Oil and Gas Electric Submersible Pumps Market Size, Share & Trends Analysis Report By Product Type (Standard Electric Submersible Pumps, High-Temperature Electric Submersible Pumps, Gas-Handling Electric Submersible Pumps, Abrasion-Resistant Electric Submersible Pumps, Corrosion-Resistant Electric Submersible Pumps), By Application (Onshore Oil and Gas Fields, Offshore Oil and Gas Fields, Shallow Water, Deepwater, Ultra-Deepwater), By End Use (Oil Production, Natural Gas Production) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Oil and Gas Electric Submersible Pumps Market Overview

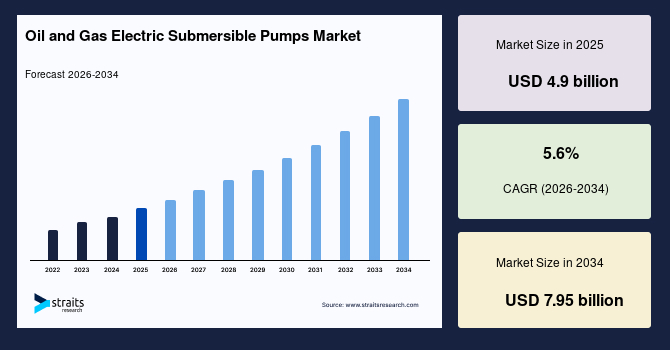

The global oil and gas electric submersible pumps market size is valued at USD 4.9 billion in 2025 and is projected to reach USD 7.95 billion by 2034, expanding at a compound annual growth rate (CAGR) of around 5.6% during the forecast period. The market growth is primarily supported by increasing oil recovery requirements, rising investments in mature and deepwater fields, and continuous technological advancements aimed at improving pump efficiency, reliability, and digital monitoring capabilities.

Key Market Trends & Insights

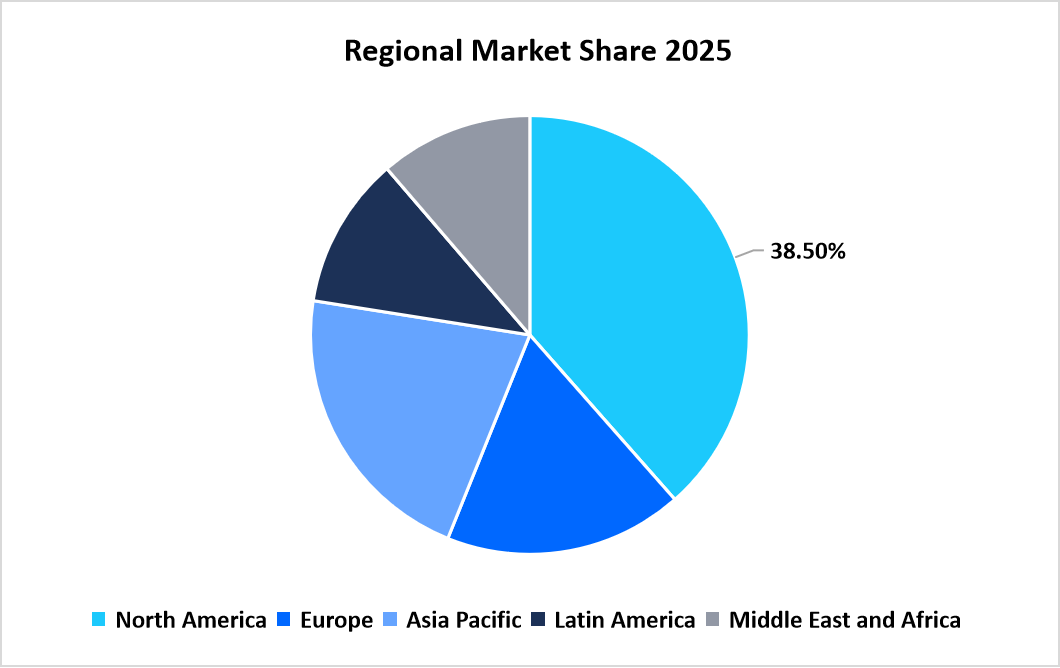

- North America dominated the market with a revenue share of 38.5% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 6.9% during the forecast period.

