Personal Health Record Software Market Size, Share & Trends Analysis Report By Component (Software, Services), By Health Record Type (Standalone PHRs, Connected PHRs, Integrated PHRs), By Application (Health Monitoring & Vital Tracking, Lab Results & Diagnostic Data Access, Appointment Scheduling & Reminders, Others), By End User (Patients, Providers, Payers) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Personal Health Record Software Market Overview

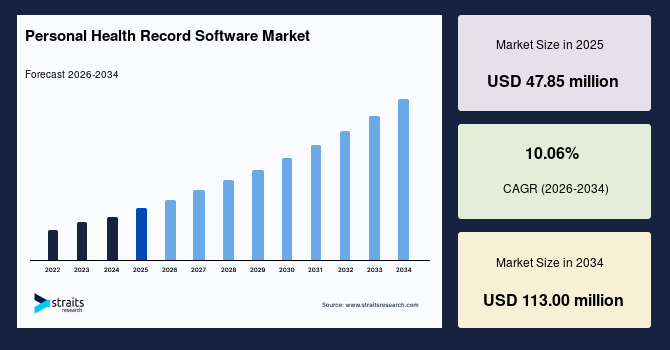

The global personal health record software market size is estimated at USD 47.85 million in 2025 and is projected to reach USD 113.00 million by 2034, growing at a CAGR of 10.06% during the forecast period. The remarkable market growth is attributed to the rising adoption of patient-controlled health data platforms for lifelong record continuity across providers, devices, and care settings, supporting personalized healthcare delivery.

Key Market Trends & Insights

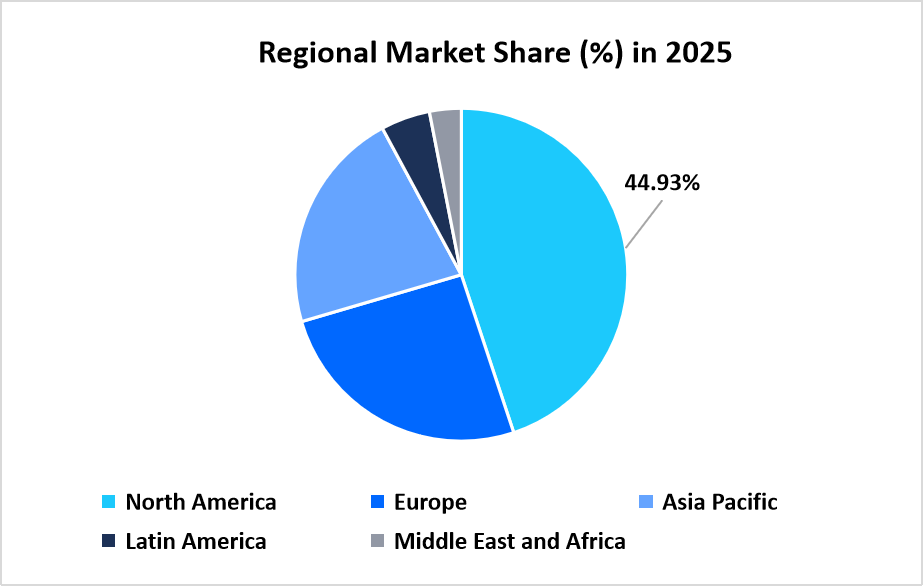

- North America held a dominant share of the global market, accounting for 44.93% market share in 2025.

- The Asia Pacific region is estimated to grow at the fastest pace, with a CAGR of 11.59% during the forecast timeframe.

- Based on the component, the software segment dominated the market in 2025.

