Tobacco Market Size, Share & Trends Analysis Report By Product (Cigarettes, Cigars & Cigarillos, Kretek, Smokeless Tobacco, Next-Generation Products (NGPs): E-cigarettes, Vapes, Heated Tobacco, Nicotine Pouches, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Tobacco Shops, Online Retail, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Tobacco Market Overview

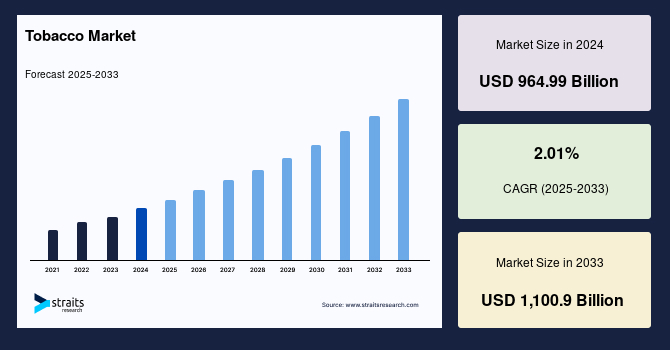

The global tobacco market size was valued at USD 964.99 Billion in 2024 and is projected to reach from USD 985.11 Billion in 2025 to USD 1,100.9 Billion by 2033, growing at a CAGR of 2.1% during the forecast period (2025-2033).The growth of the market is attributed to rising disposable incomes in developing regions.

Key Market Indicators

- Asia Pacific dominated the Toaster Market and accounted for a 48.87% share in 2024

- Based on product, cigarettes continue to dominate the global tobacco market.

- Based on distribution channel, supermarkets and hypermarkets remain the dominant distribution channels.

Market Size & Forecast

- 2024 Market Size:USD 964.99 Billion

- 2033 Projected Market Size:USD 985.11 Billion

- CAGR (2025-2033): 2.1%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The global market encompasses the production, distribution, and sale of tobacco products derived from the Nicotiana plant, primarily Nicotiana tabacum. These products include cigarettes, cigars, smokeless tobacco, and emerging alternatives like e-cigarettes and heat-not-burn devices. Tobacco's addictive properties, particularly due to nicotine, have sustained its demand across various demographics and regions. Despite increasing health awareness and regulatory measures, tobacco remains a significant commodity, with a vast global consumer base ensuring its continued economic relevance.

The tobacco market's growth is propelled by several factors. Product innovation, such as developing e-cigarettes and flavoured tobacco, attracts younger demographics. Emerging markets, especially in Asia-Pacific, exhibit rising consumption due to increasing disposable incomes and urbanisation. Furthermore, strategic mergers and acquisitions among key players enhance market penetration and product diversification. Despite regulatory challenges, these dynamics collectively contribute to the market's resilience and expansion.

Tobacco Market Trend

Shift towards Reduced-Risk Products (rrps)

The global tobacco industry is undergoing a transformative shift towards Reduced-Risk Products (RRPs), such as e-cigarettes, heated tobacco products, and nicotine pouches. This transition is driven by increasing health consciousness among consumers and stringent regulatory pressures on traditional tobacco products.

- For instance, Philip Morris International (PMI) exemplifies this trend, reporting a 41.4% year-over-year increase in U.S. shipments of its Zyn nicotine pouches in Q3 2024, totalling 149.1 million cans.

- Similarly, British American Tobacco (BAT) is intensifying its focus on RRPs, aiming to become a predominantly smokeless business by 2035. BAT's new product sales, including brands like Vuse, Glo, and Velo, grew by 8.9% in 2024, despite a 5.2% decline in overall revenue due to regulatory challenges.

