Pneumatic Actuator Market Size, Share & Trends Analysis Report By Actuator Type (Linear Pneumatic Actuators, Rotary Pneumatic Actuators), By Technology (Single-Acting Pneumatic Actuators, Double-Acting Pneumatic Actuators), By Application (Valve Automation, Motion Control Systems, Material Handling, Automation Systems, Aircraft and Defense System Actuation), By End Use Industry (Aerospace & Defense, Oil & Gas, Automotive, Food, Pharmaceuticals, Power Generation, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Pneumatic Actuator Market Overview

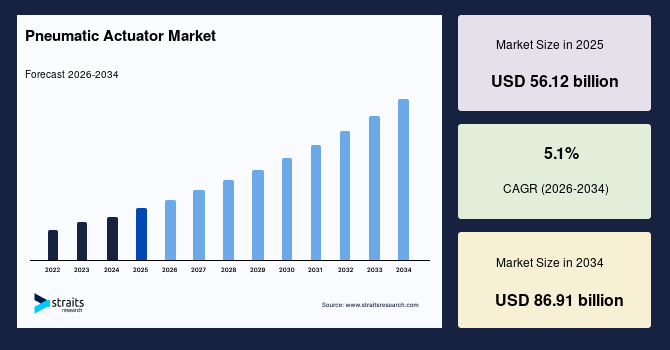

The global pneumatic actuator market size is valued at USD 56.12 billion in 2025 and is estimated to reach USD 86.91 billion by 2034, growing at a CAGR of 5.1% during the forecast period. Consistent growth of the market is supported by the rising adoption of industrial automation across manufacturing and process industries, increasing demand for reliable and cost-effective motion control solutions, and expanding use of pneumatic actuators in valve automation, material handling, and aerospace and defense system actuation, where durability, safety, and rapid response are critical.

Key Market Trends & Insights

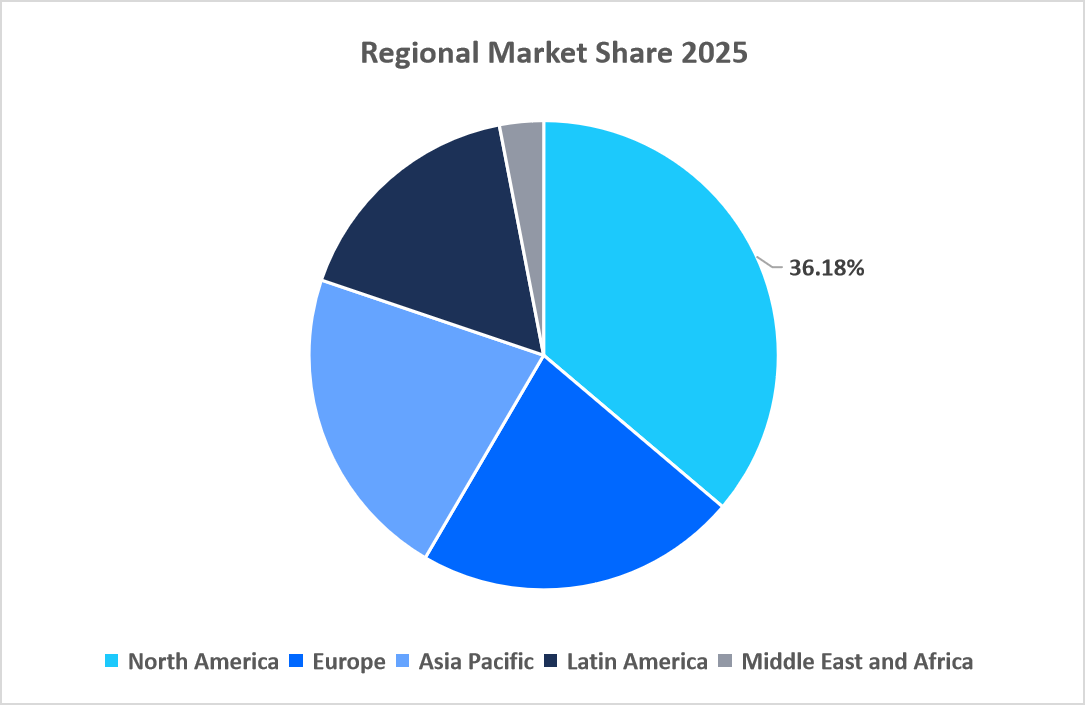

- North America dominated the market with a revenue share of 36.18% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 6.42% during the forecast period.

