Ship Repair and Maintenance Service Market Size, Share & Trends Analysis Report By Vessel Type (Cargo Ships, Tankers, Container Ships, Passenger Ships & Ferries, Offshore Vessels, Naval Ships, Fishing Vessels, Others), By Location of Service (Onshore, Offshore), By Application (General Services, Dockage, Engine Parts, Electric Works, Auxiliary Services, Others), By End-user (Government & Defense, Commercial) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Ship Repair and Maintenance Service Market Size

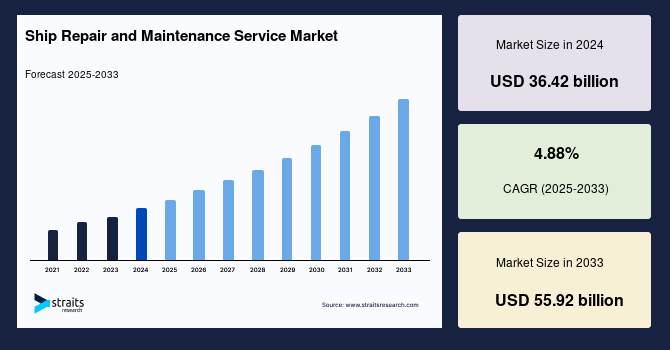

The global ship repair and maintenance service market size was valued at USD 36.42 billion in 2024 and is estimated to grow from USD 38.20 billion in 2025 to reach USD 55.92 billion by 2033, growing at a CAGR of 4.88% during the forecast period (2025–2033).

A major driver of the global market is the aging global fleet, with many vessels over 15–20 years old requiring frequent repairs to maintain operational efficiency and safety. This aging fleet drives demand for regular dry-docking, engine overhauls, and structural inspections.

Additionally, the expansion of the cruise and offshore energy sectors contributes significantly to market growth. Cruise liners and offshore support vessels operate in challenging environments and under strict safety standards, requiring continuous maintenance. The rise in mechanical failures and corrosion-related issues due to prolonged sea exposure further accelerates the need for timely repairs.

Moreover, government-led investments in expanding shipyard capacity and modernizing maritime infrastructure in key regions such as China, Singapore, and the UAE are making repair services more accessible and efficient, encouraging shipowners to undertake regular maintenance and boosting market momentum.

Latest Market Trend

Digitalization in Maintenance Services

Digitalization is transforming the ship repair and maintenance services market through the integration of IoT, AI, and real-time monitoring tools. These technologies enable predictive maintenance by continuously analyzing vessel data to identify wear and tear before failure occurs.

- In February 2025, the U.S. Navy equipped the USS Fitzgerald with Enterprise Remote Monitoring v4 (ERM v4), an AI/ML system developed by Fathom5 to enhance onboard predictive maintenance. The system processes 10,000 sensor readings per second, detecting early signs of component failure and prompting proactive part replacements. This real-world application significantly cuts downtime, keeping critical vessels mission-ready.

Commercial shipping firms are now adopting similar AI-powered systems to reduce maintenance costs, minimize unplanned outages, and extend vessel life cycles. As digital solutions prove effective in high-stakes scenarios, the maritime sector is rapidly embracing smart maintenance practices for long-term operational efficiency.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 36.42 Billion |

| Estimated 2025 Value | USD 38.20 Billion |

| Projected 2033 Value | USD 55.92 Billion |

| CAGR (2025-2033) | 4.88% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Damen Shipyards Group, Hyundai Mipo Dockyard Co., Ltd., Sembcorp Marine Ltd., China Shipbuilding Industry Corporation (CSIC), Fincantieri S.p.A. |

to learn more about this report Download Free Sample Report

Ship Repair and Maintenance Service Market Growth Factor

Expanding Global Seaborne Trade

The steady expansion of global seaborne trade continues to be a major driver for the ship repair and maintenance service market. As maritime transport remains the backbone of international trade, the need to ensure vessels are operational, compliant, and efficient is paramount.

