Pet DNA Testing Market Size, Share & Trends Analysis Report By Type (Dogs, Cats, Other Animals), By Sample (Blood, Saliva, Faecal, Others), By Test (Breed Profile, Genetic Diseases, Health and Wellness), By End-User (Pet Owners, Breeders, Veterinarians) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Pet DNA Testing Market Overview

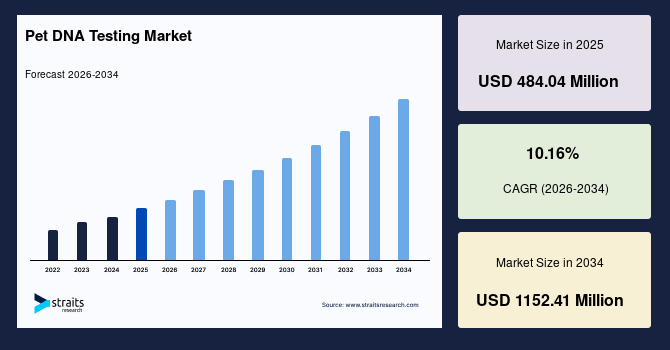

The global pet DNA testing market size is estimated at USD 484.04 million in 2025 and is projected to reach USD 1152.41 million by 2034, growing at a CAGR of 10.16% during the forecast period. Remarkable growth of the market is propelled by the rising adoption of genetic screening for early health risk identification, increasing demand for breed verification among pet owners and breeders, and expanding integration of DNA-based insights into preventive veterinary care.

