Palmitic Acid Market Size, Share & Trends Analysis Report By Type (Distilled Type, Fractionated Type), By Source (Animal-based, Plant-based), By Applications (Soap and Detergent, Food , Pharmaceuticals, Personal care and Cosmetics, Greases and Lubricants, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Palmitic Acid Market Size

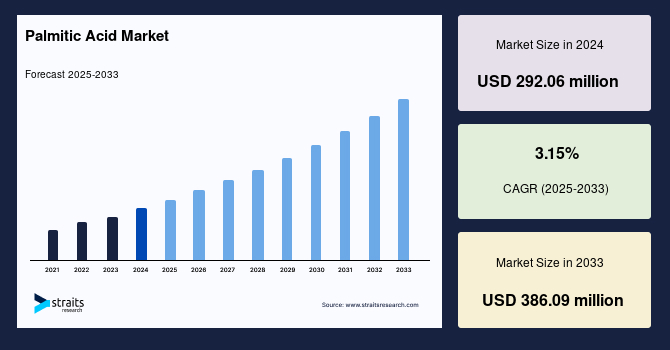

The global palmitic acid market size was valued at USD 292.06 million in 2024. It is estimated to reach from USD 301.26 million in 2025 to USD 386.09 million by 2033, growing at a CAGR of 3.15% during the forecast period (2025–2033). The increasing demand from the food industry primarily drives the global palmitic acid market. In addition, palmitic acid is also used in the production of biodiesel, particularly in the transesterification process. The growing demand for clean energy is estimated to increase the demand for biodiesel, thereby driving the global palmitic acid market.

Moreover, the shift towards sustainable and eco-friendly products has paved the way for the development of bio-based palmitic acid sourced from renewable feedstocks, which is estimated to create opportunities for market growth.

Palmitic acid is a saturated fatty acid commonly found in animal and plant fats. It's a crucial component of the fats in our bodies and various foods. Chemically, it's a straight-chain, 16-carbon fatty acid with the molecular formula C??H??O?. It is a major component of palm oil, from which it derives its name, and also found in significant amounts in meats, dairy products, and some vegetable oils.

Palmitic acid plays crucial roles in the body, serving as a source of energy, aiding in the absorption of nutrients like vitamins, and contributing to the structure of cell membranes. However, excessive consumption of palmitic acid, particularly from sources like processed foods, has been linked to various health issues, including cardiovascular diseases. Therefore, maintaining a balanced diet with a moderate intake of palmitic acid-containing foods is essential for overall health and well-being.

Highlights

- Fractioned type dominates the type segment

- Europe is the highest shareholder in the global market

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 292.06 Million |

| Estimated 2025 Value | USD 301.26 Million |

| Projected 2033 Value | USD 386.09 Million |

| CAGR (2025-2033) | 3.15% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Wilmar International Limited, ADM, Akzo Nobel N.V., Emery Oleochemicals, Vantage Specialty Chemicals |

to learn more about this report Download Free Sample Report

Palmitic Acid Market Growth Drivers

Growing Demand in Food Industry

There has been a growing demand for palmitic acid in the food industry in recent years. The escalating consumer preference for convenient and processed foods has propelled the need for additives that enhance texture, stability, and flavor, thereby driving global market growth. Palmitic acid is a crucial food additive, contributing to the desired mouthfeel and sensory attributes of various processed foods, including chocolates, baked goods, and margarine.

Additionally, the growing awareness of the health benefits of certain saturated fats, including palmitic acid, has influenced consumer perceptions, leading to increased incorporation in food formulations. The versatility of palmitic acid in improving product consistency and shelf-life extension further amplifies its appeal to food manufacturers seeking to meet evolving consumer demands while ensuring product quality and market competitiveness. This trend underscores palmitic acid's integral role in catering to the dynamic needs of the modern food industry.

