Precision Medicine Software Market Size, Share & Trends Analysis Report By Component (Software, Services), By Delivery Mode (Cloud-based, On-premise), By Application (Oncology, Cardiology, Neurology / CNS, Rare & Genetic Disorders, Infectious Diseases (pathogen genomics), Immunology / Autoimmune, Others), By Technology (AI / Machine Learning models & Generative AI, Rule-based engines (clinical guidelines, pathways), Cloud & Containerized Pipelines (Kubernetes/Docker), High-performance compute / HPC for genomics, Interoperability / FHIR / HL7 integration, Others), By End Use (Hospitals, Pharmaceutical & Biotech companies, Diagnostic Laboratories & Genomic Service Providers, Contract Research Organizations (CROs), Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Precision Medicine Software Market Overview

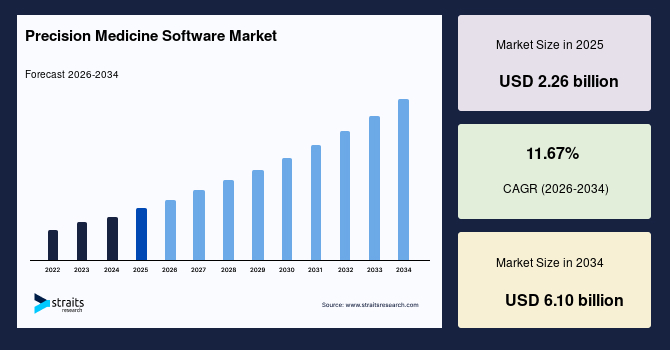

The global precision medicine software market size is estimated at USD 2.26 billion in 2025 and is projected to reach USD 6.10 billion by 2034, growing at a CAGR of 11.67% during the forecast period. The remarkable growth of the market is due to the surge in pharmacogenomic-based prescribing by healthcare systems, which further supports driving the demand for software that aligns genomic information with drug efficacy and safety profiles.

Key Market Trends & Insights

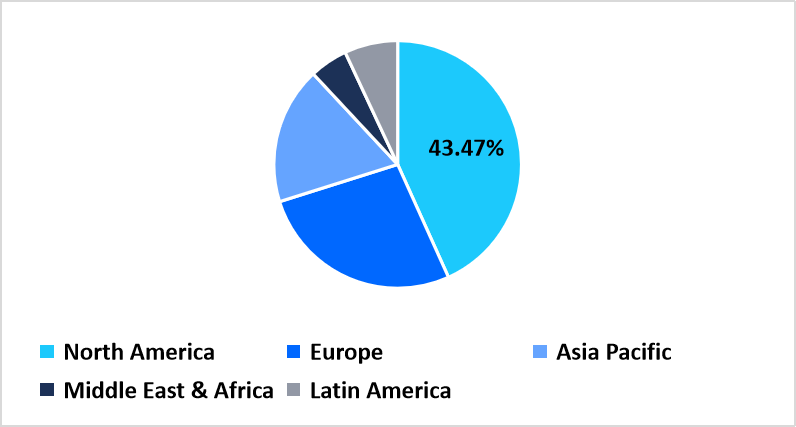

- North America held a dominant share of the global market, accounting for 43.47% share in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 13.67%.

- Based on Component, software dominated the market with 79.90% share.

- Based on the Delivery Mode, the cloud-based segment dominated the market with a 73.40% share.

- Based on the Application, the oncology segment dominated the market with a 34.30% share.

- Based on Technology, AI/machine learning models & generative AI segment dominated the market growth with 38.98%.

