Microplastic Detection Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Technology (Spectroscopy, FTIR Spectroscopy, Raman Spectroscopy), By Application (Water Treatment, Food & Beverage, Cosmetics, Environmental Monitoring, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Microplastic Detection Market Overview

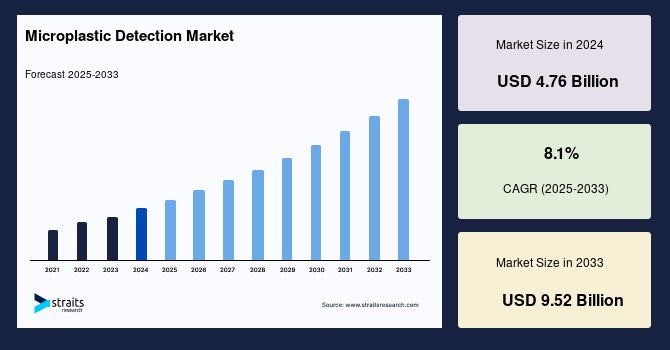

The global gold Microplastic Detection Market size was valued at USD 4.76 Billion in 2024 and is projected to reach from USD 5.10 Billion in 2025 to USD 9.52 Billion by 2033, growing at a CAGR of 8.1% during the forecast period (2025-2033).The growth of the market is attributed to stringent environmental regulations and public awareness.

Key Market Indicators

- Europe dominated the gold microplastic detection market and accounted for a 35% share in 2024

- Based on component , the solution segment, encompassing hardware like spectroscopy systems, microscopy equipment

- Based on technology, FTIR spectroscopy leads the technology segment due to its non-destructive

- Based on application , the water treatment segment commands the largest market share.

Market Size & Forecast

- 2024 Market Size:USD 4.76 Billion

- 2033 Projected Market Size:USD 9.52 Billion

- CAGR (2025-2033): 8.1%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The global microplastic detection market is experiencing robust growth, driven by escalating environmental concerns, stringent regulatory frameworks, and advancements in detection technologies. Microplastics, tiny plastic particles less than 5mm, pollute water, soil, and air, posing risks to ecosystems and human health. Increasing awareness of these impacts and government mandates like the EU Water Framework Directive fuel demand for precise detection solutions.

Additionally, industries such as water treatment, food and beverage, and cosmetics are adopting advanced technologies, including spectroscopy and microscopy, to comply with regulations and ensure product safety. Technological innovations, such as portable detection devices and AI-driven analytics, enhance efficiency and accessibility, particularly in developing regions. North America and Asia-Pacific lead due to strong regulatory support and industrial adoption, while Europe emphasises sustainable practices. The market’s trajectory reflects a global push to mitigate microplastic pollution through innovative, scalable solutions.

Microplastic Detection Market Trend

Advancements in Spectroscopy and Portable Detection Systems

A prominent trend in the market is the rapid advancement of spectroscopy techniques, particularly Fourier-Transform Infrared (FTIR) and Raman spectroscopy, alongside the development of portable detection systems. FTIR spectroscopy is valued for its non-destructive, high-specificity analysis of polymer types in environmental samples. Raman spectroscopy is driven by its ability to detect particles as small as 1 µm, critical for assessing health and environmental risks. Integrating miniaturised spectroscopy and AI-driven analytics, portable devices enable real-time monitoring in field studies, expanding accessibility in resource-limited regions.

- For instance, in May 2025, McGill University researchers developed "HoLDI-MS" (hollow-laser desorption/ionisation mass spectrometry), a cost-effective, high-throughput technology for detecting nanoplastics and microplastics. This 3D-printed platform enables direct analysis of samples without complex preparation, including waterborne plastic particles, making it ideal for field use and global monitoring efforts.

The trend aligns with regulatory pressures, such as the EPA’s water quality monitoring initiatives, and supports global efforts to combat microplastic pollution through precise, on-site detection.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 4.76 Billion |

| Estimated 2025 Value | USD 5.10 Billion |

| Projected 2033 Value | USD 9.52 Billion |

| CAGR (2025-2033) | 8.1% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Agilent Technologies, Thermo Fisher Scientific, Danaher Corporation, Shimadzu Corporation, Bruker Corporation |

to learn more about this report Download Free Sample Report

Microplastic Detection Market Growth Factor

Stringent Environmental Regulations and Public Awareness

Stringent environmental regulations and rising public awareness are key drivers of the microplastic detection market. Governments worldwide are implementing policies to curb plastic pollution, mandating industries to monitor and report microplastic emissions. The EU Water Framework Directive and the EPA’s water quality initiatives push for advanced detection in water treatment. Public awareness of microplastics in food, water, and air has surged, with studies like those from the UN Environment Programme highlighting 400 million tons of annual plastic waste.