These developments underscore the industry's strategic pivot towards RRPs to align with evolving consumer preferences and regulatory landscapes.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 964.99 Billion |

| Estimated 2025 Value | USD 985.11 Billion |

| Projected 2033 Value | USD 1,100.9 Billion |

| CAGR (2025-2033) | 2.01% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Philip Morris International, British American Tobacco, Japan Tobacco International, Altria Group, Imperial Brands |

to learn more about this report Download Free Sample Report

Tobacco Market Growth Factor

Rising Disposable Incomes in Developing Regions

The escalating disposable incomes in developing regions is a significant driver of tobacco market growth. As consumers in countries like China, India, and various African nations experience increased purchasing power, the demand for premium tobacco products rises correspondingly.

- For example, in China, the State Tobacco Monopoly Administration reported a 3.5% increase in cigarette sales volume in 2024, attributing the growth to higher consumer spending and urbanisation. Similarly, India's market witnessed a 4.2% growth in 2024, fueled by economic expansion and a growing middle class.

Tobacco companies are capitalising on this trend by introducing premium product lines and expanding their regional distribution networks. Aggressive marketing strategies and localised product offerings are further stimulating demand. However, this growth trajectory is tempered by increasing regulatory scrutiny and public health campaigns aimed at curbing tobacco use, necessitating a balanced approach by industry players.

Market Restraint

Regulatory Challenges and Health Concerns

Regulatory challenges and health concerns remain formidable restraints on the global tobacco market. Governments worldwide are implementing stringent regulations to deter tobacco consumption, including advertising bans, plain packaging laws, and increased taxation. For example, British American Tobacco faced a £6.2 billion provision for a proposed product litigation settlement in Canada in 2024, significantly impacting its financial performance. Additionally, the company reported a 5.2% decline in revenue, partly due to regulatory and fiscal challenges in markets like Bangladesh and Australia.

Health concerns associated with tobacco use have led to public smoking bans and intensified anti-smoking campaigns, further constraining market growth. These factors are compelling tobacco companies to diversify their product portfolios and invest in RRPs to mitigate the impact of declining traditional tobacco sales.

Market Opportunity

Expansion of Next-Generation Products

The expansion of next-generation tobacco products presents a significant opportunity for market growth. Companies invest heavily in innovative products to cater to changing consumer preferences and regulatory requirements.

- For instance, Philip Morris International's investment of $600 million in a new Colorado manufacturing plant to produce Zyn nicotine pouches exemplifies this strategic shift. The facility is expected to commence operations by 2025, creating 500 jobs and significantly increasing production capacity.

Moreover, the U.S. Food and Drug Administration's authorisation of Zyn nicotine pouches in January 2025 has bolstered PMI's position in the market, recognising the product's lower risk profile compared to traditional tobacco products. This regulatory endorsement will likely accelerate the adoption of next-generation products, offering tobacco companies a viable path to sustain growth amid declining cigarette consumption.

Regional Insights

Asia-Pacific remains the largest and most influential region in the global market, accounting for a substantial share of global consumption and revenue. The region’s dominance is driven by its vast population, cultural acceptance of tobacco usage, and relatively lower regulatory restrictions in some countries. Despite increasing public health campaigns, the entrenched nature of tobacco in society ensures continued demand. Rising disposable incomes, urbanisation, and the introduction of modern retail formats are further fueling market growth. Simultaneously, companies are targeting millennials through flavoured variants and digital marketing strategies. However, intensifying anti-smoking campaigns, plain packaging laws, and increased taxation are beginning to reshape consumer behavior.

Asia Pacific Tobacco Market Trends

- China is the world's largest tobacco producer and consumer, with China National Tobacco Corporation holding a monopoly. While control measures like public smoking bans and anti-smoking advertisements are gradually being implemented, the government must manage its dependency on tobacco tax revenue. The domestic industry is also exploring the e-cigarette market, although recent regulatory tightening is tempering its expansion.

- India's market is diverse, encompassing cigarettes, bidis, and smokeless tobacco.ITC Limited is a major player, and the government imposes high taxes and pictorial warnings to deter consumption. The government’s imposition of high excise duties and graphic health warnings has somewhat moderated consumption. Nonetheless, the market remains buoyant due to the sheer size of the consumer base and ongoing rural penetration.

