Palletizers Market Size, Share & Trends Analysis Report By Product Type (Conventional Palletizers, Robotic Palletizers), By End Use Industry (Food and Beverage, Pharmaceuticals, Chemicals, Consumer Goods, E-commerce and Logistics), By Automation Level (Manual Palletizers, Semi-Automatic Palletizers, Fully Automatic Palletizers) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Palletizers Market Overview

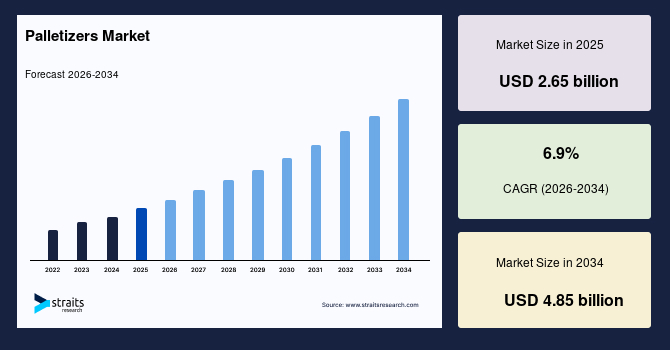

The global palletizers market is valued at USD 2.65 billion in 2025 and is projected to reach USD 4.85 billion by 2034, growing at a CAGR of 6.9% during the forecast period. The market growth is primarily driven by rising automation across manufacturing and logistics, increasing demand for operational efficiency, growing labour shortages in industrial settings, and the need for safe, consistent, and high-speed material handling solutions across end-use industries.

Key Market Trends & Insights

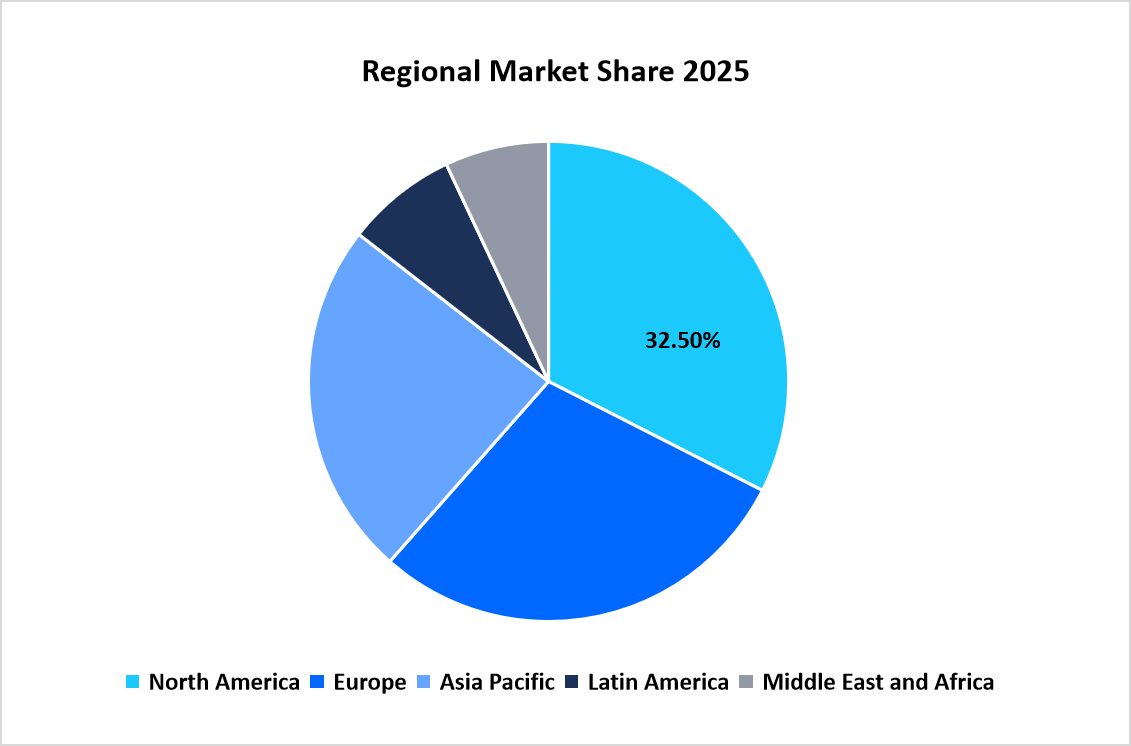

- North America dominated the market with a revenue share of 34.9% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 9.1% during the forecast period.

