Virtual Mirror Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Deployment Model (Cloud, On-Premises), By Technology (3D Body Scanning, Photo Accurate VFR, 3D Augmented Reality and Virtual Reality), By Industry (Retail, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Virtual Mirror Market Size

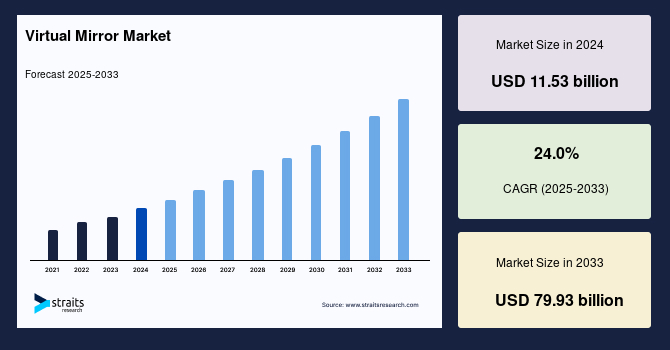

The global virtual mirror market size was valued at USD 11.53 billion in 2024 and is expected to grow from USD 14.30 billion in 2025 to reach USD 79.93 billion by 2033, growing at a CAGR of 24.0% during the forecast period (2025-2033).

The key factors driving the virtual mirror market share are the growing adoption of virtual mirrors in the retail and automotive industries, rising demand for virtual dressing rooms, and technological advancements.A virtual mirror is an interactive display technology that employs augmented reality (AR) or virtual reality (VR) to replicate the experience of trying clothing, accessories, makeup, or hairstyles without actually wearing them. It usually consists of a display screen, cameras, sensors, and software that overlays virtual images over the user's reflection in real time.

One of the major factors driving Virtual Mirror market growth is ongoing retail innovation in brick-and-mortar stores, which has resulted in widespread adoption of virtual mirrors to improve in-store customer experience and compete with online platforms. Additionally, consumers' growing awareness of augmented reality (AR) Technology and increasing acceptance drive market growth. Aside from that, the widespread availability of smartphones and internet access, which makes it easier for customers to use virtual mirrors, is driving market growth.

Furthermore, the increasing adoption of virtual mirrors, which provide cost-effective solutions for retailers by eliminating the need for physical inventory and trial rooms, is driving market growth. Aside from that, incorporating data analytics into virtual mirrors to gain insights into consumer preferences and purchasing behaviors is creating a positive outlook for the market.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 11.53 Billion |

| Estimated 2025 Value | USD 14.30 Billion |

| Projected 2033 Value | USD 79.93 Billion |

| CAGR (2025-2033) | 24.0% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Astrafit, MemoMi, Fits.me, VIRTusize, SmartPixels |

to learn more about this report Download Free Sample Report

Virtual Mirror Market Growth Factor

Increasing E-Commerce Adoption

E-commerce has increased around the world. Statista estimates that India's e-commerce market will generate more than USD 63 billion in revenue by 2023. This is due to the country's growing internet penetratVirtual Realityion and smartphone use. According to Forbes, e-commerce sales are expected to increase by 8.8% in 2024. This follows a 17% increase in 2021. Consumer preferences are shifting toward online shopping for convenience, accessibility, and diverse product options. According to a 2023 survey, 72% of respondents prefer to shop online for vacation and entertainment purchases. However, 69% of consumers prefer to shop in-store, while 52% prefer to buy from an online retailer that sells a variety of brands. Online shopping via smartphones is ranked second in popularity, with 34%.

Given the limitations of traditional online shopping, such as the inability to try on products before purchasing, virtual try-on solutions have emerged as an essential tool for retailers. According to Gartner, by 2024, 50% of large enterprises will have implemented product virtual try-on and augmented reality technologies for their online and mobile channels, demonstrating the growing use of virtual mirrors in e-commerce. One of the most challenging aspects of online shopping is returning items. Virtual mirrors can help with this. Virtual mirrors help reduce returns by allowing customers to try on products virtually and see how they look before purchasing, resulting in retailer cost savings and increased overall customer satisfaction.

Additionally, major retailers in various industries, including fashion, beauty, eyewear, and furniture, increasingly incorporate virtual mirrors into their online platforms to recreate the in-store try-on experience. For example, Sephora's Virtual Artist enables customers to try makeup virtually using smartphone cameras, increasing customer engagement and sales.

Market Restraint

User Experience Limitations

Despite technological advancements, virtual mirrors may not accurately replicate the in-person try-on experience. Lighting conditions, body proportions, and fabric textures can all impact the virtual representation of a product, resulting in differences between the virtual try-on and the actual product. A customer using a virtual mirror to try on a dress may discover that the virtual representation does not accurately depict how it fits or drapes on their Body. The virtual mirror may need to include subtle details like the fabric texture or how the garment moves with the wearer, resulting in a less accurate representation of the product.

