Virtual Prototype Market Size, Share & Trends Analysis Report By Tools (Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), Computational Fluid Dynamic (CFD), Computer-Aided Engineering (CAE), Finite Element Analysis (FEA)), By Deployment (On-premise, Cloud), By Applications (Automotive, Healthcare, Aerospace, Consumer Electronic, Others (Telecom, etc.)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Virtual Prototype Market Size

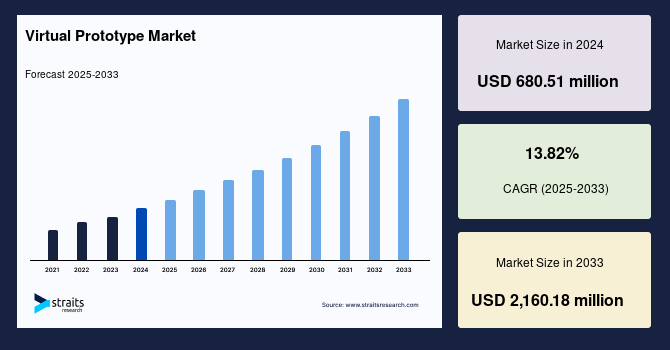

The global virtual prototype market size was valued at USD 680.51 million in 2024 and is expected to grow from USD 766.73 million in 2025 to reach USD 2,160.18 million by 2033, growing at a CAGR of 13.82% during the forecast period (2025-2033).

A virtual prototype is a digital simulation or model of a product or system created using advanced computer-aided design (CAD) software or other simulation tools. It enables designers and engineers to test, evaluate, and optimize a product’s design before creating a physical prototype.

By simulating real-world behaviors such as stress, thermal dynamics, fluid flow, and mechanical movement, virtual prototypes help identify potential issues early in the development process, significantly improving the design process. These simulations not only enhance product performance but also reduce costs and development time, making them an invaluable tool in product innovation.

The global virtual prototype market is experiencing rapid growth, driven by the increasing adoption of advanced simulation tools across industries such as automotive, aerospace, consumer electronics, and manufacturing. These sectors are leveraging virtual prototyping to streamline product development cycles, reduce the need for physical testing, and ensure precise real-time simulations.

As businesses prioritize cost-efficiency, faster time-to-market, and optimized product performance, virtual prototyping is becoming a key enabler of innovation, improving design accuracy and overall operational efficiency. This trend is expected to intensify as industries explore the full potential of virtual prototypes in the development of next-generation products.

| Historic Market Size (2020-2023) | |

|---|---|

| Year | USD million |

| 2020 | 417.10 |

| 2021 | 467.92 |

| 2022 | 527.45 |

| 2023 | 597.55 |

Source: Straits Research

Latest Market Trend

Integration of Ai in Virtual Prototype

The integration of AI into virtual prototyping is transforming industries by enabling smarter, more efficient design processes. In the automotive sector, AI-driven simulations are revolutionizing safety features by accurately predicting car crash outcomes, allowing manufacturers to fine-tune designs and enhance product reliability. This technological advancement promotes greater efficiency, reduces design flaws, and fosters the development of more robust products.

- For example, Beijing-based Space Transportation is set to test its Cuantianhou near-space reusable spaceplane prototype in the second half of 2025. The company recently conducted a test flight of a commercial transport plane capable of reaching Mach 4, with follow-up engine technology assessments planned for November 2024.

As industries across the globe increasingly recognize the potential of AI-powered virtual prototyping, its adoption is accelerating, reshaping product development and setting new standards for innovation.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 680.51 Million |

| Estimated 2025 Value | USD 766.73 Million |

| Projected 2033 Value | USD 2,160.18 Million |

| CAGR (2025-2033) | 13.82% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | ESI Group, Autodesk, Altair Engineering, Synopsys, ANSYS |

to learn more about this report Download Free Sample Report

Virtual Prototype Market Growth Factors

Rising Complexity of Products

The growing complexity of modern products, especially in industries like aerospace and automotive, is driving the demand for advanced simulation and analysis tools. Virtual prototyping is emerging as a cost-effective solution to address these challenges, enabling manufacturers to simulate intricate systems and optimize designs with precision. By reducing development cycles and minimizing physical testing, virtual prototyping allows companies to navigate the complexities of product design efficiently.