- Based on Product Type, the Conventional palletizerssegment held the highest market share of 55.8% in 2025.

- By End Use Industry, the E-commerce and logisticssegment is estimated to register the fastest CAGR growth of 10.2%.

- By Automation Level, the fully automatic palletizerscategory dominated the market in 2025 with a revenue share of 62.3%.

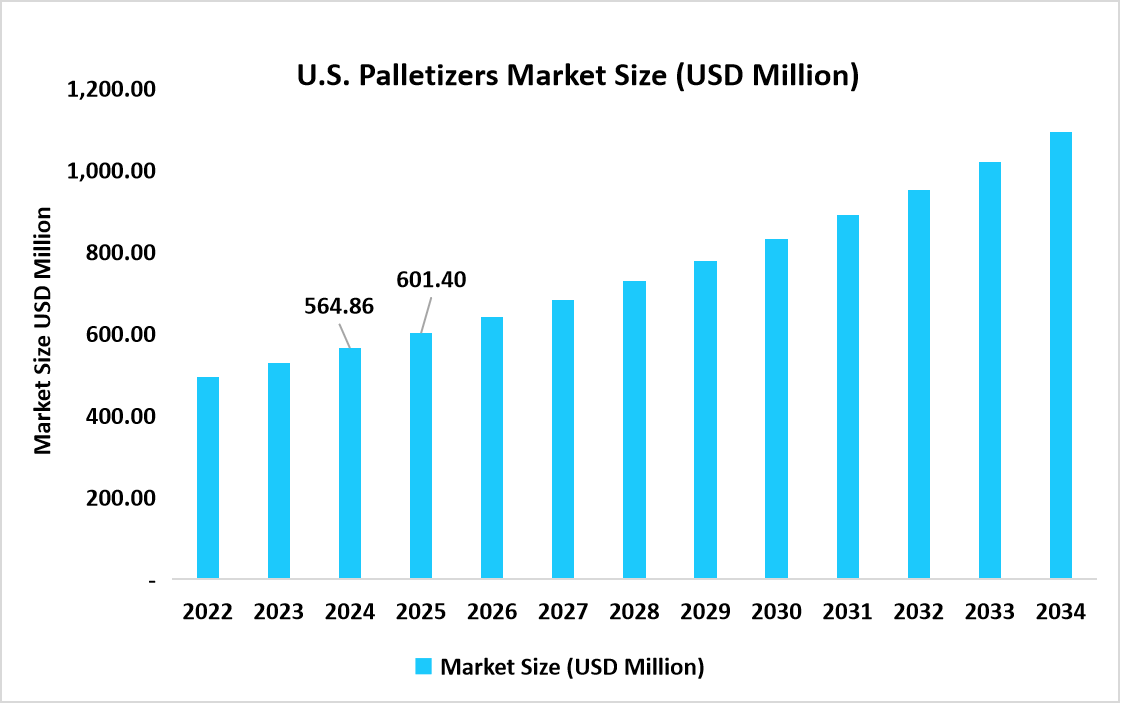

- U.S. dominates the market, valued at USD 564.86 million in 2024 and reaching USD 601.40 million in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 2.65 billion

- 2034 Projected Market Size: USD 4.85 billion

- CAGR (2026-2034): 6.9%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global palletizers market covers equipment and systems used to automatically stack, arrange, and organize products such as cartons, bags, cases, bottles, and sacks onto pallets for storage and transportation. These systems include conventional palletizers, robotic palletizers, and hybrid solutions deployed across various industries, including food and beverage, pharmaceuticals, chemicals, e-commerce, and consumer goods. Increasing production volumes, product standardization, technological advancements in robotics and control systems, and broader adoption of automated warehousing and distribution infrastructure support the market’s expansion.

