Refinery Catalysts Market Size, Share & Trends Analysis Report By Product (Zeolites, Metallic, Chemical Compounds, Others), By Application (FCC Catalysts, Alkylation Catalysts, Hydrotreating Catalysts, Hydrocracking Catalysts, Catalytic Reforming, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Refinery Catalysts Market Size

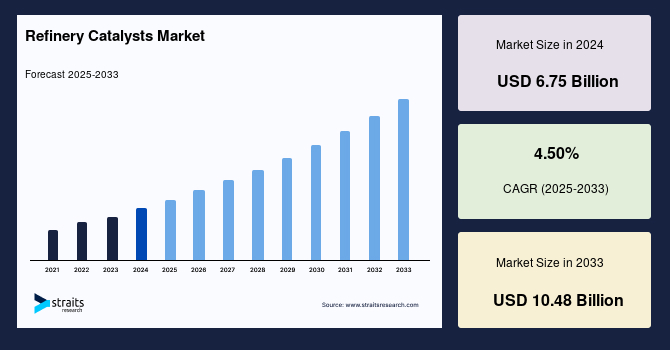

The global refinery catalysts market size was valued at USD 6.75 billion in 2024 and is projected to grow from USD 7.05 billion in 2025 to reach USD 10.48 billion by 2033, growing at a CAGR of 4.50% during the forecast period (2025–2033).

Refinery catalysts are substances used in petroleum refineries to accelerate chemical reactions without being consumed during the refining process. They play a crucial role in processes like catalytic cracking, hydrocracking, and hydrotreating, helping convert crude oil into valuable products like gasoline, diesel, jet fuel, and other petrochemicals. These catalysts enhance yield, improve fuel quality, and reduce harmful emissions. Common types include zeolites, metals, and metal oxides. As global energy demands rise and environmental regulations tighten, the demand for efficient and sustainable refinery catalysts continues to grow.

One of the primary drivers of the global market is the enforcement of stringent environmental regulations across major economies. Additionally, technological advancements in catalyst design have significantly improved their efficiency, selectivity, and lifespan. Innovations such as nanostructured catalysts and zeolite-based formulations are enhancing the catalytic performance in cracking and hydroprocessing applications. Furthermore, the expansion of refining capacity, especially in fast-growing economies like India, China, and countries in the Middle East, is boosting the demand for refinery catalysts. Developments collectively support the robust growth of the global market.

Latest Market Trends

Rise in Demand for Renewable Feedstock Processing Catalysts

The rise in demand for renewable feedstock processing catalysts, particularly in bio-refining, is a key trend in the global market. As industries and governments focus on reducing carbon emissions, biofuels derived from renewable biomass have gained significant attention. Refiners are increasingly turning to catalysts optimized for processing bio-based feedstocks, such as agricultural residues and waste materials, to produce sustainable fuels like biodiesel, bio-jet fuel, and bioethanol.

- For instance, in November 2024, Shell Catalysts & Technologies partnered with Licella to develop a low-carbon, integrated solution for converting biomass into advanced biofuels. This collaboration combines Shell's hydroprocessing technology with Licella's Cat-HTR™ (Catalytic Hydrothermal Reactor) technology, aiming to produce sustainable aviation fuel (SAF) and other low-carbon fuels from renewable wood and agricultural biomass residues.

This trend is expected to drive further innovation in catalyst technologies and expand biofuel production globally.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 6.75 Billion |

| Estimated 2025 Value | USD 7.05 Billion |

| Projected 2033 Value | USD 10.48 Billion |

| CAGR (2025-2033) | 4.50% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | WR. Grace & Co., Albemarle Corporation, BASF SE, Honeywell UOP, Haldor Topsoe A/S |

to learn more about this report Download Free Sample Report

Refinery Catalysts Market Growth Factor

Surge in Global Demand for Petroleum-Derived Fuel Products

The growing global demand for petroleum-derived fuel products is a key driver for the market. The increasing consumption of gasoline, diesel, and jet fuel, especially in emerging economies, has intensified the need for advanced refining processes.

- According to the International Energy Agency (IEA), global oil demand is projected to increase by over 1 million barrels per day (bpd) in 2025, reaching a total of 103.9 million bpd. This marks a significant acceleration from the 830,000 bpd growth observed in 2024.

This surge in demand emphasizes the need for refining processes to meet fuel production requirements while adhering to stringent environmental regulations, thereby driving the demand for catalysts that enhance refining efficiency and product quality.

Market Restraint

Volatility in Crude Oil Prices

The volatility in crude oil prices remains a significant restraint for the global market. Fluctuating oil prices affect refining margins, which can influence investment decisions in refinery upgrades and catalyst purchases. When crude prices drop, refiners may scale back their operations or delay catalyst replacement, leading to reduced demand for catalysts. Additionally, the unpredictable nature of crude oil prices makes it difficult for manufacturers to forecast demand for refinery catalysts accurately. This uncertainty affects the profitability of refinery projects and can delay the adoption of advanced catalysts for cleaner fuel production.

