Personalized Vitamins Market Size, Share & Trends Analysis Report By Type (Wellness Supplements, Disease-Based Supplements), By Formulations (Tablets, Capsules, Powders, Gummies/Chewable, Liquids), By Sales Channel (Online, Offline) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Personalized Vitamins Market Size

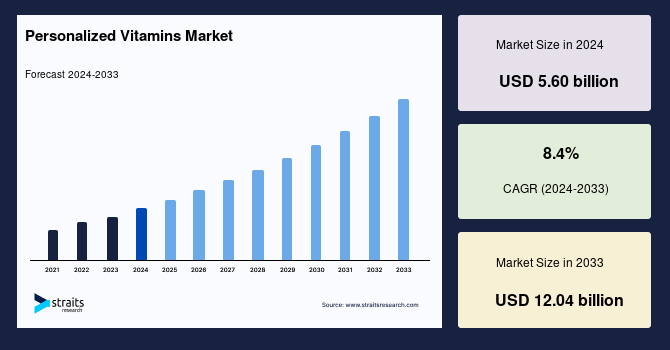

The global personalized vitamins market size was valued at USD 5.60 billion in 2024 and is anticipated to grow from USD 6.07 billion in 2025 to reach USD 11.57 billion in 2033, growing at a CAGR of 8.4% during the forecast period (2025–2033).

Personalized vitamins are supplements designed to meet an individual’s unique health needs, lifestyle, and genetic makeup. Unlike generic multivitamins, these formulations consider factors such as age, diet, activity level, allergies, and even DNA or blood test results. The goal is to deliver the precise nutrients your body requires in optimal amounts, enhancing absorption and overall effectiveness. Many companies now offer personalized vitamin services through online assessments and lab testing, providing customized daily packs or capsules to support better health and wellness.

The market is experiencing rapid growth, driven by rising consumer demand for tailored health solutions, advancements in DNA testing, and increasing awareness of preventive healthcare. Companies are leveraging AI, health assessments, and genetic testing to develop supplement lines that cater to individual dietary needs and deficiencies. Moreover, the expansion of e-commerce platforms and subscription-based models is further fueling market growth by offering convenience and accessibility.

- For example, Care/of provides a customized vitamin subscription service, offering third-party-tested supplements in single-serving daily packs. Consumers complete an online quiz detailing their diet, health concerns, and wellness goals, allowing Care/of to recommend a personalized set of vitamins and supplements. This approach not only simplifies supplement selection but also enhances the consumer experience by addressing specific health needs.

Such personalized strategies are reshaping the supplement industry by improving consumer engagement and providing tailored wellness solutions. As companies like Care/of continue to innovate, the market for personalized vitamins is expected to expand further, driven by convenience, customization, and a growing emphasis on individual health optimization.

Market Trends

Rising Focus on Personalized Gummy Vitamins

Consumers are increasingly seeking convenient, effective alternatives to traditional tablets, driving the demand for personalized gummy vitamins. Gummies offer an easy-to-take format while delivering targeted nutrients, making them highly preferred among individuals who struggle with swallowing pills. Advanced technologies such as 3D printing enable the precise formulation of nutrient combinations based on unique health requirements.

- For instance, in 2022, Elo introduced Elo Smart Gummies, a 3D-printed customized gummy supplement offering 389 million possible nutrient combinations to support various health objectives. Each gummy contains the potency of seven pills in a single dose. A pilot study demonstrated that Elo Smart Gummies were as effective as vitamin D soft gel pills in increasing vitamin D serum levels over 12 weeks.

As more consumers prioritize ease of use and efficacy, brands investing in innovative gummy formulations are well-positioned to capture a larger market share.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 5.60 Billion |

| Estimated 2025 Value | USD 6.07 Billion |

| Projected 2033 Value | USD 11.57 Billion |

| CAGR (2025-2033) | 8.4% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | HUM Nutrition Inc., Viome Life Sciences, Inc., Vous Vitamins, LLC. , Herbalife Nutrition, Metagenics |

to learn more about this report Download Free Sample Report

Personalized Vitamins Market Growth Factors

Increasing Prevalence of Chronic Conditions

The increasing global burden of chronic diseases is a key driver of the personalized vitamins market. Consumers are actively seeking condition-specific nutritional supplements to prevent and manage health conditions, addressing deficiencies that contribute to long-term wellness challenges.

