Postmenopausal Osteoporosis Treatment Market Size, Share & Trends Analysis Report By Drug Class (Branded, Generics), By Type (Bisphosphonates, Parathyroid Hormone Therapy, Calcitonin, Selective Estrogen Inhibitors Modulator (SERM), Rank Ligand Inhibitors, Other Products), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Postmenopausal Osteoporosis Treatment Market Overview

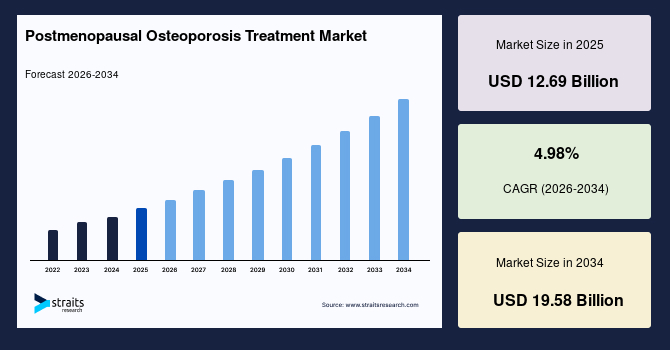

The global postmenopausal osteoporosis treatment market size is estimated at USD 12.69 billion in 2025 and is projected to reach USD 19.58 billion by 2034, growing at a CAGR of 4.98% during the forecast period. Sustained growth of the market is propelled by the rising uptake of advanced therapies among women with early diagnosed bone density loss.

Key Market Trends & Insights

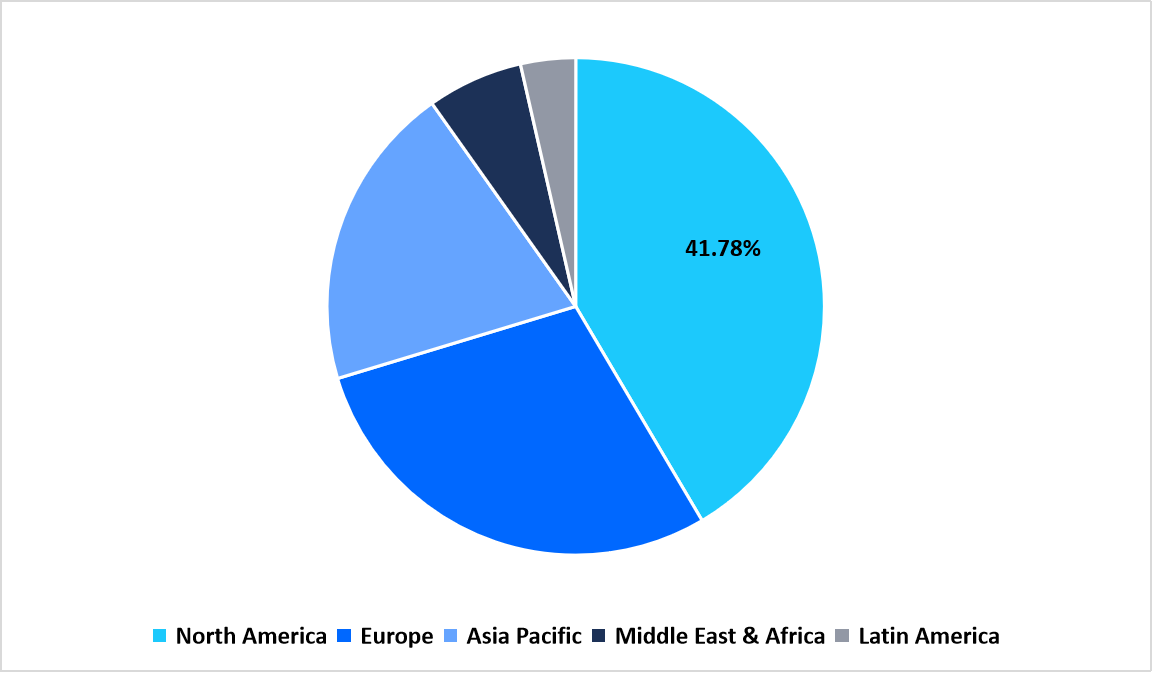

- North America held a dominant share of the global market, accounting for 41.78%.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 6.98%.