Furthermore, virtual try-on technology is only sometimes wholly accurate. Some customers have reported issues with inaccurate sizing, poor fit representation, and lighting and camera quality variations that must accurately represent colors. Some have also claimed that the Technology does not accurately describe how items will fit their face or Body. Inaccuracies in virtual mirror representations can influence consumer perception and trust in the Technology. Suppose customers discover that virtual try-on experiences do not accurately reflect the product. In that case, they may be less likely to use virtual mirror applications or purchase based on the results.

Market Opportunity

Expansion across Industries

While virtual mirrors are widely used in the fashion and beauty industries, there is significant room for growth in other markets, such as home decor, automotive, and healthcare. Virtual mirrors, for example, could be used to visualize furniture placement in a room, simulate car customization options, or preview cosmetic surgery results. Expanding into new industries creates new revenue streams and increases the market reach of virtual mirror technology. Virtual mirrors can be used in the home decor industry to allow customers to see furniture and decor items before purchasing. For example, Ikea's ""Place"" app uses augmented reality to allow users to virtually place furniture in their homes using their smartphones' cameras. The app accurately scales products based on room dimensions. This improves the online shopping experience and allows customers to make more informed purchasing decisions.

Additionally, virtual mirrors can simulate car customization options and configurations in the automotive industry. For example, Audi and BMW have implemented virtual configurators that allow customers to customize their vehicles virtually by selecting paint color, interior trim, and optional accessories. Customers can personalize their vehicles based on their preferences, increasing customer satisfaction and brand loyalty. The growing adoption of augmented and virtual reality technologies and the demand for immersive and interactive shopping experiences present significant growth opportunities for using virtual mirrors in various industries. Companies that capitalize on these opportunities can generate new revenue streams, differentiate themselves in the market, and meet the changing needs of consumers across multiple sectors.

Regional Analysis

North America: Dominant Region

North America is the most significant global virtual mirror market shareholder and is estimated to grow at a CAGR of 23.9% over the forecast period. The United States is home to the largest retail brands and hotel chains, which has boosted demand for virtual mirrors nationwide. However, their adoption in the automotive industry will likely be hampered because the United States government has classified virtual side mirrors as mirrorless. The Asia Pacific region is expected to grow the fastest over the next six years, owing to increased online shopping. Countries such as China, Japan, and India are major automotive and retail hubs with a growing demand for virtual mirrors.

Europe: Growing Region

Europe is anticipated to exhibit a CAGR of 24.1% over the forecast period. Spain, the United Kingdom, France, and Russia are the most profitable country markets for using virtual mirrors in the retail and hospitality industries. Europe is renowned for its fashion and hospitality industries. The regional market is also open to automotive industry innovations due to the adoption of virtual windscreen solutions for luxury vehicles. The BRICS nations, which account for more than 40% of the world's population, have a large pool of potential consumers and internet users. The increasing internet penetration rate and e-commerce development in BRICS nations have contributed to the region's potential for virtual mirror adoption.

Asia-Pacific is expected to have significant market opportunities in the coming years. China is the world's fastest-growing e-commerce market. China's leading e-commerce websites, such as Alibaba and Baidu Inc., can serve as potential platforms for virtual mirror deployments. Developing economies like India will provide lucrative market opportunities in the coming years. Growing digitization across industries, cloud adoption, and other factors are expected to drive market growth during the forecast period.

The Middle East and Africa are expected to have a moderate growth rate. Digital transformation in the retail industry is expected to support market growth in the region. Latin America is expected to maintain a steady growth rate.

Segmental Analysis

By Component

The software segment will have the largest market share over the forecast period. Virtual mirror solutions are built around software, including algorithms, applications, and programming, that allow for creating and operating virtual try-on experiences. This includes image processing algorithms for facial recognition, body tracking, and gesture recognition. Rendering engines create realistic virtual overlays that accurately represent the appearance of products on users. User interfaces provide simple controls and interactions that allow users to navigate and personalize their virtual try-on experiences.

Additionally, the need to provide visual interactive features on dedicated hardware systems such as kiosks and mirrors has increased software demand. The software ensures that clothes and accessories can be tried in a virtual world through compatible displays on apps and websites. For example, L'Oreal implemented an AR-based virtual mirror that allows for virtual makeup try-ons to replicate the effect and feel of the actual product.

Meanwhile, virtual mirrors' hardware components include the physical devices and equipment needed to create and display the virtual try-on experience. This includes cameras, displays, sensors, processors, and any other hardware infrastructure that may be required. High-resolution cameras capture the user's image, while displays show virtual overlays in real time. Sensors track user movements and gestures, allowing for interactivity. Processors handle computation and rendering tasks to ensure users have a smooth and responsive experience. The quality and capabilities of hardware components significantly impact virtual mirrors' realism, accuracy, and performance. Manufacturers constantly innovate hardware technologies to improve image quality, processing speed, and overall user experience.

By Deployment Model

The cloud deployment segment will have the highest CAGR during the forecast period. Cloud deployment entails storing virtual mirror software and data on remote servers managed by third-party cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. In this mode, users can access virtual mirror applications and services via web browsers or mobile apps, eliminating the need for on-site hardware infrastructure and software maintenance. Cloud deployment provides numerous advantages, including scalability, flexibility, and cost-effectiveness.

