Satellite NTN Market Size, Share & Trends Analysis Report By Service Component (Satellite Infrastructure, Network Services, Managed Security Services, Ground Segment and Terminal Equipment, System Integration), By Orbit Type (Low Earth Orbit (LEO), Medium Earth Orbit (MEO), Geostationary Orbit (GEO), Highly Elliptical Orbit (HEO)), By Frequency Band (L-Band, S-Band, C-Band, Ku-Band, Ka-Band), By Application (Broadband internet access, Direct-to-Device (D2D) connectivity, Backhaul and network extension, IoT/M2M connectivity, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Satellite NTN Market Overview

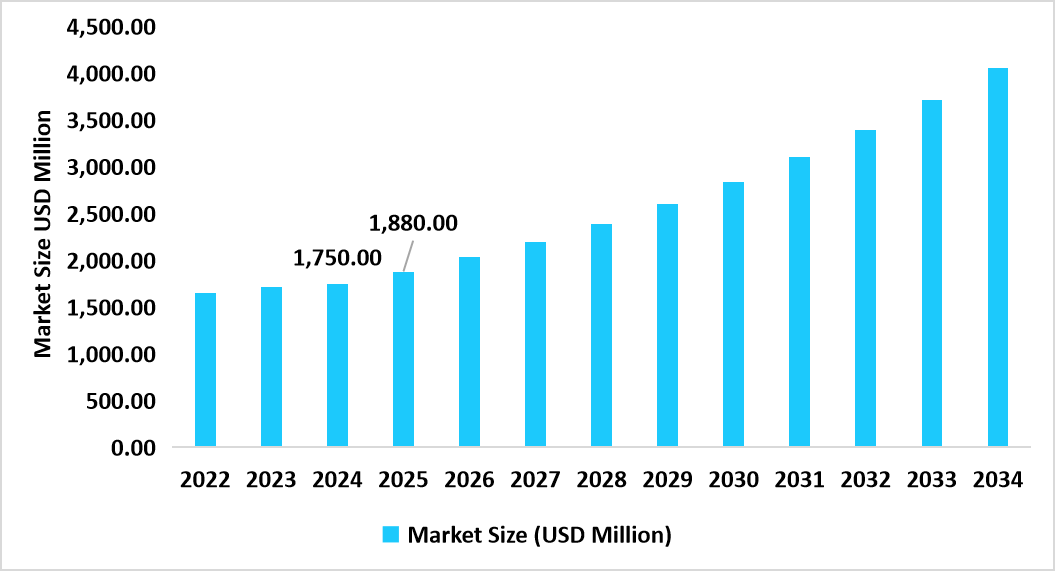

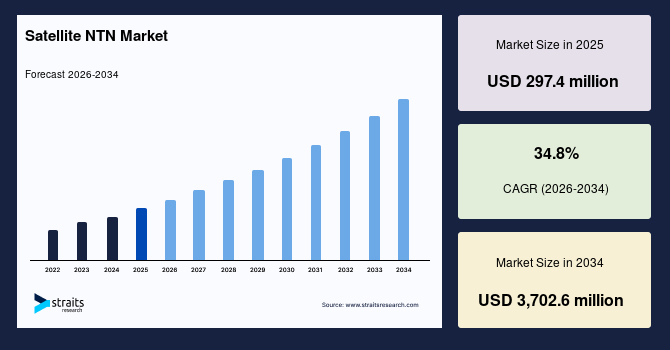

The global satellite NTN market size is valued at USD 297.4 million in 2025 and is estimated to reach USD 3,702.6 million by 2034, growing at a CAGR of 34.8% during the forecast period. The rapid expansion of the market is driven by increasing demand for seamless coverage beyond terrestrial network reach, strong adoption of direct-to-device satellite connectivity, and accelerating deployments of 5G-NTN architecture, which enable reliable broadband, IoT, and mission-critical communications across remote, maritime, and aviation environments.

