Spray Drying Equipment Market Size, Share & Trends Analysis Report By Product (Rotary Atomizer, Nozzle Atomizer, Fluidized, Centrifugal), By Stage (Single-Stage, Two-Stage, Multi-Stage), By Cycle (Open, Closed), By Flow (Co-Current, Counter-Current, Mixed Flow), By Applications (Food & Dairy, Pharmaceuticals & Nutraceuticals, Chemical, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Spray Drying Equipment Market Overview

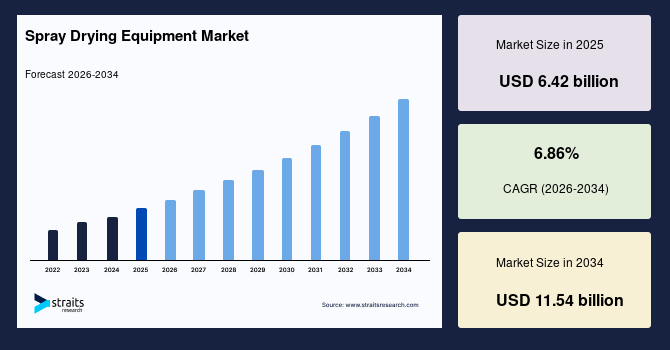

The global spray drying equipment market size was valued at USD 6.42 billion in 2025 and is estimated to reach USD 11.54 billion by 2034, growing at a CAGR of 6.86% during the forecast period (2026–2034). The market is driven by rising demand for instantized foods, powdered beverages, and ready-to-mix products, alongside growing adoption in the pharmaceutical and chemical industries. Advancements in energy-efficient dryers and expanding processing capacities further accelerate market growth.

Key Market Trends & Insights

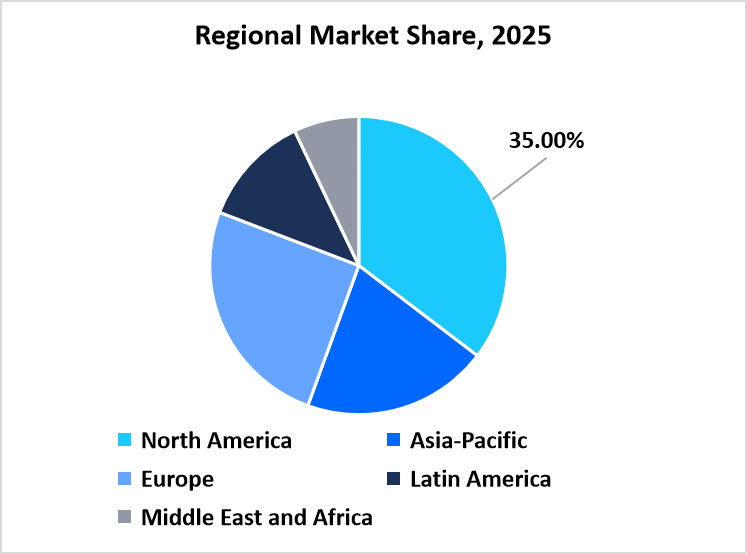

- North America held the largest market share, over 35% of the global market.

- Asia-Pacific is the fastest-growing region, with a CAGR of 7.94%.

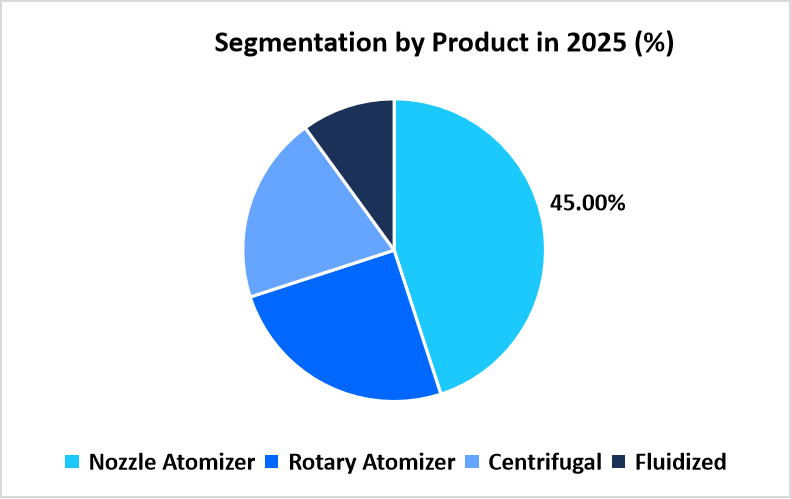

- By Product, the Fluidized spray segmentis expected to witness the fastest CAGR of 7.14%.

