Peptide Synthesis Market Size, Share & Trends Analysis Report By Product Type (Reagents, Peptide Synthesizers, Resins), By Application (Drug Development, Research and Diagnostics, Therapeutics, Vaccine Development, Others), By End-User (Pharmaceutical and Biotech Companies, Academic and Research Institutes, Contract Research Organizations (CROs), Diagnostic Laboratories), By Technology (Solid-Phase Peptide Synthesis (SPPS), Liquid-Phase Peptide Synthesis (LPPS), Hybrid Synthesis) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Peptide Synthesis Market Size

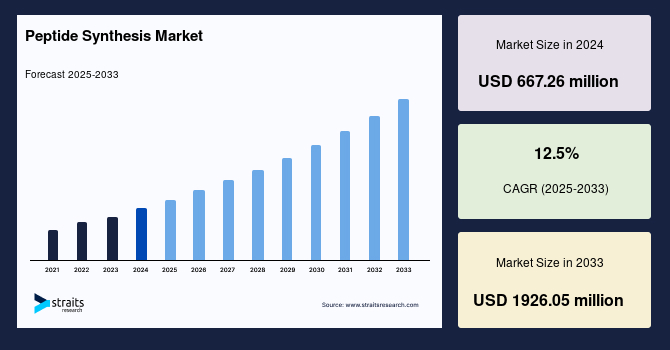

The global peptide synthesis market size was valued at USD 667.26 million in 2024 and is projected to reach from USD 750.66 million in 2025 to USD 1926.05 million by 2033, growing at a CAGR of 12.5% during the forecast period (2025-2033).

Peptide synthesis is creating peptides by linking amino acids in a specific sequence. Peptides are short chains of amino acids essential for various biological functions. Peptide synthesis plays a vital role in drug development, diagnostics, and the production of vaccines, hormones, and enzymes. It has applications in the pharmaceutical, biotechnology, and research industries for developing peptide-based therapeutics, vaccines, and other biopharmaceuticals. Due to their specificity and fewer side effects, peptides are increasingly used as targeted therapeutics, making peptide synthesis critical in advanced pharmaceutical research.

The peptide synthesis market is driven by the demand for peptide-based therapies. The growing prevalence of chronic diseases such as cancer, diabetes, and neurological disorders has increased the need for targeted peptide therapeutics. Additionally, advancements in peptide synthesis technologies, such as solid-phase peptide synthesis (SPPS) and microwave-assisted peptide synthesis, have improved the efficiency and yield of peptide production. Furthermore, the increasing focus on personalized medicine and biologics in the healthcare industry is driving the adoption of peptides, fostering market growth.

Current Market Trends

Advancements in Peptide Synthesis Technologies

The peptide synthesis market is transformed by continuous technological advancements, enhancing process efficiency, scalability, and affordability. Solid-phase peptide synthesis (SPPS) continues to be the dominant method, with innovations such as microwave-assisted SPPS significantly improving reaction kinetics, yields, and peptide purity.

- For instance, according to a 2024 report by Thermo Fisher Scientific, their optimized instruments now offer enhanced reproducibility and scalability, crucial for research and pharmaceutical manufacturing.

Furthermore, artificial intelligence (AI) revolutionizes sequence design and synthesis process control by predicting optimal routes, minimizing side reactions, and improving batch consistency. These advancements are reducing development timelines and manufacturing costs, making peptide synthesis more accessible to biotech startups, academic labs, and pharmaceutical giants alike. These innovations set the stage for exponential market growth and broader therapeutic applications.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 667.26 Million |

| Estimated 2025 Value | USD 750.66 Million |

| Projected 2033 Value | USD 1926.05 Million |

| CAGR (2025-2033) | 12.5% |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Key Market Players | Merck KGaA, Thermo Fisher Scientific Inc., GenScript, Novozymes A/S, Bachem Holding AG |

to learn more about this report Download Free Sample Report

Peptide Synthesis Market Growth Factors

Rising Demand for Peptide Therapeutics

The surge in demand for peptide-based therapeutics is a major catalyst driving the global peptide synthesis market forward. Peptides are increasingly favored in drug development due to their high specificity, low toxicity, and efficacy in modulating complex biological functions. Their ability to target protein-protein interactions and bind to receptors with high affinity makes them ideal for treating diseases like cancer, metabolic disorders, cardiovascular conditions, and autoimmune diseases.

