Allergy Diagnostics and Therapeutics Market Size, Share & Trends Analysis Report By Type (Diagnostics, Therapeutics), By Allergen Type (Food, Inhaled, Drug, Other allergen types), By Test Type (In Vivo Tests) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Allergy Diagnostics and Therapeutics Market Overview

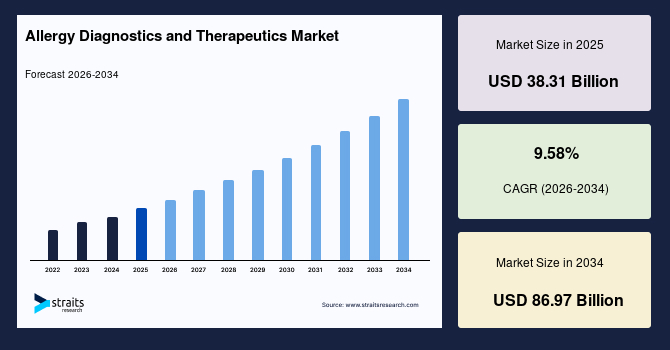

The global allergy diagnostics and therapeutics market size is estimated at USD 38.31 billion in 2025 and is projected to reach USD 86.97 billion by 2034, growing at a CAGR of 9.58% during the forecast period. Sustained growth of the market is propelled by the rising adoption of comprehensive allergy assessment protocols across clinical settings, expanding use of in vivo and in vitro testing methods, and increasing reliance on a wide spectrum of therapeutic options for respiratory, food, drug, and environmental allergies.

Key Market Trends & Insights

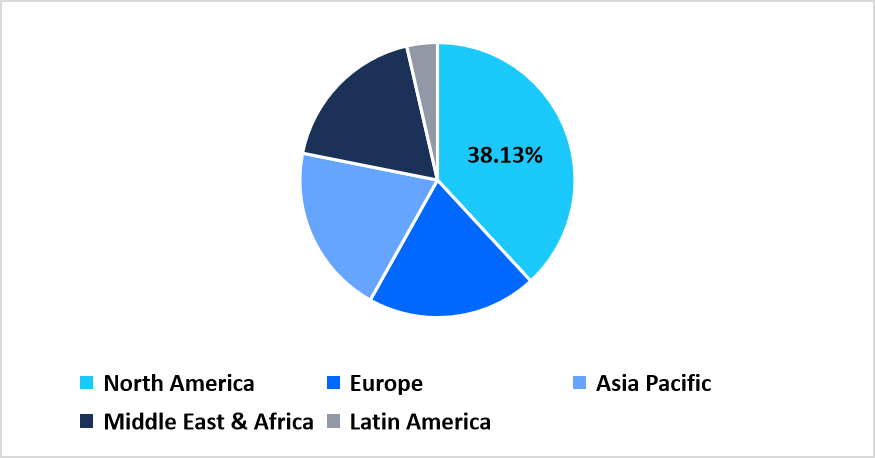

- North America held a dominant share of the global market, accounting for 38.13%.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 11.58%.

- Based on Type, the diagnostics segment is anticipated to register the fastest growth of 10.58%.

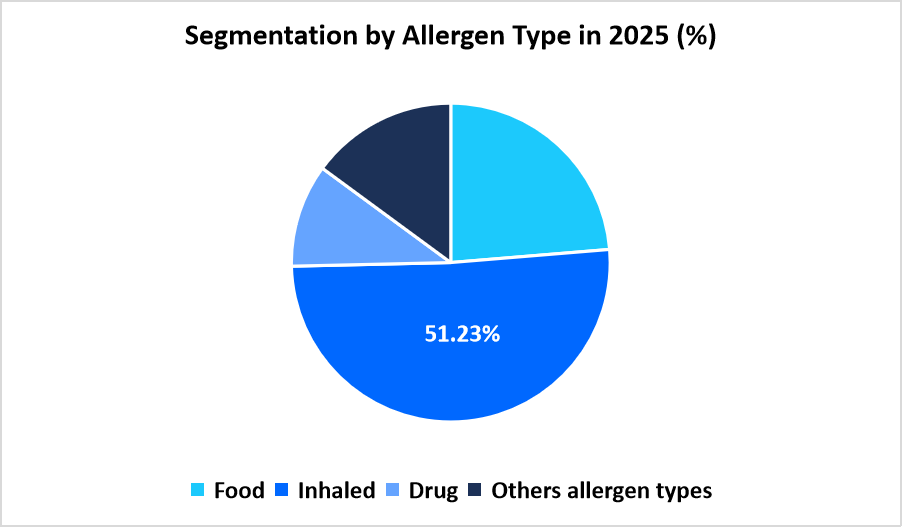

- Based on Allergen Type, the inhaled segment dominated the market in 2025 with a revenue share of 51.23%.