Key Market Trends & Insights

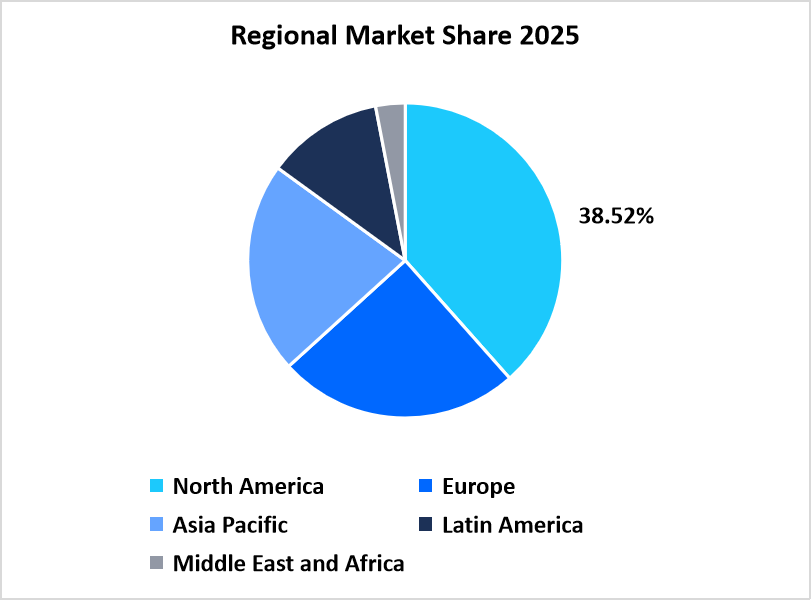

- North America dominated the market with a revenue share of 38.52% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 37.94% during the forecast period.

- Based on Service Component, the Network Services segment held the highest market share of 44.61% in 2025.

- By Orbit Type, the LEO segment is estimated to register the fastest CAGR growth of 36.82%.

- Based on Frequency Band, the Ka-Band segment dominated the market with a revenue share of 42.37% in 2025.

- By Application, Direct-to-Device (D2D) connectivity is expected to grow at the fastest CAGR of 38.21% during the forecast period.

- The U.S. dominates the Satellite NTN market, valued at USD 113.9 million in 2024 and reaching USD 128.5 million in 2025.

Table: U.S Satellite NTN Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 297.4 million

- 2034 Projected Market Size: USD 3,702.6 million

- CAGR (2026-2034): 34.8%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global market integrates advanced satellite-based communication services, including network services, managed services, and professional services that ensure seamless connectivity beyond traditional terrestrial infrastructure. These services are delivered via multiple orbital configurations such as Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Orbit (GEO), leveraging diverse frequency bands like L-band, S-band, C-band, Ku-band, and Ka-band to support high-capacity transmission.

Satellite NTN offerings include broadband internet access, satellite IoT and M2M communication, maritime and aeronautical connectivity, and public safety communications. The ecosystem is driven by applications such as direct-to-device (D2D) communication, enterprise and industrial networks, government and defense operations, and mobility platforms across aviation and maritime sectors. Delivered globally across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, Satellite NTN solutions enable reliable, resilient, and scalable communication capabilities to enhance digital inclusivity and enable connected services worldwide.

Latest Market Trends

LEO-Driven Acceleration of 5G and IoT Ecosystems

Low Earth Orbit (LEO) satellites are quickly revolutionizing the network environment with lower latency and higher bandwidth capacity for sophisticated cellular and IoT use cases. Satellite communication previously came with high signal delay and narrowband constraints, limiting uptake in latency-sensitive services. With tens of thousands of LEO satellites launched around the world, NTN integration into 5G standards is enabling real-time applications including autonomous logistics, precision agriculture, and factory automation across hitherto inaccessible points. This growth is driving exponential connectivity for devices, enabling IoT deployments to expand beyond the boundaries of terrestrial networks.

Direct-to-Device (D2D) Becomes a Consumer Connectivity Revolution

A fundamental shift is happening as everyday smartphones acquire the power of directly communicating with satellites without the need for external hardware. Previously, satellite connections were reserved for specialized hardware, expensive terminals, and business-centric solutions. Now, chipset makers and satellite operators are supporting native satellite messaging, voice, and broadband capabilities, transforming universal connectivity into a mainstream consumer solution. This trend is quickly growing demand for broadband emergency alerts, rural broadband, and mobile-first services — making D2D one of the most disruptive revenue drivers in the market.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 297.4 million |

| Estimated 2026 Value | USD 400.9 million |

| Projected 2034 Value | USD 3,702.6 million |

| CAGR (2026-2034) | 34.8% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Airbus, Analog Devices, Inc., Bae Systems, Filtronic Plc, Honeywell International Inc. |

to learn more about this report Download Free Sample Report

Market Driver

5G and IoT Growth Needing Beyond-Terrestrial Scalability

With 5G and massive IoT implementations growing worldwide, terrestrial networks are no longer sufficient to cater to coverage demands of industries working in remote, maritime, and aerospace settings. Satellite NTN complements cellular network coverage by offering ultra-wide area connectivity for smart farming, mining automation, maritime shipping, and extensive environmental monitoring initiatives. National smart infrastructure projects are increasingly embracing satellite-supported IoT for real-time tracking of transportation fleets, pipelines, borders, and climate-sensitive assets. Such a need for widespread data networks is fueling a high-growth cycle of adoption of satellite NTN systems.