- Based on Drug Class, the generics segment is anticipated to register the fastest CAGR of 5.12% during the forecast period.

- Based on Type, the bisphosphonates segment dominated the market with a revenue share of 49.25%.

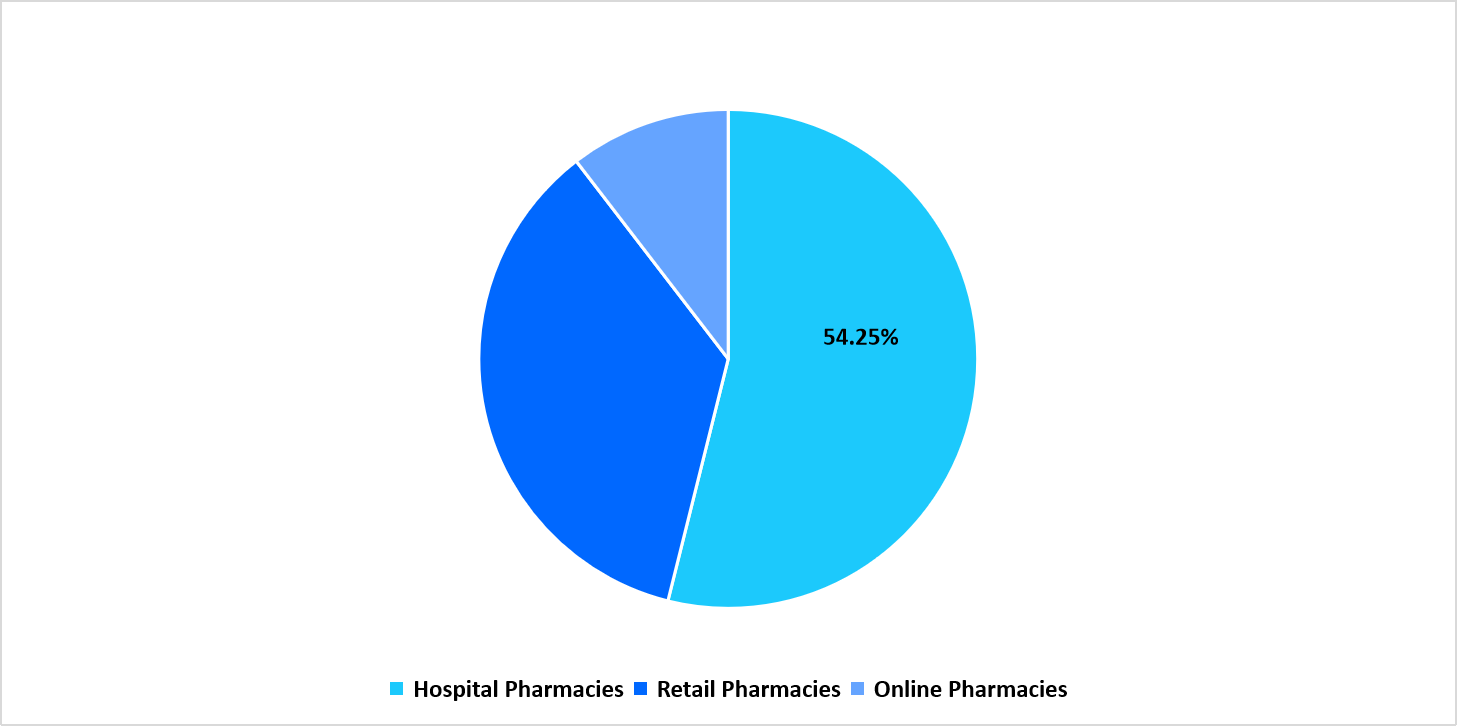

- Based on Distribution Channel, the hospital pharmacies segment dominated the market in 2025, with a market share of 54.25%.