- For instance, a report published in February 2024 by Preventing Chronic Disease revealed that among 129 million Americans, 42% suffer from two or more major chronic conditions. Likewise, the U.S. spends 90% of its $4.1 trillion healthcare expenditure on managing chronic diseases.

The growing awareness of preventive healthcare has led individuals to prioritize personalized vitamins tailored to their specific health needs. Whether targeting cardiovascular health, metabolic conditions, or immune support, the demand for customized nutritional solutions continues to accelerate, further driving market growth.

Expansion of E-Commerce & Direct-to-Consumer (dtc) Sales

The rise of digital commerce has transformed how consumers purchase personalized vitamins, making customized supplements more accessible. E-commerce and DTC sales allow brands to offer personalized solutions at scale, delivering customized formulations directly to consumers' doorsteps. The convenience, personalization, and flexibility of online shopping are major factors fueling this market expansion.

- For instance, in February 2025, the U.S. e-commerce sales for 2024 totaled approximately $1.192 trillion, representing 16.1% of all retail sales. The shift toward digital shopping indicates a growing reliance on online platforms for purchasing health and wellness products, including personalized vitamins.

Brands leveraging AI-driven assessments, subscription models, and digital health integrations are improving customer engagement while optimizing product recommendations. This is expected to drive global personalized vitamins market growth.

Market Restraining Factor

Regulatory Challenges & Compliance Issues

Regulatory challenges and compliance concerns significantly restrain the market. Since these supplements involve DNA analysis, blood tests, and health data, they face strict oversight from agencies like the FDA and EFSA. Companies must navigate complex regulations, including product classification, substantiating health claims, and adhering to data privacy laws such as HIPAA and GDPR. These requirements prolong approval timelines, increase operational costs, and create market entry barriers. Moreover, evolving global regulations add uncertainty, making compliance more challenging. As a result, regulatory hurdles slow innovation and restrict the widespread adoption of personalized vitamins, limiting overall market growth.

Market Opportunity

Growing Demand for Plant-Based & Clean-Label Ingredients for Personalized Vitamins

The demand for plant-based, organic, and clean-label personalized supplements is on the rise, driven by increasing health consciousness, ethical considerations, and sustainability concerns. Consumers are actively seeking natural, non-GMO, and additive-free formulations, preferring brands that emphasize transparency and ingredient purity.

- For instance, a 2023 survey conducted by Ingredion found that 78% of consumers are willing to pay more for products with clean-label and natural ingredients. This trend reflects a growing preference for minimally processed, chemical-free supplements aligned with modern dietary choices, including vegan, gluten-free, and allergen-friendly formulations.

Brands capitalizing on this opportunity by offering plant-based and environmentally friendly personalized vitamin options can attract health-conscious and sustainability-driven consumers.

Regional Insights

North America dominates the global market with 42.5% market share, driven by increasing consumer awareness of personalized nutrition, a rising prevalence of chronic diseases, and a growing demand for health and wellness products. The region benefits from a well-established healthcare infrastructure and high disposable income, further fueling market expansion. Moreover, the adoption of digital health solutions, such as at-home testing kits and AI-based recommendations, enhances accessibility and personalization. The presence of key market players and favorable regulatory policies further strengthen North America's leading position.

The U.S. market is leading, driven by high consumer awareness and demand for customized wellness solutions.

- For instance, in February 2024, the U.S. Pharmacopeia (USP) introduced regulatory reforms to ensure dietary supplement quality, reinforcing market credibility. With an estimated 80% of Americans using dietary supplements and the industry experiencing immense growth, the demand for personalized vitamins continues to surge, further solidifying the U.S. as a dominant market player.

Canada market is expanding rapidly, fueled by rising consumer awareness and emerging industry players.

- In May 2023, Canadian startup VitaminLab secured Series A funding from Nimbus Synergies and DSM Venturing to scale production and market reach. This investment highlights growing confidence in personalized supplements, driving demand.

As more companies innovate and expand, Canada is set to become a key market for personalized nutrition solutions.

