AI in Regulatory Affairs Market Size, Share & Trends Analysis Report By Component (Software/Platform, Services), By Deployment Mode (Cloud-based, On-Premises), By Application (Regulatory Intelligence, Data Migration & Integration, Dossier Management, Document Management, Product Registration & Approvals, Pharmacovigilance & Safety Reporting, Regulatory Submissions & Publishing, Others), By End Use (Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies, CRO/CDMO, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

AI in Regulatory Affairs Market Size

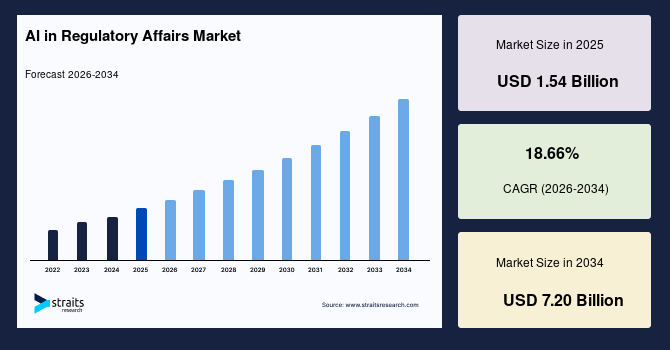

The AI in regulatory affairs market size was valued at USD 1.54 billion in 2025 and is estimated to reach USD 7.20 billion by 2034, growing at a CAGR of 18.66% during the forecast period (2026-2034). The market is evolving rapidly as regulatory functions, once heavily reliant on manual processes, increasingly adopt AI-powered tools for compliance management, regulatory intelligence, and submission automation to address rising regulatory complexity, growing clinical trial volumes, and the need to accelerate global approval timelines.

Key Market Insights

- North America dominated the AI in regulatory affairs market with the largest share of 37.68% in 2025.

- Asia Pacific is expected to be the fastest-growing region in the AI in regulatory affairs market during the forecast period, expected to grow at a CAGR of 20.66%.

- Based on the component, the services segment is anticipated to register a CAGR of 19.83% during the forecast period.

- Based on deployment mode, the on-premises segment is anticipated to register a moderate growth of 19.99% during the forecast period.

- Based on application, the regulatory intelligence segment dominated the market with a revenue share of 20.14% in 2025.

- Based on end use, the pharmaceutical companies segment dominated the market with a revenue share of 40.45% in 2025.

- The US AI in regulatory affairs market size was valued at USD 503.76 million in 2025 and is projected to reach USD 595.94 million in 2026.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 1.54 Billion |

| Estimated 2026 Value | USD 1.83 Billion |

| Projected 2034 Value | USD 7.20 Billion |

| CAGR (2026-2034) | 18.66% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | IQVIA, Freyr Solutions, Nemko Group AS, DDReg Pharma, ArisGlobal |

to learn more about this report Download Free Sample Report

AI in Regulatory Affairs Market Trends

Transition from manual regulatory tracking to AI-driven regulatory intelligence

The AI in regulatory affairs market is undergoing a transition from manual regulatory tracking practices to AI-driven regulatory intelligence platforms that support continuous monitoring and forward-looking assessment of regulatory change. Workflows earlier had limited responsiveness to frequent guideline updates and jurisdiction-specific variations. This is because they utilized periodic reviews of authoritative websites and static regulatory databases. AI-based systems today have better identification ability for policy shifts and enable faster internal alignment. They use natural language processing (NLP) and semantic mapping for regulatory texts issued by authorities. Thus, the market is transitioning toward advanced AI platforms for proactive compliance planning and long-term regulatory strategy. This limits dependence on traditional administrative tools.

