Release Liner Market Size, Share & Trends Analysis Report By Material Type (Silicone-Coated, Non-Silicone-Coated), By Substrate Type (Paper-Based Liners, Film-Based Liners), By Labeling Technology (Pressure-Sensitive Adhesives (PSA), Glue-Applied Labels, Shrink Labels, In-Mold Labels, Others), By Application (Labels, Pressure-sensitive Tapes, Hygiene, Industrial, Medical, Other Applications) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Release Liner Market Size

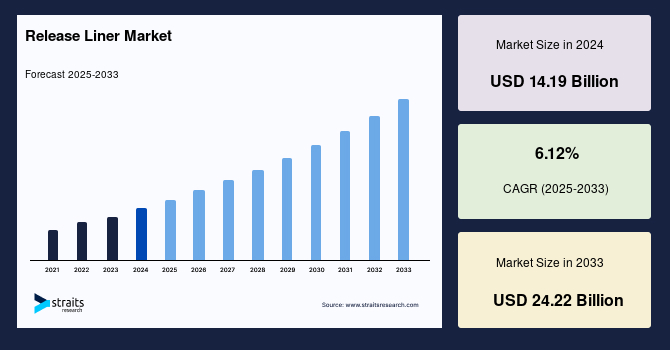

The global release liner market size was valued at USD 14.19 billion in 2024 and is projected to grow from USD 15.06 billion in 2025 to reach USD 24.22 billion by 2033, growing at a CAGR of 6.12% during the forecast period (2025–2033).

The global release liners market is driven by the growing demand across industries such as packaging, electronics, automotive, and healthcare. Pressure-sensitive labels, widely used in the food, pharmaceutical, and logistics sectors, rely heavily on release liners for clean and efficient application, especially as regulations on labeling accuracy tighten. In the automotive and electronics industries, release liners are crucial in the production of adhesive tapes, die-cut parts, and protective films, which are essential for advanced assembly processes.

Additionally, the healthcare sector's rising need for sanitary products, wound care dressings, and transdermal drug delivery systems is accelerating liner demand. As end-user industries continue to evolve and adopt sophisticated adhesive solutions, the requirement for durable, high-performance release liners is expected to grow steadily, reinforcing the market’s expansion across developed and emerging economies.

Latest Market Trends

Technological Advancements

Technological advancements are significantly shaping the future of the global release liner market. Innovations in coating, curing, and base materials are enhancing liner durability, performance, and environmental compatibility. These developments are enabling release liners to meet the specialized demands of industries like automotive, medical, and packaging.

- For instance, in February 2024, Loparex launched its Bubble Liner Technology, designed to improve the performance and efficiency of release liners, particularly in construction applications. The technology offers anti-skid properties for enhanced safety and handling, superior temperature and pressure resistance, and unique aesthetics for brand differentiation.

Such advancements not only boost functionality but also align with evolving regulatory and sustainability standards. Furthermore, automation and digitalization in production processes are reducing defects and improving coating precision, ultimately driving operational efficiency and product quality in the release liner manufacturing landscape.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 14.19 Billion |

| Estimated 2025 Value | USD 15.06 Billion |

| Projected 2033 Value | USD 24.22 Billion |

| CAGR (2025-2033) | 6.12% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | 3M Company, Mondi Group, Loparex LLC, UPM-Kymmene Oyj, Mactac (LINTEC Corporation) |

to learn more about this report Download Free Sample Report

Release Liner Market Growth Factor

Growth in E-Commerce Packaging

The rapid expansion of the e-commerce sector has significantly boosted the demand for effective packaging solutions, including pressure-sensitive labels that rely on release liners. E-commerce businesses require durable, tamper-evident, and informative labels for packaging, shipping, and product identification. This dependency fuels consistent demand for high-performance release liners across the globe.

- According to SellersCommerce, the global e-commerce market is experiencing robust growth, with retail e-commerce sales projected to reach approximately $6.86 trillion in 2025, marking an 8.4% increase from $6.33 trillion in 2024. This upward trajectory is expected to continue, with estimates suggesting the market will surpass $8 trillion by 2027, growing at an annual growth rate of around 7.6%–7.8%.

This exponential growth in online retail drives an increased need for packaging materials, including release liners, particularly in sectors like apparel, electronics, and consumer goods.

Market Restraint

Environmental Concerns and Disposal Issues

One of the key restraints in the global release liner market is the environmental concern associated with disposal. Traditional release liners, particularly those coated with silicone or made from plastic films, are often non-recyclable and contribute significantly to landfill waste. This creates challenges for sustainability-focused industries and results in increasing regulatory scrutiny.

The lack of large-scale recycling infrastructure and limited awareness further exacerbate the issue. Moreover, companies are facing pressure from both governments and consumers to adopt eco-friendly alternatives, which may increase operational costs. These factors collectively hinder the widespread adoption of conventional release liners and push manufacturers to seek greener but often costlier solutions.