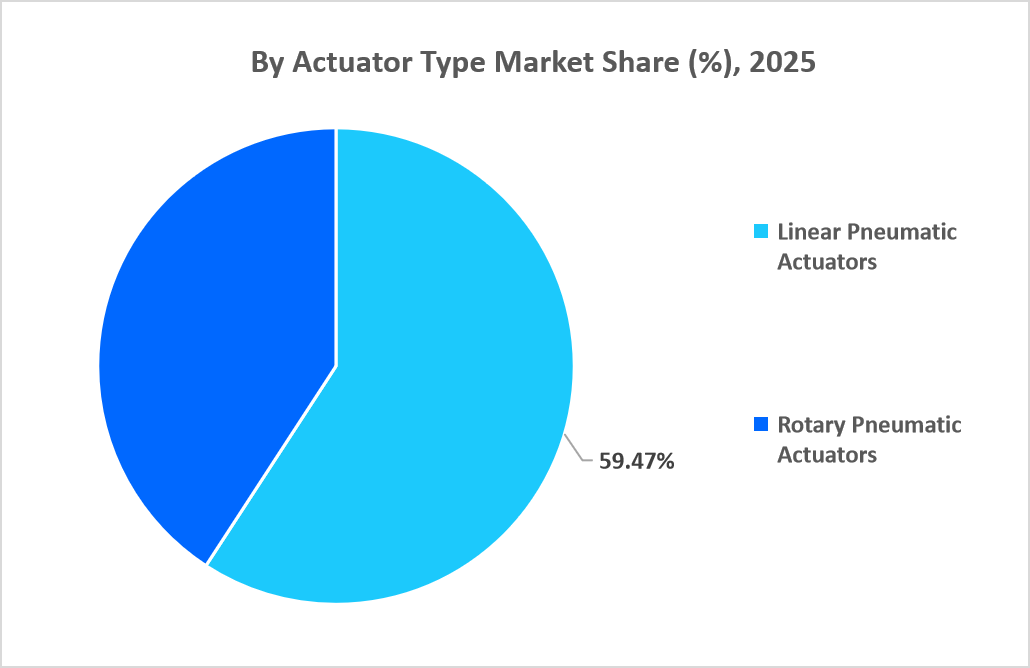

- Based on actuator type, the Linear Pneumatic Actuators segment held the highest market share of 59.47% in 2025.

- By technology, the Double Acting Pneumatic Actuators segment is estimated to register the fastest CAGR growth of 5.86% during the forecast period.

- Based on application, the Valve Automation segment dominated the market in 2025, accounting for a market share of 42.36%

- Based on end-use industry, the Oil & Gas segment is projected to grow at a CAGR of 5.48% during the forecast period.

