Zero Trust Network Access Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment Mode (Cloud-Based, On-Premises, Hybrid), By Organization Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Technology (Identity and Access Management (IAM), Policy Enforcement Gateway (PEG), Micro-Segmentation, Continuous Authentication Systems, Endpoint Security Integration), By Application (Information Technology (IT) & Telecommunications, BFSI, Healthcare, Defense, Retail, Industrial, Energy and Utilities, Education, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-203

Zero Trust Network Access Market Overview

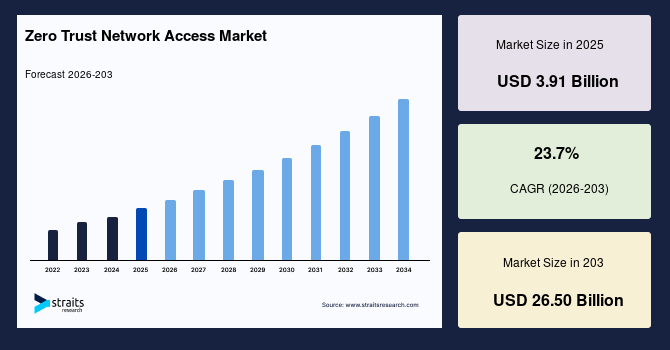

The global zero trust network access market size is valued at USD 3.91 billion in 2025 and is estimated to reach USD 26.50 billion by 2034, growing at a CAGR of 23.7% during the forecast period. Strong market growth is driven by the rapid shift toward cloud-based infrastructure, rising cyber threats targeting remote work environments, and increasing regulatory focus on identity-centric access controls, which collectively push organizations to adopt Zero Trust Network Access solutions as a core component of modern cybersecurity architectures.

Key Market Trends & Insights

- North America dominated the market with a revenue share of 38.62% in 2025.

- Asia Pacific is anticipated to grow at the fastest CAGR of 25.91% during the forecast period.

- Based on component, the Software segment held the highest market share of 68.45% in 2025.

- By deployment mode, the Cloud-Based segment is estimated to register the fastest CAGR growth of 26.34%.

- Based on organization size, Large Enterprises dominated the market in 2025 with a 59.27% share.

- By technology, Identity and Access Management (IAM) is projected to remain the leading segment in 2025, while Continuous Authentication Systems are forecast to grow at the fastest CAGR of 27.12%.

- Based on application, the IT & Telecommunications segment dominated the market in 2025, driven by strong cloud adoption and cybersecurity investments.

- The U.S. leads the market, valued at USD 1.47 billion in 2024 and reaching USD 1.62 billion in 2025.

Table: U.S Zero Trust Network Access Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 3.91billion

- 2034 Projected Market Size: USD 26.50 billion

- CAGR (2026-2034): 23.7%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The global zero trust network access market includes a comprehensive suite of cybersecurity solutions focused on continuous identity verification, least-privilege access control, micro-segmentation, and real-time risk monitoring to secure remote and hybrid workforce environments. These solutions comprise advanced technologies such as identity and access management, policy enforcement gateways, endpoint security integration, and continuous authentication systems, all designed to eliminate implicit trust and prevent lateral movement of cyber threats.

Zero Trust Network Access offerings are deployed through cloud-based, hybrid, and on-premises models and are delivered as software and managed security services. They are adopted across diverse sectors including IT & telecommunications, BFSI, healthcare, defense, retail, industrial, education, and energy & utilities, enabling organizations of all sizes to safeguard digital assets, comply with regulatory standards, and support secure digital transformation worldwide.

Latest Market Trends

Increased Adoption of Cloud and Hybrid Workforce Models

The growth in cloud computing and hybrid work patterns is driving Zero Trust Network Access solutions. Cloud-hosted applications, remote workers, and contractors need secure, frictionless access outside the boundaries of conventional networks. Organizations are increasingly adopting cloud-hosted ZTNA platforms with endpoint protection and continuous authentication systems to ensure compliance and minimize the threat of data breach. This shift indicates an overall trend towards secure digital transformation where cybersecurity is an intrinsic driver of business agility and not a defensive response.

