Synthetic Rope Market Size, Share & Trends Analysis Report By Material (Polypropylene (PP), Polyester, Nylon, Polyethylene (HDPE, UHMWPE), Aramid, Specialty Fibers, Others), By Type (Single Braid, Double Braid, Hollow Braid, Plaited Rope, Twisted Rope), By Application (Marine & Fishing, Oil & Gas, Construction, Industrial Lifting & Crane, Mining, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Synthetic Rope Market Size

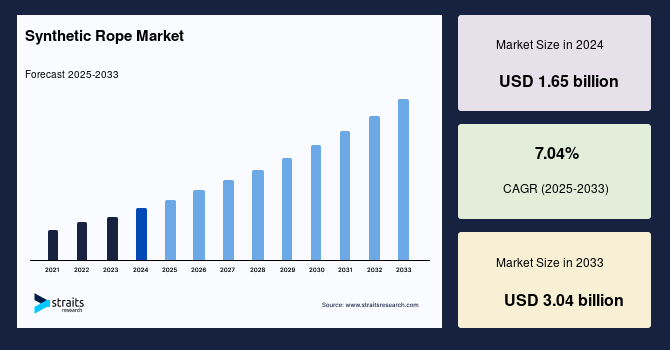

The global synthetic rope market size was valued at USD 1.65 billion in 2024 and is projected to grow from USD 1.77 billion in 2025 to USD 3.04 billion by 2033, growing at a CAGR of 7.04% during the forecast period (2025–2033).

The global synthetic rope market is experiencing significant growth, primarily driven by the increasing preference for high-strength-to-weight ratio materials across industries. Synthetic ropes, being considerably lighter yet stronger than traditional steel ropes, improve handling efficiency, reduce labor requirements, and enhance overall safety in operations. This advantage is particularly beneficial in industries such as marine, oil & gas, and defense, where operational reliability and ease of deployment are critical.

Additionally, the rapid expansion of offshore oil exploration, deep-sea fishing, and maritime shipping activities is fueling the demand for corrosion-resistant and low-maintenance rope solutions. Furthermore, advancements in material science have further enhanced the performance characteristics of synthetic ropes, enabling their use in more demanding and high-load environments. These factors collectively contribute to the surging acceptance of synthetic ropes as a reliable and efficient alternative to traditional rope materials.

Emerging Market Trends

Product Innovation

Product innovation is a significant trend driving the synthetic rope market as manufacturers focus on enhancing performance, safety, and sustainability. Companies are investing in advanced materials and engineering techniques to meet the demands of industries like marine, construction, and energy.

- For instance, in October 2023, Braden unveiled the TRS synthetic rope, designed to complement its TR series planetary recovery winches. The rope features a UHMPE 32-carrier urethane-coated braided sleeve over a Vectran LCP 12-strand core, offering a lightweight, abrasion-resistant, and torque-neutral solution. This innovation addresses industry needs for safer and more efficient lifting and recovery operations.

Similar developments, including the integration of bio-based fibers and smart technologies, are shaping a new generation of synthetic ropes that are not only high-performing but also aligned with global environmental and safety standards.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.65 Billion |

| Estimated 2025 Value | USD 1.77 Billion |

| Projected 2033 Value | USD 3.04 Billion |

| CAGR (2025-2033) | 7.04% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Bridon-Bekaert Ropes Group, Yale Cordage, Teufelberger Holding AG, Samson Rope Technologies, Cortland |

to learn more about this report Download Free Sample Report

Synthetic Rope Market Growth Factors

Infrastructure Development

The growing emphasis on infrastructure development across emerging economies is significantly driving demand for synthetic ropes. These ropes are preferred in large-scale projects for their lightweight, corrosion resistance, and high tensile strength ideal for lifting, hoisting, and rigging. Governments are ramping up investments in transport, energy, and urban expansion to fuel economic growth and improve connectivity.

- For instance, the International Finance Corporation (IFC) is investing $50 million in equity to support the $1 billion Emerging Markets Infrastructure Fund II (EMIF II). This fund focuses on critical transport infrastructure and renewable energy projects in South and Southeast Asia and Africa, aiming to address infrastructure gaps and reduce carbon emissions.

Such large-scale developments require reliable, durable materials, making synthetic ropes indispensable in construction equipment, cranes, and support systems. This trend is anticipated to sustain long-term market growth.

Market Restraint

Competition from Steel Ropes

One significant restraint in the global synthetic rope market is the strong competition from traditional steel ropes. Steel ropes have long been the industry standard, particularly in applications requiring high tensile strength, fire resistance, and minimal elongation under load. Many end-users remain loyal to steel ropes due to their proven reliability, especially in heavy-duty sectors like mining, construction, and oil & gas.