As a result, the segment's growth can be attributed to cost-effective plans, lower operational costs, unlimited storage space, and easier integration and updating capabilities. Furthermore, real-time data access, hassle-free deployment, and remote assistance are all appealing features driving demand for cloud-based deployment.

On-premise deployment entails installing and hosting virtual mirror software and data on local servers in the retailer's physical location. This mode gives retailers complete control and ownership of the hardware infrastructure, software applications, and data storage, allowing customization, security, and compliance with internal policies and regulations. On-premise deployment provides greater data control and privacy because sensitive customer information remains within the retailer's infrastructure.

In addition, on-premises deployment is standard in the retail industry and is widely used by brick-and-mortar stores. The software is installed and runs on mirror-like structures in retail stores. End users are skeptical about data security in the cloud, so retail store owners frequently prefer on-premises deployment methods. Customers' concerns about data visibility, security, and accessibility drive demand for on-premises deployment.

By Technology

The 3D augmented reality and virtual reality segment had the highest revenue share in 2023 and is expected to continue dominating the market during the forecast period. To improve the customer experience, prominent retailers are incorporating AR-based smart mirrors into their stores. They are also working on incorporating online AR technology into their solution offerings to gain a competitive advantage. People can interact with a virtual mirror using speech, body language, and hand gestures. The retail and automotive industries have seen numerous technological advancements influencing payment and inventory management activities. AR/VR, AI, facial recognition, gesture recognition, and sensor-based technologies used in virtual mirrors are all expected to enter these markets. These technologies support product features and enable customization, giving vendors a competitive advantage.

3D Body scanning Technology uses specialized scanners to take precise measurements and dimensions of a person's Body. These scanners generate detailed 3D models of the user's Body, including precise size, shape, and proportions measurements. Virtual mirrors use 3D Body scanning Technology to create digital avatars or replicas of themselves, allowing users to try on clothing, accessories, and other products virtually. This Technology provides users with a highly personalized and accurate virtual try-on experience, allowing them to see how garments fit and drape on their body shapes. Retailers can use 3D Body scanning Technology to provide made-to-measure or custom-fit clothing, increasing customer satisfaction and reducing returns.

By Industry

The retail segment is further divided into two categories: e-commerce and brick-and-mortar. A virtual mirror used in the retail industry is also known as a memory mirror or a smart mirror. These mirrors improve the in-store and online shopping experience for customers. For example, Nike has an in-store customizer that allows customers to design a pair of sneakers virtually. In 2023, the retail segment accounted for a significant market revenue share and is expected to proliferate over the forecast period.

The other segment includes the automotive and hospitality verticals. The retail, automotive, and hospitality industries are undergoing rapid transformations, primarily driven by virtualizing mirrors to perform various tasks. In May 2019, Honda announced that its electric vehicle would feature a side camera mirror system similar to Audi's E-Tron electric SUV. The solution for each industry varies depending on the function to be accessed via a virtual mirror; however, the concept is consistent across all deployments. Big data and IoT are expected to boost the segment's growth.

List of Key and Emerging Players in Virtual Mirror Market

- Astrafit

- MemoMi

- Fits.me

- VIRTusize

- SmartPixels

- SenseMi

- Virtual Mirror

- Reflexion

- Zugara

- Holition

- Styku

- MirrAR

- True Fit

- Fashion3D

- Sizebay

- Styliff

- Dressformer

- 3D-A-PORTER

- Metail

- Tylko

Recent Developments

- March 2024- Rakuten launched the "Service Inclusion" initiative to develop services that embrace diversity, equity, and inclusion.

- July 2023- A new AI-powered shopping feature lets you virtually try on clothes. Shoppers in the United States can virtually try on women's tops from Google's brands, which include Anthropologie, Everlane, H&M, and LOFT.

- March 2024- Walmart announced that it would expand its existing Beauty Virtual Try-On capabilities through its app to include hair color options. So far, the capability has applied to nearly 500 products in the category. Cosmetics and apparel are the retailer's other virtual try-on categories. In late January, the chain launched an augmented reality eyewear try-on experience.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 11.53 Billion |

| Market Size in 2025 | USD 14.30 Billion |

| Market Size in 2033 | USD 79.93 Billion |

| CAGR | 24.0% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Deployment Model, By Technology, By Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Virtual Mirror Market Segments

By Component

- Hardware

- Software

- Services

By Deployment Model

- Cloud

- On-Premises

By Technology

- 3D Body Scanning

- Photo Accurate VFR

- 3D Augmented Reality and Virtual Reality

By Industry

- Retail

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Tejas Zamde

Research Associate

Tejas Zamde is a Research Associate with 2 years of experience in market research. He specializes in analyzing industry trends, assessing competitive landscapes, and providing actionable insights to support strategic business decisions. Tejas’s strong analytical skills and detail-oriented approach help organizations navigate evolving markets, identify growth opportunities, and strengthen their competitive advantage.