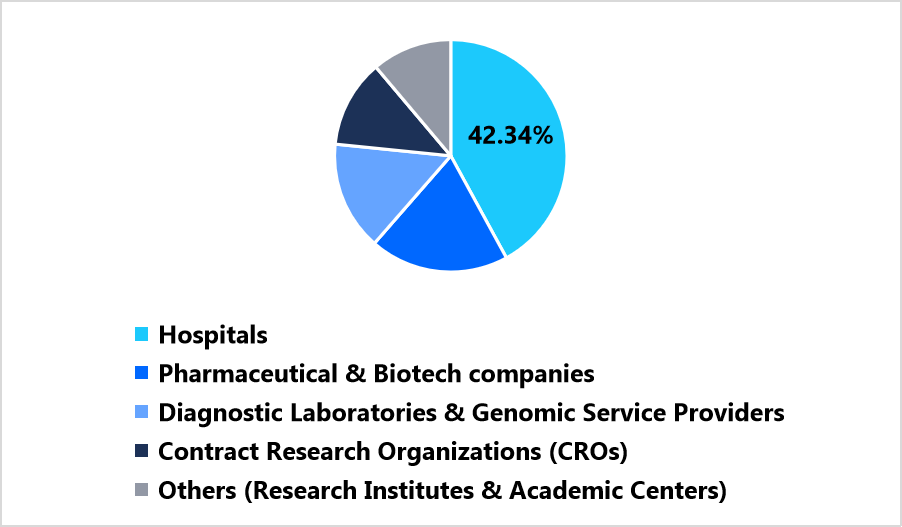

- Based on End User, the hospitals segment dominated the market in 2025, with a revenue share of 42.34%.

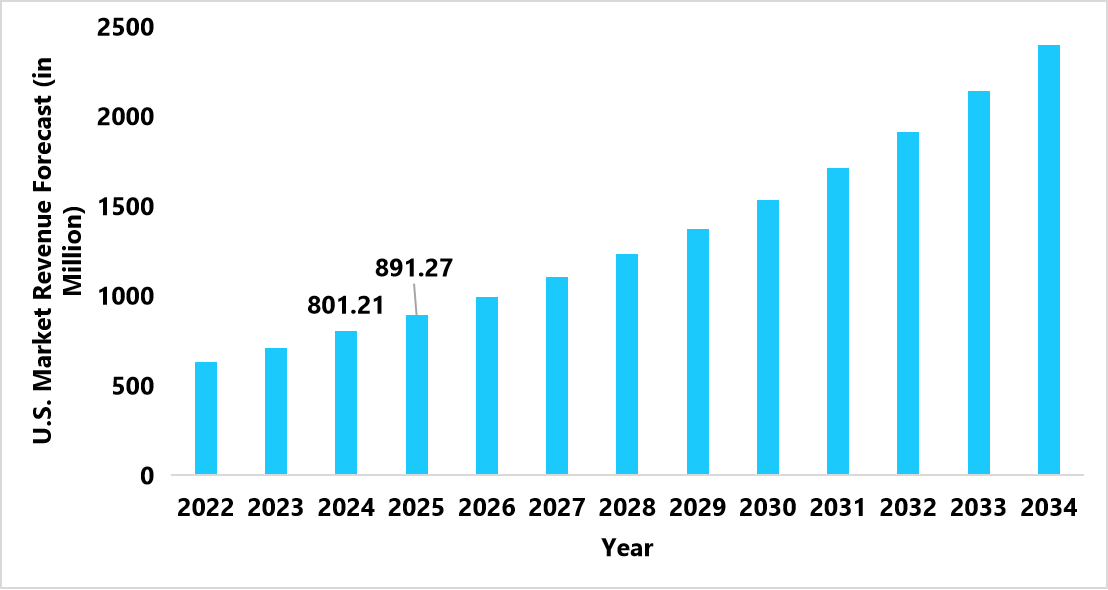

- The U.S. dominates the global market, valued at USD 801.21 million in 2024 and reaching USD 891.27 million in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 2.26 billion

- 2034 Projected Market Size: USD 6.10 billion

- CAGR (2025 to 2034): 11.67%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The precision medicine software market comprises digital platforms and analytical solutions designed to collect, process, and interpret genomic, clinical, and molecular data to enable personalised healthcare decisions. It includes software and related services such as implementation, clinical interpretation, validation, regulatory support, and data curation. Cloud-based deployment dominates due to flexible data access and scalability, while on-premise solutions are preferred for institutions requiring localised control. Applications span oncology, cardiology, neurology, rare and genetic disorders, infectious diseases, immunology, and other therapeutic areas, supporting data-driven diagnosis and treatment selection. Technologies such as AI, machine learning, rule-based systems, high-performance computing, and interoperability frameworks enhance precision in analysis. The software serves hospitals, pharmaceutical and biotech companies, diagnostic laboratories, contract research organisations, and academic institutions globally.

