Aluminum Beverage Cans Market Size, Share & Trends Analysis Report By Product Type (2 Piece Can, 3 Piece Can), By Industry (Carbonated Soft Drinks, Alcoholic Beverages, Fruit and Vegetable Juices, Tea and Coffee), By Distribution Channel (Direct Sales Channel, Distribution Channel) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Aluminum Beverage Cans Market Size

The global aluminum beverage cans market size was valued at USD 35.56 billion in 2024 and is estimated to reach from USD 37.69 billion in 2025 to USD 60.75 billion by 2033, growing at a CAGR of 6.0% during the forecast period (2025-2033).

Aluminum beverage cans are lightweight, recyclable containers for packaging soft drinks, energy drinks, and alcoholic beverages. Made primarily from aluminum alloy, these cans are preferred for their durability, corrosion resistance, and ability to preserve freshness by protecting contents from light and oxygen exposure. Aluminum cans are widely used for convenience, stackability, and sustainability, as they can be recycled indefinitely without losing quality. The manufacturing process involves forming, coating, and sealing to ensure safety and hygiene. Compared to plastic or glass, aluminum cans offer a lower carbon footprint and reduced environmental impact, making them a popular choice in the beverage industry for efficient and eco-friendly packaging.

The global aluminum beverage cans market is expected to experience significant growth owing to increased adoption of sustainability among players, which will positively influence the dominance of the worldwide packaging landscape. The lightweight structure, 100% recyclability, and durability of aluminum cans have become vital packaging solutions in the circular economy. According to the International Aluminum Institute (IAI) data, the recycling rate for Aluminum beverage cans globally is over 75%, with regions such as Europe and North America, which is expected to increase in forecasted years. This high recyclability makes Aluminum cans a highly adopted packing solution for beverage manufacturers aiming to reduce environmental footprints and support sustainability.

.png)

Companies operating in this space focus on sustainability, lightweight, and innovative designs to meet consumer preferences for recyclable and convenient packaging. CSDs and alcoholic beverages remain dominant segments, while energy and health-focused beverages contribute to growth due to changing consumption patterns.

Emerging Market Trends

Focus on Sustainable Packaging Solutions

The growing emphasis on sustainability influences the market, as aluminum is a recyclable material with minimal environmental impact. Companies increasingly adopt closed-loop recycling systems to reduce their carbon footprint and meet global sustainability goals. This trend is further supported by rising regulatory pressure and consumer demand for eco-friendly packaging. Governments worldwide are implementing policies to curb single-use plastics, leading to a shift toward aluminum cans as a sustainable alternative. This trend is also reinforced by the increasing awareness of circular economy principles, which encourage industries to adopt recyclable and reusable materials.

Furthermore, the demand for specialty cans, such as slim and sleek designs, is increasing across product segments like energy drinks, craft beers, and health-focused beverages. These cans offer aesthetic appeal and cater to the evolving needs of consumers who seek differentiation in packaging. Specialty cans allow brands to target niche markets and align with consumer preferences for premium and functional packaging.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 35.56 Billion |

| Estimated 2025 Value | USD 37.69 Billion |

| Projected 2033 Value | USD 60.75 Billion |

| CAGR (2025-2033) | 6.0% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Ball Corporation, Crown Holdings Inc., Ardagh Group, Can-Pack S.A., Toyo Seikan Group Holdings, Ltd. |

to learn more about this report Download Free Sample Report

Aluminum Beverage Cans Market Growth Factors

Increasing Consumption of Beverages

The rising global consumption of beverages, including carbonated soft drinks, alcoholic beverages, and energy drinks, is driving the demand for aluminum cans. Urbanization, changing lifestyles, and growing disposable incomes contribute to increased beverage consumption, particularly in emerging economies. Additionally, aluminum cans are preferred for their ability to preserve the taste and quality of beverages, making them an ideal packaging solution. The popularity of on-the-go consumption further boosts the demand for canned beverages, as they offer convenience and portability. This driver reflects the broader shift toward packaged beverages in developed and developing markets.

