Plasmid Purification Market Size, Share & Trends Analysis Report By Product & Service (Instruments, Kits & Reagents, Services), By Grade (Transfection Grade, Molecular Grade), By Application (Gene Editing, Cloning & Protein Expression, Transfection, Others), By End Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Plasmid Purification Market Overview

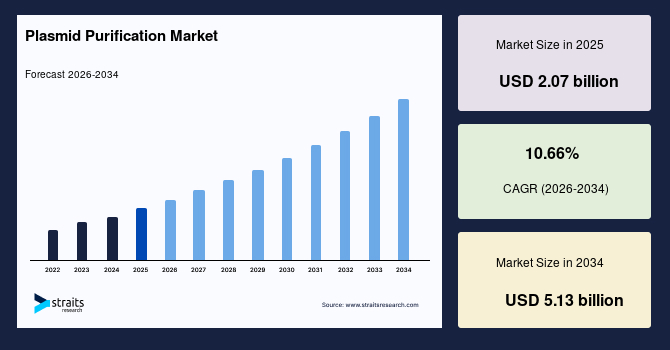

The global plasmid purification market size is valued at USD 2.07 billion in 2025 and is estimated to reach USD 5.13 billion by 2034, growing at a CAGR of 10.66% during 2026-2034. The global market has observed remarkable growth, stimulated by the increasing use of minicircle DNA vectors that require high-purity plasmids for improved transgene expression in gene therapies.

Key Market Trends & Insights

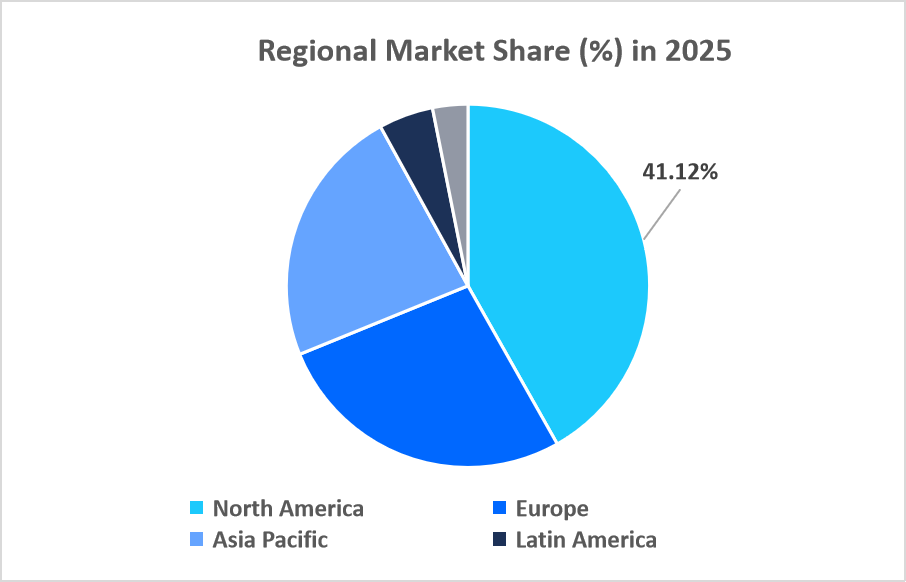

- North America held a dominant share of the global market, accounting for 41.12% in 2025.

- The Asia Pacific region is estimated to grow at the fastest pace, with a CAGR of 12.78% during the forecast period.

- Based on product & service, the services segment is expected to register the fastest CAGR of 11.04% during 2026-2034.

- Based on grade, the transfection grade segment is estimated to grow at the fastest CAGR of 11.34% during the forecast period.