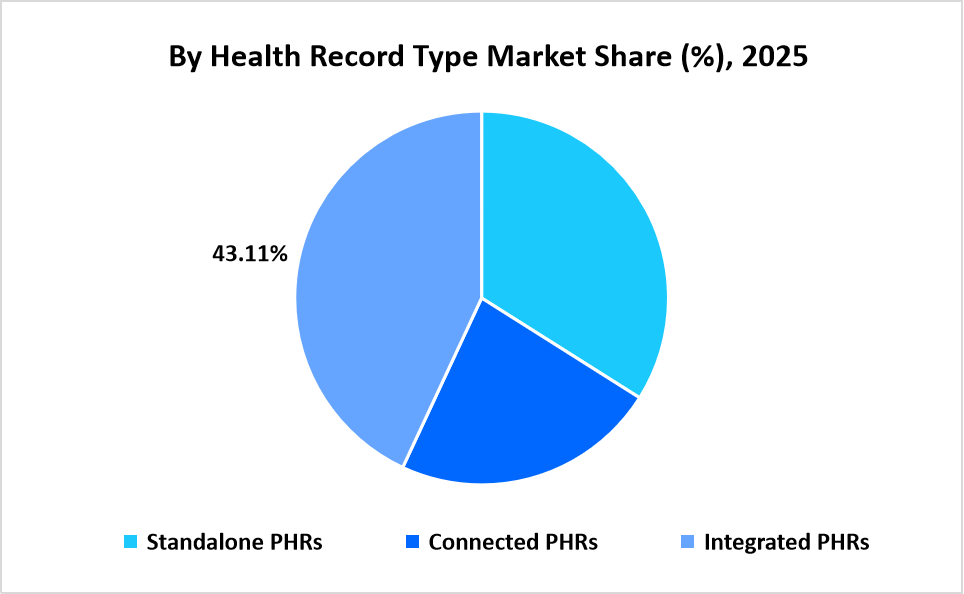

- By health record type, the connected PHRs segment is estimated to grow at the fastest pace with a CAGR of 10.85% during 2026-2034.

- By application, the lab results & diagnostic data access segment dominated the market in 2025, accounting for 41.38% revenue share.

- Based on end user, the patient segment dominated the market in 2025.

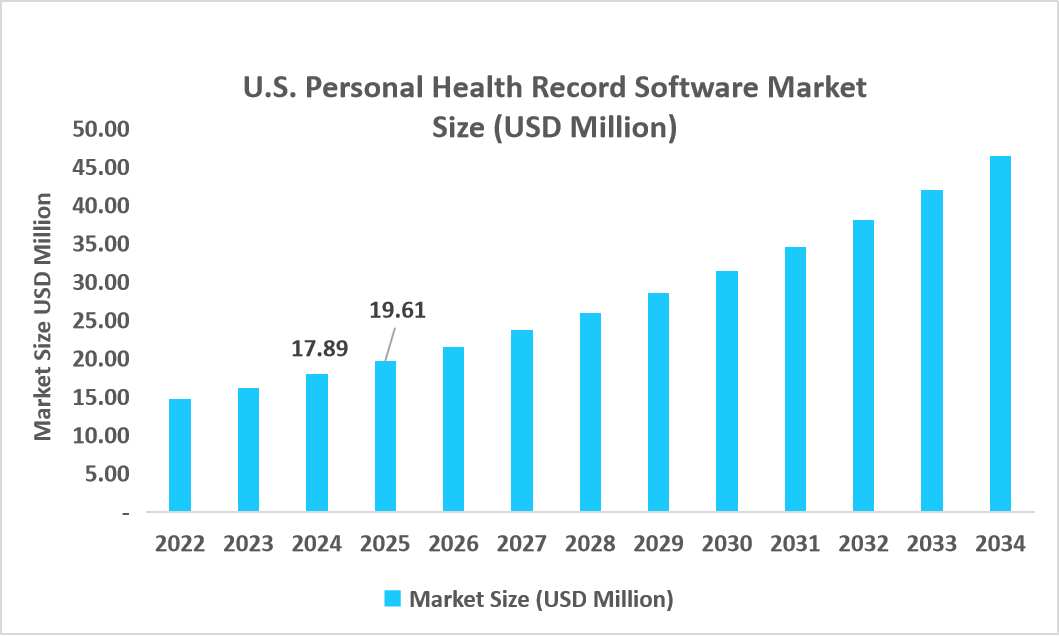

- The U.S. dominates the personal health record software market, valued at USD 17.89 million in 2024 and reaching USD 19.61 million in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 47.85 million

- 2034 Projected Market Size: USD 113.00 million

- CAGR (2026-2034): 10.06%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The personal health record software market comprises digital solutions, including web-based and cloud-based software platforms, along with associated services, which support standalone, connected, and integrated PHR models. These solutions are applied for health monitoring, vital tracking, lab and diagnostic data access, appointment scheduling, and related functions, and are utilized by patients, healthcare providers, and payers to improve data accessibility, care coordination, and patient engagement.

Market Trends

Rise of Patient Controlled Interoperable Health Data Ecosystems

The shift toward patient-controlled, interoperable health data ecosystems is a key trend supporting market growth. PHR providers are developing platforms that allow individuals to aggregate medical records from multiple healthcare systems, wearable devices, and diagnostic sources into a single, unified interface. This approach enhances data portability, supports continuity of care, and aligns with value-based healthcare models, which, in turn, strengthens patient empowerment and long term platform adoption.

