Synthetic Fibers Market Size, Share & Trends Analysis Report By Product (Nylon, Polyester, Polyolefins, Acrylics, Others), By Applications (Automotive, Clothing, Home Furnishing, Filtration, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Synthetic Fibers Market Overview

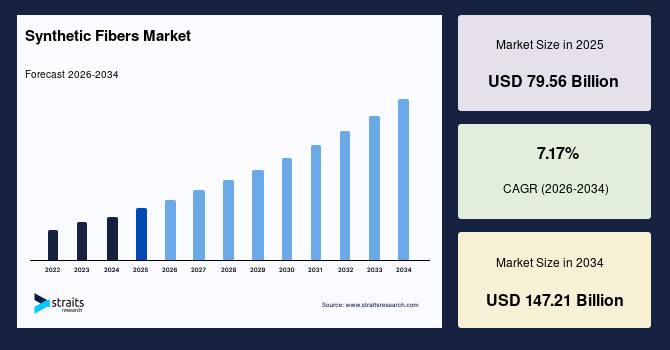

The global synthetic fibers market size was valued at USD 79.56 billion in 2025 and is estimated to reach USD 147.21 billion by 2034, growing at a CAGR of 7.17% during the forecast period (2026–2034). The market is driven by rising demand from the expanding textile and apparel industry. Growing use in sportswear, fashion, and technical textiles, coupled with cost-effectiveness, durability, and versatility, continues to strengthen market growth.

Key Market Trends & Insights

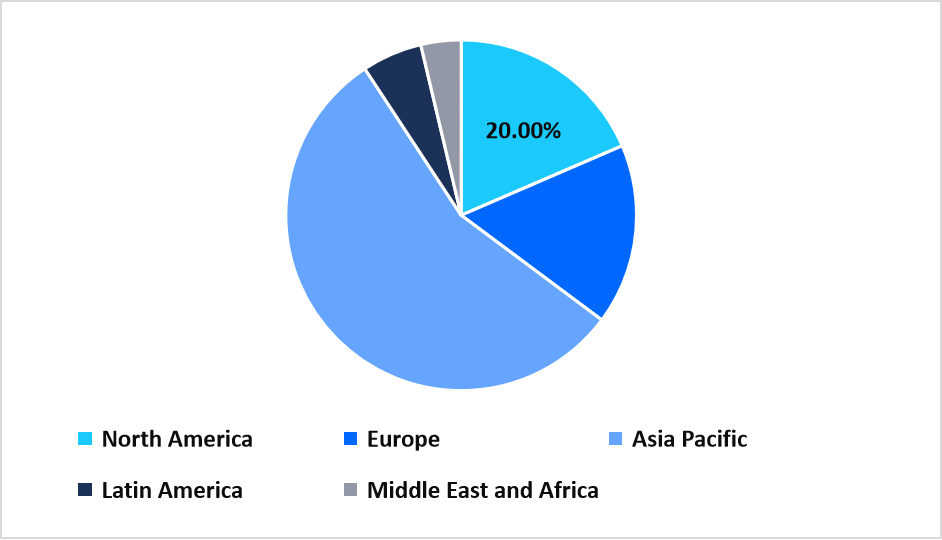

- Asia-Pacific held the largest market share, over 65% of the global market.

- North America is the fastest-growing region with a CAGR of 8.75%.

- By Product, the polyester segment held the highest market share of over 45%.

- By Application, the home furnishing segment is expected to witness the fastest CAGR of 7.34%.

