Residential Filters Market Size, Share & Trends Analysis Report By Type (HVAC Filters, Water Filters, Air Purifier Filters, Furnace Filters, Range Hood Filters, Others), By Filter Media (Fiberglass, Activated Carbon, HEPA, Electrostatic, Pleated Paper/Polyester, UV, Ceramic, Others (cotton, mesh, etc.)), By Efficiency (MERV 1-4, MERV 6-10, MERV 10-13, MERV 14-16, MERV 17-20), By Application (Air Filtration, Water Filtration, Others (refrigeration, washing machine, etc.)), By Distribution Channel (Online, E-commerce Website, Company Website, Offline, Supermarkets/ Hypermarkets, Specialty Stores, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Residential Filters Market Overview

The global residential filters market size was valued at USD 4.74 billion in 2025 and is estimated to reach USD 7.71 billion by 2034, growing at a CAGR of 5.68% during the forecast period (2026–2034). Rising health awareness, increasing indoor air and water pollution, urbanization, and growing demand for safe, high-quality drinking water and clean air are key drivers of the global market, encouraging the adoption of advanced filtration systems in households worldwide.

Key Market Trends & Insights

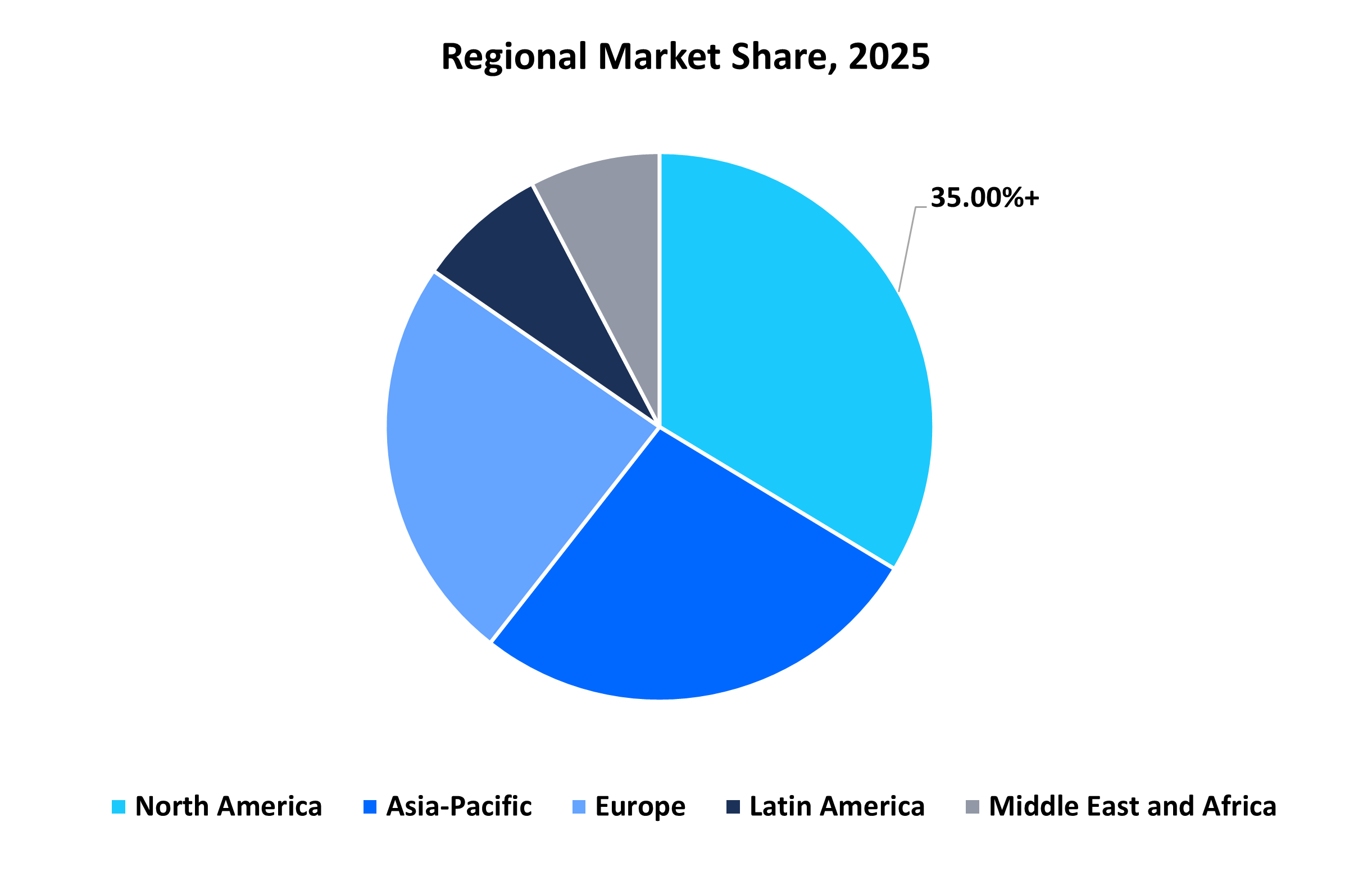

- North America held the largest market share, over 35% of the global market.

- Asia-Pacific is the fastest-growing region, with a CAGR of 6.12%.

- By Type, the HVAC filters segment held the highest market share of over 30%.

- By Filter Media, the HEPA filters segment is expected to witness the fastest CAGR of 5.86%.

- By Efficiency, the MERV 6-10 segment held the highest market share of over 30%.

- By Application, the water filtration segment is expected to witness the fastest CAGR of 6.12%.

- By Distribution Channel, the online segment is expected to witness the fastest CAGR of 6.32%.