Demand in Biofuel Production

The demand for palmitic acid in biofuel production stems from its role in the transesterification process to produce biodiesel. As governments worldwide seek to reduce reliance on fossil fuels and mitigate environmental impact through initiatives like The National Wildlife Federation, biofuels are gaining traction as renewable alternatives. Palmitic acid, sourced from palm oil or animal fats, serves as a feedstock in biodiesel production due to its chemical properties that are conducive to conversion.

This demand is further fueled by programs that support sustainable practices and policies that favor renewable energy sources. The development of cutting-edge biofuel technologies and research into productive production techniques are also beneficial. Consequently, the biofuel sector plays a significant role in stimulating the growth of the palmitic acid market, with its demand influenced by evolving energy policies, environmental concerns, and technological advancements in the renewable energy sector.

Market Restraining Factor

Environmental Concerns

Environmental concerns surrounding the production of palmitic acid, particularly its predominant sourcing from palm oil, pose a significant restraint on market growth. The palm oil industry has been associated with deforestation, habitat destruction, and biodiversity loss in regions such as Southeast Asia and South America, raising sustainability issues. Efforts to address these concerns through sustainable palm oil certification and supply chain transparency initiatives have been undertaken, but challenges persist. Regulatory pressures and consumer awareness regarding palm oil production's environmental and social impacts further exacerbate the restraint. As a result, market players are increasingly exploring alternative, sustainable sources of palmitic acid and adopting responsible sourcing practices to mitigate the environmental footprint associated with palm-derived palmitic acid.

Market Opportunity

Bio-Based Alternatives

One significant opportunity within the palmitic acid market lies in developing and commercializing bio-based alternatives. With increasing environmental concerns and regulatory pressures to decrease dependence on fossil fuels and lower the environmental impact of industrial operations, there is a surging demand for sustainable and eco-friendly alternatives across various industries. This trend presents a lucrative opportunity for market players to capitalize on the shift towards bio-based palmitic acid derived from renewable feedstocks such as vegetable oils.

Moreover, bio-based palmitic acid provides opportunities for product differentiation and market positioning based on sustainability credentials, appealing to environmentally-conscious consumers and businesses. Market players can leverage these opportunities by investing in research and development initiatives to optimize bio-based production processes, enhance product performance, and expand application possibilities across diverse industries. By embracing bio-based alternatives, companies can meet the evolving market demands and contribute to a more sustainable and resilient future.

Regional Analysis

Europe Dominates the Global Market

Europe is the most significant global palmitic acid market shareholder and is expected to expand substantially during the forecast period. In Europe, the palmitic acid market exhibits robust growth driven by several factors that reflect the region's unique economic, regulatory, and consumer landscape. Europe's stringent regulatory framework regarding food safety and product quality standards underscores the demand for high-quality ingredients like palmitic acid, particularly in the food and pharmaceutical industries. This regulatory environment fosters innovation and drives investment in sustainable sourcing and production methods to fulfill stringent compliance requirements. Moreover, Europe's well-established and growing cosmetic and personal care industry represents a significant market for palmitic acid, which is utilized in skincare formulations for its emollient properties.

For instance, according to EuroDev, The European beauty and personal care market is forecasted to achieve a USD 143.30 billion value by the conclusion of 2023, exhibiting a consistent yearly growth rate of 1.62% from 2023 to 2028. The presence of major cosmetic brands like L'Oréal, Chanel, Dior, Lancôme, etc, further boosts the regional market expansion. Moreover, Europe's diverse and affluent consumer base, coupled with a strong infrastructure for research and development, positions the region as a key hub for market growth and product innovation in the palmitic acid sector. Thus, Europe's dynamic market landscape presents lucrative opportunities for market players to capitalize on evolving consumer trends and regulatory requirements, driving continued expansion in the palmitic acid market.

