Sintered Steel Market Size, Share & Trends Analysis Report By Type (Stainless Steel, Carbon Steel, Alloy Steel, Tool Steel), By Application (Automotive, Machinery and equipment) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Sintered Steel Market Size

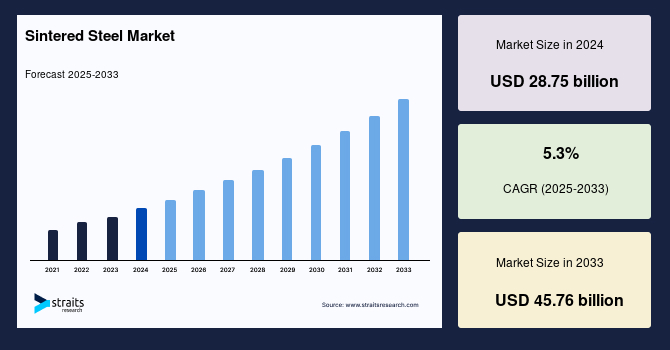

The global sintered steel market size was valued at USD 28.75 billion in 2024 and is projected to reach from USD 30.27 billion in 2025 to USD 45.76 billion by 2033, registering a CAGR of 5.3% during the forecast period (2025-2033).

The growing emphasis on producing metal parts cheaply with less waste and greater accuracy is expected to fuel the market growth, particularly in the automotive industry. Sintered steel is made by compacting and heating powdered metal particles to form a solid mass that does not melt. Sintered steel is widely employed in various industries due to its distinct features and advantages.

The rise of the sintered steel market is analogous to the increase of a well-forged blade steady, strong, and shaping the destiny of several sectors. Sintered steel components are becoming increasingly important in the automobile industry, where lightweighting and fuel efficiency are key drivers. Sintered steel is utilized in electric motor components, and the demand for electric vehicles contributes to the increase. Furthermore, the expanding consumer electronics industry and the rising need for precise components in manufacturing drive growth. The ability of sintered steel to make complicated shapes while maintaining high strength adds to its popularity

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 28.75 Billion |

| Estimated 2025 Value | USD 30.27 Billion |

| Projected 2033 Value | USD 45.76 Billion |

| CAGR (2025-2033) | 5.3% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | GKN Hoeganaes Corporation - USA, Sumitomo Electric Industries, Ltd. - Japan, Miba AG - Austria, Sintex a/s - Denmark, SMC Powder Metallurgy Inc. - USA |

to learn more about this report Download Free Sample Report

Sintered Steel Market Growth Factor

Increasing Demand from the Automotive Industry

The automotive sector is a significant consumer of sintered steel components used in various applications, including transmission systems, engine parts, chassis components, and steering mechanisms. Sintered steel elements, such as gears, bearings, bushings, and structural components, are critical to modern cars' performance, dependability, and efficiency.

Additionally, the rising demand for sintered steel components in the automotive sector is driven by increased global vehicle production, a growing trend toward lightweighting to improve fuel efficiency and reduce emissions, and a need for high-performance, cost-effective solutions. According to Statista, worldwide car manufacturing in 2023 is expected to reach 94 million, a 10% rise from 2022. Global light vehicle production will rise 10.1% to 90.9 million units in Q4 2023.

Moreover, sintered steel components provide various benefits for automotive applications, including a high strength-to-weight ratio, dimensional accuracy, wear resistance, and cost-effectiveness. These features make them ideal for critical automotive systems that require high durability, precision, and efficiency. Using sintered steel components allows car makers to achieve high performance, safety, and regulatory demands while improving vehicle performance, decreasing weight, and increasing fuel efficiency. Sintered steel components improve modern vehicles' overall performance, reliability, and sustainability, resulting in widespread acceptance across automotive platforms.

Market Restraint

Competition from Alternative Materials

Sintered steel components compete with cast iron, aluminum, and composites in automotive applications. Automotive producers, for example, may use cast iron for elements such as engine blocks and brake rotors because of its superior heat dissipation and wear resistance. Similarly, aluminum is recommended for lightweighting applications like engine blocks, gearbox cases, and structural components, as it reduces weight and improves fuel efficiency.

Furthermore, composites such as carbon fiber reinforced polymers (CFRP) are becoming more popular in vehicle body panels and structural components due to their high strength-to-weight ratio and design versatility. Regulatory demands are pushing the growing use of lightweight materials in automobile manufacturing for fuel efficiency and emissions reduction, consumer demand for fuel-efficient vehicles, and improvements in material technologies. Aluminum, composites, and advanced high-strength steels (AHSS) are some of the most common lightweight materials utilized in automotive applications to reduce weight and increase performance.

