Tallow Market Size, Share & Trends Analysis Report By Animal Source (Cattle/Bovine, Sheep/Goat, Pig, Other), By Applications (Food & Beverage, Animal/Pet Feed, Pharma, Personal Care & Cosmetics, Other Industrial (lubricant, biodiesel, etc.)), By Distribution Channel (B2B, B2C, Online Sales, Hypermarkets/Supermarkets, Wholesale Stores, Others (DTC, Convenience Stores, etc.)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Tallow Market Overview

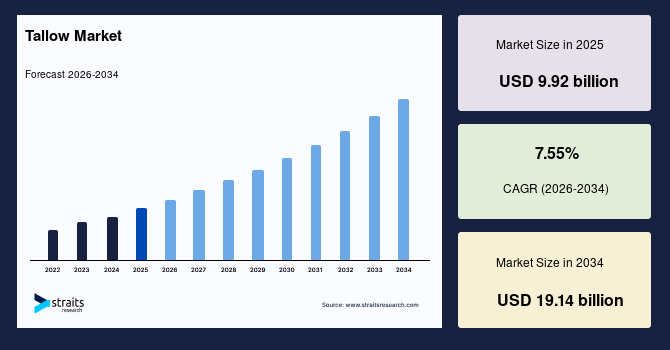

The global tallow market size was valued at USD 9.92 billion in 2025 and is estimated to reach USD 19.14 billion by 2034, growing at a CAGR of 7.55% during the forecast period (2026–2034). Key market drivers include rising demand for biofuels and renewable energy, growing use in animal feed and oleochemical industries, increasing applications in cosmetics and personal care, and expanding demand for sustainable and eco-friendly industrial products.

Key Market Trends & Insights

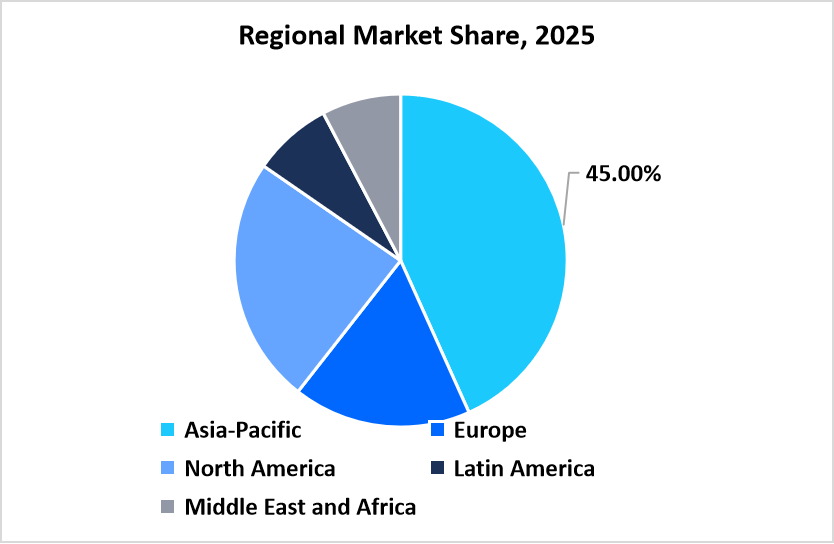

- Asia-Pacific held the largest market share, over 45% of the global market.

- North America is the fastest-growing region with a CAGR of 8.28%

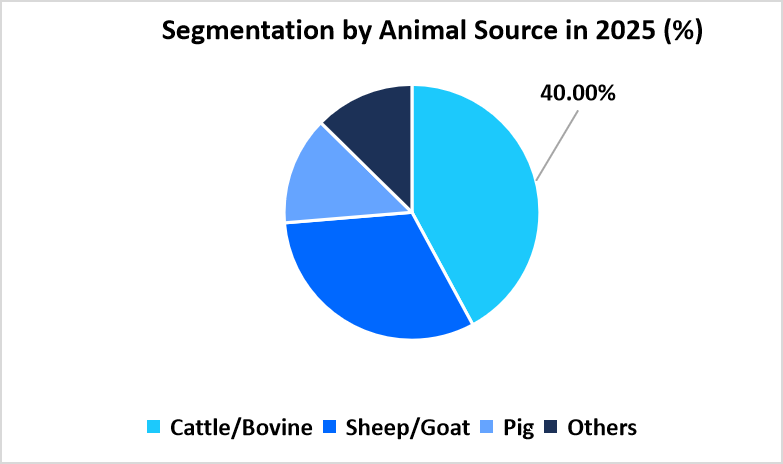

- By animal source, the cattle/bovine segment held the highest market share of over 40%.