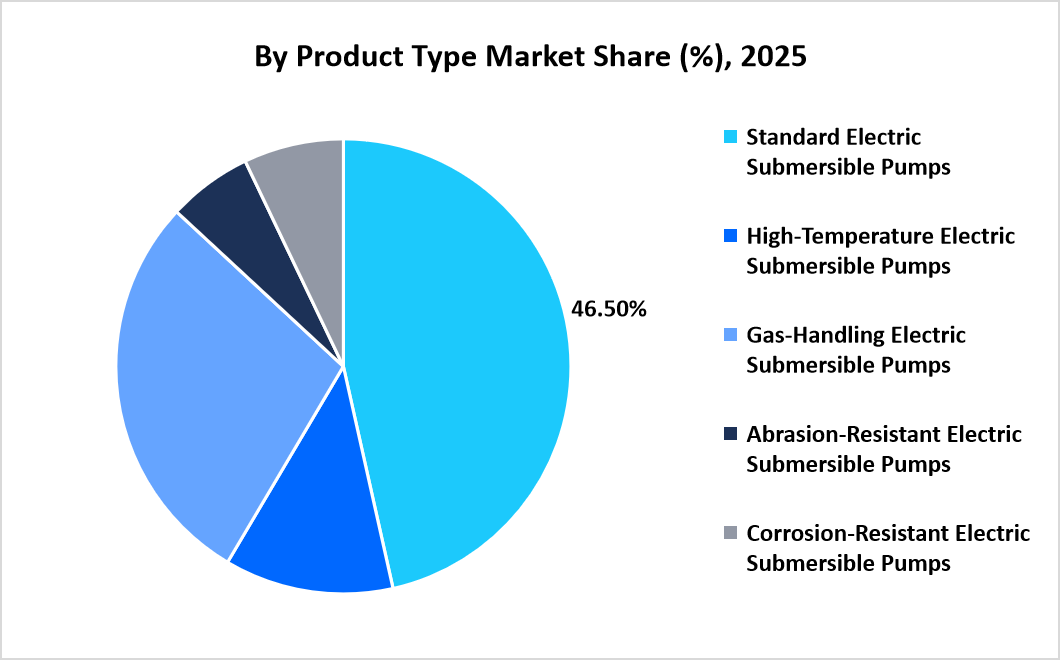

- Based on Product Type, the Standard electric submersible pumps segment held the highest market share of 46.5% in 2025.

- By Application, the Offshore applications segment is estimated to register the fastest CAGR growth of 6.4%.

- Based on End User, the Oil production category dominated the market in 2025.