- Based on Test Type, the in vivo tests segment is anticipated to register the fastest CAGR of 10.12%.

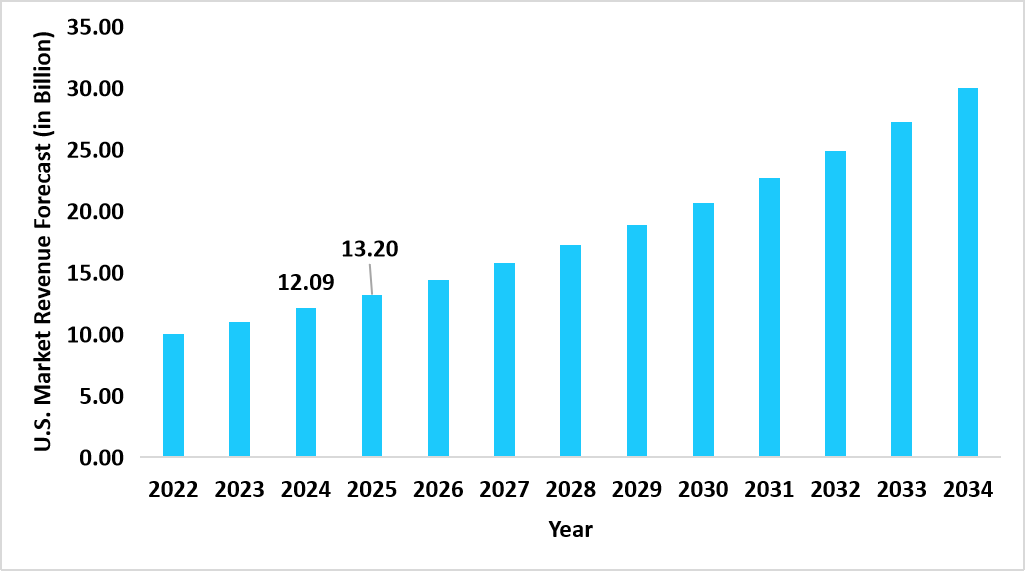

- The U.S. dominates the global allergy diagnostics and therapeutics market, valued at USD 12.09 billion in 2024 and reaching USD 13.20 billion in 2025.

Graph: U.S. Market Revenue Forecast (2022 – 2034)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 38.31 billion

- 2034 Projected Market Size: USD 86.97 billion

- CAGR (2025 to 2034): 9.58%

- Dominating Region: North America

- Fastest Growing Region: Asia Pacific

The allergy diagnostics and therapeutics market encompasses a wide range of products and clinical solutions aimed at identifying and managing allergic conditions across diverse patient groups. The diagnostics segment includes instruments, consumables, and testing services that support both in vivo procedures, such as skin prick, intradermal, and patch tests, as well as in vitro assays used to measure immune reactions. The therapeutics segment covers a broad portfolio of treatment options, including antihistamines, decongestants, corticosteroids, mast cell stabilizers, leukotriene inhibitors, nasal anticholinergic agents, immunomodulators, epinephrine products, and various forms of immunotherapy used for long-term management. Market activity is further categorized by allergen type, including food-related triggers such as dairy products, poultry products, tree nuts, peanuts, shellfish, wheat, soy, and other food allergens, inhaled allergens, drug-related allergens, and other less common sources. Together, these diagnostic and therapeutic offerings form an integrated ecosystem that supports early detection, accurate classification, and sustained management of allergic disorders across clinical and community settings.

Latest Market Trends

Rising Use of Allergen Signal Mapping in Clinical Evaluation

A growing trend in the allergy diagnostics and therapeutics market is the use of allergen signal mapping during patient assessment. Clinics are adopting structured mapping tools that chart individual reactions across multiple environmental and dietary triggers. This approach creates clearer profiles of allergy patterns and guides physicians toward more precise selection of test panels and treatment combinations. As mapping methods become more common in specialty centers, diagnostic pathways shift toward pattern based allergy management.