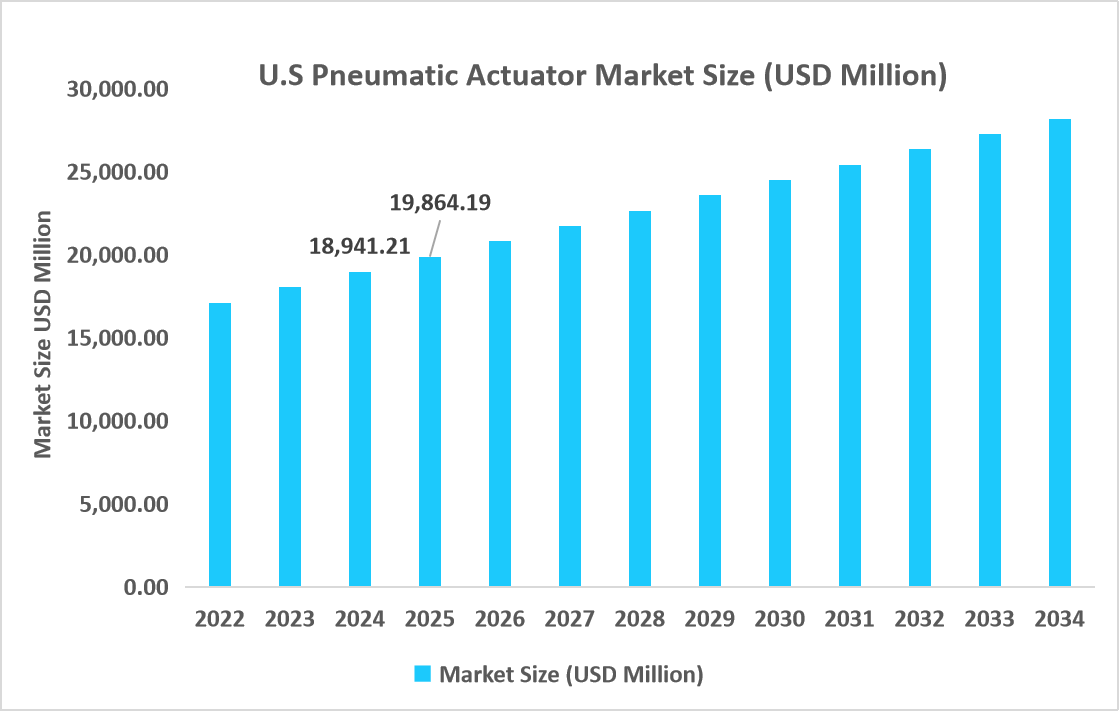

- The U.S. dominates the pneumatic actuator market, valued at USD 18.94 billion in 2024 and reaching USD 19.86 billion in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 56.12 billion

- 2034 Projected Market Size: USD 86.91 billion

- CAGR (2026-2034): 5.1%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The pneumatic actuator market covers a vast number of actuations available in the market, some of which include linear pneumatic actuators and rotary pneumatic actuators, which have applications in converting compressed air into controlled motion, significantly in a mechanical system. Moreover, pneumatic actuators find applications in operations with different technologies like single-acting and double-acting pneumatic operation, to name a few, in motion control applications significantly in different sectors with diverse actuation requirements like valve automation, motion control system applications, material handling operations in industry, automation system applications, and aircraft/defense system applications, to name a few, with applications in aerospace and defense, oil and gas, automobile sectors, food processing plants, pharmaceutical applications, and power generation sectors, to name a few.

Market Trends

Transition From Manual Control To Automated Pneumatic Actuation Systems

Industrial processes are witnessing a gradual shift from manual and mechanically operated control mechanisms to automated pneumatic control mechanisms that can respond much faster and ensure repeatable performance and safe operation. In the conventional approach, many industrial processes used manual operation of valves and simple mechanical controls. However, with advancements in pneumatic control technology, these mechanisms can now control valves accurately and monitor them centrally. This shift towards automated control mechanisms has greatly enhanced processes and ensured safe operation of processes that were hazardous in nature, especially in the oil and gas industry and other associated sectors.

Increased Acceptance of Pneumatic Actuators In Aerial And Military Applications

The integration of pneumatic actuators in the aerospace and defense industry has seen tremendous growth due to the lightweight nature of the component and its safety and reliability even under harsh conditions. Before this growth, the aerospace and defense industry actuation systems comprised mainly of hydraulic and electromechanical actuators; nevertheless, with the desire to reduce weight and ease maintenance of equipment, the aerospace industry turned to using pneumatic actuators in flight control systems, braking systems, weapon launching systems, and ground handling equipment. The integration of pneumatic actuators in the aerospace industry indicates the industry’s desire to develop actuation systems with safety and heavy-duty functionality.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 56.12 billion |

| Estimated 2026 Value | USD 59.01 billion |

| Projected 2034 Value | USD 86.91 billion |

| CAGR (2026-2034) | 5.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Emerson Electric Co., Parker Hannifin Corporation, Festo SE & Co. KG, SMC Corporation, Bosch Rexroth AG |

