Rail Logistics Market Size, Share & Trends Analysis Report By Service (Freight Transport, Warehousing & Storage, Intermodal Logistics, Supply Chain Management, Digital & IT Solutions), By Cargo Type (Bulk Cargo, Liquid Cargo, Containerized Cargo, Automotive Cargo, Temperature-Sensitive Goods), By End-Use Industry (Agriculture, Energy & Utilities, Manufacturing, Retail, Automotive, Chemicals, Food & Beverages, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Rail Logistics Market Overview

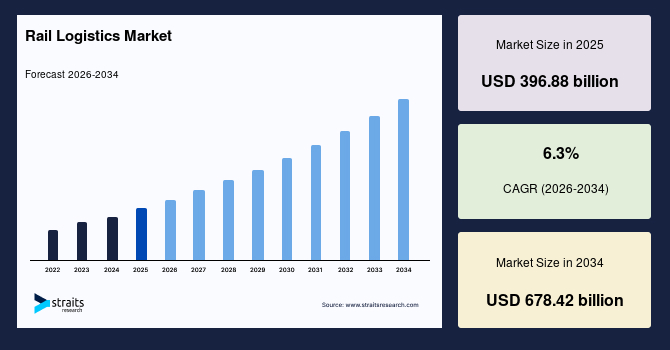

The rail logistics market size is estimated at USD 396.88 billion in 2025 and is projected to reach USD 678.42 billion by 2034, growing at a CAGR of 6.3% during forecast period. The growth of the market is driven by increasing government-sponsored investments in railway modernization as well as cross-border freight corridors that help improve efficiency in operations, shorten transit times, and encourage ecologically friendly transportation. Moreover, supportive policies and infrastructure development initiatives for decongesting road networks and diverting cargo movement to railways are also promoting industries towards adopting rail-based logistics solutions proactively in increasing numbers.

Key Market Trends & Insights

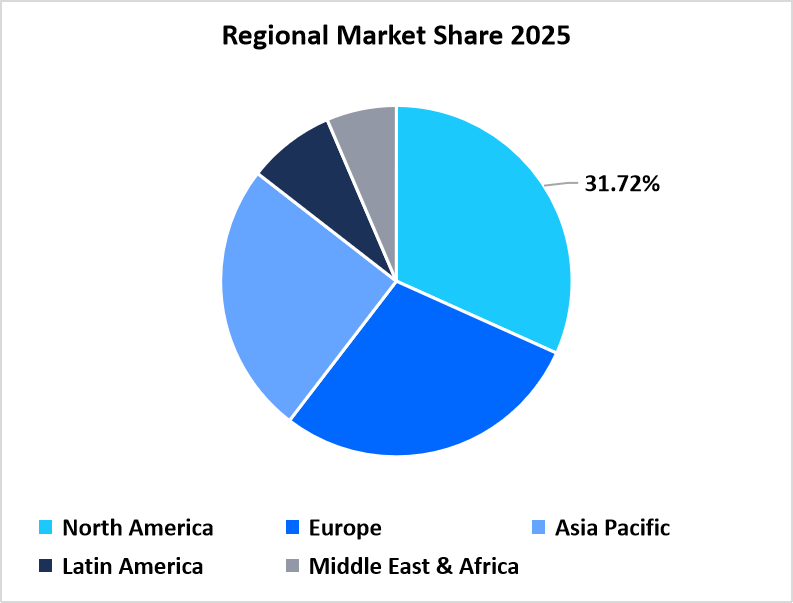

- North America held a dominant share of the market, accounting for 31.72% share in 2025.

- The Asia Pacific region grew at the fastest pace, with a CAGR of 7.4%.