- For instance, in December 2024, ESI Group partnered with China Automotive Engineering Research Institute to co-develop virtual simulation solutions for China’s automotive sector. This collaboration underscores China’s commitment to advanced simulation technologies for managing complex automotive designs.

This technological shift ensures improved product performance, safety, and reliability, solidifying virtual prototyping as an essential tool in modern engineering and manufacturing.

Increasing Demand for Product Customization

With increased demand for customized products, manufacturing processes are changing dramatically. Virtual prototyping is becoming an important step in the entire process to cater to the consumer's expectations. In the case of consumer electronics, companies use virtual simulations to design and customize products according to specific customer requirements. This method not only helps increase market competitiveness but also saves time-to-market and production costs.

- For instance, in 2024, the Ministry of Electronics and Information Technology (MeitY) introduced NSAM to promote additive manufacturing. This strategy aims to enhance product customization capabilities across industries using 3D printing and related technologies.

With personalization becoming a key differentiator in various industries, virtual prototyping continues to grow in adoption, empowering manufacturers to deliver tailored, high-quality products that align with evolving consumer needs.

Market Restraint

High Initial Investment Costs

One of the primary challenges to virtual prototyping adoption is the high initial investment required, which can be a barrier for smaller companies. The costs associated with software licenses, high-end hardware infrastructure, and specialized employee training can strain the budgets of small and medium-sized enterprises (SMEs). However, the significant cost benefits such as reduced development time and improved product quality continue to make virtual prototyping appealing to larger corporations. As technology advances, more cost-effective, tailored solutions for SMEs are expected to emerge, helping to overcome these barriers and encourage broader adoption across various industries.

Market Opportunity

Growth in Emerging Economies

Emerging economies, particularly in countries like India and Brazil, are increasingly adopting virtual prototyping as their manufacturing sectors experience rapid growth. Governments in these regions are actively promoting digitalization and technological innovation, creating significant opportunities for market players to expand their presence. As a result, advanced solutions for product development are gaining traction, with virtual prototyping playing a key role in driving efficiency, cost reduction, and improved product quality.

- For example, in October 2023, in India, CircuitSutra Technologies introduced a virtual prototype of an ARM Cortex-based SoC using SystemC and its CSTML library. Capable of booting Linux, the prototype supports software development and promotes SystemC-based ESL methodologies, enabling hardware/software co-design, pre-silicon firmware development, architecture optimization, and high-level synthesis.

This development exemplifies how emerging economies are embracing innovative solutions to enhance their manufacturing capabilities.

Regional Insights

North America: Dominating Region

North America holds the largest revenue share in the global virtual prototype market, largely due to its well-established automotive and aerospace industries. These sectors have long relied on virtual prototyping technologies to enhance product design and development. Significant R&D investments have accelerated the evolution and refinement of these tools. Given the critical nature of products in these industries, which require rigorous testing and validation, virtual prototyping plays a pivotal role.

- For instance, in June 2023, the Canadian government invested over $4 million to establish an Aerospace Innovation Hub at the University of Calgary, aimed at fostering aerospace innovation through technology development, prototyping services, and testing equipment.

This ongoing demand for precision and innovation ensures North America's continued leadership in the market while also driving advancements in virtual prototyping solutions.

Asia-Pacific: Fastest Growing Region

Asia-Pacific is expected to experience the highest growth in the virtual prototype, driven by the rapid adoption of digitization and Industry 4.0 technologies by SMEs. As these companies seek to enhance their product design and development capabilities, virtual prototyping solutions have become essential. The expanding pool of engineers and designers in the region, along with the growing use of cloud-based technologies, has facilitated easier collaboration and work-from-home options, fueling demand for virtual prototyping solutions across various industries.