- By applications, the pharma, personal care & cosmetics segmentis expected to witness the fastest CAGR of 7.89%.

- By distribution channel, the B2C segment is expected to witness the fastest CAGR of 8.12%.

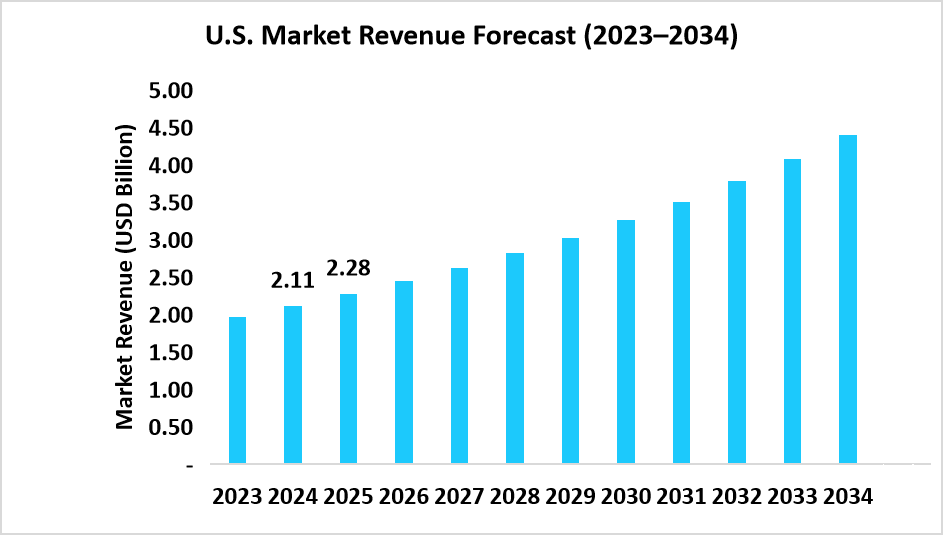

- The U.S. tallow market was valued at USD 2.11 billion in 2024 and reached USD 2.28 billion in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 9.92 billion

- 2034 Projected Market Size: USD 19.14 billion

- CAGR (2026-2034): 7.55%

- Asia-Pacific: Largest market share

- North America: Fastest growing

Tallow is a rendered form of animal fat, primarily obtained from beef or mutton, used for centuries in food, industrial, and cosmetic applications. It is valued for its high melting point, stability, and biodegradability. Common applications include animal feed, personal care products, candles, lubricants, and soaps. Moreover, tallow serves as a raw material in biodiesel production and specialty chemicals. Its natural composition and functional versatility make it a sustainable and cost-effective ingredient across multiple industries worldwide.

The market is driven by growing demand for sustainable and natural ingredients across industries. Rising consumer awareness of environmentally friendly and biodegradable products is encouraging manufacturers to adopt tallow in personal care, cosmetics, and industrial applications. Opportunities also lie in developing innovative tallow-based derivatives for high-value sectors, such as specialty chemicals, pharmaceuticals, and advanced lubricants. Moreover, emerging markets with increasing livestock production offer untapped potential, enabling expansion of supply chains and new product formulations to meet evolving global demand.

Exclusive Market Trends

Shift toward sustainable sourcing and traceable supply chains

In response to growing environmental awareness, the tallow industry is increasingly emphasizing sustainable sourcing and traceable supply chains. Companies are investing in ethical procurement practices, ensuring that raw materials are responsibly sourced from verified suppliers, minimizing environmental impact, and promoting transparency throughout the production process.