Asia-Pacific represents a significant and rapidly growing market for palmitic acid, fueled by the region's burgeoning population, coupled with soaring disposable incomes and urbanization, which has resulted in increased consumption of processed foods, cosmetics, and pharmaceuticals, all of which are major end-user industries for palmitic acid. For instance, according to The Economic Times, India's per capita disposable income is projected to reach 2.14 lakh in 2023-24, growing at 8.9% in FY24 and 14.5% in FY23. This rise in disposable income in emerging economies is estimated to drive the regional palmitic acid market. Moreover, the presence of robust manufacturing and favorable government policies supporting industrial growth contribute to the region's attractiveness for palmitic acid producers and suppliers. As a result, Asia-Pacific emerges as a pivotal market offering lucrative opportunities for market players looking to capitalize on the region's dynamic economic landscape and consumer preferences.

Segmental Analysis

Based on Type

The fractioned type segment is estimated to own the market. Fractionated Type Palmitic Acid refers to refining palmitic acid, a saturated fatty acid found in palm oil and animal fats, into its purest form. This method extracts palmitic acid from other fatty acids through fractional distillation or crystallization, yielding a product with a greater palmitic acid concentration. Fractionation is useful in various industrial applications, including food, cosmetics, and pharmaceuticals, since it permits the modification of fatty acid compositions. Fractionated palmitic acid is often preferred for its stability and consistency in formulations. It is crucial in producing specific textures and functionalities in products like chocolates, margarines, and skincare creams. This controlled purification process ensures quality and enhances the versatility of palmitic acid in diverse sectors.

Based on the Source

Animal-based palmitic acid is derived from animal fats, primarily sourced from beef tallow and dairy products. While historically significant, this segment is gradually declining due to sustainability concerns and evolving consumer preferences for plant-based alternatives. Animal-based palmitic acid offers similar chemical properties and applications as its plant-based counterpart but may face scrutiny regarding ethical and environmental considerations in its production process. Despite its diminishing prominence, it still finds niche applications in industries where animal-derived ingredients are accepted or preferred. However, stringent regulations and increasing awareness of animal welfare and environmental sustainability are prompting industry players to explore and invest in sustainable sourcing practices and alternative sources of palmitic acid, thereby shaping the future trajectory of the animal-based segment in the palmitic acid market.

Based on the Application

The pharmaceutical segment of the palmitic acid market is vital, with palmitic acid serving as a crucial excipient in drug formulations. Pharmaceutical-grade palmitic acid adheres to stringent quality standards to ensure efficacy, stability, and patient safety. It functions primarily as a lubricant and binder in the production of solid dosage forms like tablets and capsules. Its lubricating properties aid in the smooth manufacturing process, preventing adhesion to equipment and facilitating tablet compression.

Moreover, palmitic acid's binding capabilities help maintain pharmaceutical tablets' integrity and structural cohesion, ensuring uniform drug distribution and consistent release profiles. Pharmaceutical companies rely on palmitic acid to enhance drug formulation properties, optimize manufacturing processes, and meet regulatory requirements. This underscores its significance in the pharmaceutical industry's pursuit of safe and effective medications.

List of Key and Emerging Players in Palmitic Acid Market

- Wilmar International Limited

- ADM

- Akzo Nobel N.V.

- Emery Oleochemicals

- Vantage Specialty Chemicals

- BASF SE

- KLK OLEO

- IOI Oleochemicals

- Kao Chemicals

- Acme Synthetic Chemicals

Recent Developments

- May 2024- Kansas State University received a USD 1 million contribution from ADM for its Global Center for Grain and Food Innovation. This center is part of the Agriculture Innovation Initiative, which includes four new or refurbished facilities directed by the College of Agriculture.

- March 2024- A significant investment initiative was completed at AkzoNobel's manufacturing facility in Bac Ninh province, located near Hanoi in Vietnam. This project aims to enhance the company's presence in Asia and improve its commitment to environmentally-friendly production methods.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 292.06 Million |

| Market Size in 2025 | USD 301.26 Million |

| Market Size in 2033 | USD 386.09 Million |

| CAGR | 3.15% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Source, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Palmitic Acid Market Segments

By Type

- Distilled Type

- Fractionated Type

By Source

- Animal-based

- Plant-based

By Applications

- Soap and Detergent

- Food

- Pharmaceuticals

- Personal care and Cosmetics

- Greases and Lubricants

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.