Next-Generation Firewall Market Size, Share & Trends Analysis Report By Product Type (Hardware NGFW, Virtual NGFW, Cloud-Native NGFW), By Technology Features (Deep Packet Inspection (DPI), Intrusion Prevention System (IPS), Application Control, Threat Intelligence Integration, AI/ML-enabled Threat Detection), By End-Use Industry (BFSI, Defense, Telecom, Healthcare, Retail, Education, Energy & Utilities, IT Services, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Next-Generation Firewall Market Overview

The global next-generation firewall (NGFW) market size is valued at USD 5.9 billion in 2025 and is estimated to reach USD 17.23 billion by 2034, growing at a CAGR of 13.2% during the forecast period. The steady expansion of the market is driven by the rising need for advanced threat prevention, deep packet inspection, and AI-enabled detection capabilities to combat encrypted and sophisticated cyberattacks. Increasing multi-cloud adoption, regulatory compliance requirements, and the shift toward zero-trust network architectures further accelerate the demand for next-generation firewall solutions across enterprises and service providers.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 35.54% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 15.82% during the forecast period.

- Based on product type, the Hardware NGFW segment held the highest market share of 52.61% in 2025.

- By technology features, Deep Packet Inspection (DPI) segment held a market share of 34.58 % in 2025.

- Based on end-use industry, the BFSI segment is projected to grow at a CAGR of 14.12% during the forecast period.

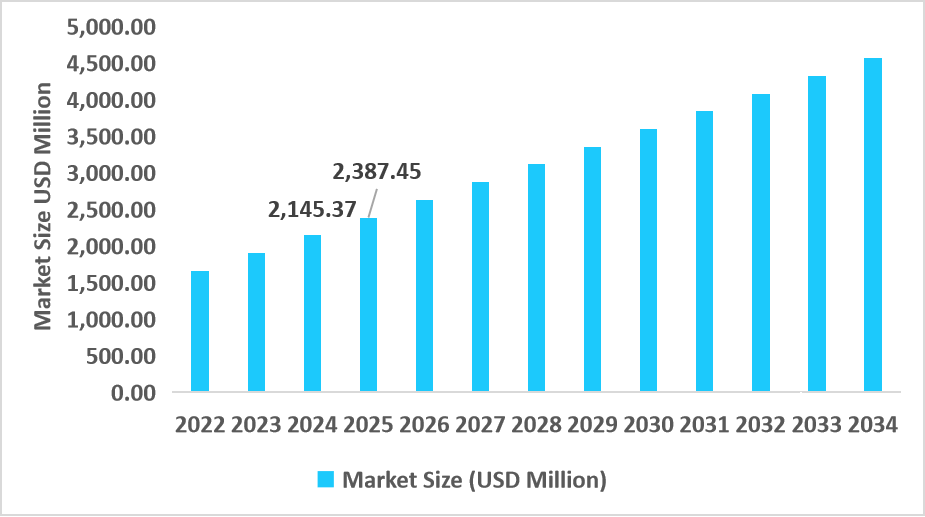

- The U.S. dominates the Next-Generation Firewall market, valued at USD 2.14 billion in 2024 and reaching USD 2.38 billion in 2025.

Table: U.S next generation firewall market Size (USD Million)

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 5.9 billion

- 2034 Projected Market Size: USD 17.23 billion

- CAGR (2026-2034): 13.2%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The next generation firewall market covers an all-encompassing suite of advanced network security technologies, including deep packet inspection, intrusion prevention systems, application control, threat intelligence integration, and AI/ML-enabled threat detection capabilities. These functionalities come on different product formats, such as hardware NGFW appliances, virtual NGFW deployments, and cloud-native firewall-as-a-service platforms.

NGFW solutions find applications in a wide range of end-use industries: BFSI, defense, telecom, healthcare, retail, education, energy and utilities, IT services, and other enterprise sectors intended for data center, branch network, cloud environment, and critical infrastructure security. By combining policy-driven controls with real-time threat prevention, next-generation firewalls protect organizations from emergent threats with comprehensive technology-driven protection in global market.

