Positron Emission Tomography Market Size, Share & Trends Analysis Report By Product Type (Full Ring PET Scanner, Partial Ring PET Scanner), By Modality (Stand-Alone PET, PET/CT, PET/MRI), By Isotope (18F-Fluorodeoxyglucose, 82Rb & 13N-Ammonia, 68Ga-Based Tracers, 64Cu & Zirconium-89 Immuno-PET), By Application (Neurology, Oncology, Cardiology, Others), By End User (Hospital & Surgical Center, Diagnostic Imaging Centers, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Positron Emission Tomography Market Overview

The global positron emission tomography market size is estimated at USD 2.01 billion in 2025 and is projected to reach USD 3.22 billion by 2034, growing at a CAGR of 5.45% during the forecast period. The consistent market growth is attributed to increasing clinical integration of dynamic PET kinetic modeling, enabling quantitative assessment of tracer metabolism for drug response monitoring and early treatment optimization.

Key Market Trends & Insights

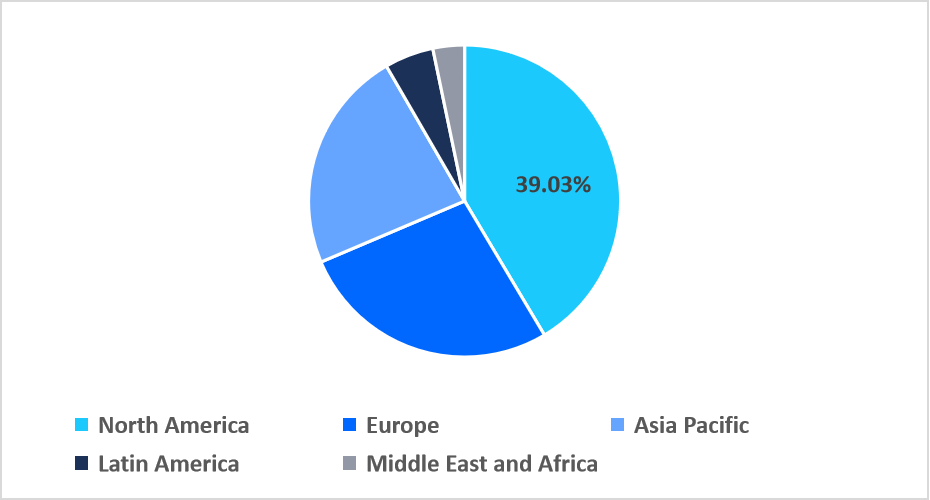

- North America held a dominant share of the global market, accounting for 39.03% share in 2025.

- The Asia Pacific region is estimated to grow at the fastest pace, with a CAGR of 6.81% during the forecast period.

- Based on product type, the full-ring PET scanner segment dominated the market in 2025.

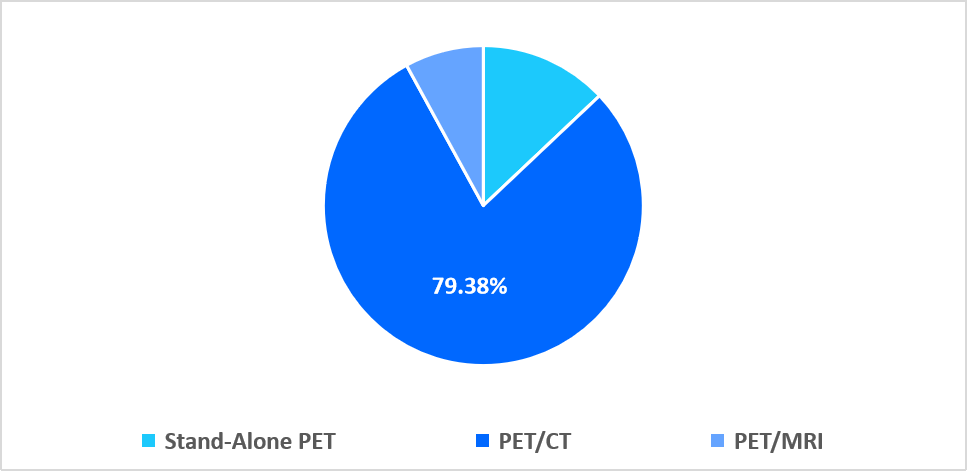

- By modality, the PET/CT segment accounted for the 79.38% revenue share in 2025.