Emergence of AI-Driven Predictive Health Insights In PHR Platforms

A trend in the personal health record software market is the integration of AI-driven predictive health insights within PHR platforms. Vendors like OneRecord and Seqster are embedding advanced analytics and machine learning models that analyze longitudinal health data to forecast health risks, suggest preventive actions, and personalize wellness guidance for users. This capability transforms PHR systems into proactive health tools, strengthening patient engagement, enhancing self-management, and driving broader adoption.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 47.85 million |

| Estimated 2026 Value | USD 52.49 million |

| Projected 2034 Value | USD 113.00 million |

| CAGR (2026-2034) | 10.06% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Health Wealth Safe Inc., Tiga Healthcare Technologies, Inform Health Limited, Knapsack Health, Record Tree |

to learn more about this report Download Free Sample Report

Market Driver

Growing Adoption of Blockchain-Enabled Data Security In PHR Solutions

A major and unique driver of the personal health record software market is the rising adoption of blockchain-enabled security features to safeguard sensitive health data. As privacy concerns intensify, providers like Healthspek and Patientory are incorporating decentralized ledger technology to ensure immutable, transparent, and patient-controlled access. This innovation builds trust among users and healthcare stakeholders, accelerating PHR adoption while meeting stringent regulatory and cybersecurity demands.

Market Restraint

Lack of Unified Data Integration Across Healthcare Systems

The lack of uniform interoperability standards across healthcare systems is a key restraint impacting market growth. Many PHR platforms struggle to seamlessly integrate data from diverse EHRs, diagnostic labs, and wearable devices, resulting in delayed health records. This fragmentation reduces clinical usability, limits provider trust, and discourages large-scale deployment, ultimately slowing market growth despite rising demand for patient-centered digital health solutions.

Market Opportunity

Expansion of Personalized Preventive Care Through Longitudinal Health Data Utilization

A key opportunity in the personal health record software market lies in leveraging long-term, patient-owned health data to enable personalized preventive care solutions. PHR platforms increasingly integrate multi-year medical histories, lifestyle data, and wearable-generated metrics to support early risk detection and tailored health recommendations. As healthcare shifts toward prevention-focused and value-based models, this capability allows PHR vendors to partner with providers and payers, expand use cases beyond record storage, and unlock new revenue streams through analytics-driven health management services.

Regional Analysis

North America dominated the personal health record software market in 2025, accounting for 44.93% market share. This growth is driven by early regulatory mandates and national interoperability initiatives that compel healthcare organizations to enable patient access and data exchange. In the U.S., regulations such as the 21st Century Cures Act mandate open access to electronic health data, substantially increasing PHR utilization.

Canada’s personal health record software industry growth is supported by Pan‑Canadian Connected Care initiatives that standardize and share health data across provinces, enabling seamless patient access and interoperability. The Pan‑Canadian Health Data Content Framework and Connected Care for Canadians Act aim to unify health information exchange and reduce fragmentation, accelerating PHR adoption and improving continuity of care across Canada’s healthcare ecosystem.

Asia Pacific Personal Health Record Software Market Insights

Asia Pacific is emerging as a fastest growing region with a CAGR of 11.59% from 2026-2034, owing to government-supported national digital health initiatives that centralize patient health data and enable interoperable PHR access. For example, South Korea’s expanded MyHealthWay platform now grants citizens access to 113 types of personal health records from over 860 institutions, enhancing data portability, patient engagement, and continuity of care across providers.

China’s market for personal health record software expanded with the government’s “Electronic Health Code” and nationwide interoperable health data platform initiative, established under the “14th Five‑Year National Health Informatization Plan”. This policy mandates that every resident will have a dynamic electronic health record and a fully functional health code, enabling unified access to medical history, diagnostics, and care interactions across healthcare providers.

Source: Straits Research

Europe Market Insights

Europe's personal health record software market growth is supported by the enactment of the European Health Data Space (EHDS), a first‑of‑its‑kind EU regulation that harmonizes cross‑border health data access and patient control across member states. By standardizing formats and governance for electronic health data use, EHDS empowers citizens with seamless, secure access to their personal health records and accelerates interoperable PHR adoption across national healthcare systems.

The UK Personal health record software industry is witnessing growth due to the NHS’s development of the Single Patient Record, which mandates a unified, patient-owned digital health record accessible via the NHS App by 2028. This policy, enshrined in the UK’s 10‑Year Health Plan, requires health and care providers to make patient data securely available, notably increasing PHR uptake and engagement.

Latin America Market Insights

Latin America's personal health record software market is witnessing steady growth, due to Peru’s participation in the Pan American Health for Health (PH4H) digital health interoperability initiative, which validates cross-system electronic clinical record exchange and lays a foundation for connected PHR access. This regional collaboration enhances secure data sharing across providers and paves the way for integrated digital health services, increasing PHR adoption throughout neighboring healthcare systems.

Argentina’s market is experiencing growth driven by the implementation of the National Digital Health Network, which connects patient data across all 24 provinces and centralizes access via the Mi Argentina/Mi Salud citizen health portal. This government initiative has already registered over 6 million patients’ records, enabling secure data exchange of personal health information, which, in turn, boosts PHR adoption.