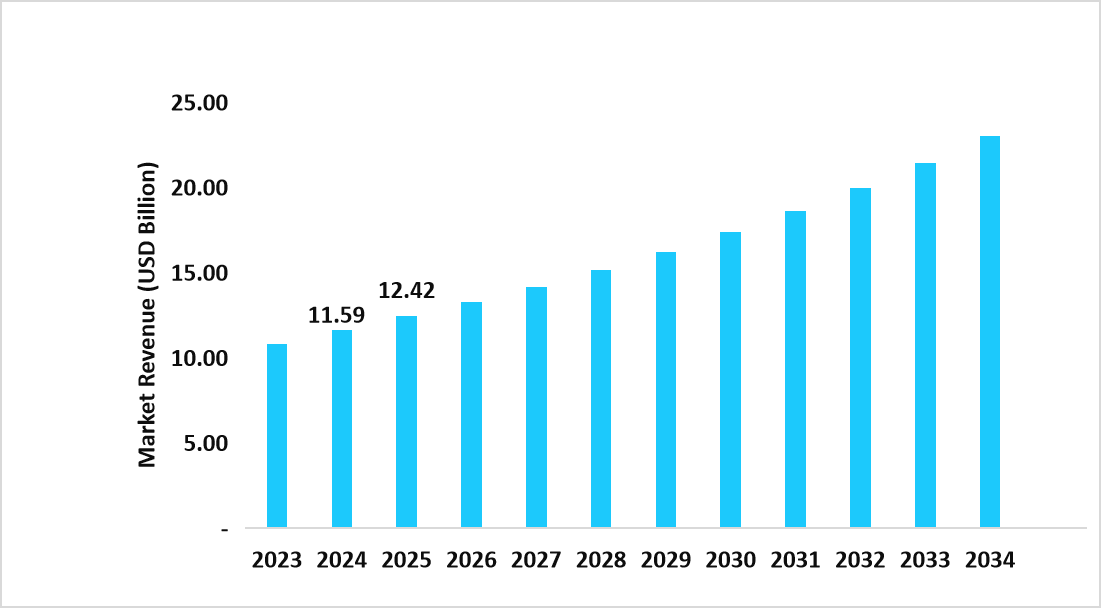

- The U.S. synthetic fibers market was valued at USD 11.59 billion in 2024 and reached USD 12.42 billion in 2025.

Graph: The US Market Revenue Forecast (2023 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 79.56 billion

- 2034 Projected Market Size: USD 147.21 billion

- CAGR (2026-2034): 17%

- Asia-Pacific: Largest market in 2025

- North America: Fastest-Growing Region

Synthetic fibers are man-made fibers produced from chemical substances, primarily derived from petrochemicals. Common types include polyester, nylon, acrylic, and spandex. These fibers are known for their durability, elasticity, resistance to moisture, and low maintenance compared to natural fibers. They are widely used in textiles, apparel, home furnishings, automotive interiors, medical textiles, and industrial applications like ropes and filters. Their adaptability allows manufacturers to engineer fibers with specific properties, such as flame resistance, stretchability, or moisture-wicking capabilities.

The market is propelled by increasing demand for cost-effective and versatile materials. Rising awareness of sustainable alternatives and recycling initiatives is creating growth avenues, while emerging economies with expanding manufacturing bases provide significant opportunities. Technological advancements in polymer production and eco-friendly fiber innovation are opening new applications in sectors like healthcare, sports, and technical textiles. Strategic collaborations and investments by major fiber producers further support market expansion, ensuring a robust outlook for the coming years.

Latest Market Trends

Rising Demand for Recycled and Bio-Based Synthetic Fibers

Growing environmental awareness and stringent sustainability goals are driving a global shift toward recycled and bio-based synthetic fibers. Manufacturers are increasingly adopting materials derived from post-consumer plastics and renewable sources to reduce carbon footprints and dependence on petroleum-based raw materials, aligning with circular economy initiatives.

In recent years, fashion and textile brands have accelerated partnerships with fiber producers to develop eco-friendly alternatives like recycled polyester and bio-nylon. These fibers not only minimize waste but also maintain durability and performance, making them ideal for apparel, upholstery, and industrial applications. This trend continues to redefine innovation and sustainability in the synthetic fiber industry.

