Trail Running Shoes Market Size, Share & Trends Analysis Report By Product Type (Light Trail Shoes, Rugged Trail Shoes, Off-Trail Shoes), By End User (Men, Women, Unisex), By Distribution Channel (Online, Offline) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Trail Running Shoes Market Size

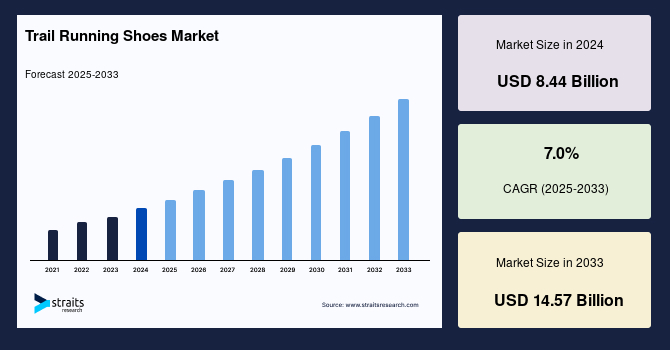

The global trail running shoes market size was valued at USD 8.44 billion in 2024 and is expected to grow to USD 9.03 billion in 2025 to reach USD 14.57 billion by 2033, exhibiting a CAGR of 7.0% during the forecast period (2025-2033).

The global market refers to the industry dedicated to the production, distribution, and sale of footwear specifically designed for off-road running on rugged terrains, including dirt trails, mountains, forests, and uneven surfaces. These shoes feature enhanced grip, stability, protection, and durability to withstand challenging environments. The market encompasses various types of shoes tailored for different trail conditions and runner preferences, including waterproof, lightweight, and cushioned designs.

The global market is driven by rising health consciousness, growing popularity of outdoor recreational activities, and increased participation in trail running events. Innovations in sole technology, breathable materials, and eco-friendly designs are shaping product development. The market serves both professional athletes and casual fitness enthusiasts worldwide. The industry is influenced somewhat by societal perceptions regarding a bias towards outdoor sports and recreation. Since off-road running has its dangers, people are searching these days for trail running shoes. Moreover, because the customers are concerned with their well-being and health, the aspect of physical fitness becomes critical. It is evidenced by trail running that the pleasures of the outdoors can be combined with cardiovascular activities, hence more people to buy suitable shoes.

Latest Market Trends

Integration of Smart Technology, Such as Fitness Tracking Sensors

The convergence of wearable technology and performance footwear increasingly influences the trail running shoe market. Smart trail running shoes embedded with sensors are gaining popularity for their ability to track fitness metrics such as distance, cadence, pace, calories burned, and foot strike pattern. These data points provide actionable insights for runners, helping them optimize their performance and training plans. Smart integration allows real-time synchronization with smartphones and wearables, making performance data immediately accessible. Professional athletes, fitness influencers, and tech-savvy consumers are showing keen interest in these advanced models.

- For instance, in October 2024, Swiss sportswear brand On introduced the Cloudboom Strike LightSpray, a laceless running shoe featuring a unique sock-like design. Crafted using a robotic arm that sprays elastic thermoplastic material around a foot-shaped form, this innovative approach results in a fully-formed upper welded to a performance midsole, eliminating the need for laces. The shoe was showcased at the 2024 Paris Olympics and worn by athletes, including Kenyan runner Hellen Obiri, who won the Boston Marathon.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 8.44 Billion |

| Estimated 2025 Value | USD 9.03 Billion |

| Projected 2033 Value | USD 14.57 Billion |

| CAGR (2025-2033) | 7.0% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | VF Corporation, New Balance, Wolverine World Wide, Inc., Brooks Sports, Inc, Adidas AG |

to learn more about this report Download Free Sample Report

Trail Running Shoes Market Growth Factors

Growing Participation in Outdoor Recreational Activities

The increasing global interest in fitness, nature exploration, and wellness tourism has led to a notable surge in outdoor recreational activities such as trail running, hiking, and trekking. This trend is supported by a growing middle-class population, particularly in Asia-Pacific and Latin America, that is actively seeking health-conscious and experience-rich lifestyles. As a result, demand for functional, durable, and stylish trail running shoes has surged. Governments and tourism boards promoting eco-trails and running festivals are further stimulating this growth. Retailers and brands are investing in campaigns promoting the physical and mental health benefits of outdoor activity, encouraging more consumers to join the trail running community. Furthermore, social media influencers and professional athletes are driving awareness, showing off the latest performance gear in scenic outdoor settings.

- For example, in February 2024, Merrell launched the Agility Peak 4, highlighting eco-friendly construction and superior cushioning, in response to increasing global participation in outdoor sports and eco-tourism.

