Polyvinyl Butyral (PVB) Market Size, Share & Trends Analysis Report By Applications (Safety Glass , Coating, Adhesive , Others), By End-User (Automotive, Building and Construction, Electrical and Electronics, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Polyvinyl Butyral (pvb) Market Size

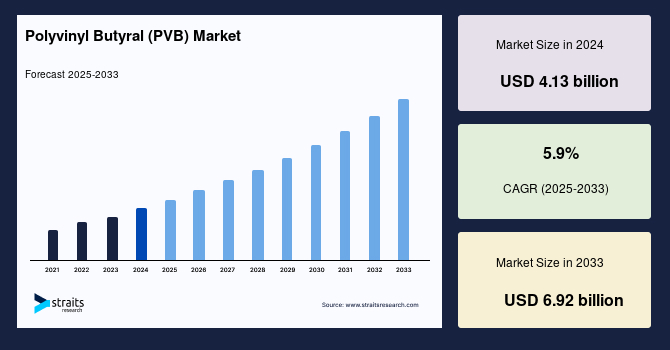

The global polyvinyl butyral (PVB) market size was valued at USD 4.13 billion in 2024 and is estimated to reach from USD 4.37 billion in 2025 to USD 6.92 billion by 2033, growing at a CAGR of 5.9% during the forecast period (2025–2033).

In recent years, the renewable energy sector's expansion, particularly in solar power, is expected to propel the demand for PVB encapsulants in photovoltaic modules, boosting the global market expansion. As construction activities worldwide surge with rapid urbanization, particularly in emerging economies, the demand for PVB will likely increase. Moreover, advancements in PVB manufacturing technologies, such as the development of eco-friendly alternatives and recycling processes, present lucrative opportunities for market players.

Polyvinyl butyral (PVB) is a synthetic resin commonly used in various industrial applications, most notably in the production of safety glass, particularly laminated glass. It is derived from the polymerization of vinyl butyral monomers. PVB possesses several key properties that make it ideal for laminated glass applications, including high transparency, excellent adhesion to glass, flexibility, and toughness. The invention of PVB dates back to 1927 and has been attributed to Canadian chemists Howard W. Matheson and Frederick W. Skirrow.

Some trade names for PVB films are KB PVB, GUTMANN PVB, Saflex, GlasNovations, Butacite, WINLITE, S-Lec, Trosifol, and EVERLAM. PVB is also offered as a 3D printer filament that exhibits superior strength and heat resistance compared to polylactic acid (PLA). The primary use of this product is for manufacturing laminated safety glass, specifically for automobile windshields. PVB is also used in other applications such as coatings, adhesives, and as a binder in photovoltaic modules.

Highlights

- Automotive dominated the end-user segment

- Asia-Pacific is the largest shareholder in the global market

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 4.13 Billion |

| Estimated 2025 Value | USD 4.37 Billion |

| Projected 2033 Value | USD 6.92 Billion |

| CAGR (2025-2033) | 5.9% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | Europe |

| Key Market Players | Eastman Chemical Company, Chang Chun Petrochemical Co., Ltd., Sekisui Chemicals Co., Ltd., Huakai Plastic Co., Ltd., King board (Fogang) Specialty Resins Limited |

to learn more about this report Download Free Sample Report

Polyvinyl Butyral (pvb) Market Growth Factors

Rising Adoption of Photovoltaic Modules

The surge in renewable energy initiatives, particularly in solar power generation, propels the demand for Polyvinyl Butyral (PVB) in photovoltaic (PV) module encapsulation. PVB encapsulants protect PV cells from environmental factors like moisture, dust, and mechanical stress while ensuring long-term performance and durability. With global solar photovoltaic capacity projected to grow exponentially, the demand for high-quality encapsulation materials like PVB is set to soar.

According to the International Energy Agency (IEA), in 2022, solar photovoltaic (PV) generation experienced an unprecedented growth of 270 TWh, representing a 26% increase and reaching nearly 1,300 TWh. In 2022, it exhibited the most significant increase in generation capacity among all renewable technologies, surpassing wind energy for the first time. Moreover, the shift towards building-integrated photovoltaics (BIPV) in architectural designs and the increasing adoption of solar panels in residential and commercial sectors further drive the demand for PVB encapsulants, positioning it as a key driver in the growth trajectory of the PVB market.