Shift from document-centric regulatory operations to data-centric lifecycle management

Companies are focusing on improving submission consistency and scalable operations. Thus, they are shifting toward data-centric lifecycle management models for better structured content reuse to enable consistent submissions. The result is a shift from document-centric regulatory operations that emphasize document compilation for each submission. This results in duplicate and inconsistent submissions across market verticals. AI platforms showcases interconnected data that flows consistently across the stages of development, submission, and post approval. This shift toward better regulatory operations is evident with consistency across dossiers. A need for scalable global submissions is strengthening traceability across product lifecycles, reinforcing sustained investment in enterprise-level AI regulatory systems.

AI in Regulatory Affairs Market Drivers

Growing regulatory complexity and authority-level adoption of AI drives the market

Enterprises are investing heavily in AI-based regulatory automation due to growing complex regulatory needs, especially in pharmaceuticals, biotechnology, and medical devices. Companies operating in these verticals need accelerated approval pathways, real-world evidence requirements, and post-approval obligations. The EU AI Act focuses on decision-making tools used in healthcare and medical devices. In this case, AI tools aid in regulatory submissions, pharmacovigilance, labeling, or risk assessment in the EU. The FDA’s 21 CFR Part 11 & Digital Health Guidance in the US governs electronic records, electronic signatures, and computerized systems for biotech and pharmaceutical sectors. In the US, AI tools help submission documents comply with Part 11 for data integrity, audit trails, and validation. Thus, the adoption of AI by regulatory authorities strengthens confidence in AI-enabled platforms and accelerates their integration across industry regulatory operations.

Rising volume of global clinical development programs increases demand for scalable regulatory workflow automation

The demand for scalable AI automation workflow is propelled by the increasing volume of clinical development data. Clinical trials are expanding worldwide, and they need to comply with regional regulatory requirements. Multi-regional trials are conducted to drive market access, which results in higher volumes of regulatory interactions, submissions, and authority correspondence. The management of parallel regulatory activities increases the risk of delays due to the use of manual or semi-automated systems strains. AI platforms manage the development pipelines by focusing on workflow orchestration, submission sequencing, and cross-regional coordination.

Market Restraint

Fragmented global regulatory data structures restrains market

Multinational regulatory operations have varied regulatory data structures, which show fragmentation across regions. There are inconsistencies in submission formats, terminology, guidance documentation, and authority-level communication practices. Such variability increases the complexity of data ingestion and normalization. Fragmented data results in complex implementation for multinational organizations that limits uniform deployment. Region-specific configuration layers act as a hindrance for AI-driven regulatory platforms, which slows broader rollout timelines.

Market Opportunity

Post-approval change management protocols provide growth opportunities

Regulatory authorities emphasize more on lifecycle oversight, variation control, and ongoing product maintenance after the initial approval. They are tightening oversight after product approval in the pharma, biotech, and medical device sectors. Post-Approval Change Management (PACM) drives opportunities for market players, since authorities are introducing structured protocol changes and scrutiny. AI can automate change classification, impact assessment, and submission routing for the structural PACM changes led by ICH Q12. As per EU MDR/IVDR protocols, even minor changes can trigger notified body review. For this, AI can review technical file changes, risk class impact, and help with resubmissions. AI systems help in automating change impact assessment for improved classification and submission readiness. This is true across product portfolios. Traditional PACM revolved around email chains, vast spreadsheets, and manual tracking & interpretation, while AI PACM has continuous intelligence systems. Thus, vendors are positioning AI platforms as an embedded long-term lifecycle optimization system within enterprises.

Technological Landscape

- DrugCard is an AI-powered regulatory intelligence software that augments regulatory updates from over 40 countries and summarizes regulatory changes from multiple authorities.

- RegulatoryIQ is an AI-powered tool that analyses submitted documents, identifies regulatory gaps, and generates compliance reports.

- Leaf Intelligence automates regulatory research and detects label changes for actionable insights.