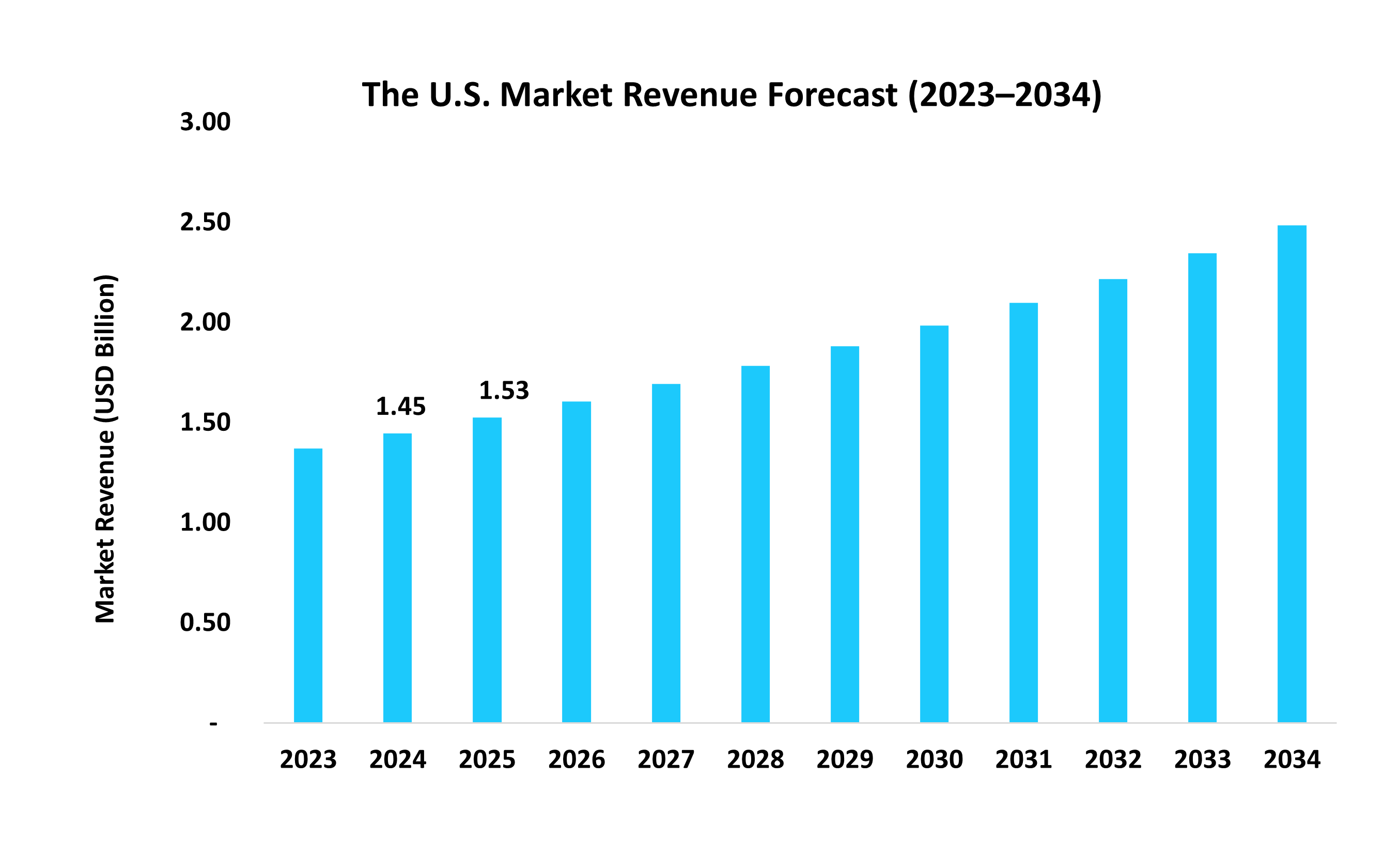

- The U.S. residential filters market was valued at USD 1.45 billion in 2024 and reached USD 1.53 billion in 2025.

Source: Straits Research Analysis

Market Size & Forecast

- 2025 Market Size: USD 4.74 billion

- 2034 Projected Market Size: USD 7.71 billion

- CAGR (2026-2034): 5.68%

- North America: Largest market

- Asia-Pacific: Fastest-growing region

Residential Filters are devices designed to remove impurities, contaminants, and pollutants from household water and air, ensuring safer and healthier living environments. They are commonly used in kitchens, bathrooms, HVAC systems, and standalone air purifiers, with applications that include removing sediments, chemicals, odors, allergens, and microorganisms. Moreover, advanced models may offer smart monitoring, enhanced energy efficiency, and ease of maintenance, making them essential for urban homes, apartments, and health-conscious households worldwide.

The market is expected to grow, supported by increasing urbanization, rising disposable incomes, and heightened consumer focus on home hygiene and preventive health. Opportunities exist in emerging markets with inadequate water infrastructure, as well as in premium segments emphasizing user convenience, energy efficiency, and tailored filtration solutions for diverse household needs. Moreover, companies that invest in enhanced service networks, subscription-based replacement programs, and regional customization can capture incremental market share and strengthen their brand presence worldwide.

Market Trends

Rising Adoption of Multi-Stage Filtration Systems

Residential consumers are increasingly choosing multi-stage filtration systems as they offer layered protection against sediments, chemicals, odours, and microorganisms. Combining multiple technologies in a single unit enhances overall efficiency and reliability, making these systems suitable for the diverse water and air quality conditions found in urban and suburban households worldwide today.

This trend is supported by increasing health awareness and a growing demand for comprehensive solutions that address multiple contaminants simultaneously. Manufacturers are responding by developing compact, energy-efficient multi-stage filters with smart monitoring features, enabling households to maintain consistent indoor environments while reducing maintenance frequency and enhancing long-term cost effectiveness.