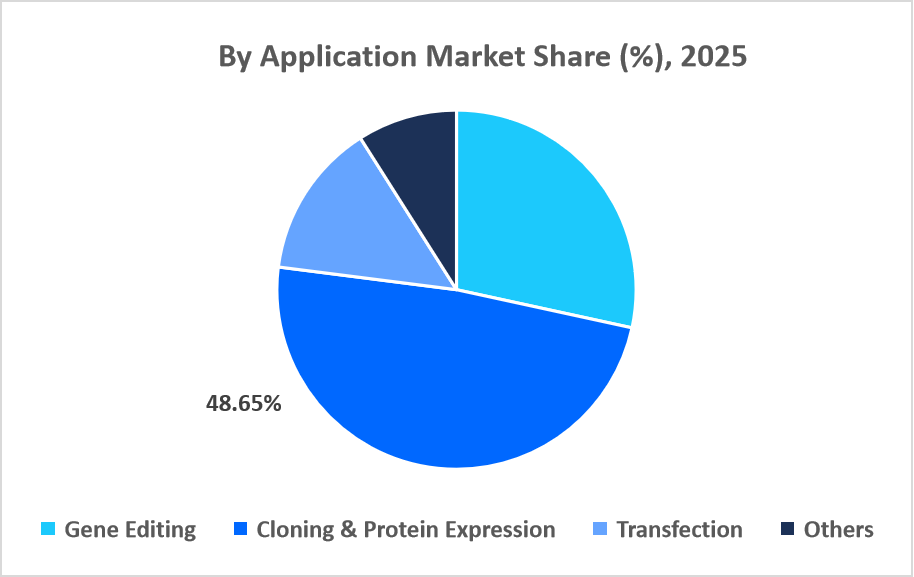

- Based on the application, the cloning & protein expression segment dominated the market in 2025, accounting for 48.65% revenue share.

- On the basis of end use, the academic & research institutes segment dominated the market in 2025.

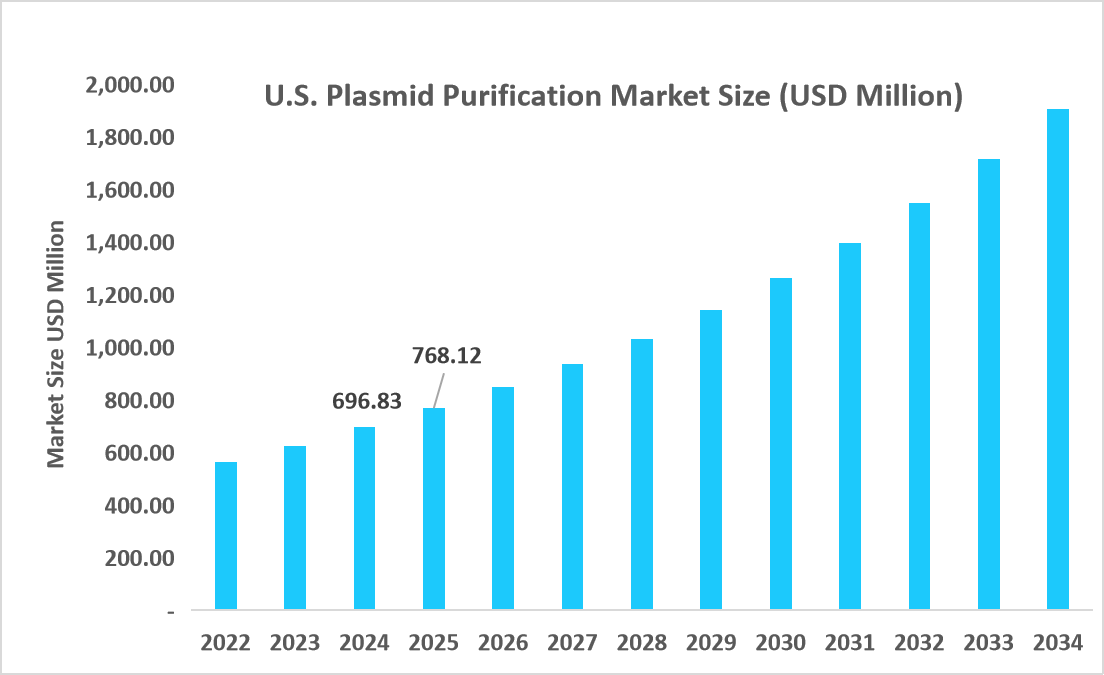

- The U.S. dominates the market, valued at USD 696.93 million in 2024 and reaching USD 768.12 million in 2025.