Middle East and Africa Market Insights

The Middle East and Africa market is expanding due to the implementation of large scale national health data exchange platforms like the UAE’s Riayati and Abu Dhabi’s Malaffi, which collectively store billions of patient records and allow real time access for thousands of providers, which uniquely accelerates PHR usage by ensuring secure, data continuity.

The personal health record software market growth in South Africa is stimulated by the Gauteng Department of Health’s initiative to digitize over 800 million paper‑based patient files across 37 public hospitals, creating a centralized electronic health data ecosystem, thereby supporting the market growth.

Component Insights

The software segment dominated the market in 2025. This growth is attributed to the surge in PHR mobile application development that consolidates real-time wearable and smartphone-generated health metrics into unified personal profiles, meeting rising consumer expectations for instant health access and data synchronization across devices.

The services segment is projected to register the fastest CAGR growth of 10.76% during the forecast period, owing to the increasing requirement for specialized interoperability-and-compliance integration services that assist healthcare organizations in securely aligning PHR platforms with evolving data exchange standards such as HIPAA and FHIR. For instance, companies like Seqster, through partnerships with Takeda, are deploying interoperable patient data solutions.

Health Record Type Insights

The integrated PHRs segment dominated the market in 2025 with a revenue share of 43.11%. This dominance is attributed to the increased adoption of real-time clinical decision support features within PHR interfaces, enabling providers to deliver context-aware alerts and personalized care recommendations directly from unified patient records, markedly improving clinical workflows. This capability has driven deeper integration and higher utilization of integrated PHR systems in value-based care models.

The connected PHRs segment is estimated to grow at the fastest CAGR of 10.85% during the forecast period. This growth is supported by the rapid integration of real-time API connections between PHR platforms and remote patient monitoring devices, enabling continuous chronic disease monitoring and accelerating clinical engagement through instantaneous data sharing. This has increased the connected PHR adoption in telehealth and chronic care management programs.

Source: Straits Research

Application Insights

The lab results & diagnostic data access segment dominated the market in 2025 with a revenue share of 41.38%, as increasing patient preference for automated visualization of diagnostic trends, such as longitudinal graphs for blood glucose and lipid profiles within PHR dashboards, enhanced self-monitoring and informed shared decision making with clinicians, driving higher engagement and usage of this application feature.

The health monitoring & vital tracking segment is expected to register fastest CAGR growth during the forecast period. This growth is driven by the surge in integration of continuous wearable sensor analytics into PHR apps, enabling real-time tracking of metrics such as heart rate variability and arrhythmia alerts, which notably improve early risk detection and personalized wellness insights for consumers.

Competitive Landscape

The global personal health record software market is moderately consolidated, with several established pharmaceutical and specialty firms capturing the largest share. Leading players such as Takeda Pharmaceutical, Amgen, Novartis, GlaxoSmithKline, and Pfizer dominate through strategic initiatives including new launches, expanded indications, and targeted collaborations. These companies continuously invest in clinical development, physician education, and market access programs to enhance their competitive position and drive market growth.

Eisai Co., Ltd.: An emerging market player

Eisai Co., Ltd. emerged as a notable player in the market, particularly in the Asia-Pacific. The company is advancing its selective URAT1 inhibitor through expanded regulatory filings and strategic partnerships to broaden geographic reach. Its focused efforts on improving renal safety profiles and combination therapy potential have strengthened its position, signaling growth beyond traditional competitors and capturing increasing clinician and patient interest in targeted gout management.

List of Key and Emerging Players in Personal Health Record Software Market

- Health Wealth Safe Inc.

- Tiga Healthcare Technologies

- Inform Health Limited

- Knapsack Health

- Record Tree

- PHR Plus

- Cloudchowk

- Medixine

- Phressia

- Health Companion

- Healthspek

- NoMoreClipboard

- Patient Ally

- Records For Living, Inc.

- Validic

- Healthbook LLC

- OneRecord

- Seqster

- Others

Strategic Initiatives

- September 2025: PracticeSuite, a cloud-based solution provider, acquired the MicroMD company, which offers the HER & PHR platforms.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 47.85 million |

| Market Size in 2026 | USD 52.49 million |

| Market Size in 2034 | USD 113.00 million |

| CAGR | 10.06% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Health Record Type, By Application, By End User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Personal Health Record Software Market Segments

By Component

-

Software

- Web-based

- Cloud-based

- Services

By Health Record Type

- Standalone PHRs

- Connected PHRs

- Integrated PHRs

By Application

- Health Monitoring & Vital Tracking

- Lab Results & Diagnostic Data Access

- Appointment Scheduling & Reminders

- Others

By End User

- Patients

- Providers

- Payers

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.