- By Stage, the Single-stage segment held the highest market share of over 60%.

- By Cycle, the Closed-cycle segment is expected to witness the fastest CAGR of 7.21%.

- By Flow, the Co-current segment held the highest market share of over 55%.

- By Applications, the pharmaceuticals and nutraceuticals segment is expected to witness the fastest CAGR of 7.98%.

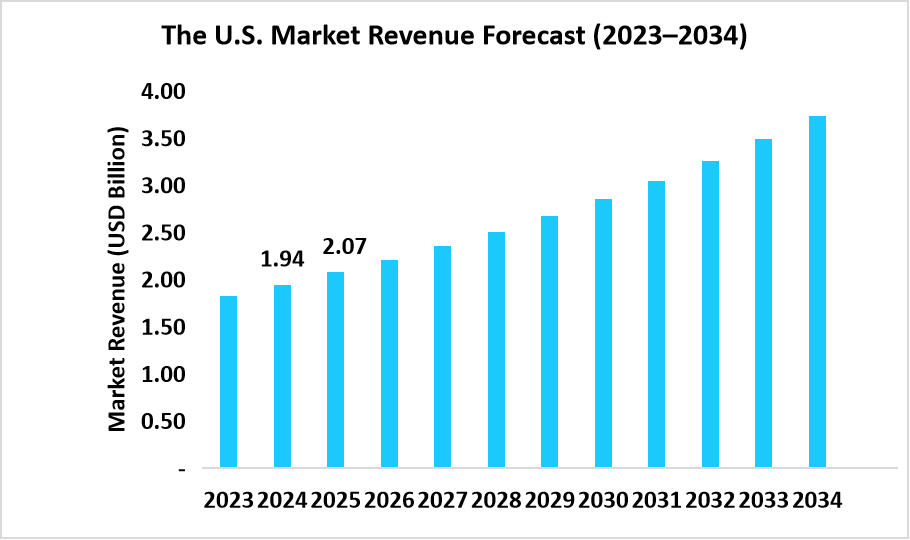

- The U.S. spray drying equipment market was valued at USD 1.94 billion in 2024 and reached USD 2.07 billion in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 6.42 billion

- 2034 Projected Market Size: USD 11.54 billion

- CAGR (2026-2034): 86%

- North America: Largest market

- Asia-Pacific: Fastest-growing region

Spray drying equipment converts liquid feed into dry, free-flowing powder by atomizing it into a hot drying chamber, where moisture evaporates instantly. This method ensures uniform particle size, high product stability, and extended shelf life. It is widely used across food and beverage processing, pharmaceuticals, nutraceuticals, chemicals, detergents, and ceramics. Key applications include producing milk powders, coffee powders, flavorings, enzymes, antibiotics, catalysts, pigments, and heat-sensitive ingredients. Its ability to preserve functional properties and deliver consistent quality makes spray drying a preferred drying technology.

The market is driven by growing industrial modernization, rising production of functional powders, and expanding use of spray drying in pharmaceuticals for controlled-release formulations. Increasing investments in automation and process optimization support wider adoption. Opportunities emerge from advancements in precision atomization, rising applications in nutraceuticals, and growing demand for high-purity powders in biotechnology. Manufacturers also benefit from expanding food processing capacities in emerging economies and the push for customized drying solutions tailored to specific product performance needs.