Source: Straits Research

Market Revenue Figures

- 2025 Market Size: USD 2.07 billion

- 2034 Projected Market Size: USD 5.13 billion

- CAGR (2026-2034): 10.66%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The plasmid purification market refers to the global industry focused on the production and supply of instruments, kits & reagents, and specialized services used to isolate and purify plasmid DNA. These products are available in transfection and molecular grades and are widely applied in gene editing, cloning and protein expression, and transfection workflows. The market serves pharmaceutical and biotechnology companies, academic and research institutes, and contract research organizations supporting genetic and molecular biology research.

Market Trends

Shift Towards High Throughput And Clinical Grade Plasmid Purification Systems

A major trend in the plasmid purification market is the widespread adoption of automated purification platforms and clinical-grade workflows, replacing manual methods. Leading manufacturers are launching systems that notably reduce hands-on time, increase throughput, and deliver highly pure plasmid DNA suitable for both research and therapeutic applications. These advancements are driven by growing demand from gene therapy and vaccine developers requiring consistent, scalable purification with minimal contamination for regulated clinical use.

Expansion of Advanced Chromatography & Membrane-Based Purification Technologies

The increasing adoption of purification technologies such as high-resolution chromatography and membrane-based tangential flow filtration (TFF) is a key trend for market growth. These methods offer superior separation of supercoiled plasmid DNA from contaminants, higher recovery rates, and lower endotoxin levels compared to traditional approaches, supporting scalable, high-purity outputs required for gene therapy, mRNA production, and clinical applications.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.07 billion |

| Estimated 2026 Value | USD 2.28 billion |

| Projected 2034 Value | USD 5.13 billion |

| CAGR (2026-2034) | 10.66% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Thermo Fisher Scientific, Inc., QIAGEN N.V., Merck KGaA, Takara Bio Inc., Promega Corporation |

to learn more about this report Download Free Sample Report

Market Driver

Surging Demand For Gene Therapy And DNA-Based Vaccines

A major driver of the market for plasmid purification is the rapid expansion of gene therapy and DNA based vaccine development, which relies on high-purity plasmid DNA as a fundamental building block. With over 700 gene therapy programs in clinical stages worldwide, many require GMP-grade plasmids for viral vector generation and therapeutic delivery, and demand for advanced purification solutions is accelerating. Additionally, the production of nucleic acid-based vaccines for infectious diseases and oncology is pushing biopharmaceutical companies to invest in scalable plasmid purification processes, thereby propelling market growth.

Market Restraint

High Cost And Complex Regulatory Compliance In Plasmid Purification

The substantial production and operational costs, combined with stringent regulatory compliance requirements, are the major factors restraining market growth. Producing GMP-grade plasmid DNA involves expensive purification systems, specialized reagents, and skilled personnel, making it difficult for smaller laboratories and biotech startups to adopt advanced workflows. Additionally, complex quality control and documentation are necessary to meet global regulatory standards, further increasing costs and extending timelines, slowing market expansion and limiting broader adoption.

Market Opportunity

Growth In Synthetic Biology And Custom Plasmid Demand

A notable opportunity in the plasmid purification market lies in the rapid expansion of synthetic biology applications and the rising demand for custom, high-purity plasmids tailored to complex engineering workflows. As synthetic biology advances, engineered organisms and circuits require highly specific plasmid constructs, boosting demand for scalable purification solutions with superior purity and reproducibility. This trend is especially notable in industrial biotech, enzyme production, and novel therapeutic research, presenting lucrative growth potential.