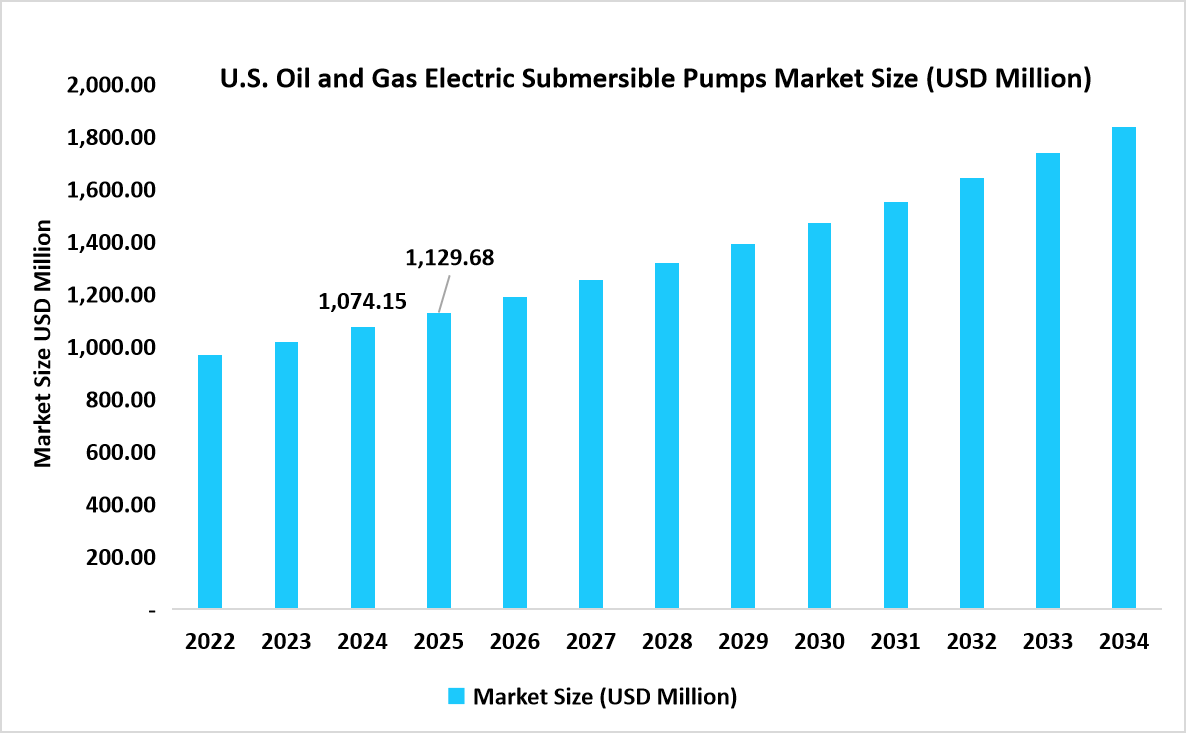

- The U.S. dominates the market, valued at USD 1,074.15 million in 2024 and reaching USD 1,129.68 million in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 4.9 billion

- 2034 Projected Market Size: USD 7.95 billion

- CAGR (2026-2034): 5.6%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global oil and gas electric submersible pumps market covers electrically powered pumping systems designed to lift fluids from deep wells to the surface, particularly in high-volume or low-pressure reservoirs. Electric submersible pumps are primarily deployed to enhance production rates, extend the economic life of wells, and support artificial lift operations where natural reservoir pressure is insufficient. The market growth is driven by rising energy demand, increasing focus on maximising recovery from existing fields, ongoing automation in oilfield operations, and innovation in materials, motor design, and digital diagnostics that improve operational efficiency and reduce downtime.

Market Trends

Digitalisation and Smart ESP Systems

Digitalisation is driving the oil and gas electric submersible pumps (ESP) market as operators seek improved efficiency, monitoring, and predictability in artificial lift operations. Modern ESPs feature sensors, real-time data transmission, and intelligent control software to track pressure, temperature, vibration, and flow rates. This allows operators to detect early signs of wear or failure and schedule proactive maintenance, minimising downtime and extending pump life. Smart ESPs are increasingly integrated into high-cost offshore and deepwater operations, where reducing intervention costs is critical. The adoption of connected and intelligent systems enhances operational efficiency and influences market growth.

Rising Deployment in Mature and Marginal Fields

ESPs are increasingly deployed in mature and marginal oil fields to sustain production from declining reservoirs. Their ability to handle high flow rates and operate effectively at significant depths makes them ideal for optimising output in brownfield and ageing assets. Deployment is prominent across regions such as the Middle East, North America, and Latin America, with ESPs supporting enhanced oil recovery and stabilisation of production. Their critical role in maintaining production reinforces steady market demand across the forecast period.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 4.9 billion |

| Estimated 2026 Value | USD 5.15 billion |

| Projected 2034 Value | USD 7.95 billion |

| CAGR (2026-2034) | 5.6% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Schlumberger, Baker Hughes, Halliburton, Weatherford International, Flowserve Corporation |

to learn more about this report Download Free Sample Report

Market Driver

Growing Focus on Enhanced Oil Recovery and Production Optimisation

The push for enhanced oil recovery (EOR) and production optimisation drives demand for ESPs. As easily accessible reserves decline, operators are seeking artificial lift technologies to increase recovery rates and maximise output from existing wells. ESPs efficiently lift large fluid volumes from deep or low-pressure reservoirs, improving production performance and well economics. Ageing infrastructure emphasises extending well life over developing new fields. Investment in ESP installations and upgrades supports field optimisation strategies, reinforcing their importance in modern oilfield operations. Consistent demand for production enhancement ensures sustained market growth for ESP technologies and associated services.

Market Restraint

High Capital and Operating Costs

ESP systems require significant upfront investment, including equipment, installation, and supporting infrastructure. Ongoing operating costs, such as power consumption, maintenance, and potential workovers, can be substantial, particularly for offshore or remote locations. High capital and operational expenses may deter smaller operators or slow deployment during periods of price volatility. Cost sensitivity in marginal or low-revenue fields limits expansion opportunities, despite technological benefits. While large operators continue to invest in ESP systems, financial constraints remain a barrier to broader market penetration, moderating the pace of new installations and replacement cycles.

Market Opportunity

Expansion in Offshore and Deepwater Developments

The continued development of offshore and deepwater oilfields presents significant growth opportunities for electric submersible pumps (ESPs). These challenging environments require high-capacity, reliable artificial lift systems that can efficiently handle complex reservoirs and large fluid volumes. ESPs are increasingly preferred for operations under harsh conditions, offering dependable performance where traditional methods may fall short. As offshore projects advance, operators are seeking tailored ESP solutions that ensure long-term reliability and minimise downtime.