Latest Market Trends

Transition from Appliance-Centric Security to Unified Cloud-Delivered Protection

Network security is in transition from appliance-centric, location-bound firewall deployments to holistic, cloud-delivered protection models that include FWaaS, centralized policy orchestration, and real-time threat visibility. In the past, organizations had to manage firewalls for data centers, each branch site, and remote offices separately, which resulted in inconsistency in policies, operational complexity, and an inability to scale security across diverse environments.

Today, cloud-native NGFW platforms unify the dashboards with automated updates and elastic throughput, thus enabling organizations to secure users and workloads wherever. Deployments involving hardware NGFWs at critical sites, integrated with cloud-native enforcement layers, have shown significant improvements in operational efficiency, policy consistency, and attack surface reduction. This holistic approach brings a number of key benefits: improved visibility across hybrid networks, reduced risks related to misconfigurations, and stronger adherence to compliance positions than ever-a decisive shift toward more agile, cloud-aligned cybersecurity architectures.

Acceleration of Encrypted Traffic Inspection Driven by Rising TLS Adoption

The sudden spike in encrypted internet traffic reshaped the security landscape, and detecting threats in encryption became an operational priority for enterprises. Most of the firewall deployments over the last few years were unable to inspect encrypted traffic due to performance degradation and limited visibility into TLS. However, in recent times, dramatic growth in the adoption of TLS 1.3 along with evolving evasion techniques employed by hackers have pushed encrypted traffic analytics to the heart of NGFW innovation. Advanced decryption offloading, hardware acceleration, and AI-assisted pattern analysis power the modern NGFWs to identify malicious behavior at speed. This marks growing enterprise awareness that encrypted channels-earlier perceived as inherently safe-have now emerged as prime vectors for sophisticated malware, command-and-control activity, and ransomware payloads.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 5.9 billion |

| Estimated 2026 Value | USD 6.68 billion |

| Projected 2034 Value | USD 17.23 billion |

| CAGR (2026-2034) | 13.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Cisco Systems, Inc., Check Point Software Technologies Ltd., Barracuda Networks, Inc., SonicWall Inc., Juniper Networks, Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Government-mandated cybersecurity compliance is accelerating NGFW adoption

With global cybersecurity regulations tightening up fast, organizations are upgrading from legacy firewalls to advanced NGFW platforms that can do deep inspection, threat intelligence correlation, and identity-based access control. More stringent compliance mandates by governments in North America, Europe, and Asia are directly driving this demand for higher-grade network security controls.

The U.S. Cybersecurity and Infrastructure Security Agency has stressed mandatory implementation of advanced network monitoring and encrypted traffic inspection across all federal agencies, a reason for the next-generation firewall deployment drive across the country. Likewise, under the European Union's NIS2 Directive, critical sectors such as energy, financial services, healthcare, and transportation have been obligated to deploy more sophisticated perimeter security measures, including intrusion prevention and continuous threat scanning.

Market Restraint

Regulatory Conflicts and Encryption Privacy Mandates throttle full-scale NGFW deployments

One significant constraint in the next generation firewall market is the growing tension between nation-state security needs and worldwide regulations around data privacy, wherein organizations can only go so far in carrying out deep inspection of encrypted traffic.

Government agencies in several countries, including the US, the UK, Singapore, and Australia, have introduced national cybersecurity directives that encourage the use of more network inspections capable of detecting encrypted threats. However, these mandates come into conflict with the strict privacy laws of the European Union's GDPR and other data-sovereignty acts, which place limits on how much user data can be decrypted, inspected, or stored by security systems.

Market Opportunity

Growing Demand for Distributed Security in Edge-Heavy Enterprises

The rapid expansion of edge computing, remote operational sites, and distributed digital ecosystems creates significant new opportunities for next-generation firewall vendors. As enterprises extend their networks to smart factories, retail chains, branch offices, logistics hubs, and IoT-enabled environments, the need for consistent and centrally managed perimeter protection increases steeply. This shift is especially prominent in industries managing large volumes of real-time data at the edge, where traditional firewall architectures struggle to maintain uniform visibility and policy enforcement.