Asia Pacific Personalized Vitamins Market Trends

Asia-Pacific is emerging as the fastest-growing market due to the rising health consciousness, increasing disposable income, and a growing demand for personalized nutrition solutions. Countries such as China, Japan, and India are witnessing a surge in consumers seeking supplements to address lifestyle-related health concerns and improve overall well-being. Moreover, the expansion of digital health platforms, rising e-commerce penetration, and increasing preference for natural and clean-label products are accelerating market growth.

India’s vast population and rising health consciousness are fueling rapid growth in the personalized vitamins industry. The Indian nutraceutical industry, projected to reach USD 18 billion by 2025, dominates 67% of the health and wellness sector. Increasing government initiatives, rising foreign direct investments, and growing demand for preventive healthcare products are accelerating market expansion, making India a key emerging market for personalized nutrition solutions.

Japan is experiencing strong market growth, fueled by rising demand for personalized vitamins and increased investment in the sector.

- In November 2022, Rem3dy Health’s 3D-printed vitamin company, Nourished, secured £2.5 million in funding from Suntory Holdings to expand in Japan.

This investment underscores the country’s growing appetite for customized wellness solutions, driving innovation and positioning Japan as a leading market for personalized nutrition.

Europe Personalized Vitamins Market Trends

Germany is a key player in Europe's market, backed by a strong healthcare infrastructure and a growing focus on preventive healthcare. The country’s well-developed nutraceutical sector adheres to stringent European Food Safety Authority (EFSA) regulations, ensuring high-quality supplements. Moreover, the presence of global nutraceutical giants, innovative startups, and leading research institutions further accelerates market growth, making Germany a major hub for personalized vitamin solutions.

France is witnessing significant growth in personalized vitamins, driven by increasing demand for preventive healthcare and natural supplements. Consumers are turning to personalized nutrition to manage lifestyle diseases, boost immunity, and enhance overall wellness. Advancements in digital health platforms and DNA-based nutritional insights are further shaping the market, enabling customized vitamin formulations tailored to individual health profiles, reinforcing France’s position in the evolving personalized nutrition landscape.

Middle East and Africa Personalized Vitamins Market Trends

Saudi Arabia’s market for personalized vitamins is growing due to increasing health awareness, higher disposable income, and a shift toward preventive care. The government’s Vision 2030 initiative promotes healthcare advancements, driving demand for personalized nutrition. A thriving e-commerce sector and strategic collaborations with global nutraceutical brands are further strengthening the market, positioning Saudi Arabia as a key player.

Type Insights

The disease-based supplements segment leads the market for personalized vitamins due to rising chronic illnesses, growing consumer awareness of preventive healthcare, and demand for targeted nutritional solutions. Consumers seek condition-specific vitamins to manage ailments, driving product innovation.

- For instance, in 2024, the FDA stated that dietary supplements intended to treat or prevent diseases are classified as drugs, underscoring the demand for disease-specific formulations. As chronic health conditions increase, disease-focused supplements will continue to shape the market, catering to health-conscious consumers.

Formulations Insights

Tablets dominate the market for personalized vitamins as they offer cost-effectiveness, stability, and long shelf life, making them ideal for long-term use. Their precise dosage control ensures effective nutrient intake, making them the preferred choice for both consumers and manufacturers. Moreover, tablets are compact, easy to store, and transport, providing convenience over liquid and gummy formulations. Their affordability and ability to deliver high concentrations of active ingredients reinforce their dominance in the market, appealing to a broad consumer base.

Sales Channel Insights

Offline sales channels continue to dominate as consumers prefer in-store consultations, expert guidance, and direct product evaluation. Pharmacies, health stores, and specialty retailers offer personalized recommendations, fostering consumer trust. Physical retail stores also strengthen brand credibility and loyalty, as shoppers can interact with products and receive immediate healthcare advice. The ability to verify product authenticity and understand ingredient benefits further drives offline sales, cementing its leading position in the market.