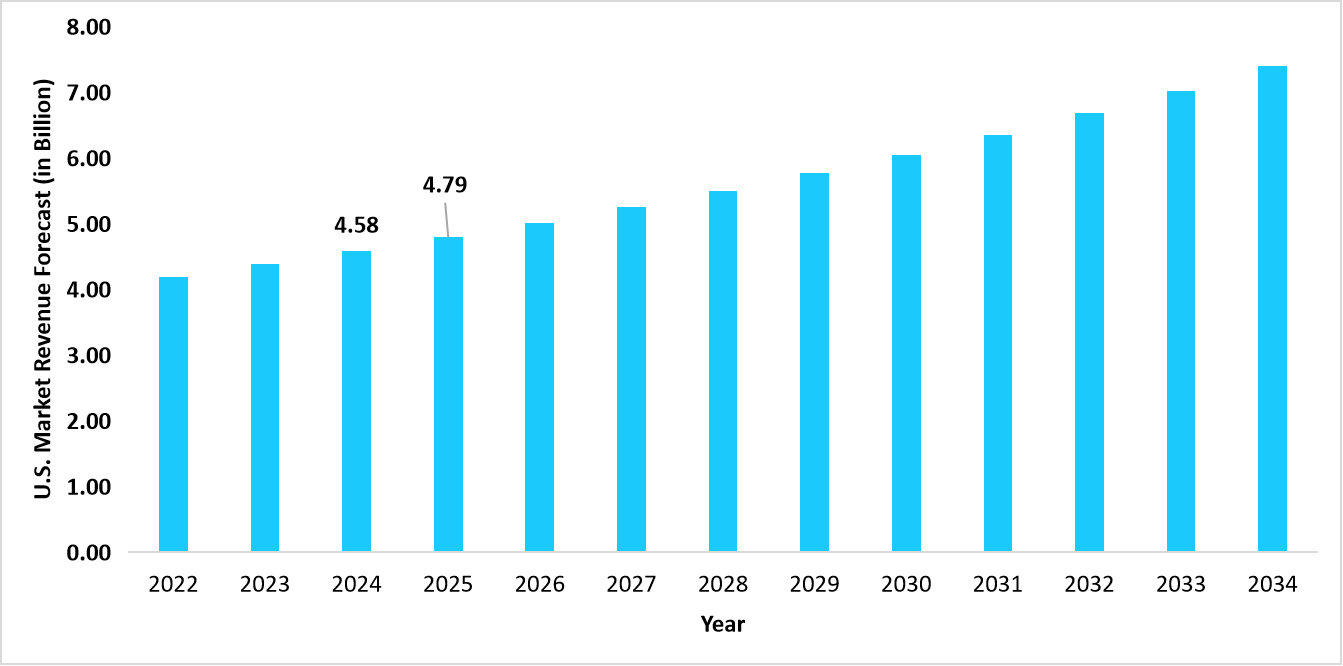

- The U.S. dominates the global postmenopausal osteoporosis treatment market, valued at USD 4.58 billion in 2024 and reaching USD 4.79 billion in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 12.69 billion

- 2034 Projected Market Size: USD 19.58 billion

- CAGR (2025 to 2034): 4.98%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The postmenopausal osteoporosis treatment market comprises therapies and products designed to manage bone density loss and reduce fracture risk in women after menopause, driven by hormonal changes that accelerate bone resorption. The market includes a wide range of drug classes such as branded and generic formulations delivered across multiple therapeutic categories, including bisphosphonates, parathyroid hormone therapy, calcitonin, selective estrogen receptor modulators, rank ligand inhibitors, and other specialized products. Treatment access spans hospital pharmacies, retail pharmacies, and online pharmacies, supported by rising diagnostic awareness, broader use of bone health assessments, and expanding availability of advanced medications across global healthcare systems.

Latest Market Trends

Adoption of Bone Turnover Biomarker Panels for Therapy Tracking

A growing trend in the postmenopausal osteoporosis treatment market is the use of bone turnover biomarker panels to track treatment response with greater accuracy than periodic scans alone. Clinicians are integrating serum marker evaluations into routine follow-up visits, which allows adjustments to therapy timelines and dosing patterns. This shift enhances precision in long-term patient management and encourages broader use of biomarker-guided care pathways.

