Polyvinylidene Fluoride (PVDF) Market Size, Share & Trends Analysis Report By Applications (Pipes and Fittings, Films and Sheets, Wires and Semiconductor Processing, Coatings, Membranes, Li-ion Batteries, Others), By End-User (Oil and Gas, Electrical and Electronics, Chemical Processing, Automotive and Processing, Aerospace and Defense, Building and Construction, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Polyvinylidene Fluoride (pvdf) Market Size

The global polyvinylidene fluoride (PVDF) market size was valued at USD 1,061.83 million in 2024 and is projected to reach from USD 1,128.2 million in 2025 to USD 1,913.80 million by 2033, growing at a CAGR of 6.8% during the forecast period (2025-2033).

Polyvinylidene fluoride (PVDF) is experiencing significant market growth due to its versatile applications across various industries, including electronics, energy storage, automotive, aerospace, and chemical processing. This surge in demand is particularly fueled by the expansion of renewable energy and semiconductor technologies. PVDF's widespread use in areas such as lithium-ion battery binders, water filtration membranes, semiconductors, coatings, and architectural films is driven by its superior chemical resistance, thermal stability, and mechanical strength, further propelling market expansion.

The increasing adoption of electric vehicles (EVs) and renewable energy systems is a major driver of PVDF demand. Additionally, manufacturers are exploring bio-based feedstocks and low-emission production methods to meet global sustainability goals while maintaining high product performance. Ongoing research and development (R&D) efforts in advanced coatings, biocompatible materials, and high-performance composites are broadening PVDF’s applications in emerging sectors like medical devices and 3D printing, further contributing to its market growth.

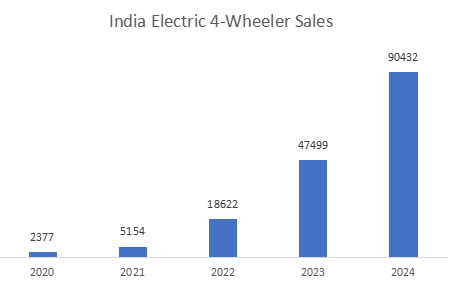

Source: Society of Manufacturers of Electric Vehicles

Polyvinylidene Fluoride (pvdf) Market Trends

Technological Advancements in the Construction Industry Owing to the Durability and Resistance of Pvdf

PVDF composites are increasingly utilized in construction due to their ability to endure extreme weather conditions such as heavy rainfall, high winds, and temperature fluctuations, ensuring long-lasting and safe structures.

- For example, PVDF-coated aluminum panels are often used in high-rise buildings and bridges to maintain their aesthetic appearance while requiring minimal maintenance over time. The material's ability to retain color and resist degradation, even under harsh environmental conditions, strengthens its position in large infrastructure projects where durability and longevity are critical.

Moreover, regulatory standards set by organizations like the Leadership in Energy and Environmental Design (LEED) and Green Building Councils encourage the use of sustainable, durable materials like PVDF, particularly in projects seeking energy efficiency and sustainability certifications.

Increasing Adoption of Pvdf across Perovskite Solar Cells

PVDF is gaining traction in renewable energy, particularly in perovskite solar cells (PSCs), due to its highly non-reactive nature, which enhances its functionality as a binder and encapsulant. Its excellent chemical resistance, mechanical strength, and flexibility make it ideal for improving the durability and efficiency of perovskite layers in solar cells.

- For instance, PVDF forms a protective layer that shields the sensitive perovskite material from environmental factors like moisture and oxygen, which are known to degrade solar cell performance.

Moreover, its high dielectric constant improves charge transport within the cell, leading to enhanced power conversion efficiency.

- A notable example of PVDF's impact can be seen in PSC research, where the use of PVDF has helped extend the operational life of perovskite solar cells while increasing their efficiency, positioning the material as a valuable component in next-generation solar technologies.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1,061.83 Million |

| Estimated 2025 Value | USD 1,128.2 Million |

| Projected 2033 Value | USD 1,913.80 Million |

| CAGR (2025-2033) | 6.8% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Arkema, Daikin Industries Ltd, Dongyue Group, 3M, INOXGFL Group |

-market.jpg)

to learn more about this report Download Free Sample Report

Polyvinylidene Fluoride (pvdf) Market Growth Factors

Expanding Applicability across Pvdf in Chemical Processing and Industrial Equipment

PVDF's remarkable thermal stability, chemical resistance, and membrane-forming properties make it a valuable material across the chemical processing and industrial sectors. It is used in various manufacturing processes, such as extrusion, injection molding, and coatings, expanding its applicability in fabricating pumps, valves, filters, and piping systems.

- For example, in chemical plants handling corrosive substances, PVDF components like tanks and heat exchangers offer long-term durability, reducing the need for frequent maintenance. Its ability to withstand temperature fluctuations, thermal cycling, and thermal shock makes it ideal for reactors and storage tanks in industries where these conditions are common.