- Based on modality, the 68Ga-based tracers segment is projected to grow at a CAGR of 5.92% during 2026-2034.

- By application, the neurology segment is estimated to grow at the fastest pace with a CAGR of 5.64% during the forecast timeframe.

- By end user, the hospital & surgical center segment dominated the market in 2025 with a revenue share of 53.06% 2025.

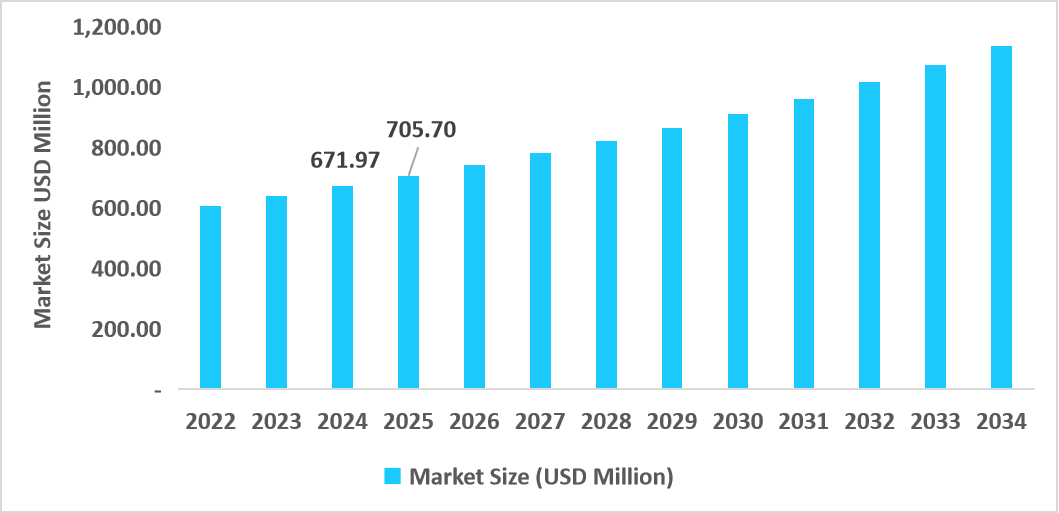

- The U.S. dominates the positron emission tomography market, valued at USD 671.97 million in 2024 and reaching USD 705.70 million in 2025.

Table: U.S. Positron Emission Tomography Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 2.01 billion

- 2034 Projected Market Size: USD 3.22 billion

- CAGR (2026-2034): 5.45%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The positron emission tomography market encompasses advanced molecular imaging systems, including full-ring and partial-ring PET scanners, delivered as stand-alone units or integrated PET/CT and PET/MRI platforms, utilizing radiotracers such as 18F-FDG, cardiac isotopes, gallium-based tracers, and immuno-PET agents. These technologies are widely applied across oncology, neurology, cardiology, and related clinical domains, supporting precise disease detection, staging, and therapy monitoring, with adoption spanning hospitals, surgical centers, and specialized diagnostic imaging facilities.

Latest Market Trends

Shift from Conventional PET/CT to High Sensitivity Digital PET Systems

A major trend in the positron emission tomography market is the shift from conventional analog PET/CT systems to high sensitivity digital PET platforms, illustrated by the 2024 clinical adoption of Siemens Healthineers’ Biograph Trinion PET/CT at Rome Imaging Center in the U.S. This transition reflects growing clinical preference for faster acquisition, lower radiation dose, and improved small-lesion detectability, strengthening PET’s role in precision diagnostics.

