Satellite Data Services Market Size, Share & Trends Analysis Report By Service Type (Satellite imagery, Geospatial analytics), By Frequency Band (L-band, C-band, X-band, Ka-band, Ku-band, Others), By Applications (Remote Sensing, Weather Forecasting, Navigation & Positioning, Signal Monitoring, Earth Observation, Others), By Industry Vertical (Defense and Security, Engineering and Infrastructure, Maritime, Transportation and Logistics, Agriculture and Forestry, Energy and Power, Environment, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Satellite Data Services Market Size

The global satellite data services market size was valued at USD 11.12 billion in 2024 and is projected to reach from USD 14.20 billion in 2025 to USD 100.44 billion by 2033, growing at a CAGR of 27.7% during the forecast period (2025-2033).

Satellite Data Services refer to the collection, processing, and delivery of data obtained from satellites orbiting the Earth. This data is utilized across a range of industries for various applications, including environmental monitoring, defense, agriculture, and disaster management. The key growth drivers for this market include the rising demand for satellite imagery in defense and agriculture, advancements in geospatial analytics, and the increasing use of satellite data for tracking environmental changes.

The growing relevance of space technology, coupled with substantial government investments in satellite infrastructure, is further propelling the market’s expansion. For example, ongoing investments through NASA’s Earth observation programs and the European Space Agency’s Copernicus project have significantly increased the demand for high-resolution satellite data. Leading companies like Maxar Technologies, Airbus SE, and Planet Labs continue to expand their service offerings to meet rising demand and maintain their competitive edge in the market.

Source: Straits Research Analysis

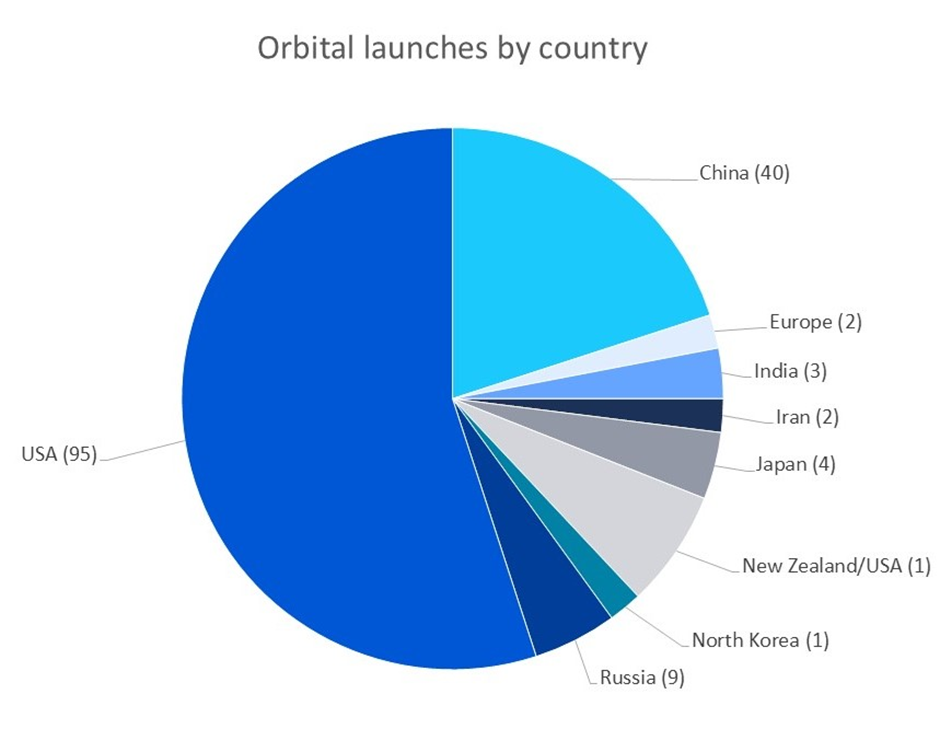

The above pie chart shows the number of orbital launches by different countries.

The United States has the highest number of launches (95), followed by China (40). Other countries with significant launch activities include Russia (9), Japan (4), and India (3).

