Targeted DNA RNA Sequencing Market Size, Share & Trends Analysis Report By Technology (NGS, Application, Others), By Workflow (Pre-sequencing, Sequencing, Data Analysis), By Application (Human Biomedical Research, Plant & Animal Sciences, Drug Discovery, Others), By Type (DNA-Based Targeted Sequencing, RNA-Based Targeted Sequencing), By End Use (Academic Research, Hospitals & Clinics, Pharma & Biotech Entities, Other Users) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Targeted DNA RNA Sequencing Market Overview

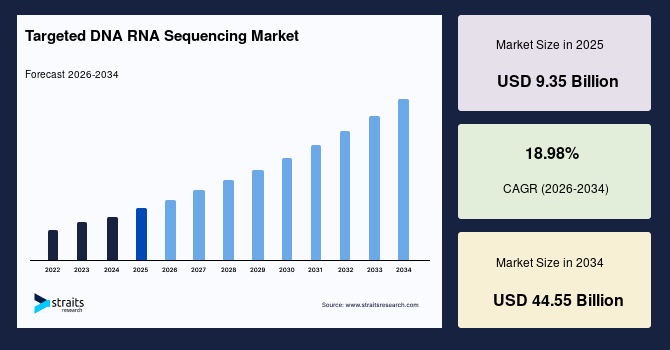

The global targeted DNA RNA sequencing market size is valued at USD 9.35 billion in 2025 and is estimated to reach USD 44.55 billion by 2034, growing at a CAGR of 18.98% during the forecast period. The observed market growth is stimulated by the rising adoption of targeted sequencing in clinical genomics programs that require focused analysis of disease-linked regions for faster and more precise diagnostic decisions.

Key Market Trends & Insights

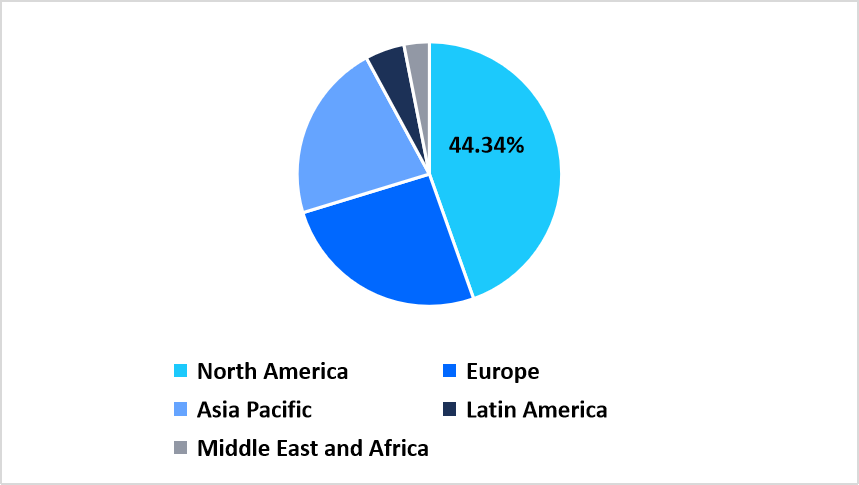

- North America held a dominant share of the global market, accounting for 44.34% in 2025.

- The Asia Pacific region is expected to grow at the fastest pace, with a CAGR of 20.98%.

- Based on Technology, the other segment is anticipated to register the fastest CAGR of 19.12% during the forecast period.

- Based on Workflow, the sequencing segment dominated the market growth with a 57.31% share.

- Based on the Application, human biomedical research dominated the market growth with a 69.12% share.

- Based on Type, RNA-based targeted sequencing is anticipated to register the fastest CAGR of 19.56% during the forecast period.

