Europe Micromachining Market Size, Share & Trends Analysis Report By Type (Traditional, Nontraditional, Other), By Process (Additive, Subtractive, Others), By Axis (3-axis, 4-axis, 5-axis), By End-Use (Automotive, Semiconductors and Electronics, Aerospace and Defense, Healthcare, Telecommunications, Others) and By Country (U.S., Canada) Forecasts, 2025-2033

Europe Micromachining Market Size

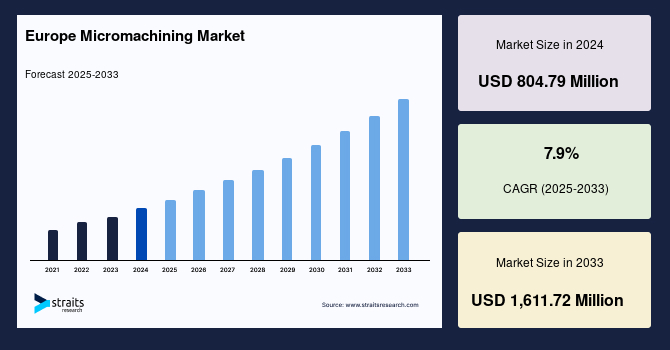

The Europe micromachining market was valued at USD 804.79 million in 2024 and is projected to reach USD 1,611.72 million by 2033, growing at a CAGR of 7.9% during the forecast period (2025-2033).

The increasing demand for precision manufacturing in industries such as automotive, aerospace, and electronics is driving the growth of the micromachining market in Europe. Furthermore, technological advancements, particularly in nontraditional micromachining processes, and the rise of Industry 4.0 fuel market expansion.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 804.79 Million |

| Estimated 2025 Value | USD 876.21 Million |

| Projected 2033 Value | USD 1,611.72 Million |

| CAGR (2025-2033) | 7.9% |

| Key Market Players | Coherent Inc., Georg Fischer Ltd., Makino, AMADA WELD TECH Co. Ltd., Coherent Inc. |

to learn more about this report Download Free Sample Report

Europe Micromachining Market Growth Factors

Precision Manufacturing in the Automotive Sector

The automotive industry is one of Europe's largest end-users of micromachining technologies, driving the market with a projected CAGR of 8.1%. As the demand for electric vehicles (EVs) and autonomous driving technologies rises, the need for precise components like sensors, battery parts, and lightweight materials increases. In 2025, Germany, the leading automotive market in Europe, is expected to invest over USD 5 billion in EV infrastructure, which will require micromachining solutions to develop intricate electronic components. Additionally, regulatory pressure on reducing carbon emissions drives innovation in lightweight materials, where micromachining is crucial in ensuring precision.

Market Restraining Factors

High Initial Costs and Technological Complexity

The high initial costs associated with micromachining equipment and the technological expertise required pose significant barriers, particularly for small and medium-sized enterprises (SMEs). The cost of advanced nontraditional micromachining systems can range between USD 100,000 and USD 300,000, making it a substantial investment. Additionally, the need for specialized training and skilled labor to operate these machines creates operational challenges. In regions like Eastern Europe, where manufacturing costs are lower, many SMEs struggle to adopt these technologies, slowing down overall market penetration.

Key Market Opportunities

Advancements in Nontraditional Micromachining

The nontraditional micromachining segment is projected to grow at the highest CAGR of 8.4% during the forecast period, driven by advancements in laser-based and electrochemical micromachining. These technologies enable high precision and are crucial in industries such as aerospace and healthcare, where conventional methods may fall short. In 2025, France announced a USD 1.2 billion investment in its aerospace industry, including innovations in micromachining to manufacture lightweight components and enhance aircraft performance. Such initiatives create lucrative opportunities for manufacturers specializing in advanced nontraditional micromachining solutions, especially as the focus on reducing waste and improving efficiency increases across industries.

Countries Insights

The Europe micromachining market is characterized by robust growth across Europe, driven by technological advancements and the demand for precision manufacturing in critical industries. Each sub-region presents unique growth drivers and challenges.

Germany is a hub for automotive and industrial manufacturing in Europe. The country’s focus on electric vehicle (EV) production drives the demand for micromachining technologies, particularly in precision parts manufacturing. In 2025, the German government is expected to invest over USD 2 billion in EV infrastructure, further boosting market growth.