Additionally, aluminum cans are lightweight and durable, making them a preferred choice for beverage packaging. Their ability to withstand transportation and storage conditions without compromising product quality is a key factor driving their adoption. Aluminum cans also offer excellent barrier properties, protecting beverages from light, air, and contaminants, which extends shelf life. The lightweight nature of aluminum reduces transportation costs and improves logistical efficiency, which is particularly beneficial for manufacturers aiming to optimize supply chains. These attributes make aluminum cans appealing to brands and consumers, especially in competitive markets where cost and product quality are critical.

Restraining Factors

Volatility in Aluminum Prices

The fluctuating prices of aluminum due to supply chain disruptions, geopolitical tensions, and variations in raw material costs pose challenges for manufacturers in the beverage cans market. Price volatility affects the profitability of companies, especially smaller manufacturers with limited resources to absorb cost increases. Additionally, high aluminum prices may discourage some manufacturers from choosing aluminum cans over alternative packaging materials. This restraint is significant for players operating in cost-sensitive markets, where price competitiveness is a key factor in determining market share.

In addition, the market faces competition from alternative materials such as PET bottles, glass, and paper-based cartons, which are often perceived as cost-effective or environmentally friendly solutions. While aluminum cans are recyclable, the energy-intensive production process and higher initial costs compared to some alternatives can deter manufacturers from adopting them universally. Furthermore, innovations in biodegradable and compostable packaging are gaining traction, presenting a competitive challenge to aluminum cans. This restraint highlights the need for aluminum manufacturers to continuously innovate and address cost and environmental concerns to maintain their market position.

Key Market Opportunity

Rising Demand for Ready-to-Drink (rtd) Beverages

The global aluminum beverage cans market is experiencing significant growth, partly driven by the escalating demand for ready-to-drink (RTD) beverages. Consumers' increasing preference for convenience and on-the-go consumption has led to a surge in RTD products such as energy drinks, seltzers, craft beers, and canned cocktails. Aluminum cans have become the preferred packaging for these beverages due to their durability, portability, and superior preservation qualities.

- For instance, the proliferation of canned cocktails has been notable, with consumers seeking bar-quality mixed drinks that are convenient for consumption at home or on the go. Similarly, the craft beer industry has embraced aluminum cans, recognizing their benefits in terms of portability and protection from light and oxygen, which can compromise beer quality. This shift has contributed to the increased adoption of aluminum cans in the beverage industry.

The sustainability aspect of aluminum cans further enhances their appeal. With a high recycling rate and the ability to be recycled indefinitely without losing quality, aluminum cans align with the growing consumer and industry focus on environmental responsibility. This eco-friendly attribute meets consumer expectations and supports beverage companies' sustainability goals, thereby driving the preference for aluminum cans over alternative packaging materials.

Regional Insights

North America: Dominant Region with 40.25% Market Share

North America leads the global aluminum beverage cans market, accounting for 30.47% market share in 2024. The U.S. and Canada are at the forefront of this growth due to consumer preferences for environmentally friendly packaging and the shift of beverage companies toward recyclable materials.

- According to the Aluminum Association 2023, more than 75% of all aluminum produced in the U.S. is still in use today, which reflects the region's strong recycling culture. Beverage cans for aluminum packaging in the U.S. were recycled at 50%, significantly more than any other material, such as glass or plastic.

Consumers increasingly demand canned beverages since cans are free from hassle and environmentally friendly. Companies in the region have invested in capacity expansion and technological innovation to meet growing demand.

For instance, in September 2021, Ball Corporation expanded its Nevada aluminum can manufacturing facility by USD 290 million. This facility manufactures lightweight cans for several beverage categories that utilize eco-friendly packaging. Similarly, Crown Holdings introduced better printing technology on aluminum cans in May 2024, allowing it to create more innovative products. This technology encourages branding and product differentiation for leading companies in a competitive environment.

Asia-Pacific: Rapid Growth in India, China, and Japan

Asia-Pacific is rapidly emerging as a significant market for aluminum beverage cans, driven by urbanization and increasing disposable incomes. Increasing demand for canned beverages, including soft drinks, energy drinks, and ready-to-drink products, is driven by shifting lifestyles and preferences. China, India, Japan, and South Korea emerged as key contributors to the market due to government policies and incentives that promote sustainable packaging solutions. Governments are actively establishing policies that promote sustainable packaging. For instance, China will ease restrictions on recycled aluminum and copper imports starting November 2024.