Additionally, industrial components exposed to extreme conditions, such as seals and gaskets, benefit from PVDF's longevity, enhancing equipment lifespan and minimizing downtime. This reliability makes PVDF crucial in reducing operational costs while extending the lifespan of critical machinery in chemical processing industries.

Restraining Factors

Supply Chain Disruptions

The global PVDF market faces challenges from frequent supply chain disruptions driven by evolving geopolitical tensions, environmental regulations, and regional industrial dynamics. For instance, disruptions in key trade routes, like the Red Sea shipping lane, have impacted global trade flows.

The United Nations Conference on Trade and Development (UNCTAD) highlights how attacks in the region have reduced traffic through the Suez Canal, compounding challenges posed by geopolitical and climate-related issues. These disruptions result in delays, increased transportation costs, and uncertainty for PVDF supply chains, affecting industries dependent on its steady availability.

Market Opportunities

Polyvinylidene Fluoride Application as A Binder Element in Lithium-Ion Batteries

The rapid growth of the electric vehicle (EV) market presents a significant opportunity for PVDF as a crucial component in lithium-ion batteries. As global adoption of EVs accelerates, the demand for energy-efficient batteries with longer lifespans and enhanced safety is rising. PVDF plays a pivotal role as a binder in lithium-ion batteries, providing thermal and electrochemical stability while ensuring strong adhesion between electrode films and current collectors.

- For example, in lithium cobalt oxide or lithium iron phosphate batteries, PVDF helps maintain the structural integrity of electrodes, reducing degradation and improving battery performance over time. With manufacturers focusing on higher energy densities and improved safety in EV batteries, PVDF’s chemical resistance and adhesive properties make it indispensable, extending not only battery life but also enhancing the safety and efficiency of EVs and other portable electronics such as smartphones and laptops.

Regional Insights

North America is A Significant Market for the Polyvinylidene Fluoride Market

North America is experiencing rapid growth in the global polyvinylidene fluoride (PVDF) market, driven by its wide applicability across various end-use sectors, including chemicals, petrochemical industries, nuclear power, aerospace, electronics, and construction.

Key Drivers

- The emphasis on renewable energy adoption, coupled with the booming electric vehicle (EV) industry, is significantly propelling the demand for PVDF. The growth of the U.S. EV and stationary energy storage markets has led to an increased need for lithium-ion batteries, necessitating a robust, secure, and local supply chain for polyvinylidene fluoride.

- Geopolitical factors, including trade policies and regulatory changes, are also shaping the PVDF market's trajectory. The U.S.-Mexico-Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA), introduces new trade rules aimed at enhancing investment while addressing labor rights and environmental standards.

Europe is the Rapidly Growing Market for Polyvinylidene Fluoride

Europe is rapidly emerging as a significant market for polyvinylidene fluoride, with Germany and France leading due to their extensive industrial landscapes and strong research and development initiatives aimed at expanding the utilization of PVDF across diverse applications.

Key Developments

- Eastern European countries, such as Poland and Hungary, are gaining traction due to increased industrial activities and investments in advanced technologies, making them attractive destinations for polyvinylidene fluoride manufacturers looking to expand their presence in Europe.

- The robust regulatory framework of the European Union, including the REACH regulation, sets stringent requirements for chemical registration, evaluation, and authorization, significantly impacting the global supply chain.

- However, Brexit has added complexity to the regulatory landscape, as the UK implements its own chemical regulations separate from the EU, affecting the dynamics of the PVDF market.

Asia Pacific Emerges as A Growing Region

The Asia Pacific region is the dominant player in the global PVDF market. It holds a significant market share due to its diverse industrial landscape and vast population, which fuel demand in consumer goods industries, which often require PVDF as a key raw material.

Key Markets

- Major consumption comes from China, Southeast Asian nations, and Japan, with China being the world’s largest chemical producer. This demand is particularly driven by the extensive use of PVDF in piping and storage lining for critical chemicals.

- The increasing demand for lithium-ion batteries in the EV sector and stationary energy storage solutions further propels PVDF market growth. The demand for lithium-ion batteries is anticipated to surge from 0.7 GWh in 2023 to 3.8 GWh by 2034.

Segmentation Analysis

By Application

The global polyvinylidene fluoride market is bifurcated into pipes and fittings, films and sheets, wires and semiconductor processing, coatings, membranes, Li-ion batteries, and others.The lithium-ion battery segment has emerged as a significant growth area for PVDF, driven largely by the booming electric vehicle (EV) market and increasing demand for energy storage systems in renewable energy applications. Polyvinylidene fluoride is utilized as a binder in the cathode materials of Li-ion batteries, where it imparts essential properties such as chemical stability, adhesive strength, and thermal resistance.

These attributes are critical for ensuring optimal battery performance and longevity. Moreover, initiatives like the European Union’s Fit for 55 and the U.S. Inflation Reduction Act are boosting demand for Li-ion batteries. Investments in renewable energy storage solutions, particularly in solar and wind sectors, further amplify the need for polyvinylidene fluoride in battery manufacturing.