Market Restraint

Strict Space Traffic and Debris Policies Retarding Constellation Expansion

The quick escalation of satellite launches has fueled concerns about orbital congestion and collision hazards. Government-sponsored space junk mitigation protocols necessitate careful monitoring, controlled de-orbiting, and operational transparency for satellites. As regulators like NASA and global rule-making coalitions roll out more stringent compliance requirements, operators are subjected to longer approval timelines to scale LEO constellations. This increased regulation, though essential for safety, constitutes a hurdle to scaling satellite NTN infrastructure at the speed commercial marketplaces demand.

Market Opportunity

Boost in Direct-to-Device (D2D) Partnerships with Telecommunication Operators

The significant opportunities for the Satellite NTN industry emanates from quickly expanding partnerships between satellite operators and large mobile network carriers to provide direct satellite communication to regular consumers. These partnerships open up the prospect of transparent roaming across terrestrial and non-terrestrial networks, keeping smartphones and consumer IoT devices connected even in situations where there is minimal or no cellular coverage. As consumer dependence on unbroken connectivity continues to grow — including for travel, transportation, and outdoor use satellite services empowered by D2D are becoming a highly sought-after commercial opportunity, enabling new subscription-based revenue streams and increased global connectivity access.

Regional Analysis

North America was the market leader in 2025 with 38.52% of the world's revenue share. The reason behind its success lies in strong satellite infrastructure, early 5G-NTN standardization, and strong collaboration between telecom operators, defence agencies, and satellite organizations. The region has a well-developed space environment based on innovation in low Earth orbit (LEO) constellations and inter-satellite link technologies.

Further, growing government interest in extending rural broadband penetration using satellite-based technology has provided market leadership a fillip. Private satellite producers and telecommunication carriers joining hands through strategic partnerships are spurring mass-scale incorporation of satellite backhaul and direct-to-device services in far-flung and underpenetrated regions.

The United States is the prime growth driver of North America's Satellite NTN market. Ongoing investments in LEO constellations, next-generation antenna systems, and edge-compute-capable payloads are reshaping the horizon of space-based communications. U.S. network operators are increasingly rolling out 5G-NTN testbeds that can enable smartphone access even beyond terrestrial cell tower coverage. In addition, the acceleration in enterprise use of satellite IoT applications in logistics, maritime, and defense sectors is fueling long-term market growth. The nation is also seeing an increase in private-sector engagement via startups and aerospace companies leading the way with hybrid space-terrestrial architectures, solidifying the U.S. position as a worldwide hub of innovation for NTN solutions.

Asia Pacific Market Insights

Asia Pacific is becoming the fastest-growing region, expected to grow at a CAGR of 37.94% from 2026–2034. The region's rapid digitalization, complemented by national connectivity initiatives in India, Japan, and Australia, is driving NTN adoption. The governments within the region are placing emphasis on satellite broadband for disaster response management, remote learning, and rural telecommunication services. The growing visibility of regional satellite operators, strategic partnerships between telecom companies and space technology startups, and expanding smallsat manufacturing capacities also fortify Asia Pacific's competitive edge. The introduction of LEO-based satellite networks for high-throughput and low-latency purposes is poised to transform mobile broadband and IoT connectivity over geographically varied terrain.

India's Satellite NTN market is rapidly accelerating with a push from the government's initiatives for commercializing space and heavy private sector investment. The country's drive towards universal internet connectivity through space-based networks is driving NTN integration in telecom, defense, and transportation industries. Major local contenders are investing in domestic LEO constellations and multi-orbit systems to provide cost-effective broadband and IoT services to rural and remote areas. Additionally, telecom operator and space startup partnerships are moving forward with 5G NTN trials for direct-to-device communications. India's new position as a regional satellite production center, helped by easing of FDI guidelines and increasing involvement of new-space players, is cementing its place as one of the fastest-growing markets in the Asia Pacific NTN ecosystem.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe is witnessing intense development in the Satellite Non-Terrestrial Network (NTN) market through massive investment in next-generation LEO and MEO constellations, as well as the strong digital inclusion culture of the region. The wide use of hybrid terrestrial-satellite networks for 5G roll-out is enhancing broadband penetration across rural areas of Southern and Eastern Europe. Moreover, European space companies are driving satellite-to-smartphone interoperability trials jointly with mobile operators, improving cross-border mobile connectivity and disaster recovery. Increasing demand for environmentally friendly satellite design and between-operator spectrum coordination also reinforces Europe's dominance in NTN ecosystem growth.