Only next-generation firewalls oriented to highly distributed environments can meet such emerging needs by providing lightweight enforcement nodes, centralized orchestration, and seamless integration across physical, virtual, and cloud edges. This increasing need for unified security in multi-edge infrastructures presents immense possibilities for NGFW vendors to provide scalable solutions that protect a variety of endpoints, allow consistency of policies, and support the migration of enterprises toward dispersed digital operations.

Regional Analysis

North America accounted for 35.54% of the total revenue and dominated the market in 2025. The region's large-scale adoption of secure, hybrid cloud models and rapid modernization of enterprise networks to support remote operations are credited for this leadership. Accelerated integrations of advanced inspection systems across financial services, technology, and healthcare organizations have been pursued to ensure uniform security across distributed infrastructures. Furthermore, strong collaboration between cybersecurity vendors, research institutions, and private-sector security operations centers has occurred in North America, enabling faster development and deployment of next-generation firewall capabilities such as deep traffic inspection, identity-driven policies, and automated threat correlation. These factors collectively enhance the demand for NGFW solutions across the region.

The growth in the U.S. NGFW market is driven by rising investments by enterprises in network segmentation and zero-trust adoption across large-scale digital environments. Large enterprises increasingly deploy micro-segmented architectures that would need high-performance firewalls with the ability to manage granular access controls and real-time threat isolation. Recent reports studied a significant rise in multi-cloud adoption among enterprises in the U.S., which has driven organizations to deploy scalable NGFW platforms across cloud, on-premises, and edge infrastructures. This strategic shift toward unified, cross-environment security management continues to reinforce the country's strong position.

Asia Pacific Next Generation Firewall Market Insights

The Asia Pacific will emerge as the fastest-growing region, with a CAGR of 15.82% from 2026-2034, driven by rapid digitization across manufacturing, telecom, and financial services in countries like India, Singapore, Indonesia, and Vietnam. Organizations in the region continue to reinforce their network defenses as a way of protecting ever-expanding digital infrastructures that include 5G networks, cross-border data exchange frameworks, and cloud-native enterprise platforms. The evolution of regional cybersecurity alliances and industry-driven security standards has accelerated NGFW adoption, driven by evolving enterprise demands for comprehensive visibility and control across complex, multi-site environments. Expansions of MSSPs across the region further enhance access and deployment of next-generation firewall solutions.

The growing large enterprise IT networks, expanding data center infrastructure, and accelerating digital service platforms in the banking, retail, and telecom sectors are driving the rapid growth of India's NGFW market. Many large enterprises and technology providers have moved to a unified network security framework to handle high-volume traffic across cloud and on-premises environments, thus creating strong demand for NGFWs with deep inspection and application-level visibility. Likewise, the growing number of domestic cybersecurity integrators and SOC service providers offering advanced solutions is also facilitating broad-based adoption with scalable deployment models for everything from startups to large corporations. These factors position India as one of the most dynamic growth hubs in the global landscape of NGFWs.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

The strong expansion of the next generation firewall market in Europe can be attributed to rapid enterprise network modernization and increased adoption of cloud-integrated security frameworks across major economies. Banking, telecom, and industrial manufacturing are among the sectors that are increasingly deploying NGFW solutions to secure distributed operations, multi-cloud platforms, and growing remote workforces. The collaborative efforts by private companies, academia, and industry alliances further accelerate the path to advanced firewall capabilities, including identity-aware access controls and deep traffic inspection, thereby considerably enhancing NGFW adoption across European markets.