Growing Popularity of Synthetic Fibers in Automotive and Industrial Applications

The market is witnessing a growing popularity of synthetic fibers in automotive and industrial applications. Manufacturers increasingly prefer synthetic fibers due to their durability, lightweight properties, and resistance to wear and tear. These fibers are widely used in automotive interiors, seat covers, airbags, and carpets, enhancing performance and longevity.

As per the Straits Research, synthetic fibers are also gaining traction in industrial sectors such as construction, filtration, and packaging. Their versatility, combined with cost-effectiveness and ease of maintenance, makes them an ideal choice for diverse applications. This trend is expected to continue as industries seek efficient and sustainable material solutions.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 79.56 Billion |

| Estimated 2026 Value | USD 84.94 Billion |

| Projected 2034 Value | USD 147.21 Billion |

| CAGR (2026-2034) | 7.17% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Reliance Industries Ltd., Indorama Corp., Teijin Ltd., Bombay Dyeing, Toyobo Co., Ltd. |

to learn more about this report Download Free Sample Report

Latest Market Trends

Rising Demand for Recycled and Bio-Based Synthetic Fibers

Growing environmental awareness and stringent sustainability goals are driving a global shift toward recycled and bio-based synthetic fibers. Manufacturers are increasingly adopting materials derived from post-consumer plastics and renewable sources to reduce carbon footprints and dependence on petroleum-based raw materials, aligning with circular economy initiatives.

In recent years, fashion and textile brands have accelerated partnerships with fiber producers to develop eco-friendly alternatives like recycled polyester and bio-nylon. These fibers not only minimize waste but also maintain durability and performance, making them ideal for apparel, upholstery, and industrial applications. This trend continues to redefine innovation and sustainability in the synthetic fiber industry.

Growing Popularity of Synthetic Fibers in Automotive and Industrial Applications

The market is witnessing a growing popularity of synthetic fibers in automotive and industrial applications. Manufacturers increasingly prefer synthetic fibers due to their durability, lightweight properties, and resistance to wear and tear. These fibers are widely used in automotive interiors, seat covers, airbags, and carpets, enhancing performance and longevity.

As per the Straits Research, synthetic fibers are also gaining traction in industrial sectors such as construction, filtration, and packaging. Their versatility, combined with cost-effectiveness and ease of maintenance, makes them an ideal choice for diverse applications. This trend is expected to continue as industries seek efficient and sustainable material solutions.

Market Drivers

Expanding Textile and Apparel Industry Worldwide

The global synthetic fibers market is being driven by the rapid expansion of the textile and apparel industry worldwide. Rising demand for versatile and cost-effective fibers has fueled growth in sectors ranging from fashion to technical textiles. In particular, Asia continues to be a key hub for synthetic fiber production and innovation.

- For instance, India’s Tirupur region is making a strategic push toward man-made fibers (MMF), aiming to increase MMF’s contribution to production from 10% to 30% by 2030. This initiative focuses on high-demand sectors such as sportswear and technical textiles, with over 5,000 units already starting limited MMF production.

- Meanwhile, Surat is emerging as a garment manufacturing hub, highlighted at the 2025 Yarn Expo, which will showcase specialty yarns designed for sportswear, technical textiles, and medical fabrics.

These developments underscore the growing role of synthetic fibers in meeting global textile demand efficiently.

Market Restraints

Fluctuating Raw Material and Fiber Processing Prices

The synthetic fibers industry faces notable challenges due to fluctuating raw material costs and variable fiber processing prices. These inconsistencies can significantly impact production expenses, making it difficult for manufacturers to maintain stable profit margins. Sudden price hikes in petroleum-based feedstocks, commonly used in synthetic fiber production, further exacerbate cost pressures. Moreover, the complex processing methods required for different fiber types can lead to operational inefficiencies and increased expenditure.

Market Opportunity

Advancements in Fiber Blending Technology

The market is witnessing opportunities through advancements in fiber blending technology, which are reshaping the way fabrics are designed and recycled. Blending natural and synthetic fibers allows manufacturers to create materials that balance durability, comfort, and cost-efficiency, making them highly attractive for both fashion and technical applications.