U.S. and China, respectively, have dominated launches into space and significantly contributed to the growth of the satellite data services industry. Increased launches led to the deployment of huge numbers of satellites into space. The launch had a significant impact on global communication and Earth observation while making it possible to collect vast amounts of data.

Sectors like telecommunications, agriculture, and logistics are evermore dependent on satellite data for real-time insights, analytics, and connectivity solutions as the satellite network expands. The satellite infrastructure will continue to grow, boosting the satellite data service market toward encouraging innovation, competition of service providers worldwide, and delivery of quality data services in addition to higher rates.

Satellite Data Services Market Trends

Expansion of Satellite Imagery Capabilities

The growing demand for high-resolution images is driving the expansion of satellite imagery capabilities. As industries increasingly require precise and detailed geographical data, advancements in satellite technology, such as small satellites and satellite constellations, are meeting this demand by enabling more frequent and comprehensive Earth observations.

High-resolution satellite imagery is particularly valuable in applications such as environmental monitoring, urban planning, and disaster management, where accuracy and detail are critical. For instance,

-

In November 2023, Planet Labs launched additional satellites to expand its Earth observation capabilities, offering more frequent imagery updates and higher resolution data for various industries.

These advancements in satellite technology are key trends driving growth in the global market.

Expansion of Geospatial Analytics for Business Intelligence

Geospatial analytics includes the acquisition and analysis of satellite-based data to understand geographical and spatial information, which is increasingly utilized in business intelligence. This is driven by the growing need for real-time, location-based insights in sectors such as transportation, energy, and urban planning.

For instance,

-

In November 2023, Esri updated its ArcGIS Geospatial Analytics platform, providing advanced tools for analyzing satellite data to optimize logistics and infrastructure development.

-

Airbus SE’s OneAtlas analytics platform integrates AI for geospatial intelligence, offering real-time analytics to support global monitoring and risk assessment in industries like energy and defense.

These advancements highlight how geospatial analytics is becoming essential for businesses looking to leverage satellite data for strategic insights.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 11.12 Billion |

| Estimated 2025 Value | USD 14.20 Billion |

| Projected 2033 Value | USD 100.44 Billion |

| CAGR (2025-2033) | 27.7% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Airbus SAS., East View Geospatial Inc., ImageSat International, L3Harris Technologies, Inc., Maxar Technologies |

to learn more about this report Download Free Sample Report

Satellite Data Services Market Growth Factors

Rising Investments in Earth Observation Programs

With the increased demand in areas of agriculture, environmental monitoring, and disaster management for accurate information within near-real time, the private and government sectors have called for increased investment in Earth observation satellites. In agriculture, it maximizes crop yields and water use, while in environmental uses, it will monitor deforestation, air and water quality, climate change, and more.

Earth observation satellites are useful in the matter of disaster management, as they provide data for early warnings on floods, earthquakes, and wildfires among other natural disasters that otherwise could have dramatic effects on the overall landscape. This investment surge accounts for the growing need to base decisions on data everywhere.

For instance,

-

NASA’s Earth Science Division received a 12% budget increase in 2023 to support satellite missions that monitor climate change, deforestation, and water resources.

-

The European Union’s Copernicus program is also expanding, with six new satellite missions planned by 2027 to enhance Europe’s ability to monitor environmental and climate-related changes.

Rising Demand for Satellite-Based Communication

Satellite Data Services are significantly driven by the growing demand for satellite-based communications. The expanding global reach of satellite networks for remote sensing and positioning applications is supporting robust industry growth. Various sectors, particularly agriculture, defense, and transportation, are increasingly leveraging satellite technology to obtain precise, real-time data, enhancing connectivity and monitoring capabilities.

This demand is further amplified by the integration of satellite technology into Internet of Things (IoT) networks, which allows smart devices to access critical information from remote locations. Improvements in satellite technology ranging from miniaturization of satellite components to reduced launch costs have facilitated the delivery of these services, stimulating growth across multiple sectors.

As organizations increasingly adopt satellite data for decision-making and operational efficiency, the market for satellite data services continues to expand, reflecting its pivotal role in modern technology ecosystems.

For instance,

- In 2023, OneWeb launched more than 500 low Earth orbit (LEO) satellites, providing global broadband services that rely on satellite data for navigation, tracking, and positioning applications.