Latest Market Trends

Rising shift toward energy-efficient drying technologies

The market is experiencing a clear transition toward energy-efficient spray drying solutions as manufacturers look to reduce operational costs and environmental impact. Companies are increasingly adopting heat recovery systems, improved air distribution designs, and optimized atomization technologies to minimize energy waste while maintaining high product quality.

As regulations tighten, industries such as food, dairy, and pharmaceuticals are prioritizing systems that deliver lower emissions and enhanced thermal efficiency. Advanced control systems, automation, and process optimization software are further supporting this shift by enabling precise monitoring, reduced downtime, and consistent performance across varying production scales.

Growing popularity of spray-dried encapsulation

Spray-dried encapsulation is gaining strong traction as industries seek protected, stable, and controlled-release ingredients for food, nutraceuticals, and pharmaceuticals. The technique helps preserve sensitive compounds such as flavors, probiotics, vitamins, and essential oils by shielding them from heat, oxidation, and moisture, while also improving their handling and shelf life.

The rising preference for microencapsulated ingredients is driving equipment manufacturers to develop advanced spray dryers capable of precise particle engineering and uniform encapsulation efficiency. This trend is also fueled by R&D investments in novel wall materials and formulations, enabling better performance in diverse end-use applications.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 6.42 billion |

| Estimated 2026 Value | USD 6.83 billion |

| Projected 2034 Value | USD 11.54 billion |

| CAGR (2026-2034) | 6.86% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | GEA Group, SPX FLOW, Büchi Labortechnik, Dedert Corporation, European SprayDry Technologies |

to learn more about this report Download Free Sample Report

Market Driver

Expanding demand for instantized foods, powdered beverages, and ready-to-mix products

The global spray drying equipment market is being propelled by surging demand for instantized foods, powdered beverages, and ready-to-mix formulations. As consumers increasingly seek convenient, shelf-stable, and nutrient-dense products, manufacturers are investing in advanced spray-drying technologies to enhance product quality and production efficiency.

- In July 2025, Alvinesa inaugurated a cutting-edge spray-drying facility at its headquarters, featuring a dual/single-effect Techniprocess dryer with a 200 kg/h evaporation capacity. A 3 kg/h pilot unit enables low-risk testing, supported by clean rooms, advanced storage, post-processing systems, and an in-house analytical lab.

This expansion highlights how industry players are scaling capabilities to meet rising global demand, further accelerating market growth.

Market Restraint

High capital investment for installing commercial-scale spray drying systems

High capital investment for installing commercial-scale spray drying systems remains a major restraint for the global spray drying equipment market. Manufacturers must allocate substantial funds for advanced dryers, automation components, and specialized materials that can withstand high temperatures.

This cost burden is even higher for small and mid-sized enterprises, limiting their ability to adopt modern spray drying technologies. Moreover, ongoing expenses for maintenance, skilled labor, and energy consumption further increase operational costs. These financial barriers slow market expansion, despite growing demand across industries.

Market Opportunity

Development of hybrid spray drying systems

The development of hybrid spray drying systems presents a significant opportunity for the global spray drying equipment market, especially as industries push for higher efficiency and lower operational costs. These next-generation systems integrate multiple drying mechanisms to enhance product quality, reduce energy consumption, and improve process flexibility.

- For instance, in February 2025, DORST Technologies launched its SMART-Compact Series PRO spray dryers, which integrate heat recovery systems that recycle fine particles from the cyclone back into the drying tower. This hybrid design, which combines energy-efficient drying, recirculation, and particle agglomeration, reduces operational costs and boosts granulate yield.

Such advancements are accelerating the transition toward sustainable, high-performance drying technologies, opening new growth avenues across food, chemical, and pharmaceutical applications.

Regional Analysis

North America’s spray drying equipment market is dominant with a market share of over 35%, supported by a mature food, pharmaceutical, and specialty chemical manufacturing base that demands high-capacity, energy-efficient spray drying solutions. Large-scale dairy, infant formula, and nutraceutical producers drive adoption of advanced atomization systems, multi-stage dryers, and integrated process controls that improve powder quality and yield. Investment in automation, clean-in-place systems, and solvent recovery technology further strengthens market momentum. Moreover, R&D collaborations between equipment makers and end-users accelerate customization for delicate bioactives and heat-sensitive formulations.