Additionally, the availability of alternative materials presents a competitive challenge for sintered steel components in the automotive and other industries. Cost, performance needs, weight considerations, design limits, and regulatory compliance are all variables that automotive manufacturers consider when evaluating material possibilities. While sintered steel has benefits such as cost-effectiveness, dimensional accuracy, and high strength, it may have limits in weight reduction and design flexibility compared to other materials such as aluminum and composites.

Market Opportunity

Increasing Adoption of Electric Vehicles

The global automotive industry is shifting significantly toward electric vehicles as governments tighten emission restrictions and customers want cleaner, more sustainable transportation options. Major manufacturers are investing considerably in electric vehicle technologies and extending their EV product lineups. As the production of electric vehicles grows, so will the demand for sintered steel components used in them, providing chances for sintered steel makers to enhance their market share and revenue. By 2030, electric vehicles will account for 62% to 86% of global sales, with China having at least 90% of the EV market.

Furthermore, cost-effectiveness is an essential aspect of the mass manufacture of electric vehicles. Sintered steel has several advantages, including cost-effectiveness, mass production capabilities, and appropriateness for high-volume manufacturing, making it an appealing option for car makers looking for economical EV component solutions. Sintered metal can cost between USD 0.8 and USD 0.89 per piece FOB, with a minimum order quantity of 2,000 pieces. Sintered steel components strike a mix between performance, durability, and cost, allowing OEMs to satisfy cost targets while still providing high-quality electric vehicles to customers.

Moreover, electric vehicles are intended to be more energy efficient and ecologically friendlier than conventional internal combustion engine automobiles. Sintered steel components improve electric vehicles' overall efficiency and sustainability by lowering weight, increasing energy efficiency, and reducing environmental effects. Using sintered steel components in EVs coincides with the industry's emphasis on sustainability and resource efficiency, boosting the acceptance of sintered steel in electric vehicle applications.

Regional Analysis

Asia-Pacific is the most significant global market shareholder and is estimated to grow at a CAGR of 5.7% over the forecast period. This region has a substantial stake because of its robust industrial sector, particularly in countries such as China, India, Japan, and South Korea. Sintered steel is commonly used to make components with complex shapes and high strength, and its popularity is expanding in Asia Pacific due to increased demand for automotive and industrial applications.

Additionally, China is a significant importer and exporter of components in the area and beyond; hence, a drop in the country's GDP is projected to impact global GDP. Numerous industries, including automotive and electrical appliances, are affected by plant closures and declining stockpiles in China, which might lead to a scarcity of supply and excessive pricing. In 2023, China surpassed Japan to become the world's largest automobile exporter. In 2023, China exported 4.91 million vehicles, and Japan shipped 5.97 million.

Furthermore, Japan is one of the world's leading steel manufacturers and exporters. The building and car manufacturing industries consume significant domestic steel production. However, in 2023, the Japanese steel giant Nippon Steel intends to produce 35 million tons of steel, with around 32 million tons being supplied. This represents an 11.4% drop from the financial year 2022/2023, which is projected to influence market growth negatively.

North America Sintered Steel Market Trend

North America is anticipated to exhibit a CAGR of 5.0% over the forecast period. The region benefits from a thriving automotive and aerospace industry, where sintered steel is used in engine, transmission, and precision components. The demand for lightweight but durable materials in these industries drives the expansion of sintered steel use in North America.

In addition, the new USMCA agreement, which clearly states that automobiles must have 75% of their components manufactured in either the United States, Canada, or Mexico to be eligible for no tariffs, is encouraging manufacturers to establish plants in North America to capitalize on zero tariffs, a larger customer base, and advanced technology. For example, in March 2019, Toyota Motor Corp. boosted its planned investment to roughly USD 13 billion by 2021 to produce additional models and parts in the United States, considering the taxes on automobile imports. The corporation intends to create over 600 jobs nationwide and enhance engine manufacturing at its Alabama plant.

Europe Sintered Steel Market Trend

Europe's market has a moderate market share. Europe has a thriving aerospace and defense industry, with companies manufacturing airplanes and defense technologies. Sintered steel is used in critical aerospace components such as aircraft engine parts, landing gear, and structural elements, which drives demand in this industry. Furthermore, the German market had the highest market share, while the UK was the fastest-expanding market in the European region.

Moreover, Europe's aerospace and defense (A&D) industry is expected to grow in 2023 due to higher defense spending, a rebound in product demand, and the expansion of commercial and military aircraft. In the fourth quarter of 2023, the industry reported 14 M&A deals totaling USD 3 billion, with Hensoldt acquiring ESG Elektroniksystem- und Logistik-GmbH for USD 732.6 million.

