Space Logistics Market Size, Share & Trends Analysis Report By Services (Space Tourism, Last Mile Delivery, Life Extension, Refueling, De-orbiting, Debris Removal, Others (Space Mining, Microgravity)), By End-User (Commercial, Government and Defense), By Orbit (Near Earth Orbit, Lower Earth Orbit, Geostationary Orbit), By Platform (Mission Extension Pods (MEPs), Cargo Modules, Service Modules, Robotic Arms and Manipulators, Space Tugs) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Space Logistics Market Size

The global space logistics market size was valued at USD 1.5 billion in 2024 and is expected to grow from USD 1.76 billion in 2025 to reach an expected value of USD 6.31 billion by 2033, growing at a CAGR of 17.3% during the forecast period (2025–2033).

Space logistics refers to the planning, transportation, and management of cargo, spacecraft, and resources needed for missions beyond Earth. It includes supply chain management for satellites, sub-orbital stations, lunar bases, and future Mars missions. Key aspects involve launch services, orbital refueling, in-space manufacturing, and debris management. Companies like SpaceX, Blue Origin, and NASA are advancing sub-orbital logistics to support deep-space exploration and commercial sub-orbital activities. As sub-orbital travel expands, efficient logistics will be crucial for sustaining long-term missions and interplanetary colonization.

The global market is witnessing rapid growth, driven by an increasing number of sub-orbital missions and rising demand for satellite services, including telecommunications, Earth observation, and navigation. This sector encompasses a wide range of services, such as satellite launching, deployment, refueling, maintenance, life extension, debris removal, and in-orbit servicing. Companies are prioritizing cost reduction, sustainability, and long-term satellite operations, fostering innovations like reusable rockets, autonomous servicing vehicles, and orbital manufacturing.

The market is further propelled by substantial investments from private enterprises and government initiatives, with agencies like NASA, the European Space Agency (ESA), and emerging sub-orbital programs in China and India collaborating with commercial players to enhance sub-orbital infrastructure. Moreover, strategic partnerships between traditional aerospace firms and new entrants are driving efficiency and cost reduction in space missions.