- For example, in September 2024, India’s Food Safety and Standards Authority launched a project with research institutes to develop validated detection methods for food contaminants, reflecting global trends.

These regulations and heightened consumer demand for safe products drive adoption of spectroscopy and chromatography solutions, ensuring compliance and environmental safety across industries like food and beverage and cosmetics.

Market Restraint

High Costs of Advanced Detection Technologies

The high cost of advanced microplastic detection technologies poses a significant restraint, particularly for developing regions and small-scale industries. Sophisticated systems like FTIR spectroscopy, Raman spectroscopy, and electron microscopy require substantial investment, with equipment costs often exceeding USD 100,000. Maintenance, calibration, and skilled personnel further escalate expenses, limiting adoption in areas with restricted financial resources. Implementing these technologies' economic and technical challenges hinder broad-based monitoring in developing countries, where infrastructure is often inadequate.

- For instance, while North America and Europe benefit from robust funding and infrastructure, regions like Africa and parts of Asia struggle to afford such solutions. This creates disparities in global microplastic monitoring, delaying compliance with environmental standards. Developing affordable, portable alternatives is critical, but current high costs deter widespread adoption, impacting market growth in budget-sensitive markets and slowing progress toward comprehensive pollution mitigation.

Market Opportunity

Development of Cost-Effective and Portable Detection Solutions

Developing cost-effective, portable microplastic detection solutions presents a significant opportunity to expand market reach and address global pollution challenges. Portable devices, leveraging miniaturised spectroscopy and sensor technologies, enable real-time environmental monitoring in remote or resource-limited areas, enhancing accessibility.

- For instance, in March 2024, Danaher Corporation introduced the CytoFLEX nano Flow Cytometer, capable of detecting particles as small as 40 nm, ideal for field-based microplastic analysis.

- Similarly, Wayne State University’s USD 1.19 million Great Lakes Protection Fund grant, awarded in September 2024, supports an open-source library for microplastic detection, fostering scalable solutions.

By reducing costs and improving usability, portable systems empower industries and research institutions to monitor microplastics effectively, driving market expansion and environmental sustainability.

Regional Analysis

Europe holds a 39% share of the global microplastic detection market in 2025, driven by its stringent environmental regulations and advanced research ecosystem. The EU Water Framework Directive and the EU’s Green Deal, targeting plastic pollution reduction by 2030, propel demand for water treatment and environmental monitoring detection technologies. Germany, France, and the U.K. lead, with Germany’s 2024 allocation of EUR 15 million for microplastic research boosting innovation. The region’s cosmetics industry, a major adopter, complies with EU bans on product microplastics, with 70% of companies using detection systems by 2024. Europe’s focus on sustainability and circular economy initiatives, like the EU’s EUR 100 million Circular Bio-based Europe program in 2024, further drives market growth, reinforcing its leadership in combating microplastic pollution through advanced detection solutions.

- Germany, a key European market, drives microplastic detection through its advanced research and regulatory framework. The government allocated EUR 15 million in 2024 for microplastic studies, focusing on water and food safety. The EU’s Green Deal, targeting plastic pollution reduction, boosts demand, with 70% of cosmetics firms adopting detection systems. Shimadzu’s IRSpirit FTIR system, widely used in Germany, supports compliance. The market, valued at USD 0.95 billion in 2024, is projected to grow at a CAGR of 7.7% through 2033. Germany’s Industry 4.0 focus ensures steady growth in environmental monitoring applications.

- The U.K.is a significant market, driven by stringent regulations and research initiatives. The 2018 microplastic ban in cosmetics and DEFRA’s 2024 allocation of GBP 10 million for detection research fuel growth. With a 55% market share, the water treatment sector adopts FTIR and Raman spectroscopy. The market is projected to grow at a CAGR of 7.6% through 2033. The U.K.’s leadership in the EU’s Circular Bio-based Europe program, with EUR 100 million in support, enables sustainable detection solutions, ensuring steady market expansion in food and environmental applications.