With a focus on network segmentation and advanced perimeter defense, driving digital manufacturing systems and high-performance industrial networks, Germany is one of the fastest-growing markets for NGFWs. Large German enterprises increasingly employ a unified firewall architecture in order to provide security for machine-to-machine communication, smart factory ecosystems, and real-time data exchanges. Local cybersecurity vendors and technology integrators also build strong partnerships in delivering customized NGFW deployments for mid-sized and large-scale industrial organizations. This entire ecosystem of enterprise demand and supportive industry collaboration furthers Germany's position within the European NGFW market.

Latin America Market Insights

The Latin America NGFW market is powered by the growing digital transformation across financial services, retail chains, and regional telecommunications providers. Organizations are strengthening perimeter defenses to protect expanding digital payment networks, cloud-based customer platforms, and cross-border data operations. The rise of regional cybersecurity training hubs and growing investment in enterprise security infrastructure are further enabling widespread adoption of NGFW technologies. Additionally, the growing availability of MSSPs is helping mid-sized enterprises get access to sophisticated firewall capabilities at affordable operational costs.

Brazil's NGFW market is expanding as companies enhance network protection for large-scale e-commerce operations, fintech ecosystems, and nationwide logistics networks. The leading cybersecurity service providers in the country are offering integrated monitoring, continuous analytics, and advanced firewall management, all to meet the rapid growth of digital transactions and cloud workloads. This strong push toward secure digital business models, coupled with increasing investment in local data centers and enterprise IT modernization, is placing Brazil among the most dynamic markets for NGFW adoption in Latin America.

Middle East and Africa NextGeneration Firewall Market Insights

The market for NGFWs in the Middle East and Africa is growing as enterprises and service providers strengthen network defenses to support large infrastructure projects, cross-border connectivity, and fast-growing digital commerce ecosystems. Organizations are deploying next-generation firewalls to secure cloud migration, protect high-traffic online platforms, and handle increasing remote workforce activity. The region's budding cybersecurity innovation centers and private-sector security partnerships further encourage the use of advanced NGFW architectures that offer deep inspection, behavioral analytics, and unified policy management.

The next generation firewall market of Saudi Arabia is expected to witness significant growth with the upgrade of network security frameworks among enterprises to support large digital platforms, increasing cloud adoption, and modernization in several commercial and industrial sectors. Companies operating in various sectors such as banking, energy, and retail are deploying NGFWs with greater visibility and segmentation to secure distributed digital infrastructures. The rise of advanced IT service providers in the country and increasing investment in enterprise cybersecurity operations have expedited this market demand toward next-generation firewall systems, further strengthening Saudi Arabia's position within the regional market.

Product Type Insights

The Hardware NGFW segment had the leading position in the market, holding a revenue share of 52.61% in 2025, driven by strong adoption across large enterprises and critical infrastructure operators needing high-performance, low-latency perimeter security. Hardware appliances remain the preferred choice for securing data centers, core networks, and high-throughput environments where deep packet inspection and advanced threat prevention must be executed reliably at scale.

The Cloud-Native NGFW segment is expected to grow at the highest CAGR of around 15.82% during the forecast period. The rapid growth is driven by the increase in multi-cloud architectures, the connectivity of the remote workforce, and the growth of distributed enterprise networks that require elastic, centrally managed firewall services.

By Product Type Market Share (%), 2025

Source: Straits Research

Technology Features Insights

The Deep Packet Inspection segment held the highest share of 34.58% in 2025, driven by the foundational capability of DPI to enhance the detection of threats and improve visibility and policy enforcement across modern enterprise networks. DPI gives organizations the capability to look deep into the traffic down to a very granular level for finding hidden threats, unauthorized applications, and encrypted malware.

The fastest growth during the forecast period is expected in the AI/ML-enabled Threat Detection segment. There is a rising demand for real-time behavioral analytics to detect unknown and zero-day threats that evade traditional signature-based systems. AI-powered NGFW capabilities are being adopted to gain full-scale automated anomaly detection, reducing response times and minimizing manual intervention across hybrid and multi-cloud architectures.