- SpaceX's Starlink satellite internet project is providing high-speed internet to remote areas worldwide, which has led to increased demand for satellite imagery and signal monitoring.

Market Restraint

Regulatory Barriers to Satellite Data Usage

The regulatory landscape governing satellite data usage, particularly in defense and security sectors, poses significant challenges for the market's expansion. Restrictions on the distribution of satellite imagery, especially high-resolution data, limit its commercial potential in certain regions and sectors.

One notable example is the U.S. government’s International Traffic in Arms Regulations (ITAR), which strictly controls the export of defense-related satellite data. ITAR regulations can delay satellite launches and limit the availability of satellite data services in international markets, restricting growth opportunities.

Such regulatory hurdles impact the global accessibility and use of high-resolution satellite data, particularly for commercial and defense applications, slowing the overall market expansion.

Market Opportunity

Integration of Artificial Intelligence (ai) and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into satellite data services presents transformative opportunities across various sectors. These technologies enable advanced data analytics, allowing organizations to extract actionable insights from vast amounts of satellite imagery and geospatial data.

- For instance, AI algorithms can analyze satellite images to identify and monitor changes in land use, helping agricultural companies optimize crop management and predict yield. By leveraging AI, farmers can receive real-time insights into crop health, irrigation needs, and pest infestations, ultimately improving productivity and resource efficiency.

A notable example is Planet Labs, which utilizes AI-driven analytics to process its vast array of daily satellite images. Their platform can automatically detect changes in land cover, urban development, and even deforestation trends, providing critical information for environmental monitoring and urban planning. Moreover, AI can enhance disaster response efforts by rapidly analyzing satellite data to assess damage after natural disasters, enabling timely and effective relief efforts.

Regional Insights

North America's satellite data services market share is projected to exhibit a 26.1% during the forecast period. This incremental growth in scientific applications can be attributed to the increasing demand from both government and non-government agencies to effectively map and analyze glaciers, rivers, and topographical features, as well as to assess the societal impacts of economic trends.

Moreover, key players in the region, such as DigitalGlobe and Harris Geospatial Solutions, Inc., empower organizations by providing a diverse array of service offerings, creating significant growth opportunities within the market. These companies leverage data from the Landsat and Terra satellites, which are highly regarded for their Earth observation capabilities.

The combination of advanced satellite data applications and strong market participation from leading firms serves to propel regional growth, positioning North America as a pivotal hub for innovation and development in satellite data services.

Europe Market Trends

The European market for satellite data services is projected to grow at a compound annual growth rate (CAGR) of 23.7% during the forecast period. This steady growth can be attributed to recent initiatives by the European Union (EU) aimed at ensuring the free availability of image data captured by the Copernicus Satellites, which enhances access to critical geospatial information.

The European Association of Remote Sensing Companies has recently launched a commercialization initiative for satellite images gathered by the WorldView-4 satellite. This initiative is designed to drive product and service development, positioning the region as a hub for exciting growth opportunities within the satellite data market.

Moreover, the regulatory framework in Europe, governed by organizations such as the European Environment Agency (EEA), the European Association of Remote Sensing Companies (EARSC), and the European Space Agency (ESA), along with DTU Space and the European Union Satellite Centre (EUSC), ensures sustainable and secure market growth.

These entities work collaboratively to promote the use of satellite data, driving innovation and compliance within the industry while fostering an environment conducive to continued expansion.

U.s Market Trends

The U.S. leads the global market due to its robust space infrastructure, large number of satellite launches, and presence of major industry players such as SpaceX, Maxar Technologies, and Planet Labs. The strong governmental backing through agencies like NASA and NOAA, along with high private sector investment in satellite-based remote sensing, drives market dominance.

China Market Trends

China is expanding rapidly, driven by government initiatives like the Belt and Road Space Information Corridor and increasing investments in the BeiDou Navigation Satellite System (BDS). China also launched a commercial SuperView-3 remote sensing satellite in April 2024, which is considered China’s first commercial optical remote sensing satellite with an ultra-large width of more than 130 kilometers. The satellite is designed to provide 0.5-meter resolution and 9-band combined image data products.