Market Trend

Growing Adoption of Robotic and Flexible Palletizing Systems

The transition from conventional palletizers to robotic and flexible palletizing systems is a defining trend in the global palletizers market. Manufacturers increasingly favour robotic solutions due to their adaptability, compact footprint, and ability to handle multiple product formats and pallet patterns. Unlike fixed-function systems, robotic palletizers can be reprogrammed quickly to support frequent product changes, shorter production runs, and customized packaging requirements. Technological improvements in vision systems, end-of-arm tooling, and collaborative robotics have also reduced complexity and costs, broadening adoption across diverse industrial users.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.65 billion |

| Estimated 2026 Value | USD 2.82 billion |

| Projected 2034 Value | USD 4.85 billion |

| CAGR (2026-2034) | 6.9% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | ABB Ltd., KUKA AG, Fanuc Corporation, Yaskawa Electric Corporation, Mitsubishi Electric Corporation |

to learn more about this report Download Free Sample Report

Market Drivers

Rising Automation Demand in Manufacturing and Logistics

The growing emphasis on automation across manufacturing and logistics is a primary driver of palletizer adoption. Companies face sustained pressure to increase productivity, improve consistency, and control operating costs amid labour shortages and rising wages. Palletizers automate repetitive and physically demanding stacking tasks, improving throughput while reducing workplace injuries and product handling errors. Demand is particularly strong in high-volume industries such as food and beverage, chemicals, and consumer packaged goods, where palletizing is a critical end-of-line function. Automated palletizing solutions support faster line speeds, standardized pallet configurations, and improved logistics efficiency, reinforcing their importance in long-term industrial automation investments.

Expansion of E-commerce and High-Throughput Distribution Centres

The rapid growth of e-commerce and modern distribution centres significantly drives demand for palletizing systems. Increasing order volumes, diverse product assortments, and accelerated delivery expectations require efficient and reliable material handling solutions. Palletizers enable distribution centres to manage high throughput while maintaining consistency and accuracy in pallet formation. The wide variation in product size, weight, and packaging common in e-commerce environments further supports demand for flexible and reprogrammable palletizing systems. As fulfillment networks expand and warehouse automation intensifies, palletizers remain essential to scalable distribution infrastructure.

Market Restraint

High Initial Investment and Integration Costs

High upfront investment remains a key restraint for the palletizers industry, particularly among small and mid-sized manufacturers. Automated palletizing systems require substantial capital outlays for equipment, system integration, facility modifications, and workforce training. In operations with limited production volumes or constrained budgets, concerns about return on investment can delay adoption. Integration challenges are more pronounced in older facilities, where palletizers must be retrofitted into existing layouts. Although long-term efficiency gains and labour savings are well established, the initial financial burden continues to slow adoption in cost-sensitive regions and among smaller enterprises.

Market Opportunity

Growth Potential in Small and Mid-Sized Manufacturing Facilities

Expanding adoption among small and mid-sized manufacturing facilities represents a significant growth opportunity for the palletizers market. Historically, automated palletizers were largely confined to large-scale operations due to space and cost constraints. Recent advancements have enabled compact, modular, and more affordable palletizing solutions suitable for smaller production environments. These systems provide adequate throughput and flexibility while requiring lower capital investment. Leasing models, standardized palletizing cells, and service-based offerings further reduce entry barriers. As smaller manufacturers face increasing labour challenges and compliance requirements, automated palletizing becomes a practical and scalable solution.

Regional Analysis

According to Straits Research, North America dominated the market in 2025, accounting for 32.5% market share. The region benefits from highly automated manufacturing, mature logistics and warehousing infrastructure, and strict workplace safety and operational efficiency standards. The food and beverage, pharmaceutical, and consumer goods industries are driving consistent demand for automated and robotic palletizing systems. Advanced IT infrastructure, adoption of Industry 4.0 practices, and strong investment in labour-saving technologies further support market growth.

The United States is the largest national market in North America due to extensive industrial and warehousing operations. High labour costs and regulatory focus on workplace safety accelerate the adoption of robotic and automated palletizers. Companies are increasingly deploying advanced systems for high-speed production lines, which reduces manual handling and improves throughput.

Asia Pacific Palletizers Market Insights

Asia Pacific is emerging as the fastest-growing region with a CAGR of 9.8% from 2026-2034, driven by rapid industrialization, expanding food and beverage and e-commerce sectors, and rising labour costs in emerging economies. Governments are increasingly promoting automation in manufacturing and logistics to enhance efficiency and reduce workplace risks. The region also benefits from increasing exports and foreign direct investment in modern packaging and material handling technologies. The increasing adoption of robotic and semi-automatic systems in small- and mid-sized enterprises supports a rapid growth rate.

