Modular Data Center Market Size, Share & Trends Analysis Report By Type (Containerized Data Centers, Prefabricated Data Centers, All-in-one datacenters), By Technology (Function Modules, Services, Cooling Technologies, Management Software & Automation), By Deployment Model (On-Premises Deployment, Modular Data Center as a Service (DCaaS), Edge Deployment, Hybrid Deployment), By Application (Telecommunications, Finance, Education & Research, Healthcare, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Modular Data Center Market Overview

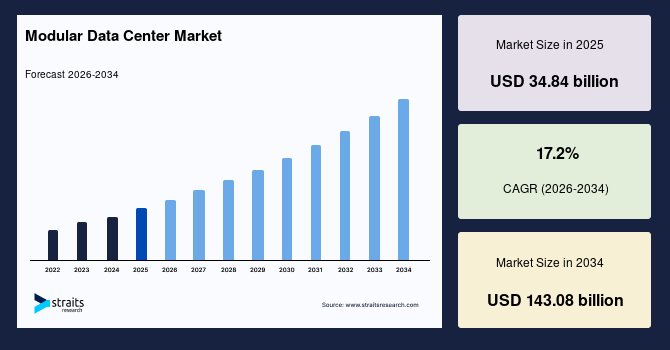

The global modular data center market size is valued at USD 34.84 billion in 2025 and is estimated to reach USD 143.08 billion by 2034, growing at a CAGR of 17.2% during the forecast period. Consistent growth of the market is supported by the rising demand for scalable and energy-efficient IT infrastructure, growing adoption of edge computing, and rapid digital transformation across industries. The ability of modular data centers to enable faster deployment, cost efficiency, and enhanced flexibility is further accelerating their adoption among enterprises and cloud service providers worldwide.

Key Market Trends & Insights

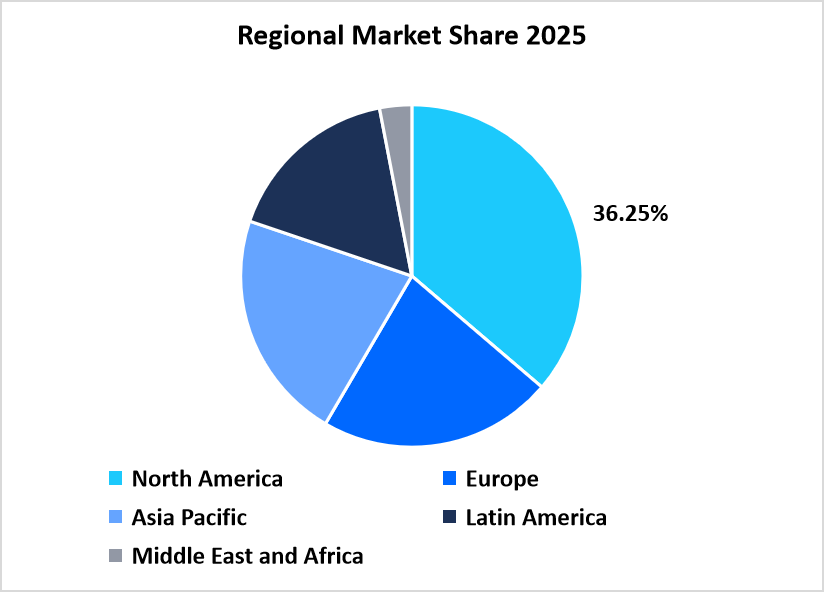

- North America dominated the market with a revenue share of 36.25% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 18.65% during the forecast period.