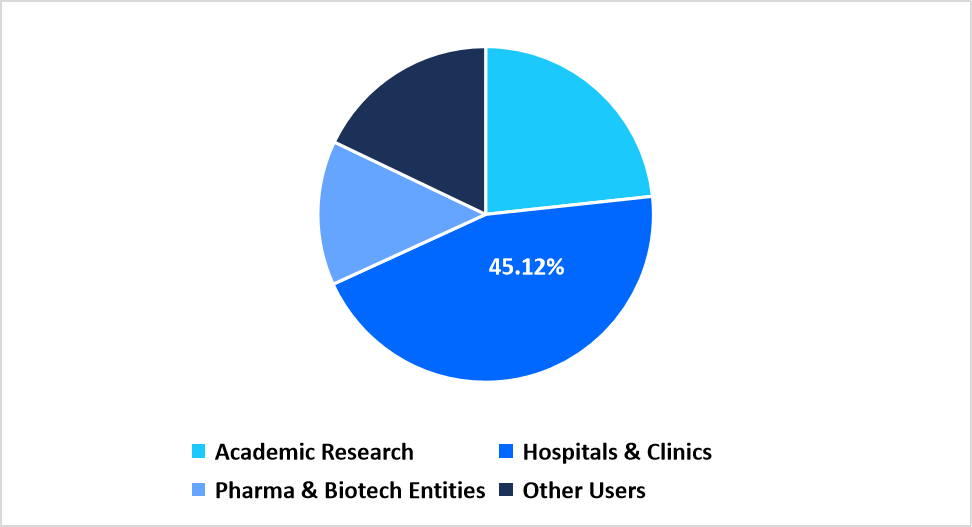

- Based on End Use, the hospitals & clinics segment dominated the market with a revenue share of 45.12% in 2025.

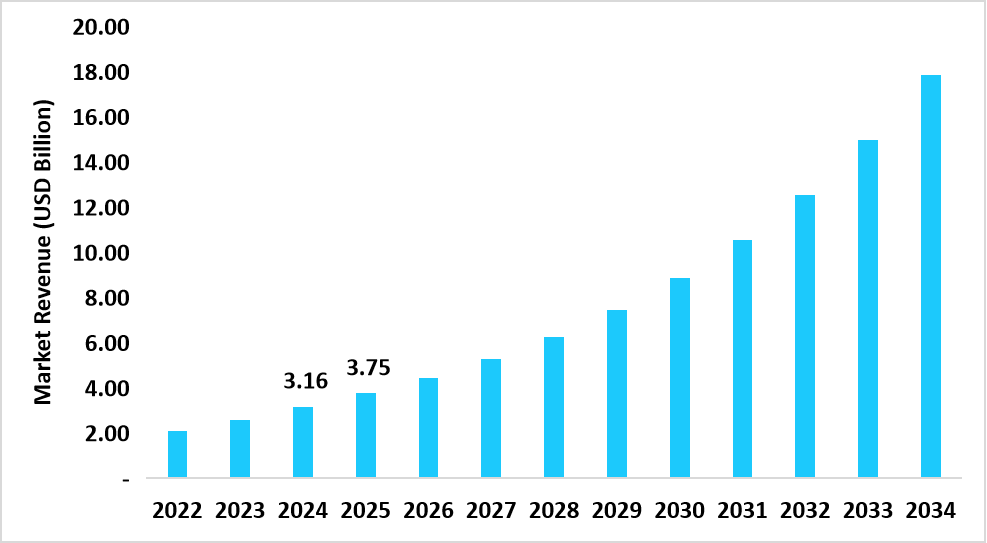

- The U.S. dominates the market, valued at USD 3.16 billion in 2024 and reaching USD 3.75 billion in 2025.