- According to UNCTAD, global seaborne trade grew by 2.4% in 2023, reaching approximately 12.3–12.4 billion tonnes. The organization projects a continued annual growth rate of around 2% in 2024 and about 2.4% per year through 2029, driven by rising global trade demands.

This surge in shipping activity leads to increased wear and tear on vessels, necessitating more frequent and sophisticated maintenance services. Ports, shipyards, and service providers are scaling up their capacities to meet this demand, especially in high-traffic maritime hubs, thereby fueling growth in the global ship repair and maintenance service market.

Market Restraint

High Capital and Operational Costs

One of the primary restraints in the global ship repair and maintenance service market is the high capital and operational costs involved. Establishing and maintaining shipyards and dry docks and acquiring specialized equipment demand significant investment. Additionally, employing skilled technicians and engineers adds to labor costs, especially in developed regions.

Shipowners also face revenue losses during vessel downtime, making them hesitant to opt for routine or preventive maintenance. Smaller shipping companies, in particular, struggle with affordability, often postponing necessary repairs, which can compromise vessel safety and compliance. These financial challenges limit the widespread adoption of repair services and hinder market growth, especially during periods of economic uncertainty.

Market Opportunity

Stringent Maritime Regulations

The growing imposition of stringent maritime regulations presents a significant opportunity for the ship repair and maintenance service market. As environmental concerns intensify, global regulatory bodies are enforcing stricter emission norms and operational standards for the shipping industry.

- For instance, the IMO's NetZero Framework is projected to be formally adopted in October 2025 and become effective from March 2027, with compliance starting January 1, 2028. It includes a global carbon-pricing mechanism (~$100/ton CO₂) and mandatory fuel intensity reductions of 30% by 2035 and 65% by 2040, driving demand for retrofitting with alternative-fuel systems like LNG, ammonia, and wind-assist technologies.

Such measures compel shipping companies to upgrade engines, install scrubbers, and implement energy-saving devices. As a result, specialized shipyards and service providers are seeing increased contracts for compliance retrofits and maintenance, opening long-term business opportunities globally.

Regional Analysis

North America dominates the ship repair and maintenance market due to the rising maritime defense budgets, increased vessel refurbishment programs, and the presence of advanced shipyards. The region emphasizes the modernization of commercial and naval fleets with eco-compliant upgrades. Technological adoption in predictive maintenance and automation also supports market expansion. Additionally, increased cruise ship traffic and port infrastructure development are fueling demand for scheduled maintenance and repair services. The region benefits from strong regulatory enforcement, ensuring timely inspection and upkeep of vessels, further driving the ship maintenance industry forward.

United States Market Trends

The U.S. ship repair and maintenance market benefits from its vast commercial fleet, naval strength, and inland waterways. Major facilities like the Detyens Shipyards (South Carolina) and BAE Systems Ship Repair (Virginia) handle the maintenance of cargo ships, tankers, and military vessels. The Jones Act also ensures domestic ship servicing, while ports like Los Angeles and Houston witness rising demand for eco-compliant retrofits such as scrubber installations and LNG conversions.

Canada's ship repair and maintenance market is driven by strong naval and commercial fleet operations, especially along the Atlantic and Pacific coasts. The Halifax Shipyard in Nova Scotia plays a key role in defense ship maintenance under the National Shipbuilding Strategy. Additionally, Vancouver Drydock offers advanced services for cruise vessels and bulk carriers, supporting trade along the Pacific corridor and Arctic expeditionary fleets requiring specialized upkeep.

Asia-Pacific's Market Trends

Asia Pacific holds a prominent share in the global ship repair and maintenance service market due to its vast commercial shipping traffic, cost-effective labor, and expanding port infrastructure. The region's dominance in global shipbuilding translates into a steady aftermarket for repair and retrofit services. Increasing investments in dry dock expansions and floating repair facilities are enhancing service capabilities. Furthermore, the growing presence of regional shipping operators and the rise in coastal shipping activities support continuous maintenance demand. With stricter maritime emission rules being implemented, the region is also seeing growth in green retrofitting and regulatory-compliant maintenance.

