Automotive Bumpers Market Size, Share & Trends Analysis Report By Material Type (Plastic, Metal, Composites), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Applications (Front Bumpers, Rear Bumpers) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Automotive Bumpers Market Size

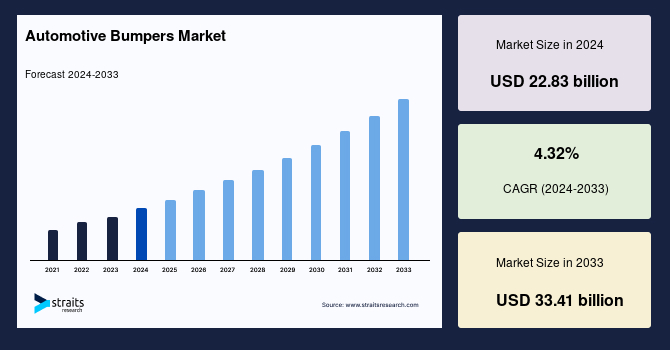

The global automotive bumpers market size was valued at USD 22.83 billion in 2024 and is expected to grow from USD 23.81 billion in 2025 to reach USD 33.41 billion in 2033, growing at a CAGR of 4.32% over the forecast period (2025–2033).

Automotive bumpers are protective components attached to the front and rear ends of a vehicle. They are designed to absorb and reduce the impact during low-speed collisions, helping to protect the car's body, important mechanical parts, and passengers. Modern bumpers are usually made from a combination of plastic, fiberglass, aluminum, or steel, and are often integrated with safety systems like sensors and cameras. Apart from safety, they also contribute to the car’s overall aesthetic and aerodynamic design.

The market is witnessing significant growth due to the increasing demand for lightweight materials, which help improve fuel efficiency and vehicle performance. At the same time, consumers are placing greater emphasis on safety, driving manufacturers to incorporate enhanced protective features. Moreover, the integration of advanced technologies, such as sensors, cameras, and smart impact detection systems, is transforming bumper design, making them not only more efficient but also smarter and more responsive.

Latest Market Trend

Integration of Advanced Technologies

The global automotive bumpers market is witnessing a shift towards advanced technology integration driven by safety, efficiency, and automation. Manufacturers are incorporating smart materials, embedded sensors, and adaptive designs to enhance vehicle performance. With the increased adoption of electric and autonomous vehicles, the market is set to expand further, emphasizing innovation in bumper technology.

- For example, BYD's "The God's Eye" smart driving system, introduced in early 2025, utilizes cameras, radars, and ultrasound sensors, with higher-end models incorporating LiDAR for improved autonomous driving features. Similarly, Tesla’s Cybertruck features a reinforced bumper with embedded sensors for adaptive collision prevention, while Mercedes-Benz's next-gen S-Class integrates active aerodynamics to optimize airflow and reduce drag.

These advancements align with the growing demand for intelligent and high-performance bumpers, improving both crash resistance and vehicle efficiency.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 22.83 Billion |

| Estimated 2025 Value | USD 23.81 Billion |

| Projected 2033 Value | USD 33.41 Billion |

| CAGR (2025-2033) | 4.32% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Toyota Boshoku Corporation, Plastic Omnium, Magna International, Inc., Toyoda Gosei Co., Ltd, SMP Deutschland GmbH |

to learn more about this report Download Free Sample Report

Automotive Bumpers Market Growth Factors

Rising Consumer Demand for Safety Features

The rising consumer demand for safety features is a key driver of growth in the global automotive bumpers market. As vehicle safety becomes a top priority, bumpers are evolving to include advanced technologies like pedestrian protection, impact absorption, and sensors for collision detection.

For example, automakers like Volvo have prioritized safety in their designs, with the Volvo XC90 incorporating innovative bumpers designed to reduce injury during low-speed impacts. The growing awareness of road safety among consumers, coupled with stricter regulations worldwide, is prompting manufacturers to enhance bumper design.

This trend is evident in the increased integration of energy-absorbing materials and sensors, contributing to the global bumpers market's expansion.

Market Restraint

High Cost of Raw Materials

High raw material costs act as a significant restraint on the growth of the global automotive bumpers market. The production of bumpers relies on various materials, including plastics, metals, and composites, whose prices have been volatile due to supply chain disruptions, high energy costs, and geopolitical tensions. The rising prices of plastic resins and aluminum have particularly impacted manufacturing costs. These materials are essential for producing lightweight, shock-resistant bumpers, but their high costs drive up overall production expenses. Moreover, the push for sustainable materials, such as bio-based plastics and recycled composites, further increases costs, limiting affordability for vehicle manufacturers.