Key Market Trends & Insights

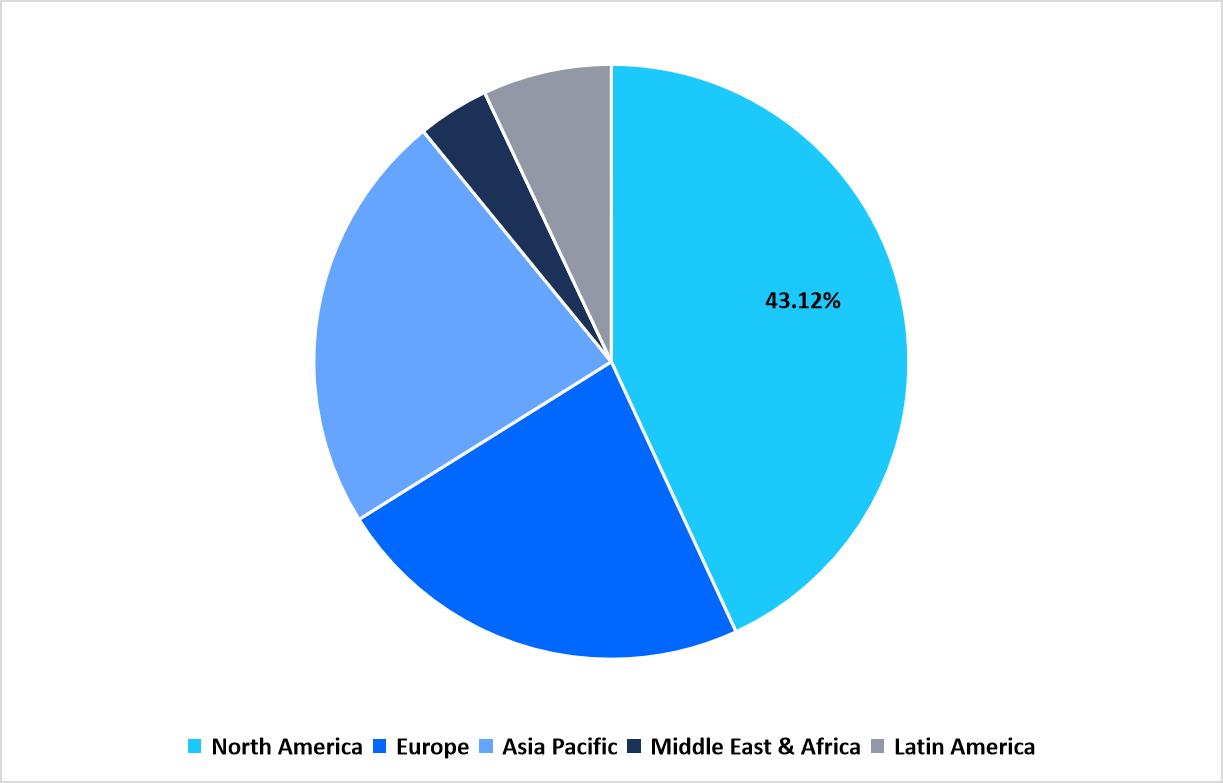

- North America held a dominant share of the global market, accounting for 43.12% share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 12.16%.

- Based on type, the dog segment dominated the market with a revenue share of 55.34%.

- Based on the sample, the saliva segment dominated the market with a revenue share of 56.74%.

- Based on the test, the breed profile dominated the market with a revenue share of 43.01%.

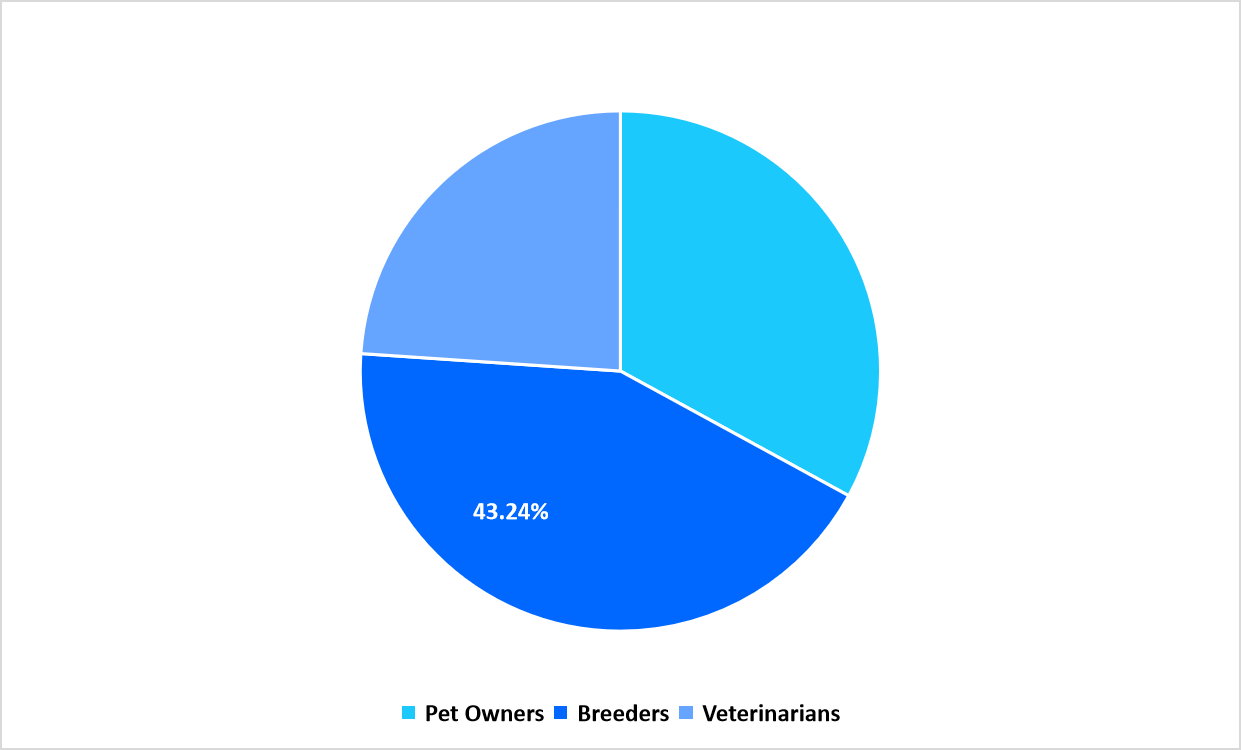

- Based on End-User, the breeders segment dominated the market with a revenue share of 43.24%