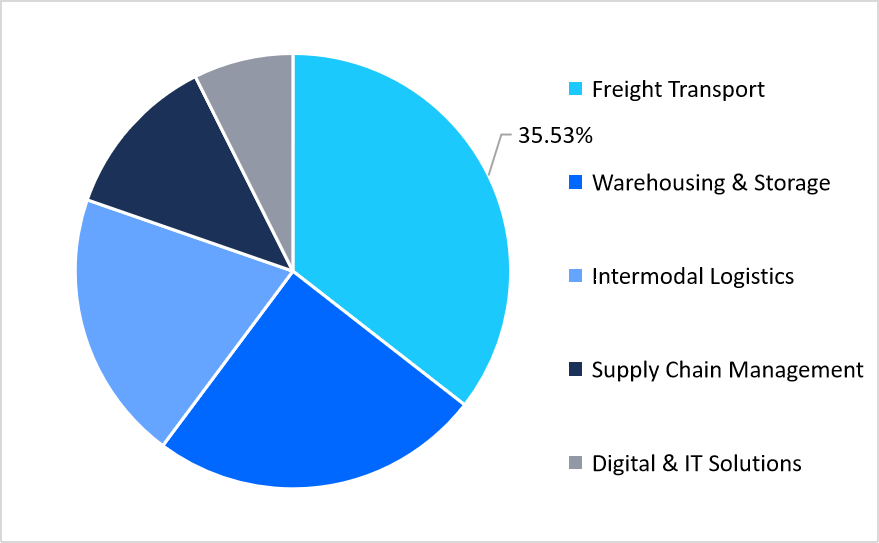

- Based on service, the freight transport segment held the highest market share of 35.53% in 2025.

- On the basis of cargo type, the containerized cargo segment was expected to register the fastest CAGR growth of 6.51%.

- Based on distance, the long-distance segment dominated the market in 2025.

- Based on end-use industry, the manufacturing segment was expected to register the fastest CAGR during the forecast period.

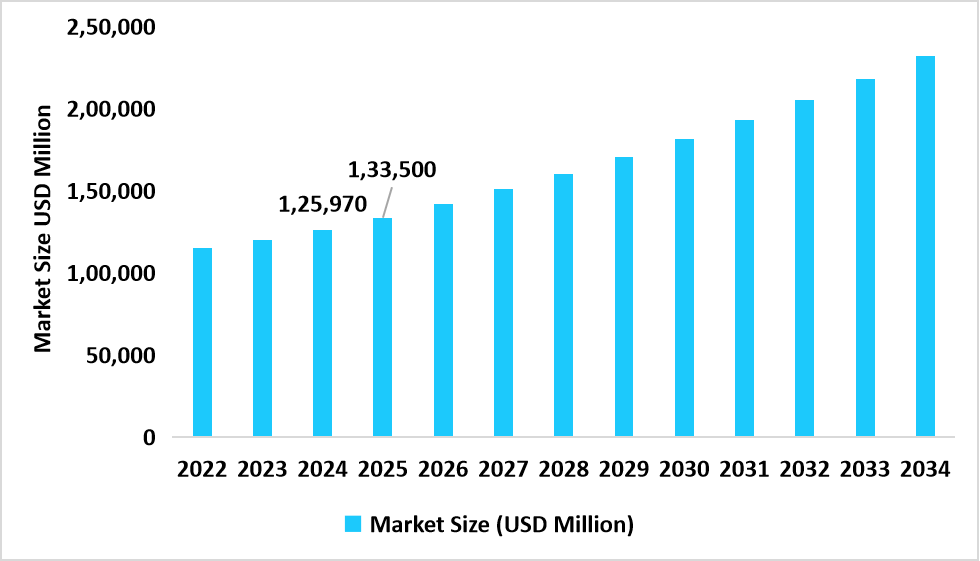

- The U.S. dominates the rail logistics market, valued at USD 125.97 billion in 2024 and reaching USD 133.50 billion in 2025.

Table: U.S Rail Logistics Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 396.88 billion

- 2034 Projected Market Size: USD 678.42 billion

- CAGR (2026-2034): 6.3%

- Dominating Region: Europe

- Fastest-Growing Region: Asia-Pacific

The global rail logistics sector is expanding as more and more companies adopt low-cost and eco-friendly modes of transport, resulting in rising demand for intermodal transport and rail freight. More dependence on containerized and thermal-controlled cargo handling and road-to-rail transportation to reduce congestion and carbon footprint has increased industry activity in the market. Furthermore, technological advancements through electronic monitoring, better route planning, and real-time tracking of freight are increasing operational efficiency and reliability. Greater private investment along with positive trade agreements enabling cross-border rail haulage are also fueling the growth of the market.