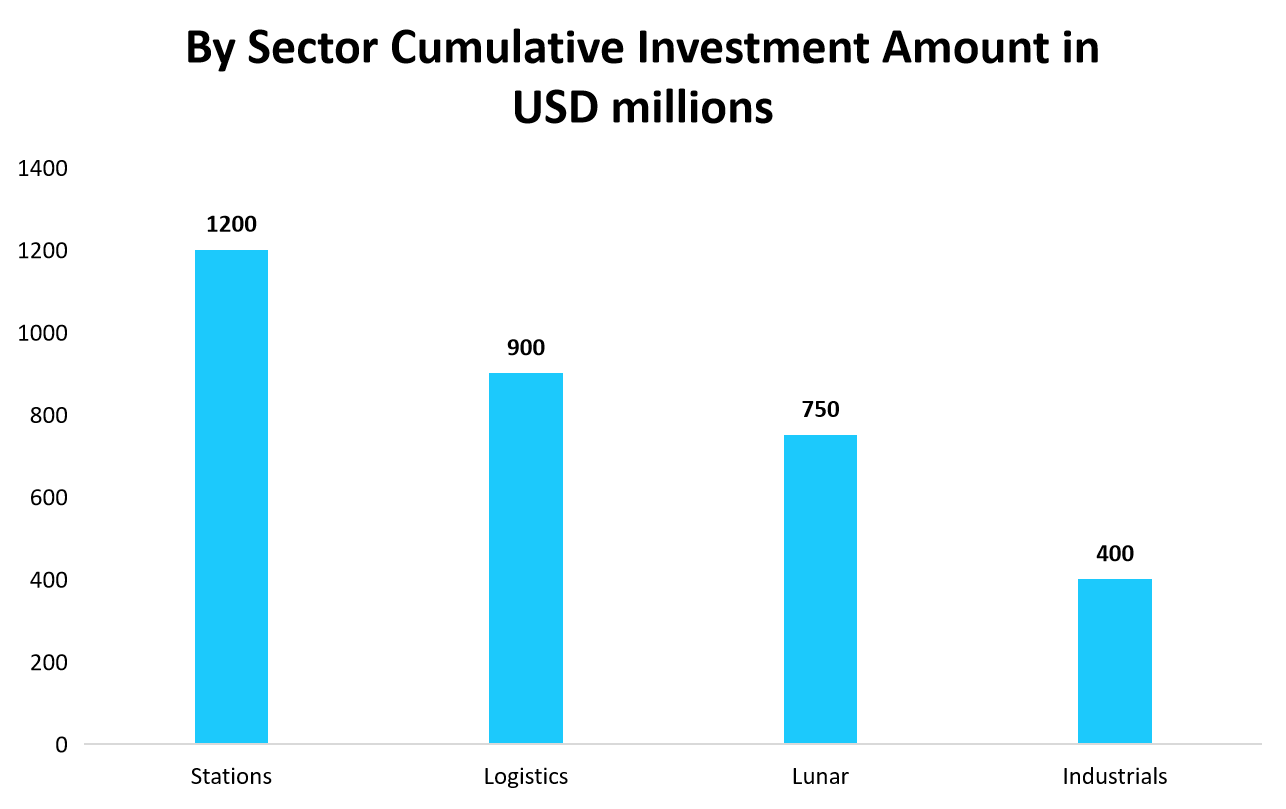

Source: SpaceNews, Straits Research

The cumulative spending mentioned above illustrates that the spending has been focused on Stations, Logistics, Lunar, and Industrials. These investments would reflect how the world is turning out to be highly interested in new industries. As industries of logistics and lunar activities begin changing with time, memristors, which provide leading-edge memory and processing, will revolutionize technology and efficiency in these evolving sectors.

Latest Market Trends

Growing Demand for Sustainable Space Operations

As space exploration accelerates, the need for sustainable sub-orbital operations has become a critical focus. The increasing number of satellite launches has raised concerns over sub-orbital debris, posing risks to spacecraft and long-term sub-orbital missions. In response, companies and space agencies are investing in innovative technologies to enhance safety and minimize risks. Key initiatives include advanced debris removal solutions, extended satellite lifespans, and improved sub-orbital travel efficiency.

- For instance, the ClearSpace-1 mission, launched in May 2023, is a pioneering effort to remove sub-orbital debris, reducing collision threats and ensuring a safer orbital environment. With the rapid expansion of satellites for telecommunications and Earth observation, such initiatives are essential for maintaining long-term space sustainability.

Rising Investments for Satellite Servicing and Expansion

The growing need for satellite maintenance, refueling, and repositioning has driven substantial investments into sub-orbital logistics. Companies are expanding their services to include satellite life extension, in-orbit repairs, and advanced servicing technologies. This trend aims to optimize sub-orbital infrastructure, reduce operational costs, and extend the functionality of existing satellites, benefiting both private enterprises and government sub-orbital agencies.

- For example, in January 2024, D-Orbit, an Italian space transportation company, secured ‚€100 million (USD 110 million) in a Series C funding round. This investment will fuel the expansion of its sub-orbital logistics services, including satellite servicing and other critical space operations, reinforcing the industry's focus on long-term sustainability and efficiency.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.5 Billion |

| Estimated 2025 Value | USD 1.76 Billion |

| Projected 2033 Value | USD 6.31 Billion |

| CAGR (2025-2033) | 17.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Maxar Technologies, SpaceX, Made In Space, Northrop Grumman, Astroscale |

to learn more about this report Download Free Sample Report

Global Space Logistics Market Growth Factors

Increasing Satellite Deployments and Infrastructure Growth

The rapid expansion of satellite deployments and the growing need for advanced space infrastructure are key drivers of the space logistics market. As companies launch large-scale satellite constellations to enhance global communications, internet connectivity, and Earth observation, the demand for efficient logistics services including satellite launches, maintenance, and transportation-continues to rise. This growing dependency on satellite networks underscores the need for innovative and cost-effective sub-orbital logistics solutions.

- For instance, in 2021, OneWeb optimized its satellite constellation plans, adjusting its U.S. market request to 6,372 satellites, aiming for a total of around 7,000. The company's first-generation deployment includes 648 satellites, with regional commercial services expected to commence in the near future.

This expansion highlights the increasing reliance on satellite networks and the corresponding need for sustainable logistics solutions to support them.