Integration of Allergy Management Modules in School Health Systems

The major trend is the expansion of allergy management modules across school health programs. Educational institutions are working with healthcare providers to create annual allergy checks for students, including controlled exposure questionnaires and preventive counseling. These school-based programs increase early recognition of mild allergy cases and support timely access to diagnostic tests and medications before symptoms escalate.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 38.31 Billion |

| Estimated 2026 Value | USD 41.84 Billion |

| Projected 2034 Value | USD 86.97 Billion |

| CAGR (2026-2034) | 9.58% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Thermo Fisher Scientific Inc., Siemens Healthineers AG, R-Biopharm AG, EUROIMMUN Medizinische Labordiagnostika AG, GROUP GmbH |

to learn more about this report Download Free Sample Report

Market Driver

Growing Demand for Predictive Risk Scoring in Allergy Care

A key driver for the market is the rising adoption of predictive risk scoring models that estimate an individual’s likelihood of developing seasonal or food related allergies. Clinics use scoring algorithms that evaluate lifestyle conditions, family history, and exposure patterns. These models promote early testing and prompt therapeutic intervention among at risk groups, which increases the use of both diagnostics and allergy treatment products.

Market Restraint

Rising Hesitation Toward Multi-Step Allergy Testing Pathways

A restraint for the market is growing hesitation among patients who undergo multi step testing processes. Lengthy evaluations that require repeated visits or staged test confirmations lead to lower follow through rates, especially in busy urban regions. This hesitation reduces completion of full diagnostic cycles, which limits downstream uptake of prescription therapies linked to confirmed allergic conditions.

Market Opportunity

Expansion of Mobile Allergy Assessment Units in Emerging Economies

A major opportunity arises from the introduction of mobile allergy assessment units across emerging economies. These units travel to coastal and inland districts to offer on site allergy tests, environmental exposure checks, and physician consultations. As more individuals receive immediate assessments within their local communities, diagnostic volumes rise and new treatment pathways open across previously underserved regions.

Regional Analysis

North America accounted for a major share of 38.13% in the global allergy diagnostics and therapeutics market in 2025 due to the rising use of advanced testing systems across hospitals and independent laboratories. Growth in this region was driven by wider patient access to allergy screening, stronger reimbursement for diagnostic panels, and increasing use of oral and injectable therapies for moderate to severe allergic conditions. Companies in the United States and Canada operated broad commercial channels that ensured steady availability of allergen extracts, IgE test kits, and prescription allergy treatments across clinics, retail pharmacies, and specialty centers.

The U.S. market expanded as federal programs supported routine allergy assessment through standardized clinical pathways. These measures encouraged earlier identification of seasonal and perennial allergies and increased the use of high-volume laboratory testing platforms and prescription therapies across outpatient facilities.

Asia Pacific Market Insights

Asia Pacific recorded the fastest pace of growth of 11.58% during the forecast period due to changing environmental conditions, rising adoption of allergy testing procedures, and broader awareness across metropolitan and semi-urban regions. Countries across East, South, and Southeast Asia introduced structured clinical protocols that promoted early evaluation for respiratory and food-related allergies, leading to increased use of diagnostic instruments and treatment products. Regional manufacturers advanced new test panels and expanded distribution networks to address growing patient volumes.

The Indian market progressed due to the introduction of digital medical systems that supported coordinated test ordering for allergy diagnosis within public hospitals. These systems improved the circulation of diagnostic kits and therapeutic prescriptions across district-level facilities, raising usage rates across state healthcare channels.

Pie Chart: Regional Market Share, 2025

Source: Straits Research

Europe Market Insights

Europe recorded consistent growth as national health agencies strengthened allergy management frameworks that encouraged routine assessment of at-risk individuals. Structured programs across major countries increased patient visits to immunologists and respiratory specialists, raising the use of specific IgE tests and immunotherapy options. Collaboration among European clinical institutes also supported a steady flow of diagnostic reagents and therapeutic supplies across regional networks.

In Germany, market expansion was influenced by federal initiatives designed to improve public awareness of chronic allergic conditions. These initiatives prompted higher consultation levels within public insurance pathways and increased the volume of diagnostic tests and long-term allergy therapies across state-funded clinics.

Middle East and Africa Market Insights

Middle East and Africa experienced rising demand for allergy diagnostics and therapies as regional authorities organized community-based screening drives across urban and semi-urban zones. These programs increased patient evaluation rates and supported wider initiation of both diagnostic testing and immunotherapy procedures. Collaborative agreements between ministries of health and private distributors improved product movement across national hospitals and remote healthcare units.

In Saudi Arabia, growth was supported by targeted wellness campaigns coordinated by local healthcare institutes. These campaigns focused on identifying early symptoms of allergic rhinitis and asthma among adults and school children, resulting in increased demand for diagnostic panels and long-term allergy medications.

Latin America Market Insights

Latin America recorded increased utilization of allergy diagnostic and treatment products due to expanded mobile healthcare initiatives across rural territories. Countries in the region adopted teleconsultation pathways that connected specialists with underserved districts, encouraging routine follow-up for chronic allergy cases. This support allowed steady distribution of laboratory test kits and prescription allergy therapies across both public and private healthcare settings.