Market Opportunity

Development of Advanced Catalysts for Heavy Oil Upgrading and Residue Conversion

One of the most promising opportunities in the global refinery catalysts market lies in the development of advanced catalysts for heavy oil upgrading and residue conversion. As conventional light crude reserves dwindle, refiners are increasingly processing heavier, more complex crude oils that require robust catalytic systems. These advanced catalysts help convert heavy fractions into lighter, high-value products like gasoline, diesel, and jet fuel.

- A study published in March 2024 by Cornell University discusses the use of supercritical carbon dioxide (scCO₂) in the synthesis of nanostructured metal catalysts. These catalysts exhibit excellent performance in biomass conversion reactions, such as oxidation and hydrogenation, which are relevant to upgrading heavy oil fractions. The scCO₂-assisted synthesis offers a promising route for designing more efficient metal catalysts for the selective synthesis of fine chemicals and fuels from biomass-derived compounds.

Such innovations support the industry’s shift toward efficiency and sustainability.

Regional Insights

The Asia-Pacific region is experiencing significant refinery catalyst market growth due to rapid industrialization, expanding refining capacities, and rising fuel consumption. The region’s strong push toward cleaner and more efficient refining processes is increasing the demand for advanced catalysts, especially in hydroprocessing. Rising energy demands, coupled with investments in refinery modernization and the development of biofuels, are also key growth drivers in this market.

- India's market is growing and is driven by increasing fuel demand and refinery expansions. With the push toward cleaner energy, companies like Indian Oil Corporation and Reliance Industries are investing in advanced catalysts for refining processes like fluid catalytic cracking (FCC) and hydrocracking to meet low-sulfur fuel standards, bolstering environmental compliance.

- China's refinery catalysts industry is witnessing significant growth due to its expanding refining capacity and the government's stringent fuel quality standards. The country’s adoption of hydroprocessing catalysts for cleaner fuels is rising, particularly in large refineries like Sinopec and China National Petroleum, which focus on reducing sulfur levels in gasoline and diesel.

North America Refinery Catalysts Market Trends

North America's refinery catalysts market is benefiting from stringent environmental regulations, driving demand for advanced catalysts, especially in hydroprocessing and desulfurization. The region's strong refinery infrastructure, along with the growing shift towards cleaner fuels, supports market expansion. Investment in upgrading refining capacity and transitioning to renewable energy sources, such as biofuels, further contributes to the market's growth, ensuring sustainable catalyst demand.

- The US market for refinery catalysts is bolstered by its extensive refining capacity, especially in states like Texas and Louisiana. Stringent emission standards and the demand for cleaner fuels drive the use of catalysts for desulfurization and hydroprocessing. The expansion of renewable fuel production also fuels growth in advanced catalytic technologies, including bio-refining catalysts.

- Canada's market is driven by its strong petroleum industry and environmental regulations. The country has advanced refineries like those in Alberta, focusing on sulfur reduction and cleaner fuel production. The growing demand for low-sulfur diesel and renewable fuel processing is boosting the use of hydroprocessing catalysts.

Europe Refinery Catalysts Market Trends

In Europe, the refinery catalysts market growth is driven by the increasing adoption of eco-friendly refining technologies to meet emission reduction targets. Stringent regulatory frameworks and the transition towards renewable energy are shaping the demand for efficient catalysts. Furthermore, the high investment in research and development to create innovative catalyst solutions supports market growth, particularly in refining processes that focus on cleaner, low-carbon fuels.

- Germany's refinery catalysts industry benefits from strict environmental regulations promoting cleaner fuels. The country’s advanced refining technology uses high-performance catalysts for desulfurization and hydrocracking. Notable examples include BASF's catalyst solutions for reducing sulfur content in diesel and gasoline. The transition towards renewable fuels also offers significant growth potential for catalysts in bio-refining processes.

- The UK's market is driven by environmental policies targeting emissions reduction. Refineries, such as those operated by ExxonMobil and Phillips 66, rely on catalysts for efficient fuel production, especially for ultra-low sulfur diesel. With a growing focus on decarbonization, the market is witnessing increased demand for advanced catalysts used in biofuels and sustainable refining processes.

Product Insights

Zeolites hold the dominant share in the refinery catalysts market due to their high thermal stability, large surface area, and exceptional shape selectivity. They are extensively used in fluid catalytic cracking (FCC) processes to enhance the yield of gasoline and light olefins from heavy hydrocarbon feedstocks. Their ability to facilitate selective reactions and withstand harsh refinery conditions makes them indispensable. Additionally, advancements in synthetic zeolites and the growing demand for clean fuel production further strengthen their position as the preferred catalyst type in modern refineries.