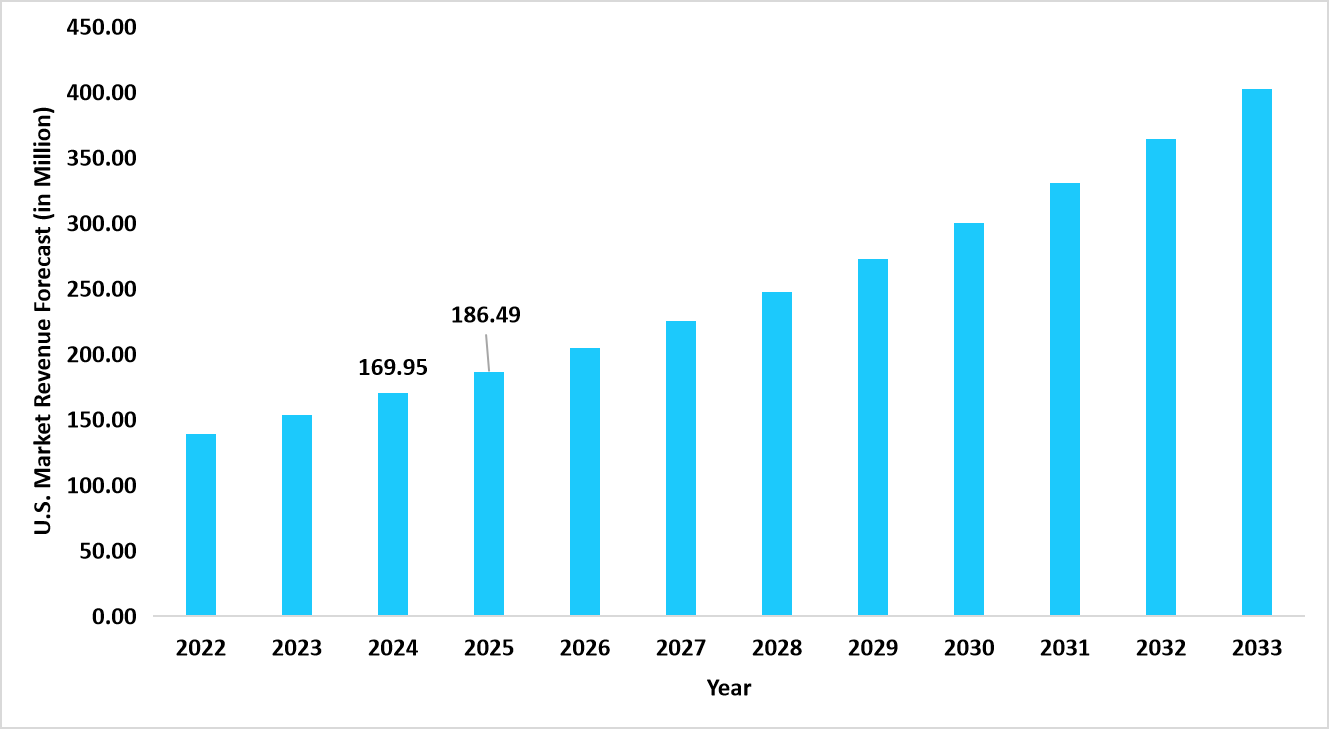

- The U.S. dominates the global Pet DNA testing market, valued at USD 169.95 million in 2024 and reaching USD 186.49 million in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 484.04 million