This shift also addresses consumer and regulatory demands for accountability in ingredient origins. By implementing traceability systems, producers can monitor quality, certify sustainability, and strengthen brand trust. As a result, sustainable tallow products are gaining preference in biodiesel, personal care, and oleochemical industries, driving innovation and responsible growth across the global market.

Increasing demand in the oleochemical industry for soaps, candles, and lubricants

The global tallow market is witnessing significant growth, driven by rising demand in the oleochemical industry for products such as soaps, candles, and industrial lubricants. Tallow’s versatility, biodegradability, and cost-effectiveness make it a preferred choice for manufacturers aiming to meet consumer preferences for natural and sustainable ingredients.

The increasing adoption of tallow-based formulations in personal care and household products is boosting market expansion. Moreover, advancements in refining and hydrogenation processes are enabling the production of high-quality derivatives, further strengthening tallow’s position across industries, from cosmetics to industrial applications.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 9.92 billion |

| Estimated 2026 Value | USD 10.64 billion |

| Projected 2034 Value | USD 19.14 billion |

| CAGR (2026-2034) | 7.55% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | SARIA SE & Co. KG, Darling Ingredients, Cargill, Incorporated, Ajinomoto Co., Inc., Vantage Specialty Chemicals, Inc. |

to learn more about this report Download Free Sample Report

Market Driver

Expanding food industry use in processed foods, confectionery, and bakery fats

The market growth is being driven by its expanding use in the food industry, particularly in processed foods, confectionery, and bakery fats. Tallow offers stability at high cooking temperatures, a rich flavor profile, and a longer shelf life, making it a preferred ingredient for manufacturers aiming to meet consumer demand for quality and natural products.

- For instance, in April 2025, Health and Human Services Secretary Robert F. Kennedy Jr. and his "Make America Healthy Again" (MAHA) campaign endorsed tallow as a healthier and tastier alternative, emphasizing its natural composition and culinary benefits. Restaurateurs such as Joe Fontana of Fry the Coop and Jesse Griffiths of Dai Due have also embraced tallow, boosting its adoption in mainstream food preparation.

This growing acceptance is significantly driving market growth and innovation across the industry.

Market Restraint

Environmental concerns related to livestock production and its carbon footprint

The market faces certain restraints, primarily due to environmental concerns associated with livestock production. Raising livestock for tallow contributes significantly to greenhouse gas emissions, deforestation, and high water consumption, drawing scrutiny from regulators and environmentally conscious consumers.

As sustainability becomes a key focus, industries are pressured to adopt greener practices, which can limit tallow production. Moreover, growing awareness of the carbon footprint linked to animal-derived products has led to increased interest in plant-based and synthetic alternatives, posing challenges for market growth and long-term adoption.

Market Opportunity

Integration into renewable energy initiatives like biodiesel and green fuels

The global tallow market presents significant opportunities through its integration into renewable energy initiatives, particularly biodiesel and other green fuels. Tallow’s high energy content, biodegradability, and availability as a by-product from meat processing make it an attractive alternative to conventional vegetable oils for sustainable fuel production.

- For instance, the U.S. Energy Information Administration (EIA) reported in its August 2025 Monthly Energy Review that from January to May 2025, tallow inputs for biodiesel increased by 26.5% compared to the same period in 2024, totaling 3.6 billion pounds, even surpassing soybean oil inputs during January and February.

- Meanwhile, Brazil is shifting focus to domestic biodiesel production using beef tallow after a 50% U.S. import tariff on Brazilian beef and by-products made exports uneconomical. This has prompted local producers, including integrated meatpackers, to increase tallow procurement, further supporting renewable energy adoption.

These trends highlight tallow’s growing role as a sustainable feedstock worldwide.

Regional Analysis

The Asia-Pacific tallow market is dominating with a market share of over 45%, fueled by increasing industrial applications, rising biodiesel production, and growing demand from the personal care and oleochemical sectors. Expansion in the meat processing industry and growing disposable incomes are driving the consumption of high-quality tallow derivatives. Moreover, companies are investing in modern refining technologies and establishing local production facilities to meet rising demand. Retail and industrial distribution channels are expanding, while awareness of sustainable and eco-friendly products encourages adoption.