Incorporating AI and Behavioral Analytics for Anticipatory Threat Detection

Businesses are utilizing AI-based behavioral analytics to improve Zero Trust Network Access solutions. Ongoing monitoring of user activity, endpoint posture, and application access trends enables organizations to detect suspicious activity in real time and react to possible threats before they become incidents. This proactive stance reduces insider danger, decreases the attack surface, and enhances regulatory compliance, marking a huge shift away from reactive security solutions to smart, adaptive access control models.

Market Summary

| Market Metric | Details & Data (2025-203) |

|---|---|

| 2025 Market Valuation | USD 3.91 Billion |

| Estimated 2026 Value | USD 4.84 Billion |

| Projected 203 Value | USD 26.50 Billion |

| CAGR (2026-203) | 23.7% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Cisco Systems, Inc., Palo Alto Networks, Inc., Zscaler, Inc., Akamai Technologies, Inc., Cloudflare, Inc. |

to learn more about this report Download Free Sample Report

Zero Trust Network Access Market Drivers

Government Initiatives for Safe Remote Workforces

National cybersecurity strategies and government directives are driving the uptake of Zero Trust Network Access products increasingly. The United States, Singapore, and Germany have published sweeping cybersecurity directives requiring agencies and operators of critical infrastructure to deploy identity-based access controls and continuous monitoring. For example, the United States Cybersecurity and Infrastructure Security Agency (CISA) has endorsed Zero Trust architectures in its federal security recommendations to protect government networks and citizen data.These regulatory pushes are causing companies to deploy ZTNA not only to comply with mandates but also to increase overall resistance to more common cyberattacks. Alignment of corporate security programs with government-sponsored frameworks is leading to widespread ZTNA adoption across public and private sectors.

Market Restraints

Limited Interoperability with Existing Systems

Most organizations struggle to merge Zero Trust Network Access models with current legacy IT systems. Government organizations and large enterprises that depend on legacy network infrastructure experience challenges in implementing identity-based access policies to the fullest extent without impacting operations.

The absence of common protocols for seamless interoperability can serve as an obstacle to adoptions, especially in industries where legacy structures are profoundly ingrained due to operational or compliance purposes. This challenge frequently results in longer deployment times and greater consulting expense. Organizations can also struggle to implement consistent policy enforcement across hybrid IT infrastructures, undermining the efficacy of their Zero Trust endeavors.

Market Opportunities

Increasing Demand for Cybersecurity Regulations in the Public and Critical Sector

Growing government interest in homegrown cybersecurity is opening up new opportunities for the zero trust network access market. Public agencies and organizations in countries like the European Union, the United States, and Australia are making identity-based access models mandatory for critical infrastructure, healthcare, and financial services. For example, the European Union Agency for Cybersecurity (ENISA) has suggested the implementation of Zero Trust models to secure sensitive government and citizen data among member states.

These policy programs are compelling promising businesses and public organizations to adopt ZTNA solutions themselves, providing solution providers with opportunities to provide compliance-compliant, secure access frameworks. As governments tighten cyber resilience requirements, vendors can ride the wave to accelerate deployment in policy-regulated industries through consulting, integration, and managed services addressing policy needs.

Regional Analysis

North America led the market in 2025 with 38.62% market share. The reason for this leadership lies in the widespread use of hybrid work models, the heavy regulation of cybersecurity, and greater investment in enterprise cloud infrastructures. Moreover, cooperative programs between industry groups and education institutions are encouraging Zero Trust frameworks through knowledge exchanges, pilot testing, and standardized best practices. All of these are driving enterprises and public organizations to adopt ZTNA solutions in the region.

Zero trust network access market growth in the U.S. is fueled by the federal government's initiative for secure digital transformation and cybersecurity readiness. For example, the U.S. National Institute of Standards and Technology (NIST) has released extensive guidelines suggesting Zero Trust architectures for federal agencies as well as critical infrastructure operators. Enterprises are increasingly following these guidelines and adopting continuous access verification and micro-segmentation strategies. Such regulatory alignment along with robust private investments in cybersecurity is further strengthening confidence in ZTNA models, promoting market growth in the country.

Asia Pacific Market Insights

The Asia Pacific region is turning out to be the fastest-growing region with a CAGR of 25.91% during 2026-2034, led by the likes of India, Japan, and South Korea. India is experiencing unprecedented ZTNA uptake in IT and BFSI industries based on robust government support for digital governance and data protection programs. Japan and South Korea are developing secure access models through large-scale public-private cybersecurity initiatives and smart city deployments. These local programs, enhancing enterprise digital security consciousness and technology deployment, are boosting Zero Trust solution rollouts throughout the Asia Pacific.