Market Opportunity

Adoption of Sustainable and Eco-Friendly Materials

The global market is witnessing a significant opportunity with the growing adoption of sustainable and eco-friendly materials. Automakers are increasingly shifting towards recycled plastics and bio-based composites to reduce carbon footprints and comply with stringent environmental regulations.

- For instance, in August 2023, Ultra-Poly, a prominent U.S.-based plastics recycler, launched a pioneering bumper recycling program. This initiative involves collecting damaged automotive bumpers directly from auto body shops, reprocessing them into new raw materials. Collaborating with Tier 1 supplier Autoneum North America, Inc., Ultra-Poly developed a product that utilizes recycled bumper material as a rigid backing substrate for a fibrous layer, creating a composite used in vibration and noise attenuation in chassis components.

This shift towards sustainable bumpers not only enhances vehicle efficiency but also aligns with circular economy goals. As regulations tighten, manufacturers investing in innovative, eco-friendly materials will gain a competitive edge in the evolving automotive market.

Regional Analysis

Asia-Pacific: Dominant Region

Asia-Pacific dominates the global automotive bumpers market, driven by high vehicle production in countries like China, India, and Japan. China, the world's largest automobile producer, fuels demand with its expanding electric vehicle (EV) industry and strong domestic car market. India’s growing middle class and rising automobile sales further contribute to regional dominance. Moreover, major automakers and component manufacturers have established production hubs in the region, benefiting from cost-effective manufacturing and increasing vehicle exports, solidifying Asia Pacific’s leadership.

North America: Significantly Growing Region

North America is experiencing significant growth in the automotive bumpers market, driven by rising vehicle safety regulations and advancements in bumper technologies. The U.S. leads with a strong focus on impact-resistant bumpers integrated with advanced driver-assistance systems (ADAS). Moreover, the surge in electric vehicle adoption, led by companies like Tesla, is boosting demand for lightweight and aerodynamic bumper designs. With increasing investments in automotive innovation, North America remains a key region poised for continued market expansion.

United States Market Trends

The U.S. automotive bumper market thrives on massive demand for luxury vehicles, requiring advanced designs that enhance safety and durability. Automakers like Tesla and Cadillac integrate lightweight yet impact-resistant materials to improve performance and fuel efficiency. Moreover, manufacturers focus on cost-effective production, utilizing materials like carbon fiber-reinforced plastics (CFRP) to balance strength and weight. With strict safety regulations and consumer preference for high-end vehicles, the U.S. remains a key market.

Countrywise Insights

- Japan- Japan’s automotive bumper market is driven by top manufacturers like Toyota and Honda, prioritizing lightweight materials to enhance fuel efficiency. With growing environmental concerns, companies incorporate high-strength thermoplastics and hybrid composites to meet emerging emission regulations. Strategic partnerships with global automotive players, such as Nissan’s collaboration with Renault, ensure access to cutting-edge technology. This focus on sustainable, high-performance materials strengthens Japan’s position.

- India – India has emerged as a leading automotive bumper market in Asia-Pacific, fueled by the rapid expansion of EVs and green transportation. Companies like Tata Motors and Mahindra & Mahindra invest in recyclable, lightweight bumpers to align with sustainability goals. The "Make in India" initiative further boosts domestic manufacturing, attracting global investments. With rising car ownership and stricter emission norms, India’s demand for eco-friendly bumper solutions continues to soar.

- Germany– Germany’s government actively promotes sustainable automotive technology through grants and incentives, strengthening the market for eco-friendly bumpers. Leading companies like Magna International and Valeo integrate advanced materials such as bio-based polymers and aluminum composites to reduce environmental impact. The country’s strong focus on research and development ensures that German bumper manufacturers stay ahead in global innovation, meeting stringent EU emissions standards and reinforcing Germany’s dominance.

- Brazil – Brazil’s automotive bumper market benefits from government incentives supporting local vehicle production and sustainable material adoption. Companies like Volkswagen Brazil and Fiat Chrysler leverage these policies to enhance manufacturing capabilities while meeting eco-friendly requirements. The growing middle class and increasing car ownership drive demand for durable, cost-effective bumpers. Moreover, Brazil’s push for bio-based plastics and locally sourced materials strengthens its position as a rising player in the automotive bumper industry.

