Vacuum Casting Market Size, Share & Trends Analysis Report By Material (Polyurethane Resin, Nylon, Silicone, ABS (Acrylonitrile Butadiene Styrene), Others), By Process Type (Silicone Molding, Thermoplastic Vacuum Casting, Rubber Molding, Others), By Application (Prototyping, Functional Testing, End-Use Product Manufacturing, Tooling & Molding, Display Models, Others), By End-Use Industry (Automotive, Aerospace & Defense, Consumer Electronics, Medical Devices, Industrial Equipment, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Vacuum Casting Market Size

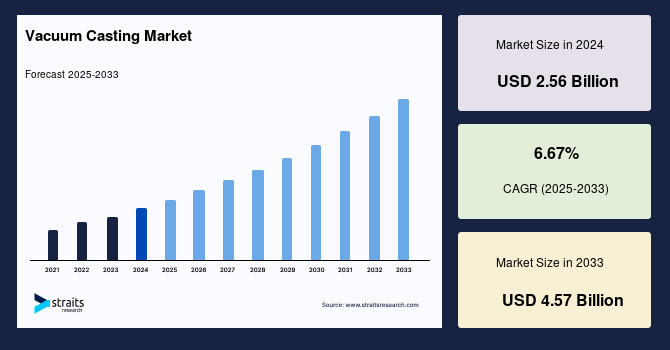

The global vacuum casting market size was valued at USD 2.56 billion in 2024 and is estimated to grow from USD 2.73 billion in 2025 to reach USD 4.57 billion by 2033, growing at a CAGR of 6.67% during the forecast period (2025–2033).

One of the primary drivers of the global market is the increasing demand for rapid prototyping and short-run production in industries such as automotive and aerospace. Vacuum casting enables the efficient creation of high-quality prototypes that closely replicate final products, reducing time-to-market and supporting faster innovation cycles.

Additionally, it serves as a cost-effective alternative to traditional injection molding for low- to medium-volume production, especially where tooling costs and setup times are prohibitive. The process allows manufacturers to produce complex and detailed parts using polyurethane resins that simulate engineering-grade plastics.

Furthermore, the growing need for lightweight, customized components in industrial applications is accelerating the adoption of vacuum casting. Its ability to deliver dimensional accuracy and design flexibility aligns with the rising trend of mass customization, making it an ideal solution for modern manufacturing environments focused on agility and efficiency.

Market Trends

Integration of Vacuum Casting with Digital Manufacturing and 3d Printing Technologies

One of the key trends shaping the global market is its integration with digital manufacturing and 3D printing technologies. This convergence is significantly enhancing production speed, design flexibility, and cost-efficiency. By combining traditional casting techniques with modern digital workflows, manufacturers can quickly produce complex parts while reducing tooling time and material waste.

- At Formnext 2024, Sheffield-based startup Fyous launched the PolyMorphic 28K, a high-speed mold-making system with 28,000 pins. Producing molds in 20 minutes, it's 14 times faster than 3D printing. It handles six tonnes of pressure, eliminating mold storage through CAD-based design, cutting costs and reducing material waste.

Such innovations exemplify how digital tools are reshaping conventional manufacturing methods. As more companies embrace digital transformation, vacuum casting is evolving into a smarter, faster, and more sustainable solution for prototyping and small-batch production across diverse industries.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 2.56 Billion |

| Estimated 2025 Value | USD 2.73 Billion |

| Projected 2033 Value | USD 4.57 Billion |

| CAGR (2025-2033) | 6.67% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Protolabs Inc., Star Rapid, 3D Systems, ProtoCAM, Tooling Tech Group |

to learn more about this report Download Free Sample Report

Vacuum Casting Market Growth Factors

Rising Use of Vacuum Casting in Medical Device and Consumer Electronics Production

One of the primary drivers of the global market is the rising utilization of technology in the medical device and consumer electronics sectors. These industries demand precise, low-volume production methods for prototyping and functional testing, making vacuum casting an ideal solution. The ability to create high-quality, detailed parts with minimal lead time is crucial, especially in the fast-paced product development cycles of electronics and medical equipment.

- For instance, in July 2024, IN3DTEC highlighted the use of vacuum casting in producing custom enclosures and functional prototypes for electronic devices, including wearables and smart home products, in an article published by the company. The process allows for the replication of intricate designs with excellent surface finishes, enabling manufacturers to test form, fit, and function before mass production. This enhances design accuracy, shortens development timelines, and improves cost efficiency.

As a result, the growing application of vacuum casting in these sectors is expected to significantly propel market growth.