Latest Market Trends

Shifting from Road to Rail for More Efficient and Greener Freight

A major change is taking place in logistics as companies increasingly replace road freight with rail transport that is less environmentally taxing and more efficient. previously, a heavy reliance on trucking resulted in traffic jams, high carbon footprints, and difficulties in complying with regulatory requirements. Today's reality, though, is characterized by a greater focus on sustainable supply chains and government policy to encouragecommitted rail freightnetworks. That transformation means rail is now the favored mode of transport for long-haul and bulk freight.

The Rise in Rail Freight Volumes

A dominant industry trend is the dramatic increase in the volume of rail cargo. In the early 2000s, rail cargo was mainly limited to a few bulk commodities and containers that made up a small share of overall cargo movement. Since 2005, however, rail freight volumes have exhibited solid and sustained growth. Growth in the industry from a specialized service to a mainstream logistics solution is driving demand and affirming the role of rail in current supply chain networks.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 396.88 billion |

| Estimated 2026 Value | USD 421.91 billion |

| Projected 2034 Value | USD 678.42 billion |

| CAGR (2026-2034) | 6.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | US Rail & Logistics, CSX Transportation, Union Pacific, CEVA Logistics, BNSF Railway |

to learn more about this report Download Free Sample Report

Market Drivers

Increasing usage of global trade corridors

The growth of global trade lanes is powering growth in the rail logistics industry more and more. In the past, cross-border freight suffered because fragmented transport systems and inefficient customs processes caused delays. Now, strategic trade lanes tying major ports and industrial centers together are facilitating more efficient movement of goods, making global businesses come to use the rail for longer-distance hauls. This large-scale growth in global rail freight movement is making the role of rail logistics an increasingly viable and competitive option against conventional road and sea-based transport, thus driving the overall market size and usage globally.

Growing demand for just-in-time (JIT) automobile supply chains

Increased use of just-in-time (JIT) production in the auto industry is leading to more dependence on rail logistics. Railroads provide efficient, high-volume movement of vital components like engines, chassis, and electronic modules between the manufacturing facilities and assembly plants. North American and European vehicle OEMs started utilizing rail corridors to move more than 2 million tons of vehicle components every year, lowering lead times, inventory expenses, and reliance on over-the-road freight, thus increasing the use of rail logistics in the industry.

Market Restraint

Limited connectivity of rail networks in developing regions

Several challenges in the rail logistics sector include low connectivity of railway networks in some emerging markets that impedes smooth cargo movement and limits market penetration. Unlike road haulage, rail needs mature lines connecting industrial centers, seaports, and distribution outlets. In markets with broken rail networks, companies still use substitute modes of transport, which retards the uptake of rail-based logistics solutions. Additionally, lack of adequate network coverage and rail connectivity gaps remain a major impediment to massive uptake of rail logistics services in these areas, constraining the market growth potential as global demand continues to rise.

Market Opportunity

Expansion of specialized freight corridors

The most significant opportunity for rail logistics industry growth is to develop out and expand dedicated freight routes for high-growth sectors like automotive, agriculture, and chemicals. With dedicated lanes specific to these markets, railroads can provide more predictable service, take pressure off the current network, and win a broader base of commercial shippers.

In addition to enhancing delivery schedules, these corridors allow firms to consolidate their supply bases and bring rail transport into the core of their supply strategy.

Regional Analysis

North America dominated the market in 2025 with a market share of 31.72%. This is attributed to the region's highly advanced and well-connected rail network linking industrial hubs, ports, and distribution terminals in a resourceful way. In addition, increased public-private partnerships and investment in modernized intermodal terminals have improved cargo handling capacity and operating reliability. Further, more general efforts at linking cross-border rail transport and aligning logistics regulation across the U.S. and Canada have helped to strengthen market confidence, as the collective stimulus toward adoption of rail logistics solutions in the region.

Its strategically integrated freight corridors and industrial distribution systems enhance the development of the U.S. market. For instance, in 2024, its rail network transported more than 1.1 billion tons of freight, both bulk and containerized, as well as automotive freight, representing the scale and effectiveness of domestic rail logistics. These strong operating systems have been continuously fostering confidence among firms, fueling the development of the nation's market.