- For example, in July 2024, the American Cancer Society projected a 5% rise in peptide-based oncology treatments, highlighting their growing role in personalized medicine. Additionally, the success of GLP-1 analogs in managing type 2 diabetes and obesity has further propelled interest in peptide drugs. Unlike monoclonal antibodies, peptides offer lower production costs, faster development cycles, and easier formulation for non-invasive delivery.

With an expanding pipeline of peptide drugs in clinical trials and regulatory approvals on the rise, the market is poised for robust growth over the next decade.

Market Restraining Factors

Challenges in Large-Scale Production and Purity

Despite significant technological strides, the peptide synthesis industry faces considerable hurdles when scaling up production. One of the primary challenges lies in maintaining the purity and integrity of complex or long-chain peptides, where side reactions and incomplete couplings can result in impurities that compromise therapeutic efficacy and safety.

- According to a 2024 study published in Nature Biotechnology, companies must invest heavily in advanced purification systems, such as high-performance liquid chromatography (HPLC), to meet stringent regulatory standards.

Addressing such barriers requires the industry to focus on process optimization, better reagent quality, and robust in-line quality monitoring systems. Until these obstacles are fully overcome, large-scale peptide production will remain a bottleneck in meeting surging therapeutic demand.

Key Market Opportunity

Emerging Applications in Vaccine Development and Diagnostics

Expanding peptide synthesis applications in vaccine development and diagnostic testing present lucrative growth opportunities for the global market. In recent years, peptides have emerged as critical components in the design of next-generation vaccines, especially in epitope-based vaccines that provide targeted and safer immune responses. Notably, companies like CureVac and Boehringer Ingelheim are leveraging synthetic peptides to develop mRNA vaccines, where peptides assist in producing antigenic proteins.

- For example, in April 2024, CureVac partnered with Boehringer Ingelheim, focused on tackling mutating influenza virus strains through advanced peptide-based technologies.

As global healthcare systems prioritize early detection and precision medicine, demand for peptide-based tools is expected to grow, creating expansive opportunities for synthesis technology providers across both therapeutic and diagnostic sectors.

Regional Insights

Europe: Dominant Region

Europe holds the dominant market share in the global peptide synthesis market, owing to its well-established pharmaceutical and biotechnology sectors. Countries such as Germany, the U.K., and France have a strong research base and are home to several leading players in peptide therapeutics, including Bayer and Roche. The region is also known for its well-regulated and high-quality manufacturing standards, making it a hub for peptide-based drug development. EIT Health, a European initiative, supports biotech startups focusing on peptide-based treatments, thus encouraging innovation in peptide therapeutics and drug discovery. Europe’s strong focus on regulatory compliance and sustainable practices, especially in biologics production, also plays a crucial role in the growth of the peptide synthesis market.

Uk Peptide Synthesis Market Trends

The UK market, with its world-class healthcare infrastructure, has led to advancements in using peptides for therapeutic purposes, with numerous biotech companies leveraging peptide synthesis for drug development. The UK government’s Innovate UK program has been pivotal in promoting early-stage peptide drug innovation. Companies like Biotage and Peptone are expanding peptide production capabilities, emphasizing high-quality peptide manufacturing for clinical trials.

- Germany’s peptide synthesis market, known for its precision engineering and strong pharmaceutical sector, has seen consistent growth in applications for drug development. As a key player in the European Union’s pharmaceutical market, Germany benefits from significant funding from the German Research Foundation (DFG). The country has a well-established biotech infrastructure, with companies like Bachem and Polypeptide Group leading the development of custom peptides for therapeutic and research purposes. German biotech firms continue to benefit from government incentives to advance peptide-based drug discoveries.

North America: Fastest-Growing Region

North America is the fastest-growing region in the global peptide synthesis market, driven by strong demand in the pharmaceutical and biotechnology sectors. The presence of leading pharmaceutical companies, including Pfizer, Amgen, and Eli Lilly, which are increasingly relying on peptide-based drugs, plays a key role in boosting market growth. North America holds the largest peptide therapeutics market due to the increasing approval of peptide-based drugs and expanding applications in cancer, metabolic diseases, and autoimmune disorders. For example, developing peptide-based vaccines for emerging diseases like COVID-19 and cancer is a high priority. As a result of these factors, North America is expected to maintain its position as the largest and fastest-growing region in the market.