Shift Toward Eco-Friendly And Recyclable Filter Materials

Residential filter manufacturers are increasingly adopting eco-friendly and recyclable materials to reduce environmental impact and comply with sustainability expectations. Consumers are favouring products with biodegradable cartridges, reduced plastic content, and longer lifecycles, encouraging brands to redesign filters that balance performance, durability, and responsible material sourcing across global residential markets.

As per Straits Research, sustainability-driven innovation is shaping product development strategies within the residential filters market worldwide. Companies are investing in recyclable housings, refill-based systems, and eco certifications, aiming to meet regulatory expectations while strengthening brand value, improving consumer trust, and supporting long-term environmental goals across households.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 4.74 billion |

| Estimated 2026 Value | USD 4.98 billion |

| Projected 2034 Value | USD 7.71 billion |

| CAGR (2026-2034) | 5.68% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | 3M, Smith Corporation, Honeywell International Inc., Pentair plc, LG Electronics |

to learn more about this report Download Free Sample Report

Market Driver

Increasing Concerns Over Indoor Air And Water Quality

Growing awareness of the health risks associated with poor indoor air and water quality is driving demand for residential filtration solutions. Urban pollution, aging pipelines, and concerns about contamination have prompted households to invest in systems that ensure safer living environments. Consumers increasingly view filtration as a preventive health measure rather than a discretionary appliance.

- For instance, in October 2025, Greenfield Water Solutions launched its NanoCeram household filtration technology, a new system designed to enhance residential water safety by effectively removing a broad range of contaminants. The innovation focuses on delivering cleaner drinking water for homes with improved filtration performance and reliability, addressing consumer concerns about tap water quality.