Table: U.S. Targeted DNA RNA Sequencing Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 9.35 billion

- 2034 Projected Market Size: USD 44.55 billion

- CAGR (2026-2034): 18.98%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The targeted DNA RNA sequencing market encompasses technologies and workflows designed to selectively analyze defined genomic and transcriptomic regions rather than entire genomes, enabling focused detection of variants, gene expression patterns, fusions, and microbial signatures with higher depth and interpretive clarity. This market includes NGS-based methods such as exome sequencing, enrichment panels, and amplicon assays, as well as applications spanning cancer gene profiling, inherited disease analysis, drug development, forensic genomics, and microbial sequencing. It further comprises pre-sequencing preparation steps, sequencing operations, and downstream data analysis pipelines that support precise characterization of selected genomic intervals. End users include academic research institutes, hospitals and clinics, pharmaceutical and biotechnology companies, and assorted laboratory groups that employ targeted sequencing to advance diagnostics, research programs, and therapeutic development.

Latest Market Trends

Shift Toward Targeted Multi-Omic Convergence Platforms

A key trend influencing the market is the shift toward platforms that merge targeted DNA and RNA sequencing with additional molecular layers within a single analytical framework. Research centers are building workflows that synchronize variant detection, transcript pattern assessment and pathway-level interpretation to create unified molecular profiles for each sample. This convergence supports deeper mapping of regulatory elements and enhances the value of targeted assays in projects exploring disease pathways, cellular states and therapeutic response patterns.

Transition from Static Gene Panels to Adaptive Panel Reconfiguration Systems

The major trend gaining momentum is the transition from fixed gene panels toward adaptive panel reconfiguration systems that allow users to adjust probe content without redesigning entire assays. Developers are introducing modular probe libraries that can be swapped or expanded depending on emerging biomarkers, new clinical insights or updated research priorities. This approach supports faster assay deployment, reduces redesign cycles and aligns sequencing activities with evolving scientific objectives across disease research and translational studies.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 9.35 Billion |

| Estimated 2026 Value | USD 11.09 Billion |

| Projected 2034 Value | USD 44.55 Billion |

| CAGR (2026-2034) | 18.98% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Illumina, Inc., Thermo Fisher Scientific Inc., QIAGEN, Agilent Technologies, Inc., Hoffmann-La Roche Ltd |

to learn more about this report Download Free Sample Report

Targeted DNA RNA Sequencing Market Driver

Expansion of Decentralized Molecular Testing Networks

A key driver for the market is the expansion of decentralized molecular testing networks across academic hospitals, regional laboratories and specialized clinics. These networks are investing in compact sequencing systems and streamlined targeted workflows that support on-site genomic evaluations for oncology, hereditary disorders and infectious disease assessments. As testing capacity disperses across broader geographic regions, demand for focused DNA and RNA panels increases due to their suitability for rapid turnaround, defined data outputs and targeted interpretation frameworks.

Market Restraint

Challenges in Harmonizing Assay Performance Across Varied Laboratory Environments

A major restraint arises from challenges associated with harmonizing targeted sequencing assay performance across laboratories with differing instrumentation, workflow structures and sample handling practices. Variability in library preparation conditions, reagent quality and sequencing depth can create inconsistencies in final datasets, making cross-site comparisons more complex. These discrepancies can slow validation cycles and require additional quality oversight when large projects depend on coordinated output from multiple facilities.

Market Opportunity

Growing Interest in Spatially Resolved Targeted Sequencing Platforms

A major opportunity emerges from rising interest in platforms that combine spatial mapping with targeted DNA and RNA sequencing. These systems allow researchers to pinpoint genomic alterations and transcript patterns within defined tissue regions rather than bulk samples. Adoption is rising across oncology, neurobiology and developmental biology as investigators seek precise insights into microenvironmental interactions and regional gene activity. This opens new avenues for targeted panel design, specialized reagent kits and advanced analytical frameworks tailored for spatial genomics.

Regional Analysis

North America leads the targeted DNA RNA sequencing market in 2025 with a large revenue share of 44.34% driven by extensive adoption of sequencing technologies across clinical genomics networks and academic centers. Expanding investments in precision medicine programs across the region strengthen sequencing workflows and expand access to targeted assays for oncology infectious disease research and hereditary disorder screening.