In Brazil, market growth was reinforced by interregional collaborations that improved monitoring of recurrent allergy cases through structured outreach clinics. Mobile medical units supplied diagnostic kits and therapeutic products to inland communities, improving access and supporting consistent market expansion across the region.

Type Insights

The therapeutics segment dominates the market in 2025. This position arises from the wide clinical use of antihistamines, corticosteroids, leukotriene inhibitors, and immunotherapy across outpatient and specialty clinics. Physicians continue to prescribe these treatments for respiratory, skin, and food-related allergies, which maintains high yearly consumption across public and private healthcare facilities.

The diagnostics segment records the fastest rise with a growth rate of 10.58%. Growth in this category is driven by higher testing volumes in hospitals and independent laboratories as structured allergy assessment protocols gain broader adoption. Increased use of instruments, consumables, and diagnostic services supports the rising pace of this segment throughout the forecast period.

Allergen Type Insights

The inhaled allergen segment dominates the market in 2025 with a share of 51.23%. This leadership is supported by rising cases linked to pollen, dust particles, and mold exposure across urban and peri-urban areas. Higher patient visits for respiratory irritation encourage clinicians to order broader inhaled allergen test panels, strengthening demand across diagnostic centers.

The drug allergen segment advances with a growth rate of 10.32%. This progress results from rising assessments related to medication sensitivity, especially antibiotics and anesthetics. Hospitals conduct more pre-procedure evaluations, which increases the use of drug allergy test panels.

Source: Straits Research

Test Type Insights

The in vitro test segment dominates the market in 2025. Its leading position results from increased use of serum-based allergy tests ordered by clinicians managing complex or multi-allergen cases. Laboratory networks process rising sample volumes as these tests are preferred for patients who cannot undergo skin-based procedures.

The in vivo test segment records the fastest rise with a growth rate of 10.12%. Higher adoption of skin prick, intradermal, and patch testing across allergy departments drives this growth. Outpatient clinics conduct more immediate response assessments as part of routine evaluations, which supports the continued expansion of this segment.

Competitive Landscape

The global allergy diagnostics and therapeutics market is moderately fragmented, with competition spread across multinational diagnostic platform manufacturers, immunotherapy innovators, global pharmaceutical companies, and several regional allergen extract producers.

ALK: A leading immunotherapy specialist

ALK remained one of the most influential players in the allergy diagnostics and therapeutics market, driven by its strong focus on sublingual immunotherapy tablets and high-quality allergen extracts. The company continued to strengthen its leadership in house dust mite, grass, and ragweed allergy treatment through innovation and clinical development.

List of Key and Emerging Players in Allergy Diagnostics and Therapeutics Market

- Thermo Fisher Scientific Inc.

- Siemens Healthineers AG

- R-Biopharm AG

- EUROIMMUN Medizinische Labordiagnostika AG

- GROUP GmbH

- HYCOR Biomedical

- Lincoln Diagnostics, Inc.

- AbbVie Inc.

- Sanofi

- Allergy Therapeutics

- ALK

- Others

Strategic Initiatives

- August 2025: Sanofi Consumer Healthcare India Limited launched Allegra D in India as a non-drowsy allergy relief medicine that also provides nasal decongestion. The tablet contains a fixed dose combination of Fexofenadine Hydrochloride IP 60 milligrams, which is a non-drowsy antihistamine, and Pseudoephedrine Hydrochloride IP 120 milligrams, which is a strong nasal decongestant. The Drug Controller General of India approved this formulation for use in adults and children aged twelve years and older.

- January 2024: ALK received FDA approval in January 2024 to extend the use of ODACTRA to adolescents aged twelve to seventeen years was not correct, because the FDA later expanded its approval in February 2025 for children aged five to eleven years instead.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 38.31 Billion |

| Market Size in 2026 | USD 41.84 Billion |

| Market Size in 2034 | USD 86.97 Billion |

| CAGR | 9.58% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Allergen Type, By Test Type |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Allergy Diagnostics and Therapeutics Market Segments

By Type

-

Diagnostics

- Instruments

- Consumables

- Services

-

Therapeutics

- Antihistamines

- Decongestants

- Corticosteroids

- Mast Cell Stabilizers

- Leukotriene Inhibitors

- Nasal Anti-cholinergic

- Immuno-modulators

- Epinephrine

- Immunotherapy

By Allergen Type

-

Food

- Dairy Products

- Poultry Product

- Tree Nuts

- Peanuts

- Shellfish

- Wheat

- Soy

- Other Food Allergens

- Inhaled

- Drug

- Other allergen types

By Test Type

-

In Vivo Tests

- Skin Prick Test

- Intradermal Test

- Patch Test

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.