Additionally, the lower initial cost of steel ropes can be appealing to cost-sensitive industries, making it challenging for synthetic alternatives to gain traction. Despite the advantages of synthetic ropes, such as reduced weight and corrosion resistance, overcoming the entrenched preference for steel remains a major hurdle.

Key Market Opportunities

Eco-Friendly Innovations

The push for sustainable solutions is unlocking new opportunities in the global synthetic rope market. Manufacturers are increasingly focusing on eco-friendly materials to meet stringent environmental regulations and rising consumer demand for green products.

- For instance, recent research published in PubMed Central in 2025 explored the use of rayon fibers as biodegradable alternatives to synthetic ropes in marine environments. These ropes exhibit rapid degradation under biotic conditions, losing 90% of their strength after two weeks for yarns and six months for small ropes, making them suitable for applications where rope loss at sea is a concern.

Additionally, innovations such as compostable mooring lines, recycled PET ropes, and bio-based fibers like Biosteel® are creating sustainable alternatives that minimize ecological footprints while maintaining functionality, offering growth potential in maritime, aquaculture, and recreational sectors.

Regional Insights

The synthetic rope market in North America is expanding steadily, driven by increased demand from the offshore oil & gas sector and advanced marine operations. A robust focus on worker safety and operational efficiency is boosting adoption across industrial and utility applications. The region’s mature construction and mining industries are also transitioning from steel to synthetic ropes due to improved handling and corrosion resistance. High investment in product innovation and the adoption of advanced materials like HMPE and aramid fibers are further supporting market growth.

Us Synthetic Rope Market Trends

The US market is robust, fueled by diverse applications across construction, maritime, and defense sectors. In the Gulf of Mexico, synthetic ropes are widely used for offshore drilling and subsea operations due to their high strength and flexibility. Additionally, synthetic ropes are preferred in the booming renewable energy sector, particularly in wind turbine installations along the East Coast, providing safer and more efficient lifting solutions.

Canada’s market is growing steadily, driven by expanding offshore oil & gas activities in regions like Newfoundland and Labrador. The fishing industry also relies heavily on synthetic ropes due to their resistance to saltwater corrosion. For example, companies supplying UHMWPE ropes to Atlantic fisheries benefit from durability and lightweight advantages, supporting both commercial and aquaculture sectors amid increasing marine infrastructure investments.

Asia-Pacific Synthetic Rope Market Trends

Asia Pacific is the fastest-growing region in the synthetic rope market, fueled by rapid industrialization and infrastructure development. High investments in maritime logistics, port expansion, and offshore exploration are significantly contributing to demand. The region is also a major manufacturing hub, which drives large-scale adoption of synthetic ropes in construction and material handling. Favorable economic growth, expanding aquaculture practices, and increasing awareness of the operational benefits of synthetic ropes over traditional alternatives are key drivers fostering market penetration across diverse industries.

India’s market for synthetic rope is expanding due to booming infrastructure, shipping, and fishing industries. The country’s growing coastal economy and initiatives like Sagarmala, which focuses on port modernization, have increased the demand for durable synthetic ropes. Companies such as Vasupujya Industries supply polypropylene and nylon ropes to support the agriculture and construction sectors. Rising awareness about the safety and replacement of traditional ropes accelerates synthetic rope adoption across industries.

China’s market is rapidly growing, driven by its vast maritime and construction sectors. The country’s expanding offshore oil and gas exploration, especially in the South China Sea, fuels the demand for high-strength synthetic ropes. Major manufacturers like Taizhou Shengfeng Rope Co. are innovating with UHMWPE ropes, catering to domestic infrastructure projects and export needs. Government investments in port expansions also boost market growth.

Europe Synthetic Rope Market Trends

Europe’s synthetic rope market is witnessing growth due to rising adoption in renewable energy sectors such as offshore wind farms and environmental emphasis on recyclable materials. Industrial automation and marine operations, especially in colder environments, are leveraging synthetic ropes for their durability and performance in extreme conditions. Regulations promoting safety and reducing carbon footprint are encouraging manufacturers to offer sustainable and lightweight solutions. The region's focus on technological innovation and stringent quality standards also supports consistent demand across maritime, utility, and heavy-lifting applications.

Germany’s market benefits from its robust automotive, construction, and maritime industries. The demand for lightweight, durable ropes in shipping and offshore wind farms is rising. For example, German companies use UHMWPE ropes in port operations for better strength and corrosion resistance. Additionally, a surging focus on renewable energy projects like the North Sea offshore wind farms drives the adoption of advanced synthetic ropes.