Integration of Fall Risk Monitoring Systems into Osteoporosis Care Plans

The emerging trend is the incorporation of fall risk monitoring tools into treatment planning for postmenopausal women. Wearable sensors and in-home motion monitoring systems are being linked with fracture prevention programs, which strengthen early identification of mobility decline. As healthcare providers focus on avoiding preventable fractures, these systems are becoming part of multidisciplinary osteoporosis management protocols.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 12.69 Billion |

| Estimated 2026 Value | USD 13.27 Billion |

| Projected 2034 Value | USD 19.58 Billion |

| CAGR (2026-2034) | 4.98% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Amgen Inc., Eli Lilly and Company, Merck & Co., Inc., Novartis AG, Pfizer Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Rising Adoption of Sequential Therapy Approaches in High-Risk Patients

A key driver in the market is the growing shift toward structured sequential therapy, where women transition between anabolic and antiresorptive drugs to achieve sustained gains in bone density. Clinical societies are endorsing structured sequencing for patients with severe bone loss, which has increased utilization across outpatient specialty centers.

Market Restraint

Limited Patient Adherence Due to Extended Treatment Durations

A restraint for the market arises from long treatment durations required for most osteoporosis therapies which reduces adherence among older women. Missed doses and therapy interruptions reduce clinical outcomes and influence prescribing patterns in primary care facilities.

Market Opportunity

Expansion of Home-Based Self-Injection Programs for Injectable Osteoporosis Therapies

An emerging opportunity is the broadening of home-based self-injection programs that allow postmenopausal women to administer injectable therapies without frequent clinic visits. Pharmaceutical companies and care coordinators are introducing structured training modules and remote follow-up services, which increase access for women in suburban and regional areas. This approach opens new channels for therapy uptake and supports long-term treatment continuation.

Regional Analysis

North America held a major share of 41.78% due to the strong adoption of biologics and anabolic treatments supported by broad insurance coverage for chronic bone disorders. The region benefited from high screening rates and frequent diagnostic assessments performed in outpatient facilities and imaging centers. Established pharmaceutical companies maintained wide distribution networks, which sustained the availability of therapies across retail pharmacies and specialty clinics.

The U.S. expanded its market presence as federal programs encouraged improved management of fracture risk in aging women, which increased prescriptions for advanced osteoporosis drugs across hospitals and community care settings.

Asia Pacific Market Insights

Asia Pacific recorded the fastest rate of 6.98% growth due to rising awareness of bone density loss among older women and expanding access to bone health assessments in developing economies. Public health campaigns encouraged routine checkups that raised treatment uptake for high-risk groups. Regional manufacturers supplied cost-friendly oral therapies to public hospitals, which increased overall consumption.

India advanced due to national digital health platforms that supported electronic tracking of osteoporosis cases and ensured the timely supply of medications through public procurement channels.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe experienced steady expansion as updated clinical guidelines encouraged sequential therapies for women with severe bone loss. Harmonized regulatory systems across member states accelerated drug approval timelines, which improved treatment availability. Specialist fracture care pathways in several countries elevated diagnosis rates and supported broader adoption of injectable therapies.

Germany progressed as coordinated programs between insurers and specialist centers promoted regular bone scans for older women which increased therapy initiation within public health networks.

Middle East and Africa Market Insights

Middle East and Africa showed rising uptake as regional authorities launched bone health awareness drives targeting populations above fifty. Expansion of diagnostic facilities and partnerships with international drug suppliers improved access to oral and injectable therapies. The gradual growth of private hospitals in metropolitan areas increased demand for branded drugs.

Saudi Arabia advanced due to national screening initiatives integrated into workforce health evaluations which elevated identification of low bone density cases and boosted use of osteoporosis medications.

Latin America Market Insights

Latin America recorded increasing utilization of osteoporosis treatments through mobile outreach programs that connected remote districts with specialists. Government-supported teleconsultation services encouraged regular follow-up for women with a history of fractures. Regional manufacturing partnerships ensured steady drug distribution across public clinics.