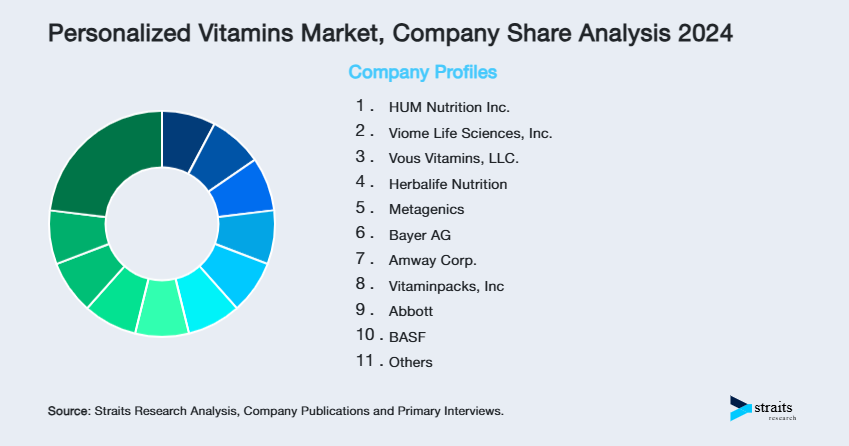

Company Market Share

Key players in the personalized vitamins industry are actively implementing strategic initiatives to strengthen their market presence. These include strategic collaborations, product approvals, mergers and acquisitions, and innovative product launches. Companies are leveraging advanced technologies such as AI-driven recommendations, DNA-based customization, and digital health integrations to enhance their offerings.

Elysium Health: An Emerging Player in the Global Personalized Vitamins Market

Elysium Health is a pioneering life sciences company dedicated to advancing aging research and developing scientifically backed health products. Its product portfolio includes cutting-edge dietary supplements designed to support longevity, cellular function, and overall well-being. By leveraging research, partnerships with leading scientists, and innovations in epigenetics and metabolism, Elysium Health aims to transform preventive healthcare.

Recent Developments by Elysium Health:

- In October 2023, Elysium Health introduced MOSAIC, a clinically supported daily softgel to fight skin aging internally. Formulated with Dr. Richard Granstein, the formula utilizes carotenoids and hyaluronic acid to shield skin at the cellular level, enhancing moisture retention, resilience, and photoaging reduction.

List of Key and Emerging Players in Personalized Vitamins Market

- HUM Nutrition Inc.

- Viome Life Sciences, Inc.

- Vous Vitamins, LLC.

- Herbalife Nutrition

- Metagenics

- Bayer AG

- Amway Corp.

- Vitaminpacks, Inc

- Abbott

- BASF

- Caligenix, Inc.

- DayTwo Inc.

- Nutrigenomix

- Elysium Health

- Vitamyna

to learn more about this report Download Market Share

Recent Developments

- November 2024 – Persona Nutrition, a subsidiary of Vitaminpacks, Inc., introduced a white-label offering to enable brands to enter the subscription-based personalized nutrition market. The development opens up more business opportunities within the personalized health market, supporting market expansion.

- April 2024 – Vitamyna, an eco-conscious supplement brand, introduced an innovative personalized daily vitamin pack builder that addresses unique health requirements and objectives. The service provides monthly doorstep delivery, making it convenient and improving consumer compliance.

Analyst Opinion

As per our analysts, the market is set for significant expansion, fueled by increasing consumer demand for tailored nutrition solutions, advancements in DNA testing and blood analysis, and a rising focus on preventive healthcare. Innovations such as 3D-printed gummies, AI-driven recommendations, clean-label ingredients, and digital health platforms are revolutionizing the market, making personalized nutrition more accessible and effective.

Despite its rapid growth, the global personalized vitamins market faces challenges such as high product costs, regulatory complexities, and consumer skepticism regarding the efficacy of personalized supplements. Standardizing quality control and ensuring scientific validation remain key hurdles. However, ongoing research, strategic collaborations, and technological advancements continue to drive industry confidence and expansion.

As digital health solutions and direct-to-consumer models gain traction, the personalized vitamins market is expected to experience sustained growth, offering consumers more precise, science-backed wellness solutions in the future.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 5.60 Billion |

| Market Size in 2025 | USD 6.07 Billion |

| Market Size in 2033 | USD 11.57 Billion |

| CAGR | 8.4% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Formulations, By Sales Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Personalized Vitamins Market Segments

By Type

- Wellness Supplements

- Disease-Based Supplements

By Formulations

- Tablets

- Capsules

- Powders

- Gummies/Chewable

- Liquids

By Sales Channel

- Online

- Offline

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.