- France- France stands at the forefront of Europe’s sustainable industry, driven by government-backed research initiatives and collaborations with manufacturers like Renault and Peugeot. With the EU Green Deal pushing for reduced carbon footprints, French companies invest in biodegradable polymers and lightweight composites for bumper production. State-funded projects ensure ongoing innovation, making France a key market for sustainable and high-performance automotive bumpers in Europe.

Segmentation Analysis

By Material Type

Plastic bumpers dominate the global automotive bumpers market due to their lightweight, cost-effectiveness, and superior impact absorption. Automakers prefer plastic materials like polypropylene and polycarbonate for their durability and design flexibility. These bumpers enhance fuel efficiency by reducing vehicle weight, aligning with sustainability trends. Moreover, plastic bumpers offer better corrosion resistance compared to metal alternatives, making them ideal for modern vehicles. Their widespread adoption across all vehicle categories secures their position as the leading material choice in the market.

By Vehicle Type

Passenger cars hold the largest share in the global automotive bumpers market, driven by high global car production and ownership rates. Increasing consumer demand for fuel-efficient, aesthetically appealing, and safety-enhanced vehicles boosts the adoption of advanced bumper designs. Governments worldwide enforce strict safety regulations, prompting automakers to incorporate impact-resistant bumpers. Moreover, the surge in electric and hybrid passenger cars further accelerates market growth, solidifying passenger vehicles as the dominant segment in bumper applications.

By Applications

Front bumpers dominate the market due to their critical role in vehicle safety and aesthetics. They serve as the first line of defense in collisions, reducing impact damage to the car’s structure. Automakers prioritize front bumper innovation, integrating energy-absorbing materials and sensors for enhanced crash protection. With rising consumer focus on safety and aerodynamics, manufacturers continue refining front bumper designs, ensuring their widespread adoption across all vehicle types and securing their market leadership.

Company Market Share

Leading companies in the global automotive bumper market are focusing on lightweight materials and sustainable solutions to enhance vehicle efficiency and reduce environmental impact. Advanced energy-absorbing technologies are being integrated to improve safety, particularly in pedestrian protection. Manufacturers are also investing in cost-effective production methods to meet growing global demand.

List of Key and Emerging Players in Automotive Bumpers Market

- Toyota Boshoku Corporation

- Plastic Omnium

- Magna International, Inc.

- Toyoda Gosei Co., Ltd

- SMP Deutschland GmbH

- Yanfeng Plastic Omnium Automotive Exterior Systems Co. Ltd

- JiangNan Mould & Plastic Technology Co., Ltd.

- Venture Otto SA (Pty) Ltd.

- NTF Private Ltd

- Fab Fours, Inc.

to learn more about this report Download Market Share

Recent Developments

- September 2024 – Toyoda Gosei Co., Ltd. announced plans to expand its manufacturing capabilities in India with a new facility in Harohalli, Karnataka, to cater to the rising demand for automotive safety components, including bumpers. This plant, a branch of Toyoda Gosei South India Pvt. Ltd., is scheduled to begin operations in January 2026. It will focus on producing essential exterior components, such as bumpers alongside airbags, steering wheels, and interior parts.

Analyst Opinion

As per our analysts, the market is poised for steady growth, driven by increasing vehicle production and the rising demand for lightweight materials. Automakers are focusing on advanced bumper designs that enhance crash safety while reducing vehicle weight, supporting fuel efficiency. The integration of smart bumpers with sensors for autonomous and connected cars is also gaining traction, further propelling market expansion.

Despite these growth drivers and opportunities, the industry faces challenges such as fluctuating raw material prices, stringent environmental regulations on plastic usage, and high production costs associated with advanced bumper technologies. Moreover, supply chain disruptions and global trade uncertainties, including tariffs on automotive components, have impacted manufacturing costs.

However, companies are mitigating these challenges through investments in sustainable materials, such as recycled plastics and bio-based composites, and by localizing production to minimize supply chain risks. Looking ahead, the push for sustainability and innovation will shape the future of the global automotive bumper market.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 22.83 Billion |

| Market Size in 2025 | USD 23.81 Billion |

| Market Size in 2033 | USD 33.41 Billion |

| CAGR | 4.32% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Material Type, By Vehicle Type, By Applications |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Automotive Bumpers Market Segments

By Material Type

- Plastic

- Metal

- Composites

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Applications

- Front Bumpers

- Rear Bumpers

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Abhijeet Patil

Research Associate

Abhijeet Patil is a Research Associate with 3+ years of experience in Automation & Process Control and Automotive & Transportation sectors. He specializes in evaluating industry automation trends, mobility innovations, and supply chain shifts. Abhijeet’s data-driven research aids clients in adapting to technological disruptions and market transformations.