- 2034 Projected Market Size: USD 1152.41 million

- CAGR (2025 to 2034): 10.16%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The pet DNA testing market refers to the industry focused on genetic analysis services for companion animals, including dogs, cats, and other small or exotic pets, to provide insights into breed composition, hereditary disease risks, trait expression, and overall wellness indicators. These tests use biological samples such as saliva, blood, fecal matter, or other tissues to extract and analyze genetic material through laboratory sequencing and bioinformatic interpretation. The market encompasses direct-to-consumer test kits, veterinary-integrated genetic screening, and breeder-focused lineage verification services, enabling pet owners, veterinarians, and breeders to make informed decisions regarding health management, preventive care, breeding choices, and behavioral understanding. As demand for personalized pet care increases, the market continues to expand with broader test offerings, improved genomic databases, and growing adoption across various end-user groups.

Latest Market Trends

Growing Use of Polygenic Scoring for Complex Behavior Traits

A rising trend in the pet DNA testing market is the adoption of polygenic scoring models that combine multiple genetic markers to predict complex behavioral tendencies such as anxiety, trainability, and social bonding patterns. Testing companies are integrating large-scale genomic datasets with behavioral observations to enhance prediction accuracy for traits that cannot be linked to a single gene. This trend is gaining momentum among trainers, breeders, and pet owners who want deeper insight into behavioral predispositions for training programs and lifestyle alignment.

Expansion of Species-Specific Genomic Panels for Exotic Companion Animals

The emerging trend is the development of genomic test panels tailored for exotic pets such as reptiles, birds, and small mammals. Companies are gradually building reference genomes for niche species to address rising interest in genetic screening beyond dogs and cats. These panels aim to offer ancestry interpretation, metabolic trait mapping, and identification of recessive mutations unique to each species, widening the market’s reach into underserved pet categories.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 484.04 Million |

| Estimated 2026 Value | USD 531.47 Million |

| Projected 2034 Value | USD 1152.41 Million |

| CAGR (2026-2034) | 10.16% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Embark Veterinary, Inc., Wisdom Panel, DNA My Dog, Orivet Genetic Pet Care, Basepaws Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Increasing Adoption of Genomics in Preventive Pet Health Planning

A key driver for the market is the growing integration of genetic reports into preventive veterinary care. Clinics are encouraging DNA testing to identify inherited markers linked to long-term conditions before symptoms occur. This adoption supports earlier lifestyle adjustments, nutrition planning, and monitoring schedules, raising the use of DNA-based assessments within structured wellness frameworks.

Market Restraint

Limited Reference Genomes for Diverse Breeds and Mixed Species

A major restraint is the shortage of complete reference genomes for many lesser-known breeds and non-traditional pets. This gap restricts accuracy in interpretation and reduces the depth of genetic insights available for species beyond mainstream companion animals. The limited genomic catalog delays expansion of multi-species testing capabilities and lowers test precision for certain populations.

Market Opportunity

Development of Longitudinal Genomic Monitoring Programs

A strong opportunity emerges from creating subscription-based programs that track genetic markers over the pet’s lifespan. These platforms can combine DNA re-testing intervals, wellness updates, and age-related genomic changes to generate dynamic health profiles. Offering repeat monitoring and progressive genomic insights opens pathways for continuous engagement with pet owners and enhances the long-term value of DNA testing services.

Regional Analysis

North America leads the pet DNA testing market with a 43.12% share due to widespread use of companion animal genetic screening, strong presence of commercial test kit providers, and high spending on pet wellness. The region benefits from a large population of dog and cat owners who actively seek breed identification, hereditary disease screening, and trait analysis services. Growth is influenced by expanding distribution of at-home saliva test kits, integration of genetic testing into veterinary workflows, and rising adoption of preventive pet healthcare. Companies continue to launch new panels that cover breed ancestry, health risk markers, and behavioural traits, encouraging wider consumer participation.

