RFID In Pharmaceuticals Market Size, Share & Trends Analysis Report By Component (RFID Tags, RFID Readers, RFID Middleware), By Type (Chipped RFID, Chipless RFID), By Application (Drug Track & Tracing Systems, Drug Quality Management, Others), By End-user (Drug Manufacturers, Hospitals & Clinics, Others (Distributors, Retailers)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Rfid in Pharmaceuticals Market Size

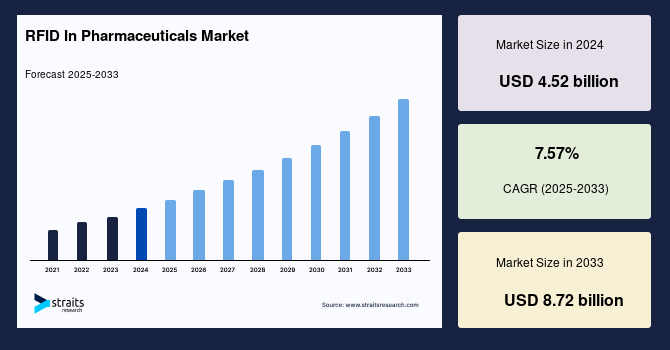

The global RFID in pharmaceuticals market size was valued at USD 4.52 billion in 2024 and is projected to grow from USD 4.86 billion in 2025 to USD 8.72 billion by 2033, exhibiting a CAGR of 7.57% during the forecast period (2025-2033).

Radio Frequency Identification (RFID) in pharmaceuticals refers to using radio frequency technology to tag, track, and manage drug products throughout the supply chain. RFID tags with unique identifiers are attached to medication packaging, allowing real-time inventory monitoring, improving traceability, and enhancing anti-counterfeiting measures. This technology ensures compliance with regulatory standards, reduces human errors, and helps in efficient recalls and stock management. RFID also enables temperature tracking for sensitive drugs and improves patient safety by verifying drug authenticity. Its implementation is growing due to the increasing demand for transparency and efficiency in pharmaceutical logistics and distribution.

The global RFID in pharmaceuticals market is driven by increased application of regulations meant to ensure a safe drug supply chain, with increased cases of fake drugs. Utilization of RFID technology helps curb this by enabling real-time tracking, authentication, and tracing of drugs to ensure their safety and integrity. Improved visibility improves the operational efficiency of higher accuracy, faster reaction, and more accurate inventory management. The pharmaceutical industry further strengthens supply chain management to increase its effectiveness in streamlining the cost-cutting process. The market will expand in the coming years through the synergy of government support and the benefits of RFID technology in supply chain management and medical monitoring.

Latest Market Trends

Increasing Adoption of Rfid for Drug Authentication

The pharmaceutical industry is intensifying its use of RFID technology to tackle the rising threat of counterfeit drugs. RFID tags give each pharmaceutical product a unique digital identity that can be tracked and authenticated throughout the supply chain. This traceability is vital in ensuring the legitimacy of medicines, especially as counterfeit drugs account for nearly 10% of the global supply, according to the World Health Organization. RFID enables end-to-end visibility, ensuring only genuine, approved drugs reach patients. Unlike barcodes, RFID allows for bulk reading of multiple items without a line of sight, increasing efficiency and reducing human error.

- For example, in August 2024, Intelliguard partnered with Cencora to enhance compatibility between RFID-tagged medications and RFID-based medication management systems. This collaboration allows Intelliguard’s Mira Prep and Mira Care stations to seamlessly read and decode Cencora’s RFID-enabled medications, streamlining the tracking and management of drug inventories. Such integrations are pivotal in combating counterfeit drugs by ensuring each pharmaceutical product can be uniquely identified and authenticated throughout the supply chain.

As the fight against falsified medications continues, RFID’s integration into pharmaceutical workflows is emerging as a powerful tool to safeguard public health and reinforce trust in healthcare systems.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 4.52 Billion |

| Estimated 2025 Value | USD 4.86 Billion |

| Projected 2033 Value | USD 8.72 Billion |

| CAGR (2025-2033) | 7.57% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Zebra Technologies Corp., CCL Healthcare, Fresenius Kabi AG, Avery Dennison Corporation, Impinj Inc. |

to learn more about this report Download Free Sample Report

Rfid in Pharmaceuticals Market Growth Factors

Regulatory Push for Rfid Implementation

One of the most influential drivers propelling RFID adoption in the pharmaceutical industry is increasing regulatory pressure from governments and healthcare agencies worldwide.