China is a significant country in the Asia Pacific due to its vast manufacturing base and growing e-commerce logistics sector. Rising labour costs and strong government support for industrial automation drive demand for both robotic and conventional palletizers. Leading domestic and international equipment manufacturers are expanding production and distribution networks in China, making the market highly dynamic.

Source: Straits Research

Europe Market Insights

Europe is a mature and high-value palletizers market, driven by strong automation adoption in manufacturing, advanced packaging systems, and stringent workplace safety and efficiency regulations. Food processing, beverage, and consumer goods industries are leading the demand for automated and robotic palletizers. Sustainability initiatives, energy-efficient equipment, and precision-driven production lines also support market expansion. The European market benefits from a long-standing industrial base and technological know-how, ensuring consistent adoption across countries and industrial segments.

Germany leads Europe due to its large industrial machinery and automotive sectors. Manufacturers deploy high-speed, fully automated palletizers to support just-in-time production and export operations. German companies focus on energy-efficient and modular systems, enhancing productivity while meeting environmental standards, making it a strategic market within Europe.

Latin America Market Insights

Latin America shows steady growth. Market expansion is supported by the modernization of manufacturing and warehousing infrastructure, growth in the food processing and beverage sectors, and increasing awareness of industrial automation. Regional governments are implementing policies to improve operational safety and productivity, encouraging investment in automated palletizing systems. Increasing e-commerce penetration and expanding retail networks are also driving demand for more efficient pallet handling solutions.

Brazil is the largest palletizers industry in Latin America, driven by its robust food and beverage manufacturing sector and expanding logistics industry. Expansion of modern retail chains and cold-chain logistics further supports growth. Both domestic manufacturers and international suppliers target Brazilian industrial hubs with robotic and semi-automatic solutions to capture rising demand.

Middle East and Africa Market Insights

The Middle East and Africa region is driven by increasing industrialization, expansion of warehousing and logistics facilities, and rising investments in food, beverage, and pharmaceutical manufacturing. Gulf countries are adopting automation to enhance labour efficiency, ensure safety, and improve operational precision. The emerging adoption in African urban centres is supported by modernized retail and food processing facilities, creating a steady growth path.

The UAE leads the Middle East due to its concentration of modern manufacturing and logistics hubs, high food import volumes, and growing e-commerce sector. Companies are increasingly deploying robotic and semi-automatic palletizers to improve operational efficiency and reduce manual labour dependency. Government support for smart factories and infrastructure modernization further encourages adoption.

Product Type Insights

According to Straits Research, Conventional palletizers dominated the market with a revenue share of 55.8% in 2025. Their dominance is driven by the widespread use in the food, beverage, cement, and chemical industries, where product dimensions and pallet configurations remain relatively uniform. These systems offer high throughput, proven reliability, and lower per-unit handling costs in large-scale operations. Their ability to operate continuously with minimal complexity makes them a preferred choice for high-volume producers focused on operational stability.

Robotic palletizers are the fastest-growing segment, projected to expand at a CAGR of 9.4%, fueled by increasing demand for flexibility, space efficiency, and multi-product handling. Robotic systems are well-suited for manufacturers with frequent changeovers, customized packaging, and limited floor space. Declining robot costs, improved software interfaces, and easier integration have accelerated adoption among small and mid-sized manufacturers. As production diversity increases across industries, robotic palletizers continue to gain traction.

Source: Straits Research

End Use Industry Insights

Food and beverage remains the dominant end-use industry, representing approximately 38.6% of total market revenue in 2025, with a CAGR of 6.6%. Palletizers are crucial in this sector due to high production volumes, stringent hygiene standards, and the requirement for consistent pallet configurations. Beverage bottling, packaged foods, and dairy processing heavily rely on automated palletizing to maintain line speed and reduce manual handling risks. Regulatory compliance and recall preparedness further reinforce investment in palletizing systems, making this segment the largest contributor to overall market demand.

E-commerce and logistics are the fastest-growing industry segments, expanding at a CAGR of 10.2%, driven by the rapid expansion of fulfilment centres, rising order volumes, and increasing automation in warehousing operations. Palletizers support faster outbound logistics, reduce labour dependency, and improve throughput efficiency. The need to handle diverse product sizes and fluctuating demand patterns favours flexible palletizing solutions, accelerating adoption in modern distribution hubs.

