Rubber Processing Chemicals Market Size, Share & Trends Analysis Report By Product (Anti-degradants, Accelerators, Flame Retardants, Processing Aid/Promoters, Others), By Application (Tire, Non-Tire) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Rubber Processing Chemicals Market Size

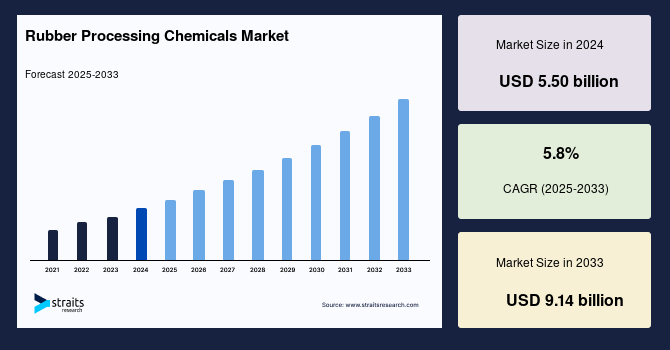

The global rubber processing chemicals market size was valued at USD 5.50 billion in 2024 and is projected to grow from USD 5.82 billion in 2025 to USD 9.14 billion by 2033, exhibiting a CAGR of 5.8% during the forecast period (2025-2033).

The global rubber processing chemicals market refers to the production and trade of chemical additives used during the manufacturing and processing of rubber to enhance its properties, such as elasticity, durability, and resistance to heat, aging, and mechanical stress. These chemicals include accelerators, activators, anti-degradants, and processing aids, essential in producing a wide range of rubber products like tires, seals, footwear, and industrial goods. The market growth is driven by rising automotive production, infrastructure development, and technological advancements in rubber formulations. Regulatory pressures regarding environmental safety and the shift toward eco-friendly additives also significantly shape this market.

The global rubber processing chemicals market is growing quickly due to increasing demand from major end-user industries such as the automotive, construction, and building industries. Such growth is fuelled by increased demand for improved resistance to heat, sunlight, oxygen, mechanical stress, and ozone, and an increasing demand for high-quality rubber products. In addition, the market is driven by a rising interest in sustainability and environmentally friendly solutions, the shift to electric cars and greener technologies in the automobile industry, and the high penetration of industrial products, which further strengthens its growth.

Key Market Trends

Increased Adoption of Eco-Friendly Solutions

Stringent environmental regulations, such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in Europe, are reshaping the rubber processing chemicals landscape. These policies push manufacturers to develop safer, greener alternatives that reduce harmful emissions and improve worker and environmental safety. As a result, the market is witnessing a shift toward bio-based, low-VOC (volatile organic compound) formulations. These eco-friendly chemicals are gaining traction in Europe, North America, and Asia, where regulatory pressure is rising.

- For instance, in March 2024, LANXESS showcased its comprehensive range of additives and solutions for the tire industry at Tire Technology Expo 2024 in Hanover, Germany. As a result, the specialty chemicals company now shows that tire manufacturers can reduce both their ecological footprint during production and that of the end product.

This trend reduces environmental impact and enhances brand reputation, offering a competitive edge in a market where green innovation is increasingly valued by regulators and customers alike.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 5.50 Billion |

| Estimated 2025 Value | USD 5.82 Billion |

| Projected 2033 Value | USD 9.14 Billion |

| CAGR (2025-2033) | 5.8% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Lanxess, Solvay, Akzo Nobel N.V., BASF SE, Arkema |

to learn more about this report Download Free Sample Report

Rubber Processing Chemicals Market Growth Factors

Growing Applications in Construction

Rapid infrastructure and urban development expansion across Asia-Pacific and the Middle East significantly boosts the demand for rubber processing chemicals. These regions are experiencing massive growth in construction activity, driven by rising urbanization, industrialization, and government investments in megaprojects. Asia-Pacific will account for over 40% of global construction output by 2030, with China, India, and Southeast Asian countries leading.

National initiatives such as China's "Belt and Road Initiative" (BRI) and India's "Smart Cities Mission" are pushing for the large-scale development of roads, bridges, railways, residential complexes, and industrial zones. Rubber chemicals are vital in producing construction materials like gaskets, seals, vibration dampeners, and waterproofing systems that must endure harsh environmental and mechanical conditions. As the demand for durable, weather-resistant materials grows, rubber processing chemicals will remain essential in ensuring long-lasting infrastructure solutions across these rapidly evolving regions.

Market Restraining Factors

Volatility in Raw Material Prices

One of the most pressing challenges for the rubber processing chemicals market is the volatility in raw material prices. Most of these chemicals rely heavily on petrochemical derivatives, making them sensitive to global crude oil price fluctuations. This instability places significant pressure on manufacturers, making maintaining consistent pricing and profit margins difficult. As production costs rise, companies may be forced to scale back output or pass on the expenses to customers, potentially reducing demand.