Latest Market Trends

Shift from Static Genomic Analysis to Dynamic Multi-Omics Integration

The market is shifting from static genomic analysis toward dynamic multi-omics integration that combines genomics, proteomics, metabolomics, and transcriptomics within unified platforms. This transition allows researchers to capture biological interactions at multiple molecular levels, enabling better identification of disease mechanisms and patient-specific biomarkers. Healthcare institutions are increasingly deploying multi-omic software solutions that enhance clinical understanding and improve therapy alignment. Vendors are integrating cross-domain data analytics into clinical workflows to support disease prevention, diagnosis, and treatment optimization. The adoption of multi-omic platforms continues to grow across oncology, neurology, and rare disease domains, establishing a foundation for highly personalized and data-driven medicine.

Shift from Centralized Data Systems to Federated Learning Frameworks

The industry is moving from centralized data systems to federated learning frameworks that allow collaboration across multiple institutions without transferring sensitive data. This shift improves patient privacy, reduces data duplication, and accelerates model training using distributed datasets. Healthcare organizations in regions such as North America and Europe are partnering with AI developers to adopt privacy-preserving computational models. These frameworks ensure compliance with strict data protection regulations while improving AI model diversity and accuracy. Global alliances between hospitals, technology providers, and research networks are expanding federated learning adoption, enabling precision medicine software to analyze broader datasets and generate globally validated clinical insights.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.26 billion |

| Estimated 2026 Value | USD 2.52 billion |

| Projected 2034 Value | USD 6.10 billion |

| CAGR (2026-2034) | 11.67% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Tempus Labs, Inc., Foundation Medicine, Inc., SOPHiA GENETICS SA, Fabric Genomics, Inc., PierianDx, Inc. |

to learn more about this report Download Free Sample Report

Precision Medicine Software Market Driver

Expansion of AI-Powered Clinical Decision Support Tools

A key driver for the precision medicine software market is the expansion of AI-powered clinical decision support tools that analyse large-scale genomic and clinical data to guide personalized treatment. These platforms enhance diagnostic precision, accelerate result interpretation, and improve care coordination. The growing integration of AI in molecular diagnostics enables faster identification of actionable mutations and pharmacogenomic markers. Software vendors are collaborating with pharmaceutical companies to support drug development pipelines through predictive analytics and real-world data insights. The incorporation of AI-based interpretation in hospital and laboratory workflows continues to strengthen adoption rates, driving greater efficiency and scalability in precision healthcare delivery.

Market Restraints

Data Standardization and Interoperability Challenges

The market faces restraint due to limited data standardization and interoperability across healthcare systems and genomic databases. Variations in data formats, clinical terminologies, and storage protocols create difficulties in harmonizing patient information for software analytics. This lack of alignment delays integration between hospitals, laboratories, and research institutions. Vendors face challenges in developing systems that align with multiple regulatory and technological frameworks. Inconsistent adoption of FHIR and HL7 standards also limits scalability of precision medicine platforms in cross-border collaborations. Overcoming these data challenges requires unified frameworks and collaborative initiatives among technology developers, policymakers, and healthcare providers to enable efficient exchange and interpretation of patient datasets.

Market Opportunity

Integration of Precision Medicine Software with Digital Therapeutics

An emerging opportunity for the market lies in integrating precision medicine software with digital therapeutics and remote patient monitoring systems. This integration enables clinicians to track treatment response continuously, optimize therapy adjustments, and generate real-time patient health insights. Combining genomic analytics with wearable sensor data enhances personalized disease management and drug adherence monitoring. Companies are focusing on developing cloud-based precision ecosystems that connect genetic interpretation tools with behavioural and physiological data platforms. Such integration supports chronic disease management in oncology, diabetes, and cardiovascular care. This combined ecosystem approach creates a strong foundation for value-based care and next-generation personalized treatment strategies.

Regional Analysis

North America holds the largest market share of 43.47% in 2025, driven by the early integration of genomic sequencing, AI-enabled decision platforms, and data analytics within clinical workflows. The region’s mature digital health infrastructure and extensive research collaborations between healthcare providers and tech firms have led to wide adoption of precision-medicine platforms. Several hospitals and academic centers have established integrated genomics programs that use software-driven insights for personalized treatment plans.

The U.S. precision medicine software market expanded with the U.S. Food and Drug Administration (FDA) introducing a dedicated review pathway for AI-based clinical decision support tools in 2025. This pathway simplified the regulatory clearance process for software used in oncology and pharmacogenomics. Furthermore, partnerships between companies such as Tempus Labs and national research networks have increased data standardization and interoperability, which has enhanced clinical adoption and market revenue.

