Window Covering Market Size, Share & Trends Analysis Report By Type (Blinds & Shades, Curtains & Drapes, Shutters, Others), By Application (Residential, Commercial), By Installation (New Construction, Retrofit), By Technology (Automatic, Manual), By Distribution Channel (Online, Offline) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Window Covering Market Size

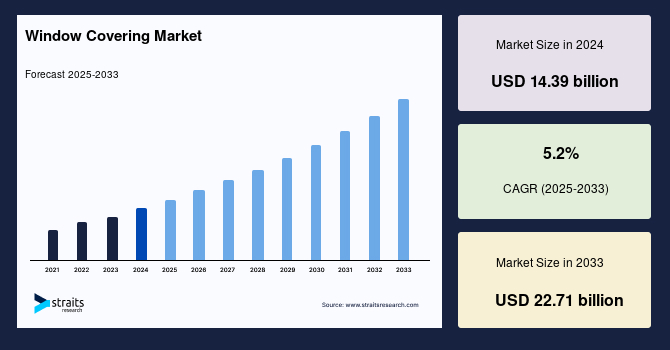

The global window covering market size was valued at USD 14.39 billion in 2024 and is projected to be worth USD 15.14 billion in 2025 and reach USD 22.71 billion by 2033, exhibiting a CAGR of 5.2% during the forecast period (2025-2033).

Window covers are a mosaic of multifunctional objects found in residential, commercial, and industrial buildings to help maximize energy efficiency, light control, privacy, and aesthetics. The coverings are blinds, shades, shutters, curtains, drapes, and films, available in wood, cloth, plastic, and metal. The global market encompasses producing, distributing, and selling materials used to cover or dress windows for functional and aesthetic purposes. Window coverings help control light, maintain privacy, enhance interior design, and improve energy efficiency by regulating indoor temperatures.

The global market demand is influenced by sustainability preferences and customization trends, contributing to the market’s steady expansion globally. The market serves residential and commercial sectors, driven by construction growth, interior design trends, and energy-saving regulations. Innovations in motorized and smart window treatments, often integrated with home automation systems, are gaining popularity. Technological advances have greatly influenced the market for window coverings. Smart or automated window coverings have become fashionable and are being remotely controlled or operated by apps or are integrated into smart home systems. Such solutions benefit users by ensuring greater convenience and energy savings by utilizing natural light and reducing the need for artificial lighting or heating.

Recent Market Trends

Growing Popularity of Motorized Window Coverings

The increasing consumer demand for motorized and automated window coverings is reshaping the global market landscape. As smart home technology becomes more mainstream, users embrace remote control solutions through mobile apps, voice assistants like Alexa or Google Home, and centralized home automation hubs. These motorized window treatments are particularly favored in luxury homes, upscale apartments, and modern commercial buildings where energy efficiency, convenience, and aesthetic value converge.

- For instance, in 2024, brands like Lutron and Somfy expanded their AI-integrated window systems, enabling real-time adaptation to weather conditions, user behavior, and energy efficiency goals in residential and commercial buildings.

Technological innovations are also enhancing the affordability and reliability of these systems, making them more accessible to middle-income homeowners.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 14.39 Billion |

| Estimated 2025 Value | USD 15.14 Billion |

| Projected 2033 Value | USD 22.71 Billion |

| CAGR (2025-2033) | 5.2% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Welspun, Coulisse, LOUVOLITE, Hunter Douglas Inc., Lotus & Windoware, Inc. |

to learn more about this report Download Free Sample Report

Window Covering Market Growth Factors

Increasing Urbanization and New Construction

Rapid urbanization and infrastructure development fuel the demand for window coverings, particularly in fast-growing economies such as India, China, Brazil, and Southeast Asia. As urban populations expand, the need for new housing, office spaces, hotels, and commercial buildings increases, each requiring tailored window treatment solutions for privacy, insulation, and aesthetic appeal. Additionally, government-led smart city and housing development programs are contributing to a construction boom in these regions, which is driving demand for both standard and smart window coverings. Rising disposable incomes and a growing middle class in urban centers also contribute to a shift in consumer preference toward high-quality and decorative window treatments.

- For instance, in 2023, the U.S. implemented the Energy Efficient Home Improvement Credit, offering tax benefits for energy-saving window coverings, accelerating market growth in eco-conscious households and urban residential developments.

Restraining Factors

Volatile Raw Material Prices

One significant constraint affecting the global window covering market is the unpredictable fluctuation in raw materials prices such as wood, aluminum, synthetic fibers, and natural textiles. These fluctuations are often influenced by global economic factors, trade policies, supply chain disruptions, inflation, and natural disasters. When material costs rise, manufacturers are forced to increase product prices, which can reduce demand primarily in price-sensitive regions. Moreover, unexpected cost surges can disrupt production planning, leading to delays in product delivery and affecting long-term supplier relationships. Maintaining profit margins becomes increasingly difficult for smaller manufacturers in such volatile conditions.