China's Market Growth Factors

China's ship repair and maintenance market is driven by its robust maritime infrastructure and global shipbuilding leadership. Major ports like Shanghai, Guangzhou, and Qingdao offer advanced dry-docking and retrofitting facilities. For example, COSCO Shipping Heavy Industry delivers comprehensive services to international fleets. With increasing green retrofits post-IMO 2020, China's dominance in ballast water system installations and scrubber retrofits has significantly strengthened its position in the global market.

Indian Market Trends

India's ship repair and maintenance market is expanding rapidly due to its strategic coastline and government initiatives like the Sagarmala project. Key players such as Cochin Shipyard and Hindustan Shipyard are enhancing capabilities in hull repairs, engine overhauls, and warship maintenance. For instance, Mazagon Dock provides naval vessel servicing. Additionally, India is emerging as a cost-effective destination for third-party commercial ship repair, attracting vessels from the Middle East and Africa.

Middle East and Africa's Market Insights

The Middle East and Africa region is experiencing notable growth in the ship repair and maintenance service market due to increasing maritime trade, expanding port infrastructure, and a rising fleet of commercial and offshore vessels. Strategic positioning along key global shipping lanes boosts demand for drydocking and emergency repair services. Governments are investing in modernizing shipyards and offering incentives to attract global maritime players. Additionally, the region's growing oil and gas activities support maintenance demand for offshore support vessels, driving long-term market opportunities across coastal economies.

Uae Market Trends

The UAE ship repair and maintenance market is thriving due to its strategic maritime hubs like Dubai Drydocks and Khalifa Port. The UAE's strong maritime infrastructure supports large vessels and offshore rigs. For instance, Drydocks World handled over 300 projects in 2023, including VLCCs and LNG carriers. The country's focus on green retrofits and digital diagnostics is enhancing its global competitiveness in ship repair and maintenance services.

Qatar's ship repair and maintenance market is growing steadily, driven by its LNG exports and marine logistics linked to Ras Laffan Port. Nakilat's Erhama Bin Jaber Al Jalahma Shipyard is central to Qatar's repair ecosystem, handling LNG tankers and offshore support vessels. In 2023, the shipyard serviced over 100 vessels. Government support and proximity to key shipping routes further boost Qatar's position in the regional maritime maintenance sector.

Vessel Type Insights

Cargo ships form a significant share of the global ship repair and maintenance service market due to their extensive role in international trade. Frequent long-haul operations lead to higher wear and tear, requiring regular maintenance, including hull cleaning, engine overhauls, and structural repairs. Rising global freight movement and port-to-port connectivity further fuel service demand. Additionally, regulatory pressure for emission control and energy efficiency upgrades is pushing operators to invest in periodic retrofitting and modern repair solutions for cargo fleets.

Location of Service Insights

The onshore segment dominates the market as most ship repair and maintenance activities are conducted in dockyards and dry docks equipped with specialized infrastructure. Onshore facilities provide access to a broader range of skilled labor, advanced machinery, and spare parts, ensuring efficient service delivery. Cost-effectiveness and logistical convenience also make onshore repairs preferable over offshore alternatives. Increasing investments in expanding and modernizing shipyards across Asia-Pacific and Europe are further boosting the demand for onshore maintenance services globally.

Application Insights

The general services segment holds a prominent share of the market, encompassing routine inspections, preventive maintenance, and standard repairs essential for vessel safety and operational efficiency. These services are performed regularly to ensure compliance with international maritime regulations. As shipowners prioritize minimizing downtime and extending vessel life, the demand for reliable and timely general maintenance continues to grow. The segment benefits from recurring service contracts, especially among commercial fleet operators, contributing significantly to the overall market revenue.