- For instance, in May 2025, a breakthrough came from Yiqi Yang, a researcher at the University of Nebraska–Lincoln, who developed a chemical recycling technology capable of separating blended textiles, removing dyes, and regenerating high-quality fibers. This innovation addresses one of the biggest challenges in textile recycling—processing mixed fabrics.

Such advancements not only expand product possibilities but also strengthen the industry’s shift toward circular and sustainable textile production.

Regional Analysis

Asia-Pacific is dominating with a market share of over 65% in the global synthetic fibers market, underpinned by rapid urbanization, large-scale textile manufacturing, and substantial investments in capacity expansion. This unmatched prevalence is fueled by high demand for affordable, durable fabrics across automotive, apparel, and home furnishing sectors, coupled with streamlined supply chains and strong raw material accessibility. Moreover, a robust presence of integrated producers and an evolving regulatory focus on sustainable fiber solutions further cements the region’s leadership.

China’s market commands global influence, driven by leading manufacturers such as Sinopec, Hengli Group, and Zhejiang Hengyi Group, which leverage advanced manufacturing and integrated petrochemical operations. Local innovation, government support for sustainable production, and strategic collaborations with international textile brands amplify China’s stature as an ecosystem hub.

India’s market is characterized by rapid capacity additions from prominent players like Reliance Industries, Indo Rama Synthetics, and Garden Silk Mills. The sector benefits from rising domestic consumption of polyester and viscose in fashion and technical textiles. Competitive labor costs, extensive raw material networks, and new product development, especially in specialty fibers and green alternatives, drive industry dynamism.

North America Market Insights

North America is the fastest-growing region with a CAGR of 8.75%, driven by increasing demand for high-performance fibers across the automotive, aerospace, and textile industries. This growth is supported by the adoption of advanced manufacturing technologies, sustainable and recycled fibers, and the expansion of e-commerce channels that facilitate broader market reach. Moreover, market players are focusing on innovation and strategic collaborations to enhance their product offerings, while evolving consumer preferences for durable and high-quality materials further stimulate demand.

The United States market showcases leadership through established companies such as Invista, Eastman Chemical Company, and Celanese Corporation, renowned for their innovation in polyester, nylon, and specialty fibers. The market is characterized by strong investments in advanced manufacturing processes, high safety standards, and continued diversification into smart and green fiber production.

Canada’s market benefits from leading players like Intertape Polymer Group and Kelheim Fibres, focusing on both performance and eco-friendly products. The sector is marked by the production of specialty technical fibers that serve automotive, construction, and geotextile industries. Investment in R&D for sustainable fiber solutions and industry partnerships encourages innovation and export growth.

Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe’s synthetic fibers market is characterized by a growing focus on sustainability and eco-friendly production, with increasing demand for recycled polyester and bio-based fibers. The fashion and automotive sectors are adopting innovative materials to reduce environmental impact, while industrial applications drive demand for high-strength and lightweight fibers. Moreover, regulatory support, consumer awareness, and technological advancements in fiber processing contribute to steady growth, positioning Europe as a leader in sustainable and innovative synthetic fiber applications.

Latin America Market Insights

Latin America’s synthetic fibers market is experiencing steady growth, fueled by expanding textile manufacturing, increasing urbanization, and rising demand in the automotive and construction sectors. Polyester and polypropylene fibers are widely used across apparel, home textiles, and industrial applications, reflecting the region’s diverse consumption needs. Moreover, initiatives, adoption of cost-effective fibers, and export-oriented growth are shaping industry trends, supported by government incentives and regional trade agreements that encourage market expansion.

Middle East and Africa Market Insights

The Middle East and Africa synthetic fibers market is gaining momentum due to accelerating industrialization, large-scale construction projects, and increasing use in automotive and technical textile applications. High-performance fibers are being adopted for durable clothing, industrial products, and infrastructure development, while manufacturers are investing in local production and distribution networks to reduce import dependency. Moreover, sustainability, energy-efficient fibers, and lightweight materials are emerging as key trends in response to environmental concerns and regional development goals.