End-Use Industry Insights

The BFSI segment will grow at the highest CAGR of 14.12% owing to increasing frequency of financial cyber-attacks and expansion of digital banking ecosystems. As most financial institutions continue to move toward mobile banking, cloud-based services, and real-time payment platforms, the need for advanced network protection to maintain sensitive transactions and customer data also grows correspondingly. With this increasing vulnerability, next-generation firewalls with deeper inspection, identity-based access control, and continuous threat monitoring have come to the fore, thereby driving demand in the BFSI sector at an unprecedented rate.

Competitive Landscape

The global next generation firewall market is fragmented, with large, established cybersecurity vendors alongside smaller, specialized network security providers. A few of the leading players have extensive product portfolios and have won significant market share due to their high threat-prevention capabilities and large enterprise customer bases. These companies further expand their presence in the market through constant platform enhancements, unified security architectures, and integrated cloud-delivered firewall services.

The key market players comprise Cisco Systems, Inc., Barracuda Networks, Inc., Check Point Software Technologies Ltd., and others. These listed industry participants compete in order to hold a stronger position in the market by introducing product innovations, enhancing threat detection capabilities, strategic acquisitions, and increasing partnerships with cloud service providers and managed security service partners. This focus on delivering high-performance, scalable firewall solutions places them well in the changing landscape of network security.

SonicWall, Inc.: An emerging market player

US-based network-security vendor SonicWall has a strong presence in firewalls and edge protection, but the company has just moved to extend its next-generation firewall portfolio to meet modern enterprise demands

- In May 2025, SonicWall announced the release of a new platform, "Next-Generation Network Security," which combines NGFW solutions with AI-driven threat detection, cloud management, and unified policy orchestration in one offering to serve both managed service providers and mid-sized enterprises.

Thus, SonicWall was able to rise to prominence in the global NGFW market on the back of partner-centric distribution, ease of cloud and edge deployment, and innovation in hardware-software integration, hence competing more effectively in the next-generation firewall space.

List of Key and Emerging Players in Next-Generation Firewall Market

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Barracuda Networks, Inc.

- SonicWall Inc.

- Juniper Networks, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Sophos Group plc

- WatchGuard Technologies, Inc.

- Forcepoint LLC

- Huawei Technologies Co., Ltd.

- Zscaler, Inc.

- Hillstone Networks Co., Ltd.

- Sangfor Technologies Inc.

- F5, Inc.

- GajShield Infotech

- Seqrite

- Aker Security Solutions

- Stormshield

- A10 Networks, Inc.

- Others

Strategic Initiatives

- November 2025: SonicWall, Inc. announced that its next-generation firewall achieved a flawless 100 % threat-block rate across all categories in the 2025 independent NetSecOPEN testing, reinforcing its product excellence and positioning it as a top-validated NGFW platform.

- June 2025: Cisco Systems, Inc. unveiled its Hybrid Mesh Firewall solution under the “Secure Network Architecture to Accelerate Workplace AI Transformation”, delivering up to 200 Gbps data-center firewall density and unified security across campus, branch and cloud environments.

- May 2025: Barracuda Networks, Inc. launched Next-Generation Threat Detection powered by Multimodal AI, enabling detection of more than three times as many malicious files at eight times the speed of previous models through NGFW-integrated sandboxing.

- February 2025: Fortinet, Inc. launched its FortiGate 7800G series next-generation firewall for AI and distributed enterprise environments, delivering up to 164 Gbps throughput and reducing power consumption by 7× versus industry average.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 5.9 billion |

| Market Size in 2026 | USD 6.68 billion |

| Market Size in 2034 | USD 17.23 billion |

| CAGR | 13.2% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Technology Features, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Next-Generation Firewall Market Segments

By Product Type

- Hardware NGFW

- Virtual NGFW

- Cloud-Native NGFW

By Technology Features

- Deep Packet Inspection (DPI)

- Intrusion Prevention System (IPS)

- Application Control

- Threat Intelligence Integration

- AI/ML-enabled Threat Detection

By End-Use Industry

- BFSI

- Defense

- Telecom

- Healthcare

- Retail

- Education

- Energy & Utilities

- IT Services

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.