Such launches highlight how manufacturers are responding to expectations for healthier indoor conditions.

Market Restraint

High Initial Installation And Replacement Costs

High initial installation and replacement costs remain a key restraint for the global residential filters market, particularly for advanced multi-stage and whole-house systems. The expense of professional installation, specialized components, and frequent cartridge or membrane replacements increases long-term ownership costs.

Price-sensitive consumers often delay adoption or opt for basic alternatives, limiting penetration in emerging markets. Inconsistent replacement practices, driven by cost concerns, can also reduce system effectiveness, negatively impacting consumer satisfaction. Overall, this cost barrier challenges affordability, scalability, and sustained market growth.

Market Opportunity

Integration of IoT, AI, and Sensor-Based Technologies

Opportunities in the global residential filters market are expanding with the integration of IoT, AI, and sensor-based technologies that transform conventional systems into intelligent home solutions. Smart filtration enables real-time monitoring, automated performance adjustments, and predictive maintenance, improving efficiency and user convenience.

- For instance, in August 2025, Samsung’s Bespoke AI Water Purifier launched is a smart countertop filtration system that uses a four-stage process to remove up to 82 harmful substances while integrating AI for enhanced control and maintenance. It features self-sterilization, app connectivity, and voice control via Bixby, making water purification more convenient and responsive to household needs.

Such innovations create strong opportunities for premiumization, recurring digital services, and deeper integration within connected smart home ecosystems globally.

Regional Analysis

North America’s residential filters market is dominant with a market share of over 35%, driven by increasing awareness of indoor air and water quality, growing urbanization, and the adoption of smart home systems. Consumers are actively seeking energy-efficient HVAC systems, water purification solutions, and high-performance air filters to maintain healthier living environments. The market benefits from robust retail networks, both online and offline, as well as innovation by key players that focuses on advanced technologies. Moreover, the demand is strong in regions with high pollution levels and stringent environmental regulations.

The U.S. market is led by companies such as Honeywell, 3M, and Lennox, which focus on developing advanced HVAC and water filtration systems with HEPA and activated carbon technology. These firms prioritize energy efficiency, smart connectivity, and durable filter media to improve indoor air and water quality.

Canada’s residential filters market is led by companies such as Honeywell, 3M, and Lennox, which focus on developing advanced HVAC and water filtration systems with HEPA and activated carbon technology. These firms prioritize energy efficiency, smart connectivity, and durable filter media to improve indoor air and water quality.

Asia-Pacific: Significantly Growing Region

The Asia-Pacific residential filters market is the fastest-growing, with a CAGR of 6.12%, fueled by rapid urbanization, industrialization, and rising pollution levels. Increasing consumer awareness about indoor air quality, coupled with government regulations on environmental standards, is driving the demand for residential filtration systems. The market benefits from a combination of domestic innovation and international brand presence. Products such as HEPA air filters, activated carbon water filters, and smart-connected filtration devices are gaining traction among middle- and upper-income households, particularly in urban areas.

China’s residential filters industry is driven by companies such as Blueair, Midea, and Xiaomi, which focus on innovative air purification systems, water filtration units, and smart HVAC-integrated filters. Brands emphasize energy-efficient, high-performance solutions designed to combat urban pollution and indoor allergens.

India’s market is driven by companies such as Blueair, Midea, and Xiaomi, which focus on innovative air purification systems, water filtration units, and smart HVAC-integrated filters. Brands emphasize energy-efficient, high-performance solutions designed to combat urban pollution and indoor allergens.

Source: Straits Research

Europe Market Trends

Europe’s residential filters market is characterized by high consumer awareness of air and water quality, stringent environmental regulations, and a strong focus on energy efficiency. Countries with dense urban populations are witnessing robust demand for advanced HVAC filters, activated carbon water filters, and HEPA air purifiers. The region benefits from well-established retail networks, e-commerce channels, and innovations by both domestic and international players. Sustainability initiatives, smart home integration, and eco-friendly materials are driving product adoption, particularly in urban households and commercial establishments that prioritize healthy living environments.

Germany’s market is led by companies such as Bosch, Vaillant, and Miele, focusing on high-performance air and water filtration solutions. Collaborations with appliance distributors, e-commerce platforms, and home improvement chains enhance consumer access and awareness, while innovations in low-emission and sustainable filters strengthen brand credibility.