Government Initiatives and Investments in Space Exploration

Governments worldwide are intensifying their focus on space exploration, recognizing its potential to drive scientific advancements, economic growth, and national security. Deep-space missions require sophisticated logistics systems, including sub-orbital station maintenance, rocket propulsion technologies, and long-term sustainable infrastructure. These developments are fueling the demand for advanced sub-orbital logistics solutions to ensure safe and efficient space transportation.

- For example, in India's Union Budget for 2025-26, Rs 13,416.20 crore was allocated to the Department of Space, reinforcing the nation's commitment to sub-orbital research, satellite technology, and geospatial advancements. This investment supports India's ambitious sub-orbital initiatives, further strengthening the global market.

Market Restraint

Rising Amount of Space Debris

The growing accumulation of space debris in Earth's orbit presents a significant challenge to the sub-orbital logistics industry. As the number of active satellites continues to rise, so does the risk of collisions and operational disruptions caused by defunct satellites, rocket fragments, and other high-speed debris. Even small objects traveling at extreme velocities can cause severe damage to operational spacecraft, making sub-orbital congestion a critical concern for future missions.

- For instance, according to the European Space Agency (ESA), there are currently approximately 6,800 active satellites in orbit, accompanied by 8,800 tons of space junk. The increasing concentration of debris in Low Earth Orbit (LEO) underscores the urgent need for innovative sub-orbital debris management solutions.

Market Opportunity

Rise of Space Tourism and Private Space Travel

The rapid expansion of space tourism is unlocking new opportunities in the space logistics market, fueling demand for specialized services such as passenger transportation, cargo delivery, and satellite deployment. As commercial sub-orbital travel becomes more frequent, the need for advanced infrastructure to support resupply missions, spacecraft maintenance, and in-orbit operations is growing significantly.

To meet these demands, companies are investing heavily in sub-orbital logistics, focusing on enhancing spaceflight safety, optimizing transport systems, and improving sustainability in private space travel.

- For instance, in 2024, Blue Origin successfully completed its eighth human spaceflight, carrying six passengers including a 21-year-old college student aboard the New Shepard rocket. This mission highlighted the increasing accessibility of commercial space travel, even though the experience of weightlessness remained brief.

While ticket prices for space tourism still vary widely, the surging interest in sub-orbital travel is driving technological advancements in spacecraft refurbishment, passenger safety systems, and operational logistics, ensuring the long-term growth of this emerging sector.

Regional Insights

North America, particularly the United States, dominates the global space logistics market due to its technological superiority, vast experience in sub-orbital exploration, and strong government and private sector investments. The presence of top space agencies like NASA and private industry leaders such as SpaceX, Blue Origin, and Lockheed Martin fuels innovation in sub-orbital transportation, satellite services, and deep-space exploration.

The region's well-established space infrastructure and government funding for defense and commercial missions further solidify its leadership.

- For instance, the U.S. space economy generated USD 211.6 billion in gross output and contributed USD 129.9 billion to the country’s GDP in 2021. Moreover, private industry employment in the sector reached 360,000 jobs, with a total compensation of USD 51.1 billion.

The growing number of commercial launches and emerging technologies like in-orbit servicing and sub-orbital tourism are expected to further strengthen North America’s dominance.

Canada's Space Logistics Market Trends

Canada is making key advancements in lunar exploration and space robotics, with USD 8.6 million allocated in the 2024 budget to the CSA’s Lunar Exploration Accelerator Program (LEAP). The country is also developing next-generation robotic systems for upcoming missions, leveraging its expertise in sub-orbital technology. With a strong focus on satellite communications and international collaborations, Canada continues to play a crucial role in space logistics and exploration.

Asia Pacific: Rapidly Growing Region

Asia-Pacific is witnessing rapid growth in the space logistics market, driven by increasing investments from nations such as China, India, Japan, and South Korea. Government-led sub-orbital missions, including China's lunar and Mars exploration programs and India's ambitious sub-orbital initiatives, are accelerating expansion. Meanwhile, private space companies in India and Japan are emerging as key players, developing cost-effective satellite launches and sub-orbital services.

- For instance, in December 2024, the leasing of logistics and industrial space across eight major cities in Asia-Pacific is projected to reach 50-53 million square feet, fueled by sustained demand.

The region's strategic focus on satellite mega-constellations, reusable launch vehicles, and lunar exploration makes it a crucial market for future space logistics innovations.