United States Peptide Synthesis Market

The United States peptide synthesis industry holds the largest share, driven by robust pharmaceutical and biotechnology sectors. As a leader in biomedical research, the country has seen substantial growth in peptide-based therapeutics, particularly for cancer, diabetes, and autoimmune diseases. The demand for high-quality peptides has surged, leading to increased investments in peptide synthesis technologies and capabilities. Notably, the U.S. government has backed innovation in peptide drug development through initiatives like the National Institutes of Health (NIH) funding for precision medicine and biotechnology research. Additionally, the ongoing expansion of contract research organizations (CROs) further boosts demand.

- Canada’s peptide synthesis industry has witnessed steady growth, supported by its strong academic and healthcare systems. The country’s investment in biotechnology and pharmaceuticals, driven by both public and private sectors, contributes to the rising demand for synthetic peptides. The Canadian Institutes of Health Research (CIHR) continues to fund peptide research, which has led to advancements in drug discovery. Vancouver and Toronto are recognized hubs for peptide research, with companies like Apeiron Biologics focusing on developing novel peptide-based therapies for cancer and infectious diseases.

Asia Pacific: A Significantly Growing Region

Asia-Pacific is experiencing significant growth in the peptide synthesis market, driven by expanding pharmaceutical and healthcare industries in countries like China, India, and Japan. The rapid adoption of advanced peptide synthesis technologies and the growing focus on precision medicine contribute to the region’s growth. China, in particular, is investing heavily in biotechnology, with a strong government push through programs focusing on advancing the nation’s biotech industry. The region’s increasing demand for peptide-based drugs for cancer, diabetes, and neurological diseases is driving market expansion.

China Peptide Synthesis Market Trends

China’s peptide synthesis industry represents one of the fastest-growing markets, driven by rapid industrialization and government investment in biotech and pharmaceutical development. The Made in China 2025 initiative has promoted the country’s push toward innovation in biotech manufacturing, with peptides crucial in drug formulation, diagnostics, and vaccine development. Companies like Peptide Institute, Inc. and Abgent are establishing themselves as significant suppliers of synthetic peptides for research and therapeutic use. The Chinese government has incentivized the growth of the biotech sector with grants and funding for peptide-related projects, which are critical for the country's expanding healthcare market.

- India’s peptide synthesis industry is growing rapidly, fueled by its increasing investment in biotechnology and its large pharmaceutical industry. India is a key supplier of generic peptides for global markets, and with the rise of biotech innovation, the domestic demand for custom peptides is increasing. The Indian Council of Medical Research (ICMR) has supported peptide research to drive innovation in drug discovery, particularly in areas such as cancer and infectious diseases. Biocon and Dr. Reddy's Laboratories are in charge of peptide synthesis, helping to establish India as a major player in the global peptide market.

Product Type Insights

The reagents subsegment holds a dominant position in the market for peptide synthesis. Reagents are critical for chemical reactions in peptide synthesis, and their role in improving yield, purity, and reaction efficiency is vital. The growth of this subsegment is primarily driven by advancements in peptide synthesis technologies that require more specialized and high-performance reagents. The growing demand for peptide-based therapeutics, especially in oncology and metabolic diseases, further boosts the need for reagents. Introducing novel reagents that provide better stability, higher efficiency, and more precise reactions is expected to increase the market value. Additionally, with increasing investments in research activities to develop new reagents for peptide synthesis, this subsegment is forecasted to expand significantly over the next decade.

Application Insights

Drug development is the largest application segment for peptide synthesis. Peptides are increasingly utilized in developing new targeted therapies, particularly for cancer, cardiovascular, and neurodegenerative diseases. The segment's growth is supported by the increasing success of peptide-based drugs offering fewer side effects than traditional small molecules. According to Pharmaceutical Technology (2024), approximately 60 peptide-based drugs are approved by the FDA, with over 100 more in clinical trials. The drug development segment is set for substantial growth, with peptide-based therapies becoming increasingly popular due to their specificity. Additionally, advancements in peptide formulation technologies that enhance peptide stability and bioavailability will further propel this subsegment.

