UAE Sleep Tech Market Size, Share & Trends Analysis Report By Product Type (Wearable Devices, Non-Wearable Devices, Sleep Aids), By Application (Sleep Monitoring and Management, Sleep Diagnostics, Therapeutic Use), By Distribution Channel (Online Retail, Offline Retail), By End-User (Residential, Commercial) and Forecasts, 2025-2033

Uae Sleep Tech Market Size

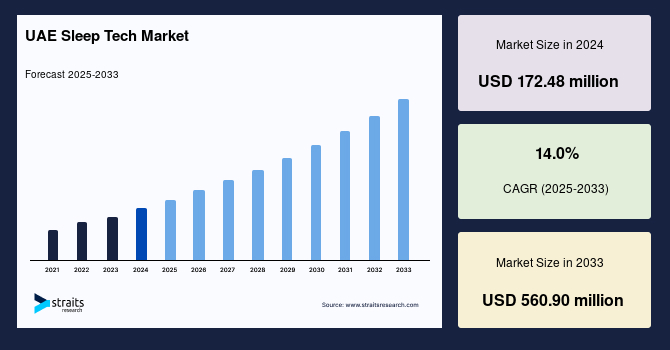

The sleep UAE tech market size was valued at USD 172.48 million in 2024 and is expected to grow from USD 196.63 million in 2025 to USD 560.90 million by 2033, at a CAGR of 14.0% during the forecast period (2025–2033). This robust growth is driven by the UAE’s increasing prevalence of sleep disorders, rising awareness of sleep health, and adoption of innovative technologies in the healthcare and consumer sectors. Furthermore, the UAE’s tech-savvy population and focus on smart healthcare solutions are significant contributors to market expansion.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 172.48 Million |

| Estimated 2025 Value | USD 196.63 Million |

| Projected 2033 Value | USD 560.90 Million |

| CAGR (2025-2033) | 14.0% |

| Key Market Players | Fitbit (Google), Apple Inc., Philips Healthcare, ResMed, Withings |

to learn more about this report Download Free Sample Report

Market Driver

Rising Prevalence of Sleep Disorders

The UAE has witnessed a significant rise in sleep-related issues, including insomnia, obstructive sleep apnea (OSA), and circadian rhythm disorders. A study by the Emirates Sleep Society in 2024 revealed that approximately 40% of adults in the UAE experience inadequate sleep, often linked to high-stress levels, sedentary lifestyles, and urbanization. These trends fuel the demand for tech solutions like wearable devices and sleep monitoring systems.

Furthermore, increasing public and private healthcare initiatives to combat sleep-related issues bolstered market growth.

- For instance, the Dubai Health Authority (DHA) launched campaigns in 2024 to raise awareness about the health risks of poor hygiene, driving the adoption of these devices. Such measures highlight the growing prioritization of sleep health in the UAE.

Market Restraint

High Costs of Advanced Sleep Tech

Despite its promising growth, the UAE market faces challenges due to the high costs associated with advanced technologies. Premium tech devices, such as wearable trackers, AI-powered monitoring systems, and smart mattresses, often come with hefty price tags, limiting their accessibility to middle-income populations.

Additionally, while insurance companies in the UAE have started covering some sleep-related medical treatments, many sleep tech solutions remain uncovered. This financial gap, combined with the need for maintenance and upgrades, hampers the adoption of this technology across diverse socioeconomic groups. As a result, the market faces obstacles in achieving widespread penetration.

Market Opportunity

Integration of Ai and Iot in Sleep Tech

The integration of artificial intelligence (AI) and the Internet of Things (IoT) into tech solutions presents significant opportunities for market expansion in the UAE. AI-powered systems can analyze sleep patterns, detect irregularities, and provide personalized insights to users. IoT-enabled devices, such as smart beds and ambient lighting systems, enhance environments by automating temperature, noise, and lighting adjustments.

Companies in the UAE are increasingly focusing on these technologies.

- For instance, a leading UAE-based healthcare provider's 2024 launch of an IoT-enabled monitoring system has garnered widespread attention. Similarly, startups specializing in AI-driven solutions, such as SleepCogni’s wearable devices, are gaining traction in the region. This growing focus on digital transformation and connected devices will unlock new avenues for innovation and market growth.

Regional Analysis

The market is characterized by strong growth across key cities, including Dubai, Abu Dhabi, Sharjah, Al Ain, and Ras Al Khaimah, each contributing to the market’s development through unique initiatives and consumer demands.