Brazil expanded its market performance as state-led monitoring programs focused on long-term follow-up of fracture patients which strengthened adherence to prescribed therapies across rural and urban zones.

Drug Class Insights

The branded segment dominated the market in 2025 due to a wide preference for advanced therapies prescribed for women with severe bone loss. Uptake remained strong across specialty clinics where physicians favored well-established clinical profiles and structured patient support programs.

The generics segment recorded the fastest growth with a pace of 5.12%, supported by the broader availability of affordable oral therapies through public procurement systems and retail channels across developing economies.

Type Insights

The bisphosphonates segment led the market with a share of 49.25%, driven by continued use as frontline therapy for newly diagnosed patients across both primary care and specialty settings. Their long-standing presence in treatment guidelines supported consistent prescription volumes across outpatient facilities.

The rank ligand inhibitors segment achieved the fastest growth at 5.45%, encouraged by wider adoption among women at higher fracture risk who required targeted drug classes administered through specialist centers.

Distribution Channel Insights

The hospital pharmacies segment dominated with 54.25%, attributed to high dispensing volumes for injectable and biologic therapies administered under supervised care in hospital-based osteoporosis units. This channel saw strong traction among newly diagnosed patients requiring structured treatment initiation.

The retail pharmacies segment grows the fastest at 5.68%, supported by expanded stocking of oral therapies and convenience-driven purchasing patterns among patients undergoing long-term treatment regimens.

Segmentation by Distribution Channel in 2025 (%)

Source: Straits Research

Competitive Landscape

The global postmenopausal osteoporosis treatment market is moderately fragmented, with competition distributed across leading multinational pharmaceutical companies, specialty biotechnology firms, and generic drug manufacturers that collectively contribute to a diverse therapeutic ecosystem. Market players compete based on innovation in anabolic therapies, biosimilar launches, strategic collaborations, geographic expansion, and continuous clinical-trial advancements aimed at reducing fracture risk and improving long-term bone health outcomes in postmenopausal women.

Radius Health: An Emerging Market Player

- Radius Health established itself as a key innovation-driven player in the postmenopausal osteoporosis market through the development of abaloparatide (Tymlos), a next-generation anabolic therapy designed to stimulate rapid bone formation. The company’s research efforts strengthened the treatment landscape by offering an alternative to traditional antiresorptive drugs and creating new growth opportunities in high-risk postmenopausal patient segments.

List of Key and Emerging Players in Postmenopausal Osteoporosis Treatment Market

- Amgen Inc.

- Eli Lilly and Company

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- GSK plc.

- Radius Health, Inc.

- UCB S.A., Belgium.

- Teva Pharmaceutical Industries Ltd.

- AbbVie

- CiplaMed

- Enzene Biosciences

- Theramex

- Sun Pharmaceutical Industries Ltd.

- Radius Health

- Others

Strategic Initiatives

- July 2025: The Scottish Medicines Consortium (SMC) recommended Eladynos (abaloparatide) for the treatment of osteoporosis in postmenopausal women at very high risk of fractures. This decision made Eladynos available via the NHS in Scotland for eligible postmenopausal women.

- March 2025: The clinical-practice guideline update by The Endocrine Society in 2025 added Romosozumab (Evenity) as a recommended treatment option for osteoporosis in postmenopausal women. The guideline recognised romosozumab as a viable first-line therapy for postmenopausal women with low bone mineral density and high fracture risk.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 12.69 Billion |

| Market Size in 2026 | USD 13.27 Billion |

| Market Size in 2034 | USD 19.58 Billion |

| CAGR | 4.98% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Drug Class, By Type, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Postmenopausal Osteoporosis Treatment Market Segments

By Drug Class

- Branded

- Generics

By Type

- Bisphosphonates

- Parathyroid Hormone Therapy

- Calcitonin

- Selective Estrogen Inhibitors Modulator (SERM)

- Rank Ligand Inhibitors

- Other Products

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.