Growing Construction Industry

The growing construction sector is a significant Polyvinyl Butyral (PVB) market driver. PVB is extensively used in architectural laminated safety glass, which finds applications in buildings' windows, doors, and facades. With urbanization and infrastructure development projects on the rise, particularly in emerging economies, there is an increasing demand for durable and safe building materials. For instance, according to The World Bank, more than 50% of the world's population resides in urban areas. The global urban population is expected to increase by 1.5 times by 2045, reaching 6 billion. This is estimated to boost the global construction industry. Moreover, stringent building regulations and standards emphasizing safety and sustainability further boost the adoption of PVB laminated glass. As construction activities continue to expand globally, driven by urbanization and economic growth, the demand for PVB in the construction sector is expected to rise steadily.

Market Restraints

Environmental Concerns

Environmental concerns significantly restrain the Polyvinyl Butyral (PVB) market. The non-biodegradable nature of PVB raises apprehensions regarding its impact on the environment, especially during disposal and recycling processes. Improper disposal of PVB-based products can lead to environmental pollution, exacerbating waste management challenges. Moreover, the recycling of PVB presents technical complexities and economic barriers, hindering the widespread adoption of sustainable practices.

Regulatory bodies increasingly enforce stringent environmental regulations to mitigate these concerns, compelling industry players to explore eco-friendly alternatives and invest in innovative recycling technologies. Addressing these environmental challenges is imperative for the long-term sustainability of the PVB market, requiring collaborative efforts from manufacturers, regulators, and stakeholders to develop responsible solutions and promote environmental stewardship.

Key Opportunities

Technological Advancements

Technological advancements present a significant opportunity for the polyvinyl butyral (PVB) market. With increasing environmental concerns surrounding non-biodegradable materials like PVB, there is a growing imperative for sustainable solutions within the industry. Companies investing in research and development to create bio-based PVB formulations or recyclable PVB products stand to gain a competitive edge. Moreover, advancements in recycling technologies offer the potential to mitigate the environmental impact of PVB waste by enabling efficient reuse of materials. Collaborative efforts between industry players, research institutions, and regulatory bodies are essential to drive innovation in this space, ensuring the continued growth and sustainability of the PVB market while meeting evolving consumer preferences and regulatory requirements. R&D investments aimed at improving PVB manufacturing processes, enhancing product performance, and minimizing environmental footprint can unlock new opportunities for market growth.

Regional Insights

Asia-Pacific: Dominant Region

Asia-Pacific is the most significant global polyvinyl butyral (PVB) market shareholder and is expected to expand substantially during the forecast period. The Asia-Pacific region emerges as a pivotal Polyvinyl Butyral (PVB) market, driven by rapid industrialization, urbanization, and infrastructural development. According to the United Nations, Asian regions are home to over 2.2 billion individuals or 54% of the global urban population. Asia's urban population is projected to rise by 50% by 2050, or by an additional 1.2 billion individuals. Nations like China and India are witnessing substantial growth in automotive production, construction activities, and solar energy installations, fueling the demand for PVB in safety glass, coatings, adhesives, and photovoltaic modules encapsulation. For instance, according to IEA, China leads the solar PV capacity additions, adding 100 GW in 2022, a rise of nearly 60% compared to 2021.

Additionally, in 2022, India installed 18 GW of solar PV, an increase of nearly 40% over 2021. In the near future, PV expansion is anticipated to accelerate even further due to the dynamic development of the domestic supply chain and a new auctioned target of increasing PV capacity to 40 GW annually. This is estimated to drive the demand for PVB in the Asia-Pacific region. Moreover, government initiatives promoting renewable energy sources and increasing awareness about energy efficiency and safety standards further propel market growth in the region. With favorable economic conditions, supportive policies, and a growing emphasis on sustainability, the Asia-Pacific region is poised to maintain its prominence in the global PVB market, presenting lucrative opportunities for market players to capitalize on.

Europe: Fastest Growing Region

Europe stands as a significant Polyvinyl Butyral (PVB) market, driven by several factors contributing to its robust growth. The region's focus on sustainability and environmental initiatives fosters the demand for PVB in various applications, particularly in the automotive and construction sectors. Moreover, Europe's emphasis on renewable energy sources fuels the adoption of photovoltaic modules encapsulated with PVB, further bolstering market growth. The European Union is accelerating solar photovoltaic (PV) installation in response to the energy crisis. In 2022, a total of 38 GW of solar PV capacity was added, marking a 50% increase compared to the previous year, 2021. The planned policies and targets outlined in the REPowerEU Plan and The Green Deal Industrial Plan are anticipated to significantly stimulate investment in solar photovoltaic (PV) technology in the upcoming years.