to learn more about this report Download Free Sample Report

Market Driver

Government-Mandated Industrial Safety And Automation Compliance

Industrial safety regulations and government-led automation mandates form a strong force for growth in the pneumatic actuator market. Various regulating authorities in major economies have been giving teeth to standards on process safety, hazardous environment operations, and emergency shut-off mechanisms at industrial facilities. The United States has regulations under OSHA and updates to safety requirements for pressure systems and automated valve controls that have driven industries such as oil & gas, chemicals, and power generation to abandon manual and semi-automated systems for reliable pneumatic actuation solutions. The EU Machinery Regulation (EU 2023/1230), in turn, strengthened requirements for the safety of automated machinery and fail-safe mechanisms and accelerated the adoption of pneumatic actuators as inherently safe and explosion-proof. These regulatory frameworks create direct demand for pneumatic actuators as compliant, low-risk solutions for motion control.

Market Restraint

Regulations On Energy Efficiency In Favor of Alternative Actuation Technologies

The most significant factors negatively impacting the pneumatic actuator industry are the steadily growing regulatory focus on energy efficiency and emissions mitigation, thereby imposing an indirect restriction on their utilization. Government policies on decreasing industrial energy consumption are increasingly focusing on analyzing the utilization of air compressor systems because of their low energy efficiency rate compared to their electric actuation counterparts." In many countries, industrial energy audits ordered by their respective national energy authorities obligate manufacturers to show improvement in their air compressor losses as well as their power consumption rates. Plants failing to meet such standards are often advised on the need to switch to their electric drive counterparts, thereby limiting the utilization rates of pneumatic actuators. Such regulatory factors are hampering the growth rate of pneumatic actuators in energy-conscious industries where the need to meet regulatory standards is emphasized.

Market Opportunity

Development of Pneumatic Actuation Technology In Hydrogen And Clean Fuel Infrastructure

The worldwide expansion of hydrogen, biofuel, and alternative fuel infrastructure is resulting in substantial opportunities in the market for pneumatic actuators. With the progression of each country in developing hydrogen production facilities, storage stations, fueling stations, and clean fuel pipelines, there is an emerging need to develop high-risk and flammable environment-compatible actuators. There is a substantial preference for the use of pneumatics in such applications because they are sparkless, extremely reliable, and safe in high-risk zones. The expansion of clean fuel systems is offering new avenues in the application of pneumatics in flow control, safety shut-off, and pressure regulation systems in clean fuel-based new-generation systems.

Regional Analysis

North America represented the single largest market share of 36.18% in 2025. This is largely because of the widespread use of automated process control systems, especially in the oil & gas, power, and more advanced manufacturing sectors. It is also significantly helped by the early adopter advantages of industrial automation technology, along with the overall need to update aging industrial infrastructure. Furthermore, the large aerospace & defense manufacturing base in the region ensures a stable market demand range across numerous applications of pneumatic actuators.

Heavy investments in the modification and automation of legacy systems have been one of the major contributing factors for the development of the pneumatic actuator market in the US. The installation of pneumatic systems is also gaining momentum for the purpose of replacing manual or electromechanical systems in refineries, chemical plants, or power stations. Moreover, the rising concern for the safety of operations, along with the possibility of downtime, has also triggered the development of the market. The US will remain the dominant country in the regional market.

Asia Pacific Market Insights

The highest rate of growth at a CAGR of 6.42% is projected to occur in the Asia Pacific region due to reasons such as rapidly growing industries, growing manufacturing capacities, and rising adoption of automation in developing nations during the forecasted period. In general, various nations in this region have been showing substantial demand for pneumatic actuators in Material Handling, Valve Automation, and Factory Automation systems due to growing industries increasing their capacities and efficiencies. In addition, rising investments in Aerospace Manufacturing and Energy are also contributing significantly to growing demand in the said region.

The Indian market for pneumatic actuators is experiencing an ever-rising trend in demand with the increased application of automation in manufacturing units, oil and gas, and other processing units for the generation of power. Establishing the large industrial corridors and upgrading the already installed units have resulted in increased demands for pneumatic actuators in the valves and motion controls of such units. Also, private units are entering into manufacturing and system integration, and this strengthens the position of the Indian market as an upcoming market in the Asia-Pacific region.