Countries Insights

- U.S.: The United States is one of the foremost virtual prototyping markets, supported by its high-end automotive and aerospace industries. Big players such as Ford and General Motors make extensive use of virtual prototyping for the reduction of design time and improvement of product performance while decreasing the time-to-market. For instance, Ford's virtual manufacturing technologies led to an 11% quality improvement in the U.S. market, surpassing the industry average of 2%.

- Germany: Germany’s automotive and aerospace industries are major adopters of virtual prototyping, focusing on innovation and precision. Leading automotive brands such as BMW and Audi leverage these technologies to optimize manufacturing processes, reduce costs, and enhance design accuracy. In June 2024, EDAG Group launched its Zero Prototype Lab in Wolfsburg, allowing customers to test vehicles and functions virtually, significantly improving development efficiency, sustainability, and speeding up time-to-market.

- Japan: Japan’s virtual prototyping is important for the development of products in the automotive, electronics, and robotics sectors. Major companies like Toyota and Sony apply these technologies to their design processes to make them more efficient, reduce reliance on physical prototypes, and enhance the quality of their products. Government support for digitalization accelerates this trend. In January 2025, Sony and Honda unveiled the Afeela 1 electric vehicle at CES, showcasing advanced virtual prototyping and innovative technologies for an enhanced user experience.

- South Korea: South Korea’s manufacturing sector, led by automotive giants like Hyundai and electronics leader Samsung, increasingly adopts virtual prototyping to enhance design and performance. The country’s embrace of Industry 4.0 and advanced simulation tools boosts its competitiveness globally. The Hyundai Motor Group, including Hyundai, Kia, and Genesis, is projected to rank third in global sales by 2032, with the automotive sector accounting for 12% of jobs and 13% of manufacturing in South Korea.

- China: China’s automotive and electronics industries are driving the adoption of virtual prototyping to enhance product development. Companies like Geely and Huawei use these technologies to improve design processes, reduce costs, and foster innovation. China’s rapid digital transformation fuels this trend, with the country becoming the world’s largest automotive producer in 2023, manufacturing 30 million vehicles, including 9 million new EVs, leading global production in this sector.

- India: India’s growing automotive and electronics sectors are increasingly adopting virtual prototyping to enhance product design and development. Government initiatives supporting digitalization will further accelerate this trend, helping manufacturers achieve faster product cycles while reducing costs. A study by NITI Aayog reveals India’s automotive sector adoption rates for industrial robots, additive manufacturing, and VR at 4%, 8%, and 6%, respectively, indicating a growing embrace of advanced manufacturing technologies.

- U.K.: The U.K.’s aerospace and automotive industries are extensively using virtual prototyping to improve product development, reduce design costs, and speed up time-to-market. Major companies like Rolls-Royce and Jaguar Land Rover leverage these technologies to streamline design processes and enhance performance. Virtual prototyping is key to fostering innovation, enabling the U.K. to remain competitive in these critical industries and maintain leadership in product development.

Segmentation Analysis

By Tools

The Computer-Aided Design (CAD) segment leads the global market, capturing a significant revenue share. CAD software is a crucial tool in product design, offering essential features for creating and modifying 3D models. It supports simulation, analysis, and manufacturing process planning, making it an integral part of the virtual prototyping workflow. Moreover, CAD’s technological maturity, seamless integration with other software, and interoperability make it a versatile solution in high demand across industries, ensuring its dominance in the market.

By Deployment

Cloud deployment holds the largest share of the virtual prototype, driven by its scalability and flexibility. Cloud solutions allow businesses to adjust computational resources in real-time, accommodating fluctuating project demands, particularly for complex simulations and large datasets. By eliminating the need for heavy capital investment in on-premises infrastructure, cloud-based solutions are especially attractive to businesses with budget constraints. These advantages are fueling widespread adoption, making cloud deployment a key growth driver in the virtual prototyping market.