Restraining Factors

Intense Competition from Counterfeit Product Types

The proliferation of counterfeit trail running shoes poses a significant threat to brand integrity and consumer confidence. These knockoff products often imitate the aesthetics and logos of leading brands but lack the technical innovation, material quality, and performance features of authentic models. They undercut pricing and mislead budget-conscious consumers, often resulting in discomfort, injury, or rapid wear and tear. Online marketplaces with limited regulation contribute to this issue by allowing counterfeit sellers to thrive. This not only affects sales revenues of legitimate companies but also damages their reputation when consumers mistakenly associate poor-quality experiences with the brand.

In addition, it discourages innovation, as companies become hesitant to invest in R&D if their designs are quickly replicated without legal recourse. Industry players are increasingly calling for tighter intellectual property protections, stricter e-commerce regulations, and consumer awareness campaigns to mitigate the impact of counterfeit goods.

Market Opportunity

Expansion of Trail Running Activities in Emerging Economies

Emerging markets present immense growth potential for the trail-running shoe industry. Countries in Asia-Pacific, Latin America, and the Middle East are witnessing a steady rise in fitness consciousness and participation in outdoor recreational sports. Trail running is being adopted as both a lifestyle and tourism activity, particularly among young adults and eco-tourists seeking nature-based experiences. The growth of infrastructure such as hiking trails, national parks, and adventure tourism hubs, further boosts demand for suitable gear. In response, international and regional brands are introducing mid-range and budget-friendly models tailored to regional terrain and climate needs.

- For instance, in January 2025, the Bengaluru Mountain Festival attracted a record-breaking 3,000 participants to the rugged trails of Avati, near Devanahalli. The event featured races across 5K, 10K, and 21K distances, highlighting the increasing popularity of trail running among urban professionals seeking an escape from city life.

Localization of marketing strategies and collaborations with local sports authorities, influencers, and tour operators are also increasing brand visibility and consumer trust.

Regional Insights

North America: Dominant Region with 78.6% Market Share

North America leads the global market, holding a commanding 78.6% share due to a deeply embedded outdoor fitness culture, well-developed retail infrastructure, and early adoption of performance-enhancing footwear technologies. The region’s growth is fueled by the rising popularity of trail running as a holistic activity that combines physical endurance with mental rejuvenation in natural settings. Consumers are increasingly focused on health and fitness, turning to outdoor activities like trail running that deliver both cardiovascular benefits and stress relief. Innovation plays a pivotal role brands continuously upgrade traction systems, cushioning technology, and lightweight materials to cater to rugged terrains.

Asia-Pacific: Fastest-Growing Region

Asia-Pacific is emerging as the fastest-growing region in the trail running shoe market, with a notable revenue contribution of 35.7% in 2023 and expectations of continued expansion through the forecast period. The region benefits from a vast and youthful population base, a surge in interest in adventure and fitness activities, and rapid urbanization. Countries such as China, India, Japan, and Australia are seeing increased participation in outdoor recreational activities, bolstered by rising disposable incomes and health awareness. E-commerce has significantly boosted product accessibility, offering diverse trail shoe options directly to consumers through brand-owned and multi-brand platforms.

Country Insights

- United States: The U.S. is a trailblazer in the trail running shoes market, driven by early technology adoption, a health-conscious population, and a vibrant outdoor sports culture. The country regularly hosts major trail races and endurance events, fostering a loyal customer base for high-performance footwear. Initiatives like Adidas’ “Trail Mentoring Program” and Team TERREX mentorships reflect the industry’s engagement with community building and personalized performance support, further enhancing brand visibility and consumer trust.

- Europe: Europe is witnessing robust growth in the trail running shoes market, supported by rising fitness consciousness, favorable outdoor landscapes, and advancements in eco-friendly shoe technologies. Younger demographics are increasingly engaged in hiking and trail running, motivated by social media inspiration and sustainable lifestyle trends. Events like the European Mountain Running Championships are also raising the sport’s profile.

- India: India’s trail running shoe market is undergoing rapid transformation, primarily driven by urban youth embracing outdoor recreation and the growing popularity of long-distance running. With increased awareness around lifestyle-related diseases, more consumers are turning to fitness as a preventive measure, fueling demand for athletic footwear. Stylish yet functional shoes designed for rugged outdoor terrains are gaining momentum across both metro and tier-2 cities, spurring market growth.

- Germany: Germany places strong emphasis on product sustainability and performance, making it a hotspot for eco-conscious consumers. The demand is centered around trail running shoes that are not only durable and ergonomic but also environmentally friendly. Local and global players such as Adidas, Salomon, and Brooks are capitalizing on this trend by offering waterproof, energy-efficient, and recyclable materials in their trail footwear lines. Design and quality remain top priorities for the German consumer.