Regional Analysis

The AI in regulatory affairs market in North America dominated the market with a share of 37.68%. The region is an early adopter of digital regulatory platforms and advanced regulatory infrastructure across pharmaceutical, biotechnology, and medical device companies. It has an established electronic submission system and structured regulatory pathways. This supports the integration of AI-based tools across regulatory intelligence, submission lifecycle management, and compliance monitoring workflows.

The US accounted for the largest regional share, which is driven by a high volume of regulatory workloads and sustained investments in automation. The country already has higher willingness to adopt AI-driven systems, which is an added advantage in a robust healthcare infrastructure. In June 2025, the US Food and Drug Administration announced the internal deployment of a generative AI system named Elsa to support scientific review activities, document summarization, and regulatory data analysis, as disclosed on the official FDA website.

Asia Pacific

The Asia Pacific AI in regulatory affairs market is expected to register a CAGR of 20.66% during the forecast period. The region is by large-scale digitization initiatives and increasing regulatory complexity across the pharmaceutical and medical device sectors. Countries across the region are investing in electronic regulatory systems to manage growing submission volumes and cross-border compliance requirements.

In China, government-led regulatory modernization programs and centralized digital submission platforms continue to accelerate adoption of AI-based regulatory tools across domestic and multinational life sciences organizations. For example, the National Medical Products Administration (NMPA) introduced AI-specific regulatory guidance and review frameworks for artificial intelligence medical devices. This enables the use of AI-driven tools for dossier validation, technical review support, and post-approval performance monitoring.

Europe

Europe has a harmonized regulatory framework and regional policies that encourage the digital transformation of regulatory processes. A unified electronic submission standard across the EU supports broader use of AI-driven systems. Regulatory agencies such as MHRA in the UK and BfArM in Germany are advancing AI integration for better assessment and evaluation of the review process. The region has mature pharmaceutical, biotech, and MedTech industries, which drive demand for AI review systems. The region also has initiatives that encourage and integrate AI innovation and adoption. For instance, InvestAI mobilizes extensive public and private capital to boost AI adoption. All these factors are expected to boost steady growth in the European AI in regulatory affairs market.

Germany has implemented digital health and regulatory modernization initiatives. The National Research Data Infrastructure links data across multiple domains for health research and regulatory purposes. Mission KI connects stakeholders such as startups, SMEs, and research institutes for the commercial deployment of AI. Companies in this country are increasingly deploying AI-driven regulatory intelligence and submission management systems to align with European Medicines Agency requirements. This helps to automate dossier preparation and accelerate cross-border regulatory approvals.

Latin America

Latin America demonstrates steady growth in the AI in regulatory affairs market with the onset of regulatory digitization and expansion of electronic submission infrastructure. National regulatory agencies are strengthening digital review systems and standardized regulatory workflows, improving readiness for AI-based regulatory tools. For instance, COFEPRIS (Mexico) aligns regulatory submissions as per global standards. The region has an evolving health-tech and digital innovation ecosystem, promoting companies to leverage AI for healthcare.

Brazil leads the region through public sector investments in regulatory information systems and structured electronic submission frameworks. For example, the Agência Nacional de Vigilância Sanitária (ANVISA) has established a comprehensive electronic petitioning and submission platform that enables regulated companies to file regulatory requests, applications and structured electronic dossiers (e-submissions) directly with the agency through its Solicita and Peticionamento electronic systems, modernizing review workflows and improving transparency and traceability of regulatory interactions.

Middle East and Africa

The Middle East and Africa market is progressing due to the modernization efforts toward digital health infrastructure. The region is also encouraging AI adoption through public sector initiatives. For instance, the Vision 2030 initiative by Saudi Arabia promotes the use of AI in the healthcare sector for predictive analysis. This is giving an economic push toward digital compliance tools. Clinical trial activities are also growing in the GCC countries. Thus, this will lead to growing demand for testing and submission tools in the Middle East and Africa AI in regulatory affairs market.