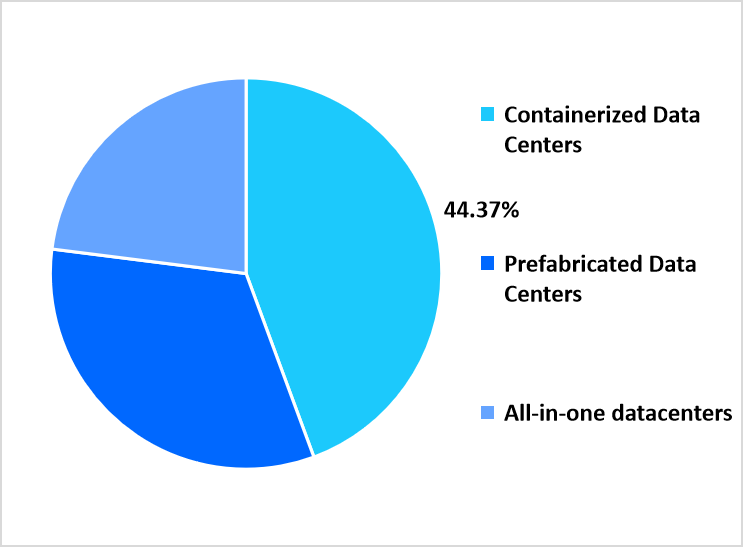

- Based on type, the Prefabricated Data Centers segment held the highest market share of 44.37% in 2025.

- By technology, the Management Software & Automation segment is estimated to register the fastest CAGR growth of 18.92%.

- Based on deployment model, the Edge Deployment segment dominated the market in 2025 with a revenue share of 39.74%

- By application, the Telecommunications segment is projected to grow at a CAGR of 17.85% during the forecast period.

- The U.S. dominates the modular data center market, valued at USD 11.95 billion in 2024 and reaching USD 13.28 billion in 2025.

Table: U.S Modular Data Center Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 34.84 billion

- 2034 Projected Market Size: USD 143.08 billion

- CAGR (2026-2034): 17.2%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

Global market consists of pre-assembled, movable, and expandable data infrastructure solutions with the capability of fast deployment and greater operational efficiency. The systems are classified by type as All-in-One Modules, Individual Functional Modules, and Containerized Data Centers, aiming to meet various capacity and design needs. Technologically, the market consists of Cooling Systems, Power Modules, IT Modules, and Others, in order to provide maximum performance and energy efficiency. By deployment model, modular data centers are categorized into Edge Deployment, Cloud Deployment, and On-Premises Deployment, which facilitates elastic scalability across businesses. In addition, by application, they support various industry verticals including Telecommunications, IT & Data Processing, Healthcare, Defense, Banking, Financial Services & Insurance (BFSI), and Energy & Utilities. These prefabricated facilities allow for fast scalability, lower latency, and increased resilience, responding to the increasing worldwide need for dynamic and sustainable data infrastructure.

Latest Market Trends

Transition from Traditional Data Centers to Modular, Scalable Facilities

The global data center landscape is being reshaped through the move of organizations from traditional, monolithic centers to modular and prefabricated centers. Monolithic centers typically have lengthy build times, high capital expenditures, and low scalability. Modular data centers, on the other hand, facilitate rapid deployment, cost savings, and on-demand scalability through pre-fabricated units that are easily added or relocated. This is a reflection of the growing requirement for flexibility and operational resiliency, particularly by organizations that have adopted the hybrid IT model. Organizations are increasingly employing modular infrastructure to allow for fluctuating workloads, digital transformation initiatives, and edge computing requirements.

Edge Computing Driving Decentralized Deployment

The exploding growth of Internet of Things (IoT), 5G networks, and applications that are latency-sensitive is fueling demand for edge-based modular data centers. In contrast to centralized implementations, edge deployments place computing resources close to sources of data in order to reduce transmission delay and improve real-time analytics. Telecommunications, manufacturing, and autonomous systems companies are increasingly leveraging edge modular data centers to process data locally while being connected to core cloud infrastructures. This phenomenon is redefining network planning by integrating centralized and distributed computing for better performance.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 34.84 billion |

| Estimated 2026 Value | USD 40.83 billion |

| Projected 2034 Value | USD 143.08 billion |

| CAGR (2026-2034) | 17.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Huawei Technologies Co.Ltd., Schneider Electric SE, Vertiv Group Corp., Dell Technologies Inc., Hewlett-Packard Enterprises Development LP |

to learn more about this report Download Free Sample Report

Market Driver

Increasing Demand for AI and High-Performance Computing (HPC) Infrastructure

The accelerating increases in artificial intelligence (AI), machine learning, and data analytics workloads are fueling heavy demand for modular data centers with creative cooling and high-density power solutions. Traditional data centers have a hard time supporting the thermal and energy requirements of AI and high-performance computing (HPC) clusters. Modular architectures, made up of scaling rack configurations and liquid-cooling systems, are an affordable way of hosting these compute-intensive workloads. The increase in the development of training AI models, autonomous systems, and data-intensive applications is compelling government and private organizations to invest in next-generation modular infrastructures to spur innovation and performance.