According to an announcement from the Ministry of Ecology and Environment (MEE), China will permit the import of recycled Aluminum and copper materials that meet specified standards. For example, in July 2023, Hindalco Industries, a key Indian aluminum producer, commissioned a manufacturing facility in Maharashtra targeting the rapidly growing Indian and regional demand for aluminum cans. This facility would focus on producing greener, high-quality cans.

Countries Insights

- United States: The U.S. market is driven by sustainability initiatives, high recycling rates (60%), and a thriving RTD beverage sector. The country’s increasing preference for eco-friendly packaging has led to significant investments by players such as Ball Corporation and Crown Holdings. In 2024, Ball Corporation announced a $300 million expansion in North America to boost aluminum can production.

- United Kingdom: The UK has made remarkable strides in aluminum packaging recycling, with 81% of beverage cans recycled in 2023. The market is growing due to government policies promoting sustainability and extended producer responsibility (EPR) schemes. Key players such as Ardagh Group and Can-Pack have increased investments in lightweight aluminum can manufacturing.

- Germany: Germany is one of the largest European consumers of aluminum beverage cans, with a well-established recycling infrastructure. The country’s recycling rate surpasses the EU average thanks to its successful deposit return scheme (DRS). Companies such as Rexam (now part of Ball Corporation) and Ardagh Group have been expanding operations to meet the rising demand for sustainable beverage packaging.

- Brazil: Brazil stands out as a global leader in aluminum can recycling, maintaining an impressive 97% recycling rate for over a decade. The country’s high beer consumption and strong environmental regulations have fueled the demand for aluminum cans. AB InBev, the world's largest beer producer, has invested heavily in expanding its aluminum can packaging in Brazil.

- India: India’s aluminum beverage can market is still in its early stages, with per capita consumption at just one can per year. However, rapid urbanization, growing consumer preference for RTD beverages, and government bans on single-use plastics are accelerating adoption. Can-Pack India and Ball Corporation are expanding their presence in the country to cater to the rising demand for canned soft and energy drinks.

- China: China has a rapidly growing aluminum beverage can market, driven by the expanding RTD tea, coffee, and energy drink segments. With a per capita consumption of 40 cans per year, the country is witnessing a shift from plastic to aluminum due to government-led environmental initiatives. Key manufacturers such as ORG Packaging and Baosteel Packaging have expanded production capabilities to meet the rising demand.

- Vietnam: Vietnam’s market is expanding due to a rising middle class, increased beer consumption, and sustainability awareness. With an annual per capita consumption of 70 cans, the country leads Southeast Asia in aluminum can usage. The rapid expansion of the craft beer industry and foreign investments in beverage production have spurred demand.

- France: France is experiencing a shift towards aluminum beverage cans, driven by government initiatives to reduce plastic packaging and a growing demand for sustainable solutions. The country’s aluminum can recycling rate aligns with the European average of 76%. Key players like Ball Corporation and Ardagh Group are expanding their manufacturing footprint to support the increasing demand for canned beverages, particularly in the organic and energy drink segments.

Type Insights

The standard cans segment dominated the market with the largest market revenue. Standard cans, typically sized at 12 oz (355 ml) and below, are the most commonly used aluminum beverage cans worldwide. They are widely employed across multiple beverage categories, including carbonated soft drinks, beer, energy drinks, iced tea, and sparkling water. Standard cans are popular for their practicality, affordability, and compatibility with existing manufacturing and filling equipment, making them a cost-effective solution for high-volume production.

The widespread use of standard cans can be attributed to their established position in the beverage market, as they have been a familiar and trusted format for decades. They offer ample space for branding and regulatory labeling while also being compatible with high-speed filling lines, which increases production efficiency.

Application Insights

Carbonated soft drinks (CSDs) represent one of the most significant applications for aluminum beverage cans. The effervescence and carbonation in these drinks require durable packaging that can withstand internal pressure, which aluminum cans provide effectively. Standard can sizes, like the 12 oz (355 ml) format, are particularly popular in this segment due to their affordability, convenience, and familiarity.