Automation Level Insights

Fully automatic palletizers dominate the market, accounting for an estimated 62.3% share in 2025, with a CAGR of 7.1%. Their dominance reflects growing emphasis on productivity, labour cost reduction, and workplace safety. Fully automatic systems operate continuously with minimal human intervention, ensuring consistent pallet quality and reduced error rates. Large manufacturers prefer these systems to support high-speed production lines and long-term operational efficiency. As automation becomes a strategic priority, fully automatic palletizers remain the preferred investment choice.

Manual and semi-automatic palletizers are the fastest-growing segment, growing at a CAGR of 8.3%. The segment’s growth is supported by the adoption of affordable automation solutions among small and mid-sized enterprises. These systems strike a balance between cost and efficiency, enabling a gradual transition from manual labour to automated handling. Their lower upfront cost and simpler installation make them attractive in emerging markets and budget-sensitive operations.

Competitive Landscape

The palletizers market is moderately fragmented, characterized by a blend of established industrial automation leaders, diversified material‑handling manufacturers, and emerging specialist technology providers. Legacy automation and packaging equipment companies dominate the market through broad product portfolios, strong after-sales support, and deep integration with manufacturing and logistics systems. Mid-tier suppliers and innovation-focused entrants compete on flexibility, cost-effectiveness, and ease of integration, appealing to small and medium-sized manufacturers transitioning to automation.

Universal Robots: An Automation Innovator

Universal Robots is a notable emerging player in the palletizers industry, recognized for its collaborative robotic (cobot) solutions that lower barriers to automation. Its core strengths include intuitive programming, safety-certified collaborative operation, and modular end-of-arm tooling that can handle varied product formats without requiring extensive engineering support. This appeals particularly to small and mid‑sized manufacturers and logistics operators seeking scalable automation without heavy capital expenditure. By offering robotics that integrate with existing conveyor and packaging lines, Universal Robots differentiates itself from traditional, fixed, mechanized palletizers and accelerates adoption among cost-conscious users.

List of Key and Emerging Players in Palletizers Market

- ABB Ltd.

- KUKA AG

- Fanuc Corporation

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Universal Robots (Teradyne)

- Dematic (Kion Group)

- Intelligrated (Honeywell)

- Westfalia Technologies (Kardex Group)

- Elematic / Pallex (various regional brands)

- Swisslog (Kion Group)

- Cimcorp

- Fives Group

- OCME S.p.A.

- Palletizing Technology Solutions

- CAMA Group

- RoboPack Solutions

- Genesis Systems Group

- WDL Systems

- Packsize (automated integration)

- ATS Automation

- Bosch Packaging Technology

- Sepro Group

- Ishida Co.

- Quicktron

Strategic Initiatives

- October 2025 - At IMHX 2025, Dematic highlighted its focus on "Flexible Automation" and "Intelligent Software". This confirms the ongoing strategy to ensure that their Robotic Palletizers are seamlessly integrated with their Warehouse Management System (WMS) and Control System (WCS) Software for enhanced real-time orchestration and high-speed fulfilment.

- April 2025 - FANUC Corporation launched FANUC ROBOT M-410/800F-32C Palletizer and R-50iA Controller. This high-payload (800kg capacity) robot is designed for full-layer, high-speed depalletizing and palletizing in large warehousing and logistics operations

- May 2025 - ABB Ltd. announced a new partnership with Progressive Palletizer software, making the easy-to-use, no-code palletizing software part of the ABB Robotics Ecosystem.

- May 2025 - KUKA AG introduced the KR TITAN ultra with a payload capacity of up to 1500 kg, specifically targeting ultra-heavy-duty material handling and palletizing applications beyond standard industrial limits.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.65 billion |

| Market Size in 2026 | USD 2.82 billion |

| Market Size in 2034 | USD 4.85 billion |

| CAGR | 6.9% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By End Use Industry, By Automation Level |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Palletizers Market Segments

By Product Type

-

Conventional Palletizers

- High-level Palletizers

- Low-level Palletizers

- Layer Palletizers

-

Robotic Palletizers

- Articulated Robotic Palletizers

- SCARA Robotic Palletizers

- Delta Robotic Palletizers

By End Use Industry

- Food and Beverage

- Pharmaceuticals

- Chemicals

- Consumer Goods

- E-commerce and Logistics

By Automation Level

- Manual Palletizers

- Semi-Automatic Palletizers

- Fully Automatic Palletizers

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.