Asia Pacific Market Insights

The Asia-Pacific is emerging as the fastest-growing region at a CAGR of 7.4% for 2026–2034, with the growth spurred by the emergence of nations such as China, India, and South Korea, which are creating rail freight networks between factories and ports and inland nodes. In particular, China's Belt and Road strategic plans have strengthened transcontinental rail routes, transforming Asian-European freight transport faster and greater in volume. These state-supported trade and logistics programs also are growing rail usage in the region. These government-backed trade and logistics initiatives are also increasing rail use in the area.

China rail logistics industry is growing very fast via dedicated freight corridors and links to ports. For instance, in 2024, rail freight movement between Europe and China moved more than 500,000 TEUs of freight, indicating robust use of the rail mode for cross-border trade. Such extensive corridor operations coupled with hospitable policies for green freight transportation render China a hotspot growth area for the world rail logistics sector.

Europe Rail Logistics Market Insights

Europe led a significant share of the global rail logistics market in 2025, underpinned by effectively integrated cross-border rail infrastructures and the EU focus on environmentally friendly freight transportation. The stringent requirements for carbon reduction and the EU Green Deal regulations are boosting the modal shift towards rail from road with high take-up across sectors. Europe also has highly sophisticated intermodal terminals together with harmonized regulations that promote free movement of goods across the member states.

Germany is the driving force of the European market because of its high-density freight corridors and robust export-based economy. Growth in 2025 was supplemented by the nation's emphasis on enhancing trans-European rail freight corridors as well as public–private partnerships. Terminal investments strategically linking seaports such as Hamburg and Rotterdam with inland production centers further cemented Germany's position as the backbone of Europe's rail logistics expansion.

Middle East & Africa Market Insights

Middle East & Africa is experiencing growth driven by mega infrastructure plans and inter country railroad connection plans. Authorities are looking towards rail logistics for economically diversifying, freeing roads from congestion, and enhancing the competitiveness of trade. Mega projects such as the Gulf Railway are in development and building integrated freight corridors that link industrial hubs to ports to facilitate future growth in the market.

The UAE is the regional power, supported by growth in Etihad Rail and its connection with strategic ports. Etihad Rail introduced new cargo operations in between Fujairah port and land freight hubs throughout 2025, cutting transit time for bulk and containerized cargoes by quite a bit. This access also further entrenched the UAE as a hub for logistics, further placing the country in regional and world trade flows.

Latin America Market Insights

The Latin American region is becoming an emerging potential destination with consistent growth on the horizon courtesy of gigantic agriculture exports, mining production, and government plans to modernize freight railroad systems. More dependence on rail transportation for the transportation of commodities such as soybeans, iron ore, and petroleum products is enhancing cost-effectiveness and easing the load on congestion-infested road networks. The region also offers private sector investment and long-term concessions for the upgrade of freight rail.

Brazil controls the Latin American market, owing to its large rail network dedicated to bulk cargo. In 2025, Brazil's government awarded rail concessions to private firms, allowing considerable renovations of corridors carrying freight between agriculture-producing areas and export terminals like Santos. The move made the operation more efficient and turned Brazil into Latin America's largest rail freight center.

Regional Market share (%) in 2025

Source: Straits Research

Service Insights

The freight transport segment led the market with a revenue share of 35.53% in 2025. This is sustained by growing industrial demand for dependable, long-haul shipping capacity. As global supply chains continue to lengthen and become more complicated, businesses increasingly turn to rail transport because it has already proven its efficiency in hauling high volumes of freight and delivering in time to industrial regions and business centers.

The warehousing & storage segment is expected to see the highest growth, posting a forecasted CAGR of approximately 6.4% from the forecast period. High growth is fueled by increasing demand for systematic inventory management, automated storage, and the growth in e-commerce and retail distribution networks. Embracing advanced technologies like automated guided vehicles (AGVs), robotics, and real-time warehouse management systems is further fueling segment growth.

By Service Market Share (%), 2025

Source: Straits Research

Cargo Type Insights

The containerized freight segment projected to reach the highest CAGR growth of 6.51% throughout the forecast period. This is complemented by the growing international trade of manufactured and consumer products, which rely on standardized containers for reduced cross-border transportation difficulties. Increased security for goods, reduced transportation hold-ups, and better delivery schedules, enabling uniform and seamless logistics activity, drive the demand for the segment.