- According to the Aluminum Association, CSDs are a leading segment in aluminum because of the material’s ability to preserve flavor and carbonation, which is essential for consumer satisfaction in this category. Aluminum cans have long been a preferred packaging choice for CSDs because they provide a barrier against light and oxygen, which helps maintain the product’s freshness and taste.

Distribution Channel Insights

The direct sales channel segment accounted for the largest market share, encompassing traditional brick-and-mortar stores, supermarkets, hypermarkets, convenience stores, liquor stores, and wholesalers. This channel is currently the dominant distribution mode for aluminum-packaged beverages due to its wide accessibility and established networks. Offline channels play a significant role in urban and rural areas, where consumers rely on physical retail outlets to purchase beverages.

Retailers, giant supermarkets, and hypermarkets serve as key points of sale for products packaged in aluminum cans, such as carbonated soft drinks, alcoholic beverages, energy drinks, and sparkling water.

Volume Capacity Insights

250ml to 330ml segment accounted for the largest market revenue. This segment represents a highly versatile and widely adopted volume range globally. Cans in this segment are often used for sparkling water, carbonated soft drinks, energy drinks, hard seltzers, and light alcoholic beverages. Common formats include slim cans (250 ml) and standard European-sized cans (330 ml), which are frequently used for single-serve beverages. These cans balance sufficient beverage volume and portability, making them popular among consumers who value practicality and convenience.

- According to NIIR and industry sources, 250 ml – 330 ml cans are preferred for single-serve packaging in urban and metropolitan regions, where consumers prioritize convenience and portability.