Market Restraint

Regulatory Fragmentation and Absence of Standardized Compliance Systems

Major restraints in the modular data center market is the lack of consistent global standards and regulatory alignment around design, deployment, and operational standards. Every nation or region has unique standards for data privacy, fireproofing, and electrical certifications that make cross-border modular implementations difficult. For instance, while the European Union has rigorous GDPR compliance and energy-efficiency certifications, a number of new economies do not have well-defined modular infrastructure certification guidelines. Regulatory fragmentation slows down the approval of projects, raises compliance costs, and restricts vendors' scalability to expand globally, thus hindering market uniformity and development.

Market Opportunity

Rising Need for Edge-Centric Infrastructure

The fast-growing deployment of 5G, IoT, and AI-based applications is creating massive opportunities for modular data center vendors to provide edge-centric infrastructure. Businesses are venturing more and more into decentralizing their IT workloads to minimize latency and enhance data processing at locations close to end-users. Modular data centers, with their small footprints and quick deployment capabilities, are a best-fit solution for this emerging trend. Telecom carriers and smart city projects are actively rolling out edge-ready modular data centers to handle traffic efficiently. This shift towards localized processing will release huge growth opportunities, especially in emerging economies embracing country-level digital connectivity initiatives.

Regional Analysis

North America led the modular data center market in 2025 with a 36.25% market share. The region's superiority is due to its advanced IT infrastructure, fast cloud service growth, and high enterprise use of modular and prefabricated solutions for scalability. The region is aided by large-scale digital transformation initiatives across sectors like BFSI, healthcare, and telecommunications, which are increasingly incorporating modular facilities to improve resilience as well as shorten deployment cycles. In addition to that, ongoing investment in high-performance computing (HPC), edge data nodes, and green energy systems is further supporting North America's leading position. The dominant presence of hyperscale providers and high participation from the private sector is still driving innovation and modular deployment in the U.S. and Canada.

The U.S. market for modular data centers is witnessing steady growth with increasing demand for quick digital infrastructure deployment both in metropolitan and rural areas. Enterprises are embracing modular units to increase disaster recovery capacity, minimize carbon prints, and enable hybrid IT environments. The U.S. government's ongoing efforts towards critical digital infrastructure modernization, together with business spending on AI data processing and local cloud nodes, is driving expansion across the country. To that end, the nation is also seeing increasing use of modular micro data centers within smart city structures as well as public sector digital programs. Strategic partnerships between telecom carriers and modular infrastructure providers are also driving local data capacity further, making the U.S. a leading innovation hub of the overall global modular data center environment.

Asia Pacific Market Insights

Asia Pacific is becoming the fastest-growing region and is expected to achieve a CAGR of 18.65% through the forecast period. This expansion is driven by rising data localization needs, robust industrial digitalization, and urbanization in key economies like China, India, Japan, and Singapore. Large-scale demand for modular infrastructure is being driven by expanding 5G networks, edge computing nodes, and hyperscale cloud zones. Governments in the region are facilitating this growth by promoting private data center investment via support policies and tax breaks. Moreover, regional businesses are increasingly implementing modular facilities to facilitate scalable and energy-efficient data operations in high-density city environments.

The Indian modular data center market is growing at a rapid pace driven by the growth in digital economy initiatives, cloud adoption, and enterprise demands for decentralized IT infrastructure. The market is experiencing intense private investment in modular edge deployments in tier-2 and tier-3 cities to facilitate localized cloud access and AI-based applications. Big telecom and IT companies are leveraging prefabricated data units to improve rural connectivity and business continuity in the event of power grid outages. New financing models and modular leasing deals are also expanding access to advanced infrastructure among mid-sized and smaller businesses. As India consolidates its position as a digital manufacturing and information technology services hub, modular data centers are proving to be a fulcrum of the long-term digital infrastructure development strategy of the nation.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe market is being propelled by the increasing requirement for scalable and efficient data infrastructure. The leadership of the region is a result of aggressive sustainability targets and increased use of prefabricated modules to achieve net-zero emissions in various industries. The European Union's Green Data Center Initiative and universal corporate pledges towards carbon neutrality are driving the adoption of liquid cooling and renewable-powered modular data centers. In addition, more investment in digital transformation from banking, telecommunication, and manufacturing industries is driving the adoption of edge-based modular units to drive real-time analytics and data sovereignty needs across the continent.