Regional Analysis

According to Straits Research, North America dominated the market in 2025, accounting for 38.5% market share, supported by large-scale upstream activity, advanced oilfield infrastructure, and early adoption of artificial lift technologies. The region’s growth is driven by extensive production from mature oil fields and unconventional shale reservoirs, where declining reservoir pressure necessitates continuous use of ESP systems. North America also benefits from the presence of leading ESP manufacturers and oilfield service providers, supporting innovation and rapid deployment across onshore and offshore assets.

The U.S. is the largest contributor within North America due to its extensive shale oil and tight oil production across basins such as the Permian, Eagle Ford, and Bakken. High well density and rapid pressure decline in unconventional wells create strong demand for gas-handling and high-efficiency ESP systems. Continued capital spending on production enhancement, coupled with advanced digital oilfield practices, supports stable ESP installations.

Asia Pacific Oil and Gas Electric Submersible Pumps Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 6.9% from 2026 to 2034, driven by rising energy demand, expanding upstream investments, and increasing efforts to enhance domestic oil and gas production. Many countries in the region operate mature fields with declining pressure, resulting in a strong demand for ESP-based artificial lift systems. National oil companies play a central role, investing steadily in production optimisation rather than exploration alone. Increasing adoption of modern ESP technologies further accelerates regional growth.

China is the primary growth engine in the Asia Pacific due to its large number of mature onshore oil fields and strategic focus on energy security. Declining reservoir pressure across major basins drives widespread ESP deployment to sustain production levels. Strong state-led investment, coupled with the expansion of domestic oilfield equipment manufacturing, supports the cost-effective adoption. The growing use of ESPs in both oil and gas wells reinforces China’s leadership in the regional market.

Source: Straits Research

Europe Market Insights

Europe represents a mature market driven by sustained production activities in offshore assets and mature onshore fields, where artificial lift is required to maintain output. The region places strong emphasis on operational efficiency, reliability, and energy optimisation, encouraging the adoption of advanced ESP systems with improved performance monitoring. While upstream investments are selective, ongoing redevelopment of existing fields supports consistent ESP demand. Europe’s focus on extending asset life rather than aggressive expansion results in moderate but predictable market growth.

Norway leads the European market due to its active offshore oil and gas sector in the North Sea. Mature offshore fields require high-capacity ESP systems to handle complex reservoir conditions and long subsea tiebacks. Operators prioritise reliability and reduced intervention frequency, driving demand for premium ESP solutions. Continued offshore redevelopment and enhanced recovery projects support stable ESP installations despite a cautious investment environment.

Latin America Market Insights

Latin America shows steady growth supported by ongoing production from mature oil fields and selective offshore developments. The region benefits from a strong reliance on artificial lift technologies as reservoirs age and natural flow declines. National oil companies continue to invest in maintaining production capacity, while private operators focus on cost efficiency and equipment reliability. Although economic and regulatory factors can influence investment cycles, consistent demand for ESP systems is expected to support moderate growth across the forecast period.

Brazil leads the Latin American market due to its active offshore oil production and large-scale mature field operations. ESPs are increasingly used in offshore and subsea environments to manage high-volume production and complex well conditions. Continued investment in offshore redevelopment and production efficiency supports demand for advanced ESP systems. Brazil’s established oilfield services ecosystem further strengthens market stability.

Middle East and Africa Market Insights

The Middle East and Africa market is supported by extensive oil reserves and long-producing fields that require artificial lift to maintain output. The region’s growth is driven by large-scale production optimisation programs rather than new exploration. National oil companies invest in ESP systems to enhance recovery rates and extend the life of fields, particularly in mature reservoirs. While growth is steady rather than rapid, the region’s high well counts and long project lifecycles ensure sustained demand for ESP installations and services.

Saudi Arabia leads the MEA region due to its vast oil reserves and continuous focus on maintaining production efficiency. ESPs are widely deployed in mature oil fields to support high-volume lifting and reservoir management. Long-term field development plans and steady capital investment ensure consistent demand for artificial lift technologies, making Saudi Arabia a cornerstone market within the region.

Product Type Insights

According to Straits Research, Standard electric submersible pumps dominated the market with a revenue share of 46.5% in 2025, supported by their broad applicability, established performance reliability, and lower cost compared to specialised variants. These systems are commonly deployed in onshore conventional fields where operating conditions are relatively stable. The segment is expected to grow, driven by replacement demand and sustained investment in brownfield optimisation projects.