Regional Analysis

North America dominated the plasmid purification market in 2025, accounting for 41.12% market share. This growth is driven by the presence of prominent nonprofit plasmid repositories like Addgene in the U.S., which accelerates early-stage research and plasmid sharing among academic and industrial labs, boosting demand for high-quality purification workflows and innovation across gene editing and therapeutic development.

In Canada, the market growth is supported by the rapid expansion of Canadian GMP-grade viral vector and plasmid production facilities in Quebec, uniquely supporting local gene therapy and vaccine developers with scalable, high-purity plasmid supply.

Asia Pacific Plasmid Purification Market Insights

Asis Pacific is emerging as a fastest growing region with a CAGR of 12.78% from 2026 to 2034. The growth is driven by the emergence of national biomanufacturing initiatives such as India’s “National Biopharma Mission,” which accelerates domestic GMP-grade plasmid DNA production for vaccines and gene therapies, reducing reliance on imports and enhancing regional research‑to‑manufacturing capabilities.

Australia’s plasmid purification industry is expanding due to the expansion of local cGMP-grade plasmid DNA manufacturing capacity by specialized CDMOs like AcuraBio using advanced single‑use purification technologies, which strengthens Australia’s ability to support domestic and international gene therapy and mRNA production pipelines. This unique regional capability reduces reliance on imported plasmids and attracts biotech investment.

Source: Straits Research

Europe Market Insights

In Europe, the plasmid purification market growth is accelerated by the establishment of transnational life science clusters like BioValley across France, Germany, and Switzerland that integrate cross-border academic and biotech collaboration, boosting high-end plasmid purification research, technology transfer, and regional biomanufacturing synergies.

In the UK, the establishment and expansion of dedicated GMP‑compliant plasmid DNA CDMO facilities, such as Charles River’s Keele site, which uniquely offers phase‑appropriate plasmid manufacturing and accelerates clinical gene therapy programs, strengthening local supply chains and attracting international biotech projects.

Latin America Market Insights

In Latin America, the plasmid purification market growth is propelled by the increasing focus on plasmid-based vaccine development against tropical diseases, such as dengue and Zika, by local research institutes and biotech firms, which boosts demand for plasmid DNA and region-specific purification solutions. This trend supports localized R&D and strengthens the market’s biotechnological relevance.

In Argentina, the rapid expansion of domestic plasmid and viral vector DNA manufacturing capacity, where the plasmid DNA segment is the fastest‑growing part of Argentina’s DNA manufacturing market. This trend supports local biotech innovation and reduces dependency on imports.

Middle East and Africa Market Insights

In the Middle East, the plasmid purification industry is expanding due to the increasing number of local clinical research centers and pilot-scale plasmid DNA production initiatives focused on region-specific vaccines and gene-based therapies, with about 15% of clinical research centers in the region now engaged in plasmid production to address local healthcare challenges.

In South Africa, the market for plasmid purification is growing due to the establishment of national omics research infrastructure like the DIPLOMICS programme, which strengthens genomics and molecular biology capabilities, thereby increasing demand for high‑quality plasmid purification to support advanced genomic research and biotech innovation within the country.

Product & Service Insights

The kits & reagents segment dominated the market in 2025 with a revenue share of 43.82%. This growth is driven by the emergence of centrifuge-free magnetic bead-based miniprep kits that eliminate equipment requirements, enabling rapid, high-throughput plasmid isolation directly from cultures with minimal instrumentation and enhanced purity for sensitive downstream applications.

The services segment is projected to witness the fastest CAGR of 11.04% during the forecast timeframe. This growth is augmented by the rapid growth of outsourced, GMP-compliant plasmid manufacturing and purification services tailored to clinical and therapeutic pipelines. Biotech and pharmaceutical companies are increasingly partnering with specialized service providers to access scalable plasmid DNA production, especially for gene therapy and mRNA vaccine programs, without building in‑house infrastructure.