The U.S. market advances due to federal commitments toward nationwide genomic surveillance and large-scale sequencing data programs. Government allocations exceeding USD 3.6 billion across genomics driven healthcare initiatives accelerate the adoption of targeted DNA and RNA panels in hospitals, research centers and biopharma programs, enhancing the country’s role as a core driver of global sequencing activity.

Asia Pacific Market Insights

Asia Pacific records the fastest growth rate of 20.98% during the forecast period, supported by rapid expansion of genomics facilities across China, India, and Australia. The region is witnessing strong uptake of targeted sequencing assays as healthcare systems integrate molecular diagnostics into population health and clinical research programs.

China’s market accelerates due to the broad establishment of sequencing clusters backed by a national initiative valued at RMB 210 billion focused on scaling genomic medicine and expanding local reagent manufacturing, which boosts the availability of targeted DNA and RNA sequencing tools across clinical and research environments.

Regional Market Share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe maintains steady growth supported by broad public sector commitments to genomic science and translational medicine. Regional research institutes and diagnostic laboratories are expanding targeted sequencing capabilities to support oncology screening, rare disease analysis, and microbiological investigations.

Germany records rising adoption fueled by federal and state-level programs that allocated more than USD 1.2 billion in 2024 to create connected genomic data networks, which strengthen procurement of targeted sequencing panels across hospitals and research consortia.

Latin America Market Insights

Latin America experiences rising demand driven by the expansion of clinical molecular testing capacity across Brazil, Mexico, and Chile. Growing emphasis on early disease detection and genetic analysis supports increased use of targeted sequencing assays in oncology, infectious disease evaluation, and population studies.

Brazil’s market grows due to new national directives allocating roughly USD 520 million toward genomics infrastructure, which expands local sequencing throughput and encourages procurement of targeted DNA and RNA kits across public and private laboratories.

Middle East and Africa Market Insights

The Middle East and Africa region registers steady development supported by growth in molecular diagnostic laboratories in Saudi Arabia, the United Arab Emirates, Kenya, and South Africa. Increasing governmental focus on improving genetic testing pathways strengthens the adoption of targeted sequencing across clinical and academic sectors.

Saudi Arabia advances due to national healthcare modernization efforts that funded more than USD 350 million for genomics and molecular testing programs, which expand sequencing installations and widen access to targeted DNA and RNA platforms across regional health systems.

Technology Insights

The NGS method category dominates the market in 2025 as exome sequencing, enrichment sequencing, amplicon sequencing and related approaches account for the largest contribution due to their capacity to focus on defined genetic regions while maintaining high analytical detail across clinical and research environments. Their extensive placement across sequencing centers supports broad adoption across oncology studies, inherited condition assessments and transcript-focused investigations where targeted outputs are required.

The Others technology category records the fastest expansion with a 19.12% growth rate as laboratories incorporate flexible targeted platforms for microbial studies, metagenomic investigations and specialized genomic assays. The entry of adaptable systems capable of supporting distinct sequencing priorities accelerates uptake across institutions expanding targeted workflows beyond conventional clinical areas.

Workflow Insights

The sequencing phase dominates the workflow structure with a 57.31% share in 2025 supported by its central role in producing region-specific reads used for downstream variant classification and transcript evaluation. Continuous installation of sequencing units across diagnostic labs and genomic research facilities reinforces the position of the sequencing phase as the core operational step within targeted workflows.

Data analysis represents the fastest-growing workflow stage at 19.78% as rising sequencing volumes across research and medical centers increase demand for computational interpretation pipelines. Adoption of automated analytics frameworks and scalable cloud systems enhances processing capacity for variant calling, expression quantification, and panel-based dataset management.

Application Insights

Human biomedical research dominates the application landscape with a 69.12% share as targeted sequencing remains central to projects that investigate disease-linked alterations, pathway-level changes, and gene expression variations across human samples. Widespread integration of targeted assays into studies on cancer progression, genetic disorders, and clinical biomarkers firmly positions this segment at the forefront of market contribution.