Market Restraint

Limitations in Scalability for High-Volume Production Runs

One of the primary restraints facing the global vacuum casting market is its limited scalability for high-volume production runs. Vacuum casting is ideal for low- to medium-volume manufacturing due to its cost-effectiveness and ability to produce high-quality, detailed parts. However, when it comes to mass production, this process becomes less efficient compared to methods like injection molding.

The time-intensive nature of mold preparation and casting cycles hinders its practicality for large-scale operations. Additionally, the lifespan of silicone molds is relatively short, requiring frequent replacements. These limitations restrict the adoption of vacuum casting in industries where high output and long-term cost efficiency are critical.

Market Opportunity

Expanding Application Scope in Electric Vehicle (ev) Component Manufacturing

The expanding application scope of vacuum casting in electric vehicle (EV) component manufacturing presents a significant growth opportunity for the market. As the EV industry prioritizes lightweight components and rapid prototyping, vacuum casting offers an efficient solution for producing complex, low-volume parts with high precision.

- A notable example is the GAC Group’s announcement in March 2025 of a $138 million investment in a new facility in Guangzhou. This plant will focus on gigacasting and unboxed manufacturing processes, using 10,000-ton die casting machines to produce battery cases and structural parts. With operations expected to begin in 2026, the facility targets a 40% cost reduction and 20% weight savings.

Vacuum casting can play a vital role in early-stage prototyping and design validation for such components, aligning with the EV sector’s innovation and speed-to-market needs.

Regional Insights

Asia Pacific is witnessing rapid growth in the vacuum casting market due to increasing industrialization and expansion of manufacturing sectors. The region’s cost-effective production environment and growing demand for customized, low-volume parts in electronics, consumer goods, and transportation industries are key growth drivers. Enhanced focus on prototyping and design validation, especially among OEMs and startups, is fueling market adoption. The rising integration of digital manufacturing technologies and growing awareness of vacuum casting’s advantages in producing intricate geometries are further strengthening the region’s market potential.

- China’s vacuum casting industry is rapidly growing due to its strong manufacturing base and expanding automotive and electronics sectors. Leading companies like BYD and Huawei use vacuum casting for prototyping and low-volume production of complex components. Additionally, China’s push for electric vehicles and advanced consumer electronics drives demand for lightweight, precise parts produced via vacuum casting, boosting market growth significantly.

- India’s market is witnessing steady growth fueled by increasing investments in aerospace, automotive, and medical device industries. Companies such as Tata Motors and Bharat Electronics utilize vacuum casting for rapid prototyping and small-batch production. Government initiatives to promote Make in India and the rise of startups in manufacturing tech are creating opportunities for vacuum casting adoption in precision component fabrication and cost-effective prototyping.

North America Market Trends

The vacuum casting market in North America is experiencing steady growth due to the increased adoption of advanced prototyping techniques across the automotive, aerospace, and medical sectors. The region’s emphasis on reducing product development timelines and enhancing customization is driving demand for low-volume, high-precision components. Additionally, the strong presence of R&D facilities and innovation hubs supports technological advancements in vacuum casting. Market players are leveraging automation and digital manufacturing technologies to boost production efficiency and meet stringent quality standards, further fueling the market's expansion across diverse end-user industries.

- The US vacuum casting industry is expanding rapidly, supported by the booming aerospace and defense sectors. Firms like Boeing utilize vacuum casting for prototyping complex, heat-resistant components. The rising electric vehicle market, with players like Tesla, also demands lightweight parts produced through vacuum casting. Furthermore, advancements in 3D printing combined with vacuum casting drive innovation, reducing time-to-market for consumer electronics and industrial applications.

- Canada’s market is growing steadily, driven by its strong automotive and aerospace industries. Companies like Bombardier rely on vacuum casting for rapid prototyping lightweight aircraft parts. Additionally, the increasing presence of medical device manufacturers in Canada using vacuum casting to produce small batches of customized components is fueling market growth. Government support for advanced manufacturing technologies also boosts adoption across sectors.

Europe: Substantial Potential for Growth

Europe's vacuum casting market benefits from strong industrial engineering capabilities and a growing emphasis on sustainable manufacturing processes. The rising need for lightweight, functional parts in automotive and industrial equipment sectors is driving vacuum casting adoption. Increasing investment in digital prototyping and the region’s focus on material innovation, especially in high-performance polymers, support market expansion. Additionally, strict regulatory standards for product safety and environmental compliance are encouraging manufacturers to adopt precise and reliable casting methods, enhancing the market’s growth across various high-tech and design-intensive applications.