Latin America Market Trends

Latin America’s market is growing steadily, driven by urbanization, rising air pollution, and increased concern for household health. Demand for air purifiers, water filters, and HVAC-compatible filtration systems is rising, particularly in metropolitan areas. The region’s market is a mix of domestic producers and international brands that tailor products for local conditions, including high humidity and water contamination. Growth is also supported by expanding retail channels, e-commerce penetration, and consumer education campaigns highlighting the benefits of indoor air and water quality management.

Brazil’s residential filters industry is dominated by companies like Electrolux, IBBL, and Consul, which focus on water purification systems and air filtration units suitable for tropical climates. Brands prioritize affordability and energy efficiency while leveraging partnerships with appliance retailers and online platforms to expand reach.

The Middle East and Africa Market Trends

The MEA market for residential filters is witnessing growth due to increasing urbanization, rising disposable income, and concerns about air pollution and water contamination. Harsh climatic conditions, including dust and high temperatures, drive demand for durable and efficient air and water filtration systems. The market is seeing innovations in smart filtration, multi-stage purification, and energy-efficient solutions that cater to both residential and commercial needs. As per Straits Research, regulatory support and infrastructure development also contribute to steady growth, particularly in urban centers with high population density.

The market for UAE residential filters is led by companies such as Blueair, LG, and Kent, offering advanced HEPA air purifiers and RO water filters tailored to high humidity and urban pollution levels. Companies leverage partnerships with retailers, distributors, and e-commerce platforms to reach households and commercial clients.

Type Insights

HVAC filters dominate the residential filters market with over 30% share, driven by their critical role in maintaining indoor air quality and energy efficiency. These filters are widely installed in homes and commercial buildings, ensuring the removal of dust, pollen, and particulates. Their broad compatibility with heating and cooling systems, durability, and low maintenance requirements make HVAC filters the preferred choice among homeowners and facility managers worldwide.

Water filters are the fastest-growing segment, recording a CAGR of 6.12%, driven by increasing awareness of the importance of safe drinking water and health concerns. Rising urbanization and demand for compact, efficient filtration systems for residential use drive adoption. Moreover, growth is particularly strong in regions facing water contamination challenges, where advanced filtration technologies, easy installation, and cost-effectiveness make water filters an essential household solution.

Source: Straits Research

Filter Media Insights

Activated carbon filters lead the media segment with over 25% market share, recognized for their high efficiency in removing odors, chlorine, and organic contaminants. Their use in water filtration systems, HVAC units, and air purifiers enhances the quality of air and water in residential spaces. Moreover, the media’s versatility, affordability, and consistent performance contribute to its dominance across global markets, particularly in regions that prioritize healthy indoor environments.

HEPA filters are the fastest-growing media segment with a CAGR of 5.86%, supported by rising consumer awareness of allergens, pollutants, and airborne pathogens. These high-efficiency filters are increasingly integrated into air purifiers, HVAC systems, and vacuum cleaners. Moreover, the rapid adoption in urban areas with air quality concerns, combined with the growing trend toward health-conscious living, are key factors driving the global expansion of the HEPA filter market.

Efficiency Insights

Filters with MERV 6-10 efficiency dominate the segment, holding over 30% of the market share, and offer a balance between filtration performance and energy consumption. They effectively remove common dust, pollen, and mold particles while being compatible with most residential HVAC systems. Their affordability, ease of maintenance, and widespread availability make them the most adopted efficiency range in homes across North America, Europe, and the Asia-Pacific regions.

MERV 10-13 filters are the fastest-growing efficiency segment with a CAGR of 5.97%, driven by increasing demand for higher indoor air quality. These filters capture finer particles, including bacteria and smoke, making them suitable for urban homes and areas with pollution concerns. Moreover, technological advancements, government air quality initiatives, and increasing awareness about respiratory health are contributing to the rapid adoption of these solutions in residential markets worldwide.

Application Insights

Air filtration dominates the application segment with over 45% market share, reflecting the growing importance of maintaining clean indoor air. Residential HVAC systems, standalone air purifiers, and ventilation units use filters to capture dust, pollen, and pollutants. Moreover, rising concerns over respiratory health, allergies, and urban air pollution drive the continuous adoption of air filtration, establishing it as the primary application segment in the global residential filters market.