Countries Insights

- China: China is rapidly enhancing its global space logistics footprint through 23 bilateral agreements in Africa and its Belt and Road Space Information Corridor initiative. The country is heavily investing in satellite technology, lunar exploration, and sub-orbital station development. With ambitious missions such as lunar base planning and Mars exploration, China is positioning itself as a dominant player in space logistics and deep-space operations.

- Russia: Russia remains a key player in the space logistics market, focusing on satellite navigation and sub-orbital station operations. The country is set to invest ₽158 billion (USD 1.9 billion) by 2026 to enhance its GLONASS satellite system, supporting global positioning and communication networks. With extensive expertise in space station operations and cosmonaut training, Russia continues to influence global space logistics through long-term partnerships and infrastructure development.

- India: India’s space economy is set to expand from USD 8.4 billion to USD 44 billion by 2033, driven by ISRO’s cost-efficient launch capabilities and a Rs.1000 crore fund for private sector participation. With advancements in satellite manufacturing, reusable launch vehicles, and deep-space exploration, India is strengthening its position in the global space logistics market. The rise of private sub-orbital startups further accelerates innovation in affordable satellite launches.

- Japan: Japan is allocating JPY 1 trillion (USD 6.6 billion) through its Space Strategy Fund to support lunar missions, sub-orbital debris elimination, and Earth observation. The country is leveraging its expertise in robotics and AI-driven satellite operations, focusing on sustainable space initiatives. With growing investments in space-based infrastructure and interplanetary exploration, Japan is emerging as a leader in sub-orbital sustainability and next-generation space logistics.

- United Kingdom: The UK is strengthening its role in commercial space logistics, attracting £8.85 billion in investments for satellite production, spaceport development, and launch services. The government continues to support sub-orbital infrastructure innovation, fostering an environment for emerging private space enterprises. With a focus on low-cost satellite deployment and orbital logistics, the UK is establishing itself as a strategic player in the growing sub-orbital economy.

Segmentation Analysis

By Services

The debris removal segment dominates the global space logistics industry, driven by the increasing volume of sub-orbital debris and the growing emphasis on sustainable sub-orbital operations. As space tourism expands and commercial satellite launches surge, organizations like SpaceX, Blue Origin, and Virgin Galactic invest in solutions to clear defunct satellites and debris. Governments and private firms recognize the risks posed by orbital congestion, fueling demand for debris removal services and boosting market revenue.

By End-Use

The commercial segment leads the market, supported by rising investments in satellite launches, space tourism, and space-based services. Telecom providers, Earth observation firms, and broadband companies increasingly rely on low-cost satellite constellations, driving the need for reliable logistics solutions. Unlike government-funded programs, commercial ventures have higher financial flexibility, allowing for rapid advancements in reusable launch systems and in-orbit servicing, solidifying their dominant market position.

By Orbit

The lower Earth orbit (LEO) segment dominates space logistics due to its strategic advantages in satellite deployment, sub-orbital stations, and mega-constellations like Starlink. LEO’s proximity to Earth results in reduced launch costs, faster deployment cycles, and lower latency, benefiting telecommunications, Earth observation, and global internet expansion. With increasing commercial and governmental reliance on LEO-based infrastructure, the segment continues to generate substantial market revenue, fostering innovation in sub-orbital logistics.

By Platform

The mission extension pods (MEPs) segment holds the largest market share, revolutionizing satellite lifecycle management. As the number of satellites in orbit grows, MEPs provide cost-effective solutions for extending operational longevity, reducing the need for expensive replacements. Satellite operators prioritize asset optimization, and MEPs enable them to maintain functionality without launches. With growing commercial demand and technological advancements, MEPs are becoming essential for sub-orbital sustainability and cost efficiency.

