustaining content per vehicle and factory line.

Asia Pacific Market Trends

Asia Pacific dominated the market with a revenue share of 44% in 2025, supported by high-volume consumer electronics manufacturing and expanding automotive and telecom investments. The region is expected to post a 10.2% CAGR from 2024 to 2034, driven by 5G densification, increased penetration of smart appliances, and higher adoption of environmental sensing in urban infrastructure.

China dominated regional revenue through extensive production of smartphones and wearable devices, as well as growing industrial automation. Local ecosystems spanning design, foundry services, and assembly provided time-to-market advantages, while domestic EV programs boosted demand for pressure and inertial sensors across battery systems and chassis controls.

Middle East & Africa Market Trends

The Middle East and Africa market is driven by smart city pilots, building automation, and early industrial IoT deployments in the energy and utilities sectors. The United Arab Emirates led regional uptake, supported by smart infrastructure programs and high-spec commercial real estate. Government-led initiatives to digitise public services will encourage the deployment of air quality and occupancy sensors, anchoring steady demand for environmental MEMS.

Latin American Market Trends

Latin America is experiencing growth as consumer device replacement cycles recover and industrial automation projects expand in the food processing, mining, and logistics sectors. Brazil dominated the region due to its sizable automotive assembly base and maturing electronics distribution networks. In-country calibration and test services will strengthen supply responsiveness, reinforcing adoption of automotive-grade pressure and inertial sensors.

Competitive Landscape

The MEMS market remains moderately consolidated, with global and regional players expanding through design wins and packaging capabilities. STMicroelectronics, Robert Bosch GmbH (Bosch Sensortec), TDK Corporation (InvenSense), Analogue Devices, and Texas Instruments have shaped core product roadmaps across the inertial, pressure, and audio categories. STMicroelectronics is positioned as a market leader with broad portfolios and embedded machine-learning capabilities in IMUs. Bosch Sensortec maintained strong positions in both consumer and automotive-grade sensors, backed by rigorous quality systems. TDK, Analog Devices, and Texas Instruments advanced integration with ASICs and power management.

List of Key and Emerging Players in Micro-Electro-Mechanical System Market

- STMicroelectronics

- Robert Bosch GmbH (Bosch Sensortec)

- TDK Corporation (InvenSense)

- Analog Devices, Inc.

- Texas Instruments Incorporated

- NXP Semiconductors

- Murata Manufacturing Co., Ltd.

- Qorvo, Inc.

- SiTime Corporation

- TE Connectivity (First Sensor)

- Honeywell International Inc.

- Omron Corporation

- Panasonic Holdings Corporation

- ROHM Co., Ltd. (Kionix)

- Silex Microsystems

- Teledyne DALSA

- Sensata Technologies, Inc.

- Broadcom Inc.

- Silicon Sensing Systems Ltd.

- AAC Technologies.

Strategic Initiatives

- September 2025 - Infineon Technologies and Kaynes Semicon signed an MoU to explore collaboration, which included the launch of the first "Made in India" MEMS Microphone by Kaynes, featuring Infineon's bare die.

- March 2025 - MIMOS & SensoremTek formed a strategic partnership in Malaysia to advance the local production of MEMS microphone sensor wafers.

- March 2025 - Texas Instruments Incorporated (TI) introduced the smallest MCU (microcontroller) in the industry, which is 38% smaller than the current smallest, expanding TI's MSPM0 MCU portfolio.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 19.37 billion |

| Market Size in 2026 | USD 21.17 billion |

| Market Size in 2034 | USD 42.98 billion |

| CAGR | 9.3% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application, By Material, By Technology |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Micro-Electro-Mechanical System Market Segments

By Type

- Sensors

- Actuators

- RF MEMS

- Optical MEMS

- Microfluidics

By Application

- Consumer Electronics

- Automotive

- Industrial

- Healthcare/Bio-MEMS

- Telecom/Networking

- Aerospace & Defense

By Material

- Silicon

- Polymers

- Metals

- Ceramics

By Technology

- Bulk Micromachining

- Surface Micromachining

- High-Aspect-Ratio (DRIE/LIGA)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.