South Africa holds a leading position in the region due to regulatory system modernization and widespread deployment of electronic regulatory workflows across public and private sector life sciences organizations. The South African Health Products Regulatory Authority (SAHPRA) has implemented an eCTD electronic submission portal as the preferred platform for registering human medicines, variations, and renewals. This enables sponsors to submit structured dossiers digitally in accordance with international standards, enhancing review efficiency and traceability across the product lifecycle.

Component Insights

The software platform segment dominated the AI in regulatory affairs market in 2025, driven by extensive adoption of AI-based regulatory intelligence systems, submission management platforms, and document automation tools across life sciences organizations. Increasing regulatory complexity and rising volumes of structured and unstructured regulatory data continue to support sustained deployment of integrated software platforms across regulatory workflows.

The services segment is projected to record a CAGR of 19.83% in the AI in regulatory affairs market, supported by growing demand for AI-enabled regulatory operations, platform implementation, system integration, and ongoing regulatory support services.

Deployment Mode Insights

The cloud-based segment dominated the AI in regulatory affairs market in 2025. This segment enhances the deployment experience due to reliance on centralized data management platforms. It has scalability features, which can be integrated across enterprises without compromising on geographical expanse. It also supports changing regulatory updates and cross-functional collaborations within global regulatory operations.

The on-premises segment is anticipated to grow at 19.99% due to the need for organizational data governance policies in the AI in regulatory affairs market. The preference for internal control over sensitive regulatory information is growing. On-premises deployment offers full control over data storage and access. This reduces third-party cloud breaches and vendor misuse of sensitive regulatory IP. It also helps demonstrate compliance during audits and avoid legal ambiguity in case of changing regulations and monitoring of datasets.

Application Insights

The regulatory intelligence segment held a 20.14% share in the AI in regulatory affairs market in 2025. The segment growth is supported by increasing use of AI for monitoring regulatory changes, tracking authority guidelines, and assessing regulatory impact across product portfolios. Continuous regulatory updates and jurisdiction-specific requirements sustain the adoption of AI-driven regulatory intelligence tools.

The pharmacovigilance and safety reporting segment is expected to grow at 19.65% in the AI in regulatory affairs market. It is driven by rising adverse event reporting volumes and increasing use of AI for safety case processing and compliance reporting. Pharmacovigilance encompasses the monitoring of huge volumes of electronic health records and adverse drug reaction reports. AI identifies safety gaps, detects long-term safety trends, and flags potential risks, which can lead to quicker interventions to safeguard compliance requirements.

End Use Insights

Pharmaceutical companies dominated the AI in regulatory affairs market in 2025 with a share of 40.45%. Pharmaceutical companies have high submission volumes and need to adhere to complex approvals. They need assistance in document extraction, validation, dossier preparation, and formatting. They also operate under pressure to accelerate clinical drug development and clinical trials, considering optimal regulatory pathways. Larger companies are using AI models not only for document submissions but also for real-world evidence monitoring, safety surveillance, and trial data systems. They also need to focus on continuous post-approval compliance requirements across global markets. AI-based regulatory platforms support structured dossier preparation and lifecycle tracking.

The CRO and CDMO segment is projected to register the fastest growth in the AI in regulatory affairs market, with a share of 19.25%. This segment is driven by increased outsourcing of regulatory activities and growing reliance on AI-enabled systems to manage multi-client regulatory operations efficiently. CROs and CDMOs are using AI to improve clinical trial workflows, optimize manufacturing processes, and enhance real-time reporting. They are also updating their offerings with the integration of AI to improve enhanced data management and faster regulatory intelligence.