Germany's Satellite NTN market is growing impressively, backed by a boom in industrial IoT connectivity demand and next-generation aerospace communication technology. The nation's leading telecommunication carriers are partnering with commercial satellite operators to roll out direct-to-device (D2D) services to enhance connectivity in logistics routes, shipping lanes, and automotive telematics. In addition, research centers and space-tech start-ups are creating next-generation phased-array antenna systems that are designed for low-latency NTN communications. The focus on digital industrialization and autonomous mobility solutions is also driving NTN integration within Germany's manufacturing and transport industries, making the country one of the most prominent hubs of innovation in Europe's NTN landscape.

Latin America Satellite Non-Terrestrial Network (NTN) Market Insights

The Latin America market is spearheaded by Brazil, Mexico, and Chile, with growing rural broadband initiatives and new small satellite programs changing regional connectivity. Private telecom companies are using satellite-based networks to offer low-cost mobile broadband and enterprise IoT services to remote and underdeveloped areas. Strategic collaborations between Latin American carriers and international satellite providers also are fostering cross-border coverage for aviation and maritime markets, enhancing the region's communications infrastructure. The emphasis on embedding satellite backhaul within 5G deployments is fueling NTN deployments across Latin America.

Brazil's Satellite NTN market is experiencing fast uptake as large telecom corporations partner with space-technology startups to develop multi-orbit connectivity offerings. The programs are focused on enhancing mobile coverage in Amazonian regions, offshore oil fields, and agriculture areas. Indigenous innovation centers are also facilitating smallsat production and NTN software development, raising the nation's competitiveness in space-tech. The adoption of satellite communication for precision farming, emergency services, and distance learning demonstrates Brazil's increasing position as a regional hub in next-generation satellite connectivity.

Middle East and Africa Market Insights

The Middle East and Africa region is experiencing growing emphasis on Satellite NTN solutions to enhance digital infrastructure, particularly in nations heavily investing in smart city and defense communication initiatives. Regional operators are focusing on satellite broadband and 5G NTN integration to provide connectivity over deserts, offshore facilities, and remote communities. Increasing collaboration among mobile network operators and international satellite companies are facilitating cross-border service continuity, enabling aviation, mining, and energy industries throughout the region.

South Africa's Satellite NTN market is picking up steam as telecom operators and domestic satellite companies work together to increase country-wide broadband coverage. Satellite IoT solutions for utility management, logistics tracking, and farm monitoring are driving NTN demand in the country's increasing usage. Private companies are also investing in next-generation user terminals optimized for low-latency satellite connectivity to facilitate seamless data exchange in underserved industries. This intersection of business innovation and connectivity growth is making South Africa a strategic deployment hub for NTNs in the MEA region.

Service Component Insights

The Network Services segment led the Satellite NTN market with a revenue share of 44.61% in 2025. This dominance is due to the upsurge in worldwide demand for flawless satellite-supported broadband and IoT connectivity, particularly among remote industrial, maritime, and mobility-based operations.

The System Integration segment is likely to grow at the highest CAGR of 38.45% over the forecast period. Growth is mainly dictated by the necessity to integrate heterogeneous satellite constellations, ground systems, and telecom networks into interoperable frameworks.

By Service Component Market Share (%), 2025

Source: Straits Research

Orbit Type Insights

The Geostationary Orbit (GEO) segment accounted for the highest revenue percentage share of 39.74% in 2025. This is supported by the broad use of GEO satellites in fixed broadband communication, TV broadcasting, and secure government networks.

The Low Earth Orbit (LEO) segment is anticipated to witness the highest growth rate, achieving a forecasted CAGR of around 36.82% over the forecast period. This strong growth is attributed to the rapid expansion of LEO constellations enabling low-latency broadband and real-time data transmission for applications such as IoT connectivity, remote sensing, and direct-to-device communication.

Frequency Band Insights

Ka-Band segment ruled the Satellite NTN market in 2025 with a revenue share of 42.37%. The leadership is mainly fueled by the fact that the band offers better bandwidth efficiency, which provides high-speed broadband access, video streaming, and enterprise-class communication services.

The S-Band segment is expected to grow the most over the forecast period, driven by growing adoption of satellite-to-smartphone communication and robust mobile backhaul solutions. Its ability to offer dependable connectivity during challenging weather conditions and high-density environments positions it well for the use in critical communication and emergency alert networks.