Market Opportunity

Liner Recycling & Reuse Programs

The surging global focus on sustainability and waste reduction presents a significant opportunity in liner recycling and reuse programs. As environmental regulations tighten and brands seek circular economy models, companies are developing innovative ways to handle liner waste.

- For instance, in February 2021, Avery Dennison officially launched its AD Circular program in Europe, which offers a comprehensive, brand-agnostic recycling solution for silicone-coated release liners. It manages collection, logistics, and compliance through a digital platform, making recycling simple for businesses. The program also provides data on CO₂ savings and recycling volumes, supporting sustainability goals and enhancing transparency in environmental reporting.

Similar initiatives are being adopted globally, and companies investing in scalable recycling infrastructure and partnerships with waste recovery firms are likely to gain a competitive edge in eco-conscious markets.

Regional Analysis

Asia Pacific is emerging as the fastest-growing market for release liners, driven by expanding manufacturing bases in industries like electronics, packaging, and consumer goods. Rapid urbanization, surging disposable incomes, and growing retail and e-commerce sectors are propelling demand for pressure-sensitive labels. Moreover, increasing investments in hygiene and medical product manufacturing are boosting the use of silicone-coated and poly-coated liners. Local players are also focusing on cost-effective and sustainable liner materials, making the region a key hub for production and innovation in the release liner segment.

- China's market is expanding due to its strong manufacturing base in electronics, automotive, and packaging. The growing e-commerce sector fuels demand for pressure-sensitive labels. For instance, Alibaba's logistics arm, Cainiao, heavily uses self-adhesive packaging labels. Additionally, the shift toward eco-friendly silicone-coated liners is gaining traction, aligning with China’s environmental regulations and green packaging initiatives under its Five-Year Plan.

- India's release liner industry is witnessing growth driven by its expanding FMCG, pharmaceutical, and personal care sectors. Brands like Hindustan Unilever and Dabur increasingly use self-adhesive labels for hygiene and cosmetic products. Rising organized retail and e-commerce also contribute to label demand. Furthermore, the "Make in India" initiative supports domestic production of silicone-coated liners, encouraging investment in local manufacturing and reducing dependence on imports.

North America Release Liner Market Trends

The North American market is witnessing robust growth owing to the strong presence of end-use industries such as logistics, healthcare, and consumer goods. The region’s advanced manufacturing infrastructure supports the production of high-performance release liners, especially for hygiene and medical applications. Additionally, the growing emphasis on sustainability is encouraging investments in recyclable and compostable liner technologies. Innovations in e-commerce packaging and pressure-sensitive labels are further enhancing demand, particularly with rising automation in packaging and label application processes across industries.

- The United States release liner industry is driven by high demand for pressure-sensitive labeling, medical devices, and electronics. Key players like Avery Dennison and 3M are investing in sustainable liner solutions. For instance, 3M’s medical tapes use advanced silicone-coated liners. The robust e-commerce and logistics sector further boosts label applications, making the U.S. a major contributor to North America’s overall release liner consumption.

- Canada’s market for release liner is growing due to increased use in packaging, construction tapes, and hygiene products. Sustainable packaging policies and support for recycling are encouraging companies like Intertape Polymer Group to innovate eco-friendly liners. The country’s expanding healthcare sector also relies on liners in wound dressings and diagnostic devices. With a focus on environmental compliance, Canada is pushing for recyclable and compostable liner solutions across various industries.

Europe Release Liner Market Trends

Europe’s release liner market growth is fueled by strict environmental regulations and the strong push toward circular economy practices. Manufacturers are focusing on liner recyclability and waste reduction, leading to a rise in linerless label innovations. The region’s well-established automotive and electronics sectors also significantly contribute to liner consumption, especially in adhesive tapes and insulation applications. Moreover, the adoption of digital label printing and smart labeling technologies in retail and logistics is driving demand for high-quality release liners that offer durability, precision, and sustainability.

- Germany’s market is driven by its robust automotive and industrial manufacturing sectors. The demand for high-performance tapes and self-adhesive labels in automotive applications, especially from firms like BMW and Bosch, fuels market growth. Additionally, Germany’s push toward sustainable packaging and recycling, aligned with EU regulations, encourages innovation in recyclable and biodegradable liner materials, promoting adoption across logistics and consumer goods industries.

- The UK release liner industry benefits from a strong retail and e-commerce presence, with companies like Tesco and ASOS relying heavily on pressure-sensitive labels for packaging and logistics. Demand for hygienic and medical adhesive products is also rising in the healthcare sector. With sustainability becoming a national priority, UK manufacturers are exploring linerless label technologies and investing in recycling-friendly liner materials to meet regulatory and consumer expectations.