End-User Insights

Pharmaceutical and biotech companies represent the leading end-user segment in the market for peptide synthesis, driven by the escalating demand for peptide-based therapeutics and personalized medicine. These organizations are at the forefront of drug discovery and development, leveraging advanced peptide synthesis technologies to produce large-scale, high-purity compounds. The surge in chronic diseases and cancer has accelerated R&D investments, making peptides vital in targeted therapies. Additionally, growing FDA approvals for peptide drugs underscore their clinical relevance. Their capability for high-throughput synthesis and robust funding and infrastructure positions them as the dominant contributors to market revenue.

Technology Insights

SPPS is the dominant technology for peptide synthesis, owing to its ability to create large quantities of peptides with high purity. The advancement in solid-phase synthesis methods, such as microwave-assisted SPPS, has improved the efficiency of peptide production. SPPS is considered the most versatile and reliable technology, enabling the production of simple and complex peptides. Furthermore, the continuous advancements in SPPS instruments and increasing demand for high-quality peptides in drug development are expected to keep this technology as the market leader.

Competitive Analysis

The global peptide synthesis market is highly competitive, with several key players competing to capture the growing demand for custom peptides. Companies typically focus on expanding their product offerings, improving synthesis technologies, and entering into strategic collaborations with pharmaceutical and biotech firms. Companies leverage extensive research, development, and manufacturing capabilities to meet the rising demand for therapeutic and research applications of peptides.

List of Key and Emerging Players in Peptide Synthesis Market

- Merck KGaA

- Thermo Fisher Scientific Inc.

- GenScript

- Novozymes A/S

- Bachem Holding AG

- MP Biomedicals

- Lonza

- PuroSynth

- Syngene

- Polypeptide Group

- Creative Diagnostics

- Thermo Fischer Scientific, Inc.

- CEM Corporation

- Biotage

- Kaneka Corporation

Recent Developments

- January 2025- Bachem acquired Peptides International, expanding its portfolio of custom peptides for biotech and pharmaceutical applications, particularly focusing on oncology and immunotherapy peptides.

- October 2024- Thermo Fisher Scientific launched a new peptide synthesis platform that integrates high-throughput capabilities with high-quality peptide production, enabling faster drug discovery and clinical research turnaround times.

Analyst’s Opinion

As per our analyst, the global peptide synthesis market is positioned for significant growth due to rising demand for peptide-based therapeutics, increasing applications in research and diagnostics, and advancements in peptide synthesis technology. Peptides have emerged as promising candidates in drug development, particularly for oncology, metabolic disorders, and autoimmune diseases, spurring the growth of peptide synthesis technologies. Key market drivers include increased investment in biotechnology and government-funded research initiatives to support peptide drug development.

The rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions is expected to propel the peptide market, as peptides offer potential solutions to target specific diseases more effectively. Moreover, peptides are becoming increasingly important in vaccine development, with COVID-19 vaccine developers showing how peptide-based platforms can be used for efficient and scalable vaccine production.

In addition, innovations in automated peptide synthesis systems, such as solid-phase peptide synthesis (SPPS) and liquid-phase peptide synthesis (LPPS), will further enhance market prospects by improving the speed, scale, and efficiency of peptide production. This trend will drive market consolidation as larger players seek to acquire smaller, specialized peptide synthesis firms.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 667.26 Million |

| Market Size in 2025 | USD 750.66 Million |

| Market Size in 2033 | USD 1926.05 Million |

| CAGR | 12.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application, By End-User, By Technology |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Peptide Synthesis Market Segments

By Product Type

- Reagents

- Peptide Synthesizers

- Resins

By Application

- Drug Development

- Research and Diagnostics

- Therapeutics

- Vaccine Development

- Others (Cosmetics, Food, and Agriculture)

By End-User

- Pharmaceutical and Biotech Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs)

- Diagnostic Laboratories

By Technology

- Solid-Phase Peptide Synthesis (SPPS)

- Liquid-Phase Peptide Synthesis (LPPS)

- Hybrid Synthesis

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Dhanashri Bhapakar

Senior Research Associate

Dhanashri Bhapakar is a Senior Research Associate with 3+ years of experience in the Biotechnology sector. She focuses on tracking innovation trends, R&D breakthroughs, and market opportunities within biopharmaceuticals and life sciences. Dhanashri’s deep industry knowledge enables her to provide precise, data-backed insights that help companies innovate and compete effectively in global biotech markets.