In recent years, supply chain issues related to the COVID-19 pandemic and international trade conflicts have amplified material cost volatility, challenging companies to find alternative sourcing strategies or innovate with cost-efficient materials.

Market Opportunity

Expansion in Smart Home Integration

The rapid expansion of the smart home ecosystem presents one of the most promising opportunities for the window-covering market. As more consumers adopt interconnected devices from smart thermostats and lighting systems to security and entertainment solutions the demand for smart window coverings that integrate seamlessly into these systems is growing exponentially. Automated blinds and shades that can be programmed or controlled via smartphone apps, voice assistants, or centralized smart hubs offer convenience, improved energy efficiency, and enhanced privacy. This growing demand creates vast opportunities for innovation in material compatibility, sensor integration, and user experience design. Companies that invest in AI, IoT, and machine learning capabilities are well-positioned to lead in this evolving landscape.

- For instance, in September 2024, Motionblinds unveiled its latest smart shading solutions at the CEDIA Expo in Denver. These innovations feature integration with Matter and Thread technologies, enhancing compatibility across smart home platforms. The new range includes battery-powered and wired options, catering to residential and commercial applications. This development underscores Motionblinds' commitment to advancing smart home integration in window coverings.

Regional Insights

North America - Dominant Region with 41.3% Market Share

North America led the global market in 2024, capturing a 41.3% revenue share, primarily driven by the U.S. housing sector's growth and heightened consumer spending on home upgrades. Rising residential construction activity and remodeling projects fuel demand for stylish, functional window coverings. Technological innovation, such as cordless blinds and motorized systems, shapes consumer preferences. Regulatory measures are also influencing market direction for instance, the 2023 ANSI/WCMA safety standard update mandates cordless or child-safe cord solutions for most window products, ensuring safety and compliance.

Asia-Pacific - Fastest Growing Region with 51% Market Share

Asia-Pacific is the largest and fastest-growing market, expected to expand at a CAGR of 11.2% between 2025 and 2033. The rapid urban development in China, India, Vietnam, and the Philippines is a major growth catalyst. Demand is particularly high in the hospitality and real estate sectors, driven by a rise in tourism and middle-class homeownership. China leads the region in revenue thanks to hotel expansion and large-scale infrastructure projects. In Japan, smart window coverings are becoming more common due to a strong focus on high-tech living and aging population needs, with a projected CAGR of 10.1%.

Country Insights

The window covering the market varies significantly across different countries based on consumer preferences, income levels, and regional trends. In the United States and much of Europe, high smart home adoption rates and a focus on sustainability drive a growing demand for motorized and energy-efficient coverings. In contrast, countries in the Asia-Pacific region, such as China and India, are witnessing rapid market growth due to urbanization and rising disposable incomes, with consumers seeking modern yet cost-effective solutions.

Below is the analysis of key countries impacting the market:

- U.S- The U.S. window covering market is heavily influenced by the growing adoption of smart home technologies and eco-friendly products. Consumers prioritize energy efficiency and automated solutions, contributing to the rising demand for motorized blinds and shades. Additionally, the country’s robust home renovation sector further drives market growth.

- Canada- In Canada, the focus on energy efficiency due to the country’s cold climate drives demand for insulated window coverings that help reduce heating costs. Home automation and sustainable materials are also key trends, with consumers showing increased interest in eco-friendly and automated window treatment solutions.

- Japan- Japan's window covering market is characterized by minimalistic designs and space-saving solutions, reflecting the country's smaller residential spaces. The demand for motorized and compact window coverings is growing, particularly in urban areas, while traditional shoji screens remain popular in certain segments.

- India- India’s window-covering market is expanding rapidly due to urbanization and rising disposable incomes. Consumers increasingly seek modern window treatments, though affordability remains a key concern. As sustainability awareness increases, the market also grows interested in eco-friendly and energy-efficient products.

- China: China's fast-paced urbanization and growing middle class drive the demand for modern and customizable window coverings. The country’s increasing focus on smart homes and automation is boosting the adoption of motorized window coverings, particularly in urban residential and commercial buildings.

- UK: In the UK, energy efficiency and home décor trends significantly influence the window covering market. Consumers increasingly opt for insulated and motorized solutions to optimize heating and lighting. The home renovation trend has also led to a higher demand for stylish, customizable window coverings.

- Germany: Germany's market for window coverings is driven by the country’s strong focus on energy efficiency and sustainability. Consumers prefer products made from eco-friendly materials and automated solutions that help regulate indoor temperatures. The growing demand for smart homes also boosts the adoption of motorized blinds and shades.