- For instance, the U.S. Drug Supply Chain Security Act (DSCSA) mandates serialization and tracking to combat counterfeit drugs and enhance supply chain transparency.RFID technology is becoming a key enabler in meeting these mandates. It offers efficient data capture without needing line-of-sight, making it ideal for large-scale compliance across multiple distribution stages.

Unlike traditional barcodes, RFID allows for efficient data capture without needing line-of-sight, making it ideal for large-scale compliance across multiple distribution stages. Pharmaceutical companies that adopt RFID ensure compliance and gain a competitive advantage through improved operational efficiency and product integrity. This regulatory push is significantly accelerating the growth of the global RFID market in the pharmaceutical domain.

Market Restraining Factors

Technical Challenges

Despite its many advantages, implementing RFID in the pharmaceutical sector has notable technical and infrastructural challenges. Integrating RFID systems with legacy enterprise resource planning (ERP), warehouse management, and supply chain systems can be complex and resource-intensive. Many older systems are not natively compatible with RFID, necessitating expensive software upgrades or middleware to ensure interoperability.

Additionally, synchronization of real-time RFID data across multiple platforms is essential, as lags or inconsistencies can result in inaccurate stock data and distribution delays. Moreover, achieving consistent RFID performance across numerous supply chain nodes remains a hurdle, especially in geographically dispersed or infrastructure-limited regions. These barriers may slow adoption and increase the initial costs for pharmaceutical firms, particularly for small- to mid-sized companies.

Market Opportunity

Rfid for Inventory Management Optimization

RFID technology is revolutionizing inventory management in the pharmaceutical sector by enabling real-time tracking, accurate stock control, and significant cost savings. Pharmaceutical companies are under constant pressure to avoid stockouts or overstocking, which can disrupt patient care and increase operational costs. With RFID, companies can automate inventory audits, track product movement within warehouses and distribution centers, and receive real-time data on inventory levels. This enhanced visibility minimizes human error, speeds up warehouse operations, and improves demand forecasting.

- For example, Terso Solutions has developed RFID-enabled storage solutions, including RFID Freezers and Refrigerators, which provide real-time visibility of pharmaceutical inventory. These systems offer secure access, remote temperature monitoring, and detailed tracking of inventory usage, thereby reducing drug waste and enhancing inventory accuracy. Such advancements are crucial for maintaining the integrity of medications and ensuring timely availability.

The improved operational efficiency and accuracy offered by RFID reduce costs and ensure the availability of critical medications when and where they are needed most.

Regional Insights

Asia Pacific: Dominant Region with 50% Market Share

The Asia-Pacific region holds a dominant position in the RFID in pharmaceuticals market, accounting for 50% of the global market share. The area is witnessing rapid growth in pharmaceutical manufacturing, with countries like China, India, and Japan leading the charge. The rise in drug trafficking involving counterfeit medicines has spurred demand for RFID solutions to ensure secure and transparent drug distribution. China, in particular, has implemented regulations promoting the adoption RFID technology for drug safety and traceability. Additionally, the region's robust pharmaceutical manufacturing base, which produces and exports large quantities of drugs, further drives the need for RFID systems to manage and track products securely. Investments in healthcare infrastructure and the growing awareness of the importance of supply chain security are contributing to the region's rapid adoption of RFID in the pharmaceutical industry.

North America: Fastest-Growing Region with the Highest Market Cagr

North America, particularly the United States, is experiencing the highest growth rate in the RFID in pharmaceuticals market. The U.S. is at the forefront of adopting RFID technology due to stringent regulatory frameworks such as the Drug Supply Chain Security Act (DSCSA), which mandates serialization and track-and-trace systems for pharmaceutical products. The growing concerns over counterfeit drugs and regulatory pressures have driven widespread adoption of RFID technology to improve supply chain transparency and drug authentication. The U.S. pharmaceutical industry’s strong infrastructure, coupled with the increasing need for real-time inventory management and regulatory compliance, is expected to continue driving market growth in North America.

Countries Insights

- The U.S.: The United States is one of the largest developed markets for RFID in the pharmaceutical sector. The Drug Supply Chain Security Act (DSCSA) mandates the serialization and traceability of pharmaceutical products, propelling the rapid adoption of RFID technology for real-time tracking and authentication. U.S. pharmaceutical firms and distributors have already integrated RFID systems to comply with regulatory requirements, reduce counterfeit risks, and enhance supply chain transparency.