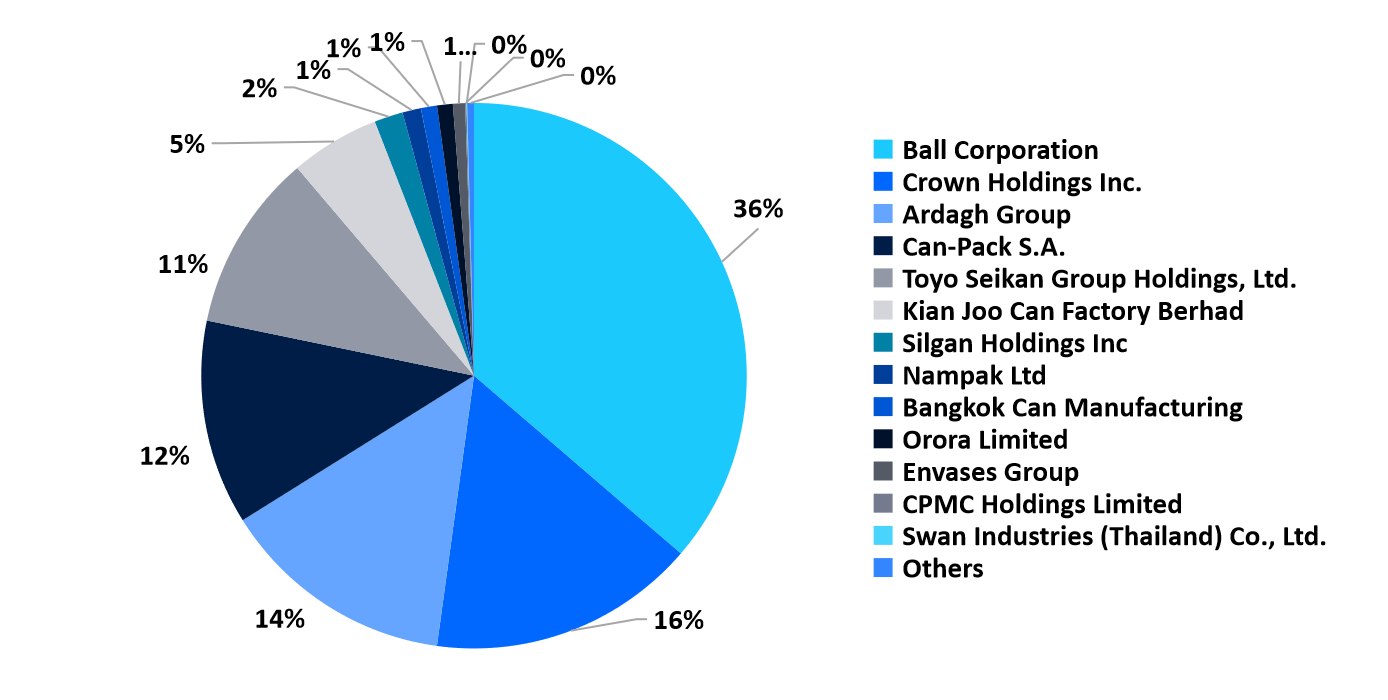

Company Market Share

The global aluminum beverage cans market has witnessed steady growth, driven by rising demand across categories such as carbonated soft drinks (CSDs), alcoholic beverages, energy drinks, and other non-alcoholic beverages. Companies operating in this space focus on sustainability, lightweight, and innovative designs to meet consumer preferences for recyclable and convenient packaging. CSDs and alcoholic beverages remain dominant segments, while energy and health-focused beverages contribute to growth due to changing consumption patterns. The market exhibits a mix of consolidation and fragmentation, with major players holding significant shares alongside smaller regional manufacturers. Intense competition and investment in production capabilities are shaping the industry’s response to growing environmental concerns and increasing demand for premium products.

Orora Limited: An Emerging Player in the Market

Orora Limited manufactures and distributes sustainable and innovative packaging and visual solutions to customers worldwide. The company operates in two businesses across two key geographic segments: Orora Beverage in Australasia and Orora Packaging Solutions in North America. It holds 23 manufacturing sites and 80 distribution sites. In Australasia, the company specializes in producing glass bottles, aluminum cans, closures and caps, and serving industries such as food, beverage, and pharmaceuticals. The North American segment focuses on packaging distribution and offers a range of packaging materials and services, including corrugated boxes, point-of-purchase displays, and visual communication solutions. Orora's extensive operations span Australia, New Zealand, the U.S., and other international markets.

Recent Development

- July 2023 - The company signed an agreement with global provider Velox-digital to supply direct-to-shape digital printing solutions. The company established its first digital printer in Victoria's Dandenong Can production facility.

List of Key and Emerging Players in Aluminum Beverage Cans Market

- Ball Corporation

- Crown Holdings Inc.

- Ardagh Group

- Can-Pack S.A.

- Toyo Seikan Group Holdings, Ltd.

- Kian Joo Can Factory Berhad

- Silgan Holdings Inc

- Nampak Ltd

- Bangkok Can Manufacturing

- Orora Limited

- Envases Group

- CPMC Holdings Limited

- Swan Industries (Thailand) Co., Ltd.

Recent Developments

- November 2024 - Ball Corporation acquired Alucan, a European key player in extruded aluminum aerosol and bottle technology, to expand the sustainable impact of extruded aluminum packaging solutions in Europe.

Analyst Opinion

As per our analyst, the global aluminum beverage cans market is experiencing consistent growth, driven by rising consumer preferences for sustainable and portable packaging solutions. Aluminum’s recyclability and durability make it a practical choice for manufacturers seeking to align with environmental policies and shifting consumer priorities. The market benefits from growing demand for carbonated soft drinks, alcoholic beverages, and energy drinks, where packaging functionality and product preservation are key factors.

However, price volatility and competition from alternative materials like PET bottles and cartons require manufacturers to focus on innovation and cost-efficiency. The market reflects a dynamic interplay between evolving consumption patterns, regulatory shifts, and industry efforts to meet environmental and operational goals.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 35.56 Billion |

| Market Size in 2025 | USD 37.69 Billion |

| Market Size in 2033 | USD 60.75 Billion |

| CAGR | 6.0% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type , By Application , By Volume Capacity, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Singapore, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Aluminum Beverage Cans Market Segments

By Type

- Standard Cans

- Slim Cans

- Specialty Cans

- Sleek Cans

By Application

- Carbonated Soft Drinks (CDS)

- Alcohol Beverages

- Energy Drinks

- Others

By Volume Capacity

- Below 250 ML

- 250 ML-330ML

- 330ML-500ML

- Above 500ML

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.