Antibodies Market Size, Share & Trends Analysis Report By Type (Monoclonal Antibodies, Polyclonal Antibodies, Antibody Drug Conjugates), By Application (Oncology, Autoimmune Diseases, Infectious Diseases, Neurological Diseases, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Antibodies Market Size

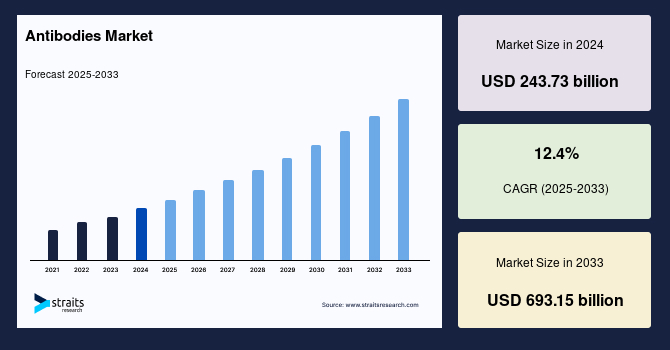

The global antibodies market size was valued at USD 243.73 billion in 2024 and is projected to grow from USD 271.76 billion in 2025 to reach USD 693.15 billion by 2033, growing at a CAGR of 12.4% during the forecast period (2025-2033).

Antibodies, also known as immunoglobulins, are key components of the adaptive immune system. They are produced by B cells, a type of white blood cell, in response to the presence of antigens, which are foreign molecules that trigger immune responses. Once antibodies bind to their specific antigens, they can neutralize harmful substances, promote their removal by other immune cells, or prevent them from entering cells and causing damage.

In diagnostics, antibodies are widely used in tests such as ELISA (enzyme-linked immunosorbent assay), Western blotting, and rapid antigen tests. These tests detect the presence of specific antigens or antibodies in blood, helping to diagnose infections, autoimmune diseases, and certain cancers.

Therapeutically, antibodies are used in the treatment of various diseases. Monoclonal antibodies, which are identical copies of a single antibody, are engineered to target specific molecules or pathogens. They have proven effective in treating conditions such as cancer, autoimmune disorders, and infectious diseases like COVID-19. T

The major factors propelling the antibodies market expansion are rising global cancer and autoimmune disease, expanding applications in diagnostics and research, rising demand for personalized medicines, growing advancements in antibody engineering, increasing investments in biotechnology and R&D, increasing approach for conjugated therapies, regulatory support, and government initiatives including funding.