The U.S. market expands due to a large base of pet owners who purchase DNA test kits for health insights and breed discovery. Demand rises as veterinary networks incorporate genetic reports into care planning and breeders use DNA markers for lineage verification. Online retail channels offer broad kit availability, while subscription-based genomic updates shape recurring use of testing services. Public interest in pet wellness encourages higher spending on comprehensive genetic evaluations.

Asia Pacific Market Insights

Asia Pacific is anticipated to register the fastest CAGR of 12.16% driven by several progresses as urban pet ownership increases, online commerce platforms expand test kit accessibility, and awareness of hereditary conditions grows among new pet adopters. Veterinary hospitals across the region are gradually integrating genetic testing into routine care to support early identification of breed-specific disorders. Rising use of digital pet health platforms encourages consumers to explore DNA-based insights covering traits, ancestry, and wellness.

India’s market develops as pet owners show growing interest in breed verification, inherited disease screening, and temperament traits. Expansion of veterinary clinics and pet diagnostic centers supports greater use of DNA-based assessments. E-commerce channels play a strong role, enabling convenient access to testing kits sourced from domestic and international brands. Increasing adoption of pedigree pets shapes the need for genetic confirmation and health-related genomic services.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe advances as households continue to invest in pet care, and genetic health screening becomes more common among breeders and veterinary practitioners. Countries across the region are seeing growing preference for DNA-based reporting to confirm lineage accuracy, manage hereditary disorders, and map breed characteristics. Consumer interest in personalized pet profiles and digitally delivered genetic reports supports market expansion across both premium and mid-range testing categories.

Germany’s market grows due to the strong adoption of genomic tools by breeders, veterinary specialists, and pet owners who seek detailed lineage and health information. Demand is strengthened by widespread use of structured breeding programs that rely on DNA markers to maintain genetic standards. Availability of multi-panel test kits through clinics, online retailers, and pet stores supports the steady rise in testing volumes.

Middle East and Africa Market Insights

The Middle East and Africa region moves forward as pet ownership increases in urban households and veterinary facilities add genetic testing services to broaden diagnostic capabilities. Availability of imported DNA test kits is improving through regional distributors, enabling wider use across premium pet care segments. Rising participation in organized pet communities and shows fuels interest in breed validation and genetic health assessment.

The UAE market advances due to growing demand for breed authentication, health marker analysis, and pedigree verification. Expansion of veterinary centers and pet boarding facilities encourages the inclusion of DNA testing as part of broader pet wellness packages. The presence of international pet diagnostic brands in Dubai and Abu Dhabi enhances access to a wide range of genetic test offerings.

Latin America Market Insights

Latin America depicts progress as companion animal ownership expands in major cities and consumers adopt new tools for monitoring pet health. Veterinary clinics are increasingly offering genomic tests to support early detection of inherited disorders and better manage breed-related risks. Online platforms facilitate access to DNA test kits for ancestry mapping and screening of polygenic traits.

Brazil’s market strengthens as the country sees a rising number of households adopting pedigree and mixed-breed pets, prompting interest in ancestry tracing and inherited disease screening. Veterinary universities and large pet care providers promote awareness of genetic testing, contributing to higher test adoption. Domestic distributors and international suppliers continue to broaden product availability across urban retail and online channels.

Type Insights

Dogs dominated the market with a share of 55.34% due to the wide adoption of breed identification and hereditary condition screening among dog owners. The segment benefits from high use of DNA kits for lineage confirmation, trait mapping, and detection of inherited risks in purebred and mixed-breed dogs. Growing participation in pet communities, competitions, and training programs further encourages routine use of genetic profiling, keeping this category in a leading position.

Cats are the fastest-growing segment with 11.12%, driven by rising attention toward feline health traits, breed verification, and screening of genetic disorders common in pedigree cats. Increased preference for indoor pets and growth of feline wellness subscriptions support strong momentum in this category.