- Germany: Germany, a key European market, is a leader in RFID adoption, driven by the European Union's Falsified Medicines Directive (FMD), which mandates serialization and authentication to prevent counterfeit drugs. As one of Europe's largest pharmaceutical manufacturing hubs, Germany has seen significant uptake of RFID technology among pharmaceutical companies and logistics providers. RFID-based track-and-trace systems are increasingly utilized to ensure regulatory compliance, enhance drug safety, and improve supply chain efficiency, contributing to greater patient confidence in pharmaceutical products.

- China: China has quickly embraced RFID technology in response to growing concerns over counterfeit drugs and the need for improved medicine safety. With the government's push for serialization and track-and-trace solutions, China is enhancing drug traceability across its massive pharmaceutical market. As a global pharmaceutical manufacturing powerhouse, RFID is crucial for tracking drugs throughout the manufacturing, transportation, and distribution.

- India: India, one of the world’s largest pharmaceutical manufacturers, is witnessing a surge in the adoption of RFID technology to combat the rise in counterfeit drugs and improve drug security. While RFID implementation is still in its early stages, the country's growing pharmaceutical industry and regulatory developments drive demand for better supply chain integrity and drug traceability solutions. As India modernizes its healthcare and manufacturing systems, RFID technology is expected to play a pivotal role in ensuring compliance with global standards and meeting local market requirements.

- United Kingdom: The United Kingdom has led RFID adoption in the pharmaceutical industry, initially driven by the EU’s Falsified Medicines Directive (FMD). Despite Brexit, the UK continues prioritizing drug safety and anti-counterfeit measures, with RFID becoming essential for tracking and tracing medications. The UK's strong regulatory framework and established pharmaceutical industry have paved the way for the widespread use of RFID technology to ensure product authenticity, improve supply chain management, and ensure patient safety.

Segmentation Analysis

By Component

The RFID tags segment commands the largest market share, accounting for over 42.3% due to their significant benefits in the pharmaceutical industry. RFID tags are extensively used to track and trace pharmaceuticals, vaccines, and medical products throughout the supply chain, ensuring improved visibility and real-time monitoring. This reduces inventory errors, such as stockouts, overstocking, and product expiration, enhancing operational efficiency. The increased adoption of RFID tags in warehouses, distribution centers, and retail locations helps streamline workflows, reduce manual errors, and improve process efficiency. This growing awareness of RFID's advantages and use in pharmaceutical supply chains will continue to drive market growth.

By Type

The chipped RFID segment holds the dominant market share, accounting for more than 65.7%. Chipped RFID technology ensures real-time authentication of drugs and materials, providing enhanced security throughout the pharmaceutical supply chain. The unique identifiers embedded in each RFID chip guarantee the traceability of products from manufacturing to distribution. This technology helps prevent the entry of counterfeit drugs into the supply chain by authenticating every drug at each stage, safeguarding patient safety and drug efficacy. Furthermore, chipped RFID aids in effective inventory management, quality control, and regulatory compliance.

By Application

The drug tracking and tracing application dominates the market with a share exceeding 52.3%. This segment's growth is fueled by the increasing prevalence of counterfeit drugs and the rising adoption of RFID technology to combat this issue. RFID technology offers a robust solution by providing real-time traceability and authentication, thereby minimizing the chances of counterfeit drugs entering the supply chain. As the global demand for secure drug-tracking systems grows, this segment is expected to continue expanding as governments and pharmaceutical companies push for enhanced supply chain transparency and regulatory compliance.

By End User

The drug manufacturer segment represents the largest share, with more than 43.1% in 2022, owing to the increasing adoption of RFID technology to prevent counterfeit drugs and streamline supply chain operations. Manufacturers depend on RFID systems to provide real-time authentication, traceability, and verification, which is crucial in identifying counterfeit products and preventing them from reaching the market. RFID technology also facilitates inventory management, helping manufacturers reduce labeling errors, prevent stockouts, and avoid overstocking. By providing accurate real-time information about stock levels, RFID systems enhance operational efficiency, ensuring better regulatory compliance and strengthening the integrity of pharmaceutical supply chains.