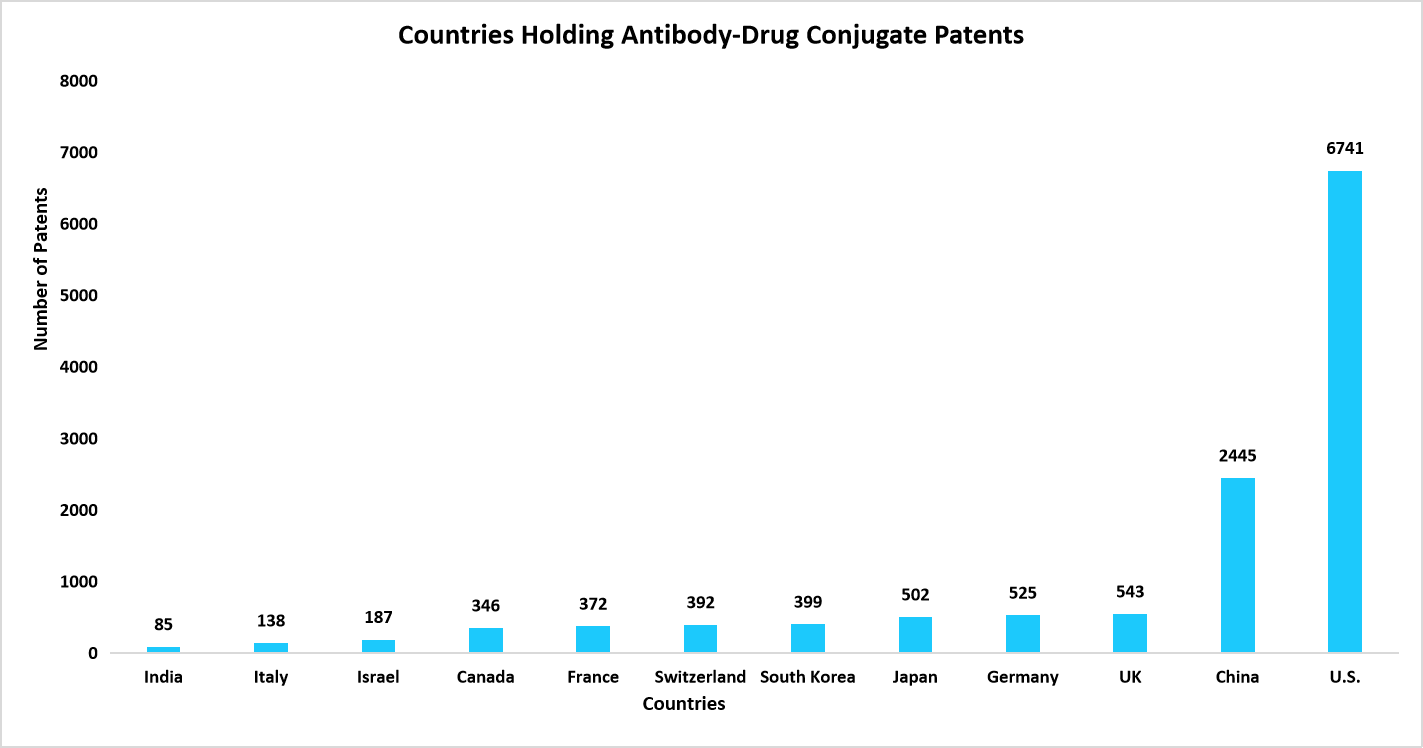

Below graph represents the total number of antibody-drug conjugate patents held by various countries;

Source: Chemical Abstracts Service and Straits Research

Antibodies Market Trends

Adoption of Conjugated Therapies

The growing use of antibody-drug conjugates (ADCs) is a key trend driving market growth. ADCs are becoming increasingly essential in managing various cancers, including metastatic breast cancer, B-cell lymphoma, and metastatic urothelial cancer. These targeted therapies combine the precision of antibodies with the potency of cytotoxic drugs, delivering treatments directly to cancer cells while minimizing damage to healthy tissue.

- Notably, the revenue of ADCs has seen impressive growth. For instance, Enhertu's revenue surged by 113%, from $602 million in 2022 to $1.28 billion in 2023. Similarly, Polivy's revenue increased by 103%, from $457.89 million in 2022 to $931.58 million in 2023. This substantial rise in revenue highlights the growing acceptance and demand for ADC therapies in oncology.

Below table indicates FDA-approved antibody-drug conjugates and their revenue in 2023

|

Antibody-Drug Conjugate Product |

Revenue 2023 ($ Million) |

|

Enhertu |

1283 |

|

Kadcyla |

2188.2 |

|

Adcetris |

292.1 |

|

Besponsa |

236 |

|

Polivy |

931.58 |

|

Padcev |

687.96 |

|

Trodelvy |

1063 |

|

Zynlonta |

69.1 |

|

Elahere |

212.1 |

|

Tivdak |

112.7997 |

Source: Company Annual Reports and Straits Research

Emerging Advancements in Antibody Engineering

Antibody engineering is pivotal in the development of more effective antibody therapies. Recent advancements are transforming the field by integrating innovative tools such as artificial intelligence (AI) to improve our understanding of antibody structures and accelerate their development.

- For instance, researchers at Stanford University have pioneered a machine learning-based method that predicts molecular changes with greater speed and accuracy. This breakthrough leverages the 3D structure of the protein backbone, combined with large language models that focus on amino acid sequences. Such advancements enable the development of more precise and efficient antibody drugs.

These growing innovations in antibody engineering are significantly influencing the market, driving the launch of more effective products, and shaping the future.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 243.73 Billion |

| Estimated 2025 Value | USD 271.76 Billion |

| Projected 2033 Value | USD 693.15 Billion |

| CAGR (2025-2033) | 12.4% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | AbbVie Inc., AstraZeneca, Bayer AG, Biogen, Bristol-Myers Squibb Company |

to learn more about this report Download Free Sample Report

Antibodies Market Growth Factors

Increasing Prevalence of Cancer and Autoimmune Diseases

The rising prevalence of cancer and autoimmune diseases is a significant driver of market growth. Antibodies, particularly antibody-drug conjugates and monoclonal antibodies, are critical in providing targeted therapies for both cancer and autoimmune conditions. As the incidence of these diseases continues to grow, so does the demand for antibody-based treatments.

For example,

- The National Health Council reports that autoimmune diseases affect approximately 50 million people in the U.S., with an annual increase of 3-12%.

- Similarly, the World Health Organization (WHO) estimated that in 2022, there were 20 million new cancer cases globally.

This growing disease burden is pushing the demand for effective antibody therapies, fueling market expansion.

Increasing Adoption of Antibodies in Diagnostics

Antibodies are also gaining traction in the diagnostic space, further driving market growth. Their ability to specifically target and bind to antigens allows for highly accurate diagnostic results. This expanding role in diagnostics, alongside their therapeutic use, is helping to solidify antibodies' place in healthcare.