Asia Pacific Market Insights

Asia Pacific registered the fastest growth with a CAGR of 13.67% during the forecast period, owing to increasing investments in AI-based healthcare technologies and the rising adoption of genomic sequencing for population-scale studies. Governments in the region have encouraged the use of software platforms that manage large-scale molecular data and clinical decision tools.

China’s market is driven by the China Precision Medicine Initiative, which expanded access to clinical bioinformatics platforms across provincial hospitals. In 2025, the National Health Commission announced funding for regional genomic-data centers, creating demand for local precision-medicine software vendors. Collaborations between companies such as Baidu Health and academic genomics institutes have further improved algorithmic capabilities and localized data analytics, broadening adoption across oncology and metabolic disease research.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe accounted for a considerable share of the global precision medicine software market in 2025, supported by the European Health Data Space (EHDS) initiative and cross-border data exchange frameworks. The region’s healthcare systems have focused on creating interoperable platforms to enable collaborative genomic research and population health analytics.

Germany’s market growth is driven by large-scale digitalization programs within university hospitals, including the rollout of the Medical Informatics Initiative (MII). Through this initiative, German institutions have integrated clinical and genomic data across networks to improve precision diagnostics. Several German vendors have also focused on developing analytics platforms compatible with national data standards, which improved the scalability of precision-medicine solutions within the country.

Middle East & Africa Market Insights

The Middle East & Africa region showed gradual adoption of precision medicine software in 2025 as national genomics programs and hospital digitalization projects expanded. The focus has been on establishing regional bioinformatics networks and training healthcare professionals in clinical genomics.

The UAE market grows following the expansion of the Emirates Genome Program, which integrated precision medicine software for large-scale population sequencing. Local hospitals partnered with international software developers to establish cloud-based genomic data management systems, strengthening local research capabilities and improving patient stratification efforts in chronic disease management.

Latin America Market Insights

Latin America represented an emerging market for precision medicine software, characterized by ongoing digital transformation in healthcare and increasing adoption of data-driven diagnostic tools. The region has focused on integrating precision-medicine software into national healthcare frameworks to address genetic diversity across populations.

Brazil’s precision medicine software market advanced after the Ministry of Health initiated the National Genomic Network in 2024. This network linked laboratories and hospitals through a unified digital infrastructure, supporting software-based analysis for rare diseases and cancer diagnostics. Partnerships between Brazilian biotech firms and global AI developers have accelerated localization of genomic analysis platforms and improved the accuracy of clinical reporting systems.

Component Insights

The software segment dominates the market with a share of 79.90% in 2025, driven by increasing adoption of integrated genomic analytics and AI-based clinical decision platforms by healthcare institutions. The segment benefits from scalable architecture, wide deployment in clinical settings, and expanding integration with electronic health record systems.

The services segment registers the fastest growth of 12.21%, supported by rising demand for clinical interpretation, data curation, validation, and regulatory compliance support. The segment gains traction as hospitals and laboratories outsource complex analytical functions to specialized providers that enhance workflow efficiency and accelerate the translation of genomic data into clinical use.

Delivery Mode Insights

The cloud-based segment dominates the market with a share of 73.40% due to higher adoption of flexible data storage and real-time collaboration across research and healthcare ecosystems. Cloud deployment supports large-scale genomic data processing, remote accessibility, and seamless updates, enabling faster deployment of precision medicine platforms across multiple regions.

The on-premise segment shows the fastest growth of 12.62%, driven by rising adoption in institutions that prioritize data sovereignty and internal governance. The model supports localized data analysis, offering greater control to healthcare systems handling confidential patient records while ensuring compliance with regional data protection frameworks and customized infrastructure preferences.

Application Insights

The oncology segment dominates the market with a share of 34.30%, driven by the growing implementation of software platforms for genomic profiling, biomarker discovery, and personalized cancer treatment selection. Precision oncology software enhances diagnostic accuracy, clinical decision support, and therapy optimization for cancer patients through real-time data-driven insights.

The rare and genetic disorders segment grows fastest at 12.82%, supported by increasing adoption of precision platforms for early diagnosis and genetic mapping. Governments and research institutions emphasize rare disease registries and whole-genome sequencing programs, which create opportunities for vendors providing specialized interpretation tools and curated genomic data management systems.