The aerospace sector in France is a crucial contributor to the micromachining market, with significant investments in lightweight materials and precision manufacturing. In 2024, France allocated USD 1.2 billion towards innovations in aerospace technology, including micromachining, to enhance aircraft efficiency and performance.

The UK’s focus on advanced healthcare technologies, particularly in the medical device sector, propels demand for micromachining. The country’s emphasis on reducing healthcare costs while improving patient outcomes drives investments in micromachined components for medical devices like stents and implants.

Italy’s semiconductor and electronics industry is contributing to the growth of the micromachining market, particularly in nontraditional micromachining processes. With a focus on developing advanced electronic components, the country is witnessing increased adoption of laser micromachining technologies to enhance production efficiency.

The telecommunications sector in Spain is a crucial driver of micromachining demand, with investments in 5G infrastructure and smart technologies. In 2024, Spain announced a USD 500 million investment in 5G development, driving the need for precision-manufactured components in communication devices.

Known for its high-precision manufacturing capabilities, Switzerland’s focus on luxury watches and medical devices fuels the demand for micromachining technologies. The country’s strong emphasis on innovation and quality ensures a steady demand for advanced micromachining solutions.

Type Insights

Nontraditional Micromachining dominates the type segment and is expected to grow at a CAGR of 8.4% over the forecast period. Nontraditional processes such as laser micromachining offer unparalleled precision, which is critical in sectors like aerospace and electronics, which are significantly growing in Europe. The increasing adoption of advanced materials like composites and ceramics, which require non-contact machining methods, fuels demand for nontraditional techniques.

Process Insights

Subtractive Micromachining dominates the process segment and is expected to grow at a CAGR of 7.4% during the forecast period. Subtractive micromachining remains essential for creating high-precision components in European automotive and healthcare applications. The ability to produce complex geometries with minimal material waste makes it a cost-effective solution for manufacturers looking to optimize production.

Axis Insights

3-axis Micromachining dominates the axis segment and is expected to grow at a CAGR of 5.8% over the forecast period due to its wide application in prototyping and small-scale production. The simplicity and versatility of 3-axis micromachining systems make them ideal for SMEs in Europe, particularly in industries like electronics, where rapid prototyping is essential.

End-Use Insights

Automotive Industry dominates the end-use segment and is expected to grow at a CAGR of 8.1% during the forecast period. The increasing demand for lightweight, energy-efficient vehicles in Europe is boosting the need for micromachining solutions that produce intricate, high-quality parts, such as sensors and battery components.

List of Key and Emerging Players in Europe Micromachining Market

- Coherent Inc.

- Georg Fischer Ltd.

- Makino

- AMADA WELD TECH Co. Ltd.

- Coherent Inc.

- Electro Scientific Industries

- Georg Fischer Ltd.

- Han's Laser Process Industry Group Co. Ltd.

- IPG Photonics Corporation

- Makino

- MITSUBISHI HEAVY INDUSTRIES Ltd.

- OpTek Ltd.

- Oxford Lasers.

Analyst Perspective

As per our analyst, the Europe micromachining market is poised for rapid expansion in the coming years. This growth is largely driven by the increasing demand for precision manufacturing in critical automotive, aerospace, and healthcare industries. The shift towards electric vehicles and sustainable manufacturing practices creates a significant market for micromachined components. Additionally, advancements in nontraditional micromachining technologies, particularly laser-based solutions, are expected to play a pivotal role in shaping the market's future. Governments across Europe are investing in innovation and infrastructure, further boosting the market’s growth potential. The ongoing trend of Industry 4.0, emphasizing automation and precision, will continue to drive the adoption of micromachining technologies across various sectors.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 804.79 Million |

| Market Size in 2025 | USD 876.21 Million |

| Market Size in 2033 | USD 1,611.72 Million |

| CAGR | 7.9% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Process, By Axis, By End-Use |

to learn more about this report Download Free Sample Report

Europe Micromachining Market Segments

By Type

- Traditional

-

Non-traditional

- Electro Discharge Machining (EDM)

- Electrochemical Machining (ECM)

- Laser

- Hybrid

By Process

- Additive

- Subtractive

- Others

By Axis

- 3-axis

- 4-axis

- 5-axis

By End-Use

- Automotive

- Semiconductors & Electronics

- Aerospace & Defense

- Healthcare

- Telecommunications

- Power & Energy

- Plastics & Polymers

- Others

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.