By End-User Industry

The global polyvinylidene fluoride market is bifurcated into oil and gas, electrical and electronics, chemical processing, automotive processing, aerospace and defense, building and construction, and others.

The chemical processing industry accounted for the largest market share in 2023, attributed to PVDF’s wide applicability in environments that handle corrosive chemicals, solvents, acids, and gases. Its use in tanks, piping systems, valves, and lining materials underscores its importance in maintaining the integrity of processing equipment.

Moreover, the demand for polyvinylidene fluoride in chemical plants, pharmaceutical production, petrochemical refining, and mineral processing highlights its critical role in ensuring operational safety and efficiency. Its stability at high temperatures and resistance to abrasion and radiation make PVDF a preferred material for challenging chemical environments, further solidifying its position in the market.

Company Market Share

Key market players are strategically investing in improving their Polyvinylidene Fluoride solutions to meet the increasing demand, where new product formulations are being researched to expand their reach to diverse applications in various end-use industries. These players also focus on key business strategies, such as strategic collaborations, relevant acquisitions, and innovative partnerships, among others. With end-users increasingly focused on securing their sustainability goals, market players are majorly prioritizing providing solutions tailored to these specific demands.

Arkema is the Dominant Player in the Global Polyvinylidene Fluoride (PVDF) Market

Arkema is one of the most important chemical companies that is involved in the production of advanced materials and performance products, with PVDF as the core product in their specialty polymer portfolio. The company has diverse expertise in high-performance polymers, especially PVDF, and holds a major position in markets requiring light, resistant, and chemically inert materials. The PVDF product lines at Arkema contribute to progress in lithium-ion batteries, coatings, and filtration systems and reflect the strategic axes of green chemistry and advanced technologies.

Recent developments at Arkema include

- Arkema and ProLogium collaborated for the production of the Kynar PVDF grades and advanced high-performance materials tailored for ProLogium’s next-generation Lithium Ceramic Batteries.

- Arkema announced a 50% PVDF capacity increase at its Pierre-Bénite site in France, where the growth is driven by strong end-user demand for sustainable solutions.

- Arkema accelerated its development in China in order to meet the strong demand from its partner customers in the lithium-ion battery business and support the significant growth in the water filtration, specialty coatings, and semiconductor sectors.

List of Key and Emerging Players in Polyvinylidene Fluoride (PVDF) Market

- Arkema

- Daikin Industries Ltd

- Dongyue Group

- 3M

- INOXGFL Group

- Kureha Corporation

- RTP Company

- Shanghai Ofluorine Co. Ltd.

- Solvay

- Hubei Everflon Polymer Co. Ltd.

- Sinochem

- Emco Industrial Plastics, Inc.

- Zhejiang Juhua Co., Ltd.

- Shanghai Ofluorine Co. Limited

- Gujarat Fluorochemicals Limited

- Othersa

Recent Developments

- May 2024: Xenia Materials, a global leader in carbon fiber reinforced polymers, launched PVDF-based compounds specifically designed for 3D printing pellet-fed applications. This innovation aims to enhance the performance and versatility of 3D printing technologies, catering to various industrial needs.

- May 2024: Arkema and ProLogium expanded their collaboration by establishing an advanced R&D laboratory in France. Supported by the France 2030 plan, this initiative will provide subsidies to Arkema for supplying PVDF for next-generation lithium-ion batteries, focusing on developing high-performance materials tailored for ProLogium’s advanced battery solutions.

- June 2024: Syensqo introduced a new grade of PVDF called Solef ZA830. This grade is specifically formulated for batteries using high nickel cathode active materials, offering exceptional cathode adhesion and enhanced processability, which is crucial for improving the performance and efficiency of modern batteries.

Analyst Opinion

As per our analyst, the global polyvinylidene fluoride (PVDF) market is poised for steady growth, driven by its diverse applications and increasing demand across various end-use industries. A significant factor contributing to this growth is the rising applicability of PVDF in the automotive sector, particularly in electric vehicles, where it plays a crucial role in enhancing battery performance and safety.

The Asia-Pacific region is expected to remain the fastest-growing market for PVDF, benefiting from substantial investments in automotive, construction, and packaging industries across major economies such as China, India, and Japan. These countries are emerging as significant consumers of PVDF, further propelling its demand and market presence. With ongoing advancements and innovations in polyvinylidene fluoride applications, the market outlook remains positive, suggesting sustained growth in the coming years.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1,061.83 Million |

| Market Size in 2025 | USD 1,128.2 Million |

| Market Size in 2033 | USD 1,913.80 Million |

| CAGR | 6.8% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Applications, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Polyvinylidene Fluoride (PVDF) Market Segments

By Applications

- Pipes and Fittings

- Films and Sheets

- Wires and Semiconductor Processing

- Coatings

- Membranes

- Li-ion Batteries

- Others

By End-User

- Oil and Gas

- Electrical and Electronics

- Chemical Processing

- Automotive and Processing

- Aerospace and Defense

- Building and Construction

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.