Technology Insights

The AI and machine learning models segment dominates the market with a share of 38.98%, propelled by rapid advancements in predictive modeling, molecular diagnostics, and personalized therapy recommendations. These platforms analyze large genomic datasets, improve diagnostic precision, and streamline patient stratification, driving widespread adoption in healthcare and research environments.

The interoperability and FHIR/HL7 integration segment is anticipated to register the fastest CAGR of 13.02%, as healthcare providers focus on ensuring seamless data exchange between clinical systems and genomic databases. The integration of standardized data formats enhances workflow efficiency, regulatory compliance, and the delivery of coordinated precision care across multi-institutional research networks and hospitals.

End Use Insights

The hospitals segment dominates the market with a share of 42.34% in 2025, owing to strong utilization of precision medicine platforms for clinical diagnostics and patient management. Hospitals employ these solutions to integrate genomic insights into treatment planning, streamline clinical workflows, and enable personalized therapies at the point of care.

The diagnostic laboratories and genomic service providers segment grows fastest at a CAGR of 13.12%, driven by expanding sequencing capabilities and increasing partnerships with software vendors. These laboratories adopt specialized bioinformatics tools to automate data interpretation, enhance result accuracy, and support pharmaceutical clients and healthcare providers in delivering personalized genomic-based diagnostic solutions.

Pie Chart: Segmentation by End Use (%), in 2025

Source: Straits Research

Competitive Landscape

The global precision medicine software market is moderately fragmented, with a few established players holding a major share, while several emerging companies are strengthening their presence through strategic collaborations, product innovations, clinical validation, and regional expansion.

Tempus, Inc.- An emerging market player

Tempus, Inc. operated as a leading AI-enabled precision-medicine platform, building a large clinical and molecular data library and expanding its capabilities through acquisitions and product launches (including AI digital pathology and clinical co-pilot features). The company emphasized enterprise deals with health systems and technology partners to embed decision support capabilities into clinical workflows.

List of Key and Emerging Players in Precision Medicine Software Market

- Tempus Labs, Inc.

- Foundation Medicine, Inc.

- SOPHiA GENETICS SA

- Fabric Genomics, Inc.

- PierianDx, Inc.

- Syapse, Inc.

- GenomOncology LLC

- 2bPrecise, LLC

- IQVIA, Inc.

- Genedata AG

- Illumina, Inc.

- QIAGEN N.V.

- Flatiron Health, Inc.

- Guardant Health, Inc.

- IBM

- Owkin, Inc.

- Inspirata, Inc.

- Strata Oncology, Inc.

- Oracle Cerner

- Siemens Healthineers AG

- Others

Strategic Initiatives

- July 2025: The Luxembourg Institute of Health (LIH) and the National Cancer Center Korea (NCCK) launched the International Health Data Space Initiative (IHDSI), together with partners NAVER Cloud Corporation, Okestro Co., Ltd., and Cipherome, Inc., to create a secure, privacy-preserving platform for cross-border health data sharing. The initiative aimed to accelerate AI-driven precision medicine and cancer research through federated access to health data.

- February 2025: GenomOncology and Pillar Biosciences announced a co-marketing partnership to advance rapid precision oncology solutions. The collaboration integrated GenomOncology’s clinical decision-support platform with Pillar’s targeted next-generation sequencing (NGS) panels, enabling healthcare providers to deliver personalized cancer treatment guidance through a streamlined workflow.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.26 billion |

| Market Size in 2026 | USD 2.52 billion |

| Market Size in 2034 | USD 6.10 billion |

| CAGR | 11.67% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Delivery Mode, By Application, By Technology, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Precision Medicine Software Market Segments

By Component

- Software

-

Services

- Implementation & integration

- Clinical interpretation & reporting services

- Validation & regulatory support

- Data curation / annotation services

- Others

By Delivery Mode

- Cloud-based

- On-premise

By Application

- Oncology

- Cardiology

- Neurology / CNS

- Rare & Genetic Disorders

- Infectious Diseases (pathogen genomics)

- Immunology / Autoimmune

- Others

By Technology

- AI / Machine Learning models & Generative AI

- Rule-based engines (clinical guidelines, pathways)

- Cloud & Containerized Pipelines (Kubernetes/Docker)

- High-performance compute / HPC for genomics

- Interoperability / FHIR / HL7 integration

- Others

By End Use

- Hospitals

- Pharmaceutical & Biotech companies

- Diagnostic Laboratories & Genomic Service Providers

- Contract Research Organizations (CROs)

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.