India's zero trust network access market is growing strongly on the back of national digital security programs and partnerships with leading IT service providers. Government agencies and large enterprises are embracing ZTNA solutions as part of larger cybersecurity modernization initiatives. For instance, various state-level digital transformation programs now require identity-based access control and continuous authentication for government services, driving a substantial growth opportunity. Such regulatory policies and enterprise-wide adoption plans are making India a significant growth center of the Asia Pacific ZTNA market.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe is seeing steady expansion in Zero Trust Network Access solutions, driven by increasing hybrid work environment adoption and regulatory efforts to improve data security and network resilience. France, the Netherlands, and Nordics are encouraging companies to embrace centralized identity verification and micro-segmentation strategies, and industry groups are facilitating knowledge sharing and best practice convergence. These drivers collectively accelerate the take-up of ZTNA architectures in BFSI, healthcare, and IT services sectors.

Industrial cybersecurity interest in the country and the safe implementation of Industry 4.0 drive the growth of the German ZTNA market. German manufacturing and automotive businesses are using Zero Trust solutions at larger levels to safeguard intellectual property, industrial control systems, and IoT devices in the connected environment. The efforts of the German Federal Office for Information Security (BSI) Cyber Strategy, including industry-specific cybersecurity guidelines, are making it easier for companies to implement continuous authentication and rigorous access policies, building trust and driving adoption of ZTNA solutions nationwide.

Latin America Market Insights

The Latin America ZTNA market is dominated by countries such as Brazil, Mexico, and Chile, which are focusing on modernizing enterprise IT infrastructures and digital transformation initiatives. Increasing awareness of cyber threats, coupled with local data protection regulations, is pushing organizations to adopt Zero Trust architectures. Cloud adoption and remote worker enablement further propel the uptake of ZTNA solutions in commercial and government markets.

The market for Brazil ZTNA is expanding with companies emphasizing secure access to remote teams and cloud applications. Leading IT service providers are providing managed ZTNA solutions, integrating identity verification and policy management over scattered environments. Government incentives in terms of digital security within financial and public sectors are pushing the market ahead, and Brazil is becoming a hub for ZTNA adoption in Latin America.

Middle East and Africa Market Insights

The Middle East and Africa ZTNA market is growing as organizations focus on protecting sensitive financial, government, and healthcare data and facilitating digital transformation. UAE, Saudi Arabia, and South Africa are embracing national cybersecurity strategies that recommend Zero Trust models for critical infrastructure.

UAE ZTNA market is expanding at a very rapid pace as organizations implement cloud-first and hybrid workplace models. Leading organizations are adopting continuous authentication, micro-segmentation, and endpoint security integrations to comply with national cybersecurity regulations. Joint initiatives by local cybersecurity organizations and private IT firms are driving adoption and awareness of ZTNA solutions even further.

Component Insights

The Software segment dominated the market with a 68.45% revenue share in 2025. It is driven by increased adoption of hybrid workforce models and cloud-based applications, for which businesses require centralized identity and policy management, as well as ongoing authentication capabilities to protect access to sensitive assets securely.

Services segment will witness the highest growth, with a projected CAGR of 27.05% during the forecast period. Robust growth is fueled by higher demand for managed ZTNA services, consulting, and integration services, especially from large enterprises with multi-layered legacy infrastructure or regulatory needs.

By Component Market Share (%), 2025

Source: Straits Research

Deployment Mode Insights

On-Premises held the market's top position with 42.18% revenue in 2025. It is fueled by organizations' strong data residency and compliance needs, including government, BFSI, and hospitals.

The Cloud-Based segment would see the largest growth, with a predicted CAGR of 26.34% over the forecast period. The growth is fueled by accelerated adoption of remote work patterns, hybrid cloud infrastructure, and growing needs for elastic, managed ZTNA solutions.

Organization Size Insights

The Large Enterprises market share ruled the market in 2025 at 59.27%. This is fueled by growing complexity in enterprise IT environments, competitive regulatory compliance demands, and the need to protect sensitive information across various locations and cloud environments.

The Small and Medium Businesses (SMEs) segment will see the highest growth, with a projected CAGR of 28.15% through the forecast period. High growth is fueled by SMEs making greater use of cloud-based applications, third-party engagement, and remote employee enablement.