Germany's data center market for modular is experiencing strong growth, fueled by heightened enterprise demand for quick scalability of IT as well as conformity with stringent data localization rules under GDPR. Market-leading industrial and colocation companies are using containerized and hybrid modular solutions to host AI workloads and digital twins in smart manufacturing environments. Strong renewable energy networks and waste-heat reuse adoption in data centers in the country are further supporting leadership in sustainable modular deployments. Strategic deployments by leading hyperscale players in Frankfurt, Munich, and Berlin alongside government bonuses for energy-efficient infrastructure—are making Germany the region's technological hub for modular data center innovation in Europe.

Latin America Market Insights

The Latin America modular data center market is expanding strongly as digital transformation drives in Brazil, Mexico, and Chile. Enterprises in the region are using modular solutions to bypass power and connectivity challenges in emerging economies. In addition, data localization regulations and the rollout of 5G networks are driving demand for modular edge deployments to accelerate data processing and minimize latency. Cloud service providers are coming together with local telcos to develop prefabricated, scalable infrastructure to cater to surging demand for online services, fintech solutions, and e-commerce data management.

Brazil's market is growing as a result of hyperscale investment convergence and indigenous enterprise transformation. Large banks and e-commerce companies are embracing modular designs to provide business resilience amid sudden bursts of data traffic. Furthermore, the nation's increasing renewable energy generation, particularly solar and hydroelectric power, is driving the development of green and self-sufficient modular data centers. Domestic system integrators are teaming up with global data center solution providers to install modular units in Tier II cities to overcome latency concerns and increase nationwide digital infrastructure coverage.

Middle East and Africa Modular Data Center Market Insights

The Middle East and Africa market is progressing as regional governments make smart city programs and AI integration plans more rapid. High energy efficiency, reduced deployment time, and scalability are the major drivers of adoption by public and private sectors. Organizations are investing in modular centers to enable local cloud service and sovereign data hosting, particularly where traditional data centers are hampered by power and cooling constraints.

The UAE modular data center market is picking up pace with aggressive digital transformation initiatives and expenditure on green data infrastructure. The nation's "Digital Economy Strategy" is pushing companies toward embracing modular spaces that are energy-efficient and can function effectively in hot climates based on innovative liquid and immersion cooling technologies. Strategic partnerships between regional telecom companies and international data infrastructure providers are facilitating swift deployment of edge-capable modular data centers in Dubai, Abu Dhabi, and Sharjah. With growing hyperscale and AI applications, the UAE is emerging as a regional hotspot for modular data infrastructure innovation, reconciling digital growth with green efficiency metrics.

Type Insights

The prefabricated data centers segment led the market with a revenue share of 44.37% in 2025. This is stimulated by increasing enterprise adoption of scalable, factory-assembled modules to deploy more quickly and with greater operational reliability

The All-in-One data centers segment is expected to experience the highest growth, posting an estimated CAGR of approximately 18.92% over the forecast period. A high growth is driven by growing adoption among SMEs and remote-edge facilities for space-efficient, pre-integrated systems that integrate IT, cooling, and power infrastructure into one enclosure.

By Type Market Share (%), 2025

Source: Straits Research

Technology Insights

The cooling technologies segment led the market with a revenue market share of 32.48% in 2025. The demand is fueled by growing interest in high-density computing and artificial intelligence workloads, which need reliable thermal management solutions to enable peak performance as well as energy efficiency.

The management software & automation segment is expected to lead with the highest CAGR of 18.92% over the forecast period. This is driven by an increased requirement for intelligent monitoring, predictive maintenance, and remote asset management for modular infrastructures.