France Market Trends

France is one of the major countries in the global market due to its prominent position in earth observation, telecommunications, and defense satellite systems. Moreover, France is home to very strong Arianespace, CNES, and Airbus Defence and Space, which are prominent in the country. France's focus on commercial satellite services as well as climate monitoring in its Copernicus program, reinforces its market position. Likewise, continued innovation in high-resolution imagery and data analytics continues to drive France's growth in this sector.

Germany Market Trends

Germany’s satellite data services market is driven by its strong emphasis on innovation, precision engineering, and partnerships with the European Space Agency (ESA). The country has heavily invested in Earth observation programs and telecommunication satellites. For instance, Germany maintains a leading role in the EU's Copernicus Earth Observation System by investing €520 million ($606 million). Companies such as OHB SE and Airbus are key players in Germany's space industry, particularly in the areas of defense, climate monitoring, and disaster management, with the German Aerospace Center (DLR) acting as a vital research and development hub for satellite data services and overall space initiatives in the country.

United Kingdom Market Trends

The rapid growth in the UK market is driven by a huge investment in space technology, further fueled by the UK Space Agency's goal of becoming the global leader in satellite services. It leads the world in Earth observation and satellite communication, which is boosted by companies like Inmarsat and Surrey Satellite Technology Limited (SSTL). Moreover, the country's growth is driven by the focus on satellite applications in terms of environmental monitoring, defense, and urban planning, and governmental initiatives such as the National Space Strategy, establishing its position.

Russia Market Trends

Russia's market is shaped by its historical legacy in space exploration and a strong presence in satellite communication. Roscosmos, the Russian space agency, is at the forefront of ongoing projects in Earth observation, telecommunication, and defense-related satellite data services. For instance, Roscosmos, the Russian space agency, partnered with Egypt, South Africa, and Algeria on numerous space-based projects for both educative and technological advancement purposes. Moreover, Roscosmos plans to build satellite constellations by producing 250-300 satellites a year by 2025 and a satellite a day by 2030. Therefore, satellite communication would underpin Russia‘s economic growth and improve digital services.

Japan Market Trends

Japan's market is significantly propelled by advancements in space technology, with the Japan Aerospace Exploration Agency (JAXA) playing a key role in development and companies like Mitsubishi Electric and NEC actively contributing to the commercialization of satellite data services through their technology and satellite manufacturing capabilities. Japan’s flagship satellite programs, such as the Himawari weather satellites and the Advanced Land Observing Satellite (ALOS), enhance its capabilities in providing satellite data for environmental monitoring and disaster relief operations.

India Market Trends

India’s market is propelled by the Indian Space Research Organisation (ISRO), which plays a central role in Earth observation, satellite communication, and navigation services. India is a major player in launching satellites for global clients, leveraging its cost-effective space programs. Moreover, the market is expanding rapidly due to the growing demand for geospatial data in agriculture, urban planning, and disaster management. ISRO’s Cartosat and RISAT satellite series enhance India’s position as a leading provider of remote sensing data globally.

Service Type Insights

In 2023, the Satellite Imagery segment dominated the Satellite Data Services market due to its extensive use across industries such as defense, agriculture, and environmental monitoring. The rise in demand for precise, real-time images from satellites to monitor natural disasters and urban development drives this segment’s growth.

- For instance, The European Space Agency's (ESA) Copernicus program utilizes satellite imagery to track deforestation, ocean pollution, and climate change. By using Sentinel satellites, the program provides critical data for global climate initiatives, supporting governments in environmental conservation and disaster management.

Frequency Band Insights

In 2023, the Ka-Band segment holds the largest market share due to its high data transfer capacity, making it ideal for communication services, remote sensing, and earth observation. Ka-Band is widely used in satellite broadband services, driving its significant market contribution.

- For instance, in remote sensing and Earth observation, Ka-band is crucial for transmitting high-resolution imagery and data quickly. Inmarsat, one of the leading satellite communication players, deployed Ka-band satellites for maritime and aviation communication services, allowing for better connectivity in sectors requiring real-time data transmission.

Application Insights

The Remote Sensing segment accounted for the largest market share in 2023, driven by the increasing use of satellite data for climate monitoring, disaster management, and agricultural applications. Remote sensing technology enables real-time data collection, supporting global efforts in environmental conservation and land use planning.