Sample Insights

Saliva dominated the market with 56.74% as most consumer DNA kits rely on easy self-collection methods that do not require clinical involvement. Pet owners prefer saliva swabs for convenience, non-invasive sampling, and shorter turnaround times. The segment benefits from wide kit availability across online retail channels, enabling broad adoption of saliva-based testing in both urban and suburban households.

Blood is the fastest-growing segment with 11.32%, supported by rising interest in advanced genomic markers that require higher-quality DNA. Veterinary clinics increasingly conduct blood-based tests for deeper analysis of hereditary disorders and complex traits, contributing to stronger demand within clinical settings.

Test Insights

Breed profile dominated the market with 43.01%, supported by high consumer interest in ancestry breakdown, lineage confirmation, and identification of mixed-breed composition. The segment leads due to strong demand from households adopting rescued or crossbred animals where the genetic background is unknown. Breed-specific trait exploration and rising social media sharing of ancestry results reinforce the popularity of this category.

Health and wellness is the fastest-growing segment, with 11.44% as pet owners adopt proactive monitoring of genetic predispositions linked to long-term conditions. Veterinary recommendations and interest in lifestyle-related insights encourage rapid expansion of wellness-focused DNA panels that map risk markers, trait variations, and age-related genomic changes.

End-User Insights

Breeders dominated the market with 43.24%, driven by the need to verify lineage purity, manage hereditary traits, and maintain structured breeding programs. Breeders rely on DNA panels to monitor genetic diversity and ensure transparent records before pairing decisions. The segment remains strong due to the wide use of genomic data in pedigree certification and selection of breeding lines.

Pet owners are the fastest-growing segment with 11.66%, supported by rising awareness of genetic health insights and increasing preference for personalized pet care. Expansion of at-home test kits and interest in behavioral traits, disease risks, and ancestry profiles fuel steady adoption among first-time and experienced pet owners alike.

Segmentation by End-User in 2025 (%)

Source: Straits Research

Competitive Landscape

The pet DNA testing market is moderately fragmented, characterized by a mix of well-established genetic testing companies and a growing number of niche providers specializing in breed identification, hereditary disease screening, and wellness genomics.

PetDx: An emerging market player

- PetDx, known for its advanced liquid biopsy genomic cancer screening for pets. It is rapidly gaining recognition as an innovative entrant in the pet DNA testing landscape, offering advanced genomic diagnostic solutions that go beyond traditional breed and health screening.

List of Key and Emerging Players in Pet DNA Testing Market

- Embark Veterinary, Inc.

- Wisdom Panel

- DNA My Dog

- Orivet Genetic Pet Care

- Basepaws Inc.

- Animal Genetics, Inc.

- GenSol Diagnostics, LLC.

- Neogen Corporation

- Zoetis Services LLC.

- Neogen Corporation

- Macrogen, Inc.

- com

- MyDogDNA

- MyCatDNA

- Cision US Inc

- EasyDNA

- DNA Diagnostics Centre

- BioPet Laboratories

- Others

Strategic Initiatives

- February 2025: The Royal Kennel Club Limited introduced two new DNA testing schemes for gangliosidosis (GM1_2 and GM2_2) in Japanese Shiba Inu dogs to help identify carriers and affected individuals.

- January 2025: DNA My Dog entered into a partnership with DreamWorks Animation’s Dog Man to launch a sweepstakes allowing dog owners to discover their pet’s breed makeup while celebrating the upcoming film.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 484.04 Million |

| Market Size in 2026 | USD 531.47 Million |

| Market Size in 2034 | USD 1152.41 Million |

| CAGR | 10.16% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Sample, By Test, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Pet DNA Testing Market Segments

By Type

- Dogs

- Cats

- Other Animals

By Sample

- Blood

- Saliva

- Faecal

- Others

By Test

- Breed Profile

- Genetic Diseases

- Health and Wellness

By End-User

- Pet Owners

- Breeders

- Veterinarians

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.