Product Insights

The polyester segment dominates the market with over 45% share, reflecting its versatility, durability, and cost-effectiveness. Widely used in textiles, apparel, and industrial applications, polyester’s strong demand continues across regions. Its consistent performance, ease of manufacturing, and compatibility with blending technologies make it the backbone of the market, ensuring stable revenue and high adoption in large-scale production worldwide.

Segmentation by Product in 2025 (%)

Source: Straits Research

Application Insights

The home furnishing segment, including upholstery, carpets, and drapery, is the fastest-growing segment, expanding at a CAGR of 8.14%. Rising demand for durable, easy-to-maintain, and aesthetically versatile fabrics in residential and commercial spaces is fueling growth. Regions with increasing urbanization and disposable income, such as Asia-Pacific and North America, are key contributors to the expanding market share.

Company Market Share

Leading companies are focusing on scaling production of performance-oriented man-made fibers, enhancing recycling technologies, and developing specialty blends for industrial, medical, and sportswear applications. They’re investing in sustainable dyeing and finishing techniques and accelerating the adoption of chemical and enzymatic recycling to process mixed fabrics. R&D is centered on reducing environmental footprint, improving fiber strength and comfort, and creating functional fabrics that meet both aesthetic and regulatory standards.

Indorama Corp.

Indorama Corporation, part of Indorama Ventures, was established in 1975 in Indonesia before expanding globally, with its headquarters now in Bangkok, Thailand. Initially starting as a small yarn producer, it has grown into the world’s largest producer of PET resins, polyester fibers, and yarns. The company operates across Asia, Europe, and the Americas, serving textiles, packaging, and industrial sectors. Its focus on scale, sustainability, and recycling has positioned it as a key synthetic fibers leader.

- In September 2025, Indorama Ventures announced a certified supply chain for low-carbon PET fibers under its deja™ Bio portfolio, enabling brands to reduce Scope 3 emissions via traceable bio-based inputs.

List of Key and Emerging Players in Synthetic Fibers Market

- Reliance Industries Ltd.

- Indorama Corp.

- Teijin Ltd.

- Bombay Dyeing

- Toyobo Co., Ltd.

- I. du Pont de Nemours and Company

- Toray Chemical Korea, Inc.

- Lenzing AG

- China Petroleum Corp. (Sinopec Corp.)

- Mitsubishi Chemical Holdings Corp.

Strategic Initiatives

- March 2025: Sateri unveiled a series of eco-friendly manmade cellulose fibers, including its Lyocell line, the EcoCosy series, and Finex recycled fiber. The company emphasized innovations like ultra-fine durable fibers for high-speed spinning and new fiber technologies (e.g., fibrillation resistant) to boost the quality/sharpness of output.

- February 2025: LYCRA introduced a pre-dyed filament fiber called COOLMAX CORE. It removes the need for separate dyeing steps, improving manufacturing efficiency and reducing environmental impact. It also retains moisture-management properties, which help in sectors like shirting, formalwear, and knitwear.

- January 2025: Ganni has signed a four-year offtake agreement with Ambercycle, a Los Angeles-based material innovation startup, to incorporate Cycora, a recycled polyester made from post-consumer textile waste, into its collections. This commitment is part of Ganni's strategy to replace 20% of its annual polyester use with Cycora in 2024, aligning with its goal to halve its carbon footprint by 2027.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 79.56 Billion |

| Market Size in 2026 | USD 84.94 Billion |

| Market Size in 2034 | USD 147.21 Billion |

| CAGR | 7.17% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Synthetic Fibers Market Segments

By Product

- Nylon

- Polyester

- Polyolefins

- Acrylics

- Others

By Applications

- Automotive

- Clothing

- Home Furnishing

- Filtration

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.