By Applications

The automotive segment dominates the global market in terms of revenue. The automotive industry’s need for cost-effective product development solutions makes virtual prototyping invaluable, as it reduces the time and cost associated with physical prototypes. As technologies like electrification, autonomous driving, and connectivity advance, the complexity of automotive designs increases, driving demand for virtual prototyping to evaluate the performance and interactions of these systems. This trend is accelerating the sector’s adoption of virtual prototyping for innovative design solutions.

Company Market Share

Key market players are increasingly investing in advanced virtual prototype technologies to stay competitive in the rapidly evolving market. These investments are directed toward enhancing product capabilities, improving simulation accuracy, and integrating artificial intelligence for more sophisticated design processes.

Zuken Inc.: An Emerging Player in the Global Virtual Prototype Market

Zuken Inc. is a rapidly emerging player in virtual prototyping, offering innovative electronic design automation (EDA) solutions that help industries across various sectors optimize their design processes. Their integrated design and simulation tools enable seamless collaboration, enhancing product development efficiency while significantly reducing the need for physical prototypes. Zuken’s solutions are particularly beneficial in the automotive, aerospace, and electronics industries, where precision and speed are critical.

Recent Developments:

- In September 2024, Zuken launched the 2025 version of its Harness Builder for E3.series, featuring advanced tools to streamline wiring harness design and manufacturing. The update enhances virtual prototyping, enabling efficient simulation, validation, and optimization, reducing development time and errors while addressing growing demand in the virtual prototype market.

List of Key and Emerging Players in Virtual Prototype Market

- ESI Group

- Autodesk

- Altair Engineering

- Synopsys

- ANSYS

- Bentley Systems

- MathWorks

- PTC

- IBM

- Dassault Systemes

- COMSOL

- MSC Software

- Siemens

- NVIDIA

- Zuken

to learn more about this report Download Market Share

Recent Developments

- April 2024 – ESI Group announced a strategic partnership with FAW-Volkswagen TE to advance intelligent simulation technology in the automotive sector. The collaboration has led to the creation of an intelligent simulation and material testing laboratory in China, aimed at driving innovations for a safer, more productive, and cleaner automotive future.

- March 2024 – Arm Limited unveiled its latest automotive software technologies and virtual prototyping solutions based on the Armv9 architecture. The new technologies, including the Arm Neoverse V3AE, Cortex-A720AE, and Mali-C720AE, will enable the automotive sector to harness artificial intelligence, significantly accelerating vehicle development cycles by up to two years.

Analyst Opinion

As per our analyst, the global market is poised for significant growth, driven by the increasing adoption of advanced simulation technologies across industries such as automotive, aerospace, and consumer electronics. This shift is transforming product development processes, offering businesses a more efficient alternative to traditional physical prototyping. The integration of AI, ML, and cloud-based platforms is further enhancing the capabilities of virtual prototyping, boosting its demand across sectors.

While the high initial investment may pose a challenge for small and medium-sized enterprises, the continuous innovation in virtual prototyping technologies and the decreasing cost of solutions will likely drive broader adoption. As a result, the global virtual prototype market is set for continued expansion, with advancements enabling greater efficiency, accuracy, and sustainability in product development.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 680.51 Million |

| Market Size in 2025 | USD 766.73 Million |

| Market Size in 2033 | USD 2,160.18 Million |

| CAGR | 13.82% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Tools, By Deployment, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Virtual Prototype Market Segments

By Tools

- Computer-Aided Design (CAD)

- Computer-Aided Manufacturing (CAM)

- Computational Fluid Dynamic (CFD)

- Computer-Aided Engineering (CAE)

- Finite Element Analysis (FEA)

By Deployment

- On-premise

- Cloud

By Applications

- Automotive

- Healthcare

- Aerospace

- Consumer Electronic

- Others (Telecom, etc.)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.