Gas-handling electric submersible pumps represent the fastest-growing subsegment, expanding at an estimated CAGR of 6.7. Growth is driven by rising production from shale, tight oil, and mature reservoirs with high gas content, where conventional pumps face efficiency challenges. Increasing adoption in North American unconventional fields and enhanced oil recovery projects supports the segment’s strong growth outlook.

Source: Straits Research

Application Insights

Onshore applications dominate the market due to the large number of producing wells and comparatively lower installation and maintenance costs. ESP deployment is particularly strong in North America, the Middle East, and parts of Asia, where operators focus on maximising output from existing assets. Ongoing artificial lift upgrades and the redevelopment of ageing fields support the onshore segment.

Offshore applications are the fastest-growing segment, with a projected CAGR of 6.4%. Growth is driven by renewed investments in offshore and deepwater projects, where ESPs are increasingly used to handle high flow rates and complex reservoir conditions. Advances in subsea-compatible ESP systems further support offshore adoption.

End Use Insights

Oil production remains the dominant end-use segment, reflecting the widespread use of ESPs in oil wells to enhance recovery and stabilise production. Continued emphasis on extending the productive life of oil reservoirs supports steady demand for ESP systems. This segment is expected to grow at a CAGR of 5.3%, aligned with gradual increases in oil demand and sustained upstream investment.

Natural gas production is the fastest-growing end-use segment, projected to expand at a CAGR of 6.1%, driven by rising global demand for cleaner-burning fuels, increasing development of gas and condensate fields, and the need for efficient liquid management in gas wells. ESP adoption in gas applications continues to rise as technology improves handling of variable flow conditions.

Competitive Landscape

The oil and gas electric submersible pumps market is moderately consolidated, characterised by a mix of established oilfield service leaders, diversified industrial manufacturers, and a limited number of specialised regional suppliers. Large legacy players dominate the market through deep technical expertise, long-standing relationships with national and international oil companies, and integrated service offerings that combine equipment, digital monitoring, and lifecycle support. Mid-tier manufacturers and regional players compete by offering cost-competitive systems, localised manufacturing, and faster delivery times, particularly in onshore and mature field applications. Newer entrants focus on niche segments such as gas-handling ESPs, high-temperature wells, or digitally enabled systems with predictive maintenance features.

Novomet: An Emerging Technology-Focused Player

Novomet has positioned itself as a technology-driven manufacturer specialising in advanced electric submersible pumping solutions for challenging reservoir conditions. The company entered the global ESP market by focusing on gas-handling and abrasion-resistant designs tailored for unconventional and mature fields. Its core strengths lie in proprietary pump stage designs, flexible system configurations, and close technical collaboration with operators to optimise well performance. Novomet primarily appeals to operators seeking customised solutions that balance performance with cost efficiency, particularly in shale and brownfield developments.

List of Key and Emerging Players in Oil and Gas Electric Submersible Pumps Market

- Schlumberger

- Baker Hughes

- Halliburton

- Weatherford International

- Flowserve Corporation

- Borets International

- Novomet

- General Electric (GE Vernova)

- Sulzer Ltd.

- Dover Corporation (ChampionX)

- KSB SE & Co. KGaA

- Mitsubishi Heavy Industries

- ITT Inc.

- Canadian Advanced ESP

- JJ Tech

- Ebara Corporation

- Lufkin Industries (Nabors)

- FlexLift

- Summit ESP

- Upstream Pumping Solutions

- Petro Lift Systems

- Schlumberger Artificial Lift Systems (regional units)

Strategic Initiatives

- June 2025 - Novomet successfully tested and announced readiness for trial of new ImpalaESP stages (e.g., NFV3800M, NHV3000M1) designed for operation in extra-harsh environments with high solids content (up to 3 g/l).

- May 2025 - Schlumberger (SLB) launched Electris, a portfolio of digitally enabled electric well completions technologies that maximise production and recovery.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 4.9 billion |

| Market Size in 2026 | USD 5.15 billion |

| Market Size in 2034 | USD 7.95 billion |

| CAGR | 5.6% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Oil and Gas Electric Submersible Pumps Market Segments

By Product Type

- Standard Electric Submersible Pumps

- High-Temperature Electric Submersible Pumps

- Gas-Handling Electric Submersible Pumps

- Abrasion-Resistant Electric Submersible Pumps

- Corrosion-Resistant Electric Submersible Pumps

By Application

- Onshore Oil and Gas Fields

- Offshore Oil and Gas Fields

- Shallow Water

- Deepwater

- Ultra-Deepwater

By End Use

- Oil Production

- Natural Gas Production

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.