Grade Insights

The transfection grade segment dominated the market in 2025, with a revenue share of 11.34% during the forecast period. This growth is attributed to the increasing use of supercoiled plasmid DNA in CRISPR-based editing applications, where elevated supercoiling enhances cellular uptake and editing efficiency, driving demand for transfection-grade purification kits tailored to precision gene modulation workflows.

The molecular grade segment is expected to register the fastest CAGR growth during the forecast period, owing to rising demand for endotoxin-free plasmids in synthetic biology applications, where ultra-pure molecular grade DNA is critical for constructing complex genetic circuits and cell-free protein expression systems with minimal background interference.

Application Insights

The cloning & protein expression segment dominated the market in 2025, with a revenue share of 48.65%. This growth is driven by the growing utilization of plasmids in cell-free protein synthesis platforms, which require high-purity plasmid DNA to produce functional proteins for rapid screening, synthetic biology, and industrial enzyme applications.

The gene editing segment is estimated to grow at the fastest rate during the forecast period. This growth is stimulated by the emergence of multi-gene editing platforms using plasmid arrays, enabling simultaneous modification of multiple genomic targets in stem cells and organoids, which accelerates complex disease modeling and functional genomics research.

Source: Straits Research

End Use Insights

The academic & research institutes segment dominated the market in 2025 because of the growing adoption of plasmid DNA for organ-on-a-chip and microfluidic modeling studies, where plasmids enable precise gene expression control in miniaturized tissue models for advanced biomedical research.

Competitive Landscape

The plasmid purification market is moderately consolidated, dominated by key players like Thermo Fisher Scientific, QIAGEN, Merck KGaA, Takara Bio, Promega, and Zymo Research. Companies compete through innovations in automated, high-throughput, and GMP-compliant purification platforms, expanding global distribution, and strategic collaborations. Focused on enhancing yield, purity, and scalability, these initiatives strengthen market positioning while meeting growing demand from gene therapy, vaccine development, and molecular biology research.

Introgen Therapeutics: An emerging market player

Introgen Therapeutics is an emerging specialist in the market, focusing on high‑quality plasmid DNA purification services tailored for advanced research and early‑stage therapeutic development. The company leverages expert molecular biology capabilities and customized workflows to deliver plasmid DNA, supporting academic, biotech, and pharmaceutical clients.

List of Key and Emerging Players in Plasmid Purification Market

- Thermo Fisher Scientific, Inc.

- QIAGEN N.V.

- Merck KGaA

- Takara Bio Inc.

- Promega Corporation

- Bio-Rad Laboratories, Inc.

- Agilent Technologies Inc.

- Illumina, Inc.

- GenScript Biotech Corporation

- Sino Biological Inc.

- New England Biolabs, Inc.

- Origene Technologies, Inc.

- InvivoGen

- Omega Bio-tek, Inc.

- Norgen Biotek Corp.

- Lucigen Corporation

- Mirus Bio LLC

- PlasmidFactory GmbH & Co. KG

- ABP Biosciences

- Lamda Biotech

- Others

Strategic Initiatives

- December 2025: Twist Bioscience Corporation launched the research-grade Plasmid DNA Preps to support the advancement of pharmaceutical and biotech clinical studies.

- August 2025: WACKER and Gearbox Biosciences collaborated to accelerate the development of next-generation plasmid DNA manufacturing technologies.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.07 billion |

| Market Size in 2026 | USD 2.28 billion |

| Market Size in 2034 | USD 5.13 billion |

| CAGR | 10.66% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product & Service, By Grade, By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Plasmid Purification Market Segments

By Product & Service

- Instruments

- Kits & Reagents

- Services

By Grade

- Transfection Grade

- Molecular Grade

By Application

- Gene Editing

- Cloning & Protein Expression

- Transfection

- Others

By End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Contract Research Organizations

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.