-

A key example is the November 2023 partnership expansion between AmoyDx and CST to develop companion diagnostics (CDx) for precision oncology. This collaboration focuses on creating diagnostic assays to identify patients who are suitable candidates for targeted therapies.

Increased investment in the development of antibody-based diagnostic assays is expected to continue driving market growth.

Market Restraining Factor

High Risk of Product Recalling

The risk of product recalls poses a significant challenge to the antibodies market, as it impacts both revenue generation and consumer trust. Several antibody products have been recalled by the U.S. Food and Drug Administration (FDA) due to safety and efficacy concerns.

-

For example, in November 2022, GSK recalled Belantamab from the U.S. market at the request of the FDA after it failed to meet primary endpoints for progression-free survival (PFS). Similarly, AstraZeneca withdrew Moxetumomab from the U.S. market in July 2023 due to insufficient usage.

These recalls not only affect the financial performance of the companies involved but also diminish confidence in the safety and efficacy of antibody treatments, which can slow market growth and hinder the development of future therapies.

Antibodies Market Opportunities

Increasing Investments in Biotechnology and R&d

The biotechnology sector is experiencing rapid growth, with an increasing preference for biologic products over chemically synthesized ones. This surge is encouraging key market players and investors to ramp up investments in biotechnology and related research and development (R&D). As antibodies are a cornerstone of the biotechnology industry, these investments are directly benefiting the market.

- For instance, in September 2024, Arch Venture Partners announced a capital fund exceeding $3 billion to support the development of early-stage biotechnology companies. Arch Ventures emphasizes that AI and data-driven insights into biology can help drive a more preventive, curative, and equitable healthcare system.

Such investments are creating valuable opportunities, further fueling market growth, and advancing the development of innovative antibody-based therapies.

Regional Insights

North America holds the largest revenue share in the global market, with 48.03% market share, driven by several key factors. The region benefits from well-established healthcare systems, which enable better access to advanced therapies, including monoclonal antibodies and antibody-drug conjugates. The high prevalence of cancer and autoimmune diseases in the region creates significant demand for effective treatments.

Moreover, rising investments in research and development (R&D) are accelerating the innovation and approval of new antibody-based therapies. The presence of major pharmaceutical players like Bristol-Myers Squibb, Merck & Co., Inc., and Regeneron Pharmaceuticals, Inc., further strengthens the market.

- United States – The U.S. market leads due to its advanced healthcare system, significant R&D investments, and strong regulatory support. For example, in September 2024, Dupixent, a monoclonal antibody, was approved for treating chronic obstructive pulmonary disease (COPD). Such product approvals ensure precise disease management and drive market growth, solidifying the U.S. as a hub for antibody innovations and expanding therapeutic options.

- Canada – Canada's antibodies market growth is fueled by government investments in biotechnology. For instance, in May 2023, the Canadian government contributed $225 million towards AbCellera’s $701 million project to establish a biotech campus with an advanced preclinical antibody development facility. These investments enhance the country’s capabilities in developing innovative antibody-based therapies, accelerating market expansion.

Asia-Pacific Antibodies Market Trends

Asia Pacific region is expected to experience the fastest CAGR, driven by the rising incidence of cancer, with the region accounting for 49.2% of global cancer cases in 2022, as estimated by the American Cancer Society. Moreover, expanding healthcare awareness, improving access to treatments, and increasing investments in research, development, and manufacturing facilities are fueling market expansion. These factors, combined with a growing focus on biotechnology innovations, position the Asia-Pacific region as a key player in the global antibodies market's future growth.

- China - In China, the increasing prevalence of cancer is driving the antibody market growth. The increasing number of cancer cases is demanding a precise diagnostic as well as treatment approach, and antibodies are the only targeted approach to detect and treat cancer. For instance, according to NIH, in 2024, 3,246,625 new cancer cases were estimated, with the highest incidence of lung cancer in China.

- India– India’s antibodies industry is expanding due to disease-specific product launches by key players. For instance, in March 2024, Roche Pharma India introduced Vabysmo (faricimab), a bispecific monoclonal antibody for vision loss, addressing a significant healthcare need in the country. These launches meet disease-specific demands and contribute to market growth.

Europe Antibodies Market Trends

- Germany– Germany’s strong healthcare system and demand for innovative diagnostics and treatments drive its market. Significant investments in R&D centers are propelling biopharmaceutical advancements. For instance, in April 2024, Merck invested over $309.57 million in a life science research center focused on developing antibodies, mRNA applications, and biopharmaceutical products, boosting innovation and market growth.