Additionally, long-term strategic planning becomes more complex in such a volatile environment, deterring investment and innovation. The industry’s heavy dependence on petroleum-based raw materials also makes it more vulnerable to environmental regulations, further complicating the cost and availability of essential inputs, thus hindering market growth.

Key Market Opportunities

Technological Advancements in Rubber Compounding

Technological innovation in rubber compounding opens new avenues for performance and sustainability in the market for rubber processing chemicals. A breakthrough involves the integration of nanotechnology, where nanoparticles like carbon nanotubes, graphene, and nano silica are used to reinforce rubber. These materials significantly enhance tensile strength, flexibility, thermal stability, and abrasion resistance, making them ideal for high-demand applications such as automotive tires, industrial belts, and sealing components.

- For instance, as of May 2024, Lehigh Technologies, a subsidiary of Michelin, continues to produce micronized rubber powders (MRP) from end-of-life tires. These MRPs are used as sustainable additives in rubber products, promoting circular economy practices.

Innovations in reactive mixing techniques, green chemistry, and precision compounding also enable better dispersion of additives, leading to more consistent performance and lower material waste. As industries seek eco-friendly, high-performance materials, developing advanced compounding technologies presents a vital growth opportunity.

Regional Insights

Asia-Pacific: Dominant Region with 62% Market Share

Asia-Pacific leads the global rubber processing chemicals market, accounting for the largest share of over 60%. The region's dominance is fueled by rapid industrialization, urban expansion, and strong growth in automotive production across countries like China, India, Japan, and South Korea. This unprecedented automotive boom drives massive demand for high-performance rubber components, including tires, hoses, bushings, and seals, boosting the consumption of rubber processing chemicals. Additionally, extensive infrastructure development projects and increasing use of rubber-based materials in construction, insulation, and flooring across Southeast Asia further augment the demand.

Moreover, regional manufacturing competitiveness, availability of raw materials, and supportive regulatory environments contribute to making Asia-Pacific the global production and export base for rubber products, amplifying the demand for rubber processing chemicals in the region.

China

As the world's largest producer of automobiles, China commands a substantial share of the rubber processing chemicals market. The nation’s expanding infrastructure and rapid urbanization drive demand for rubber-based products in the construction and automotive sectors. Government mandates on pollution control push manufacturers toward eco-friendly, bio-based rubber chemicals, reinforcing China's position as a manufacturing and environmental leader.

Japan

Japan’s emphasis on innovation in automotive materials supports strong demand for rubber processing chemicals. With leading OEMs focusing on tire performance, fuel efficiency, and sustainability, Japan is advancing cutting-edge technologies such as nanomaterials and self-healing rubber. Its leadership in green chemistry promotes the adoption of low-emission, high-performance additives.

India

India is emerging as a growth powerhouse, supported by its rapidly expanding automotive and construction sectors. The country’s position as one of the top tire producers globally, coupled with large-scale infrastructure projects and a growing middle class, drives demand for performance-enhancing and cost-efficient rubber chemicals. India’s “Make in India” initiative further fuels domestic chemical production and adoption.

North America: Fastest Growing Region with the Highest Market Cagr

North America is poised to be the fastest-growing region in the rubber processing chemicals market, led primarily by the United States. The U.S. remains a global leader in automotive and industrial manufacturing, producing approximately 13.5 million vehicles in 2023. The surge in demand for electric and hybrid cars, with over 800,000 EVs sold in the U.S. alone in 2023, is reshaping the requirements for specialized rubber compounds that support energy efficiency, thermal management, and performance.

Rubber processing chemicals are also crucial to the region's well-developed aerospace, oil & gas, and construction sectors, where durability and safety under extreme conditions are essential. Rising awareness of sustainable manufacturing and stringent environmental regulations push manufacturers to adopt more advanced, eco-friendly chemical solutions. Technological advancements, R&D investments, and the resurgence of domestic manufacturing under U.S. government initiatives are expected to accelerate regional growth further.

United States

The U.S. is a top-tier market, driven by its robust automotive, aerospace, and construction sectors. The accelerating adoption of EVs, demand for high-performance tires, and focus on sustainable materials fuel innovation in advanced and green rubber processing chemicals. Strong R&D capabilities and consumer preference for eco-conscious products are reshaping the market.

- Germany– As the automotive heart of Europe, Germany’s demand for high-end rubber chemicals remains strong. The rise of EVs and government environmental regulations accelerates the transition to sustainable and low-VOC compounds. Besides automotive, Germany’s construction and healthcare sectors support steady consumption of rubber products, boosting demand for specialty chemicals.