North America Tobacco Market Trends

North America is currently the fastest-growing region in the global tobacco market, largely fueled by a sharp increase in demand for NGPs such as nicotine pouches, e-cigarettes, and heated tobacco products. Regulatory scrutiny, including potential bans on flavoured and menthol cigarettes, is accelerating the shift toward reduced-risk alternatives. Moreover, the FDA’s designation of Zyn as a Modified Risk Tobacco Product (MRTP) in early 2025 has boosted consumer and investor confidence in the product’s market potential. The region is also witnessing growing advocacy for harm reduction, which supports market expansion for innovation-driven companies.

- The U.S. tobacco market is evolving, with declining cigarette sales and increasing demand for NGPs.PMI's investment in a new Zyn production facility in Colorado underscores the shift towards smokeless products. Additionally, the FDA's authorisation of Zyn as a Modified Risk Tobacco Product in January 2025 has bolstered its market position.

- Canada's market is highly regulated, with plain packaging laws and significant taxation. The government actively promotes smoking cessation, impacting traditional tobacco sales. BAT faced a £6.2 billion provision for a proposed product litigation settlement in Canada, highlighting the financial risks associated with regulatory compliance.

Europe Tobacco Market Trends

Europe is a mature yet significantly evolving market, shaped by strict regulatory frameworks and an increasing focus on public health. Countries across the European Union are intensifying efforts to reduce tobacco use, including extending taxation policies to vaping and heated products. Nevertheless, the market is witnessing a growing shift toward NGPs as consumers become more health-conscious. Demand for e-cigarettes, nicotine pouches, and heated tobacco products has surged, particularly among younger adults and former smokers. Germany and France remain significant contributors to the regional market due to their large population bases and established retail infrastructure. Meanwhile, Eastern European countries continue to exhibit higher.

- The UK is implementing progressive tobacco control measures, including the proposed Tobacco and Vapes Bill, aiming to phase out smoking among future generations. Despite these challenges, the market is witnessing growth in NGPs, with consumers seeking alternatives perceived as less harmful.

- Germany maintains a significant tobacco market, with a strong presence of traditional and NGP products. Regulations are stringent, focusing on advertising restrictions and health warnings. BAT's Vuse and Glo products have seen increased adoption, indicating a growing preference for NGPs.

Product Insights

Cigarettes continue to dominate the global tobacco market, accounting for the majority of total revenue. In 2024, the cigarette segment was valued at USD 722.27 billion and is projected to grow at a CAGR of 2.4% through the forecast period. Despite the growing awareness of the health risks associated with smoking, cigarettes remain resilient due to several underlying factors. Nicotine dependence, combined with cultural normalisation in many regions, continues to fuel demand. Moreover, manufacturers are innovating with flavoured, slim, low-tar, and mentholated variants to appeal to a broader demographic, including younger consumers and women. Aggressive marketing in regions with laxer regulations, rising stress levels, and urbanisation has supported consistent consumption trends in emerging economies.

Distribution Channel Insights

Supermarkets and hypermarkets remain the dominant distribution channels for tobacco products, accounting for over 50% of global sales in 2024. Their strategic location, ease of access, and competitive pricing make them a preferred choice among consumers, particularly in urban areas. These large-format retailers offer extensive shelf space, allowing manufacturers to showcase multiple brands, engage in seasonal promotions, and introduce new product variants. Furthermore, bundling tobacco products with other consumer goods enhances basket size and drives impulse purchases. Meanwhile, collaborations between tobacco companies and retail chains have led to exclusive offerings and loyalty programs that further incentivise repeat purchases.