Material Type Insights

Silicone-coated release liners dominate the global market due to their excellent release properties, durability, and compatibility with various adhesives. These liners provide superior resistance to high temperatures and chemicals, making them suitable for demanding applications in labels, tapes, and medical products. Their wide adoption across diverse industries, including automotive, electronics, and healthcare, contributes to their leading position. Additionally, advancements in silicone coating technology are further enhancing their performance and expanding their usage in high-speed label applications.

Substrate Type Insights

Paper-based liners lead the substrate segment, attributed to their cost-effectiveness, recyclability, and widespread availability. Subtypes such as glassine and clay-coated kraft (CCK) are commonly used in pressure-sensitive applications due to their uniform thickness and smooth surface. These liners are especially preferred in the label industry for their printability and ease of processing. Additionally, the global shift toward sustainable and eco-friendly packaging solutions is encouraging manufacturers to opt for paper-based release liners over plastic alternatives.

Technology Insights

The pressure-sensitive adhesives (PSA) segment holds a significant share in the release liner market due to its widespread application in labels, tapes, and graphics. PSAs provide strong adhesion without requiring heat or water, making them ideal for a variety of end uses. Their compatibility with a range of substrates and ease of use support their popularity. With rising demand in packaging, healthcare, and industrial sectors, PSA-based label solutions continue to drive consistent growth in the release liner industry.

Application Insights

Labels represent the largest application segment in the release liner market, driven by the growing demand across packaging, logistics, retail, and food & beverage industries. The increasing use of self-adhesive labels for branding and product information has significantly boosted the need for reliable release liners. Moreover, rapid urbanization and e-commerce growth are fueling the consumption of label stock materials globally. As label innovation continues to evolve, the requirement for efficient, high-performance release liners is expected to remain strong.

Company Market Share

Companies in the release liner market are focusing on expanding production capacities, adopting sustainable and recyclable materials, and enhancing product performance through advanced coating technologies. Many are investing in R&D to develop linerless solutions and improve silicone efficiency. Strategic mergers, acquisitions, and regional expansions are also being pursued to tap into emerging markets and strengthen global distribution networks, ultimately driving market share growth and competitiveness across key application industries.

Avery Dennison Corporation

Avery Dennison Corporation is a Fortune 500 global materials science company founded in 1935 by R. Stanton Avery and merged with Dennison Manufacturing in 1990, headquartered in Mentor, Ohio. It specializes in pressure-sensitive adhesive materials, release liners, printed and RFID-enabled labels, specialty tapes, and medical products, serving packaging, graphics, apparel, healthcare, automotive, and logistics sectors across 50+ countries with ~35,000 employees. The company reported roughly $8.8 billion in 2024 revenue.

- In April 2025, Avery Dennison inaugurated its first ARC‑certified RFID inlay and label factory in Pune, India, supporting the “Make in India” initiative. They also introduced the India‑specific AD Cobra RFID inlay, tailored for local environmental and operational needs.

List of Key and Emerging Players in Release Liner Market

- 3M Company

- Mondi Group

- Loparex LLC

- UPM-Kymmene Oyj

- Mactac (LINTEC Corporation)

- Avery Dennison Corporation

- Ritrama S.p.A.

- Gascogne Laminates

- Siliconature S.p.A.

- DuPont Teijin Films

Recent Developments

- April 2025- Elkem ASA’s Silicones division introduced two new products in their SILCOLEASE range, specifically designed for release liners. These additions emphasize circular economy and recycled silicone content, targeting labelstock and tape converters focused on sustainability.

- November 2024- Techlan Ltd unveiled a new addition to its Re‑Liner™ line: a 120 gsm PE‑coated kraft release liner made from 100% recycled content. Launched in February 2025, it’s positioned as a robust, eco-friendly alternative, promoting carbon footprint reduction and aligning with circular packaging initiatives.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 14.19 Billion |

| Market Size in 2025 | USD 15.06 Billion |

| Market Size in 2033 | USD 24.22 Billion |

| CAGR | 6.12% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material Type, By Substrate Type, By Labeling Technology, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Release Liner Market Segments

By Material Type

- Silicone-Coated

- Non-Silicone-Coated

By Substrate Type

-

Paper-Based Liners

- Glassine

- Clay Coated Kraft (CCK)

- Poly-Coated Kraft (PCK)

-

Film-Based Liners

- Polyethylene (PE)

- Polypropylene (PP)

- Polyester (PET)

- Other Plastics

By Labeling Technology

- Pressure-Sensitive Adhesives (PSA)

- Glue-Applied Labels

- Shrink Labels

- In-Mold Labels

- Others

By Application

- Labels

- Pressure-sensitive Tapes

- Hygiene

- Industrial

- Medical

- Other Applications

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.