Deployment Model Insights

The edge deployment segment dominated the market in 2025 with 39.74% revenue share, as the increasing demand for low-latency data processing and proximity-based computing power drove demand. The rapid deployment of 5G infrastructure, IoT environments, and AI applications has driven the demand for nearer-decentralized data centers closer to end users.

Hybrid deployment segment is also anticipated to register the highest growth rate during the forecast period, assisted by growing enterprise preference towards consolidating on-premises systems with public and private cloud infrastructures. The hybrid model offers operational flexibility, enhanced security, and optimal resource utilization.

Application Insights

The telecommunications segment is expected to witness a CAGR of 17.85% during the forecast period because of the explosive rise in data consumption and network densification of worldwide 5G and IoT ecosystems. As telecom operators expand their infrastructure for supporting high-speed connectivity, they are more and more placing modular data centers to support increasing data traffic as well as edge processing requirements.

Competitive Landscape

The global market is fragmented and has well-established vendors for technology and infrastructure solutions that provide highly customizable, power-effective modular systems. A number of prominent players have a significant market share by virtue of their robust product portfolio, global deployment capabilities, and strong focus on sustainability-driven innovation.

Industry players such as Hewlett-Packard Enterprises Development LP, Huawei Technologies Co. Ltd., Schneider Electric SE and others are in tough competition to expand market share through product differentiation, alliances, and expansion into emerging markets. The companies are putting emphasis on quick deployment solutions, liquid cooling support, and AI-powered monitoring systems to optimize operational efficiency and reliability of modular data centers.

Latos Data Centres: An emerging market player

Latos Data Centres, a UK digital infrastructure company established in 2021, has fast established itself within the modular data center segment as a provider of fast-deploy, renewable-energy-powered edge and hyperscale centers.

- In September 2025, Latos gained planning consent for a USD 130 million modular "neural-edge" data centre in Stockton-on-Tees, delivering two data halls and ultra-low latency cloud services by 2027.

In this way, Latos has established itself as a serious force in the international modular data center marketplace, with standardized modular building, energy-efficient engineering, and a nationwide roll-out plan of 40 sites by 2030.

List of Key and Emerging Players in Modular Data Center Market

- Huawei Technologies Co.Ltd.

- Schneider Electric SE

- Vertiv Group Corp.

- Dell Technologies Inc.

- Hewlett-Packard Enterprises Development LP

- IBM Corporation

- Eaton Corporation plc

- Rittal GmbH & Co. KG

- Cisco Systems, Inc.

- Caterpillar Inc.

- Johnson Controls International plc

- CommScope Holding Company, Inc.

- BladeRoom Group Ltd.

- Eltek

- STULZ GmbH

- Flexenclosure AB

- ZTE Corporation

- E+I Engineering Group

- Smart Modular Technologies

- BASELAYER Technology, LLC

- Others

Strategic Initiatives

- August 2025: Vertiv Holdings Co. announced the completion of its acquisition of Great Lakes Data Racks & Cabinets (~USD 200 million), enhancing its integrated infrastructure solutions for high-density modular data centers and expanding its rack and white-space capabilities globally.

- July 2025: Modine Manufacturing Company announced a USD 100 million investment in its North American manufacturing capacity to scale production of critical modular data-centre cooling equipment.

- June 2025: Schneider Electric SE launched its Prefabricated Modular EcoStruxure Pod Data Centre solution, built to support high-density racks up to 1 MW and beyond, enabling rapid deployment of AI-centric data centres globally.

- May 2025: Huawei Technologies Co. Ltd. Digital Power unveiled its “RAS™” framework for next-generation AI data centres and announced support for Uzbekistan’s USD1.5 billion AI development strategy via modular infrastructure.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 34.84 billion |

| Market Size in 2026 | USD 40.83 billion |

| Market Size in 2034 | USD 143.08 billion |

| CAGR | 17.2% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Technology, By Deployment Model, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Modular Data Center Market Segments

By Type

- Containerized Data Centers

- Prefabricated Data Centers

- All-in-one datacenters

By Technology

- Function Modules

- Services

- Cooling Technologies

- Management Software & Automation

By Deployment Model

- On-Premises Deployment

- Modular Data Center as a Service (DCaaS)

- Edge Deployment

- Hybrid Deployment

By Application

- Telecommunications

- Finance

- Education & Research

- Healthcare

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.