Asia-Pacific Microplastic Detection Market Trends

Asia-Pacific is the fastest-growing region, with a projected CAGR of 9.2% through 2033, driven by rapid industrialisation, urbanisation, and increasing environmental awareness in China, India, and Japan. China’s 2021 ban on microplastics in cosmetics and India’s 2024 food safety initiative mandating detection in food products fuel market expansion. The region’s water treatment sector, handling 60% of global wastewater, demands advanced detection, with China investing USD 80 billion in water infrastructure. Japan’s Shimadzu Corporation expanded its spectroscopy portfolio, targeting environmental monitoring. The region’s growth is further supported by rising research, with Asia-Pacific contributing 40% of global microplastic studies, positioning it as a key hub for detection technology adoption.

- China dominates the Asia-Pacific market, holding a 45% regional share in 2024, driven by heavy industrialisation and plastic production. The 2021 microplastic ban in cosmetics and USD 80 billion water infrastructure investment in 2024 will fuel detection demand. The water treatment sector, handling 60% of global wastewater, relies on spectroscopy. China’s market is projected to grow at a CAGR of 9.4% through 2033. Government initiatives like the 14th Five-Year Plan emphasise pollution control, reinforcing China’s leadership in microplastic detection technology adoption.

- India’s microplastic detection market is growing rapidly, driven by urbanisation and regulatory advancements. The 2024 Food Safety and Standards Authority project, with USD 5 million funding, develops detection methods for food contaminants. The water treatment sector, spurred by USD 12 billion infrastructure projects like Mumbai 3.0 in 2025, boosts demand. The market grows at a CAGR of 8.5% through 2033. India’s 40% contribution to global microplastic studies in 2024 and rising environmental awareness drive adoption in the water and cosmetics sectors.

North America Microplastic Detection Market Trends

North America holds a significant market share, growing at a CAGR of 8.0% through 2033. The region’s growth is driven by robust R&D, regulatory support, and adoption of water treatment and food safety. The U.S. EPA’s 2024 water quality monitoring initiative and USD 10 million annual funding for microplastic research spur innovation. The food and beverage sector, with 65% of U.S. firms using detection systems in 2024, fuels demand. Danaher’s CytoFLEX nano Flow Cytometer, launched in March 2024, enhances water and food safety applications. North America’s leadership in technological innovation, with companies like Agilent and Thermo Fisher advancing spectroscopy, ensures steady growth, addressing microplastic challenges in environmental and public health domains.

- The U.S. leads the global market, driven by robust R&D and regulatory support. The EPA’s 2024 water quality monitoring initiative and USD 10 million annual microplastic research funding propel water treatment and food safety adoption. In September 2024, the U.S. Department of Energy awarded Wayne State University USD 1.19 million to develop an open-source microplastic detection library, enhancing environmental monitoring. Companies like Danaher and Agilent are advancing spectroscopy solutions fueled by innovation and public health concerns.

- Canada’s microplastic detection market is expanding, driven by environmental monitoring and water treatment needs. The USD 50 million Clean Water and Wastewater Fund, extended in 2025, supports detection technologies in treatment facilities. The market benefits from a 5% rise in environmental research funding, focusing on microplastics in the Great Lakes. Canadian firms leverage FTIR spectroscopy for water and soil analysis, with the water segment holding a 51% share. The market is projected to grow at a CAGR of 7.9% through 2033, supported by government initiatives and proximity to U.S. innovation hubs.

Component Insights

The solution segment, encompassing hardware like spectroscopy systems, microscopy equipment, and portable detectors, dominates the microplastic detection market due to its essential role in enabling precise identification and quantification of microplastics. The demand for advanced hardware is driven by stringent environmental regulations and the need for real-time monitoring in water treatment and food safety. The market is fueled by innovations in portable devices. The growth is further supported by increased research funding, with the U.S. allocating USD 10 million annually to detection studies. Its critical role in scaling detection capabilities across industries reinforces the segment's dominance, ensuring compliance with global standards and addressing public health concerns.