Source: Straits Research

Europe Market Insights

The European market is experiencing an increasing trend in the pneumatic actuator market, which is a result of the modernization of manufacturing plants and the increasing adoption of automated valve control systems in process industries. Emphasis on industrial efficiency, process safety, and standardization of automation parts in multiple industrial sites is also a major factor encouraging consistent market growth in Europe. The increasing adoption of pneumatic actuators in the food processing, pharmaceutical, and energy sectors is also supplementing market growth in Europe.

The market for pneumatic actuators in Germany is growing because of its heavily automated production sector and emphasis on precision engineering. Industries in Germany are increasingly incorporating pneumatic actuators in motion control and valve automation. Germany's presence in car manufacturing, machinery, and process technology is hastening the adoption of rugged and reliable pneumatic actuation technology, solidifying Germany's position in Europe as a major market.

The Latin America Market Insights

The Latin America market of pneumatic actuators is growing largely due to increased investments in industrial infrastructure and the rising trend of automation in the oil & gas industry, mining industry, and power generation industry. the Latin America countries are also modernizing their old industry by implementing new control systems to enhance efficiency and safety. Rising manufacturing hubs & system integrators in the Latin America market are also fueling the demand for pneumatic actuators.

The Brazilian market for pneumatic actuators is rising due to large-scale industrial installations looking to implement automated flow control and material handling systems. Virtually all refineries are modernizing, there is a surge in power generation capacity, and an increasing focus on automated processing plants in the food and beverage industry, leading to a sustained demand for pneumatic actuators. Emerging investments to develop Brazilian productivity and safety are making it a leading global contributor in Latin America markets.

The Middle East and Africa Market Insights

The Middle East and African market for pneumatic actuators is emerging as the region that develops its energy, water treatment, and processing facilities. Investments in the upgrading of refineries, pipelines, and desalination plants are increasing the demand for a stable actuation solution that can survive the environmental conditions in the region. Pneumatic actuators are very popular due to their strength and appropriateness for use in high-temperature and hazardous zones.

The Saudi market for pneumatic actuators is growing steadily because of continued investment in the diversification of industry and major projects in the fields of energy and infrastructure. The use of pneumatic actuators for the automatic control of valves, pipelines, and industrial processes is on the rise because of the growing emphasis on reliability and safety. Downstream industrial complex projects and upgrades of existing infrastructure continue to boost the pneumatic actuation market in Saudi Arabia.

Actuator Type Insights

The Linear Pneumatic Actuators market segment led with a revenue share of 59.47% in the year 2025. This is because linear pneumatic actuators play a dominant role in valve automation, material handling, and motion control applications, which require linear motion or high force output.

The Rotary Pneumatic Actuators market will have the fastest growth rate of 6.4% during the forecast period. This growth will follow from an increase in the demand for the product in the area of the operation of the quarter-turn valve. Aerospace & Defense will also drive the growth for this type of product.

Source: Straits Research

Technology Insights

The Single Acting Pneumatic Actuators market showed a substantial market share in 2025 of about 44.18% and is likely to experience steady growth due to their simple design, low air consumption, and ubiquitous presence in basic valve control applications and safety shut-off applications.

The Double-Acting Pneumatic Actuators category is anticipated to witness the quickest CAGR of 5.86% throughout the forthcoming years because of rising applications for bidirectional actuation support, larger force generation capacity per actuation cycle, and enhanced precision within continuous operation processes.

Application Insights

The Valve Automation category leading in 2025 represented a 42.36% revenue share, as pneumatic actuators are widely used in flow control, shut-off, and safety valves in process industry applications. The high penetration of pneumatic actuators in oil & gas, power generation, chemical plants, and water treatment plants primarily fuels their large revenue share in the global smart actuators market.

The Aircraft and Defense System Actuation market is expected to grow at the fastest rate during the forecast period. This is because of growing demand for pneumatic actuators in flight control systems, braking systems, and other ground support equipment, where weight reduction, reliability, and electromagnetic interference resistance are of utmost importance.