Moreover, the regional key players are involved in strategic initiatives like mergers and acquisitions, expansions, collaborations, etc. For instance, in January 2021, Trosifol, a company that specializes in manufacturing polyvinyl butyral (PVB) interlayers for window glass, is increasing its production capacity at its facility in Holešov, Czech Republic, which is located around 70 kilometers east of Brno. Thus, the factors are estimated to augment the market growth.

Polyvinyl Butyral (pvb) Market Segmentation Analysis

By Application

The safety glass segment is a cornerstone of the polyvinyl butyral (PVB) market, accounting for a substantial portion of its revenue. PVB's unique properties make it indispensable in the production of laminated safety glass, which is widely utilized in automotive, architectural, and security applications. In the automotive industry, laminated safety glass incorporating PVB interlayers ensures passenger safety by preventing glass fragmentation upon impact, reducing the risk of injuries during accidents. Moreover, using PVB in automotive windshields enhances acoustic insulation and UV protection, contributing to driving comfort and longevity.

Architectural safety glass applications include facades, skylights, and balustrades, where PVB interlayers provide structural integrity, sound insulation, and resistance to forced entry, enhancing building safety and aesthetics. In security applications such as bank teller windows and bullet-resistant glass, PVB-based laminates offer protection against vandalism and ballistic threats. The safety glass segment's sustained growth is driven by stringent safety regulations, increasing awareness regarding occupant safety, and the growing emphasis on building resilience against natural disasters and security threats.

By End-User

The automotive segment is estimated to have the highest market share. Polyvinyl Butyral (PVB) plays a vital role in the automotive sector, primarily in manufacturing laminated safety glass for windshields. PVB interlayers sandwiched between layers of glass provide enhanced safety by preventing shattering upon impact, reducing the risk of injury to vehicle occupants. This laminated glass also improves structural integrity, offering protection against intrusion during accidents and contributing to the overall safety ratings of vehicles.

Moreover, PVB laminates offer additional benefits such as sound insulation and UV protection, enhancing driving comfort and longevity of interior components. The automotive industry's stringent safety regulations and consumers' increasing emphasis on safety features drive the demand for PVB in automotive applications. Advancements in PVB technology, such as thinner and lighter interlayers, enable automakers to design sleeker and more aerodynamic vehicles while maintaining safety standards. As automotive safety remains a top priority, using PVB in laminated glass continues to be indispensable in modern vehicle manufacturing.

List of Key and Emerging Players in Polyvinyl Butyral (PVB) Market

- Eastman Chemical Company

- Chang Chun Petrochemical Co., Ltd.

- Sekisui Chemicals Co., Ltd.

- Huakai Plastic Co., Ltd.

- King board (Fogang) Specialty Resins Limited

- Tiantai Kanglai Industrial Co., Ltd.

- Dulite Co., Limited

- Guangzhou Aojisi New Material Co., Ltd.

- Qingdao Haocheng Industrial Co., Ltd

- Jiangxi RongXin New Materials Co., Ltd.

- HuzhouXinfu New Materials Co., Ltd.

- Zhejiang Pulijin Plastic Co., Ltd.

Recent Developments

- May 2023: Eastman, the manufacturer of SaflexTM PVB for architectural applications, announced the French national certification of laminated glass containing a Saflex Structural (DG) interlayer.

- July 2023: Eastman expanded its range of SaflexTM FlySafeTM 3D polyvinyl butyral (PVB) interlayers for laminated glass in order to enhance the environment for birds. The new improvements provide architects and designers with additional options to safeguard birds and adhere to updated construction requirements, all while maintaining the visual appeal of the design.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 4.13 Billion |

| Market Size in 2025 | USD 4.37 Billion |

| Market Size in 2033 | USD 6.92 Billion |

| CAGR | 5.9% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Applications, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Polyvinyl Butyral (PVB) Market Segments

By Applications

- Safety Glass

- Coating

- Adhesive

- Others

By End-User

- Automotive

- Building and Construction

- Electrical and Electronics

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.