Emergence of Immune PET and Targeted Radiotracers

A key driver in the positron emission tomography market is the rapid adoption of immune PET and highly specific molecular tracers, which enable visualization of immune markers and tumor biology beyond conventional glucose-based imaging. These agents support precision oncology by revealing tumor heterogeneity, immune cell infiltration, and therapy targets, expanding PET usage into immunotherapy monitoring and drug development. For example, Ga-68 PSMA PET tracers have recently gained clinical approval in Europe, thereby accelerating the adoption of this technology in prostate cancer care and driving the development of new clinical pathways.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.01 Billion |

| Estimated 2026 Value | USD 2.10 Billion |

| Projected 2034 Value | USD 3.22 Billion |

| CAGR (2026-2034) | 5.45% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Siemens Healthineers, GE HealthCare, Koninklijke Philips N.V., Canon Medical Systems, United Imaging Healthcare |

to learn more about this report Download Free Sample Report

Market Drivers

Escalating Cancer & Neurodegenerative Disease Burden

The rising global incidence of cancer and neurodegenerative disorders such as Alzheimer’s and Parkinson’s is a major driver for the positron emission tomography market. For instance, according to the National Institute of Health (NIH), about 7.2 million Americans aged 65 and older are living with Alzheimer’s dementia in 2025. Thus, PET’s ability to detect metabolic changes before structural abnormalities makes it indispensable for early diagnosis, staging, and therapy monitoring across these high-impact diseases, fueling widespread clinical adoption. Additionally, escalating utilization of PET-CT in oncology and neurology has notably expanded procedure volumes worldwide, with emerging indications and guidelines further anchoring PET in standard care pathways.

Market Restraint

High Capital & Operational Costs Restrict PET Market Expansion

A major restraint in the positron emission tomography market is the substantial capital investment and ongoing operational costs required for PET systems, which limit adoption among smaller healthcare providers and in emerging regions. PET/CT and PET/MRI installations cost a million dollars, with added expenses for radiotracer production, facility shielding, and specialized staff, making cost recovery difficult. For instance, recent U.S. data shows financial barriers continue to hinder PET uptake in rural and resource-constrained hospitals due to high acquisition and maintenance costs.

Market Opportunities

Expansion of Full Body and High Sensitivity Pet Platforms as a Strategic Opportunity

The development and commercialization of total-body and high-sensitivity PET platforms that enhance imaging throughput and clinical utility is a key opportunity that supports market growth. Leading manufacturers like United Imaging launched its uPET total-body PET/CT system in 2024, offering full-body dynamic imaging with superior sensitivity and broader scan coverage, unlocking applications in oncology, cardiology, neurology, and theranostics.

This broadened clinical scope and improved operational efficiency strengthen diagnostic value and drive adoption across large hospital networks and research centers, accelerating overall PET market growth.

Regional Analysis

North America dominated the positron emission tomography market in 2025, accounting for 39.03% market share. This growth is driven by the FDA’s Transitional Pass Through reimbursement mechanism, which temporarily unbundles payment for newly approved PET radiotracers, improving early commercial uptake. In 2025, over 23 FDA-approved PET radiotracers, including PSMA agents for prostate cancer, have leveraged TPT status, boosting clinical adoption by reducing financial barriers for hospitals and outpatient imaging centres, and accelerating advanced PET utilisation beyond conventional FDG imaging.

U.S. dominated the positron emission tomography market, accounting for more than 90% share, owing to rapid clinical adoption of FDA-approved targeted PET radiotracers for prostate cancer and CNS imaging. With 23 distinct PET tracers approved and PSMA PET procedures increasing over 30% year-over-year in 2024, U.S. centres are expanding advanced molecular imaging services, driving PET demand beyond conventional FDG scans.

Table: Positron Emission Tomography Units Per Million People (2023)

|

Country |

PET Units |

|

U.S. |

5.4 |

|

Japan |

4.6 |

|

Australia |

4 |

|

South Korea |

3.8 |

|

Italy |

3.5 |

|

Iceland |

2.9 |

|

Finland |

2.7 |

|

Austria |

2.7 |

|

Belgium |

2.6 |

|

France |

2.6 |

|

Malta |

2.3 |

Source: World Health Organisation

Asia Pacific Market Insights

Asis Pacific is emerging as the fastest-growing region with a CAGR of 6.81% from 2026-2034, owing to regulatory streamlining and government support for local radiotracer approvals and manufacturing. In 2025, China’s National Medical Products Administration (NMPA) approved amyloid F-18 tracers for Alzheimer’s diagnosis, prompting wider clinical adoption and boosting regional PET utilisation beyond oncology alone. This localised regulatory progress accelerates advanced PET deployment across major APAC healthcare systems.