End Use Industry Insights

The Oil & Gas industry is expected to register a CAGR of 5.48% during the forecast period, owing to increasing investments in upstream, midstream, and downstream infrastructure, as well as the adoption of automatic valve control systems. As operators focus on safety, leak prevention, and quick shutdown systems in hazardous environments, there is a steady demand for pneumatic actuators, resulting in a steady growth rate for the Oil & Gas industry.

Competitive Landscape

The market for pneumatic actuators is moderately fragmented on the global level, with the presence of large-scale global players in the automation market. Certain players have penetrated the market with their large offerings and establishment in the market for many years. Apart from this, the market is occupied by large-scale players from the automation industry.

Key participants in this market include Emerson Electric Co., Parker Hannifin Corporation, Festo SE & Co. KG, and others. These prominent market participants engage in intense competition to reinforce their market position by constantly expanding their product lines, collaborations, acquisitions, and developing application-specific pneumatic actuation solutions to serve specific end-use markets through further expansion of their manufacturing presence and strengthening their customer-centric service experience.

Valworx: An emerging market player

Valworx, a US-based provider of industrial automation, is a rising competitor in the market of pneumatic actuators. Valworx sets itself apart through its compact and module-based designs of the pneumatic actuators that can be either automated or manually controlled, thus benefiting end-use consumers with easy-control functionality.

- In July 2025, Valworx launched a new line of pneumatic/manually combined actuator systems, with torques from 10 Nm to 450 Nm, supporting double-acting and spring return systems for valve automation applications where manual override is necessary.

Thus, Valworx found itself to be a major participant in the worldwide pneumatic actuator market, exploiting innovative product applications, extended torque lines, and combined actuator technologies to better penetrate the marketplace.

List of Key and Emerging Players in Pneumatic Actuator Market

- Emerson Electric Co.

- Parker Hannifin Corporation

- Festo SE & Co. KG

- SMC Corporation

- Bosch Rexroth AG

- Flowserve Corporation

- Rotork plc

- IMI plc

- Norgren (IMI Group)

- Camozzi Group

- CKD Corporation

- Metso (Neles)

- Burkert Fluid Control Systems

- Airtac International Group

- Moog Inc.

- Rockwell Automation

- Bimba Manufacturing

- Kitz Corporation

- Azbil Corporation

- Emerson ASCO

- Others

Strategic Initiatives

- October 2025:Parker Hannifin showcased its unique axial valve design with pneumatic or electro-pneumatic control at industry exhibitions in 2025, reflecting product innovation that improves actuation performance and addresses limitations of traditional actuator systems, supporting broader application in fluid control and process automation.

- October 2025: Rotork launched the RTP-4000 series, a new generation of intelligent valve positioners designed to optimize control for both single-acting and double-acting pneumatic actuators, featuring non-contact position feedback and real-time diagnostics for enhanced performance in demanding oil & gas and industrial applications.

- February 2025: Aventics expanded its product range with new bellows and rotary pneumatic actuators, offering higher force, improved corrosion resistance, and flexible stroke configurations for integration into both new automation systems and retrofit projects.

- July 2024: Emerson introduced the AVENTICS™ Series XV pneumatic valve platform, featuring higher flow performance and universal connectivity across factory automation, automotive, and packaging applications.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 56.12 billion |

| Market Size in 2026 | USD 59.01 billion |

| Market Size in 2034 | USD 86.91 billion |

| CAGR | 5.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Actuator Type, By Technology, By Application, By End Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Pneumatic Actuator Market Segments

By Actuator Type

- Linear Pneumatic Actuators

- Rotary Pneumatic Actuators

By Technology

- Single-Acting Pneumatic Actuators

- Double-Acting Pneumatic Actuators

By Application

- Valve Automation

- Motion Control Systems

- Material Handling

- Automation Systems

- Aircraft and Defense System Actuation

By End Use Industry

- Aerospace & Defense

- Oil & Gas

- Automotive

- Food

- Pharmaceuticals

- Power Generation

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.