- The United States spray drying equipment market is shaped by key players such as GEA Group, SPX FLOW, and Dedert Corporation, all focusing on automation, energy reduction, and high-volume production systems. Companies are expanding capabilities in food-grade and pharma-grade dryers, with innovations in real-time monitoring, closed-loop drying, and improved powder recovery.

- Canada’s spray drying equipment market is driven by companies such as Büchi Labortechnik, Carrier Vibrating Equipment, and Advanced BioTech Solutions, which focus on compact, efficient, and research-oriented systems. Firms are strengthening capabilities in pilot-scale dryers, clean-processing technologies, and customized systems for dairy powders, plant proteins, and biotechnology applications.

Asia-Pacific: Significantly Growing Region

The Asia-Pacific spray drying equipment market is the fastest-growing, with a CAGR of 7.94%, propelled by expanding dairy, instant beverage, pharmaceutical, and chemical industries across emerging economies. Increasing demand for powdered infant formula, instant foods, and specialty nutraceutical powders is driving investment in mid- to large-scale spray dryers, multi-nozzle systems, and continuous drying technologies. Moreover, local equipment builders and international OEMs are partnering to deliver cost-optimized, energy-efficient solutions that meet hygiene and safety standards. Focused investments in operator training, after-sales service, and localized spare-parts networks accelerate adoption and improve uptime in Asia-Pacific’s rapidly scaling production hubs.

- China’s spray drying equipment market is led by companies such as Shanghai Pilotech, Shinma Drying Engineering, and Changzhou Lemar Drying, which focus on high-capacity dryers, automated control systems, and energy-optimized solutions. The country also emphasizes R&D-backed innovations in cyclone separators, multi-stage drying, and clean-in-place systems.

- India’s market is shaped by companies such as SSP Pvt. Ltd., Shree Balaji Process Equipment, and Acmefil Engineering, focusing on affordable, energy-efficient, and application-specific drying solutions. Manufacturers are optimizing designs for dairy powders, spices, nutraceuticals, and herbal formulations, supported by demand for processed foods and functional ingredients.

Source: Straits Research

Europe Market Trends

Europe’s spray drying equipment market continues to advance as a mature market driven by the strong dairy, pharmaceutical, nutraceutical, and specialty chemical industries. The region focuses heavily on energy efficiency, emission control, and digital monitoring systems that help manufacturers comply with stringent EU regulatory frameworks. The adoption of multi-stage dryers, closed-loop systems, and automated cleaning technology is accelerating as processors strive to enhance yield and product uniformity. The growing demand for powdered ingredients, instantized formulations, and bio-based chemicals encourages companies to invest in high-performance systems engineered for precision, sustainability, and operational safety across both large and mid-sized production facilities.

- Germany’s spray drying equipment market features companies such as GEA Group, which develops advanced multi-stage dryers, high-pressure nozzle systems, and Industry 4.0-enabled automation solutions. These firms are working on energy-optimized drying chambers, heat recovery units, and solvent-capable closed-loop systems for pharma and chemicals.

Latin America Market Trends

Latin America’s spray drying equipment market is witnessing steady adoption of spray drying equipment driven by rising demand for instant beverages, dairy powders, flavorings, and nutraceutical ingredients. The region emphasizes scalable, cost-efficient systems that support seasonal agricultural output and diversified food-processing needs. Growth in infant formula production, coffee processing, and bio-based chemicals is encouraging producers to modernize plants with multi-nozzle systems, energy recovery modules, and automated controls. As per Straits Research, increasing collaboration between equipment suppliers and local processors is enhancing access to maintenance, spare parts, and training, ensuring consistent uptime and improving powder quality across rapidly expanding manufacturing environments.

- Brazil’s spray drying equipment market includes active participation from companies like Dedert and SPX FLOW’s regional partners, offering solutions tailored for dairy, coffee, and flavor processing. These firms are working on installing high-capacity dryers, optimizing atomizer performance, and enabling automated CIP systems for hygiene-intensive operations.