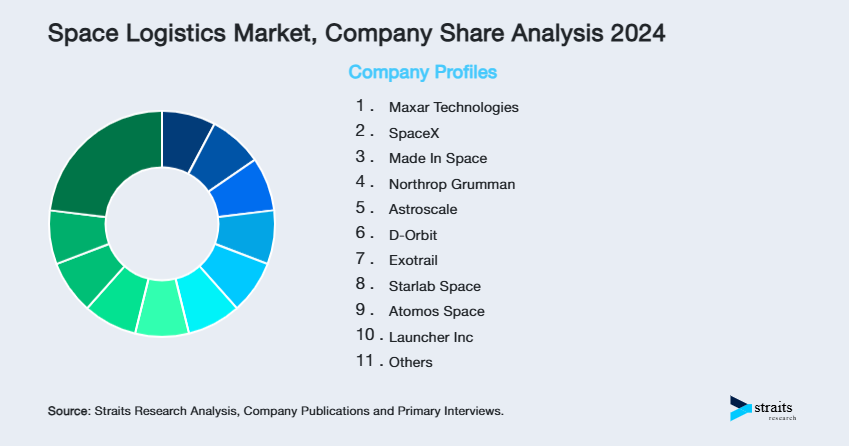

Company Market Share

Leading market players are actively investing in advanced space logistics technologies while leveraging collaborations, acquisitions, and strategic partnerships to enhance their offerings and strengthen their market position. These efforts drive innovation in satellite deployment, sub-orbital transportation, and orbital services, enabling companies to expand their global footprint and stay competitive in the rapidly evolving sub-orbital industry.

Starlab Space: An Emerging Player in the Global Space Logistics Market

Starlab Space is a rising player in the space logistics market, specializing in innovative sub-orbital solutions and commercial operations. Established through a partnership between Voyager Space and Airbus, the company is advancing sub-orbital station technology and cargo delivery systems. With a strong emphasis on efficiency, sustainability, and seamless integration across its services, Starlab is well-positioned for growth as the sub-orbital industry expands, unlocking new opportunities in the evolving market.

Recent Developments:

- In June 2024, Starlab Space formed a Strategic Partnership with Palantir Technologies, Naming Palantir the Exclusive Supplier of Enterprise-Wide Software Data Management Solutions for the Starlab Commercial Space Station, Enhancing Space Architecture Using AI-driven, Adaptive Software to Optimize Resilience and Effectiveness.

List of Key and Emerging Players in Space Logistics Market

- Maxar Technologies

- SpaceX

- Made In Space

- Northrop Grumman

- Astroscale

- D-Orbit

- Exotrail

- Starlab Space

- Atomos Space

- Launcher Inc

- Others

to learn more about this report Download Market Share

Recent Developments

- January 2025 – D-Orbit enters into a Launch Service Contract with Pale Blue Inc. to execute an in-orbit validation mission of Pale Blue's water ion thrusters. D-Orbit will use its ION Satellite Carrier to successfully demonstrate the innovative water-based propulsion system for a variety of spacecraft missions.

- February 2025 – ATMOS Space Cargo was approved by the U.S. Federal Aviation Administration (FAA) to conduct its Phoenix re-entry capsule test flight in April 2025 aboard SpaceX's Bandwagon-3 mission. The 100kg payload and inflatable heat shield enable the safe water landings of in-orbit life sciences research.

Analyst Opinion

As per our analysts, the global space logistics market is experiencing rapid growth and is set to expand further, driven by the increasing demand for satellite deployment, sub-orbital station support, and cargo transportation to LEO. With rising commercial interest in space and advancements in propulsion technologies, including water-based propulsion systems and AI-driven software for data management, innovation in the sector will continue to accelerate.

Despite the high costs of space missions, regulatory complexities, and risks associated with orbital debris, the market is overcoming these challenges through strategic collaborations between traditional sub-orbital agencies and emerging private players. Companies are focusing on cost-efficient launch systems, reusable space vehicles, and automated in-orbit servicing, making sub-orbital missions more sustainable and accessible.

As commercial space operations expand, with satellite mega-constellations, space-based manufacturing, and commercial sub-orbital stations, space logistics will become a critical enabler of these advancements. This creates significant opportunities for companies involved in sub-orbital transportation, satellite servicing, and payload delivery, ensuring that space becomes a more viable and economically sustainable frontier.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.5 Billion |

| Market Size in 2025 | USD 1.76 Billion |

| Market Size in 2033 | USD 6.31 Billion |

| CAGR | 17.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Services, By End-User, By Orbit, By Platform |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Space Logistics Market Segments

By Services

- Space Tourism

- Last Mile Delivery

- Life Extension

- Refueling

- De-orbiting

- Debris Removal

- Others (Space Mining, Microgravity)

By End-User

- Commercial

- Government and Defense

By Orbit

- Near Earth Orbit

- Lower Earth Orbit

- Geostationary Orbit

By Platform

- Mission Extension Pods (MEPs)

- Cargo Modules

- Service Modules

- Robotic Arms and Manipulators

- Space Tugs

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.