Product Insights

Anti-degradants dominate the market due to their critical role in enhancing the durability and performance of rubber products, particularly in the automotive tire industry. Anti-degradants significantly improve resistance to environmental stressors such as ozone, oxygen, heat, and UV exposure, extending the functional lifespan of tires and other rubber components. They are essential for high-performance and long-wear applications, including passenger vehicles, commercial trucks, and industrial equipment. Beyond tires, anti-degradants are increasingly used in non-tire applications like conveyor belts, hoses, gaskets, and seals. Their ability to prevent cracking, fatigue, and degradation under extreme conditions makes them indispensable across multiple end-use industries such as construction, manufacturing, oil & gas, and mining.

Application Insights

Tires remain the largest application segment driven by the global rise in vehicle production and increasing consumer demand for safety, efficiency, and performance-enhancing tires. The trend toward eco-friendly and energy-efficient green tires, which offer improved rolling resistance, enhanced braking, and superior cornering capabilities, has significantly increased the use of specialized rubber processing chemicals. Moreover, the shift toward electric vehicles (EVs) reshapes tire design requirements, focusing strongly on lower rolling resistance, reduced noise, and higher torque tolerance. These new performance expectations demand more advanced chemical formulations for rubber compounds.

Company Market Share

The market for rubber processing chemicals is very competitive, with multiple significant players driving innovative solutions and growth in different regions. Sustainability, environmentally friendly solutions, and technologies are driving the competitive environment of the market forward, coupled with new developments in the tire and automotive industries.

China Petrochemical Corporation (sinopec): An Emerging Player in the Rubber Processing Chemicals Market

China Petrochemical Corporation (Sinopec) is the largest market player in China's rubber processing chemicals market. It is one of the biggest suppliers of synthetic rubber and its by-products. Since it is among the largest oil and gas companies worldwide, it enjoys a tremendous production scale and an integrated supply chain that helps the company enjoy the edge in the rubber chemicals market. Its massive footprint in the domestic automotive and tire industries and its growing international operations enhance its leadership position in rubber chemicals.

Recent Developments at China Petrochemical Corporation (sinopec) Include:

- In April 2023, Hainan Baling Chemical New Material Co., Ltd., a Sinopec subsidiary, put the styrene-butadiene copolymer (SBC) project, the Project, into production in Hainan, China, with an annual production capacity reaching 170,000 tons. Sinopec became the world's largest producer of plants to produce SBC. Baling New Material and Sinopec Hainan Refining & Chemical Co., Ltd. spent 1.924 billion yuan (USD 279.74 million) on the Hainan Baling project.

List of Key and Emerging Players in Rubber Processing Chemicals Market

- Lanxess

- Solvay

- Akzo Nobel N.V.

- BASF SE

- Arkema

- Eastman Chemical Company

- T. Vanderbilt Holding Company, Inc.

- Behn Meyer

- KUMHO PETROCHEMICAL

- Paul & Company

- China Petrochemical Corporation

- Merchem Limited

to learn more about this report Download Market Share

Recent Developments

- April 2024- Sumitomo Chemical exhibited bio-based polyolefins at Chinaplas 2024, highlighting its commitment to sustainability by presenting environmentally friendly alternatives to conventional polyolefins. This aligns with the industry's broader trend towards eco-friendly products and materials driven by environmental concerns and rising consumer demand, as Plastics & Rubber Asia reported.

Analyst Opinion

As per our analyst, the global rubber processing chemicals market is experiencing robust growth, primarily driven by the surge in automotive production, rising demand for high-performance tires, and the global shift toward sustainable manufacturing. Countries like China and India continue to dominate due to rapid industrialization and infrastructure development, while innovation-led markets such as the U.S., Japan, and Germany are shaping the transition to advanced, eco-friendly rubber chemicals. The growing emphasis on green tires, electric vehicles, and low-emission manufacturing practices is accelerating the adoption of specialized additives and environmentally compliant compounds. Additionally, increasing R&D in nanotechnology, bio-based materials, and smart rubber compounds is redefining product development across applications. With stringent regulations pushing for reduced VOC emissions and improved recyclability, the market is poised to evolve rapidly. As emerging economies ramp up production capacity and developed nations prioritize innovation, the rubber processing chemicals market is positioned for sustained, innovation-led expansion worldwide.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 5.50 Billion |

| Market Size in 2025 | USD 5.82 Billion |

| Market Size in 2033 | USD 9.14 Billion |

| CAGR | 5.8% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Rubber Processing Chemicals Market Segments

By Product

- Anti-degradants

- Accelerators

- Flame Retardants

- Processing Aid/Promoters

- Others

By Application

- Tire

- Non-Tire

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.