Metallic catalysts play a vital role in refinery operations, particularly in hydroprocessing applications such as hydrotreating and hydrocracking. These catalysts, often composed of metals like platinum, nickel, cobalt, and molybdenum, enable the effective removal of sulfur, nitrogen, and heavy metals from crude oil fractions. The segment benefits from increasing regulatory pressure for ultra-low sulfur fuels and the rising need for heavier crude oil processing. Although they are costlier than other types, their high efficiency and longer operational life support their steady demand across global refining operations.

Application Insights

FCC catalysts dominate the application segment owing to their critical role in producing gasoline, diesel, and other valuable hydrocarbons from heavy feedstocks. They are widely used in refineries due to their flexibility, high throughput, and compatibility with zeolite materials. The growing global demand for high-octane fuels and light olefins, coupled with rising fuel consumption in emerging economies, drives the adoption of FCC units. Technological advancements in catalyst design for better selectivity and efficiency further reinforce their market leadership among refinery catalyst applications.

Hydrotreating catalysts are essential for removing contaminants like sulfur, nitrogen, and metals from petroleum feedstocks, helping refineries meet stringent environmental regulations. These catalysts improve fuel quality and extend the life of downstream catalysts and equipment. With increasing regulatory pressure for ultra-low sulfur diesel and gasoline, demand for hydrotreating catalysts continues to rise. Typically composed of base metals such as cobalt and molybdenum, these catalysts are also integral to pre-treating feed for other processes, including hydrocracking, making them a crucial component of modern refinery operations.

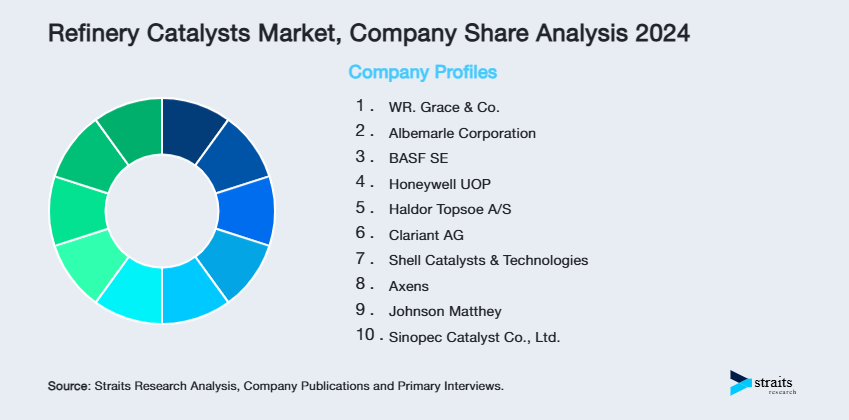

Company Market Share

Companies in the global refinery catalysts market are focusing on innovation, strategic partnerships, and capacity expansion to strengthen their market position. They are investing in R&D to develop high-performance, environmentally friendly catalysts and are aligning with refiners to customize solutions based on feedstock variations. Additionally, companies are enhancing their global footprint by establishing production facilities in emerging economies and leveraging digital technologies to improve catalyst efficiency and operational outcomes.

List of Key and Emerging Players in Refinery Catalysts Market

- WR. Grace & Co.

- Albemarle Corporation

- BASF SE

- Honeywell UOP

- Haldor Topsoe A/S

- Clariant AG

- Shell Catalysts & Technologies

- Axens

- Johnson Matthey

- Sinopec Catalyst Co., Ltd.

to learn more about this report Download Market Share

Recent Developments

- October 2024 – Bharat Petroleum Corporation Limited (BPCL) has commenced the commercial use of its locally developed FCC Bottoms Cracking Additive, named "Bharat BCA," at its Mumbai Refinery. This development marks a significant milestone in BPCL's pursuit of efficient, sustainable, and cost-effective refining technologies.

Analyst Opinion

As per our analyst, the global refinery catalysts market is poised for steady growth driven by stringent environmental mandates and the rising global demand for cleaner fuels. The increasing emphasis on ultra-low sulfur diesel and the ongoing modernization of refineries are prompting investments in advanced catalytic technologies. Particularly, the adoption of hydrocracking and fluid catalytic cracking (FCC) catalysts is witnessing significant traction.

However, the market faces notable challenges, such as fluctuating crude oil prices, high catalyst development costs, and regulatory hurdles related to catalyst disposal. Additionally, the dependency on rare earth materials poses a risk to consistent supply. Despite these challenges, the market outlook remains positive. The shift towards renewable feedstocks, coupled with innovation in catalyst composition and performance, presents ample growth opportunities. Emerging economies with expanding refinery capacities further enhance the market’s potential over the forecast period.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 6.75 Billion |

| Market Size in 2025 | USD 7.05 Billion |

| Market Size in 2033 | USD 10.48 Billion |

| CAGR | 4.50% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Refinery Catalysts Market Segments

By Product

- Zeolites

- Metallic

- Chemical Compounds

- Others

By Application

- FCC Catalysts

- Alkylation Catalysts

- Hydrotreating Catalysts

- Hydrocracking Catalysts

- Catalytic Reforming

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.