Application Insights

Direct-to-Device (D2D) connectivity segment is expected to expand at the highest CAGR of 38.21% through the forecast period, boosted by growing integration of satellite links into consumer smartphones and IoT devices. As satellite providers and mobile network operators join hands to provide terrestrial coverage into remote and underserved areas, D2D services are also emerging as a major facilitator of global seamless connectivity.

Competitive Landscape

The global Satellite Non-Terrestrial Network (NTN) market is fragmented and is dominated by top-ranked aerospace, defense, and semiconductor companies that are aggressively building next-generation satellite communication ecosystems. A limited number of prominent players occupy a significant share in the market due to their rich product portfolios, satellite constellation networks, and long-term partnerships with telecom operators and government agencies.

Key players in the market comprise Airbus, Analog Devices, Inc., BAE Systems, and a host of up-and-coming satellite technology companies. These market stalwarts are fortifying their competitive holds by way of strategic alliances, massive satellite deployment initiatives, and NTN solutions' integration with terrestrial 5G infrastructures. Moreover, unabated merger and acquisition activities along with cross-industry partnerships are allowing these players to enhance their geographic reach and ramp up innovation in next-gen low-latency satellite communication technologies.

OQ Technology: An emerging market player

OQ Technology is a Luxembourg satellite communications firm focusing on 5G Non-Terrestrial Network (NTN) infrastructure, providing end-to-end IoT and direct-to-mobile connectivity solutions. It stands out by creating end-to-end satellite-based 5G networks that combine low Earth orbit (LEO) constellations with terrestrial mobile networks.

- In September 2025, OQ Technology launched its “5NETSAT” project, deploying ten LEO satellites along with dedicated ground infrastructure to enable global NB-IoT services. This initiative targets underserved sectors such as agriculture, mining, and utilities, enhancing connectivity in remote industrial environments and strengthening OQ Technology’s footprint in the expanding Satellite NTN ecosystem.

As a result, OQ Technology has become a prominent company in the market worldwide, utilizing strategic funding and multi-region deployment strategies to further establish its place in satellite-to-mobile connectivity for IoT ecosystems and enterprise.

List of Key and Emerging Players in Satellite NTN Market

- Airbus

- Analog Devices, Inc.

- Bae Systems

- Filtronic Plc

- Honeywell International Inc.

- L3Harris Technologies

- Mini-Circuits

- Qorvo, Inc.

- Smiths Interconnect

- SWISSto12

- Teledyne Technologies

- Thales Alenia Space

- SpaceX

- OneWeb

- Amazon Kuiper

- SES S.A.

- Eute SatixFy

- Mynaric AG

- lsat Group

- Telesat

- Others

Strategic initiative

- June 2025: Cubic³ and SoftBank Corp. formed a strategic partnership to integrate satellite-based non-terrestrial networks with terrestrial networks for software-defined vehicles (SDVs) and other mobile assets.

- March 2025: Space42 and Viasat, Inc. announced a Memorandum of Understanding to explore a shared multi-orbit 5G NTN infrastructure. The collaboration will target use cases including D2D and next-generation mobile satellite services across L-band, S-band and terrestrial spectrum.

- February 2025: Skylo Technologies, Inc. raised USD 30 million in a funding round to scale its direct-to-device satellite network worldwide. This funding supports deployment across five continents and expands IoT connectivity in Brazil, Australia, and New Zealand.

- October 2024: Kratos Defense & Security Solutions, Inc. and Radisys Corporation entered a partnership to develop a cloud-native 5G-NTN platform under their “OpenSpace” brand. The solution aims to enable seamless satellite access for terrestrial networks and capitalize on the $35 billion revenue opportunity in NTN over the next decade.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 297.4 million |

| Market Size in 2026 | USD 400.9 million |

| Market Size in 2034 | USD 3,702.6 million |

| CAGR | 34.8% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service Component, By Orbit Type, By Frequency Band, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Satellite NTN Market Segments

By Service Component

- Satellite Infrastructure

- Network Services

- Managed Security Services

- Ground Segment and Terminal Equipment

- System Integration

By Orbit Type

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

- Highly Elliptical Orbit (HEO)

By Frequency Band

- L-Band

- S-Band

- C-Band

- Ku-Band

- Ka-Band

By Application

- Broadband internet access

- Direct-to-Device (D2D) connectivity

- Backhaul and network extension

- IoT/M2M connectivity

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.