- UK – The UK’s market is expanding due to regulatory support and advanced product approvals. For example, in October 2023, the Medicines and Healthcare products Regulatory Agency (MHRA) authorized Jemperli, a monoclonal antibody for endometrial cancer, in combination with chemotherapy. Such approvals improve patient care and strengthen the market’s growth trajectory.

- France - In France, the government's commitment to improving cancer care and increasing funding for oncology and chronic diseases drives the market for antibodies. For instance, in August 2024, the French government funded $22.35 million to ImCheck to develop the company’s most advanced drug candidate, a T cell-activating monoclonal antibody. Such funding is influencing market growth in France.

Type Insights

The monoclonal antibodies (mAbs) segment leads the global antibodies industry, contributing the largest revenue share. This dominance is driven by the high specificity of mAbs, targeting only a single epitope on an antigen, which enhances their effectiveness. Moreover, the approval of several mAb-based products by the U.S. Food and Drug Administration (FDA) has further propelled their use. For example, in 2022, 13 monoclonal antibodies received first approvals in both the U.S. and Europe, expanding treatment options and boosting market growth.

Application Insights

The oncology segment is the largest revenue-generating application in the global market, primarily driven by the rising incidence of cancer. As cancer cases continue to rise, there is an increasing demand for effective therapies, which antibodies, especially monoclonal antibodies and antibody-drug conjugates, provide. According to the American Cancer Society, an estimated 2,001,140 new cancer cases were expected in the U.S. in 2024, highlighting the urgent need for targeted antibody treatments to address this growing health burden.

Company Market Share

Key players in the market are actively engaging in strategic collaborations, acquisitions, and partnerships to strengthen their product pipelines, accelerate innovation, and expand their global footprint. These strategies enable them to access advanced technologies, enhance research capabilities, and address unmet medical needs.

Proteogenix: An Emerging Provider in the Global Antibodies Market

ProteoGenix is an emerging player in the market, recognized for its innovative and comprehensive antibody services spanning discovery, development, and production. The company specializes in custom antibody solutions, leveraging advanced technologies such as phage display and hybridoma development to create high-affinity antibodies for diverse applications.

Recent Development:

-

In July 2022, ProteoGenix significantly expanded its R&D facilities, doubling its capacity to accommodate the rapid growth and development of its cutting-edge phage display, antibody development, and bioproduction platforms. This expansion included the integration of state-of-the-art equipment and advanced technologies to enhance its service capabilities and throughput.

List of Key and Emerging Players in Antibodies Market

- AbbVie Inc.

- AstraZeneca

- Bayer AG

- Biogen

- Bristol-Myers Squibb Company

- Lilly

- GSK plc.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- F. Hoffmann-La Roche Ltd

- Sanofi

- Takeda Pharmaceutical Company Limited

Recent Developments

- November 2024 – Precision Biologics unveiled the development of its new monoclonal antibody, PB-223, at the Society for Immunotherapy of Cancer (SITC) conference in Houston, Texas. This novel antibody is designed to target specific cancer antigens, offering a highly targeted approach to cancer therapy.

- November 2024 – Aditum Bio and Leads Biolabs announced the formation of Oblenio Bio, a joint venture focused on the development of a tri-specific T-cell engager antibody for the treatment of autoimmune diseases. The innovative tri-specific antibody is designed to modulate T-cell activity precisely, providing a novel therapeutic approach for complex autoimmune conditions.

Analyst Opinion

As per our analysts, the global antibodies industry is expanding rapidly, driven by advancements in antibody engineering, the increasing prevalence of cancer and autoimmune diseases, and the growing adoption of antibody-based therapies in diagnostics and treatment. Despite challenges such as high development costs, stringent regulatory requirements, and occasional product recalls affecting trust and revenue, the market continues to thrive.

Moreover, the rise of innovative technologies like AI in antibody development, coupled with significant investments in R&D and strategic collaborations, is fueling growth. Emerging markets in Asia-Pacific and the adoption of advanced antibodies like ADCs and bispecific antibodies are further enhancing opportunities. This robust momentum highlights the market's resilience and its critical role in addressing global healthcare challenges.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 243.73 Billion |

| Market Size in 2025 | USD 271.76 Billion |

| Market Size in 2033 | USD 693.15 Billion |

| CAGR | 12.4% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Antibodies Market Segments

By Type

- Monoclonal Antibodies

- Polyclonal Antibodies

- Antibody Drug Conjugates

By Application

- Oncology

- Autoimmune Diseases

- Infectious Diseases

- Neurological Diseases

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Mitiksha Koul

Research Associate

Mitiksha Koul is a Research Associate with 2 years of experience in market research. She focuses on analyzing industry trends, competitive landscapes, and growth opportunities to support strategic decision-making. Mitiksha’s strong analytical skills and research expertise enable her to deliver actionable insights that help businesses adapt to evolving market dynamics and achieve sustainable growth.