Technology Insights

The Identity and Access Management (IAM) segment led the market in a revenue growth rate of 41.78% in 2025 with its indispensable role to consolidate authentication, offer least-privilege access, and facilitate compliance in cloud and enterprise environments.

The Continuous Authentication Systems market will experience the fastest growth over the forecast period. This is driven by increasing demands for adaptive security mechanisms that continuously authenticate user activity, device integrity, and network traffic.

Application Insights

The Healthcare segment is expected to increase at the highest rate over the forecast period with a CAGR of 28.45%, fueled by the growing need for secure remote access to electronic health records, telemedicine platforms, and networked medical devices. With healthcare organizations continuing to scale digital operations, ZTNA solutions are being deployed more and more to provide data security and compliance with regulations.

Competitive Landscape

The global zero trust network access market is moderately fragmented, with the presence of established cybersecurity vendors and specialized service providers. A few key players account for the major market share through comprehensive ZTNA solutions, cloud-based deployments, and managed services offerings.

The major players in the market include Zscaler, Inc, Cisco Systems, Cloudflare, Inc, and others. These industry players are competing to strengthen their market position through the launch of innovative solutions, strategic partnerships, and acquisitions. Companies are focusing on enhancing capabilities in identity and access management, continuous authentication, and endpoint security integration to capture a larger share of the growing ZTNA market.

VDURA: An Emerging Market Player

VDURA, previously Panasas, is a U.S. company with expertise in software-defined storage solutions designed specifically for artificial intelligence (AI) and high-performance computing (HPC) applications. It stands out from the competition by providing a modular data platform that plugs easily into Kubernetes and offers end-to-end encryption, satisfying the changing demands of contemporary businesses.

- In June 2025, VDURA made Version 11.2 of its Data Platform available, featuring Kubernetes Container Storage Interface (CSI) integration, increased end-to-end encryption, and a premium support offering. The company also previewed V-ScaleFlow, a tiering technology for migrating data between QLC flash and high-density HDDs to maximize performance and cost-effectiveness.

VDURA's emphasis on HPC and AI workloads places it at the forefront of the enterprise storage market, meeting increasing needs for high-performance and scalable storage solutions.

List of Key and Emerging Players in Zero Trust Network Access Market

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Zscaler, Inc.

- Akamai Technologies, Inc.

- Cloudflare, Inc.

- Fortinet, Inc.

- Ivanti, Inc.

- Check Point Software Technologies Ltd.

- Broadcom Inc.

- Okta, Inc.

- Microsoft Corporation

- Google LLC

- Netskope, Inc.

- CrowdStrike Holdings, Inc.

- McAfee Corp.

- Hewlett Packard Enterprise

- Appgate, Inc.

- Citrix Systems, Inc

- Forcepoint LLC

- Versa Networks, Inc.

- Others

Strategic Initiatives

- July 2025: Palo Alto Networks was named a Leader in The Forrester Wave™: Zero Trust Platforms, Q3 2025, highlighting its significant market innovation and customer traction. The company announced that over 19,000 organizations had deployed its Zero Trust solution, covering more than 85 million user sessions monthly.

- March 2025: Cloudflare launched the industry's first quantum-safe Zero Trust Network Access solution, setting a new industry standard with broader protocol support.

- February 2025: Zscaler introduced innovations in intelligent segmentation, extending Zero Trust to branches, factories, and clouds, with support for AWS and Azure, and GCP support slated for February 2025.

- March 2024: Cisco was named an Overall Leader in the KuppingerCole Zero Trust Network Access Leadership Compass, excelling in all four evaluation categories: overall, product, innovation, and market leadership.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 3.91 Billion |

| Market Size in 2026 | USD 4.84 Billion |

| Market Size in 203 | USD 26.50 Billion |

| CAGR | 23.7% (2026-203) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-203 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Deployment Mode, By Organization Size, By Technology, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Zero Trust Network Access Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid

By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Technology

- Identity and Access Management (IAM)

- Policy Enforcement Gateway (PEG)

- Micro-Segmentation

- Continuous Authentication Systems

- Endpoint Security Integration

By Application

- Information Technology (IT) & Telecommunications

- BFSI

- Healthcare

- Defense

- Retail

- Industrial

- Energy and Utilities

- Education

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.