Australia’s positron emission tomography market expanded steadily, and this growth is attributed to the rapid increase in prostate-specific membrane antigen (PSMA) PET imaging utilization following government subsidisation under the Medicare Benefits Schedule (MBS), substantially boosting scan volumes. Between 2023 and early 2025, PSMA-PET studies for primary staging increased markedly, reflecting growing clinical reliance on advanced molecular imaging for prostate cancer management.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe's positron emission tomography market growth is supported by the strategic expansion of localised cyclotron and radiopharmaceutical production hubs, enhancing on site tracer availability and reducing reliance on imported isotopes. In 2025, European radiopharma leader Curium secured major contracts to supply cyclotron-produced PET tracers to multi site hospital networks, improving clinical access and shortening tracer delivery times across Germany and France. This localised supply chain advancement accelerates PET adoption in regional diagnostic and research centers.

UK PET market growth is driven by the formal NHS England commissioning policy for PSMA PET-CT imaging in high-risk and recurrent prostate cancer, which integrates specific PET radiotracers into routine NHS care pathways. In 2025, this policy expanded access to Ga-68 and F-18 PSMA PET-CT scans across NHS facilities, prompting wider clinical uptake and referral growth in targeted molecular imaging services.

Latin America Market Insights

Latin America positron emission tomography market is witnessing steady growth, due to the emergence of public private partnerships to bolster PET/SPECT imaging infrastructure and tracer access, reducing cost and logistical barriers. In 2025, countries like Mexico expanded domestic production of PET radioisotopes through consolidated procurement and joint hospital-government initiatives, improving the availability of hybrid PET/CT systems in regional oncology centers, thereby enhancing clinical adoption beyond traditional urban hubs.

Brazil's positron emission tomography market is experiencing growth driven by active engagement of national health authorities in expanding PET-CT diagnostic indications through public consultations and policy reviews, such as proposals to extend PET-CT use for staging locally advanced oesophageal carcinoma and metastatic breast cancer in 2025. These deliberations signal evolving reimbursement and clinical guidelines, encouraging broader clinical adoption of PET imaging across major oncology centres nationwide.

Middle East and Africa Market Insights

The Middle East and Africa positron emission tomography market is expanding due to the emergence of AI-driven PET imaging protocol standardisation initiatives across multi-country healthcare networks, improving diagnostic consistency and workflow efficiency. For instance, hospitals in the UAE and Saudi Arabia adopted AI-based PET reconstruction and low-dose imaging software, which enhanced image quality while reducing tracer dose variability, accelerating clinical confidence, and broadening the adoption of PET diagnostics in oncology and neurology.

The positron emission tomography market growth in this country is supported by the introduction of the country’s first pay‑per‑use PET‑CT scanner model, enabling advanced imaging access without heavy capital investment. In January 2025, EASE launched this pay‑per‑use PET‑CT system in Rustenburg, expanding diagnostic PET services to underserved populations and neighbouring regions, thereby lowering entry barriers and accelerating market adoption in previously cost-constrained healthcare settings.

Product Type Insights

The full-ring PET scanner segment dominated the market in 2025. This growth is attributed to the deployment of extended axial field‑of‑view full‑ring systems like total‑body PET in clinical research networks for simultaneous dynamic imaging across the entire body, which enhances pharmacokinetic studies and multi‑organ metabolic assessments. For instance, in June 2025, Scotland’s first total‑body PET scanner at Edinburgh Royal Infirmary began operations, boosting demand for full‑ring systems with research‑grade capabilities.

The partial ring PET scanner segment is projected to register the fastest CAGR growth of 6.11% during the forecast period, owing to the rising adoption of compact, task‑specific PET systems in outpatient musculoskeletal and arthritis imaging clinics, where limited detector rings suffice for regional joint metabolic assessment. These streamlined scanners, deployed increasingly in 2025 research pilots in U.S. orthopaedic networks, offer optimized workflows and lower maintenance costs tailored to localized imaging.

Modality Insights

The PET/CT segment dominated the market in 2025 with a revenue share of 79.38% in 2025. This dominance is attributed to the clinical validation and rapid adoption of specialized integrin‑targeted PET/CT tracers that enhance lesion detection and staging accuracy for cancers like lobular breast and rare lung tumors, driving demand for PET/CT systems optimized for these advanced tracers in oncology practices worldwide.