Technology Insights

FTIR spectroscopy leads the technology segment due to its non-destructive, highly specific analysis of microplastic polymers. Its widespread adoption in environmental monitoring and food safety drives growth, benefiting the segment from regulatory mandates like the EU Water Framework Directive. For example, Thermo Fisher Scientific’s Nicolet iS20 FTIR Spectrometer, upgraded in 2023, enhances microplastic identification accuracy. The technology’s ability to analyse diverse sample types, including water and soil, supports its dominance. Growth is further propelled by increasing academic and industrial research, with over 1,500 studies published globally on microplastic detection, underscoring FTIR’s critical role in addressing environmental pollution.

Application Insights

The water treatment segment commands the largest market share, driven by the urgent need to monitor microplastics in drinking water, wastewater, and marine environments. Rising regulatory pressure, such as the EPA’s water quality initiatives, fuels demand for detection technologies in treatment facilities. The microplastic detection market is expected to grow, with water treatment leading due to its role in ensuring public health.

- For instance, Danaher Corporation’s CytoFLEX nano Flow Cytometer, launched in March 2024, detects particles as small as 40 nm, enhancing water quality assessments. Urbanisation and industrial wastewater challenges in Asia-Pacific further drive growth. The segment’s dominance is supported by global initiatives, such as the UN’s Decade of Ocean Science, promoting advanced detection to mitigate microplastic pollution in aquatic ecosystems.

List of Key and Emerging Players in Microplastic Detection Market

- Agilent Technologies

- Thermo Fisher Scientific

- Danaher Corporation

- Shimadzu Corporation

- Bruker Corporation

- PerkinElmer Inc.

- Horiba Ltd.

- JEOL Ltd.

- Zeiss Group

- Nikon Corporation

- Hitachi High-Tech

- Oxford Instruments

- Malvern Panalytical

- Anton Paar GmbH

to learn more about this report Download Market Share

Recent Development

Aug 2025:Shimadzu released a Particle Analysis System for Microplastics promoted as the “world’s first quick and accurate measurement of particle mass and volume” combining IR microscope with infrared/Raman microscopy for rapid particle mass/volume measurements . This is a direct product development aimed at microplastics laboratories.

June 2025: Bruker’s Applied MS business unveiled innovations at , including the new timsMetabo platform oriented to PFAS and environmental-contaminant detection Bruker explicitly frames this as support for environmental monitoring workflows (PFAS / low-mass contaminants), which is adjacent and highly relevant to environmental microcontaminant detection markets.

July 2025: Agilent signed an agreement with Nanyang Technological University’s NEWRI (Nanyang Environment & Water Research Institute) to enhance water-contaminant research in Singapore, explicitly calling out analytical workflows that support emerging contaminants (including microplastics) and joint work on environmental monitoring.

May 2025:Agilent co-hosted a webinar (22 May 2025) on Microplastics Analysis (LDIR / GC-MS / pyrolysis workflows) the webinar describes use cases and workflows (LDIR imaging, pyrolysis-GC/MS etc.) for microplastic identification/quantification in environmental and food matrices.

May 2025: Shimadzu’s MAP-100 Microplastic Automatic Preparation Device (automates pretreatment/extraction of microplastics from water samples) was listed in the Japanese Ministry of the Environment’s “Reducing Leakage of Microplastics: Good Practices by the Japanese Business Sector” recognition that positions the device for routine environmental monitoring workflows.

April 2025: Agilent product literature (LDIR 8700 Chemical Imaging System) explicitly positions the 8700 LDIR as a fast, automated solution for microplastics workflows (imaging + spectral matching) a commercial product/solution development relevant to labs scaling microplastic analysis.

Feb 2025: ResearchAndMarkets / BusinessWire published a Microplastic Detection Market Report (28 Feb 2025) that lists Thermo Fisher Scientific, Agilent, Bruker, Shimadzu, Danaher among the prominent players and discusses market drivers (regulation, environmental monitoring needs) useful evidence that Thermo Fisher (and the other firms) are actively referenced in 2025 market developments.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 4.76 Billion |

| Market Size in 2025 | USD 5.10 Billion |

| Market Size in 2033 | USD 9.52 Billion |

| CAGR | 8.1% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Technology, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Microplastic Detection Market Segments

By Component

- Solution

- Services

By Technology

- Spectroscopy

- FTIR Spectroscopy

-

Raman Spectroscopy

- Microscopy

- Chromatography

- Others

By Application

- Water Treatment

- Food & Beverage

- Cosmetics

- Environmental Monitoring

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.