- Brazil: Brazil's diverse landscape and tropical climate make it an ideal setting for trail running, with demand centered around breathable, water-resistant, and high-grip trail shoes. Domestic and international brands are launching weather-adapted designs to meet the unique environmental needs of Brazilian runners. With a growing number of nature enthusiasts and athletes, the market presents lucrative opportunities for high-performance and value-for-money footwear offerings.

- France: France has carved a niche in the trail running shoes market, fueled by its rich tradition of mountain sports and globally recognized events like the Ultra-Trail du Mont-Blanc (UTMB). French consumers demand superior traction, weatherproofing, and endurance in footwear. Local companies like Salomon leverage regional expertise and alpine terrain familiarity to create tailored products, competing effectively alongside international giants such as Nike and Adidas.

Trail Running Shoes Market Segmentation Analysis

By Product Type

Rugged trail shoes lead the product type segment due to their superior grip, reinforced toe caps, and durable outsoles that are ideal for difficult terrains like rocky, muddy, or uneven paths. Designed for serious trail runners and ultramarathoners, these shoes offer enhanced protection, water resistance, and stability. As trail running grows in popularity as an extreme sport and adventure activity, especially in mountainous or forested regions, demand for rugged designs continues to rise. Their increasing adoption by professional and recreational runners alike drives this segment’s dominance within the market.

By End User

Men are the leading end-user segment in the market, primarily due to their higher participation in outdoor sports, marathons, and endurance events. Men’s trail running shoes are often designed with added durability, larger size options, and robust support to meet the specific biomechanics and usage intensity of male runners. Additionally, men's athletic footwear continues to dominate overall sports shoe sales globally. Marketing campaigns, professional endorsements, and product innovations targeted at male consumers have also contributed to the segment’s leading position, especially in regions where outdoor fitness activities are ingrained in the culture.

By Distribution Channel

The offline distribution channel remains dominant in the trail running shoes market, accounting for the majority of global sales. Specialty sports stores and branded retail outlets are preferred for their personalized customer service, expert guidance, and the ability to try on shoes before purchase key factors when selecting gear for specific trail conditions. Offline retailers also host in-store events and collaborations with athletes, enhancing brand loyalty and product awareness. Despite the growth of e-commerce, many consumers still rely on physical stores for purchasing performance footwear, especially in regions with well-established retail infrastructures and outdoor sports communities.

Company Market Share

The market environment in the trail running shoes market is highly competitive, where several big brands try to grab their maximum share based on innovation and performance, and customer loyalty. Local players are gaining market share, and new entrants that deliver localized and oriented solutions, innovative technologies like 3D printing, that are oriented, for example, towards particular customer segments. The market is expanding, and competition is increasing day by day as companies also want to spread into core emerging economies, want to improve in shoe technology, and the major trend that is shifting worldwide is green products.

List of Key and Emerging Players in Trail Running Shoes Market

- VF Corporation

- New Balance

- Wolverine World Wide, Inc.

- Brooks Sports, Inc

- Adidas AG

- Nike, Inc.

- SKECHERS USA, Inc.

- ASICS America Corporation

- Deckers Brands

- Amer Sports

Recent Developments

- July 2024- Nike, Inc. unveiled the Nike Ultrafly trail running shoe, which boasts advanced technologies such as a carbon Flyplate in the sole for increased speed and traction. Over the course of two years, top athletes worked to develop this product.

Analyst Opinion

As per our analyst, the global market is fueled by increasing participation in outdoor activities, heightened health consciousness, and the rising popularity of trail running events like the Ultra-Trail du Mont-Blanc (UTMB). Technological advancements in footwear design, including enhanced cushioning and traction, are attracting both seasoned athletes and casual runners. The market is also witnessing a surge in female participation, contributing significantly to demand.

Additionally, the shift towards sustainable and ethically produced footwear is influencing consumer preferences, prompting brands to innovate in eco-friendly designs. Emerging economies, particularly in the Asia-Pacific region, are becoming key markets due to urbanization, increasing disposable incomes, and a growing interest in fitness and outdoor sports. Overall, the trail running shoes market is poised for continued growth, driven by a combination of lifestyle trends, technological innovation, and expanding global participation in trail running activities.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 8.44 Billion |

| Market Size in 2025 | USD 9.03 Billion |

| Market Size in 2033 | USD 14.57 Billion |

| CAGR | 7.0% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By End User, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Trail Running Shoes Market Segments

By Product Type

- Light Trail Shoes

- Rugged Trail Shoes

- Off-Trail Shoes

By End User

- Men

- Women

- Unisex

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.