Dubai is a hub for technological innovation and luxury lifestyles, significantly contributing to the market. The city’s tech-savvy population and government-backed health campaigns fuel demand for advanced tech solutions. Leading retailers in Dubai’s healthcare and consumer electronics sectors, such as Carrefour and Sharaf DG, are expanding their tech offerings.

Abu Dhabi’s focus on healthcare innovation is evident through initiatives like the SEHA Sleep Disorders Center, which promotes health education and treatment. The city also attracts investment from global sleep tech companies, supported by its advanced healthcare infrastructure. This fosters the adoption of monitoring systems in medical and residential settings.

Sharjah’s growing middle-class population is driving demand for affordable tech solutions. Retailers in the city are increasingly offering mid-range products, such as budget-friendly sleep trackers, to cater to this demographic. Additionally, educational campaigns in Sharjah focus on the importance of sleep health and boosting awareness.

Al Ain, known for its healthcare-focused developments, is witnessing rising adoption of sleep tech in hospitals and clinics. Institutions like Tawam Hospital have incorporated advanced sleep monitoring systems, reflecting the city’s commitment to integrating innovative technologies into healthcare services.

Ras Al Khaimah’s thriving tourism industry is influencing the market, with hotels incorporating smart sleep solutions, such as temperature-controlled mattresses and noise-canceling devices, to enhance guest experiences. This trend is expected to expand as luxury accommodations prioritize wellness offerings.

Product Type Analysis

Wearable devices dominate the product type segment and are expected to grow at a CAGR of 14.3% over the forecast period. Wearable devices dominate the UAE market, driven by their portability, ease of use, and advanced functionalities. These devices, including smartwatches and fitness trackers, monitor sleep patterns, heart rates, and oxygen levels. Companies like Fitbit and Garmin have witnessed increasing adoption in the UAE, supported by fitness-conscious consumers seeking integrated health monitoring solutions.

Application Analysis

Sleep monitoring and management leads the application segment and is expected to grow at a CAGR of 14.3% during the forecast period. This segment is fueled by rising awareness about sleep disorders and the need for precise diagnostics. Hospitals and clinics in the UAE increasingly adopt advanced monitoring systems, such as polysomnography and home-based devices, ensuring accurate assessments of sleep health. Innovations in data analytics further drive the segment’s growth.

Distribution Channel Analysis

Online dominates the distribution channel segment and is expected to grow at a CAGR of 14.2% over the forecast period. Online distribution channels are emerging as key growth drivers, supported by the UAE’s high internet penetration and shift towards e-commerce platforms. Retailers like Amazon.ae and Noon.com offer a wide range of sleep tech products supported by seamless delivery services. Moreover, consumers benefit from access to reviews and product comparisons, enhancing their buying decisions.

End-User Analysis

Residential leads the end-user segment and is expected to grow at a CAGR of 14.3% during the forecast period. Residential users account for a significant portion of the UAE market, owing to increasing interest in home-based solutions for sleep health. Smart home systems integrated with these devices, such as temperature-controlled mattresses and intelligent lighting, are gaining popularity among tech-savvy households.

List of Key and Emerging Players in UAE Sleep Tech Market

- Fitbit (Google)

- Apple Inc.

- Philips Healthcare

- ResMed

- Withings

- Dreem

- Xiaomi

- Huawei

- Garmin

- Bose

- Sleep Number

- Eight Sleep

Analyst Perspective

As per our analyst, the UAE sleep tech market is poised for rapid expansion in the coming years. This growth is primarily driven by rising health awareness, technological advancements, and increasing consumer demand for personalized solutions. The UAE’s commitment to smart city initiatives and digital transformation ensures that tech innovations remain prioritized across sectors. Government-backed health campaigns and collaborations with global tech companies will also be pivotal in shaping the market’s trajectory.

Moreover, the integration of AI and IoT into sleep tech solutions is anticipated to address challenges such as affordability and accessibility. As the UAE continues prioritizing wellness and innovation, the market is well-positioned to emerge as a significant contributor to the country’s healthcare and technology sectors.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 172.48 Million |

| Market Size in 2025 | USD 196.63 Million |

| Market Size in 2033 | USD 560.90 Million |

| CAGR | 14.0% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Application, By Distribution Channel, By End-User |

to learn more about this report Download Free Sample Report

UAE Sleep Tech Market Segments

By Product Type

- Wearable Devices

- Non-Wearable Devices

- Sleep Aids

By Application

- Sleep Monitoring and Management

- Sleep Diagnostics

- Therapeutic Use

By Distribution Channel

- Online Retail

- Offline Retail

By End-User

- Residential

- Commercial

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.