The UK market is expanding, driven by its strong maritime and oil & gas sectors. Synthetic ropes are widely used in offshore drilling rigs and fishing fleets, offering superior strength and flexibility. For instance, North Sea oil platforms employ aramid fiber ropes to enhance safety and durability. Increasing investment in coastal infrastructure and renewable energy, such as offshore wind farms, further propels market growth.

Material Insights

The polypropylene (PP) segment held a prominent share in the market owing to its lightweight, cost-effectiveness, and resistance to water and chemicals. Its buoyant nature makes it ideal for marine, fishing, and general-purpose applications. PP ropes are also widely used in agriculture, packaging, and utility sectors for their ease of handling and affordability. Their strength-to-weight ratio and resistance to mildew and rot enhance durability in outdoor environments. Additionally, PP ropes are available in various colors and diameters, catering to diverse end-use requirements. Their broad usability and economical pricing continue to drive demand in both developing and developed regions.

Type Insights

The single braid segment holds a significant share of the synthetic rope market due to its simplicity, strength, and flexibility. Comprising interwoven strands in a single-layer construction, these ropes offer easy handling and are less prone to kinking. They are preferred in applications requiring moderate strength, low stretch, and durability, such as sailing, rigging, and utility work. Single braid ropes also allow for efficient splicing and are typically used when smooth operation over pulleys is necessary. Their lighter weight and low maintenance requirements make them suitable for various marine, recreational, and industrial applications, driving consistent market demand.

Application Insights

The marine and fishing segment represents one of the largest application areas in the synthetic rope market. Synthetic ropes are essential in this sector due to their high tensile strength, resistance to abrasion, UV exposure, and saltwater corrosion. They are widely used in mooring, anchoring, towing, trawling, and netting operations. Compared to traditional materials, synthetic ropes offer increased safety, reduced weight, and ease of handling, improving operational efficiency for fishermen and marine operators. Their buoyancy and durability further enhance their performance in demanding sea environments, solidifying their role as a critical component in global maritime and fishing industries.

Company Market Share

Leading companies in the synthetic rope market are focusing on innovation and expansion to strengthen their market position. They are investing in advanced materials to enhance rope strength and durability, developing eco-friendly and sustainable products, and integrating smart technologies for improved safety and monitoring. Additionally, firms are expanding their global footprints through strategic partnerships and targeting emerging markets to capitalize on growing infrastructure and maritime demands, driving overall market growth.

Yale Cordage: Yale Cordage, founded in 1950 and based in the United States, is a leading manufacturer of high-performance synthetic ropes. The company specializes in advanced fiber technologies, producing ropes for critical applications in industries like marine, arborist, utility, and defense. Known for innovation, Yale Cordage integrates high-modulus fibers such as Dyneema® and Vectran® to deliver superior strength, durability, and safety. Its commitment to quality and custom-engineered solutions has positioned it as a prominent player in the global synthetic rope market.

- In September 2024, Yale Cordage partnered with Applied Fiber to integrate advanced termination technology into their synthetic ropes, aiming to enhance performance and expand application versatility.

List of Key and Emerging Players in Synthetic Rope Market

- Bridon-Bekaert Ropes Group

- Yale Cordage

- Teufelberger Holding AG

- Samson Rope Technologies

- Cortland

- Marlow Ropes

- New England Ropes

- Sterling Rope Company

- Trelleborg AB

- WireCo WorldGroup

to learn more about this report Download Market Share

Recent Developments

- May 2025- WireCo launched the Oliveira Durascend, a rotation-resistant synthetic rope designed for mobile and tower cranes with capacities of up to 100 tonnes. Available in diameters ranging from 8mm to 19mm, Durascend offers a cost-effective solution without compromising performance, making it ideal for small and medium-sized cranes.

- January 2025- EDELRID introduced the Siskin Eco Dry, currently the lightest single rope in the market, weighing just 48 grams per meter. Designed for demanding sport climbing routes, it features a robust sheath structure for top handling and abrasion resistance, and is permanently water-repellent and dirt-resistant thanks to its PFC and PFAS-free Eco Dry finish. The rope's water absorption is less than 2%, far below the required threshold, ensuring durability in wet conditions. It also boasts triple certification for use as a single, half, and twin rope, offering versatility for climbers.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.65 Billion |

| Market Size in 2025 | USD 1.77 Billion |

| Market Size in 2033 | USD 3.04 Billion |

| CAGR | 7.04% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material, By Type, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Synthetic Rope Market Segments

By Material

- Polypropylene (PP)

- Polyester

- Nylon

- Polyethylene (HDPE, UHMWPE)

- Aramid

- Specialty Fibers

- Others

By Type

- Single Braid

- Double Braid

- Hollow Braid

- Plaited Rope

- Twisted Rope

By Application

- Marine & Fishing

- Oil & Gas

- Construction

- Industrial Lifting & Crane

- Mining

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.