United States Micromachining Market Size, Share & Trends Analysis Report By Type (Traditional, Nontraditional, Other), By Process (Additive, Subtractive, Others), By Axis (3-axis, 4-axis, 5-axis), By End-Use (Automotive, Semiconductors and Electronics, Aerospace and Defense, Healthcare, Telecommunications, Others) and Forecasts, 2025-2033

United States Micromachining Market Size

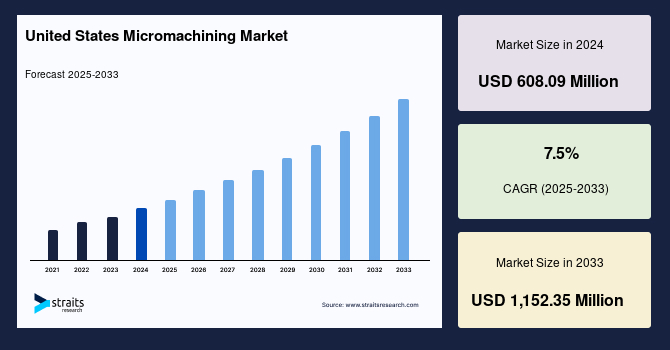

The United States micromachining market was valued at USD 608.09 million in 2024 and is projected to grow from USD 659.90 million in 2025 to reach USD 1,152.35 million by 2033, exhibiting at a CAGR of 7.5% during the forecast period (2025–2033).

The rise in precision manufacturing, particularly in the automotive, aerospace, and healthcare sectors, is the primary driver of market growth in the United States. In addition, the increasing adoption of electric vehicles (EVs) and advancements in medical devices fuel the demand for micromachined components in the U.S.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 608.09 Million |

| Estimated 2025 Value | USD 659.90 Million |

| Projected 2033 Value | USD 1,152.35 Million |

| CAGR (2025-2033) | 7.5% |

| Key Market Players | Coherent Inc., Georg Fischer Ltd., Makino, AMADA WELD TECH Co. Ltd., Coherent Inc. |

to learn more about this report Download Free Sample Report

United States Micromachining Market Growth Factors

Increasing Demand for Precision Manufacturing in the Healthcare Industry

The healthcare sector's rising demand for advanced, miniaturized medical devices is a significant driver of the micromachining market in the U.S. Medical technologies such as pacemakers, surgical tools, and diagnostic equipment require high-precision micromachined components for optimal performance. The U.S. healthcare industry, which accounts for nearly 20% of the country's GDP, invested USD 400 million in medical device manufacturing technologies in 2024, emphasizing the importance of precision in miniaturized devices. The growing use of minimally invasive surgeries and the development of microelectromechanical systems (MEMS) in medical applications further drive demand for micromachining.

Market Restraint

High Costs of Micromachining Technologies

The high initial cost of acquiring and maintaining micromachining equipment is a significant barrier to market growth. Advanced micromachining systems, particularly nontraditional methods like laser and electrochemical micromachining, can cost between USD 200,000 to USD 500,000. For small and medium-sized enterprises (SMEs) in the U.S., this high cost of entry, coupled with the need for skilled labor to operate complex machinery, limits the widespread adoption of micromachining technologies. Additionally, the ongoing costs of operation, maintenance, and replacing tools and parts further strain budgets, particularly in regions where industrial investments may be slower.

Market Opportunity

Growing Electric Vehicle (ev) Market

The U.S. automotive industry, particularly the electric vehicle (EV) sector, presents significant opportunities for the micromachining market. The shift towards electrification in the automotive industry has increased demand for precision components such as battery connectors, sensors, and lightweight materials, all of which require micromachining processes. In 2025, the U.S. EV market is expected to grow by 12%, with investments in EV manufacturing reaching over USD 30 billion. Government incentives and tax credits for EV production further boost the demand for micromachined components, making it a lucrative opportunity for micromachining firms to cater to the automotive industry.

Country Insights

The United States micromachining market is characterized by growth across key cities, each with a unique set of drivers and opportunities. The United States is North America's largest market for micromachining, driven by established industries such as automotive, semiconductors, and aerospace.

Detroit is a significant driver of micromachining demand and is known as the automotive hub of the U.S., particularly in the EV sector. With companies like General Motors investing USD 6.6 billion in EV manufacturing, the city's transition towards electric vehicle production fuels demand for precision components such as battery connectors, sensors, and control units.