- Germany’s market is driven by its strong automotive and aerospace industries, emphasizing rapid prototyping and lightweight components. Companies like BMW and Airbus leverage vacuum casting to produce durable prototype parts with high precision. Additionally, Germany’s focus on Industry 4.0 adoption and advanced manufacturing technologies further fuels demand for vacuum casting in medical devices and industrial machinery sectors.

- The UK vacuum casting market benefits from a robust aerospace and defense manufacturing sector, with firms such as Rolls-Royce utilizing vacuum casting to create complex, high-performance components. Growing investments in electric vehicle startups and medical technology development also support market growth. Moreover, UK manufacturers adopt vacuum casting for rapid prototyping and low-volume production, aiding innovation in consumer electronics and industrial design applications.

Material Insights

The polyurethane resin segment holds a significant share in the vacuum casting market due to its versatility, durability, and cost-effectiveness. It is widely used in producing functional prototypes and end-use parts with properties closely resembling thermoplastics. Its excellent surface finish, impact resistance, and dimensional stability make it ideal for low-volume manufacturing. The material’s adaptability to mimic various grades of plastics enhances its usage across industries such as automotive, consumer electronics, and industrial equipment. Growing demand for rapid prototyping and customized components further boosts the adoption of polyurethane resin in vacuum casting applications.

Process Type Insights

Silicone molding is a core process in vacuum casting, renowned for its precision and ability to replicate fine details. It is especially suited for producing high-quality prototypes and short-run production parts. The flexibility, thermal stability, and excellent mold release properties of silicone molds make them ideal for duplicating intricate designs with minimal distortion. This segment is gaining traction as manufacturers seek faster turnaround times and reduced tooling costs. The demand is driven by sectors like healthcare, automotive, and electronics, where accuracy and material fidelity are critical. Advancements in silicone materials are further enhancing mold lifespan and casting quality.

Application Insights

The prototyping segment dominates the vacuum casting market, fueled by the increasing need for rapid product development across industries. Vacuum casting offers a quick, cost-efficient solution for creating highly detailed and functional prototypes, enabling faster design validation and iterative improvements. It is extensively used in automotive, aerospace, and medical device sectors to produce realistic prototypes before mass production. The ability to simulate end-use product characteristics without high investment in tooling makes vacuum casting highly attractive. As time-to-market becomes a critical success factor, the reliance on vacuum casting for prototype development continues to expand globally.

End-User Insights

The automotive segment represents a major end-user in the vacuum casting market, driven by the industry's demand for lightweight, durable, and complex components. Vacuum casting enables cost-effective prototyping and limited production of parts such as dashboards, housings, handles, and engine components. It supports the industry's push toward innovation, design flexibility, and faster product development cycles. Automotive manufacturers utilize this process to test the form, fit, and function of parts before scaling up production. With the rising adoption of electric vehicles (EVs) and autonomous systems, the need for custom parts and rapid prototyping through vacuum casting is growing significantly.

List of Key and Emerging Players in Vacuum Casting Market

- Protolabs Inc.

- Star Rapid

- 3D Systems

- ProtoCAM

- Tooling Tech Group

- R&D Mould

- Visiativ

- Materialise NV

- ALine Inc.

- KAYE Plastics

to learn more about this report Download Market Share

Recent Developments

- January 2025- Wall Colmonoy has secured funding through the Defence Technology Exploitation Programme (DTEP) to advance its Project EVaCC (Experimental Vacuum Investment Casting Capability). This initiative focuses on developing state-of-the-art Vacuum Precision Investment Casting (VPIC) technology, enhancing the UK's domestic defence manufacturing capabilities and reinforcing a resilient supply chain for the Ministry of Defence.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 2.56 Billion |

| Market Size in 2025 | USD 2.73 Billion |

| Market Size in 2033 | USD 4.57 Billion |

| CAGR | 6.67% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material, By Process Type, By Application, By End-Use Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Vacuum Casting Market Segments

By Material

- Polyurethane Resin

- Nylon

- Silicone

- ABS (Acrylonitrile Butadiene Styrene)

- Others

By Process Type

- Silicone Molding

- Thermoplastic Vacuum Casting

- Rubber Molding

- Others

By Application

- Prototyping

- Functional Testing

- End-Use Product Manufacturing

- Tooling & Molding

- Display Models

- Others

By End-Use Industry

- Automotive

- Aerospace & Defense

- Consumer Electronics

- Medical Devices

- Industrial Equipment

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.