The PET/MRI segment is estimated to grow at a CAGR of 5.72% during the forecast period. This growth is supported by the expansion of PET/MRI in simultaneous metabolic‑diffusion imaging for neuroinflammatory and neurodegenerative research, enabling concurrent assessment of molecular PET biomarkers and MRI diffusion metrics.

By Modality Market Share (%), 2025

Source: Straits Research

Isotope Insights

The 18F-Fluorodeoxyglucose segment dominated the market in 2025 with a revenue share of 58.44%, due to its advancement into full body dynamic perfusion and metabolic imaging using high temporal resolution early dynamic 18F‑FDG PET, enabling quantitative blood flow metrics alongside traditional glucose uptake analysis, broadening research and clinical applications beyond static imaging.

The 68Ga-Based Tracers segment is expected to register the fastest CAGR during the forecast period. This growth is driven by the emergence of integrin-targeted ^68Ga tracers that reveal disease processes such as idiopathic pulmonary fibrosis and αvβ6-integrin-expressing tumors unseen by traditional PET tracers, expanding clinical utility beyond conventional cancer imaging and driving demand for ^68Ga tracers.

Application Insights

The oncology segment dominated the market in 2025, accounting for 48.57% revenue share, due to the adoption of PSMA PET imaging for early biochemical recurrence detection in prostate cancer, which allows precise lesion localization even at ultra-low PSA levels, which in turn, supports segment growth.

Competitive Landscape

The positron emission tomography market is consolidated, dominated by a few global imaging giants that hold the majority of market share and continuously innovate to stay competitive. Key players such as Siemens Healthineers, GE Healthcare, and Philips Healthcare lead with advanced digital PET/CT and PET/MRI platforms, deep R&D investments, and extensive global service networks. Other competitors include Canon Medical Systems and United Imaging, which expand geographic reach through competitive offerings and emerging market penetration.

Telix Pharmaceuticals: An emerging market player

An emerging player in the positron emission tomography market is Telix Pharmaceuticals, a biotech firm advancing novel PET imaging agents that are expanding diagnostic scope. In 2025, Telix’s next‑generation PSMA‑PET imaging agent Gozellix achieved U.S. commercialization, offering improved shelf life and broader accessibility for prostate cancer PET scans compared to traditional gallium‑based products.

This strategic radiotracer launch underscores Telix’s growing influence in molecular imaging beyond established OEM scanner manufacturers.

List of Key and Emerging Players in Positron Emission Tomography Market

- Siemens Healthineers

- GE HealthCare

- Koninklijke Philips N.V.

- Canon Medical Systems

- United Imaging Healthcare

- Hitachi Medical Corporation

- Toshiba Medical Systems

- Neusoft Medical Systems

- Positron Corporation

- Mediso Ltd.

- Spectrum Dynamics Medical Ltd.

- Agfa HealthCare NV

- Segami Corporation

- SOFIE Biosciences, Inc.

- Eckert & Ziegler Strlzg AG

- Hyperfine, Inc.

- Cardinal Health

- Others

Strategic Initiatives

- October 2025: Positron Corporation partnered with MedAxiom to boost innovation and best practices that improve outcomes and performance across cardiovascular medicine.

- May 2025: Telix received approval for its Illuccix, a prostate cancer PET imaging agent, in the Czech Republic.

- April 2025: Telix Pharmaceuticals received product approval for its Illuccix in France for the detection and localization of prostate-specific membrane antigen.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.01 Billion |

| Market Size in 2026 | USD 2.10 Billion |

| Market Size in 2034 | USD 3.22 Billion |

| CAGR | 5.45% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Modality, By Isotope, By Application, By End User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Positron Emission Tomography Market Segments

By Product Type

- Full Ring PET Scanner

- Partial Ring PET Scanner

By Modality

- Stand-Alone PET

- PET/CT

- PET/MRI

By Isotope

- 18F-Fluorodeoxyglucose

- 82Rb & 13N-Ammonia

- 68Ga-Based Tracers

- 64Cu & Zirconium-89 Immuno-PET

By Application

- Neurology

- Oncology

- Cardiology

- Others

By End User

- Hospital & Surgical Center

- Diagnostic Imaging Centers

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.