Silicon Valley is critical in the micromachining market, particularly semiconductors and electronics. The demand for smaller, more efficient chips has led to increased investment in micromachining technologies. In 2025, the semiconductor industry in Silicon Valley is expected to grow by 9%, driving demand for advanced micromachining systems.

Houston has a growing need for precision manufacturing with its robust aerospace and defense industries. The aerospace sector, which contributed USD 52 billion to the local economy in 2024, relies heavily on micromachined components for aircraft engines and space exploration technologies.

Boston, as a leader in healthcare and medical device manufacturing, is driving growth in micromachining for miniaturized medical devices. The city’s medical technology industry, which grew by 8% in 2024, is increasingly adopting micromachining technologies for producing pacemakers, stents, and diagnostic equipment.

Seattle's aerospace industry, home to major players like Boeing, significantly contributes to the micromachining market. The city's focus on precision manufacturing for aircraft parts, particularly in producing lightweight materials for fuel efficiency, continues to drive demand for subtractive micromachining processes.

Austin’s booming tech industry, particularly in semiconductors and electronics, creates a substantial market for micromachining. The city’s semiconductor industry is expected to grow by 10% in 2025, driven by investments in precision manufacturing for electronics miniaturization and 5G technology.

Type Insights

Nontraditional Micromachining dominates the type segment and is expected to grow at a CAGR of 8.1% over the forecast period. Nontraditional micromachining, including laser and electrochemical processes, is becoming increasingly prevalent in industries such as healthcare and aerospace in the United States. These methods offer high precision and are well-suited for miniaturized medical devices and aerospace components, where intricate designs and material strength are critical.

Process Insights

Subtractive Micromachining dominates the process segment and is expected to grow at a CAGR of 7.0%, driven by the automotive and aerospace sectors in the United States. Subtractive methods are crucial for creating complex geometries and lightweight materials, which are essential for electric vehicle components and aerospace parts where weight and efficiency are prioritized.

Axis Insights

3-axis Micromachining dominates the axis segment and is expected to grow at a CAGR of 5.4% over the forecast period. The segment remains famous for its flexibility and cost-effectiveness in small to medium-scale manufacturing in the United States. 3-axis systems are widely used in prototyping and low-volume production, particularly in industries like healthcare and electronics, where smaller batch sizes are standard.

End-Use Insights

Automotive Industry dominates the end-use segment and is expected to grow at a CAGR of 7.8% during the forecast period. The growing emphasis on electric vehicles and autonomous driving systems in the United States drives demand for high-precision parts that can be produced using micromachining technologies.

Analyst Perspective

As per our analyst, the United States micromachining market is poised for rapid expansion in the coming years. This growth is largely driven by advancements in precision manufacturing across multiple industries, particularly in the automotive, healthcare, and aerospace sectors. The rise of electric vehicles, which require high-precision components produced through micromachining, is a significant factor driving the market. Additionally, the U.S. healthcare sector’s increasing adoption of miniaturized medical devices is fueling demand for nontraditional micromachining technologies. The aerospace industry’s focus on lightweight materials and fuel-efficient designs contributes to market expansion. Moreover, government support for advanced manufacturing technologies and investments in research and development will continue to play a significant role in shaping the future of the micromachining market in the U.S.

List of Key and Emerging Players in United States Micromachining Market

- Coherent Inc.

- Georg Fischer Ltd.

- Makino

- AMADA WELD TECH Co. Ltd.

- Coherent Inc.

- Electro Scientific Industries

- Georg Fischer Ltd.

- Han's Laser Process Industry Group Co. Ltd.

- IPG Photonics Corporation

- Makino

- MITSUBISHI HEAVY INDUSTRIES Ltd.

- OpTek Ltd.

- Oxford Lasers.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 608.09 Million |

| Market Size in 2025 | USD 659.90 Million |

| Market Size in 2033 | USD 1,152.35 Million |

| CAGR | 7.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Process, By Axis, By End-Use |

to learn more about this report Download Free Sample Report

United States Micromachining Market Segments

By Type

- Traditional

-

Non-traditional

- Electro Discharge Machining (EDM)

- Electrochemical Machining (ECM)

- Laser

- Hybrid

By Process

- Additive

- Subtractive

- Others

By Axis

- 3-axis

- 4-axis

- 5-axis

By End-Use

- Automotive

- Semiconductors & Electronics

- Aerospace & Defense

- Healthcare

- Telecommunications

- Power & Energy

- Plastics & Polymers

- Others

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.