Type Insights

Stainless steel has a sizable market share and is the dominant sector in the global sintered steel industry. Stainless steel is a flexible, corrosion-resistant alloy with at least 10.5% chromium by mass. It is noted for its high strength, endurance, and resistance to rust and corrosion, making it useful in various applications. In the sintered steel market, stainless steel is often used in components that require high mechanical qualities and corrosion resistance, such as automobile parts, household appliances, food processing machinery, and medical devices.

Additionally, the sintering technique enables the creation of complicated stainless steel components with precise dimensions and surface polish, making it an ideal material for demanding applications requiring durability and dependability. Stainless steel is widely used in various industries, including consumer goods, construction, and automobiles, due to its better corrosion resistance, strength, and aesthetic appeal.

Alloy Steel is the market segment with the fastest pace of growth. Manganese, silicon, nickel, chromium, molybdenum, and vanadium are alloying elements added to steel to improve mechanical qualities. Alloy steels have higher strength, hardness, and toughness than carbon steel, making them ideal for applications demanding great performance and durability. In the sintered steel market, alloy steel is utilized in components that must withstand harsh circumstances such as high temperatures, pressure, and wear.

Furthermore, combining multiple components improves alloy steel's mechanical properties, including strength, toughness, and wear resistance. As a result, it is ideal for applications that require solid and long-lasting materials, such as energy infrastructure, industrial gear, and aerospace components. The alloy steel market is developing due to the increasing demand for high-performance materials in various industries.

Application Insights

The automobile industry may be the dominant participant in the global market. The automobile industry is a crucial user of sintered steel components used in various applications throughout vehicles. Transmissions, engines, chassis, and drivetrains all use sintered steel components. Sintered steel components in automobiles include gears, bearings, bushings, structural pieces, and engine components. These components are critical to modern cars' performance, dependability, and efficiency.

The automotive industry benefits from sintered steel's qualities, including high strength, durability, dimensional correctness, and cost-effectiveness. Sintered steel components help to reduce vehicle weight, enhance fuel efficiency, and reduce pollutants, making them vital in the automotive sector. The rise in EVs drives demand for sintered steel components essential to electric powertrains.

Machinery and Equipment is the market category with the fastest growth rate for sintered steel. The machinery and equipment industry covers various industries, including manufacturing, construction, agriculture, mining, and power generation. Sintered steel components are crucial in machinery and equipment applications, including power transmission, hydraulic systems, bearings, gears, and structural components. Sintered steel has high strength, wear resistance, dimensional accuracy, and cost-effectiveness, making it ideal for demanding machinery and equipment applications.

Additionally, the key drivers of this segment's growth include infrastructural expansion, increased manufacturing operations, and the growing use of automation and precision technology. Sintered steel is a common choice for machinery and equipment parts due to its high strength, dimensional accuracy, and complicated shapes.

List of Key and Emerging Players in Sintered Steel Market

- GKN Hoeganaes Corporation - USA

- Sumitomo Electric Industries, Ltd. - Japan

- Miba AG - Austria

- Sintex a/s - Denmark

- SMC Powder Metallurgy Inc. - USA

- Hitachi Powdered Metals Co., Ltd. - Japan

- Capstan Incorporated - USA

- Höganäs AB - Sweden

- AMES S.A. - Spain

- MPP - USA

- Sumitomo Corporation - Japan

- Burgess-Norton Manufacturing Company - USA

- Sintercom India Ltd. - India

- Metal Powder Products Company - USA

- Carpenter Technology Corporation - USA

- C. Starck Group - Germany

- AMETEK Specialty Metal Products - USA

- Porite Group - Japan

- Pometon S.p.A. - Italy

- ASCO Sintering Co. - USA

- Johnson Electric Holdings Limited - Hong Kong

- Pacific Sintered Metals - USA

- Metaldyne Performance Group Inc. - USA

- Hitachi Chemical Co., Ltd. - Japan

- FMS Corporation - USA

Recent Developments

- March 2024- JFE Steel and Hitachi started providing solutions for the steel industry.

- April 2024- Johnson Electric made a significant breakthrough in the automotive sector by creating a new, highly efficient Electric Power Steering (EPS) motor. This unique innovation is intended to give a smooth and responsive driving experience while lowering fuel consumption and pollutants.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 28.75 Billion |

| Market Size in 2025 | USD 30.27 Billion |

| Market Size in 2033 | USD 45.76 Billion |

| CAGR | 5.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Sintered Steel Market Segments

By Type

- Stainless Steel

- Carbon Steel

- Alloy Steel

- Tool Steel

By Application

- Automotive

- Machinery and equipment

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.