Window Covering Market Segmentation Analysis

By Type

The blinds and shades segment led the global market, contributing 43.2% of overall sales in 2024. This dominance stems from rising consumer awareness of energy efficiency and the increased use of acoustic solutions like honeycomb blinds that reduce noise and improve insulation. These window coverings are designed for functionality, aesthetics, and smart home integration. Driven by rapid urbanization, expanding middle-class incomes, and a boom in home improvement projects, the demand for blinds and shades is witnessing an upsurge.

By Application

The residential sector remains the primary driver of the window-covering market. The surge in urban populations, especially in China, India, and Southeast Asia, has created a robust demand for compact, space-efficient window solutions. Consumers increasingly opt for window coverings that enhance natural lighting, ensure privacy, and offer energy savings, particularly in smart homes and eco-conscious households. The growing popularity of open-plan living has further boosted demand for multifunctional window treatments like layered shades and blackout blinds.

By Installation

The retrofit market is driven by increasing interest in home remodeling and personalized interior design. Post-COVID, homeowners have prioritized upgrading living spaces to align with new lifestyles, such as remote work and energy conservation. This shift has spurred demand for easy window coverings to integrate into existing structures without major architectural changes. The rise of retro-inspired aesthetics has also encouraged using wood blinds, Roman shades, and vintage-style drapes in modern interiors.

By Technology

Despite the growing popularity of automation, manually operated blinds and curtains remain popular due to affordability, wide availability, and ease of use. Urban consumers living in smaller apartments often favor practical, multipurpose solutions that deliver style without the complexity of installation or maintenance. Many brands are introducing manually operated blinds with enhanced UV resistance, thermal insulation, and dual-functionality for day/night privacy.

By Distribution Channel

Physical retail outlets home improvement centers, department stores, and specialty decor stores remain dominant due to consumer preferences for hands-on texture, color, and dimensions inspection. Regions like India and Southeast Asia continue to rely on wholesale and unorganized retail markets for cost-effective solutions. In-store consultations, customization services, and bundled installation support have also helped retain offline channels as the preferred choice for consumers, particularly in mid and high-end segments.

Company Market Share

The entire market window is fragmented and polarized between big multinational companies and small regional players trying to compete for market shares. Smaller regional players would provide cost-effective designs of locally preferred models to cater to specific consumer needs. That's further influencing market shares, given the rising demand for smart window coverings, which are also finding competitive competition in automation-focused segments.

Lutron Electronics: An emerging player in the market

New entrants in the market for window covering solutions focus on newer innovative solutions while also working on widening their portfolio to match up with big companies. An example of such a company is Lutron Electronics, whose smart window coverings are gaining popularity among consumers. They provide technologies like automated controls and energy-efficient solutions. For instance, blinds and The Shade Store have become popular because their online platforms allow consumers to customizable, easy-to-order window coverings. These emerging players have capitalized on increased demand for home interconnectivity, sustainability, and customization into a thriving competition as the landscape evolves.

List of Key and Emerging Players in Window Covering Market

- Welspun

- Coulisse

- LOUVOLITE

- Hunter Douglas Inc.

- Lotus & Windoware, Inc.

- Bombay Dyeing & Manufacturing Co Ltd.

- Insolroll Window Shading Systems

- Springs Window Fashions

- SKANDIA WINDOW FASHIONS, INC.

- Polar Shades Sun Control

- Norman International Inc.

- MechoShade Systems, LLC

- Lafayette Interior Fashions

- Comfortex Window Fashions

- The Shade Store, LLC

- Decora Blind Systems Ltd

to learn more about this report Download Market Share

Recent Developments

- August 2024- Graber launched an innovative Visualizer tool to enhance consumer confidence in window treatment purchases. This high-tech interface lets users virtually try on various blinds and shade styles before committing, improving the online buying experience.

Analyst Opinion

As per our analyst, the global market is witnessing steady growth, driven by rising consumer focus on home aesthetics, energy efficiency, and smart home integration. Urbanization and increasing disposable incomes, particularly in emerging economies, boost demand for stylish and functional window treatments such as blinds, shades, and curtains. Notably, the surge in residential construction and renovation projects post-pandemic has reinvigorated market momentum.

Additionally, integrating motorized and smart window coverings creates new growth avenues, especially in tech-savvy and high-income markets. Commercial spaces also adopt modern, automated solutions for energy savings and improved ambiance. Overall, the market is evolving to align with lifestyle trends, sustainability goals, and technological advancements, presenting robust opportunities across residential and commercial segments.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 14.39 Billion |

| Market Size in 2025 | USD 15.14 Billion |

| Market Size in 2033 | USD 22.71 Billion |

| CAGR | 5.2% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application, By Installation, By Technology, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Window Covering Market Segments

By Type

- Blinds & Shades

- Curtains & Drapes

- Shutters

- Others

By Application

- Residential

- Commercial

By Installation

- New Construction

- Retrofit

By Technology

- Automatic

- Manual

By Distribution Channel

- Online

- Offline

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.