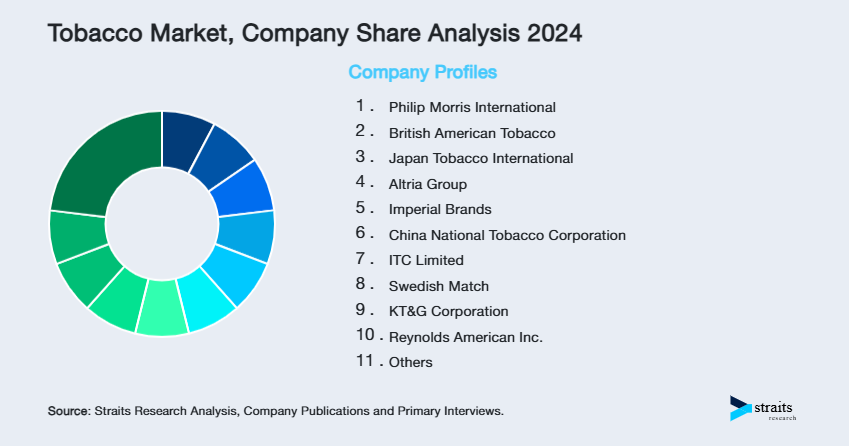

List of Key and Emerging Players in Tobacco Market

- Philip Morris International

- British American Tobacco

- Japan Tobacco International

- Altria Group

- Imperial Brands

- China National Tobacco Corporation

- ITC Limited

- Swedish Match

- KT&G Corporation

- Reynolds American Inc.

- Gudang Garam

- Djarum

to learn more about this report Download Market Share

Recent Development

- September 2025: PMI announced its participation in the Barclays Global Consumer Staples Conference.During the conference, the company reaffirmed its 2025 full-year forecast, projecting adjusted diluted earnings per share (EPS) to grow by 13% to 15%. This strong performance is being driven by momentum in products like its IQOS heated tobacco system and ZYN nicotine pouches.

- August 2025:Altria Group announced an increase in its quarterly dividend to $1.06 per share, up from the previous $1.02.This represents an annualized yield of 6.3%.

- August 2025: BAT announced that its Chief Financial Officer, Soraya Benchikh, is stepping down from her role and the company's board of directors. She will remain with the company to support the transition until December 31, 2025.

- July 2025: PMI reported its second-quarter and first-half results for 2025.The company raised its full-year guidance, with a reported diluted EPS increase of 26.6% to $1.95 for the second quarter.The smoke-free product business now accounts for 41% of the company's total net revenues.

- July 2025: The U.S. Food and Drug Administration (FDA) authorized the marketing of Swedish Match's ZYN nicotine pouches and specific versions of PMI's IQOS devices and consumables, marking the first-ever such authorizations in their respective categories.

- July 2025: The JT Group released its financial results for the second quarter of 2025.

- July 2025: BAT released its Half-Year Report for the first six months of 2025. The report highlighted that the company remains on track to meet its full-year guidance, with performance driven by its "New Category" brands, which include vapor products and oral nicotine.

- July 2025: Altria reported its second-quarter results for 2025.The company's oral tobacco segment, driven by its on! brand of nicotine pouches, saw a 10.9% increase in adjusted operating income. The on! brand's shipment volume increased by 26.5% year-over-year.

- May 2025: BAT was recognized as one of Europe's Best Employers for 2025 by the Financial Times and Statista, placing it in the top 5% of the 15,000 companies evaluated.

- May 2025: The JT Group launched its new heated tobacco products, Ploom AURA and EVO.

- April 2025: JTI invested over PLN 40 million in one of the largest solar farms in the Łódź Region of Poland, aligning with the company's sustainability initiatives.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 964.99 Billion |

| Market Size in 2025 | USD 985.11 Billion |

| Market Size in 2033 | USD 1,100.9 Billion |

| CAGR | 2.01% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Tobacco Market Segments

By Product

- Cigarettes

- Cigars & Cigarillos

- Kretek

- Smokeless Tobacco

- Next-Generation Products (NGPs): E-cigarettes, Vapes, Heated Tobacco, Nicotine Pouches

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Tobacco Shops

- Online Retail

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.