- For instance, Remote sensing is extensively used in agriculture for crop monitoring, soil assessment, and water management. Companies like Trimble and Planet Labs provide satellite data services to large-scale farmers and agribusinesses, enabling more precise and efficient use of resources, which directly impacts yield and reduces environmental degradation.

Industry Vertical Insights

In 2023, the Defense and Security segment holds the largest market share, driven by the growing demand for satellite data in military surveillance, reconnaissance, and national security applications. Governments worldwide continue to invest in satellite-based intelligence to enhance situational awareness and threat detection.

- For instance, Maxar Technologies is a key player, supplying satellite imagery to various defense organizations, including the U.S. government. The company’s high-resolution satellite data has been instrumental in global conflict zones, supporting military operations and providing situational awareness.

Company Market Share

Key market players are investing in advanced technologies and pursuing strategies such as collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Planet Labs: An Emerging Key Player of Satellite Data Services Market

Planet Labs is an emerging key player in this market. It is known for its fleet of small, high-resolution satellites that provide real-time Earth imagery and geospatial data. The company supports applications across various sectors, including agriculture, environmental monitoring, and disaster response, with its accessible and frequent satellite imagery.

Recent Developments by Planet Labs

-

In September 2024, Planet Labs (PL) signed a Multi-Year Contract with the German Space Agency, providing Near-Daily Imagery and a Deep Archive of Satellite Data.

List of Key and Emerging Players in Satellite Data Services Market

- Airbus SAS.

- East View Geospatial Inc.

- ImageSat International

- L3Harris Technologies, Inc.

- Maxar Technologies

- Planet Labs Inc.

- Satellite Imaging Corporation

- SpecTIR LLC

- ICEYE

- Northrop Grumman

- Descartes Labs

- Earth-i

- Trimble Inc.

- Ursa Space Systems Inc.

- Others

Recent Developments

-

July 2024 - Amazon announced that they are getting ready to use forthcoming production satellites for its Project Kuiper broadband constellation to showcase data relay capabilities for NASA in the spring. After launching two prototype spacecraft in low Earth orbit (LEO) last year, the business just finished its first round of in-orbit demos, a representative for Amazon's Kuiper Government Solutions (KGS) told SpaceNews.

-

September 2024 - Airbus successfully launched the Copernicus Sentinel-2C satellite on a Vega rocket from Kourou, French Guiana. The satellite will replace Sentinel-2A and work alongside Sentinel-2B, providing high-resolution multispectral imagery for applications such as agriculture and water quality monitoring. This launch ensures continued Earth observation capabilities, supporting global environmental monitoring efforts since 2015.

Analyst Opinion

As per our analyst, the global satellite data services market is poised for substantial growth, driven by increasing demand from sectors such as defense, agriculture, and environmental monitoring, all of which require high-resolution satellite imagery and real-time geospatial analytics. A significant factor propelling this growth is the accelerated adoption of Ka-band frequency technology, which enables high-speed satellite broadband and communications services, particularly in rural and underserved regions.

Moreover, robust investments from both government and private entities exemplified by organizations like NASA and SpaceX are enhancing technological advancements in Earth observation programs. This investment not only fosters innovation but also facilitates the integration of satellite data into climate monitoring and disaster management strategies, underscoring the critical role of remote sensing in global sustainability efforts.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 11.12 Billion |

| Market Size in 2025 | USD 14.20 Billion |

| Market Size in 2033 | USD 100.44 Billion |

| CAGR | 27.7% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service Type, By Frequency Band, By Applications, By Industry Vertical |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Satellite Data Services Market Segments

By Service Type

- Satellite imagery

- Geospatial analytics

By Frequency Band

- L-band

- C-band

- X-band

- Ka-band

- Ku-band

- Others

By Applications

- Remote Sensing

- Weather Forecasting

- Navigation & Positioning

- Signal Monitoring

- Earth Observation

- Others

By Industry Vertical

- Defense and Security

- Engineering and Infrastructure

- Maritime

- Transportation and Logistics

- Agriculture and Forestry

- Energy and Power

- Environment

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.