China’s tallow market is growing rapidly, with companies like Yihai Kerry, COFCO, and New Hope Group investing in biodiesel, oleochemicals, and personal care products. Emphasis is placed on modern rendering technologies, sustainable sourcing, and quality control to meet industrial and consumer requirements. Collaborations with soap, chemical, and renewable energy manufacturers enhance distribution and application.

India’s market is developing rapidly as companies such as Godrej Agrovet, Amar Tallow Industries, and Venkys expand applications in biodiesel, personal care, and oleochemicals. Investments in refining infrastructure, quality improvement, and plant-based tallow alternatives are ongoing. Moreover, innovative applications, including lubricants, soaps, and renewable energy solutions, are further strengthening demand in India’s emerging tallow market.

North America: Significantly Growing Region

North America’s tallow market is the fastest growing, with a CAGR of 8.28%, driven by the large-scale meat processing industry, increasing demand for biodiesel, and rising consumption of personal care and oleochemical products. Strong infrastructure, advanced technology, and established supply chains support efficient tallow production and distribution. Leading players are investing in R&D to produce high-quality, sustainable tallow derivatives for food, cosmetics, and industrial applications. Moreover, government incentives for renewable energy and bio-based chemicals are encouraging manufacturers to expand operations, while growing awareness of sustainable sourcing further fuels market growth.

The United States tallow market is expanding with companies like Cargill, JBS, and Tyson Foods focusing on high-purity tallow for biodiesel, personal care, and industrial applications. Brands are investing in refining technologies to improve product quality and sustainability. Moreover, growing demand for environmentally friendly and multifunctional tallow products is driving expansion, while regulatory support for sustainable sourcing and renewable fuels strengthens market growth.

Canada’s tallow market is witnessing steady growth with companies such as Maple Leaf Foods, Cargill, and Burns & McBride focusing on biodiesel, oleochemicals, and personal care applications. Efforts include refining tallow for high-purity products and expanding supply chain networks for domestic and export markets. Companies are investing in R&D to enhance sustainability and multifunctional applications in the industrial and cosmetic sectors.

Source: Straits Research

European Market Trends

Europe’s tallow market is witnessing steady growth, supported by rising demand for oleochemicals, biodiesel, and high-quality soap manufacturing. Companies are focusing on sustainable sourcing, waste-to-value processes, and modernization of rendering facilities. Players such as Bunge, Loders Croklaan, and Oleon are investing in product innovation and eco-friendly processing technologies. As per Straits Research, collaboration with chemical, food, and personal care manufacturers ensures broad application and consistent supply.

Latin America Market Trends

Latin America’s tallow market is growing gradually with rising industrial applications, particularly in biodiesel production, oleochemicals, and personal care products. Companies such as JBS, Minerva Foods, and Bunge are investing in modern rendering plants and sustainable sourcing strategies. Partnerships with the chemical and food industries help expand product reach. Moreover, regulatory compliance, eco-friendly processing, and waste utilization practices are increasingly emphasized, making Latin America an emerging and strategically important market in the global tallow landscape.

Middle East and Africa Market Trends

The Middle East and Africa tallow market is witnessing steady expansion due to growing demand in biodiesel, soap manufacturing, and oleochemical industries. Companies are investing in modern rendering facilities and sustainable sourcing to meet industrial and domestic requirements. Collaborations with personal care and chemical manufacturers enhance product utilization. Moreover, increasing awareness of renewable energy and eco-friendly products supports adoption, while rising urbanization creates new opportunities.

Animal Source Insights

Cattle or bovine tallow dominates the global market with over 40% share, driven by its wide availability and versatility. It is extensively used in food, personal care, and industrial applications due to its favorable fat composition and stability. Established supply chains and consistent production make bovine tallow the backbone of the industry, sustaining market demand across both mature and emerging regions.