The Middle East and Africa Market Trends

The Middle East and Africa spray drying equipment market is gradually expanding as governments and private sectors invest in food security, dairy processing, pharmaceuticals, and specialty ingredient production. The region is adopting compact to mid-scale spray drying systems designed for arid climates, reduced energy consumption, and high operational reliability. Growing interest in powdered beverages, fortified nutritional products, and food additives is accelerating the installation of multi-stage dryers and automated moisture-control systems. Partnerships with global OEMs support technology transfer, training, and long-term service arrangements, helping manufacturers improve consistency and scale production efficiently across emerging industrial hubs.

- Saudi Arabia’s market benefits from suppliers such as GEA, Buchi, and regional engineering firms delivering solutions for dairy, nutritional powders, and pharmaceutical intermediates. These companies are working on GMP-compliant drying towers, precision atomizers, and energy-recovery systems aligned with the country’s industrial diversification strategy.

Product Insights

Nozzle atomizers dominate the product segment with over 45% market share due to their precision droplet formation, suitability for heat-sensitive materials, and strong adoption across food, dairy, chemical, and nutraceutical sectors. Their ability to generate uniform particle structures supports consistent solubility and product stability. As manufacturers focus on maintaining ingredient functionality and powder quality, nozzle-based systems remain the preferred choice for high-volume, application-specific spray drying processes.

Fluidized spray drying equipment is the fastest-growing product segment, advancing at a CAGR of 7.14%. Its rise is driven by expanding use in producing agglomerated and instantized powders with superior flowability and dispersibility. Fluidized systems support flexible scalability and energy-efficient drying, appealing to manufacturers modernizing processing lines. Their capability to handle complex formulations positions them as a strong choice for sectors seeking improved powder characteristics and controlled particle engineering.

Source: Straits Research

Stage Insights

Single-stage spray dryers command over 60% market share, supported by their operational simplicity, cost efficiency, and broad acceptance in food, chemical, and pharmaceutical manufacturing. These systems suit large-scale production where consistent moisture reduction and predictable particle size are essential. Their reliability and ease of integration make single-stage configurations the default option for companies prioritizing throughput and stability while managing a wide range of heat-sensitive raw materials.

Two-stage spray drying systems are the fastest-growing segment, expanding at a CAGR of 7.42%. They are increasingly chosen for products requiring tighter control of thermal exposure and improved energy savings. By combining primary drying with secondary fluidized-bed finishing, these systems create powders with enhanced solubility and reduced moisture. Their value is rising across dairy, nutraceutical, and specialty chemical sectors, needing advanced powder properties and more efficient processing cycles.

Cycle Insights

Open-cycle spray dryers hold over 70% market share, driven by their widespread use in food, dairy, feed, and commodity chemical applications. They provide cost-effective air-based drying suitable for non-explosive, non-toxic materials. Industries favor open configurations for their straightforward operation, lower capital requirements, and suitability for high-volume production. Their long-established industrial footprint strengthens dominance as manufacturers continue prioritizing scalability and predictable drying outcomes.

Closed-cycle spray drying is the fastest-growing category with a CAGR of 7.21%, propelled by demand for safer processing of solvents, flammable ingredients, and high-value compounds. These systems recycle inert gases, minimize emissions, and improve product purity. As pharmaceutical, nutraceutical, and specialty chemical producers adopt stricter quality and safety standards, closed-cycle dryers gain momentum for delivering controlled environments and supporting sensitive, solvent-dependent formulations.

Flow Insights

Co-current flow dominates the market with over 55% share because it enables gentle drying by exposing materials to descending temperature gradients. This approach preserves flavor, nutrients, and bioactivity, making it ideal for food, dairy, and nutraceutical powders. Moreover, its ability to minimize thermal degradation while maintaining consistent particle quality ensures strong adoption across industries prioritizing product integrity and optimized heat management.

Mixed-flow spray dryers are the fastest-growing flow configuration at a CAGR of 6.98%. They combine the benefits of co-current and counter-current patterns, allowing tailored temperature profiles for complex formulations. This flexibility supports the production of powders with controlled density, improved stability, and balanced moisture content. As manufacturers diversify product portfolios, mixed-flow systems gain traction for enabling advanced customization and higher process efficiency.