The bulk cargo segment had the largest market share of 32.7% in 2025 due to persistent demand for raw materials and commodities such as coal, grains, and minerals. Its dominance is also supplemented by established infrastructure for handling bulk and low-cost long-distance large-volume transportation, making it the preferred choice for long-distance industrial and commercial supply chains.

End Use Industry Insights

By end-use industries, the manufacturing sector dominated the market in 2025 with a revenue share of 31.4%, driven by the increasing need to efficiently transfer raw materials and finished products between plants, warehouses, and export points. The adoption of rail logistics as a scalable and reliable solution supports high-volume operations, thereby reinforcing the sector’s leadership.

Retail sector is anticipated to experience the highest growth of 7.1% over the forecast period. This segment is driven by increasing demand from consumers for on-time deliveries, growth in distribution networks, and the adoption of advanced logistics technologies like real-time tracking and automated sorting systems, promoting swift adoption of rail-based freight solutions.

Competitive Landscape

The global rail logistics market was moderately fragmented, with the availability of established rail operators and specialized logistics service providers. Very few players account for the major market share through their extensive service portfolio and integrated freight solutions. On the other hand, various regional providers cater to local markets.

The major players in the market include CSX Transportation, DHL, BNSF Railway and others. These industry players compete with each other to gain a strong market foothold through expansion of service networks, strategic partnerships, and mergers & acquisitions.

Telegraph : An emerging market player

Telegraph is a cutting-edge U.S.-based company transforming freight rail logistics with its cloud-based operating platform. Established in 2020 and with its headquarters located in Chicago, Illinois, the firm improves supply chain visibility by offering real-time visibility into rail operations, exceptions, and asset management.

- In August 2025, Telegraph signed a strategic alliance with a top North American intermodal carrier to implement its operating system within their current infrastructure. The union will look to simplify operations, eliminate delay times, and enhance overall supply chain effectiveness.

The integration is projected to allow the carrier to better handle complicated logistics networks and serve their clients more effectively.

List of Key and Emerging Players in Rail Logistics Market

- US Rail & Logistics

- CSX Transportation

- Union Pacific

- CEVA Logistics

- BNSF Railway

- DHL

- PLS Logistic Services

- Rhenus Group

- Canadian National Railway

- Rail Logistics, Inc.

- Telegraph

- Deutsche Bahn

- Norfolk Southern Corporation

- Aurizon

- Kansas City Southern Railway

- Genesee & Wyoming Inc

- SBB Cargo International AG

- Nippon Express Holdings, Inc

- Rail Cargo Group

- RSI Logistics

Strategic Initiatives

- July 2025: Canadian National Railway announced a USD 170 million investment in Illinois, focusing on track maintenance and infrastructure enhancements to bolster freight capacity.

- October 2024: Union Pacific expanded its intermodal network by adding five new Focus Sites, providing businesses with additional connections to its 32,000-mile rail network.

- June 2024: Indian Railways inaugurated a direct rail link from Maruti Suzuki's Manesar plant to the Western Dedicated Freight Corridor, aiming to reduce CO₂ emissions by 175,000 tonnes annually.

- May 2024: DB Cargo Scandinavia launched a new intermodal rail link to Norway via Hirtshals, enhancing eco-friendly freight routes for hydrogen and CO₂ transport.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 396.88 billion |

| Market Size in 2026 | USD 421.91 billion |

| Market Size in 2034 | USD 678.42 billion |

| CAGR | 6.3% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service, By Cargo Type, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Rail Logistics Market Segments

By Service

- Freight Transport

- Warehousing & Storage

- Intermodal Logistics

- Supply Chain Management

- Digital & IT Solutions

By Cargo Type

- Bulk Cargo

- Liquid Cargo

- Containerized Cargo

- Automotive Cargo

- Temperature-Sensitive Goods

By End-Use Industry

- Agriculture

- Energy & Utilities

- Manufacturing

- Retail

- Automotive

- Chemicals

- Food & Beverages

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.