Drug discovery is the fastest growing application with a 19.35% rate driven by increased use of targeted DNA and RNA panels for lead identification, mechanistic exploration, and early-stage candidate evaluation. Pharmaceutical pipelines integrate targeted sequencing to refine decision-making during preclinical development and strengthen precision-oriented therapeutic strategies.

Type Insights

DNA-based targeted sequencing dominates the type category in 2025 due to its broad use in mutation assessment, genomic profiling, and focused region analysis. Its placement across oncology diagnostics, hereditary disease testing, and specialized research programs supports extensive utilization throughout diverse sequencing environments.

RNA-based targeted sequencing is the fastest growing type with a 19.56% rate as laboratories expand transcript-level investigations, including fusion detection, expression monitoring and pathway activity studies. Increased deployment across immunology, oncology, and neurological research reinforces the rapid upward trajectory of this segment.

End Use Insights

Hospitals and clinics dominate the end-use category with a 45.12% share driven by escalating adoption of targeted sequencing for cancer diagnostics, inherited disease confirmation and treatment planning. Expanded installation of sequencing facilities within healthcare systems enables streamlined use of targeted panels in routine medical evaluation.

Pharma and biotech entities mark the fastest growth rate at 19.22% as research divisions incorporate targeted sequencing for biomarker validation, therapeutic assessment, and companion diagnostic exploration. Integration of sequencing into R&D pipelines strengthens reliance on targeted assays to support drug development initiatives.

By End Use Market Share (%), 2025

Source: Straits Research

Competitive Landscape

The global Targeted DNA RNA Sequencing market is fragmented with numerous regional and mid-scale manufacturers operating alongside established genomics suppliers as adoption expands across clinical diagnostics and research workflows.

Illumina, Inc.: An emerging market player

Illumina, Inc. is a leading participant in the targeted DNA and RNA sequencing market, gaining wider visibility through its sequencing platforms and targeted panels that support high-throughput variant detection and gene expression profiling. By offering scalable workflows and a broad portfolio of assays, the company is strengthening its presence across clinical laboratories and research institutions worldwide.

List of Key and Emerging Players in Targeted DNA RNA Sequencing Market

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- QIAGEN

- Agilent Technologies, Inc.

- Hoffmann-La Roche Ltd

- BGI

- PacBio

- Oxford Nanopore Technologies plc.

- Twist Bioscience

- Bio-Rad Laboratories, Inc.

- Integrated DNA Technologies, Inc.

- Takara Bio Inc.

- PierianDx

- Azenta Lifesciences

- Others

Strategic Initiatives

- February 2025: Hoffmann-La Roche Ltd in Switzerland launched its SBX sequencing technology, delivering ultra-rapid, scalable next-generation sequencing to accelerate genomic research, enhance clinical applications, and strengthen its competitive position in precision medicine markets.

- May 2024: Foundation Medicine launched FoundationOneRNA in the U.S., an RNA sequencing test detecting cancer-related fusions across 318 genes, complementing DNA-based tests for enhanced ac

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 9.35 Billion |

| Market Size in 2026 | USD 11.09 Billion |

| Market Size in 2034 | USD 44.55 Billion |

| CAGR | 18.98% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Technology, By Workflow, By Application, By Type, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Targeted DNA RNA Sequencing Market Segments

By Technology

-

NGS

- Method

- Exome Sequencing

- Enrichment Sequencing

- Amplicon Sequencing

- Others

-

Application

- Cancer Gene Sequencing

- Inherited Disease Screening

- Drug Development

- Forensic Genomics

- 16S ribosomal RNA (rRNA) sequencing

- Others

By Workflow

- Pre-sequencing

- Sequencing

- Data Analysis

By Application

- Human Biomedical Research

- Plant & Animal Sciences

- Drug Discovery

- Others

By Type

- DNA-Based Targeted Sequencing

- RNA-Based Targeted Sequencing

By End Use

- Academic Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Other Users

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.