End-User Insights

The government & defense segment leads the market due to consistent demand for the maintenance of naval ships and coast guard fleets. National security requirements necessitate high operational readiness, prompting frequent and comprehensive maintenance routines. Government contracts ensure steady revenues and long-term service agreements for shipyards and maintenance providers. Moreover, increasing defense budgets, particularly in countries like the U.S., China, and India, are driving investments in naval modernization and support infrastructure, thereby solidifying this segment's dominance in the global market.

Company Market Share

Companies in the ship repair and maintenance service market are focusing on expanding dry dock facilities, investing in advanced diagnostic tools, and integrating digital technologies like AI and IoT for predictive maintenance. They are also forming strategic partnerships with shipping lines and port authorities to secure long-term contracts. Additionally, many are enhancing workforce training and adopting eco-friendly practices to align with environmental regulations and attract environmentally conscious clients.

Hyundai Mipo Dockyard Co., Ltd.

Hyundai Mipo Dockyard (HMD), founded in April 1975 and publicly listed in December 1983, is a subsidiary of HD Hyundai and headquartered in Ulsan, South Korea. It began as a ship repair yard and transitioned into shipbuilding, specializing in midsized vessels such as product/chemical tankers, container ships, LPG/LNG carriers, ferries, and offshore support ships. HMD operates four large dry docks capable of handling vessels up to 400,000 DWT and has repaired over 8,000 ships while delivering around 70 new builds annually.

- In March 2025, Hyundai Mipo Dockyard delivered South Korea’s first hybrid diesel-electric Ro-Ro vessel, “Chaumine,” built for CLdN. The ship features twin shaft lines and enhanced fuel efficiency, representing a significant step toward sustainable maritime transport. This development aligns with the industry's shift toward greener and energy-efficient vessel technologies.

List of Key and Emerging Players in Ship Repair and Maintenance Service Market

- Damen Shipyards Group

- Hyundai Mipo Dockyard Co., Ltd.

- Sembcorp Marine Ltd.

- China Shipbuilding Industry Corporation (CSIC)

- Fincantieri S.p.A.

- Keppel Offshore & Marine

- Singapore Technologies Engineering Ltd.

- Huntington Ingalls Industries, Inc.

- Babcock International Group PLC

- Mazagon Dock Shipbuilders Limited

Recent Developments

- May 2025- Hyundai Mipo Dockyard signed an MoU with Lloyd’s Register to implement digital twin technology and smart quality assurance for Type C cargo tanks used in LNG and CO₂ carriers. This collaboration aims to enhance design accuracy, operational safety, and inspection efficiency through advanced digital engineering and real-time performance monitoring.

- February 2025- Cochin Shipyard Ltd (CSL) and Deendayal Port Authority (DPA) are investing ₹1,750 crore to develop a state‑of‑the‑art ship repair hub at Vadinar, Gujarat. DPA will fund ₹700 crore for jetty and civil works, while CSL will install two floating dry docks (₹1,050 crore). The facility, with DPR submitted, will service up to 32 vessels annually.

- February 2025- Damen Shipyards unveiled its new Logistics Support Ship (LSS) range—two vessels (LSS 9000 at 127 m and LSS 11000 at 140 m)—equipped with NATO-standard replenishment‑at‑sea systems, Ro‑Ro cargo capability, modern navigation/communication systems, and modular configurations. These ships are designed for sustained deployments, enhanced fleet reach, and cost‑effective logistical support.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 36.42 Billion |

| Market Size in 2025 | USD 38.20 Billion |

| Market Size in 2033 | USD 55.92 Billion |

| CAGR | 4.88% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Vessel Type, By Location of Service, By Application, By End-user |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Ship Repair and Maintenance Service Market Segments

By Vessel Type

- Cargo Ships

- Tankers

- Container Ships

- Passenger Ships & Ferries

- Offshore Vessels

- Naval Ships

- Fishing Vessels

- Others

By Location of Service

- Onshore

- Offshore

By Application

- General Services

- Dockage

- Engine Parts

- Electric Works

- Auxiliary Services

- Others

By End-user

- Government & Defense

- Commercial

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.