Source: Straits Research

Applications Insights

The food and beverage sector dominates tallow applications, accounting for over 35% market share. Tallow’s stability, high smoke point, and flavor-enhancing properties make it a preferred ingredient in cooking, frying, and bakery applications. Its extensive use in both industrial and household food preparation ensures steady consumption, securing this segment’s position as the largest contributor to global tallow demand.

Distribution Channel Insights

B2C distribution is the fastest-growing channel, growing at a CAGR of 8.12%. Online sales, hypermarkets, and direct-to-consumer platforms are expanding access to packaged and ready-to-use tallow products. Urban and health-conscious consumers increasingly purchase for home cooking, skincare, and DIY uses, boosting market share and signaling a shift toward retail-focused growth opportunities globally.

Company Market Share

Companies are focusing on expanding production capacities, enhancing refining technologies, and developing sustainable sourcing practices to meet growing demand. Many are investing in advanced rendering processes to improve product purity and quality for use in food, cosmetics, and biofuel applications. Moreover, several firms are emphasizing circular economy initiatives by converting animal by-products into valuable tallow derivatives. Strategic collaborations and facility expansions are also key trends driving competitiveness and market penetration.

Darling Ingredients

Darling Ingredients Inc. is a U.S.-based company founded in 1882, originally as a small rendering business in Chicago. Headquartered in Irving, Texas, it processes both edible and inedible bio-nutrients from animal agriculture and food industries. It operates via three main segments: feed ingredients, food ingredients, and fuel ingredients. Moreover, the firm now runs operations on five continents, transforming animal byproduct streams into products like fats, proteins, gelatin/collagen, renewable fuels, and more.

- September 2025 - Darling Ingredients announced it had secured an agreement to sell $125 million in production tax credits generated by its Diamond Green Diesel joint venture under the U.S. Inflation Reduction Act. The proceeds are expected to be received later in 2025, assuming certain funding conditions are met.

List of Key and Emerging Players in Tallow Market

- SARIA SE & Co. KG

- Darling Ingredients

- Cargill, Incorporated

- Ajinomoto Co., Inc.

- Vantage Specialty Chemicals, Inc.

- Jacob Stern & Sons Inc

- Australian Tallow Producers

- Parchem

- Baker Commodities Inc.

- Cailà & Parés

- Wilmar International Limited

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- IOI Corporation Berhad

- Louis Dreyfus Company B.V.

- Ventura Foods

- AAK AB

- Ag Processing Inc.

- Olenex

- Fuji Oil Holdings Inc.

Recent Development

- June 2025 - Moo Elixir is revolutionizing the skincare industry by transforming beef tallow into luxurious, professional-grade products. Founded by siblings Miranda and Brian Robertson, the brand emerged from their shared skepticism about conventional skincare ingredients. Miranda's background in dermatology fueled her curiosity about product formulations, leading to the discovery of tallow's skin benefits.

- August 2025 - Real Good Foods, a frozen meal brand, committed to transitioning its entire product line away from seed oils to beef tallow. This move aligns with the growing "Make America Healthy Again" movement, which criticizes seed oils for their health implications.

- February 2025 - Coast Packing Company, a fourth-generation, family-owned business based in Vernon, California, has broken ground on a new Edible Fats and Oils Refinery and Packaging Facility in Amarillo, Texas. The facility, located at 9400 Centerport Blvd., is expected to open in Summer 2026.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 9.92 billion |

| Market Size in 2026 | USD 10.64 billion |

| Market Size in 2034 | USD 19.14 billion |

| CAGR | 7.55% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Animal Source, By Applications, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Tallow Market Segments

By Animal Source

- Cattle/Bovine

- Sheep/Goat

- Pig

- Other

By Applications

- Food & Beverage

- Animal/Pet Feed

- Pharma, Personal Care & Cosmetics

- Other Industrial (lubricant, biodiesel, etc.)

By Distribution Channel

- B2B

- B2C

- Online Sales

- Hypermarkets/Supermarkets

- Wholesale Stores

- Others (DTC, Convenience Stores, etc.)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.