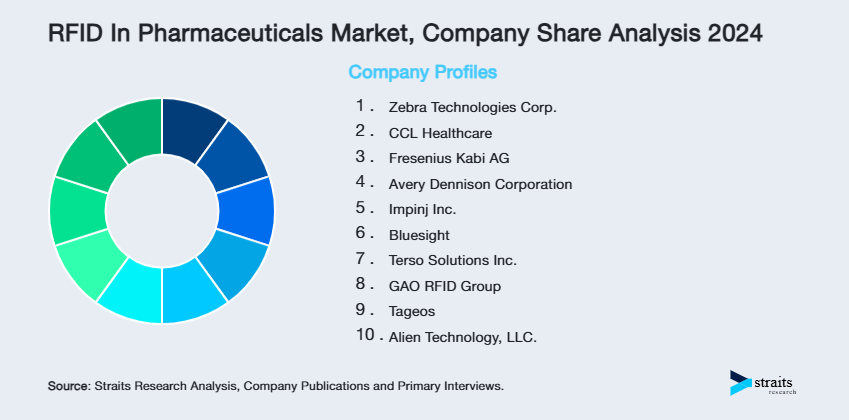

Company Market Share

The market for RFID in Drugs is very cutthroat, with organizations holding significant pieces of the pie because of the far-reaching RFID arrangements that address recognisability, validation, and the entire need of store network management. Organizations are also fostering the market through inventive RFID arrangements and expanding their overall presence. As the drug business defies the issue of fake medications and pursues higher production network transparency, RFID innovation adoption will continue to grow.

Avery Dennison Corporation: An Emerging Player in the Rfid in Pharmaceuticals Market

Avery Dennison Company, a noticeable player in the RFID market fabricating industry, fundamentally adds to the drug area with its creative RFID arrangements. The organization's RFID decorates and labels are broadly used for bundling and medication marking, offering essential advantages in drug detectability and against falsifying endeavours. With its worldwide presence and mastery in store network arrangements, Avery Dennison maintains its position, especially in North America and Europe.

Recent developments at Asahi Kasei include:

- In January 2023, the organization extended its production capacity in the Americas with another manufacturing site in Querétaro, Mexico. This speculation upholds Avery Dennison's objective of furnishing each thing with an exceptional computerized personality, improving associated and straightforward inventory chains. With a normal venture of more than $100 million, the new office will produce more than 600 innovation occupations, further fortifying the organization's role in further developing store network effectiveness across different businesses.

List of Key and Emerging Players in RFID In Pharmaceuticals Market

- Zebra Technologies Corp.

- CCL Healthcare

- Fresenius Kabi AG

- Avery Dennison Corporation

- Impinj Inc.

- Bluesight

- Terso Solutions Inc.

- GAO RFID Group

- Tageos

- Alien Technology, LLC.

to learn more about this report Download Market Share

Recent Developments

- April 2024- Germany-based global provider of innovative functional label solutions for the healthcare industry, Schreiner MediPharm, has launched late-stage customization capabilities for its RFID-Labels series. This new service offering enables the company's smart labels to be supplied on short notice with order-specific programming for their integrated RFID chips.

- April 2024- A global leader in processing and packaging machinery and related solutions, ProMach acquired Etiflex, a leading manufacturer of pressure-sensitive and RFID labels. The acquisition of Etiflex further expands ProMach's labeling and coding capabilities throughout North America and marks the company's first acquisition in the Mexican market.

Analyst Opinion

As per our analyst, the global RFID in pharmaceuticals market has tremendous growth opportunities driven by increasing regulatory pressure, enhanced security against counterfeit drugs, and the growing demand for transparency and efficiency in pharmaceutical supply chains. The adoption of RFID technology is expected to accelerate as countries implement stricter drug safety regulations and pharmaceutical companies look to improve operational efficiency, compliance, and patient trust. RFID technology will continue to evolve, playing a critical role in enhancing the integrity of drug distribution systems worldwide. As more pharmaceutical companies realize the benefits of RFID in securing their supply chains, improving operational efficiency, and complying with regulations, RFID will remain a central pillar in the transformation of the pharmaceutical industry.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 4.52 Billion |

| Market Size in 2025 | USD 4.86 Billion |

| Market Size in 2033 | USD 8.72 Billion |

| CAGR | 7.57% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Type, By Application, By End-user |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

RFID In Pharmaceuticals Market Segments

By Component

- RFID Tags

- RFID Readers

- RFID Middleware

By Type

- Chipped RFID

- Chipless RFID

By Application

- Drug Track & Tracing Systems

- Drug Quality Management

- Others

By End-user

- Drug Manufacturers

- Hospitals & Clinics

- Others (Distributors, Retailers)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.