| SEGMENT | INCLUSION | DOMINANT SEGMENT | SHARE OF DOMINANT SEGMENT, 2025 |

|---|---|---|---|

|

COMPONENT |

|

Software/Platform |

XX% |

|

DEPLOYMENT MODE |

|

Cloud-based |

XX% |

|

APPLICATION |

|

Regulatory Intelligence |

20.14% |

|

END USE |

|

Pharmaceutical Companies |

40.45% |

|

REGION |

|

North America |

37.68% |

Regulatory Bodies Governing AI in Regulatory Affairs Market

| REGULATORY BODY | COUNTRY/REGION |

|---|---|

|

US Food and Drug Administration (FDA) |

US |

|

European Medicines Agency (EMA) & EU National Competent Authorities |

Europe |

|

National Medical Products Administration (NMPA) |

China |

|

Central Drugs Standard Control Organization (CDSCO) |

India |

|

Pharmaceuticals and Medical Devices Agency (PMDA) |

Japan |

Competitive Landscape

The AI in regulatory affairs market is moderately fragmented, with a mix of established software providers and emerging vendors. Leading players and other specialized regulatory technology firms dominate the market. They offer advanced AI-enabled platforms that have deep domain expertise and an easier integration with quality and clinical systems. Companies focus on product innovations, strategic partnerships with life sciences organizations, and platform scalability to strengthen their market presence. They compete on factors such as regulatory compliance accuracy, automation, interoperability, regulatory intelligence, workflow customization, deployment flexibility, and data security.

List of Key and Emerging Players in AI in Regulatory Affairs Market

- IQVIA

- Freyr Solutions

- Nemko Group AS

- DDReg Pharma

- ArisGlobal

- RegASK

- IBM

- Oracle

- Microsoft

- Google (Alphabet)

- Tempus AI

- Accenture

- Wipro

- Zenovel

- EVERSANA

- Innoplexus

- Workiva

- ComplyAdvantage

- MetricStream

- Viz.ai

- ArisGlobal

- Veeva Systems

- Clarivate

- RegAsk

Latest News on Key and Emerging Players

| TIMELINE | COMPANY | DEVELOPMENT |

|---|---|---|

|

October 2025 |

RegAsk |

The company introduced the first vertical agentic AI command center for regulatory affairs for improved regulatory intelligence. |

|

October 2025 |

ArisGlobal |

The company received the Frost & Sullivan 2025 New Product Innovation Award for its MedDRA Coding Agent, an agentic AI component for AI automation in pharmacovigilance. |

|

September 2025 |

Elsevier |

The company launched PharmaPendium AI, a gen AI assistant for regulatory intelligence in drug development. |

|

August 2025 |

Clarivate |

Clarivate launched an AI-powered Regulatory Assistant within the Cortellis Regulatory Intelligence suite, designed to help regulatory professionals easily navigate global requirements. |

|

August 2025 |

Nemko Group AS |

The company entered into an agreement with the Korean Standards Association to commercialize the AI Trust Mark. It is a global certificate standardization to build trustworthiness and reliability for AI compliance tools used in regulatory affairs. |

Source: Secondary Research

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 1.54 Billion |

| Market Size in 2026 | USD 1.83 Billion |

| Market Size in 2034 | USD 7.20 Billion |

| CAGR | 18.66% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Deployment Mode, By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

AI in Regulatory Affairs Market Segments

By Component

- Software/Platform

- Services

By Deployment Mode

- Cloud-based

- On-Premises

By Application

- Regulatory Intelligence

- Data Migration & Integration

- Dossier Management

- Document Management

- Product Registration & Approvals

- Pharmacovigilance & Safety Reporting

- Regulatory Submissions & Publishing

- Others

By End Use

- Pharmaceutical Companies

- Biotechnology Companies

- Medical Device Companies

- CRO/CDMO

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Dhanashri Bhapakar

Senior Research Associate

Dhanashri Bhapakar is a Senior Research Associate with 3+ years of experience in the Biotechnology sector. She focuses on tracking innovation trends, R&D breakthroughs, and market opportunities within biopharmaceuticals and life sciences. Dhanashri’s deep industry knowledge enables her to provide precise, data-backed insights that help companies innovate and compete effectively in global biotech markets.