Water filtration is the fastest-growing application segment, with a CAGR of 6.12%, driven by increasing awareness of the importance of safe drinking water. Residential setups, including under-sink, countertop, and whole-house systems, are witnessing rising adoption. Contamination concerns, stringent health regulations, and innovative, easy-to-install solutions drive market expansion. Growth is particularly strong in regions with water quality challenges, establishing water filtration as a key emerging application.

Distribution Channel Insights

Offline channels dominate the market with an over 60% share, driven by the accessibility of residential filters through supermarkets, hypermarkets, and specialty stores. Consumers prefer in-store purchases for their immediate availability, personalized assistance, and the opportunity to inspect products. Retail promotions, established distribution networks, and trusted local brands collectively contribute to the dominance of offline channels, particularly in mature markets, where conventional retail remains the primary sales avenue.

Online distribution is the fastest-growing channel with a CAGR of 6.32%, fueled by e-commerce adoption and consumer preference for convenience. Platforms such as brand websites and e-commerce marketplaces offer detailed product information, easy comparison, and home delivery. The rising digital penetration in urban regions, coupled with promotional campaigns and subscription-based filter delivery models, is accelerating growth, making online channels a critical driver for the market globally.

Company Market Share

Leading companies are focusing on expanding their product portfolios to capture a larger market share by emphasizing innovation, performance, and consumer convenience. Leading players are investing in advanced filtration technologies, including multi-stage systems, IoT-enabled smart features, and energy-efficient designs, which address diverse water and air quality challenges. Firms are also strengthening their distribution through e-commerce, partnerships with builders, and retail networks, while enhancing after-sales service and filter replacement programs.

Daikin Industries Ltd.

Daikin Industries Ltd. is a Japanese multinational founded in 1924, in Osaka, Japan, originally as a small metalworking business. Over the decades, it expanded into climate control and air‑filtration technology, becoming a global leader in HVAC solutions for residential, commercial, and industrial markets. Today, the company develops a broad range of products and operates internationally with tens of thousands of employees, reflecting its long history of innovation and global growth.

List of Key and Emerging Players in Residential Filters Market

- 3M

- Smith Corporation

- Honeywell International Inc.

- Pentair plc

- LG Electronics

- Samsung Electronics

- Daikin Industries Ltd.

- Panasonic Corporation

- Kärcher

- Philips

- Bosch Home Comfort

- GE Appliances

- Whirlpool Corporation

- Coway Co., Ltd.

- Blueair AB

- Honeywell Home

- Aquasana

- Brita GmbH

- Culligan International

- Puritan’s Pride

Recent Development

- November 2025 - Coway launched the Airmega 350 air purifier in Australia, featuring its new HyperVortex™ filtration system that delivers powerful purification for large spaces up to 182 m². The unit operates quietly, combining pre-filter, activated carbon, and HEPA filtration to remove ultra-fine particles and VOCs, and includes smart features such as real-time air quality indicators and auto modes.

- October 2025 - Filterbuy, Inc. introduced an enhanced 20x20x1 air filter designed to capture more than 90% of airborne particles during peak allergy seasons, targeting common household allergens. The improved filter media increases surface area for particle capture without restricting airflow, helping homeowners improve indoor air quality and reduce allergy symptoms.

- January 2025 - Coway Co., Ltd. was named a CES 2025 Innovation Awards Honoree by the Consumer Technology Association for three conceptual products, including smart air purifiers and a digital healthcare bidet, recognizing their innovation, engineering, and design excellence in the consumer technology sector.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 4.74 billion |

| Market Size in 2026 | USD 4.98 billion |

| Market Size in 2034 | USD 7.71 billion |

| CAGR | 5.68% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Filter Media, By Efficiency, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Residential Filters Market Segments

By Type

- HVAC Filters

- Water Filters

- Air Purifier Filters

- Furnace Filters

- Range Hood Filters

- Others

By Filter Media

- Fiberglass

- Activated Carbon

- HEPA

- Electrostatic

- Pleated Paper/Polyester

- UV

- Ceramic

- Others (cotton, mesh, etc.)

By Efficiency

- MERV 1-4

- MERV 6-10

- MERV 10-13

- MERV 14-16

- MERV 17-20

By Application

- Air Filtration

- Water Filtration

- Others (refrigeration, washing machine, etc.)

By Distribution Channel

- Online

- E-commerce Website

- Company Website

- Offline

- Supermarkets/ Hypermarkets

- Specialty Stores

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.