Applications Insights

Food and dairy applications dominate the market with over 45% share, driven by rising demand for milk powders, coffee creamers, flavors, and functional food ingredients. Spray drying ensures stable, lightweight powders with long shelf life and consistent reconstitution properties. The sector’s continuous innovation in nutrition, convenience foods, and ingredient encapsulation reinforces dependence on spray drying, solidifying its leadership across global food-processing operations.

Pharmaceuticals and nutraceuticals represent the fastest-growing segment, expanding at a robust CAGR of 7.98%. Growth is supported by increasing use of spray drying for enhancing solubility, stabilizing bioactives, and producing inhalable or controlled-release formulations. As demand for high-purity, shelf-stable, and precision-engineered ingredients accelerates, spray drying becomes a preferred technology for modern drug delivery systems and advanced nutraceutical powders.

Company Market Share

Leading spray-drying equipment manufacturers are continuously focusing on designing more energy-efficient systems, improving atomization technologies, and integrating advanced process controls to boost powder quality and yield. They are also customizing solutions for specialty applications, like pharmaceuticals, food, and chemicals, while offering modular and scalable units. Moreover, investments emphasize automation, remote monitoring, and system miniaturization to cater to both large-scale industrial players and niche research markets.

SPX FLOW

SPX FLOW was established in 2015 in Charlotte, North Carolina, following the spin-off of SPX Corporation’s flow business into an independent company. It focuses on process solutions for food and beverage, pharmaceutical, and industrial applications, offering mixing, pumping, heat-exchange, and dehydration technologies. Over the years, SPX FLOW has expanded its global footprint through manufacturing sites, innovation centers, and service hubs, strengthening its position as a provider of efficient, high-performance equipment.

List of Key and Emerging Players in Spray Drying Equipment Market

- GEA Group

- SPX FLOW

- Büchi Labortechnik

- Dedert Corporation

- European SprayDry Technologies

- Shandong Tianli Drying Technology

- Tetra Pak

- Swenson Technology

- Yamato Scientific

- Labplant UK

- Marriott Walker Corporation

- Freund-Vector Corporation

- Carrier Vibrating Equipment

- SANOVO Technology Group

- New AVM Systech

- Acmefil Engineering Systems

- Changzhou Lemar Drying Engineering

- Tokyo Rikakikai (Eyela)

- SiccaDania

- OKAWARA MFG Co., Ltd.

Recent Development

- September 2025 - Researchers from KERI and KIMS developed a spray-drying-based dry electrode manufacturing technology for high-capacity secondary batteries. They mix active materials + conductive additives in a slurry, then spray dry it — producing a composite powder that improves electrode homogeneity and energy density.

- August 2025 - SPX FLOW launched an upgraded SmartDry automation system for its Anhydro spray dryers. The new design uses smarter optimisation algorithms to boost capacity by up to 8%, doubles throughput versus the old model, and offers real-time control, weather-based adjustments, and seamless integration.

- June 2025 - At CPHI 2025, Shinma Drying showcased its spray drying innovations, highlighting energy-efficient (“modular” + “intelligent control”) designs. Their LPG-series centrifugal spray dryer was a highlight: claimed to reduce energy consumption by >20% and increase drying efficiency by ~30%.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 6.42 billion |

| Market Size in 2026 | USD 6.83 billion |

| Market Size in 2034 | USD 11.54 billion |

| CAGR | 6.86% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Stage, By Cycle, By Flow, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Spray Drying Equipment Market Segments

By Product

- Rotary Atomizer

- Nozzle Atomizer

- Fluidized

- Centrifugal

By Stage

- Single-Stage

- Two-Stage

- Multi-Stage

By Cycle

- Open

- Closed

By Flow

- Co-Current

- Counter-Current

- Mixed Flow

By Applications

- Food & Dairy

- Pharmaceuticals & Nutraceuticals

- Chemical

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.